Market

Artificial Intelligence Coins on the Rise: DIA, DEAI, and LAMB

As the first week of October 2024 wraps up, several Artificial Intelligence (AI) coins are making waves with standout price performances and increasing investor interest.

In this analysis, BeInCrypto highlights the top three AI coins dominating the market, examining the key drivers behind their rise and what could be on the horizon in the coming weeks.

DIA

DIA is a company specializing in cross-chain oracles for Web3. It delivers services like digital asset price feeds, adjustable NFT floor price feeds, multi-chain randomness for DeFi and GameFi applications, and the creation of bespoke oracles for decentralized apps.

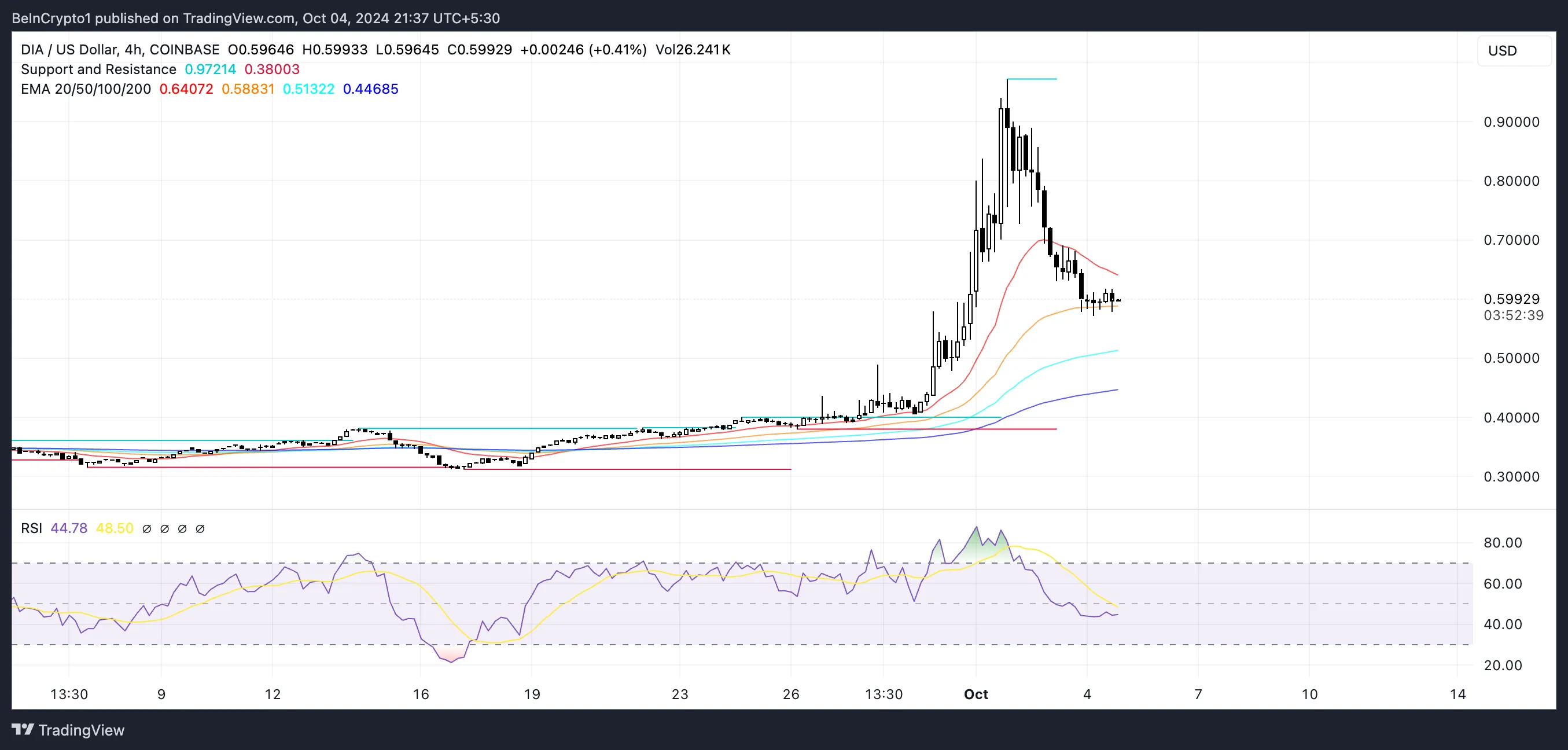

DIA surged 47.79% over the past seven days, ranking it among the top-performing artificial intelligence coins during this period. Its price skyrocketed from $0.41 on September 29 to $0.92 by October 1, marking an impressive 124% gain. Following this surge, the price corrected back to $0.59.

Despite this retracement, DIA’s Exponential Moving Average (EMA) lines remain bullish. The short-term EMAs continue to stay above the long-term ones, signaling that the bullish trend is still intact, although it has weakened compared to the earlier peak.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

The DIA’s Relative Strength Index (RSI) currently stands at 44.68, which suggests it is neither overbought nor oversold. RSI is a momentum indicator that ranges from 0 to 100 and is used to gauge whether an asset is overbought (above 70) or oversold (below 30) territory.

With DIA’s RSI at 44.68, it indicates that the asset is in a neutral zone, showing steady movement without extreme pressure in either direction. This level suggests there is still potential room for upward growth before hitting an overbought condition. That implies that DIA could have more upside momentum ahead.

Zero1 Labs (DEAI)

DEAI is the token from Zero1 Labs, a platform dedicated to developing decentralized artificial intelligence applications. Zero1 Labs offers Keymaker, an open platform that includes a DeAI (Decentralized Artificial Intelligence) toolset, API, and dApp Store, along with Cypher, a blockchain optimized for AI and large language models, with a focus on data governance and ownership. The platform is designed to simplify the creation and monetization of DeAI apps.

DEAI price surged 14.05% in the last week, currently sitting at $0.41. DEAI EMA lines are strongly bullish, with the short-term lines all above the long-term lines. They also show a good distance between them, which shows the uptrend is sustainable.

DEAI currently shows support at $0.31, and its next resistance is at $0.43, which should be tested soon. Its relative Strength Index (RSI) currently stands at 61.41. That indicates that while it is nearing the overbought threshold of 70, it still has some room for potential growth.

With DEAI’s RSI approaching 70, the token shows signs of strength and upward momentum. However, it could be nearing a point where gains could slow or a correction may occur. While there is still room for growth, this momentum may not last much longer as it inches closer to the overbought zone.

Lambda (LAMB)

LAMB is the coin of Lambda, a storage network that defines itself as the “leading omnichain modular storage”, supporting DeFi and artificial intelligence applications. LAMB price followed the same trend from DIA and DEAI, surging from $0.0016 on September 27 to $0.0030 on September 30. That represents an 87,5% growth in just three days.

It then dropped to $0.0023, but its price chart still shows a growing potential for the next few days. LAMB EMA lines still look bullish, although the distance between its two short-term lines is not as big as before. This could indicate that the current uptrend is less strong.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

LAMB’s RSI currently sits at 50.33, signaling that the asset is in a neutral position, neither overbought nor oversold. This leaves ample room for growth as it indicates that LAMB is not facing excessive buying pressure yet.

If the current uptrend continues, LAMB could soon retest the $0.0030 resistance level, presenting a potential 32% increase opportunity. With its RSI comfortably in the middle, there is space for further upward momentum before any significant resistance is encountered.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price 25% Rally: Breaking Barriers and Surpassing Odds

XRP price rallied above the $1.15 and $1.20 resistance levels. The price is up over 25% and might rise further above the $1.420 resistance.

- XRP price started a fresh surge above the $1.20 resistance level.

- The price is now trading above $1.250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is up over 25% and it seems like the bulls are not done yet.

XRP Price Eyes Steady Increase

XRP price formed a base above $1.050 and started a fresh increase. There was a move above the $1.150 and $1.20 resistance levels. It even pumped above the $1.25 level, beating Ethereum and Bitcoin in the past two sessions.

There was also a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair. A high was formed at $1.4161 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high.

The price is now trading above $1.30 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.400 level. The first major resistance is near the $1.420 level. The next key resistance could be $1.450.

A clear move above the $1.450 resistance might send the price toward the $1.50 resistance. Any more gains might send the price toward the $1.550 resistance or even $1.620 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Supported?

If XRP fails to clear the $1.420 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3350 level. The next major support is near the $1.2850 level.

If there is a downside break and a close below the $1.2850 level, the price might continue to decline toward the $1.240 support or the 50% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high in the near term. The next major support sits near the $1.20 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.3350 and $1.2850.

Major Resistance Levels – $1.4000 and $1.4200.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

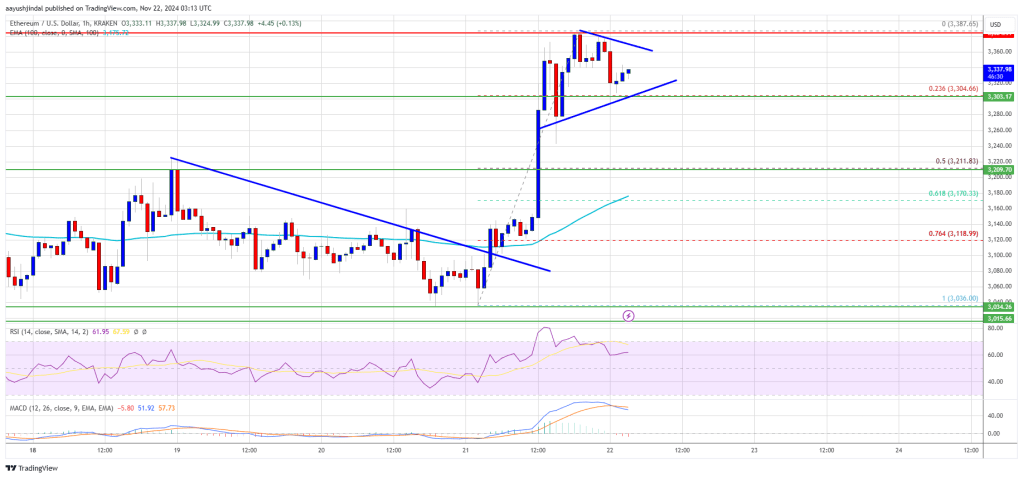

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market20 hours ago

Market20 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market24 hours ago

Market24 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin17 hours ago

Altcoin17 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market23 hours ago

Market23 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin22 hours ago

Altcoin22 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin15 hours ago

Bitcoin15 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings