Market

Telegram Airdrop, Grayscale’s Altcoins, and More

This week in crypto, we’ve got some juicy updates you won’t want to miss. This includes Telegram’s hottest airdrops to Grayscale’s picks for the top altcoins and the latest drama in the US Securities and Exchange Commission’s (SEC) showdown with Ripple.

During the first week of October, the anticipation of “Uptober” died, with Bitcoin and other major crypto assets struggling. In the past seven days, Bitcoin is down by around 6.5%, currently trading at $61,400.

Despite the choppy price actions, there are some earning opportunities with the Telegram airdrops.

3 Upcoming Telegram Airdrops

As the crypto market enters Q4, several key Telegram airdrops are poised to capture the interest of digital asset enthusiasts. This month features promising opportunities for those looking to engage with emerging blockchain projects without an upfront financial investment.

Read more: Best Upcoming Airdrops in 2024

MemeFi, a leading Telegram-based game, invites users to battle meme-themed characters for cryptocurrency rewards. Scheduled for October 9, the MemeFi airdrop requires participants to engage through various tasks to be eligible for airdrop claims post token generation event. The allure of the airdrop is heightened by its massive 90% token distribution to users, a notable increase from its competitors.

Second on the list is X Empire, which offers players the chance to earn through strategic gameplay enhancements. The October 15 airdrop emphasizes the importance of active participation and network engagement, promising substantial returns for diligent players. This game merges the thrill of earning with the excitement of crypto gaming.

Lastly, TapSwap stands out with its straightforward earning mechanics, making it accessible to all crypto enthusiasts. The airdrop, set for mid-to-late October, rewards users for daily engagements and offers additional bonuses for financial supporters. Despite some launch delays, the project’s potential valuation and token prospects keep the community eager.

Why the Hamster Kombat (HMSTR) Airdrop Failed

Hamster Kombat’s much-anticipated airdrop faced setbacks, leading to widespread disappointment within the crypto community. Various reasons left the community disappointed with the HMSTR airdrop.

For instance, the airdrop’s execution saw many loyal players disqualified due to a last-minute anti-cheat system implementation, benefiting a few over the many. This move sparked significant backlash from the community.

“Hamster Kombat has cheated the community. They have allocated a large portion of airdrops to YouTubers and influencers for referrals. They’ve implemented vesting without informing the community. They’ve made people work like labor, day and night to collect keys from their games and gave $5 or $10 tokens,” Crypto with Khan, a prominent crypto influencer commented.

Read more: Top 8 Hamster Kombat Alternatives in 2024

Moreover, the airdrop was plagued by frequent postponements and abrupt rule changes, eroding trust and patience among participants. Additionally, an unexpected decision to withhold 11.25% of the tokens until next year further fueled dissatisfaction.

As a result, the HMSTR token’s value plummeted shortly after launch, with prices dropping over 60%. This decline was a major blow to investors’ confidence and financial outcomes.

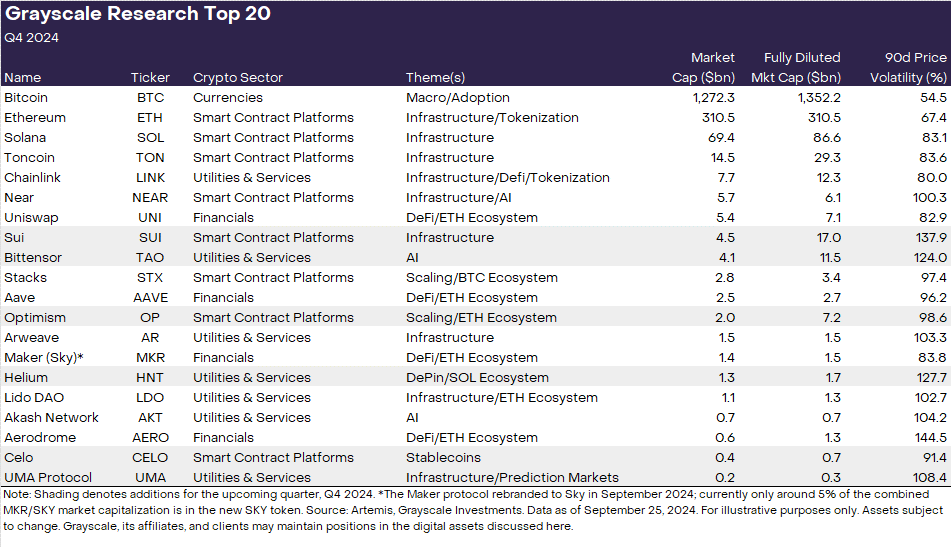

Grayscale’s Top 20 Crypto

Grayscale has updated its investment strategy, identifying 20 cryptocurrencies that show promise for significant gains. This selection includes exciting additions like Sui (SUI) and Bittensor (TAO), which align with current market trends towards decentralized AI.

Grayscale’s strategy involves a meticulous analysis of potential market leaders based on diverse factors from network growth to token economics. This comprehensive approach ensures that the investment firm remains at the forefront of market dynamics, ready to capitalize on emerging opportunities.

“The Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter. Our approach incorporates a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks,” Grayscale said.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Ripple vs. XRP Drama Returns

The SEC has resumed its legal challenge against Ripple, appealing a recent court decision that favored XRP.

The ongoing legal battle could significantly affect the classification and regulation of XRP as a non-security. Ripple’s CEO has voiced frustration over the SEC’s actions, emphasizing the unnecessary strain this puts on the firm and its stakeholders.

“While we’ll fight in court for as long as we need, let’s be clear: XRP’s status as a non-security is the law of the land today – and that does not change even in the face of this misguided – and infuriating – appeal,” Garlinghouse stated.

This development has stirred the market, impacting XRP’s price. As a result, XRP’s price-action struggled during this week. Since Monday, the XRP price has been down by over 17%.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Binance May Soon Delist These 5 Altcoins

Binance is poised to potentially delist five altcoins, reflecting its rigorous compliance and performance standards. The altcoins under scrutiny include Bluzelle (BLZ), CLV (CLV), SelfKey (KEY), Prosper (PROS), and VITE (VITE). Each of these tokens was added to Binance’s Monitoring Tag list, which signals possible issues with volatility, trading volume, or compliance with regulatory standards.

“Keep in mind that tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance warned.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Following the announcement, there was an immediate market reaction with a noticeable decline in the prices of the flagged altcoins. VITE experienced the most substantial impact, plummeting nearly 25%. The others saw declines ranging from about 4.5% to over 15%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Experts Raise Red Flags Over Finances

Circle’s initial public offering (IPO) filing has raised concerns among industry experts, who are sounding alarms over the company’s financial health, distribution costs, and valuation.

While the move marks a significant step toward mainstream financial integration, experts’ skepticism casts doubt on the company’s long-term prospects.

Analysts Highlight Red Flags With Circle IPO

On April 1, BeInCrypto reported that Circle had filed for an IPO. The company plans to list its Class A common stock on the New York Stock Exchange (NYSE) under “CRCL.”

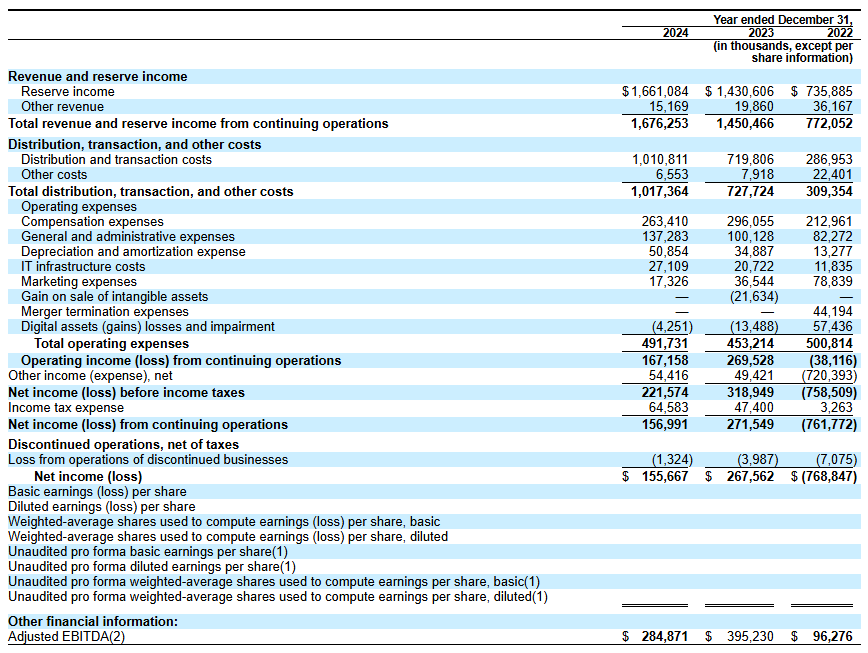

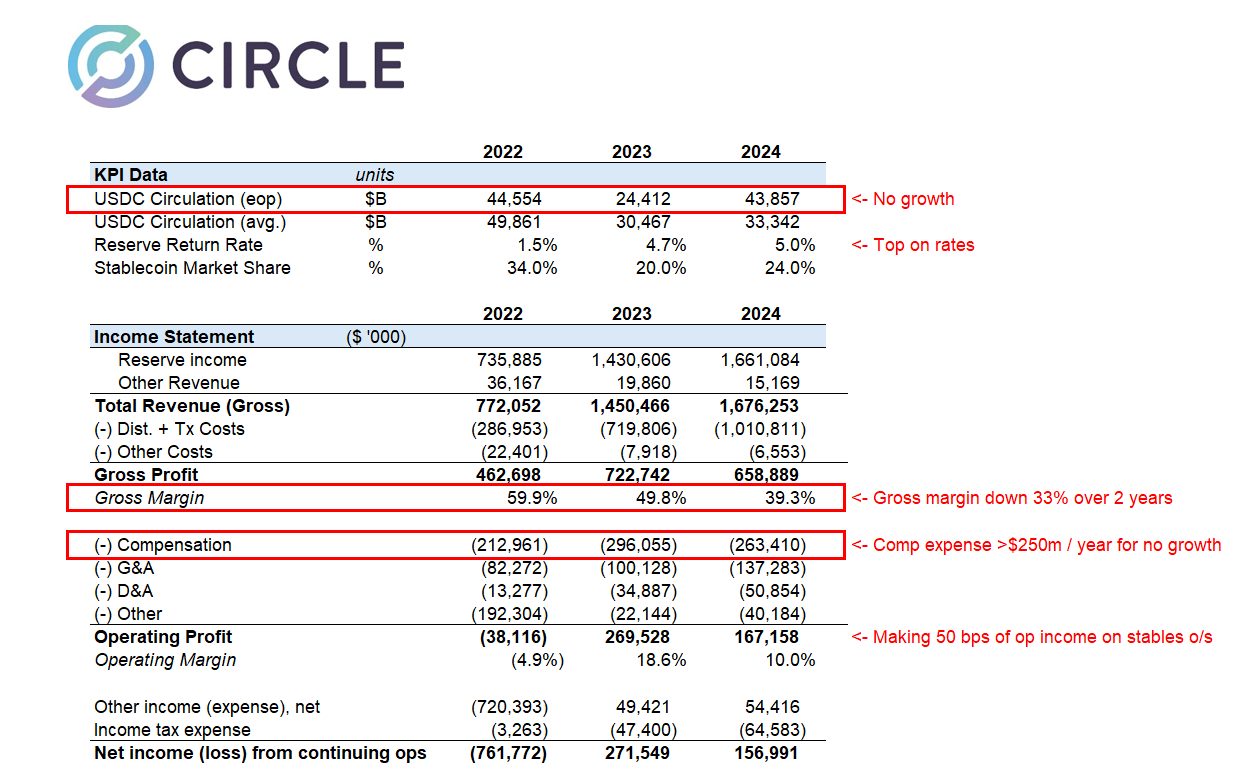

Circle’s IPO filing reveals revenue of $1.67 billion in 2024, a notable increase from previous years. However, a closer examination of the company’s financials has uncovered some challenges.

Matthew Sigel, Head of Digital Assets Research at VanEck, noted that revenue increased 16% year over year. Yet, at the same time, the company reported a 29% decrease in EBITDA year over year, indicating a decline in operational profitability. Additionally, net income fell by 42%, reflecting a significant drop in overall profitability.

Sigel pointed out four factors contributing to the decline in these financial metrics. He explained that the company’s rapid expansion and new service integrations negatively impacted net income.

Furthermore, the discontinuation of services like Circle Yield reduced other revenue streams. This, in turn, exacerbated the decline in profitability.

“Costs related to restructuring, legal settlements, and acquisition-related expenses also played a role in the decline in EBITDA and net income, despite overall revenue growth,” Sigel added.

Importantly, he focused on Circle’s increased distribution and transaction costs. Sigel revealed that the cost rose due to higher fees paid to partners like Coinbase and Binance.

A related post by Farside Investors on X (formerly Twitter) shed further light on these expenses.

“In 2024, the company spent over $1 billion on “distribution and transaction costs,” probably much higher than Tether as a % of revenue,” the post read.

This prompts speculation that Circle may be overspending to maintain its market share in the competitive stablecoin sector. The company’s historical performance further fuels skepticism.

Farside Investors added that in 2022, Circle recorded a staggering $720 million loss. Notably, the year was marked by significant turmoil in the crypto industry, including the high-profile collapses of FTX and Three Arrows Capital (3AC).

This suggests that Circle may be vulnerable to market shocks. Thus, it calls into question the company’s risk management capabilities—especially in the inherently volatile crypto market.

“The gross creation and redemption numbers are a lot higher than we would have thought for USDC. Gross creations in a year are many multiples higher than the outstanding balance,” Farside Investors remarked.

In addition, analyst Omar expressed doubts about Circle’s $5 billion valuation.

“Nothing to love in the Circle IPO filing and no idea how it prices at $5 billion,” he questioned.

He drew attention to several concerns, including the company’s gross margins being severely impacted by high distribution costs. The analyst also pointed out that the deregulation of the US market is poised to disrupt Circle’s position.

Additionally, Omar stressed that Circle spends over $250 million annually on compensation and another $140 million on general and administrative costs, raising questions about its financial efficiency. He also noted that interest rates—core income drivers for Circle—will likely decline, presenting additional challenges.

“32x ’24 earnings for a business that just lost its mini-monopoly and facing several headwinds is expensive when growth structurally challenged,” Omar said.

Ultimately, the analyst concluded that the IPO filing was a desperate attempt to secure liquidity before facing serious market difficulties.

Meanwhile, Wyatt Lonergan, General Partner at VanEck, shared his predictions for Circle’s IPO, outlining four potential scenarios. In the base case, he forecasted that Circle would capitalize on the stablecoin narrative and secure key partnerships to drive growth.

In a bear case, Lonergan speculated that poor market conditions might lead to a Coinbase buyout.

“Circle IPOs, the market continues to tank, Circle stock goes with it. Poor business fundamentals cited. Coinbase swoops in to buy at a discount to the IPO price. USDC is all theirs at long last. Coinbase acquires Circle for something close to the IPO price, and they never go public,” Lonergan claimed.

Lastly, he outlined a probable scenario where Ripple bids up Circle’s valuation to a staggering $15 to $20 billion and acquires the company.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Approaches Resistance—Will It Smash Through?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave above the $1,850 level. ETH is now consolidating and facing key hurdles near the $1,920 level.

- Ethereum started a recovery wave above $1,820 and $1,850 levels.

- The price is trading above $1,860 and the 100-hourly Simple Moving Average.

- There is a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,900 and $1,920 resistance levels to start a decent increase.

Ethereum Price Starts Recovery

Ethereum price managed to stay above the $1,750 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,820 and $1,850 resistance levels.

The bulls even pushed the price above the $1,880 resistance zone. There was a move above the 50% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low. However, the bears are active near the $1,920 zone.

Ethereum price is now trading above $1,850 and the 100-hourly Simple Moving Average. There is also a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,900 level. The next key resistance is near the $1,920 level and the 61.8% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low.

The first major resistance is near the $1,970 level. A clear move above the $1,970 resistance might send the price toward the $2,020 resistance. An upside break above the $2,020 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,920 resistance, it could start another decline. Initial support on the downside is near the $1,860 level and the trend line. The first major support sits near the $1,845 zone.

A clear move below the $1,845 support might push the price toward the $1,800 support. Any more losses might send the price toward the $1,765 support level in the near term. The next key support sits at $1,710.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,860

Major Resistance Level – $1,920

Market

Bitcoin Price Bounces Back—Can It Finally Break Resistance?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave above the $83,500 zone. BTC is now consolidating and might struggle to settle above the $85,500 zone.

- Bitcoin started a decent recovery wave above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $83,500 zone.

Bitcoin Price Starts Recovery

Bitcoin price managed to stay above the $82,000 support zone. BTC formed a base and recently started a decent recovery wave above the $82,500 resistance zone.

The bulls were able to push the price above the $83,500 and $84,200 resistance levels. The price even climbed above the $85,000 resistance. A high was formed at $85,487 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,550 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,200 level. The first key resistance is near the $85,500 level. The next key resistance could be $85,850. A close above the $85,850 resistance might send the price further higher. In the stated case, the price could rise and test the $86,650 resistance level. Any more gains might send the price toward the $88,000 level or even $88,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $84,500 level and the trend line. The first major support is near the $83,500 level and the 50% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

The next support is now near the $82,850 zone. Any more losses might send the price toward the $82,000 support in the near term. The main support sits at $80,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $83,500.

Major Resistance Levels – $85,200 and $85,500.

-

Bitcoin19 hours ago

Bitcoin19 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market21 hours ago

Market21 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin20 hours ago

Bitcoin20 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Altcoin17 hours ago

Altcoin17 hours agoWill XRP, SOL, ADA Make the List?

-

Market23 hours ago

Market23 hours agoXRP Bulls Fight Back—Is a Major Move Coming?

-

Market22 hours ago

Market22 hours agoIs CZ’s April Fool’s Joke a Crypto Reality or Just Fun?

-

Market20 hours ago

Market20 hours agoXRP Price Struggles as Whale Selling Rises To $2.3 Billion

-

Market19 hours ago

Market19 hours agoFake Gemini Bankruptcy Emails Target Users