Market

Should SOL Holders Worry About Solana’s 13% Drop Extending?

Solana’s (SOL) price has faced a tough time maintaining its upward momentum, particularly after repeated failed attempts to secure $161 as a support level over the past two months.

Another failed breach of this level recently triggered a 13% decline in SOL’s price, pushing it down to $139. As the cryptocurrency battles ongoing downward pressure, traders are left wondering if further declines are on the horizon.

Solana Traders Have a Trick up Their Sleeve

At the moment, the macro momentum for Solana is pointing toward a bearish outlook, as reflected in key technical indicators. The Relative Strength Index (RSI) has fallen below the neutral line of 50.0, signaling increasing bearish momentum. RSI’s position in the bearish zone suggests that selling pressure has intensified, with little indication of a reversal in the near term.

Following Solana’s failed breach of the $161 resistance level, the buildup of bearish sentiment has gained strength. With the RSI showing no signs of recovery, it appears that SOL is set to face more downward pressure in the short term, potentially leading to further price declines.

Read more: Solana vs. Ethereum: An Ultimate Comparison

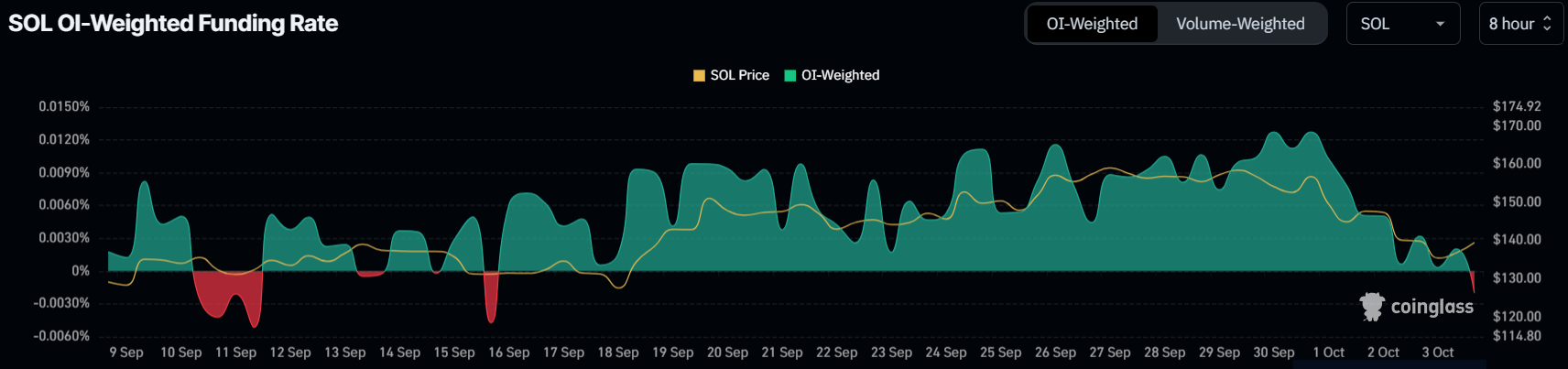

Market sentiment around Solana has also shifted to the downside. Traders are positioning themselves to capitalize on a potential further decline by placing short contracts in the Futures market. These short contracts have now surpassed long contracts as traders look to profit from SOL’s falling price.

This sentiment shift is further evidenced by Solana’s funding rate, which has turned negative for the first time in over two weeks. The negative funding rate indicates that the market is now predominantly bearish, with traders anticipating more losses in the near future.

SOL Price Prediction: Finding Support

Solana’s price is currently trading at $139, just below the local support level of $140. Considering the ongoing bearish momentum and negative market sentiment, a further drop to $124 is more likely. This level acted as a support for SOL last month, with the cryptocurrency bouncing back from it previously.

However, if Solana fails to hold the $124 support level, a drop to $120 could be next, forming the lower limit of the consolidation range under $161. This would represent a further decline for the cryptocurrency, leaving it vulnerable to additional losses.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

On the other hand, if Solana manages to flip $140 into a support level, it could have a chance to rise back toward the $160 range. Breaching the local resistance at $155 would invalidate the current bearish outlook, giving SOL a renewed opportunity to recover and potentially push higher in the weeks ahead.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Token Unlocks to Watch Next Week: AVAX, ADA and More

Token unlocks release tokens previously restricted under fundraising agreements. Projects strategically schedule these releases to minimize market pressure and prevent token price declines.

Here are three major token unlocks to keep an eye on next week.

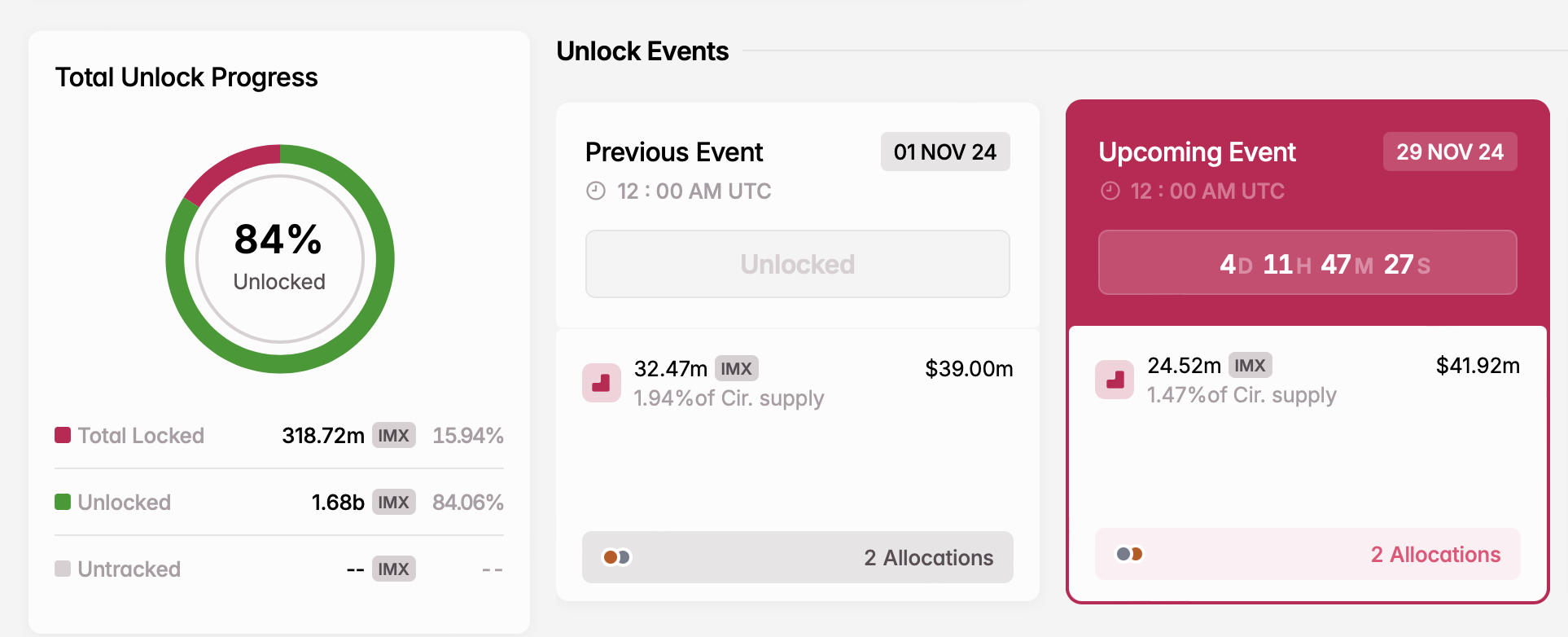

Immutable (IMX)

- Unlock date: November 29

- Number of tokens unlocked: 24.52 million IMX

- Current circulating supply: 1.67 billion IMX

Immutable, a Layer-2 solution for scaling NFTs on Ethereum, raised $12.5 million in just one hour during its IMX token sale on CoinList in September 2021. By March 2022, the project secured $60 million in an investment round, followed by an additional $200 million from investors such as ParaFi Capital, Declaration Partners, and Tencent Holdings.

On November 29, Immutable will release 24.52 million new IMX tokens into circulation. These tokens will support project development and growth within the broader Immutable ecosystem.

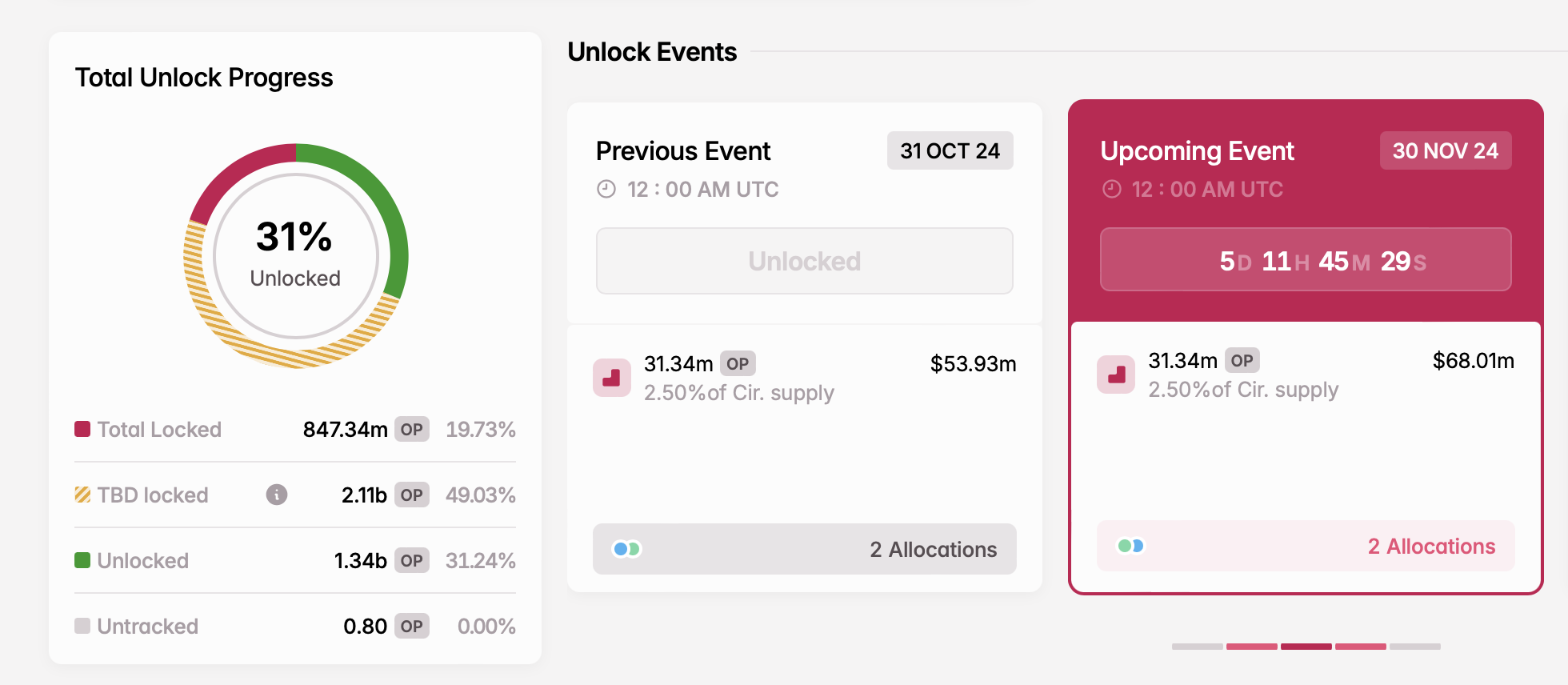

Optimism (OP)

- Unlock date: November 30

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.25 billion OP

Optimism, a Layer-2 scaling solution, enhances transaction speed and reduces costs on the Ethereum mainnet. Its OP token is vital for governance, enabling holders to vote on proposals and influence the network’s development and management.

On November 30, Optimism will release 31.34 million OP tokens into circulation. Tokenomist (formerly TokenUnlocks) reports that core contributors and investors will receive these tokens.

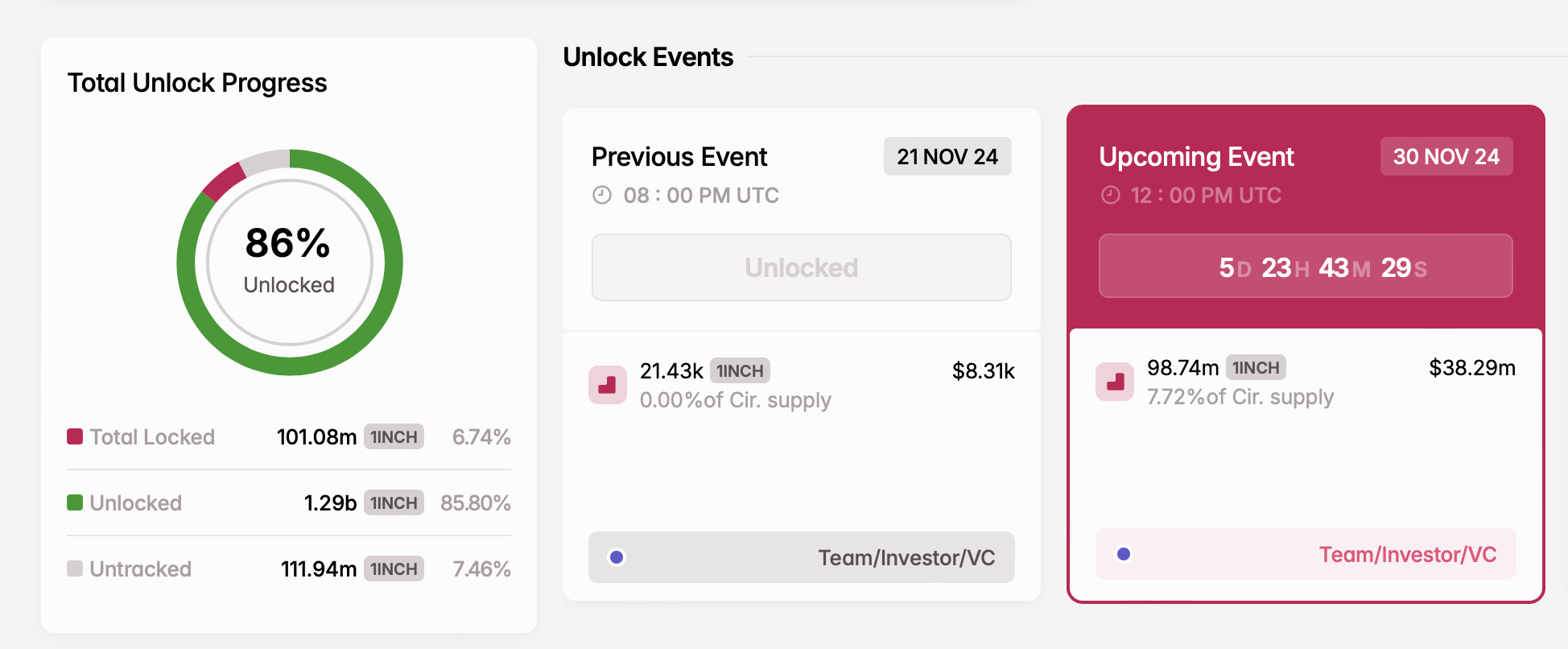

1Inch (1INCH)

- Unlock date: November 30

- Number of tokens unlocked: 98.74 million 1INCH

- Current circulating supply: 1.27 billion 1INCH

1inch is a decentralized exchange aggregator that pools liquidity from multiple DEXs to offer users the best trading rates. It streamlines trading by identifying the most efficient transaction routes, minimizing slippage, and lowering fees.

On November 30, 1inch will unlock nearly 100 million 1INCH tokens. These tokens are allocated for developers, early investors, and venture capital funds.

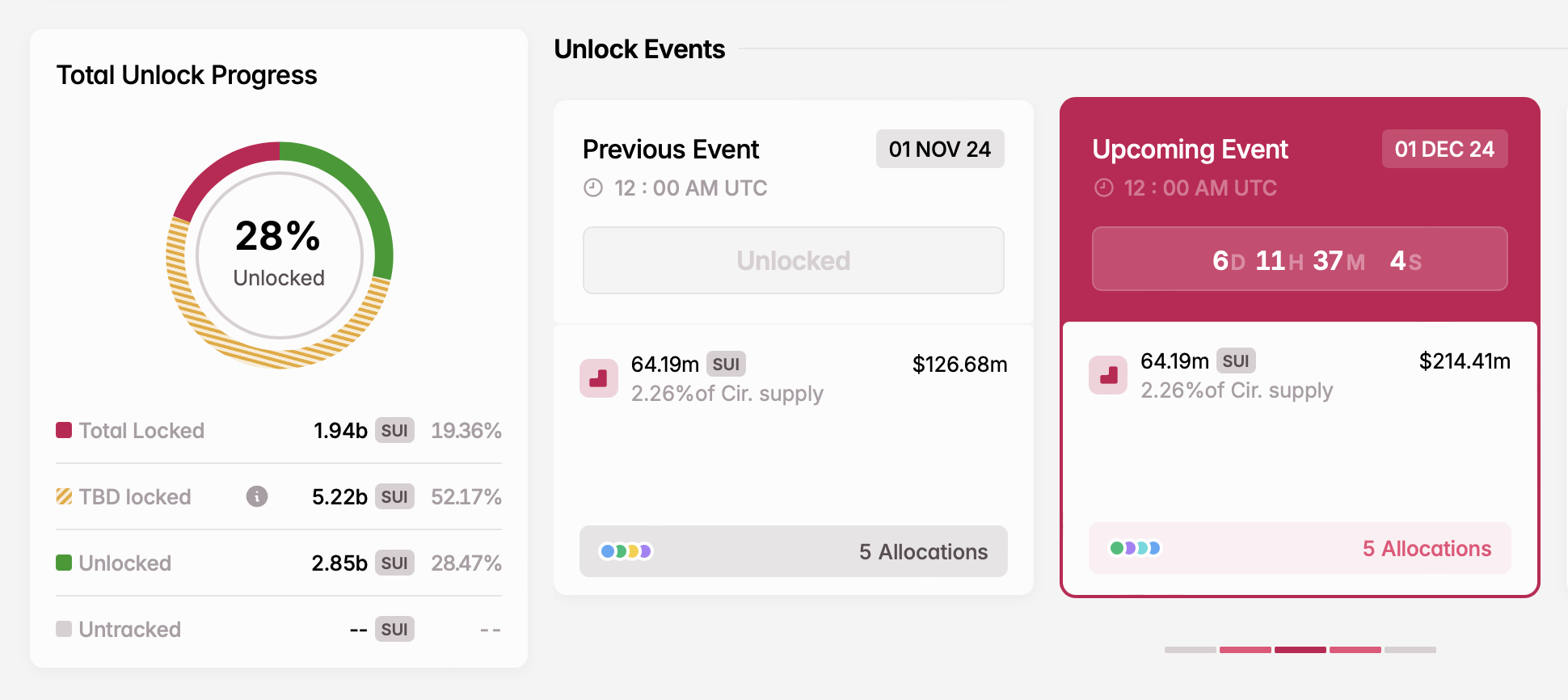

Sui (SUI)

- Unlock date: December 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 2.84 billion SUI

Sui is a high-performance Layer-1 blockchain designed to enhance network operations and security using a Proof-of-Stake consensus mechanism. Developed by Mysten Labs, the project was founded in 2021 by former Novi Research employees who were instrumental in creating the Diem blockchain and the Move programming language.

The SUI token supports governance, allowing holders to vote on key proposals and influence the platform’s direction. On December 1, the next token unlock will release a significant portion of tokens allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

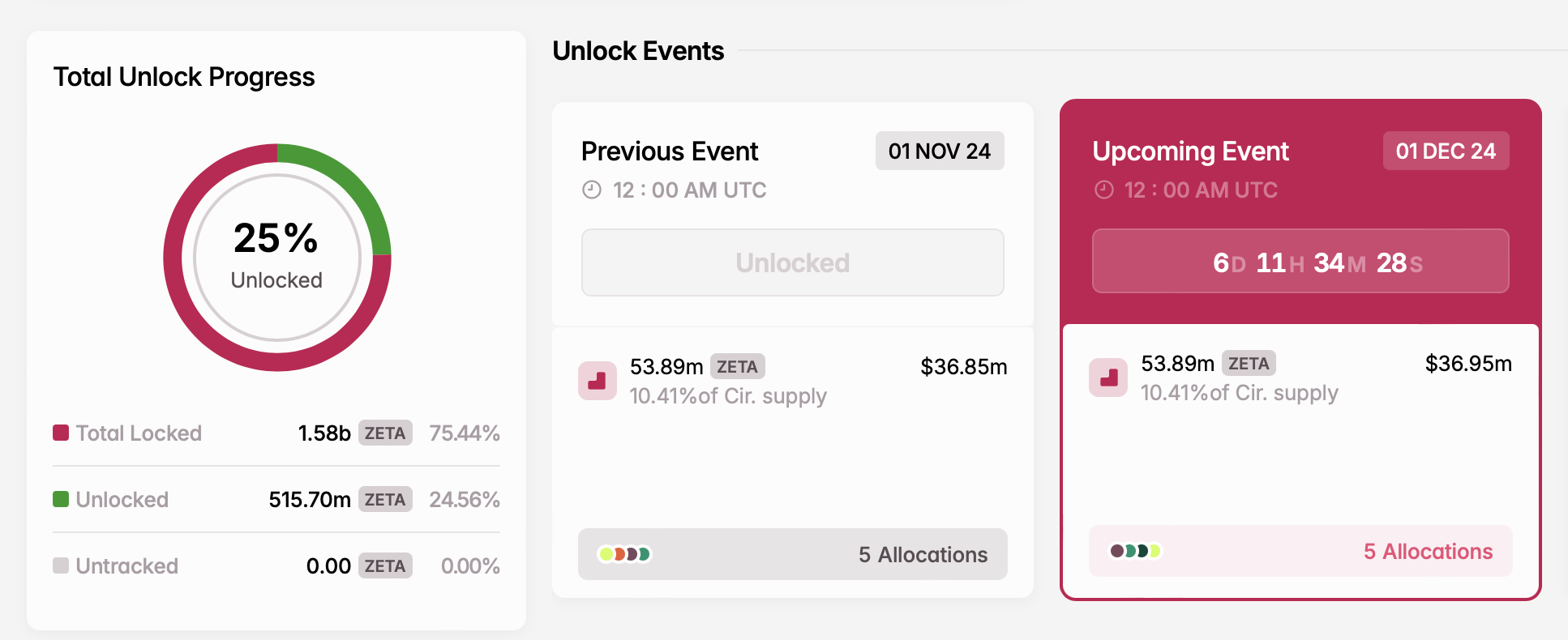

ZetaChain (ZETA)

- Unlock date: December 1

- Number of tokens unlocked: 53.89 million ZETA

- Current circulating supply: 517.85 million ZETA

ZetaChain is a decentralized blockchain platform designed to enable seamless interoperability between different blockchain networks. The platform’s standout feature enables cross-chain communication, allowing the exchange of tokens and data across blockchains like Ethereum and Binance Smart Chain.

On December 1, ZetaChain will release nearly 54 million ZETA tokens. These tokens will support various initiatives, including a user growth pool, an ecosystem growth fund, rewards for core contributors, advisory roles, and liquidity incentives.

Next week’s cliff token unlocks will also include Cardano (ADA), Ethena (ENA), and dYdX (DYDX), among others, with a total combined value exceeding $540 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is the XRP Price Decline Going To Continue?

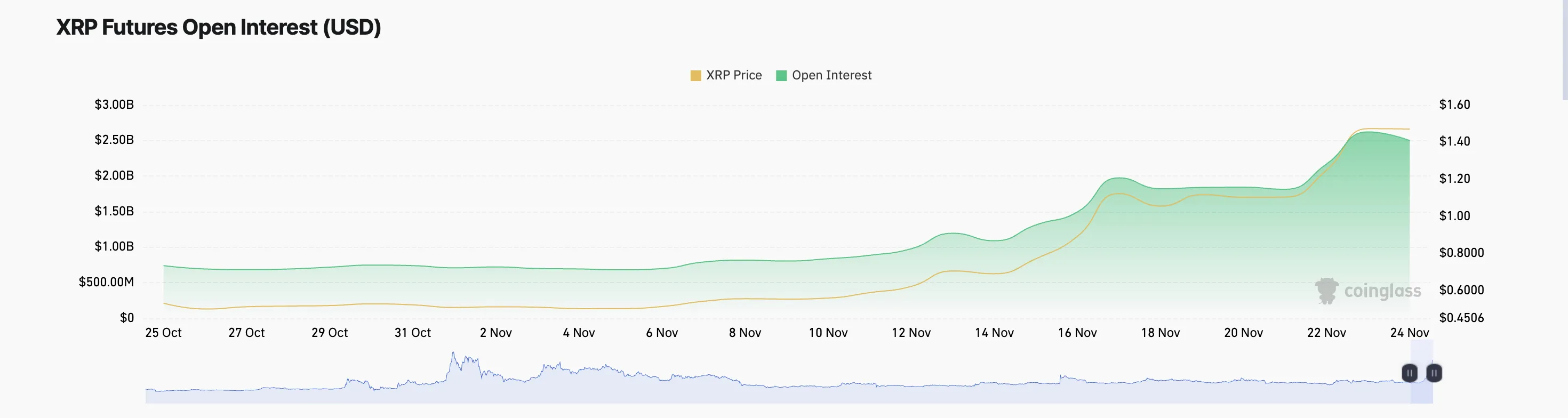

Ripple’s XRP hit a year-to-date high of $1.63 on November 23. However, fading bullish momentum has made future traders doubtful about the rally’s sustainability. An increasing number are opening short positions, expecting a near-term price correction.

Currently trading at $1.44, XRP has declined by 6% in the past 24 hours. This analysis explores the recent activity in the token’s futures market and assesses the likelihood of a continued XRP price decline.

Ripple Traders Bet on a Price Drop

A drop in its open interest has accompanied XRP’s price decline over the past 24 hours. Per Coinglass data, this sits at $2.52 billion, falling by 9% during that period.

Open interest refers to the total number of active contracts in a derivatives market, such as futures or options, that have not been settled. When open interest drops as an asset’s price falls, traders are closing their positions to lock in profits or minimize losses, indicating reduced market participation.

In XRP’s case, this suggests waning confidence in the continuation of the uptrend and hints at a sustained reversal in the asset’s price movement.

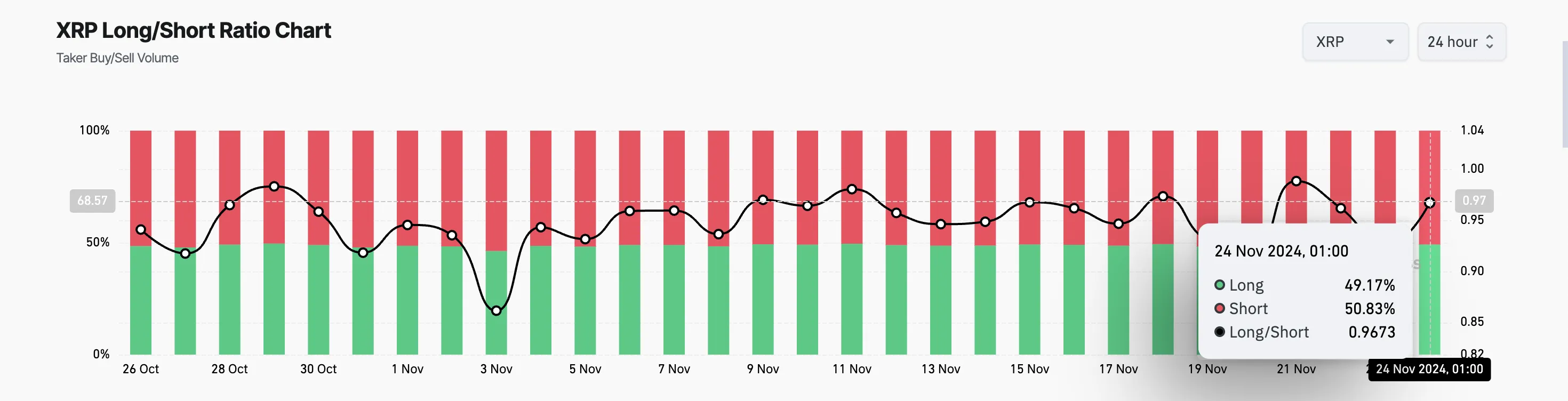

Moreover, XRP’s Long/Short ratio confirms this bearish outlook. As of this writing, this sits at 0.96%, with 51% of all positions opened shorting the altcoin.

The Long/Short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price decreases) in a market. When the ratio is below 1, it indicates that there are more short positions than long positions, suggesting a bearish sentiment among traders.

This imbalance in the XRP market reflects growing pessimism about the asset’s near-term prospects and may contribute to continued downward pressure on its price.

XRP Price Prediction: More Declines Imminent

XRP is currently trading at $1.44, holding above the $1.33 support level. If bearish sentiment intensifies, the price could drop to this support. A further decrease in buying pressure at that level may push XRP down to $1.15.

On the other hand, a shift in market sentiment from negative to positive will invalidate this bearish outlook. Should this happen, the altcoin will reclaim its year-to-date high of $1.63 and attempt to surpass it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Winklevoss Urges Scrutiny of FTX and SBF Political Donations

Gemini co-founder Cameron Winklevoss has called for a renewed investigation into the dropped campaign finance charges against Sam Bankman-Fried, the convicted founder of the now-defunct FTX exchange.

Winklevoss emphasized the need for the incoming US Attorney General to address unresolved concerns about how these charges, tied to election interference involving stolen customer funds, were handled.

Winklevoss Demands Probe Into FTX-Linked Election Interference Accusations

In a November 23 post on X, Winklevoss expressed the belief that the campaign finance allegations remain a critical issue. He pointed to the Department of Justice under Merrick Garland, which declined to pursue these charges due to extradition technicalities with the Bahamian government.

According to Winklevoss, the DOJ chose not to work through the required legal processes to include the campaign finance violations in the indictment, leaving the matter unaddressed.

“Merrick Garland’s DOJ refused to pursue campaign finance charges against SBF because they were not included in his extradition…Since when has paperwork stood in between a prosecutor and adding more charges? Especially when it involves election interference with $100m of stolen customer funds,” Winklevoss stated.

Federal prosecutors initially dropped the campaign finance charge last year, attributing their decision to objections from Bahamian authorities. This charge involved over $100 million allegedly funneled from Alameda Research to fund more than 300 political contributions.

According to the indictment, these contributions, often made through straw donors or corporate funds, aimed to enhance Bankman-Fried’s influence in Washington, D.C.

The indictment also noted that Bankman-Fried became a top political donor in the 2022 midterm elections. He allegedly used the funds to gain favor with candidates across party lines, potentially shaping legislation favorable to FTX and the broader crypto industry.

Winklevoss’ remarks come as other key figures in the FTX collapse face their consequences. While Caroline Ellison and Ryan Salame received sentences of two years and 7.5 years, respectively, Gary Wang and Nishad Singh avoided prison by cooperating with prosecutors. Bankman-Fried is currently serving a 25-year prison sentence for fraud and other crimes.

Meanwhile, FTX has announced plans to implement its approved reorganization strategy starting in January. The exchange’s bankruptcy managers have recovered billions of dollars for creditors and are intensifying efforts to reclaim assets held by other entities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin11 hours ago

Altcoin11 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Ethereum23 hours ago

Ethereum23 hours agoDeribit Moves $783M in Ethereum To Cold Storage: A Bullish Signal for ETH?

-

Market23 hours ago

Market23 hours agoSolana Sees Surge in Meme Coin Activity and Rising Fees

-

Market22 hours ago

Market22 hours agoWhy BTC Miners Are Selling Their Coins

-

Market20 hours ago

Market20 hours agoKraken Eyes Token Expansion as Trump Promises Crypto Support

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Price To $28: Wave Analysis Reveals When It Will Reach Double-Digits

-

Market19 hours ago

Market19 hours agoXRP To Hit $40 In 3 Months But On This Condition – Analyst

-

Market18 hours ago

Market18 hours agoExploring Hottest New Coins: FINE, CHILLGUY, and CHILLFAM