Market

BlackRock Executive Predicts Bitcoin Market at $5.4 Trillion Soon

BlackRock’s US Head of Thematics and Active ETFs, Jay Jacobs, said there is plenty of room for Bitcoin adoption. Jay still estimates a market of Brazilian Real 30 trillion ( ~ $5.4 trillion) in the coming years.

The executive attended the Digital Assets Conference in Brazil on Thursday. Mercado Bitcoin promoted the event in partnership with CME Group, Deribit, and Fireblock.

BlackRock is the largest fund manager on the planet and one of the first to have authorization and issue Bitcoin ETFs in the US.

Why do Investors Demand Bitcoin?

Jacobs said the fund manager began looking at Bitcoin after growing demand from clients looking for different assets in portfolios.

“They (investors) want something other than stocks and bonds. If you look at the last couple of years, there has been this growing correlation between stocks and bonds. It has been very difficult to achieve diversification, particularly in an environment of higher rates. And then people have actually tried to scour the opportunity to get alternatives. Maybe this is going to private markets,” Jacobs explained.

Read more: Who Owns the Most Bitcoin in 2024?

In addition, another demand that drove BTC adoption at BlackRock was sophisticated investors who wanted a more liquid portfolio to diversify investments.

That said, BlackRock now manages nearly 370,000 BTC, emerging as one of the largest Bitcoin holders. It has already surpassed MicroStrategy’s Bitcoin holding and now only lags behind Satoshi Nakamoto and crypto exchange Binance.

According to the latest data from SoSoValue, BlackRock’s iShare Bitcoin Trust’s (IBIT) Bitcoin stash is worth $22.33 billion.

When asked about the BTC rally, Jacobs said he could not answer. Nonetheless, he believes that diversifying investments with the most valuable cryptocurrency on the market is an assertive strategy.

“It is difficult to paint a picture for each portfolio. What we have found is that it really is more important to look at certain types of investors who can withstand volatility, who can withstand the falls, who have a long-term view,” Jacobs said.

Moreover, Jacobs indicated that BlackRock is also focused on Bitcoin education.

“We want to make it accessible and we want to help people understand Bitcoin first and foremost,” Jacobs stated.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

For Jacobs, Bitcoin is a monetary alternative, while Ethereum is more of a bet on blockchain adoption. The executive said that one of the trends that are changing the world today is geopolitical fragmentation. This is currently changing supply chains.

“We also see the emergence of AI for more technology growth, more technology adoption and digitalization. We see demographic changes around the world. We see aging populations in some countries, others very young in emerging markets. I think this could be another favorable wind for digital assets. Markets where digital assets may be most relevant also have the majority of Millennials and Gen Z who will be the most digital native,” Jacobs concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin ETFs Could Overtake Gold ETFs by End of The Year

Spot Bitcoin exchange-traded funds (ETFs) in the US are nearing a major milestone. They are set to become the biggest BTC holders in the world, even surpassing the amount held by Bitcoin’s creator, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

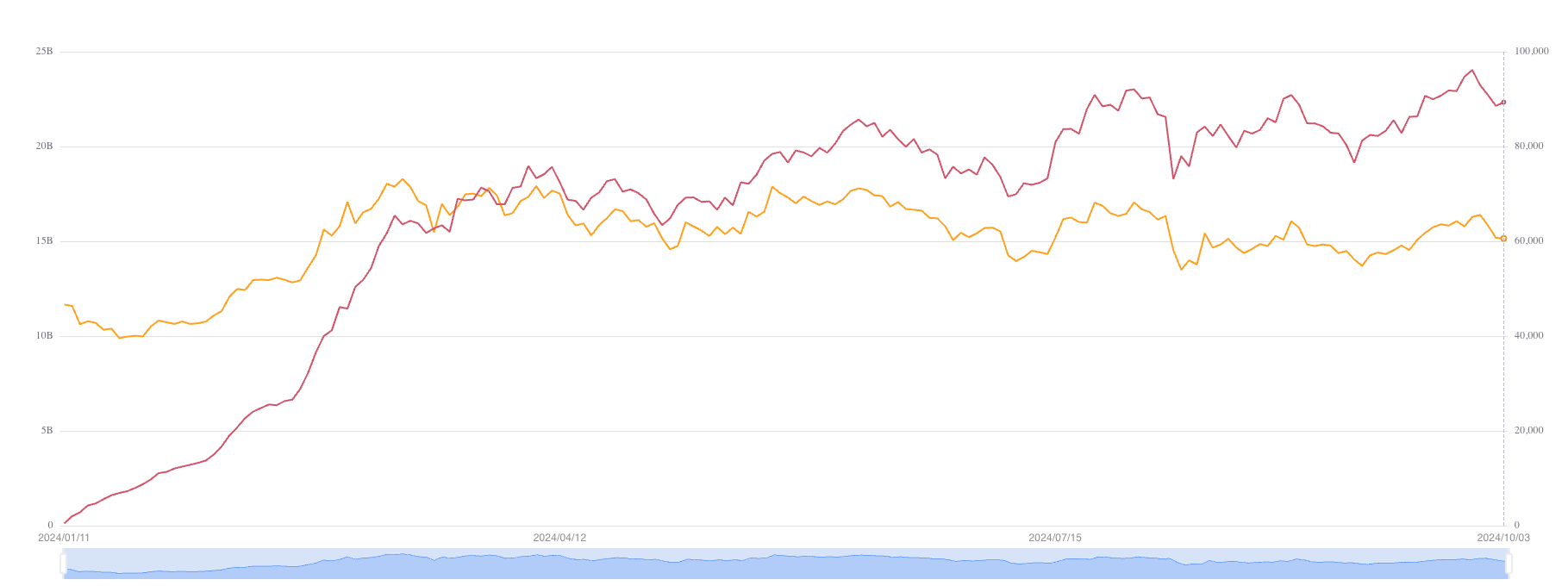

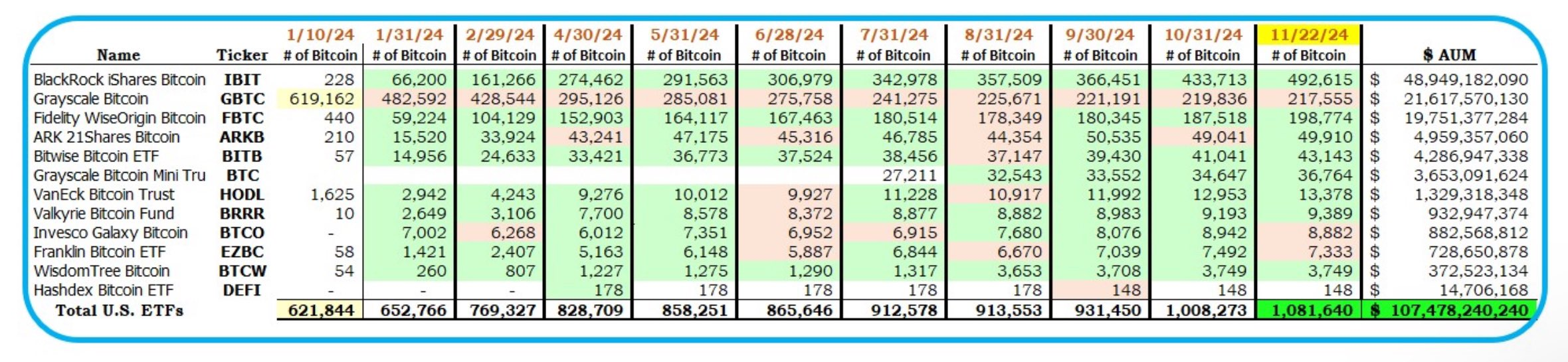

Since their launch in January, US spot Bitcoin ETFs have grown significantly. According to crypto analyst HODL15Capital, these funds now hold about 1.081 million Bitcoin, just below Nakamoto’s estimated 1.1 million.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is believed to own approximately 5.68% of the total Bitcoin supply. These holdings, valued at over $100 billion, place Nakamoto among the world’s wealthiest individuals — if they are alive and a single person.

However, Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that ETFs are now 98% of the way to overtaking Nakamoto. He predicted that if the current pace of inflows continues, this could happen by Thanksgiving.

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good. If next 3 days are like the past 3 days flow-wise it’s a done deal,” Balchunas stated.

SoSoValue data shows inflows into these ETFs grew by around 97% week-on-week to $3.3 billion over the last five trading days, with BlackRock’s iShares Bitcoin Trust (IBIT) contributing $2 billion. This surge coincides with the introduction of options trading for these products, which many believe is attracting more institutional investors.

Meanwhile, Bitcoin ETFs are also narrowing the gap with gold ETFs, which currently hold $120 billion in assets under management (AUM). According to Balchunas, Bitcoin ETFs manage $107 billion and could overtake gold ETFs by Christmas.

These bullish predictions reflect Bitcoin’s exceptional performance in 2024. The top cryptocurrency has surged nearly 160% since January, trading near the $100,000 landmark. In addition, its $1.91 trillion market capitalization now exceeds that of silver and major corporations like the state-owned oil company Saudi Aramco.

However, BTC still lags behind gold, which remains the world’s largest asset with a market capitalization of more than $18 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Ethereum Price May Fall Under $3,000

Ethereum (ETH) is currently facing significant downward pressure, with its price declining by 3% over the past 24 hours. This bearish trend could push ETH’s price below the critical $3,000 price level.

This analysis examines the factors contributing to this likelihood.

Ethereum Sellers Re-Emerge

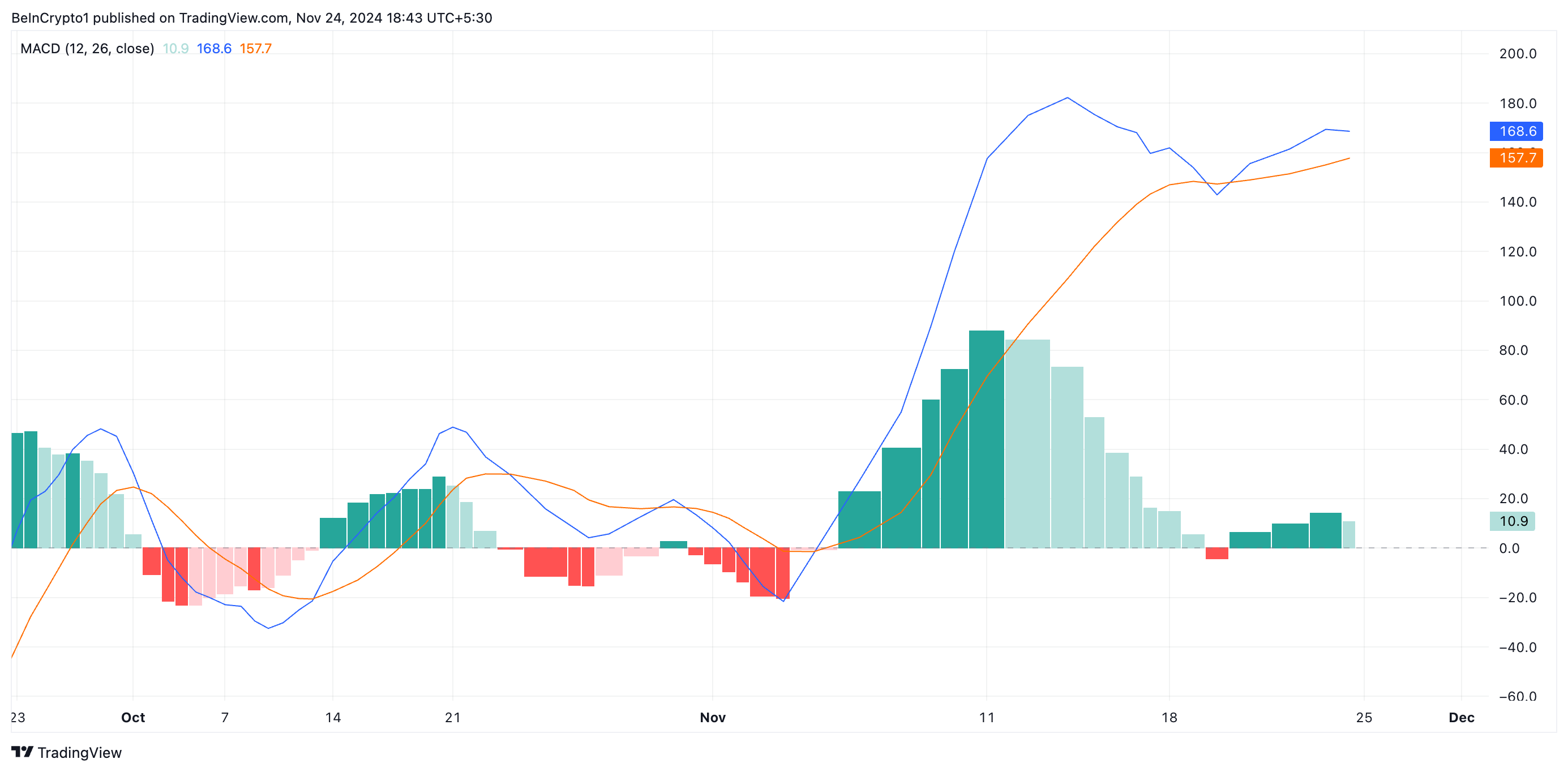

An assessment of the ETH/USD one-day chart has revealed that the coin’s moving average convergence divergence (MACD) indicator is forming a potential death cross. As of this writing, the coin’s MACD line (blue) is attempting to fall below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. A MACD death cross occurs when the MACD line (the shorter-term moving average) crosses below the signal line (the longer-term moving average), indicating a bearish trend or momentum reversal. This signal suggests that selling pressure is increasing, and the asset’s price could decline further.

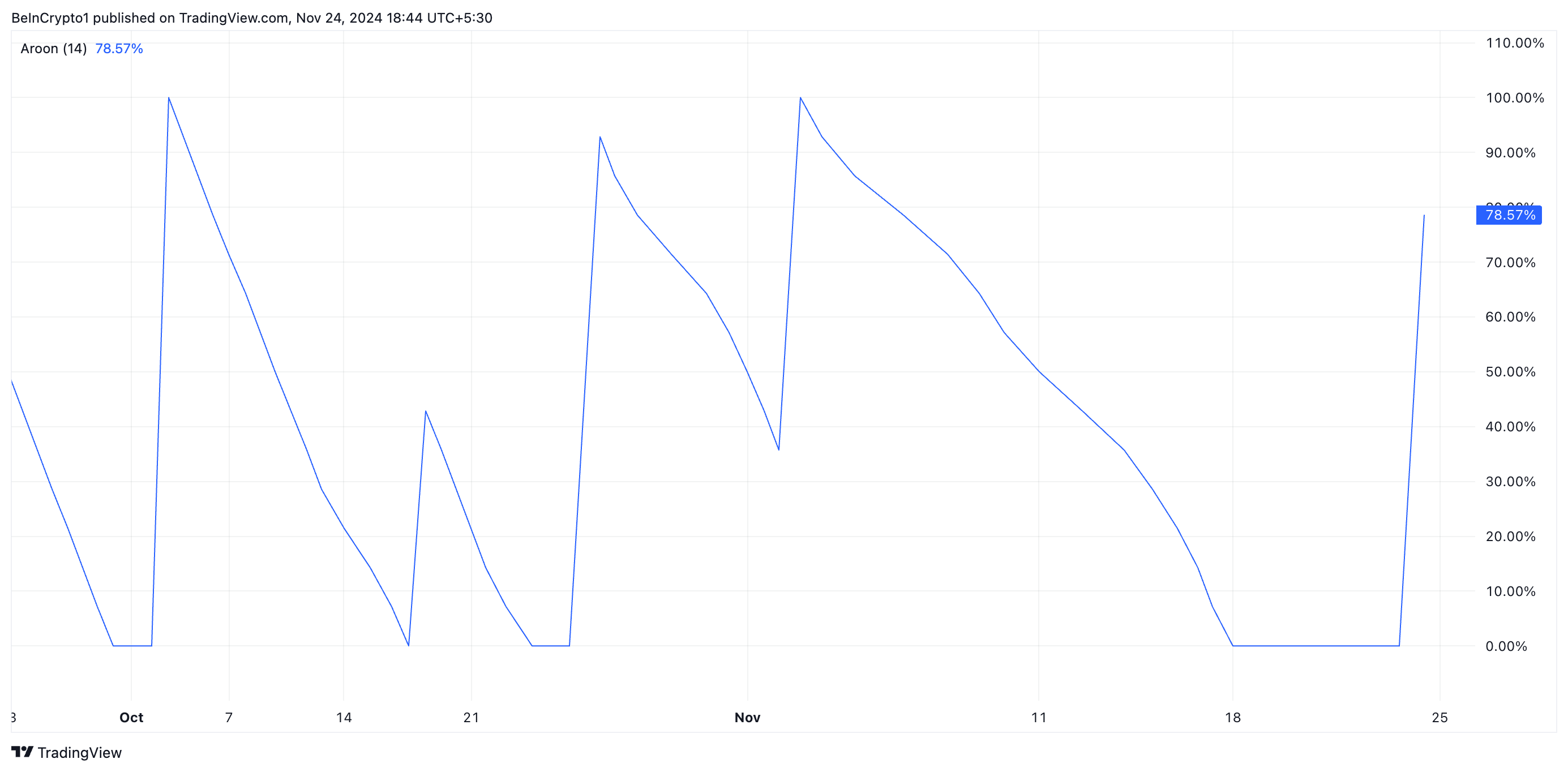

ETH’s rising Aroon Down Line confirms this strengthening bearish pressure. It currently sits at 78.57%, confirming that the decline in ETH’s price is gaining momentum.

The Aroon Indicator evaluates the strength of an asset’s price trend through two components: the Aroon Up line, which reflects the strength of an uptrend, and the Aroon Down line, which reflects the strength of a downtrend. A rising Aroon Down line indicates that recent lows are occurring more frequently, signaling growing bearish momentum or the start of a downtrend.

ETH Price Prediction: Key Support Level To Watch

ETH currently trades at $3,333, resting above the support formed at $3,203. This level is crucial because a decline below it will cause ETH to exchange hands under $3000. According to readings from the coin’s Fibonacci Retracement tool, the Ethereum price will drop to $2,970 if this happens.

However, a resurgence in the demand for the leading altcoin will invalidate this bearish thesis. If this occurs, Ethereum will rally toward $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

Cantor Fitzgerald, a prominent US financial services firm, is expanding its alliance with Tether, a key player in the digital asset industry and the issuer of the world’s largest stablecoin.

According to reports, the firm has agreed to acquire a 5% stake in Tether as part of a broader collaboration that includes Bitcoin-backed lending initiatives.

Tether Mints $13 Billion USDT as Cantor Fitzgerald Deepens Tie

The acquisition talks, reportedly finalized in 2023, valued the 5% stake at approximately $600 million. This partnership positions Tether to gain strategic advantages, particularly as Cantor Fitzgerald’s CEO, Howard Lutnick, takes on his new role as Secretary of Commerce under President-elect Donald Trump.

Market observers suggest that the nomination raises the possibility of enhanced regulatory support for Tether, which has faced scrutiny over potential violations of sanctions and anti-money laundering regulations—a claim the company has denied. However, Lutnick has promised to step down from his positions at Cantor Senate confirmation.

Beyond the ownership stake, Tether is expected to support Cantor Fitzgerald’s Bitcoin lending program, a multi-billion-dollar initiative. The program aims to offer loans backed by Bitcoin, initially funded with $2 billion, with plans for significant future expansion.

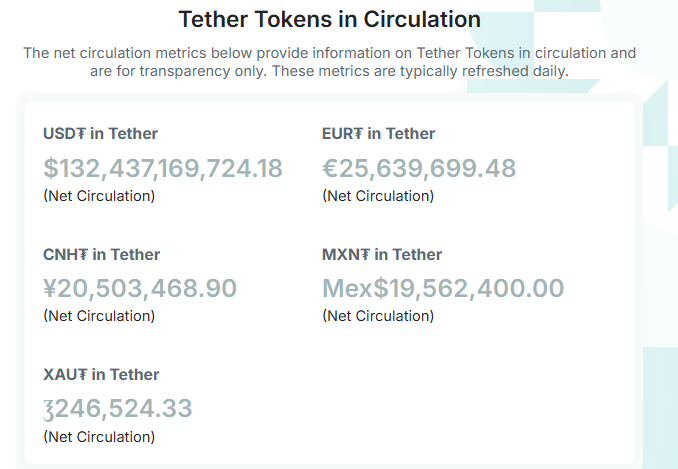

Meanwhile, Cantor Fitzgerald is already a critical partner for Tether, reportedly holding a significant portion of the stablecoin issuer’s $134 billion reserves in US Treasury bills.

As Cantor Fitzgerald deepens its involvement with Tether, the firm has continued its aggressive token minting. On November 24, blockchain analytics platform Lookonchain reported that stablecoin company minted an additional $3 billion USDT, bringing the total minted since November 8 to $13 billion. This expansion has pushed the total supply of USDT to approximately $132 billion.

The increased USDT supply may reflect the growing demand for stablecoins, often used to hedge market positions or facilitate crypto transactions without converting to fiat. This liquidity influx could reduce volatility and enhance price stability across the digital asset market.

This surge in USDT supply coincides with a broader market rally led by Bitcoin and other assets such as Dogecoin and Solana, signaling renewed investor confidence in the crypto ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin17 hours ago

Altcoin17 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Market14 hours ago

Market14 hours agoWhy a New Solana All-Time High May Be Near

-

Bitcoin11 hours ago

Bitcoin11 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market11 hours ago

Market11 hours agoWinklevoss Urges Scrutiny of FTX and SBF Political Donations

-

Bitcoin10 hours ago

Bitcoin10 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin9 hours ago

Bitcoin9 hours agoAI Company Invests $10 Million In BTC Treasury

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Price To $100,000? Here’s What To Expect If BTC Makes History

-

Market9 hours ago

Market9 hours agoIs the XRP Price Decline Going To Continue?