Market

Why TIA Price May Plunge By 30%

The modular blockchain network Celestia will conduct the large token unlock in October, with a massive $1 billion worth of TIA set to be released. Many of its holders have begun selling their tokens before this event.

If selling pressure intensifies, TIA’s price may fall by 30%. This analysis delves into what you need to know as the unlock date approaches.

Celestia Traders Offload Tokens

Token Unlocks data shows that on October 30, Celestia will release 175.56 million TIA tokens, valued at approximately $1 billion, which constitutes 81.86% of the circulating supply. These tokens will be distributed among early supporters, seed investors, and core contributors.

The anticipation of a large token unlock event such as this can often create uncertainty and negative sentiment among investors, leading them to sell their holdings before the event. This has been the case with TIA, which has witnessed a spike in selling pressure over the past week.

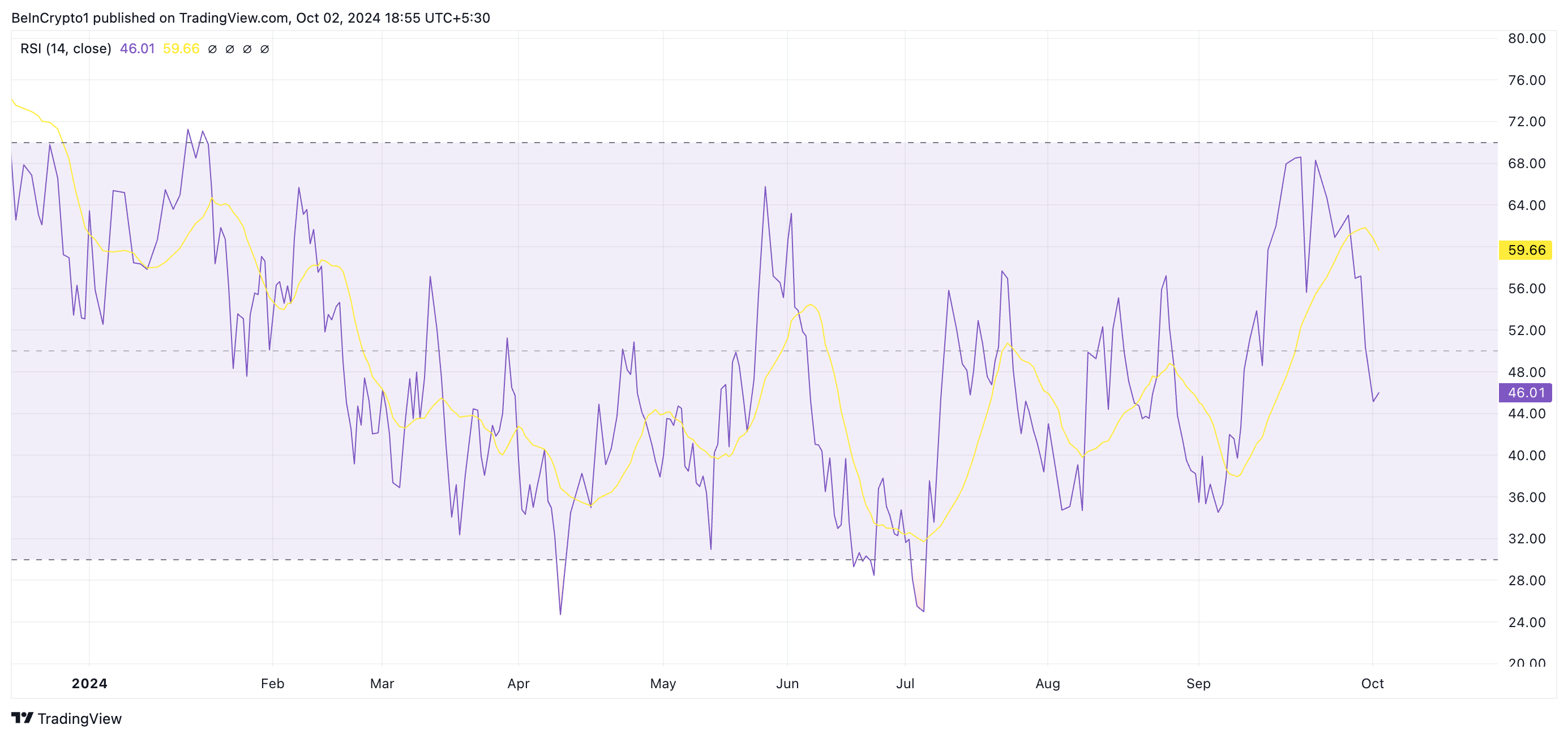

TIA trades at $5.12, noting an 18% price decline over the past week. This makes it the biggest loser among the top 100 cryptocurrencies by market capitalization during this period. The token’s plummeting Relative Strength Index (RSI) confirms the decline in TIA’s demand over the past few days.

Read more: 10 Best Altcoin Exchanges In 2024

This indicator measures an asset’s overbought or oversold conditions. It ranges from 0 to 100, with values above 70 indicating that the asset is overbought and likely to face a decline, while values below 30 suggest it is oversold and may be due for a rebound.

At 46.42, TIA’s RSI shows that selling activity currently outweighs buying pressure, but it does not yet signal extreme conditions. This middle-range reading suggests that the market is relatively neutral, though leaning toward selling pressure.

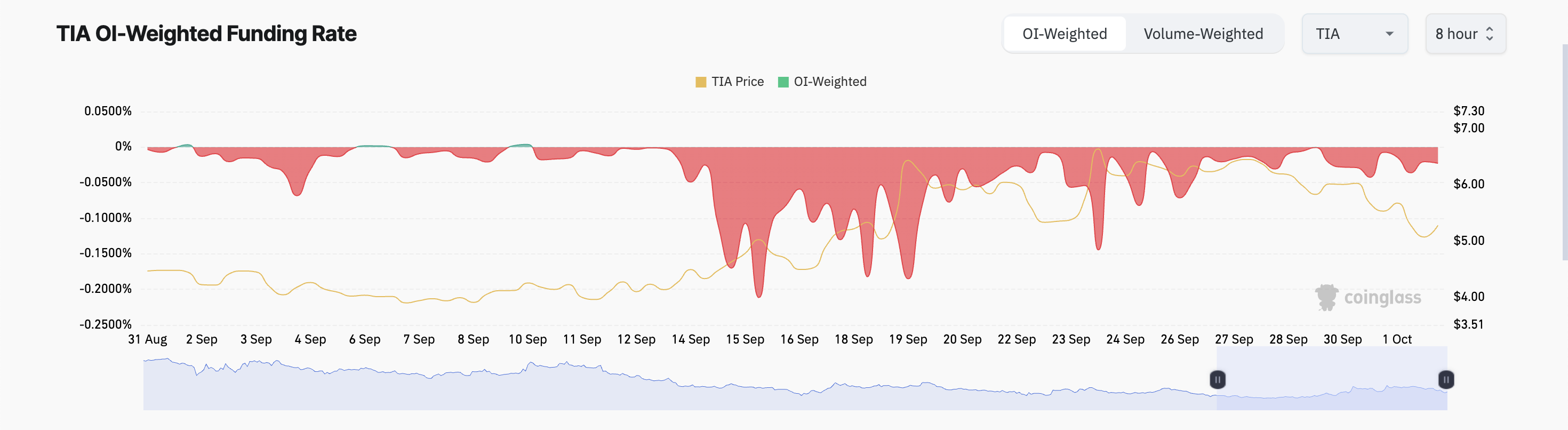

Furthermore, TIA’s negative funding rate reflects the bearish bias. This stands at -0.022% at press time, indicating that futures traders are betting on its continued price decline.

TIA Price Prediction: 30-Day Low on the Horizon

A negative funding rate suggests that more traders are betting against the asset (short positions) than for it (long positions). This puts downward pressure on the asset’s price, reflecting a lack of confidence in price appreciation.

Read more: Which Are the Best Altcoins To Invest in October 2024?

If selling pressure persists, TIA’s price will fall 30% to trade at $3.72, a low it last reached on September 4. However, if it sees a shift in market sentiment from bearish to bullish, and a spike in demand follows, TIA’s price will climb toward $10.37.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

Cantor Fitzgerald, a prominent US financial services firm, is expanding its alliance with Tether, a key player in the digital asset industry and the issuer of the world’s largest stablecoin.

According to reports, the firm has agreed to acquire a 5% stake in Tether as part of a broader collaboration that includes Bitcoin-backed lending initiatives.

Tether Mints $13 Billion USDT as Cantor Fitzgerald Deepens Tie

The acquisition talks, reportedly finalized in 2023, valued the 5% stake at approximately $600 million. This partnership positions Tether to gain strategic advantages, particularly as Cantor Fitzgerald’s CEO, Howard Lutnick, takes on his new role as Secretary of Commerce under President-elect Donald Trump.

Market observers suggest that the nomination raises the possibility of enhanced regulatory support for Tether, which has faced scrutiny over potential violations of sanctions and anti-money laundering regulations—a claim the company has denied. However, Lutnick has promised to step down from his positions at Cantor Senate confirmation.

Beyond the ownership stake, Tether is expected to support Cantor Fitzgerald’s Bitcoin lending program, a multi-billion-dollar initiative. The program aims to offer loans backed by Bitcoin, initially funded with $2 billion, with plans for significant future expansion.

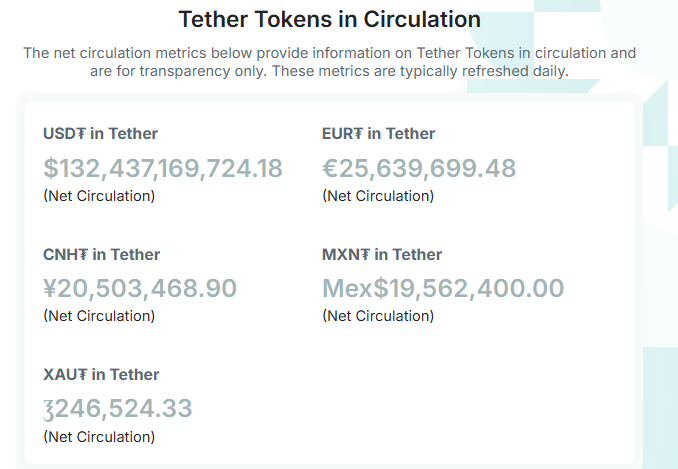

Meanwhile, Cantor Fitzgerald is already a critical partner for Tether, reportedly holding a significant portion of the stablecoin issuer’s $134 billion reserves in US Treasury bills.

As Cantor Fitzgerald deepens its involvement with Tether, the firm has continued its aggressive token minting. On November 24, blockchain analytics platform Lookonchain reported that stablecoin company minted an additional $3 billion USDT, bringing the total minted since November 8 to $13 billion. This expansion has pushed the total supply of USDT to approximately $132 billion.

The increased USDT supply may reflect the growing demand for stablecoins, often used to hedge market positions or facilitate crypto transactions without converting to fiat. This liquidity influx could reduce volatility and enhance price stability across the digital asset market.

This surge in USDT supply coincides with a broader market rally led by Bitcoin and other assets such as Dogecoin and Solana, signaling renewed investor confidence in the crypto ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can the SAND Token Price Rally Be Sustained?

SAND, the token powering the metaverse platform The Sandbox, has seen a meteoric rise, surging 55% in the past 24 hours. This performance far outpaces leading assets like Bitcoin and Ethereum, which each gained just 1% during the same period. SAND’s trading volume has also skyrocketed, surpassing $1.91 billion — a climb of over 500% in 24 hours.

On-chain data has shown a significant increase in daily SAND transactions and a decrease in selling pressure. These factors suggest the potential for a sustained rally.

The Sandbox Holders Adopt a Bullish Approach

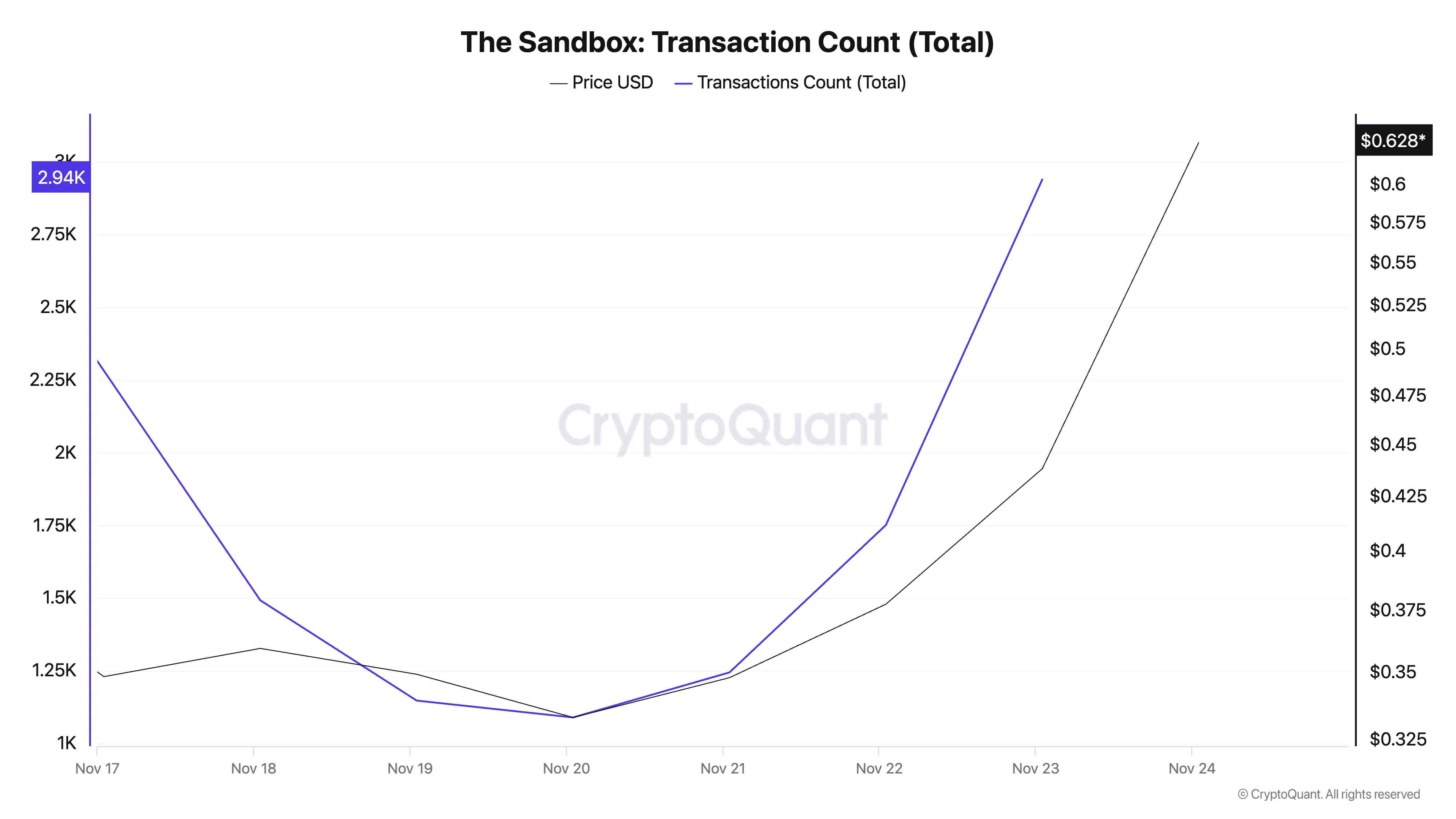

According to CryptoQuant’s data, the daily count of SAND transactions has rocketed over the past few days. For context, on November 23, 2,940 transactions involving SAND were completed, representing the highest count over the past seven days.

This is a bullish signal for the metaverse-based token because a surge in an asset’s transaction count indicates increased activity and interest. It signals higher demand and participation by market participants. Also, it suggests growing confidence in SAND’s price, potentially driving it further upward.

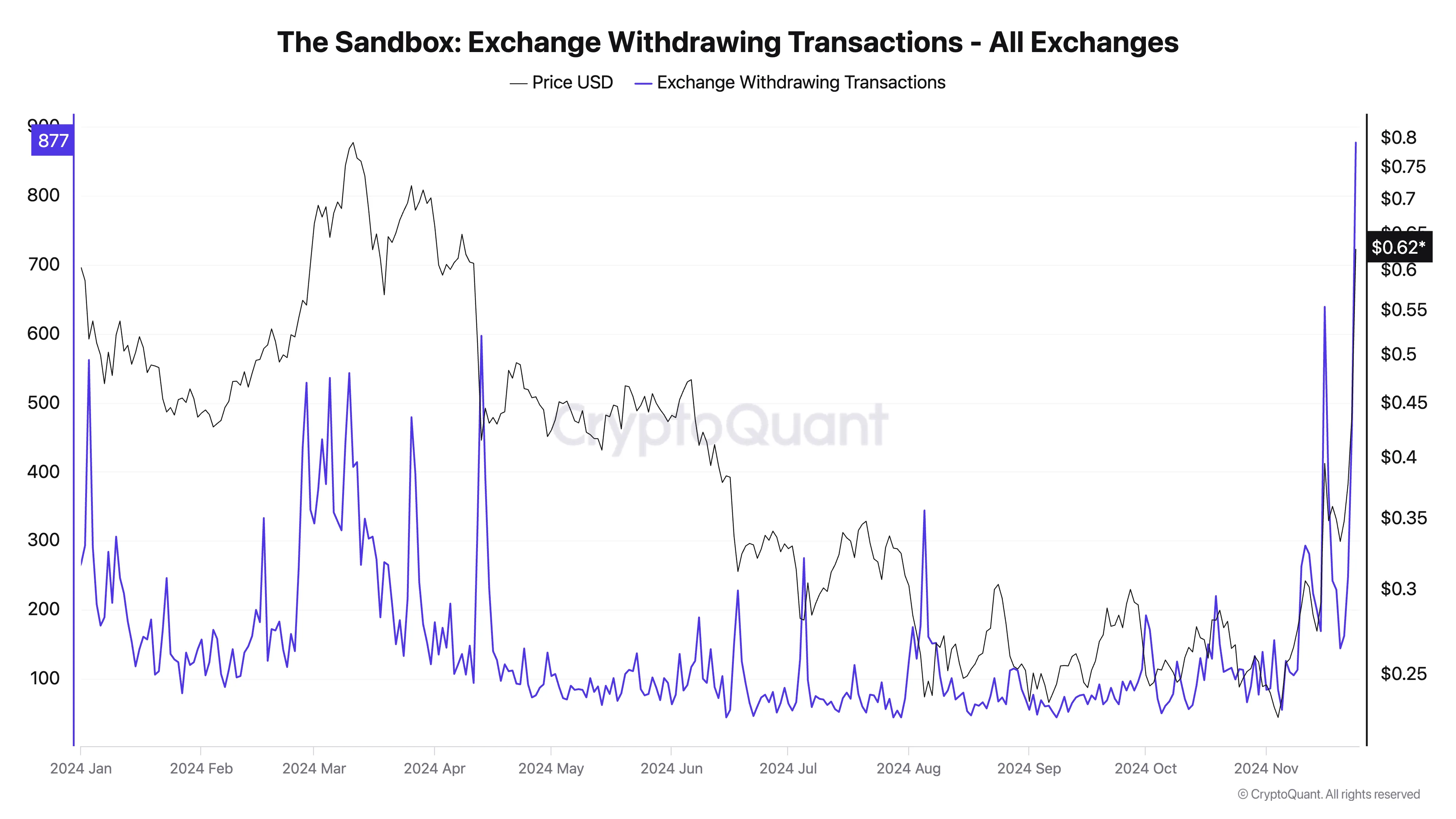

Additionally, a notable increase in exchange withdrawals for SAND has been observed. Per CryptoQuant’s data, the token’s exchange withdrawal transactions currently total 877, its single-day highest since June 2023.

The exchange withdrawing transaction metric tracks the number of cryptocurrency withdrawals from exchanges. A spike in this metric indicates that investors are moving their assets off exchanges. This is a bullish signal, suggesting increased confidence and a potential long-term holding trend.

SAND Price Prediction: Rally Above $0.66?

On the daily chart, SAND is trading at $0.61, a level last seen in April. Its price currently sits below the resistance at its cycle peak of $0.66. If bullish momentum strengthens, SAND could rally toward this peak and reclaim it.

Conversely, if bullish sentiment wanes and selling pressure strengthens, the SAND token price may plunge toward support at $0.56, invalidating this bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Token Unlocks to Watch Next Week: AVAX, ADA and More

Token unlocks release tokens previously restricted under fundraising agreements. Projects strategically schedule these releases to minimize market pressure and prevent token price declines.

Here are three major token unlocks to keep an eye on next week.

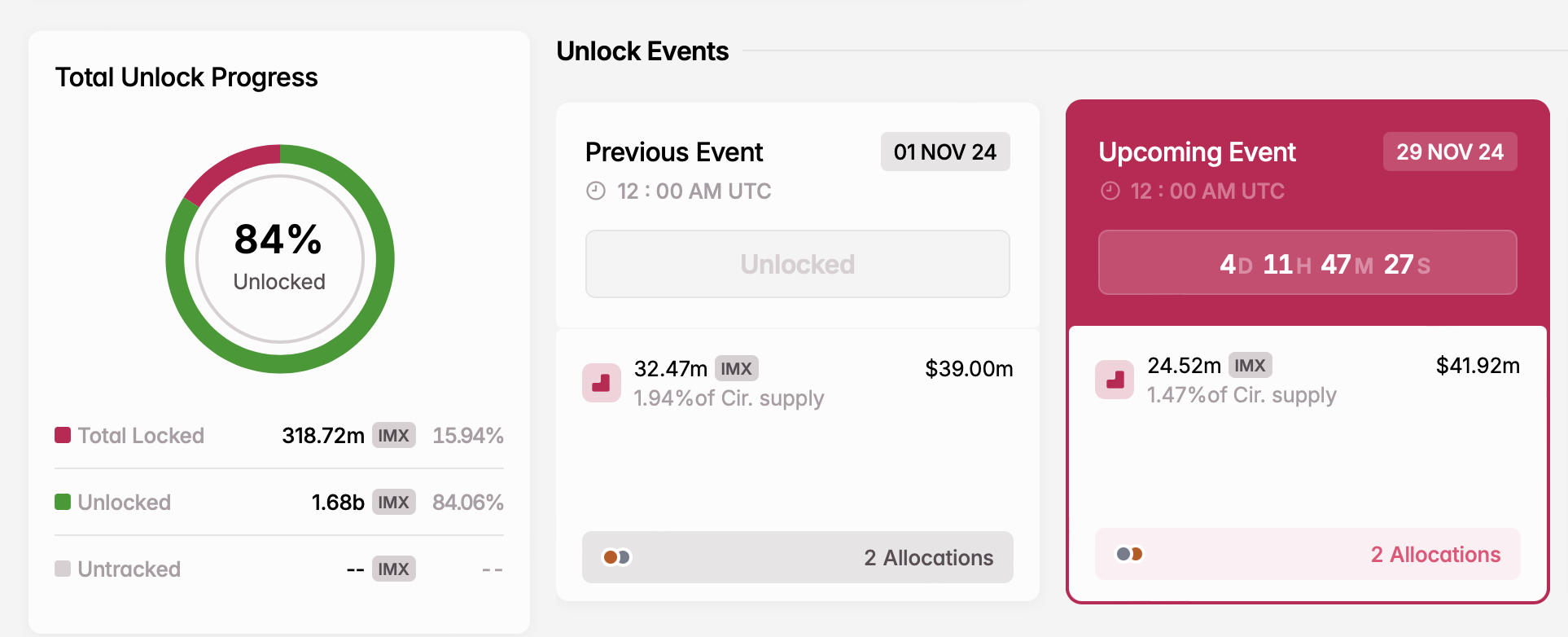

Immutable (IMX)

- Unlock date: November 29

- Number of tokens unlocked: 24.52 million IMX

- Current circulating supply: 1.67 billion IMX

Immutable, a Layer-2 solution for scaling NFTs on Ethereum, raised $12.5 million in just one hour during its IMX token sale on CoinList in September 2021. By March 2022, the project secured $60 million in an investment round, followed by an additional $200 million from investors such as ParaFi Capital, Declaration Partners, and Tencent Holdings.

On November 29, Immutable will release 24.52 million new IMX tokens into circulation. These tokens will support project development and growth within the broader Immutable ecosystem.

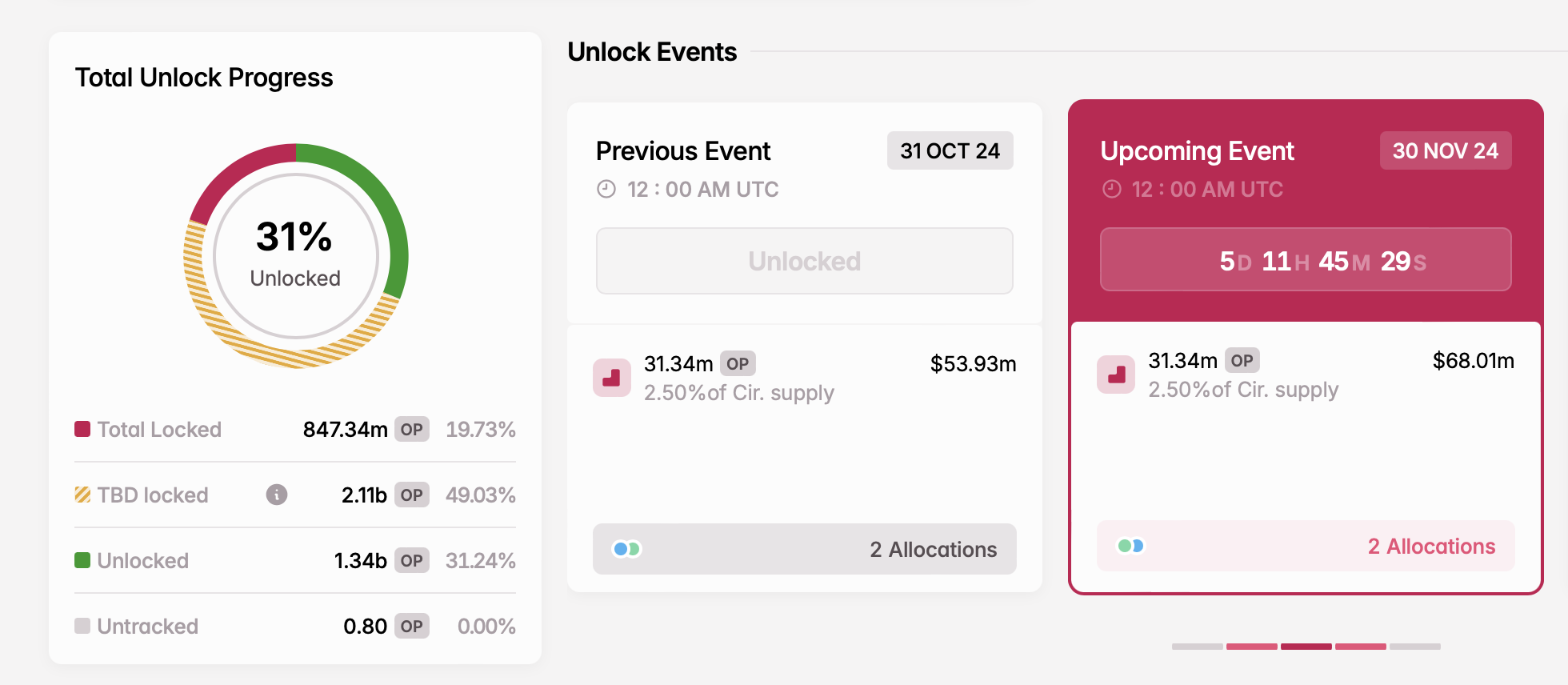

Optimism (OP)

- Unlock date: November 30

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.25 billion OP

Optimism, a Layer-2 scaling solution, enhances transaction speed and reduces costs on the Ethereum mainnet. Its OP token is vital for governance, enabling holders to vote on proposals and influence the network’s development and management.

On November 30, Optimism will release 31.34 million OP tokens into circulation. Tokenomist (formerly TokenUnlocks) reports that core contributors and investors will receive these tokens.

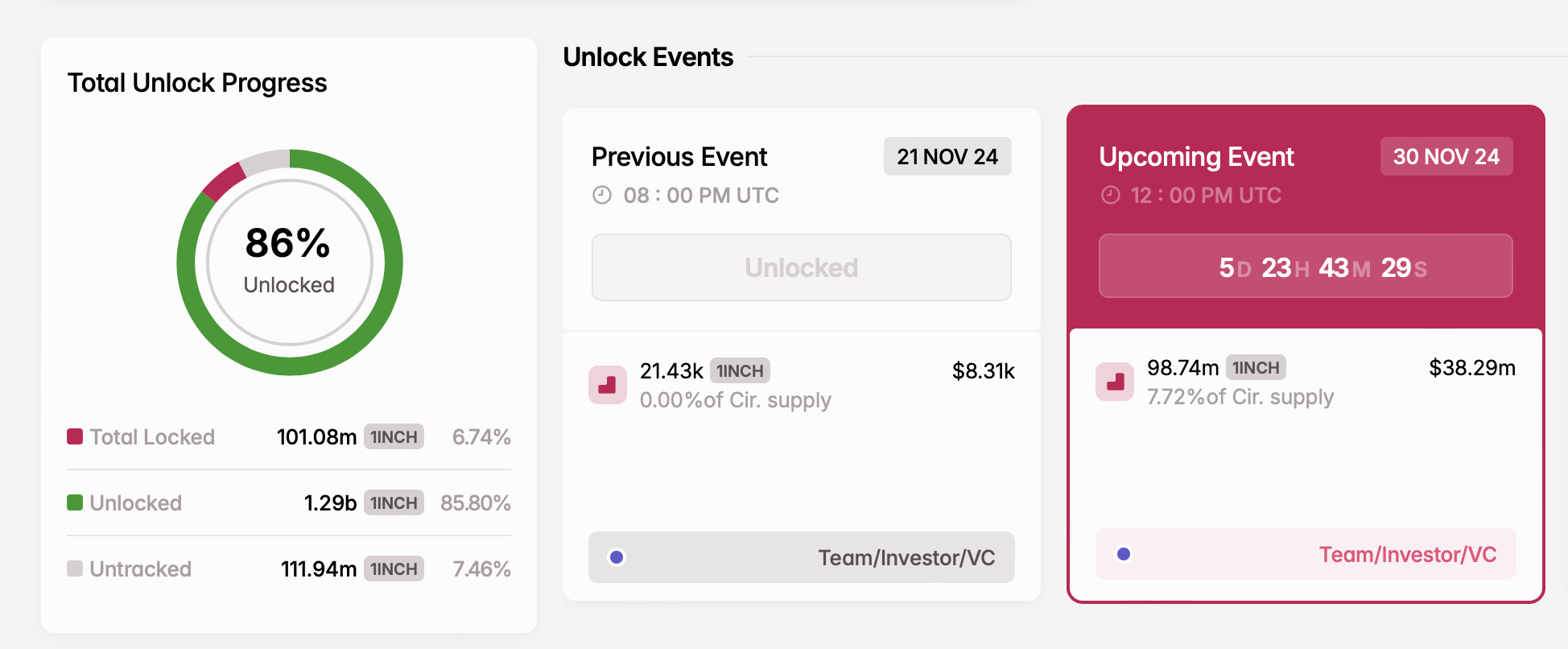

1Inch (1INCH)

- Unlock date: November 30

- Number of tokens unlocked: 98.74 million 1INCH

- Current circulating supply: 1.27 billion 1INCH

1inch is a decentralized exchange aggregator that pools liquidity from multiple DEXs to offer users the best trading rates. It streamlines trading by identifying the most efficient transaction routes, minimizing slippage, and lowering fees.

On November 30, 1inch will unlock nearly 100 million 1INCH tokens. These tokens are allocated for developers, early investors, and venture capital funds.

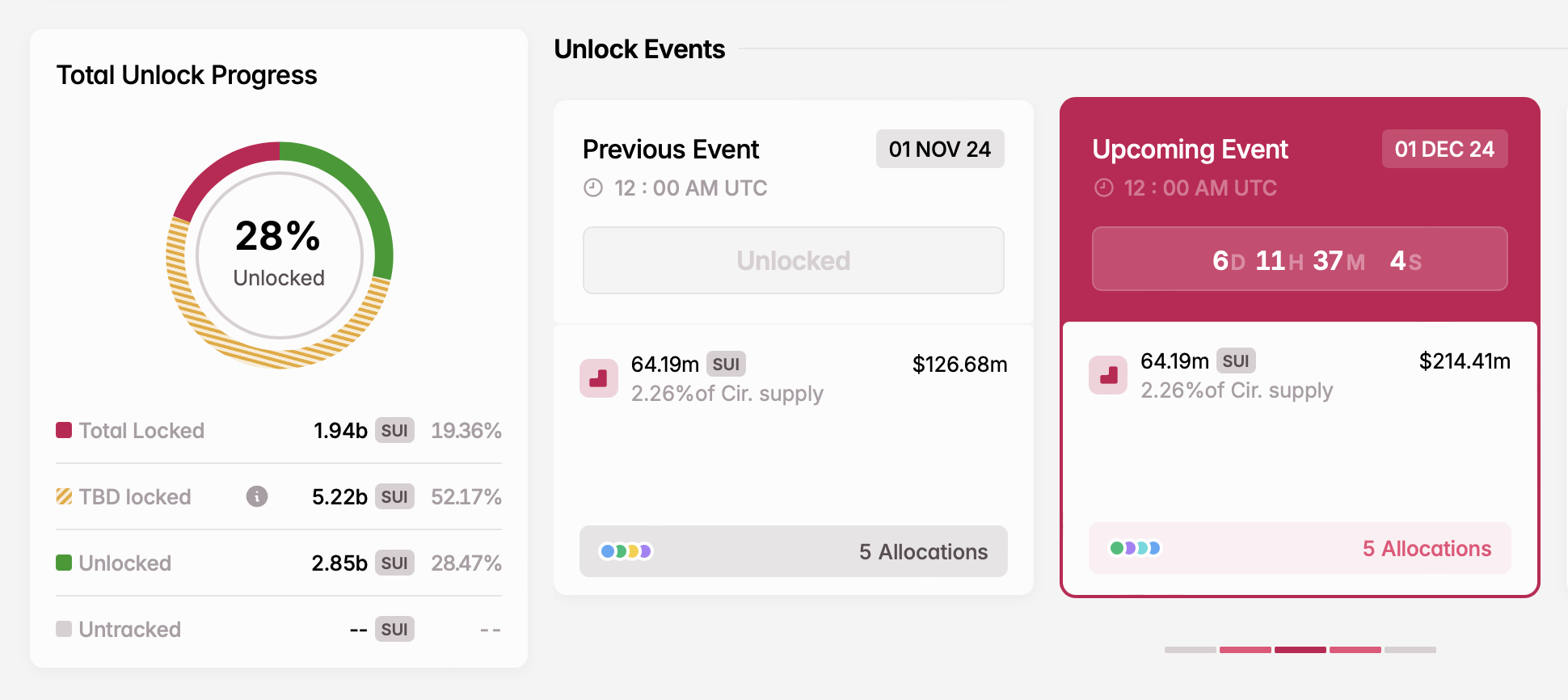

Sui (SUI)

- Unlock date: December 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 2.84 billion SUI

Sui is a high-performance Layer-1 blockchain designed to enhance network operations and security using a Proof-of-Stake consensus mechanism. Developed by Mysten Labs, the project was founded in 2021 by former Novi Research employees who were instrumental in creating the Diem blockchain and the Move programming language.

The SUI token supports governance, allowing holders to vote on key proposals and influence the platform’s direction. On December 1, the next token unlock will release a significant portion of tokens allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

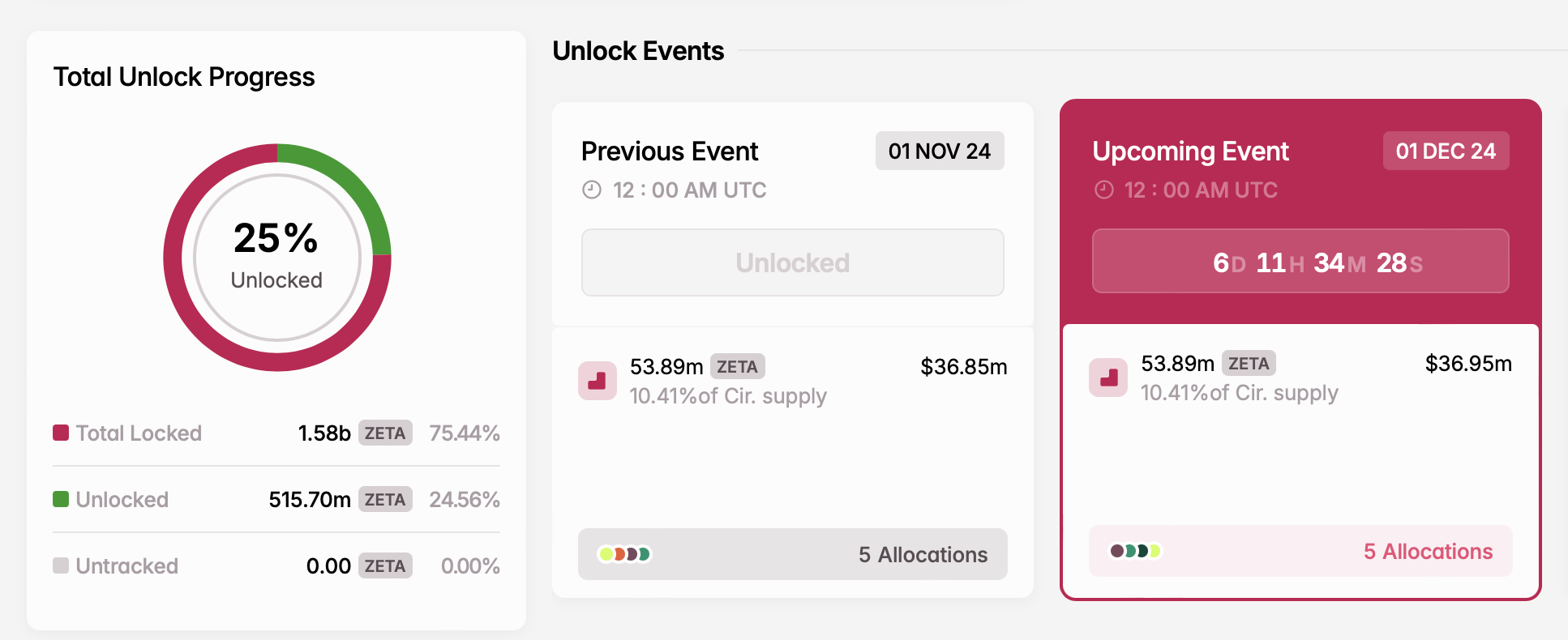

ZetaChain (ZETA)

- Unlock date: December 1

- Number of tokens unlocked: 53.89 million ZETA

- Current circulating supply: 517.85 million ZETA

ZetaChain is a decentralized blockchain platform designed to enable seamless interoperability between different blockchain networks. The platform’s standout feature enables cross-chain communication, allowing the exchange of tokens and data across blockchains like Ethereum and Binance Smart Chain.

On December 1, ZetaChain will release nearly 54 million ZETA tokens. These tokens will support various initiatives, including a user growth pool, an ecosystem growth fund, rewards for core contributors, advisory roles, and liquidity incentives.

Next week’s cliff token unlocks will also include Cardano (ADA), Ethena (ENA), and dYdX (DYDX), among others, with a total combined value exceeding $540 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin13 hours ago

Altcoin13 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Market22 hours ago

Market22 hours agoKraken Eyes Token Expansion as Trump Promises Crypto Support

-

Altcoin22 hours ago

Altcoin22 hours agoXRP Price To $28: Wave Analysis Reveals When It Will Reach Double-Digits

-

Market21 hours ago

Market21 hours agoXRP To Hit $40 In 3 Months But On This Condition – Analyst

-

Market10 hours ago

Market10 hours agoWhy a New Solana All-Time High May Be Near

-

Bitcoin7 hours ago

Bitcoin7 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market20 hours ago

Market20 hours agoExploring Hottest New Coins: FINE, CHILLGUY, and CHILLFAM

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin Price To $100,000? Here’s What To Expect If BTC Makes History