Market

Will Ripple (XRP) get an ETF? Crazy days ahead for Ethereum, Rexas Finance (RXS) could shake up RWAs

The cryptocurrency market is anything but quiet, with constant developments keeping everyone on their toes. Recently, exciting news has emerged for major players like Ripple (XRP), Ethereum (ETH), and a new player, Rexas Finance (RXS). Some experts believe Ripple is on the verge of a potential ETF launch, while Ethereum continues its rollercoaster ride, eyeing the $4,100 mark. Meanwhile, Rexas Finance is stealing the show with its potential to disrupt traditional real estate and real-world asset (RWA) investments. Let’s dive into the opportunities and challenges these three projects face.

Is there a possibility that ripple (XRP) will get an ETF?

And so the whispers begin, and the Ripple community is restless thinking: Will Ripple be next to get an ETF? With the imminent launch of the first US XRP trust by Grayscale, it is looking more and more likely.

An ETF for Ripple would be an important development, providing the opportunity to get exposure to XRP for investors if they don’t want to buy or keep the token in their wallets. This could bring in more liquidity, increased trading activity, and a rise in the price of Ripple. Though as of now an ETF is by no means guaranteed, Grayscale’s step indicates that the time when XRP is seen being launched on traditional exchanges as a part of an ETF might not be very far off.

Crazy days ahead for Ethereum (ETH)?

Ethereum (ETH) has witnessed both the bull and the bears, but the question that still lingers is: Is that moment where ETH breaches the $4,100 price level finally going to happen?

For the third time, investors have tried to breach this level only to be shut down once more making investors question if this crucial resistance barrier is one that ETH has to power through. Presently trading at $2,639, Ethereum has had a turbulent as well as exhilarating trip. Should it clear the $4,100 resistance level, the floodgates may burst wide open for profits; however, every rejection risks turning sentiment bearish instead. At the same time, Ethereum still stands out as one of the most attractive assets in the crypto world and many say that it is just a matter of time before this ETH psychological barrier is overcome.

Rexas Finance (RXS) preparing to revolutionize real estate investments

Finally we come to Rexas Finance (RXS), which has already gained traction even at its presale stage and could be on track to change the way we view investments in RWA. Consider buying a slice of a swanky apartment in Paris or a vacation home on the Caribbean Sea without ever leaving your house. That is what Rexas Finance is providing—a platform to invest in real estate all over the globe, be it complete real estate or only a portion which depends on how much one wishes to invest.

In the presale stage 3, Rexas Finance is currently valued at $0.050 having increased by 66.7% from $0.030, the price in stage 1. As the project goes to the next listing price of $0.20, the earliest investors are already looking at an opportunity to make a 300% growth by the time the project is finally launched.

What makes Rexas Finance unique is the fact that its concept of fractional ownership of real-world assets such as real estate, commodities, and even art, lets investors own and trade slices of these asset classes in the form of the token with the use of blockchain technology. Anyone can use Rexas Finance to invest in high-culture housing activities without quitting his or her job. This democratizes real estate investment since all people who wish to take risks on the economy can do so even when they don’t have enough money to purchase whole buildings.

The expansion of Rexas Finance is not narrative for narrating’s sake; it’s firmly grounded in utility. This project seeks to open up the $280 trillion global real estate market by making this traditionally difficult-to-invest asset class liquid and accessible to the average person.

Conclusion: There is a bright future ahead

Be it Ripple (XRP) making waves with the bullish outlook of an ETF coming, Ethereum (ETH) being quite volatile, or Rexas Finance (RXS) changing the perspective of how we invest in tangible assets – the prospects of crypto are exhilarating. Rexas Finance however presents something completely new – it enables everybody in the world to invest in properties irrespective of their location while the battles of Ripple and Ethereum continue in the high-stakes market.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

South Carolina Could Spend 10% of Funds on Bitcoin Reserve

Representative Jordan Pace introduced legislation to create a Bitcoin Reserve for South Carolina, joining a nationwide effort. Currently, nearly half of all US states have an active bill to create a similar Reserve.

However, the talking point that this bill “allows 10% of state funds” in Bitcoin investments is taking off like wildfire. It may scare off fiscal conservatives, which contributed to recent failures.

South Carolina Joins the Bitcoin Reserve Race

Since President Trump announced his intention to create a US Bitcoin Reserve, many state governments have attempted to create smaller models.

In the last month, these efforts have been intensifying, with more and more states joining the effort. Today, South Carolina filed its own Bitcoin Reserve bill, allowing the state to make substantial purchases:

“The State Treasurer may invest in digital assets including, but not limited to, Bitcoin with money that is unexpended, unencumbered, or uncommitted. The amount of money that the State Treasurer may invest in digital assets from a fund specified in this section may not exceed ten precent of the total funds under management,” it reads.

State Representative Jordan Pace proposed South Carolina’s Bitcoin Reserve legislation. He claimed that this bill “gives the Treasurer new tools to protect taxpayer dollars from inflation,” one of crypto’s most well-known use cases. Pace is currently the bill’s only sponsor, and it’s unclear what chances it has of passing.

Still, there may be challenges ahead. Similar proposals in other Republican-led states—like Montana and Wyoming—have already failed. This was largely due to concerns over using public funds to buy cryptocurrency.

Even though Trump backs the idea on a national level, not all GOP lawmakers are convinced at the state level.

That said, there are some signs of progress elsewhere. For example, Texas has advanced its Bitcoin Reserve bill, achieving bipartisan support. A key reason for its success is that the bill doesn’t require the state to make crypto purchases; it simply allows them at the Treasurer’s discretion.

Likewise, South Carolina’s bill wouldn’t force the state to invest 10% of its funds into Bitcoin. It just opens the door for that possibility, giving the state financial flexibility rather than a mandate.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

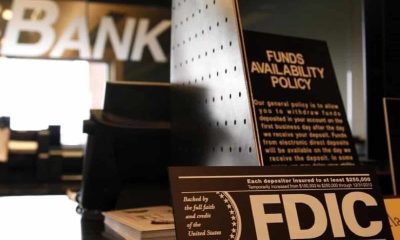

FDIC and CFTC Rescind Old Crypto Guidelines

The FDIC and CFTC have both been working to change previous crypto guidelines. As federal regulators reconcile with the industry, they are removing old rules that specifically target crypto.

The former institution is removing the requirement that banks report crypto business, while the latter holds crypto to the same standards as other industries.

FDIC and CFTC Change Crypto Policies

The FDIC is one of the top financial regulators in the US, and it’s turning over a new leaf. After being one of the principal architects of Operation Choke Point 2.0, it recently began declassifying documents and changing rules that allowed crypto debanking.

Today, the agency is revoking a 2022 directive that impacted banks’ interactions with crypto:

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years. I expect this to be one of several steps the FDIC will take to lay out a new approach for how banks can engage in crypto- and blockchain-related activities in accordance with safety and soundness standards,” said FDIC Acting Chairman Travis Hill.

Specifically, it rescinded a rule that mandated that all banks and institutions under its supervision notify the FDIC of any crypto involvement. The new guideline claims that banks “may engage in permissible crypto-related activities without receiving prior FDIC approval” without enacting any other policies.

Since Gary Gensler left the SEC, all the top US financial regulators have been trying to rework their relationship with crypto. In an apparent coincidence, the CFTC made a very similar move to the FDIC by rescinding two crypto guidelines.

Both of these actions did not establish a new policy; they merely removed the old ones.

Essentially, both of the CFTC’s rule changes are set to ensure that crypto-related derivatives are subject to the same requirements as non-crypto ones. This is somewhat surprising, considering that the industry has typically tried to insist that it necessitates specific regulations.

However, this is largely beside the point. The FDIC and CFTC are both working to remove previous guidelines that opposed the crypto industry.

These institutions will undoubtedly be amenable to creating new ones in the spirit of cooperation. In the meantime, this olive branch can help build a lot of goodwill.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network (PI) Drops Further Despite Telegram Wallet Deal

Pi Network (PI) has been under heavy selling pressure, with its price down more than 61% over the last 30 days. Despite a recent partnership with the Telegram Crypto Wallet, PI has struggled to regain momentum, as technical indicators remain mostly bearish.

Its BBTrend has been negative for 12 consecutive days, and although the RSI has recovered slightly from oversold levels, it still sits below the neutral 50 mark. With the downtrend firmly intact and critical support levels approaching, PI’s next move will likely depend on whether buyers can step in and reverse the current trajectory.

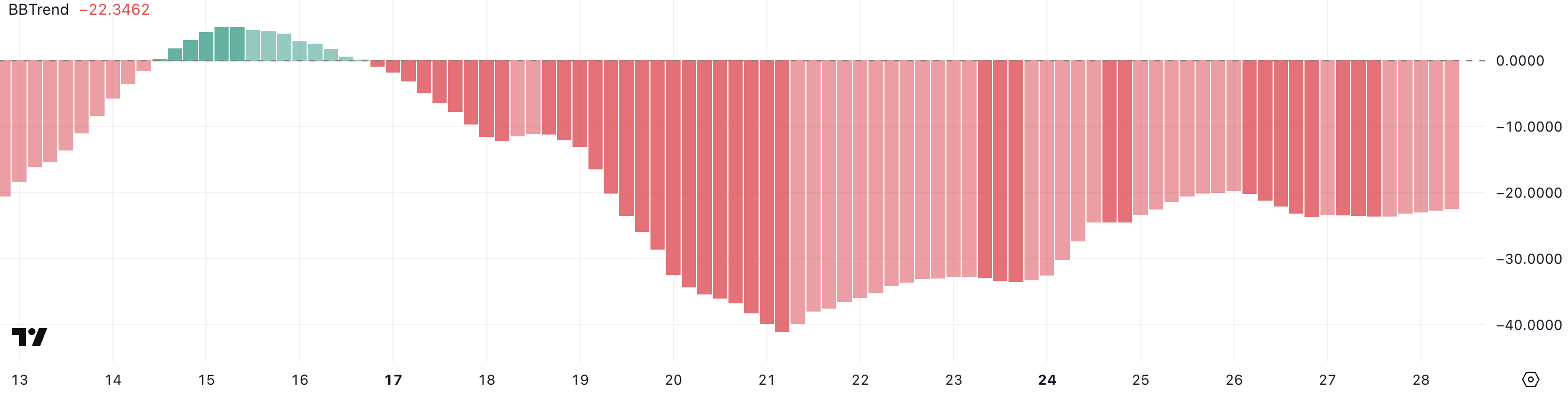

PI BBTrend Has Been Negative For 12 Days

Pi Network (PI) continues to face bearish pressure, as reflected in its BBTrend indicator, which remains deep in negative territory at -22.34.

This is despite recent headlines about the Telegram Crypto Wallet integrating Pi Network, news that has yet to translate into sustained upward momentum.

The BBTrend hit a recent low of -41 on March 21 and has stayed negative since March 16, marking twelve consecutive days of bearish trend signals. This prolonged weakness highlights the ongoing struggle for buyers to regain control of the market.

BBTrend, or Bollinger Band Trend, is a momentum-based indicator that helps gauge the strength and direction of a trend. Positive BBTrend values indicate bullish momentum, while negative values point to bearish sentiment—the further from zero, the stronger the trend.

With PI’s BBTrend sitting at -22.34, the market remains firmly under bearish influence, even if the worst of the recent downtrend may be easing slightly from its extreme lows.

Unless this trend flips back into positive territory soon, PI’s price could remain under pressure, with buyers staying cautious despite the recent integration news.

Pi Network RSI Has Recovered From Oversold But Still Lacks Bullish Momentum

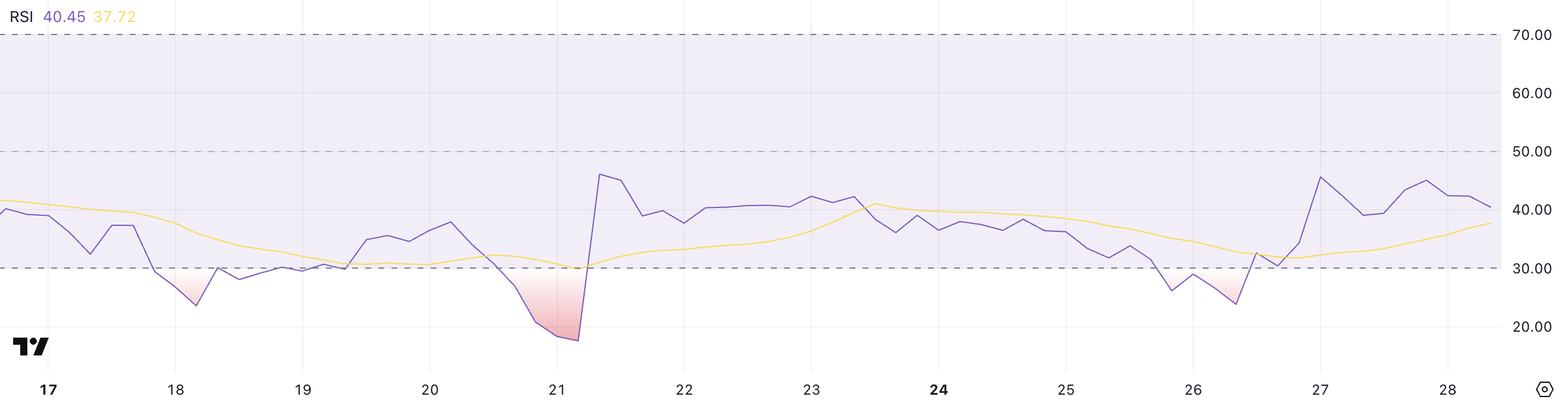

Pi Network is showing early signs of recovery in momentum, with its Relative Strength Index (RSI) rising to 40.45 after hitting 23.8 just two days ago.

While this rebound suggests a reduction in overselling pressure, PI’s RSI hasn’t crossed above the neutral 50 mark in the past two weeks—highlighting ongoing weakness in bullish conviction.

Despite the slight uptick, the market has yet to see enough strength to shift sentiment meaningfully in favor of buyers. This cautious climb could either lead to a breakout or stall into continued consolidation.

The RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and those below 30 suggesting the asset is oversold.

With PI’s RSI currently at 40.45, it’s in a neutral-to-bearish zone—no longer extremely oversold but still lacking strong buying pressure.

For a clearer trend reversal, the RSI would likely need to break above 50, which hasn’t happened in two weeks. Thus, the current move is more of a potential bottoming attempt rather than a confirmed shift.

Will PI Continue Its Correction?

PI price is currently trading within a well-established downtrend, as indicated by the alignment of its EMA (Exponential Moving Average) lines—where shorter-term EMAs remain firmly below longer-term ones.

This setup reflects persistent selling pressure, and if the correction continues, PI could revisit key support levels at $0.718, with a potential drop to $0.62 if that floor fails to hold.

However, recent signs of life in the RSI hint that a short-term rebound might be brewing, offering some hope for a recovery.

If bullish momentum builds, PI could challenge resistance at $1.05 in the near term. A breakout above that level would shift sentiment and open the door for further gains, with $1.23 and even $1.79 as potential targets if the uptrend strengthens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin23 hours ago

Bitcoin23 hours agoStrategic Bitcoin Reserve Proposed by Brazil’s VP Advisor

-

Market22 hours ago

Market22 hours agoXRP Price Slides Slowly—Is a Bigger Drop Coming?

-

Regulation13 hours ago

Regulation13 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Market24 hours ago

Market24 hours agoDogecoin (DOGE) Faces Market Correction—Will Buyers Step Back In?

-

Market23 hours ago

Market23 hours agoTerra’s Crypto Claims Portal Opens Soon: Key Dates and Info

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Is Pi Network Coin Price Up 5% Despite Altcoins Market Correction?

-

Market21 hours ago

Market21 hours agoSUI Open Interest Surges 50%, Death Cross Could Fade Quickly

-

Altcoin16 hours ago

Altcoin16 hours agoTRUMP Crypto Whale Incurs Massive $15M Loss Amid Price Slump, Here’s How