Market

Bitwise XRP ETF Filing in Delaware: All the Details

Bitwise has applied for an XRP ETF in the state of Delaware. An anonymous spokesperson has apparently confirmed that the application is genuine.

An XRP ETF is just one of several ETF-related ventures Bitwise has started recently.

A Surprise Filing

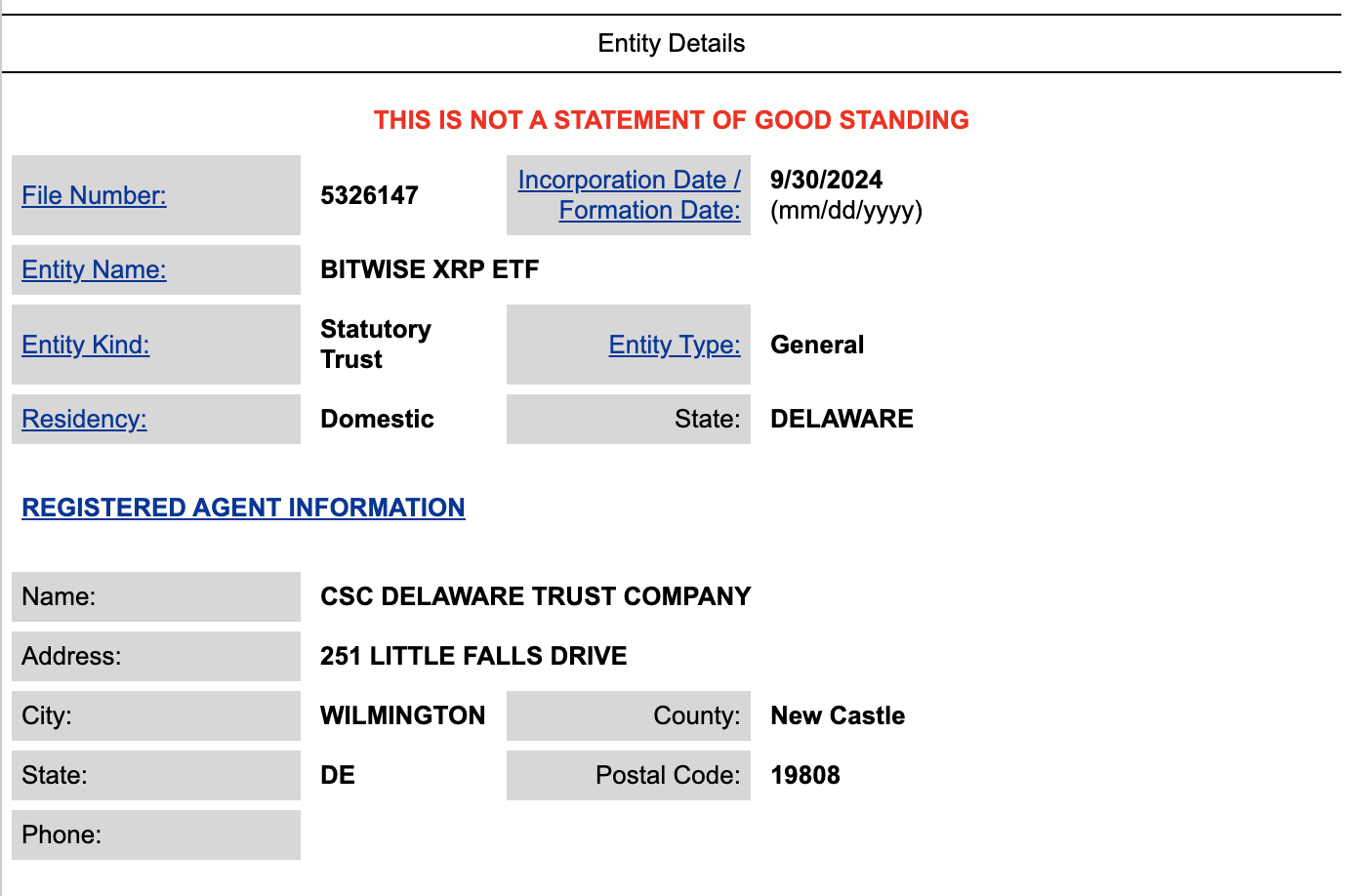

Bitwise Asset Management has applied for an entity named Bitwise XRP ETF in the state of Delaware. According to the filing, publicly available on the Delaware Department of State website, Bitwise filed this ETF on September 30. The registered agent for this filing was CSC Delaware Trust Company, which provides compliance services for legal and corporate endeavors.

“Bitwise positioning to file for XRP ETF is highly noteworthy IMO. Bitwise is highly credible crypto-native fund firm that doesn’t just throw stuff at wall. That’s simply not in their DNA. This is strategic,” Nate Geraci, the President of the ETF store, said.

Read More: XRP ETF Explained: What It Is and How It Works

This agent’s website claims that Delaware is the preferred location for a variety of corporate filings due to its reputation for business-friendly tax and regulation. In fact, BlackRock filed its Ethereum ETF in Delaware less than one year ago. This location suggests Bitwise is making a genuine effort despite the difficulty of winning regulatory approval.

Already, an anonymous spokesperson from Bitwise has confirmed that the filing is genuine. It will be difficult to predict how the SEC will react at this time, but it’s certainly a surprising development.

The XRP ETF has its supporters, but generally, it is not viewed as the most likely cryptoasset to become the third US ETF.

Read More: How To Buy XRP and Everything You Need To Know

Still, this bold move is very in character for Bitwise. Chief Investment Officer Matt Hougan made publicly bullish statements on new ETF approvals just two weeks ago, and Bitwise acquired a European crypto ETP issuer in August.

A new project like this would fit right in. Ripple’s executives, too, are bullish that the SEC will eventually give an XRP ETF the green light.

“I think it’s just a matter of time, and it’s inevitable there’s gonna be an XRP ETF, there’s gonna be a Solana ETF, there’s gonna be a Cardano ETF, and that’s great,” Ripple CEO Brad Garlinghouse stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Market Mirrors Nasdaq and S&P 500 Amid Recession Fears

As traditional markets show clear signs of an impending recession, the crypto space is not immune from damage. Liquidations are surging as the overall crypto market cap mirrors declines in the stock market.

Even though the source of these problems is localized to the US, the damage will have global implications. Traders are advised to prepare for a sustained period of trouble.

How Will A Recession Impact Crypto?

Several economic experts have warned that the US market is poised for an impending recession. For all we know, it’s already here.

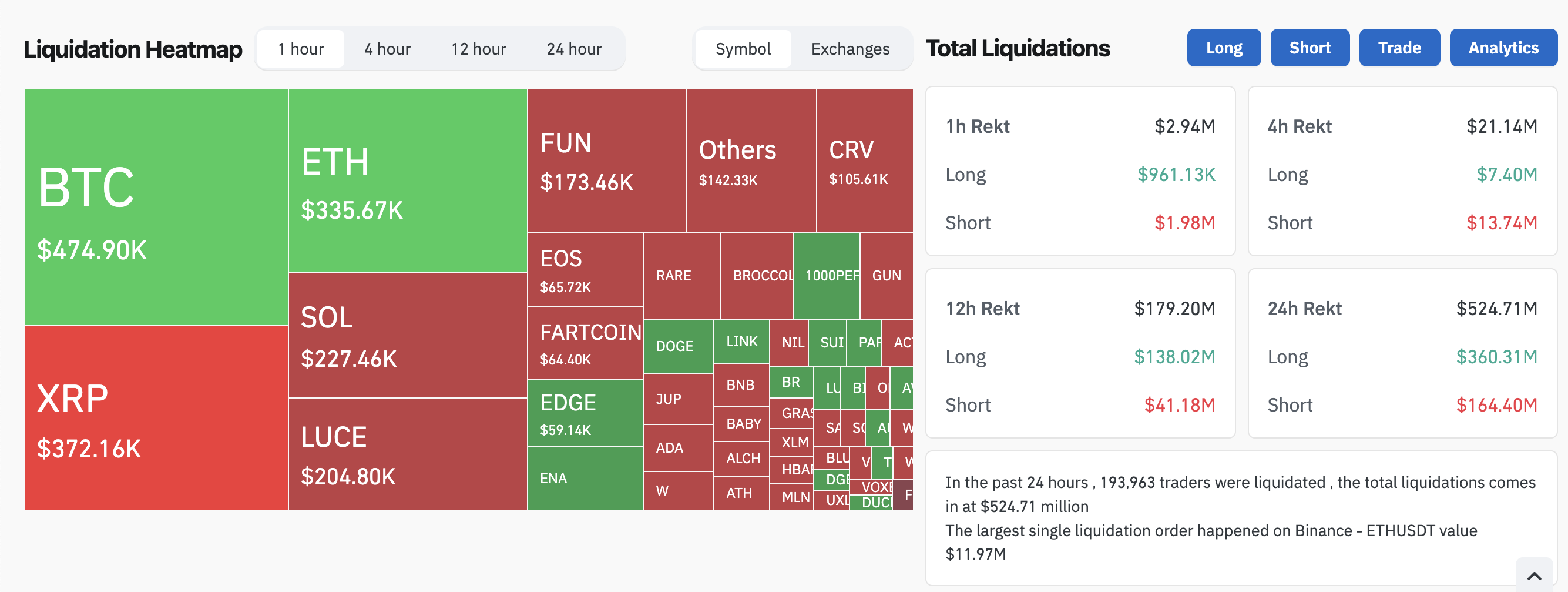

Since Donald Trump announced his Liberation Day tariffs, all financial markets have taken a real hit. The overall crypto market cap is down nearly 8%, and liquidations in the last 24 hours exceeded $500 million.

A few other key indicators show a similar trend. In late February, the Crypto Fear and Greed Index was at “Extreme Fear.” It recovered in March but fell back down to this category today.

Similarly, checkers adjacent to crypto, such as Polymarket, began predicting that a recession is more likely than not.

Although the crypto industry is closely tied to President Trump’s administration, it is not the driving force behind these recession fears. Indeed, crypto actually seems to be tailing TradFi markets at the moment.

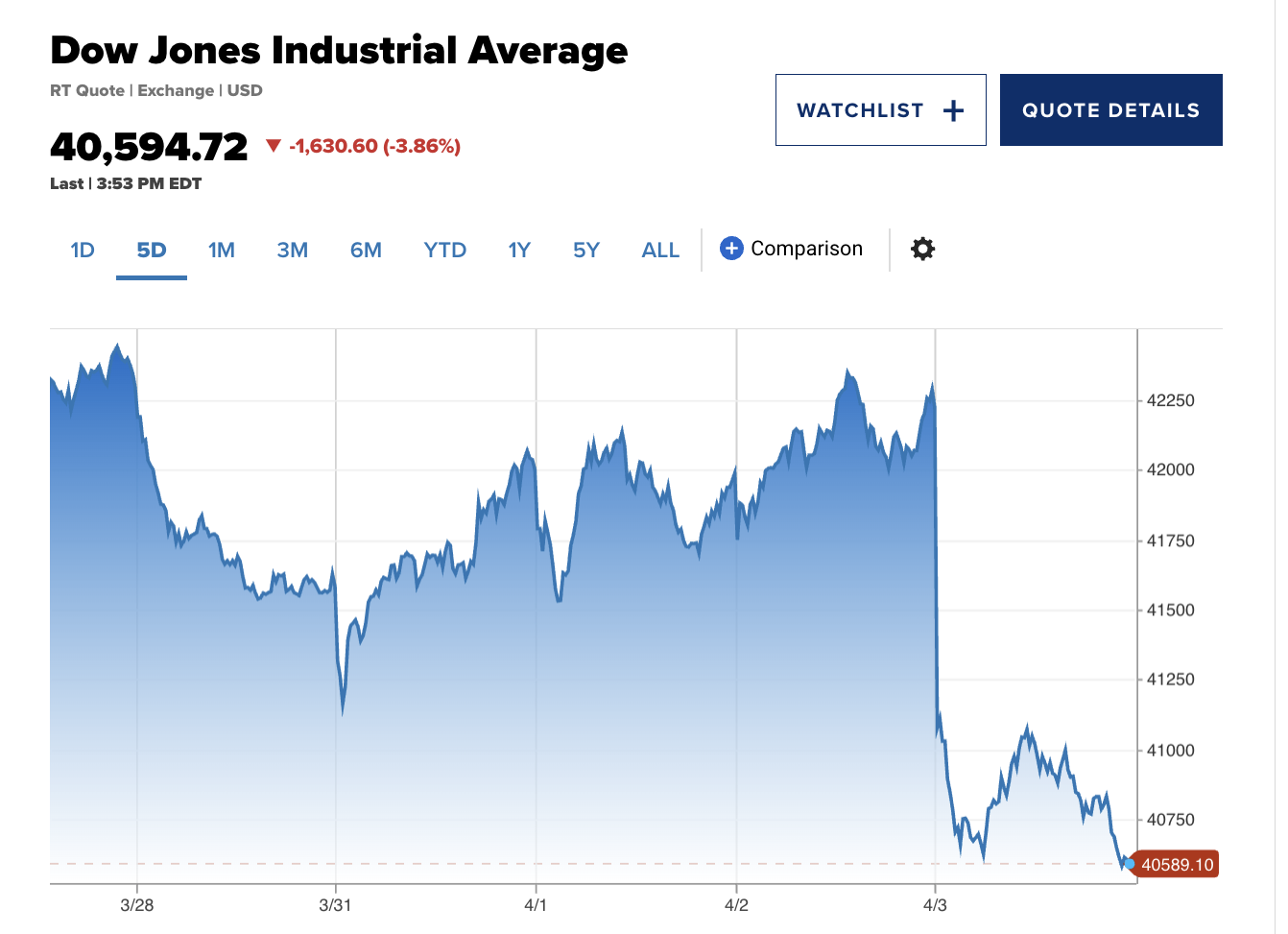

The Dow dropped 1600 points today, and the NASDAQ and S&P 500 both had their worst single-day drops since at least 2020.

Amidst all these recession fears, it’s been hard to identify an upside for crypto. Bitcoin briefly looked steady, but it fell more than 5% in the last 24 hours.

This doesn’t necessarily reflect its status as a secure store of value, as gold also looked steady before crumbling. To be fair, though, gold has only fallen 1.2% today.

In this environment, crypto enthusiasts worldwide should consider preparing for a recession. Trump’s proposed tariffs dramatically exceeded the worst expectations, and the resultant crisis is centered around the US.

Overall, current projections show that the crypto market will mirror the stock market to some extent. If the Nasdaq and S&P 500 fall further, the implications for risk assets could worsen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

Changpeng “CZ” Zhao, former CEO of Binance, is advising Kyrgyzstan on becoming a crypto hub. He signed an agreement with the Kyrgyz National Investment Agency to build the nation’s Web3 capacities.

A cornerstone of this plan is Kyrgyzstan’s A7A5 stablecoin, pegged to the Russian ruble and focused on emerging markets. CZ claimed that he has been advising several governments “officially and unofficially” regarding crypto.

CZ Helps Kyrgyzstan Drive Crypto Adoption

Countries worldwide are becoming more interested in crypto integration lately. Although Kyrgyzstan has not been a particular hub for crypto activity, it is trying to turn a new leaf.

According to the latest announcements, the country is developing a new A7A5 stablecoin pegged to the Russian ruble. Kyrgyzstan’s crypto turn is also being influenced by Changpeng “CZ” Zhao, the founder of Binance.

“A Memorandum of Understanding has been signed between the National Investment Agency under the President of the Kyrgyz Republic and Changpeng Zhao (CZ). In accordance with the Memorandum, the parties intend to cooperate in the development of the cryptocurrency and blockchain technology ecosystem in the Kyrgyz Republic,” claimed President Sadyr Zhaparov.

CZ is a very influential figure in crypto and has been involved with a few official governments in his career. For example, last month, allegations surfaced that he was working with President Trump to establish a new dollar-backed stablecoin.

Meanwhile, CZ acknowledged his business in Kyrgyzstan, claiming that he introduced President Zhaparov to X, the social media site.

“I officially and unofficially advise a few governments on their crypto regulatory frameworks and blockchain solutions for gov efficiency, expanding blockchain to more than trading. I find this work extremely meaningful,” CZ claimed via social media.

Although CZ’s connection with Kyrgyzstan’s new A7A5 stablecoin is not fully known, it would align with his recent alleged Trump dealings.

Zhaparov’s statement claimed that the Binance founder will provide infrastructural, technological support, technical expertise, and consulting services on crypto and blockchain technologies.

Also, the president went on to state that this agreement with CZ will strengthen Kyrgyzstan’s standing in the growing Web3 environment. The long-term plan is to help create new opportunities for Kyrgyz businesses and society as a whole.

Presumably, this will involve some cooperation with Russia, as A7A5’s press release mentions “a new class of digital assets tied to the Russian economy.” This stablecoin is bucking significant tradition by aligning with the ruble instead of the dollar.

However, this is part of its strategy to focus on emerging markets. This novel experiment could demonstrate new market opportunities and challenge the dominance of USD-pegged stablecoins in the region.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Wormhole (W) Jumps 10%—But Is a Pullback Coming?

Wormhole (W) surged nearly 12% on Thursday after the project unveiled its official product roadmap. The project’s one-year anniversary has sparked speculative interviews.

However, technical data shows buyers and sellers locked in a fierce battle, as momentum indicators suggest a weakening trend. The DMI, Ichimoku Cloud, and EMA structures all reflect market indecision, with no clear direction confirmed just yet.

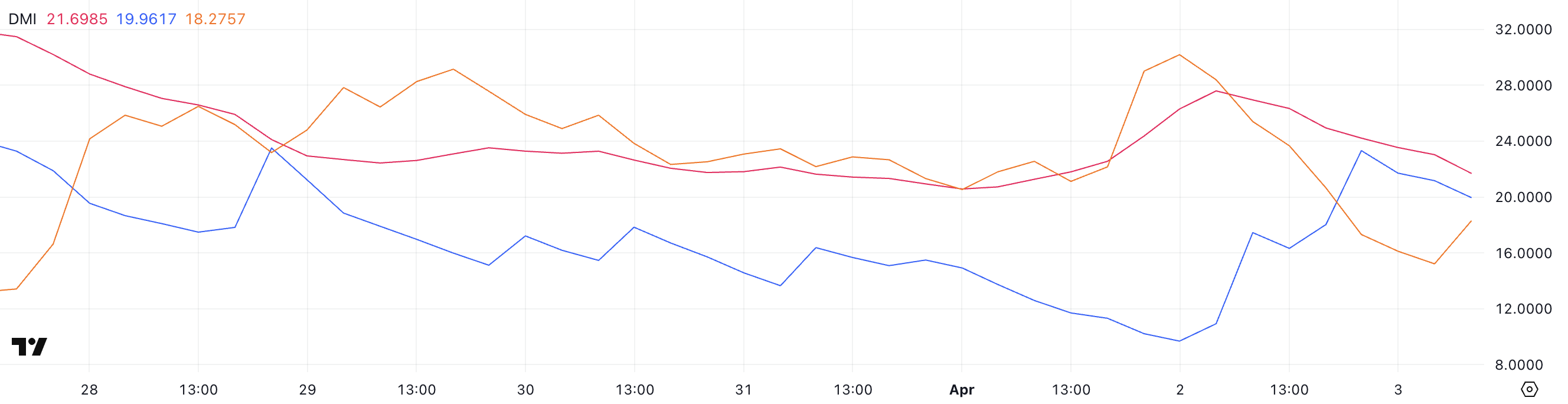

Wormhole DMI Chart Shows Market Indecision

Wormhole’s DMI chart shows its ADX (Average Directional Index) has dropped to 21.69 from 27.59 just a day earlier, signaling that the recent trend may be losing strength.

The ADX is a key indicator used to measure the strength—not the direction—of a trend. Generally, values below 20 suggest a weak or non-existent trend, while values above 25 indicate a strong trend.

With ADX now hovering near the threshold, it suggests that the bullish momentum seen in recent days could be fading.

Looking deeper, the +DI (Positive Directional Indicator) has fallen to 19.96 after peaking near 24 earlier, though it had surged from 9.68 the previous day.

Meanwhile, the -DI (Negative Directional Indicator) climbed to 18.27 after dropping to 15.21 earlier, following a sharp decline from 30.18 yesterday. This narrowing gap between +DI and -DI—combined with a weakening ADX—suggests uncertainty and potential indecision in price action.

With a $137.64 million token unlock on the horizon, this shift could hint at a cooling bullish impulse and the risk of renewed selling pressure if supply outweighs demand.

Ichimoku Cloud Shows Mixed Signals

Wormhole’s Ichimoku Cloud chart shows a mixed outlook. Price action is attempting to break through resistance but still faces notable headwinds.

The Tenkan-sen (blue line) has recently flattened and is closely aligned with the Kijun-sen (red line), signaling indecision or a potential pause in momentum.

Typically, when these lines are flat and close together, it indicates consolidation rather than a clear trend continuation or reversal.

Meanwhile, the Kumo (cloud) remains thick and red ahead, reflecting strong overhead resistance and a bearish long-term bias.

The price is hovering near the lower edge of the cloud but has yet to make a decisive move above it—suggesting that bullish momentum is tentative at best.

For a confirmed trend reversal, a clean break above the cloud with bullish crossovers would be needed. Until then, the chart points to a market still trying to find direction, especially ahead of a major token unlock event that could further impact sentiment and price action.

Will Wormhole Reclaim $0.10 In April?

Wormhole, which builds solutions around interoperable bridges, continues to see its EMA setup reflect a bearish structure. Short-term moving averages are still positioned below the longer-term ones, an indication that downward pressure remains dominant.

However, one of the short-term EMAs has started to curve upward, hinting at a possible shift in momentum as buyers begin to step in. This early uptick could signal the beginning of a trend reversal, though confirmation is still pending.

If bullish momentum gains traction, Wormhole may attempt to break the nearby resistance at $0.089. A successful breakout could open the door for a move toward higher resistance levels at $0.108 and even $0.136.

Conversely, failure to clear $0.089 could reinforce bearish control, pushing the price back to test support at $0.079.

A break below that level could expose W to further downside toward $0.076, $0.073, and potentially below $0.07—marking uncharted territory for the token.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Market18 hours ago

Market18 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market17 hours ago

Market17 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market21 hours ago

Market21 hours agoXRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

-

Market13 hours ago

Market13 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Ethereum12 hours ago

Ethereum12 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Market16 hours ago

Market16 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K