Market

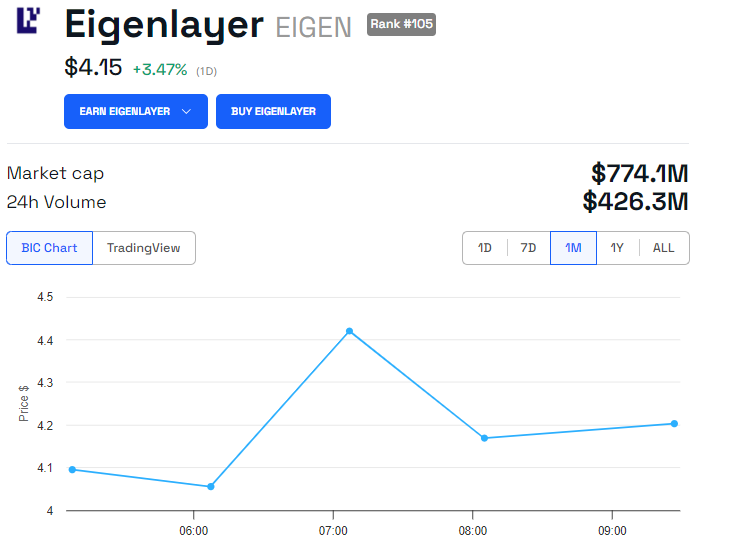

Justin Sun Moves $21.8 Million In EIGEN Amid Token Unlock Buzz

Justin Sun claimed all his EIGEN tokens from the EigenLayer liquid restaking protocol on Tuesday via five different addresses and moved them to the HTX digital currency trading platform.

EIGEN is the native token for the EigenLayer ecosystem, a leading restaking protocol on the Ethereum blockchain. This development comes amid hype over the EIGEN token listing on multiple tier-one exchanges.

Justin Sun Transfers $21.5 Million in EIGEN Tokens to HTX

Spotonchain reported the transaction, indicating that the Tron executive deposited all 5.24 million EIGEN tokens to HTX during the early hours of the Asian session. The transaction happened shortly after EIGEN debuted on major exchanges, including Binance. WuBlockchain corroborated the report.

“Justin Sun’s team has transferred 5.37 million EIGEN to Huobi HTX through five addresses, worth about $21.8 million. Based on the current price of 4.06 USDT, the EIGEN FDV is about $6.8 billion,” Wu Blockchain reported.

Crypto researcher Ai on X speculated on whether Justin Sun “is ready to ship EIGEN,” noting that it is currently unclear whether the receiving address belongs to the exchange. Nevertheless, the expert highlighted that the controversial crypto executive could make a profit of around $22.19 million if he cashed in at the current price of $4.13.

Read more: What Is Liquid Staking in Crypto?

Sun reportedly received the largest airdrop of EigenLayer’s EIGEN tokens, amassing over $38.74 million in airdrops through the Ethereum Restaking track. This positions him to become the biggest beneficiary in the latest round of liquid restaking tokens (LRT), as per Ai’s report, which noted pending airdrop settlements from protocols like Puffer, Zircult, Swell, and Kelp.

Interestingly, when high-profile figures transfer significant token amounts to exchanges, it is often seen as a sign of intent to sell. While Justin Sun hints at selling his EIGEN tokens, two whales are accumulating, purchasing 702,324 EIGEN tokens valued at $2.86 million on Tuesday morning.

Specifically, one spent 588 ETH or $1.55 million to buy 383,672 EIGEN at an average price of $4.05. The other spent 1.31 million USDC to buy 318,651 EIGEN at $4.1 per token. These purchases come in time for the EIGEN token unlock.

Eigen Foundation Announces Token Unlock

The Eigen Foundation, which drives the growth of the EigenLayer ecosystem, has announced the unlocking of the EIGEN token for Season 2. This follows the opening of stake drop claims in mid-September, with the claim window running from October 1, 2024, to March 16, 2025, on the Eigen Foundation’s website.

Justin Sun’s involvement with EigenLayer isn’t new; his participation in the Season 1 airdrop in May sparked controversy. With this latest token unlock, users can freely transfer, trade, or stake their EIGEN tokens, fully engaging in the token’s utility.

EigenLayer also introduces a unique shared security system, where staked ETH serves as security for protocols beyond Ethereum. The EIGEN token plays a role in securing Actively Validated Services (AVSs), further enhancing its utility.

Read more: Ethereum Restaking: What Is It And How Does It Work?

This development positions EigenLayer as a “verifiable cloud for crypto,” opening opportunities for sidechains, Oracle networks, bridges, and more. According to BeInCrypto, the EIGEN token is currently trading at $4.15, reflecting a 3.47% increase since Tuesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

GOAT Price Sees Slower Growth After Reaching $1B Market Cap

GOAT price has skyrocketed 214.29% in one month, recently breaking into the $1 billion market cap and securing its place as the 10th largest meme coin. It now stands just ahead of MOG, which closely trails its position in the rankings.

However, recent indicators suggest that GOAT’s uptrend may be weakening, raising questions about whether it can sustain its rally or face a potential correction.

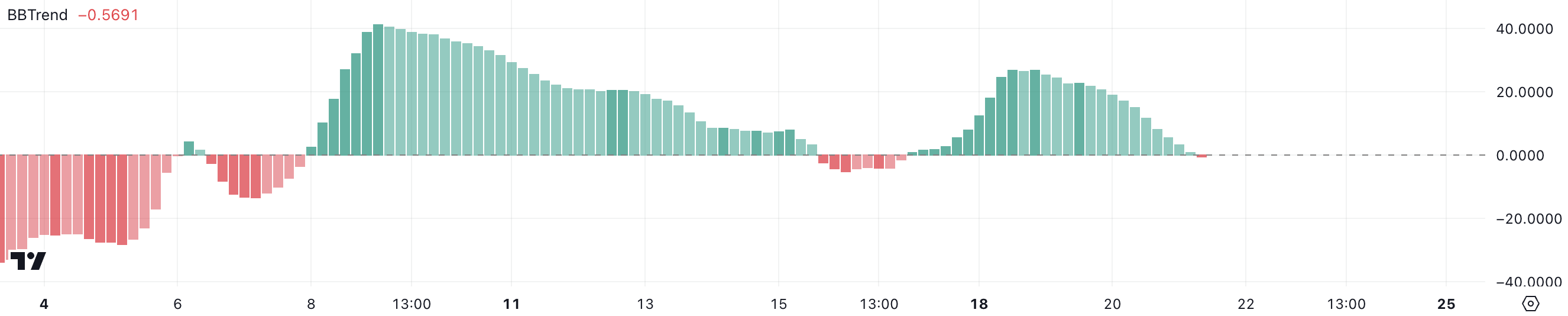

GOAT BBTrend Is Negative For The First Time In 4 Days

GOAT BBTrend has turned negative for the first time since November 17, now sitting at -0.54. This shift suggests that bearish momentum is beginning to take hold, with the asset’s recent upward trajectory starting to weaken potentially.

BBTrend measures the strength and direction of price trends using Bollinger Bands, with positive values indicating an uptrend and negative values signaling a downtrend. A negative BBTrend reflects increased downward pressure, which could indicate the start of a broader market shift.

GOAT has had an impressive November, gaining 61% and reaching a new all-time high on November 17.

However, the current negative BBTrend, if it persists and grows, could signal the potential for further bearish momentum.

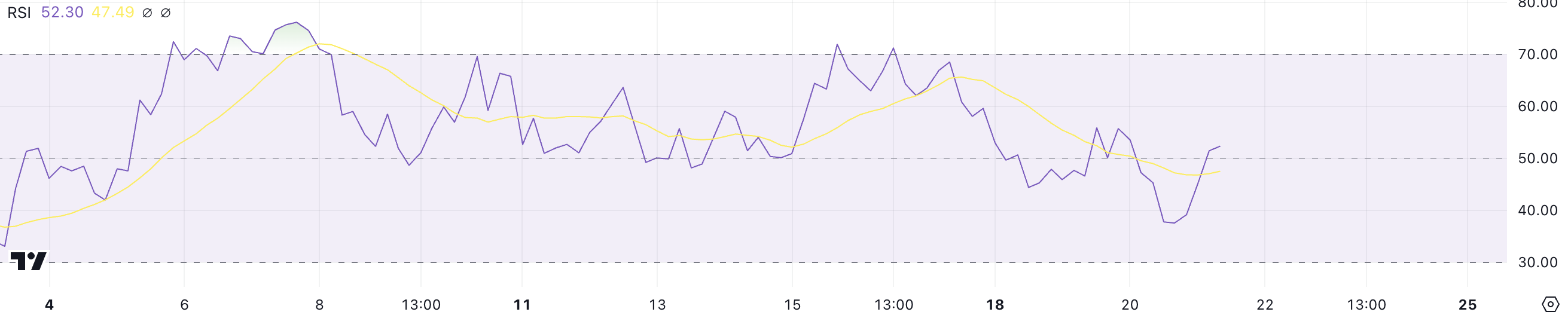

GOAT Is In A Neutral Zone

GOAT’s RSI has dropped to 52, down from over 70 a few days ago when it reached its all-time high. This decline indicates that buying momentum has cooled off, and the market has moved out of the overbought zone.

The drop suggests a shift toward a more neutral sentiment as traders consolidate gains and the strong bullish pressure seen earlier subsides.

RSI measures the strength and velocity of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 52, GOAT’s RSI is in a neutral zone, neither signaling strong bullish nor bearish momentum.

This could mean the current uptrend is losing strength, and the price may consolidate or move sideways unless renewed buying pressure reignites upward momentum.

GOAT Price Prediction: A New Surge Until $1.50?

If GOAT current uptrend regains strength, it could retest its all-time high of $1.37, establishing its market cap above $1 billion, a fundamental threshold for being among the biggest meme coins in the market today.

Breaking above this level could pave the way for further gains, potentially reaching the next thresholds at $1.40 or even $1.50, signaling renewed bullish momentum and market confidence.

However, as shown by indicators like RSI and BBTrend, the uptrend may be losing steam. If a downtrend emerges, GOAT price could test its nearest support zones at $0.80 and $0.69.

Should these levels fail to hold, the price could fall further, potentially reaching $0.419, putting its position in the top 10 ranking of biggest meme coins at risk.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple (XRP) Price Hits 109% Monthly Gain as Indicators Weaken

Ripple (XRP) price has experienced a significant rally, rising 51.33% in the last seven days and an impressive 109.09% over the past month. This strong momentum has propelled XRP into a bullish phase, with key indicators like EMA lines supporting its upward trajectory.

However, signs of weakening momentum, such as a declining RSI and negative CMF, suggest that caution may be warranted. Whether XRP continues to push higher or faces a steep correction will depend on how the market reacts to these shifting dynamics.

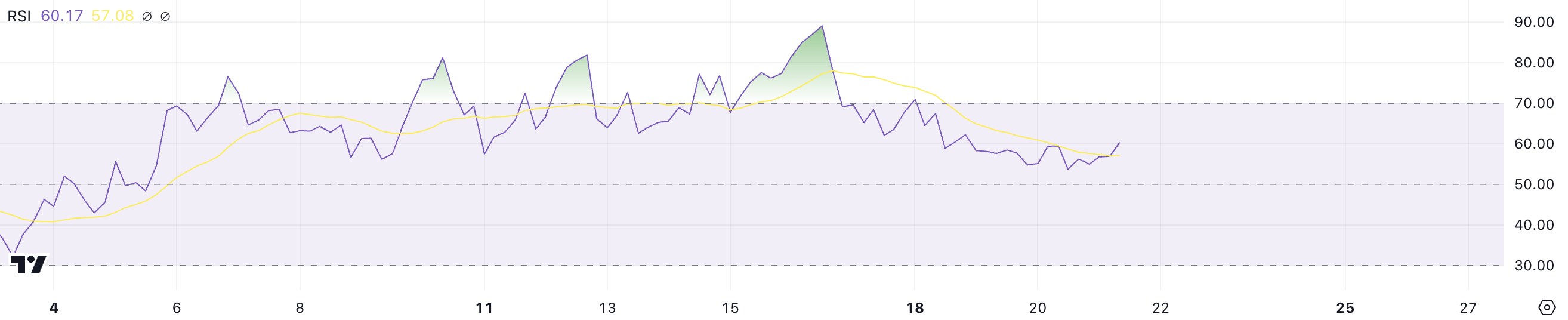

XRP RSI Is Below The Overbought Zone

XRP’s RSI has dropped to 60 after nearly hitting 90 on November 16 and staying above 70 between November 15 and November 17.

This decline indicates that Ripple has moved out of the overbought zone, where intense buying pressure previously drove its price higher. The drop suggests that the market is cooling off, with traders potentially taking profits after the strong rally.

The RSI measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 60, XRP’s RSI reflects a still-positive momentum but shows a more balanced sentiment compared to the previous surge.

While the uptrend remains intact, the lower RSI could indicate a slower pace of gains, with the possibility of consolidation as the market stabilizes. If buying pressure returns, XRP price could extend its upward movement, but a further decline in RSI might signal a weakening bullish momentum.

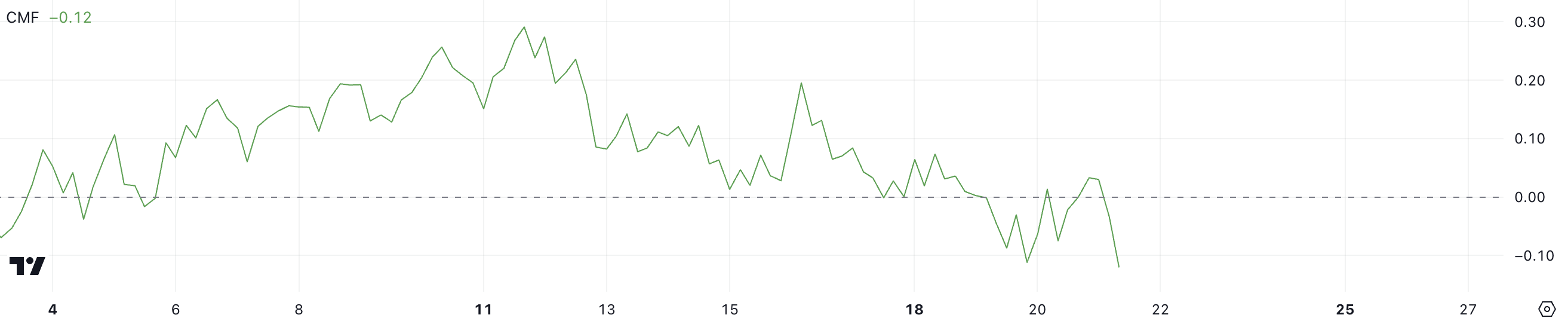

Ripple CMF Is Now Negative After Staying Positive For 14 Days

XRP Chaikin Money Flow (CMF) is currently at -0.12, after showing positive levels between November 5 and November 19. That is also its lowest level since October 31. This shift into negative territory reflects increased selling pressure and a potential outflow of capital from the asset.

The transition from positive CMF values earlier this month signals a weakening in bullish momentum as more market participants reduce exposure to Ripple.

The CMF measures the volume and flow of money into or out of an asset, with positive values indicating capital inflow (bullish) and negative values showing capital outflow (bearish).

XRP’s CMF at -0.12 suggests that bearish sentiment is beginning to gain traction, potentially putting pressure on its price despite the recent uptrend. If the CMF remains negative or declines further, it could indicate sustained selling pressure, challenging Ripple’s ability to continue its upward movement.

Ripple Price Prediction: Biggest Price Since 2021?

XRP’s EMA lines currently display a bullish setup, with short-term lines positioned above the long-term lines and the price trading above all of them.

However, the narrowing distance between the price and some of these lines suggests a potential slowdown in bullish momentum. This could signal that the uptrend is weakening, leaving XRP price vulnerable to a shift in market sentiment.

If a downtrend emerges, as indicated by the weakening RSI and negative CMF, Ripple price could face significant pressure and potentially drop to its support at $0.49, representing a substantial 56% correction.

On the other hand, if the uptrend regains strength, XRP could climb to test the $1.27 level and potentially break through to $1.30, which would mark its highest price since May 2021.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

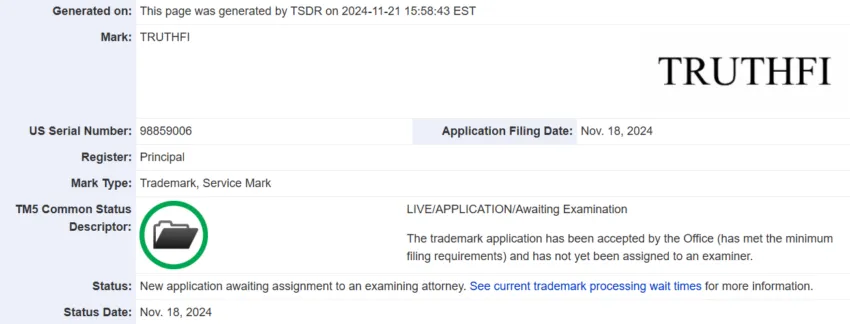

Trump Media Files Trademark for Crypto Platform TruthFi

Trump Media & Technology Group is exploring the development of a crypto payment platform, as revealed by a recent trademark filing.

The application, submitted by Donald Trump’s social media company on Monday, outlines plans for a service named TruthFi. The proposed platform aims to offer crypto payments, financial custody, and digital asset trading.

Following the trademark announcement, Trump Media’s stock rose approximately 2%. At the time of writing, the stock was trading at $30.44, up by nearly 75% this year.

However, details about TruthFi remain scarce, including its timeline or operational specifics. This initiative suggests an effort by Trump Media to expand its business model beyond Truth Social.

The social media platform was established back in 2022, after Trump was banned from Facebook and X (formerly Twitter).

Nevertheless, launching a large-scale cryptocurrency platform could require Trump Media to acquire additional resources or partner with an established firm. This is because the firm currently has a small workforce of less than 40 employees.

“The filing, made with the USPTO on Monday, indicates that Trump Media plans to offer: Digital wallets, Cryptocurrency payment processing services, and A digital asset trading platform,” US Trademark Attorney Josh Gerben wrote on X (formerly Twitter).

As reported by BeInCrypto earlier, Trump Media is also in discussions to purchase the b2b crypto trading platform Bakkt. Shares in Bakkt surged by nearly 140% since the news earlier this week.

Meanwhile, the President-elect’s crypto plans seem to be in full swing even before he takes office in January. He is also reportedly considering the first-ever crypto advisor role for the White House, and interviewing several potential candidates.

Earlier today, the current SEC chair Gary Gensler announced his resignation before Trump’s term begins. Gensler’s resignation boosted the crypto market, as it signals a major change in the SEC’s regulatory stance.

Notably, XRP surged 7% to its highest value in three years. Bitcoin also neared $99,000, as the overall crypto market cap reached $3.4 trillion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum20 hours ago

Ethereum20 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market24 hours ago

Market24 hours agoSteady Climb Toward New Highs

-

Market21 hours ago

Market21 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin22 hours ago

Altcoin22 hours agoBTC Reaches $97K, Altcoins Gains

-

Market16 hours ago

Market16 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Altcoin14 hours ago

Altcoin14 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market19 hours ago

Market19 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?