Market

3 Winners as US Elections Approach

The US presidential election is scheduled for November 5. With October already here, meme coins tied to the top 3 presidential candidates, dubbed “PolitiFi meme coins,” have seen explosive growth amid the heightened political climate.

Among them is MAGA (TRUMP), which the meme coin community built in favor of former President Donald Trump. The other two include Kamala Horris (KAMA), which supports current Vice President Kamala Harris, and lately, Jeo Boden (BODEN), a token initially deployed when current President Joe Biden was still in the race.

MAGA (TRUMP)

Two weeks ago, PolitiFi meme coins plummeted to their lowest points in seven months. MAGA (TRUMP), which is reflective of Donald Trump’s Make America Great Again campaign, also felt the heat during that period.

But in the last seven days, TRUMP’s price has increased by 75.60% and currently changes hands at $3.19. This renewed rally is linked to the speculation that the US presidential candidate may start mentioning crypto in their campaign even though they’ve avoided it in past debates.

According to the 4-hour chart, the recent resurgence was also validated by the golden cross on September 26. For context, a golden cross occurs when the shorter Exponential Moving Average (EMA) crosses above the longer one.

As seen below, the 20 EMA (blue) had crossed over the 50 EMA (yellow). Apart from that, the Relative Strength Index (RSI), which measures momentum, is now above the signal line and reinforces the bullish thesis.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Should this remain the same, TRUMP’s price could breach the overhead resistance at $3.40. If that happens, the meme coin’s value might climb to $4.11 before the US elections come in full force.

However, if Trump’s chances of winning the election drop significantly in the coming weeks, this forecast might not happen. Instead, the token might decline to $2.35 if it fails to hold the support line at $2.82.

Kamala Horris (KAMA)

KAMA’s price is currently $0.0087, representing a 68.50% increase within the past week. The meme coin initially plunged to $0.0053 on Thursday, September 26. But since Kamala Harris reportedly displayed commitment toward crypto expansion, the token has been rising.

Despite significant gains, the 4-hour chart suggests KAMA’s price may face challenges in maintaining its upward trend. This is primarily due to the Awesome Oscillator (AO) and Moving Average Convergence Divergence (MACD), both momentum indicators, turning downward.

As such, KAMA might experience a pullback as it attempts to hit $0.0090. If the meme coin does not break above this point, a decline could be next.

In that scenario, KAMA’s price could decrease to $0.0075. Increased buying pressure and rising support for Kamala Harris on the outside could change things for the better. Should that happen, KAMA could erase one zero and climb to $0.011.

Jeo Boden (BODEN)

Jeo Boden was a trending PolitiFi meme coin and registered notable upswings earlier in the year. However, after President Joe Biden dropped out of the race, BODEN’s price crashed.

Things are starting to change again, especially as the token increased by 62% in the last seven days. This uptrend suggests that, even though Biden is no longer a candidate, BODEN could remain a notable force among PolitiFi meme coins.

As of this writing, BODEN’s price is $0.0092. Based on the 4-hour chart, the Bull Bear Power (BBP) had hit higher green histogram bars. The BBP measures the strength of buyers to sellers. When it increases, buyers (bulls) are in control, and the price might increase.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in October 2024

Conversely, a negative reading of the BB suggests that bears (sellers) are dominant. Considering the current condition, BODEN’s price could be set to climb to $0.011. Retracement to $0.083 might, however, happen if buying pressure decreases.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Approaches $100K: The Countdown Is On

Bitcoin price is rising steadily above the $95,000 zone. BTC is showing positive signs and might soon hit the $100,000 milestone level.

- Bitcoin started a fresh increase above the $95,000 zone.

- The price is trading above $95,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $100,000 resistance zone.

Bitcoin Price Sets Another ATH

Bitcoin price remained supported above the $92,000 level. BTC formed a base and started a fresh increase above the $95,000 level. It cleared the $96,500 level and traded to a new high at $98,999 before there was a pullback.

There was a move below the $98,000 level. However, the price remained stable above the 23.6% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. There is also a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair.

The trend line is close to the 50% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. Bitcoin price is now trading above $96,000 and the 100 hourly Simple moving average.

On the upside, the price could face resistance near the $98,880 level. The first key resistance is near the $99,000 level. A clear move above the $99,000 resistance might send the price higher. The next key resistance could be $100,000.

A close above the $100,000 resistance might initiate more gains. In the stated case, the price could rise and test the $102,000 resistance level. Any more gains might send the price toward the $104,500 resistance level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $100,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $98,000 level.

The first major support is near the $96,800 level. The next support is now near the $95,500 zone and the trend line. Any more losses might send the price toward the $92,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $96,800, followed by $95,500.

Major Resistance Levels – $99,000, and $100,000.

Market

This Is Why XRP Price Rallied By 25% and Could Soon Hit $2

Ripple’s (XRP) price rallied by 25% in the last 24 hours following Gary Gensler’s announcement that he would resign as the US Securities and Exchange Commission (SEC) chair on January 20, 2025.

This development comes as a relief to the popular “XRP Army,” which has had to deal with suppressed price action due to the Gensler-led SEC’s nonstop petitions against Ripple. But that is not all that happened.

Ripple Bears Face Notable Liquidation Following Gensler’s Notification

Gensler’s announcement appears to be a positive development for the broader crypto market. But XRP holders seemed to benefit the most. This was particularly significant given the unresolved Ripple-SEC legal issues that have persisted throughout the SEC Chair’s tenure.

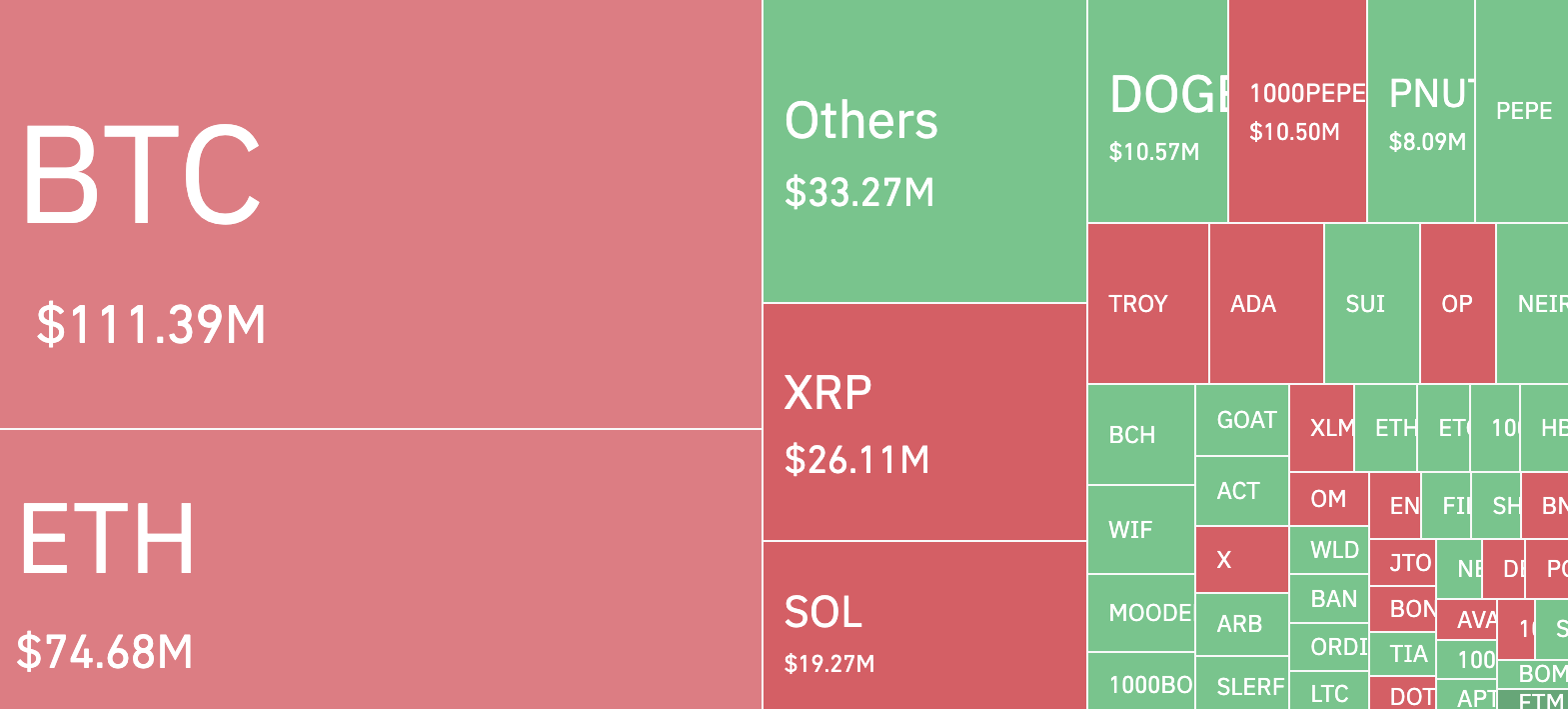

As a result, it came as no surprise that XRP price rallied and outpaced those of any other cryptocurrency in the top 10. Furthermore, the development triggered liquidations totaling $26.11 million over the last 24 hours.

Liquidation occurs when a trader fails to meet the margin requirements for a leveraged position. This forces the exchange to sell off their assets to prevent further losses. In XRP’s case, the liquidation primarily resulted in a short squeeze.

A short squeeze happens when a large number of short positions (traders betting on price declines) are forced to close, driving the price higher as they rush back to buy back the asset.

At press time, XRP trades at $1.40 and currently has a market cap of $80.64 billion. With Gensler almost gone, crypto lawyer John Deaton noted that XRP price gains could be higher, and the market cap could climb to $100 billion.

“XRP soon will achieve a $100B market cap. Times are changing,” Deaton wrote on X.

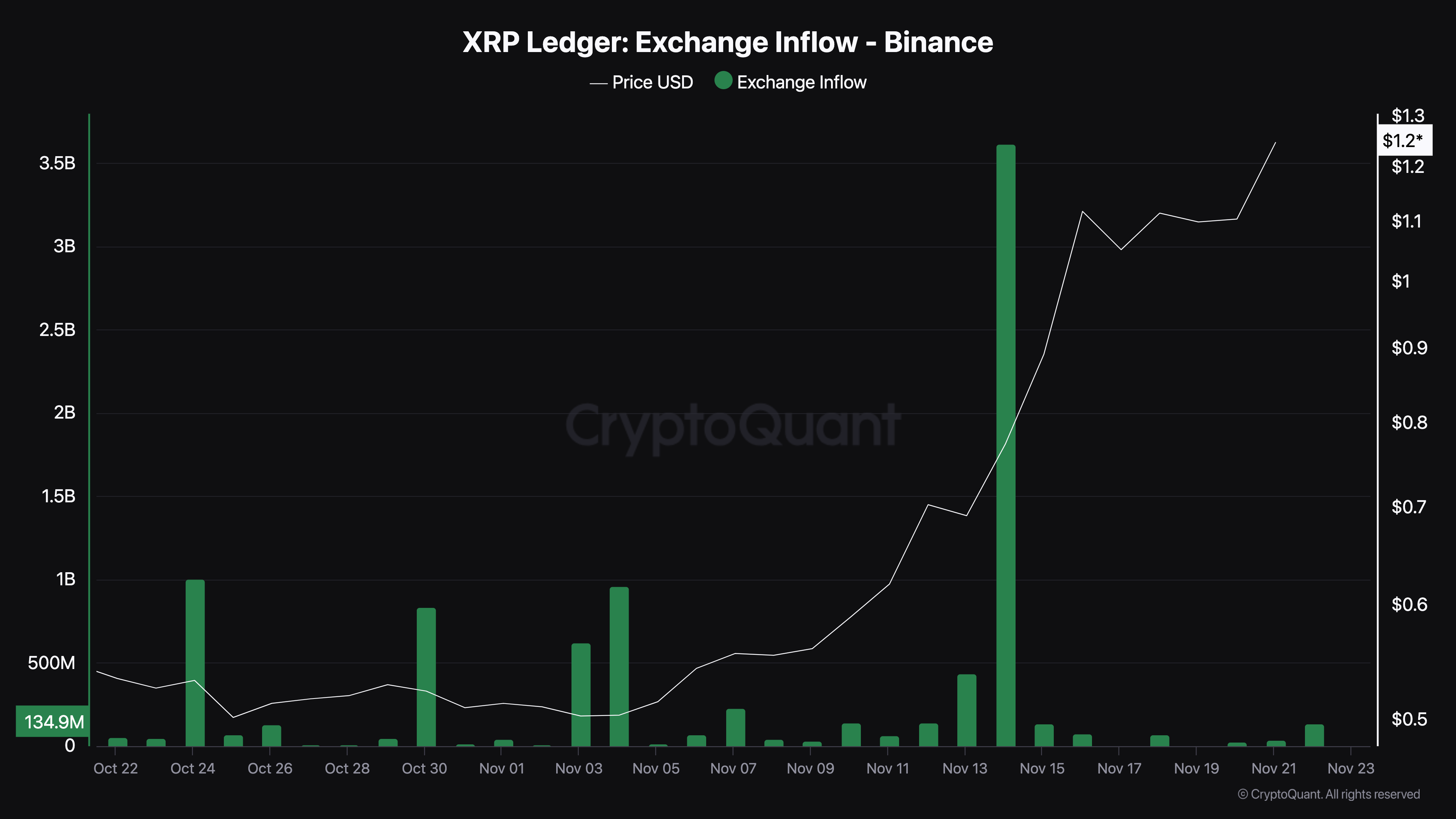

Meanwhile, CryptoQuant data shows that the total number of XRP sent into exchange has significantly decreased. Typically, high values indicate increased selling pressure in the spot market. This is because it suggests that more assets are being offloaded, potentially driving prices lower.

However, since it is low, XRP holders are refraining from selling. If this remains the case, the token’s value could rise higher than $1.40.

XRP Price Prediction: $2 Coming?

According to the 4-hour chart, XRP has been trading within a range of $1.04 to $1.17 since November 18. This sideways movement has resulted in the formation of a bull flag — a bullish chart pattern that signals potential upward momentum.

The bull flag begins with a sharp price surge, forming the flagpole, driven by significant buying pressure that outpaces sellers. This is followed by a consolidation phase, where the price retraces slightly and moves within parallel trendlines, creating the flag structure.

Yesterday, XRP broke out of this pattern, signaling that bulls have seized control of the market. If this momentum persists, XRP’s price could surpass $1.50, potentially approaching the $2 threshold.

However, this bullish scenario hinges on market behavior. If holders decide to secure profits, selling pressure could push XRP’s price below $1, erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Shows Renewed Energy: Rally Incoming?

Dogecoin is consolidating gains above the $0.380 resistance against the US Dollar. DOGE is holding gains and eyeing more upsides above $0.400.

- DOGE price started a fresh increase above the $0.3750 resistance level.

- The price is trading above the $0.3800 level and the 100-hourly simple moving average.

- There was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could continue to rally if it clears the $0.400 and $0.4080 resistance levels.

Dogecoin Price Eyes More Upsides

Dogecoin price remained supported above the $0.350 level and recently started a fresh increase like Bitcoin and Ethereum. DOGE was able to clear the $0.3650 and $0.3750 resistance levels.

The price climbed above the 50% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low. Besides, there was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair.

Dogecoin price is now trading above the $0.3750 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.3950 level or the 61.8% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low.

The first major resistance for the bulls could be near the $0.400 level. The next major resistance is near the $0.4080 level. A close above the $0.4080 resistance might send the price toward the $0.4200 resistance. Any more gains might send the price toward the $0.4500 level. The next major stop for the bulls might be $0.500.

Are Dips Supported In DOGE?

If DOGE’s price fails to climb above the $0.400 level, it could start a downside correction. Initial support on the downside is near the $0.3850 level. The next major support is near the $0.3750 level.

The main support sits at $0.3550. If there is a downside break below the $0.3550 support, the price could decline further. In the stated case, the price might decline toward the $0.3200 level or even $0.300 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.3850 and $0.3750.

Major Resistance Levels – $0.4000 and $0.4200.

-

Market24 hours ago

Market24 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Bitcoin19 hours ago

Bitcoin19 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation13 hours ago

Regulation13 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market19 hours ago

Market19 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin22 hours ago

Altcoin22 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin24 hours ago

Altcoin24 hours agoVitalik Buterin, Coinbase’s Jesse Pollack Buy Super Anon (ANON) Tokens On Base

-

Altcoin19 hours ago

Altcoin19 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K