Market

Lummis Criticizes SEC’s Gensler, Demands Crypto Clarity

Wyoming Senator Cynthia Lummis criticized the US Securities and Exchange Commission (SEC) and its chair, Gary Gensler, urging for improved crypto regulation in the country.

Many within the crypto community have also expressed frustration, accusing Congress of unfairly placing the blame solely on the SEC.

Senator Lummis Predicts Gary Gensler’s Exit as SEC Chair

Speaking on CNBC’s Squawk Box, Lummis suggested that Gensler may step down as SEC chair next year, though she acknowledged that he “loves the job” and might not want to leave. She noted, however, that this scenario could change if Vice President Kamala Harris wins the November elections.

Lummis voiced her disapproval of Gensler, primarily due to his failure to recognize Bitcoin (BTC) and Ethereum (ETH) as commodities. She also implied that other cryptocurrencies may qualify as commodities and called for clearer regulatory guidelines.

“We need to have a clear definition. The Howey Test is available to us, and as it has been updated, there are maybe other assets just besides Bitcoin and Ethereum that would qualify for the jurisdiction of the Commodity Futures Trading Commission,” the Senator added.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Lummis indicated the need for clearer crypto regulation in the US, saying it would give clarity to companies. She highlighted the EU “very effective” approach to crypto regulation, urging the US not to let other countries get ahead.

The Senator expressed concern that the SEC claims to have all the necessary tools for regulation, but criticized how they are being applied. Specifically, she pointed to the agency’s strategy of “regulation by enforcement,” which has resulted in numerous court cases. Additionally, she argued that the SEC’s use of penalties to regulate the industry was misguided.

“You can commit fraud with yachts, with art, with coins, with minerals. It is not the asset itself that is fraudulent,” she said.

On the other hand, Lummis agreed that Congress needs to regulate crypto in the country and not leave the full mandate to the SEC. One investigative journalist echoed this sentiment, criticizing Congress for neglecting its own duties and unfairly placing the blame on the SEC for the regulatory confusion in the crypto space.

“Congress, including Lummis, should be writing the rules in the first place! Instead, Gensler’s left playing referee, making the whole situation look like a game of dodgeball with no rulebook. Lummis is working with Senator Gillibrand on a proposal — because maybe someone finally realized that Congress should stop pointing fingers and start writing laws,” JungleIncXRP wrote.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This debate comes just days after the SEC commissioners appeared for a two-day session before House committees. Both Congress and the Senate Banking Committees reviewed the agency’s handling of crypto regulations.

Lummis isn’t alone in opposing the SEC’s approach. As BeInCrypto reported, 42 Congressmen are also calling on the securities regulator to allow banks to custody crypto.

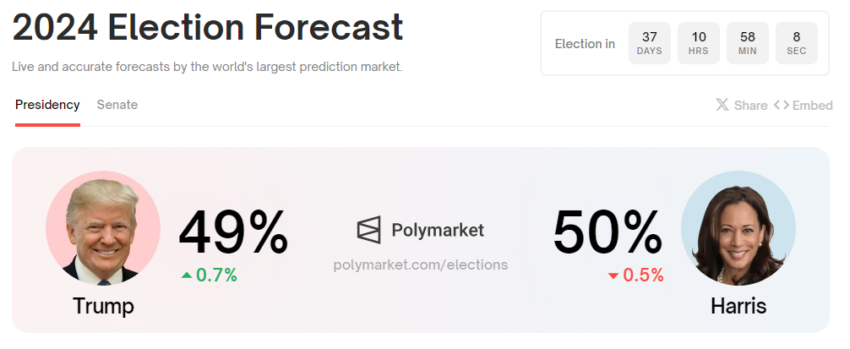

As the US elections near, SEC Chair Gary Gensler’s future is uncertain. Donald Trump has pledged to remove him if elected, while Kamala Harris narrowly leads the race, according to Polymarket.

Despite the growing calls for Gensler’s exit from the crypto community, Harris could potentially appoint him as Treasury Secretary if she wins the presidency.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can the SAND Token Price Rally Be Sustained?

SAND, the token powering the metaverse platform The Sandbox, has seen a meteoric rise, surging 55% in the past 24 hours. This performance far outpaces leading assets like Bitcoin and Ethereum, which each gained just 1% during the same period. SAND’s trading volume has also skyrocketed, surpassing $1.91 billion — a climb of over 500% in 24 hours.

On-chain data has shown a significant increase in daily SAND transactions and a decrease in selling pressure. These factors suggest the potential for a sustained rally.

The Sandbox Holders Adopt a Bullish Approach

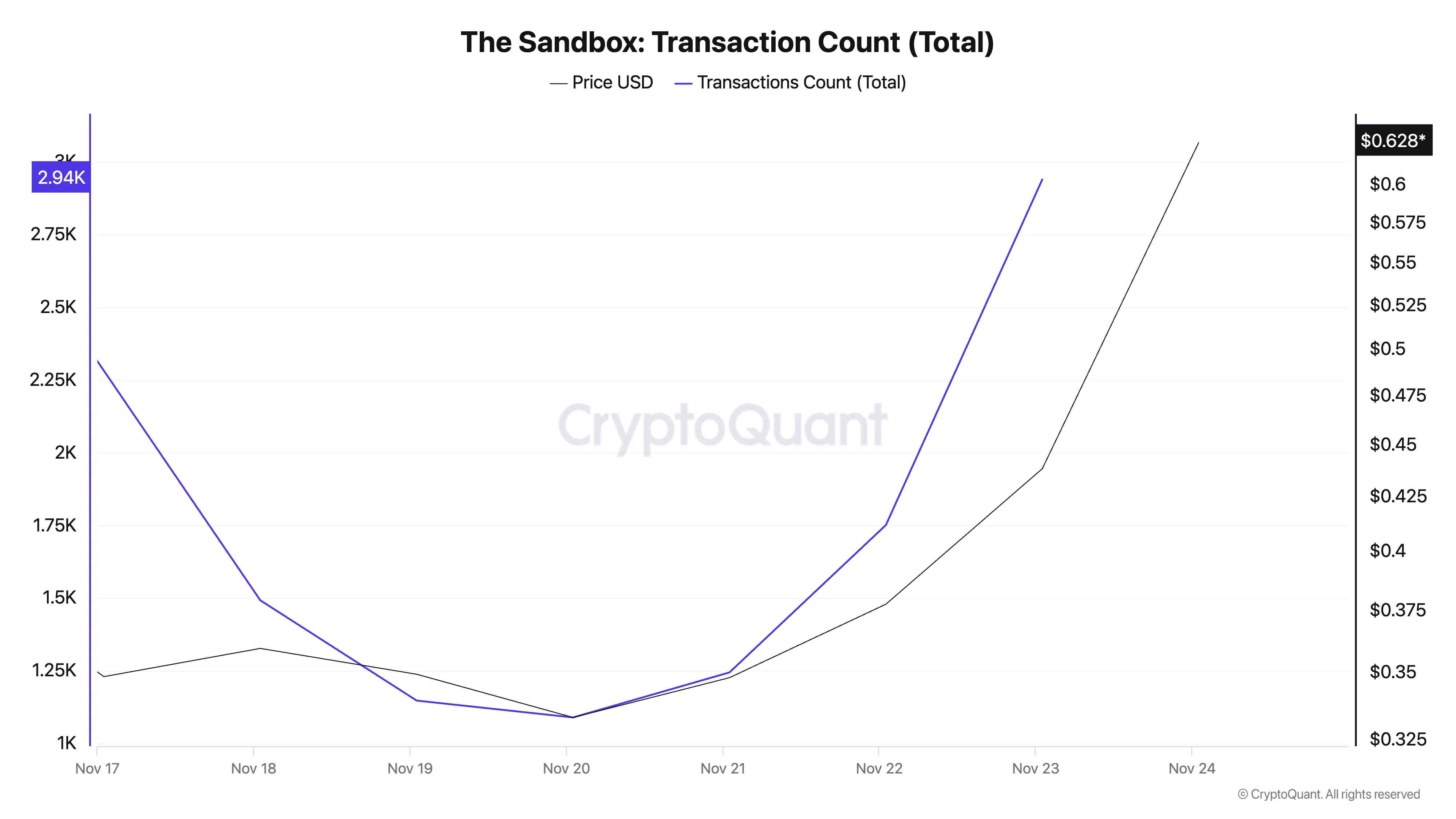

According to CryptoQuant’s data, the daily count of SAND transactions has rocketed over the past few days. For context, on November 23, 2,940 transactions involving SAND were completed, representing the highest count over the past seven days.

This is a bullish signal for the metaverse-based token because a surge in an asset’s transaction count indicates increased activity and interest. It signals higher demand and participation by market participants. Also, it suggests growing confidence in SAND’s price, potentially driving it further upward.

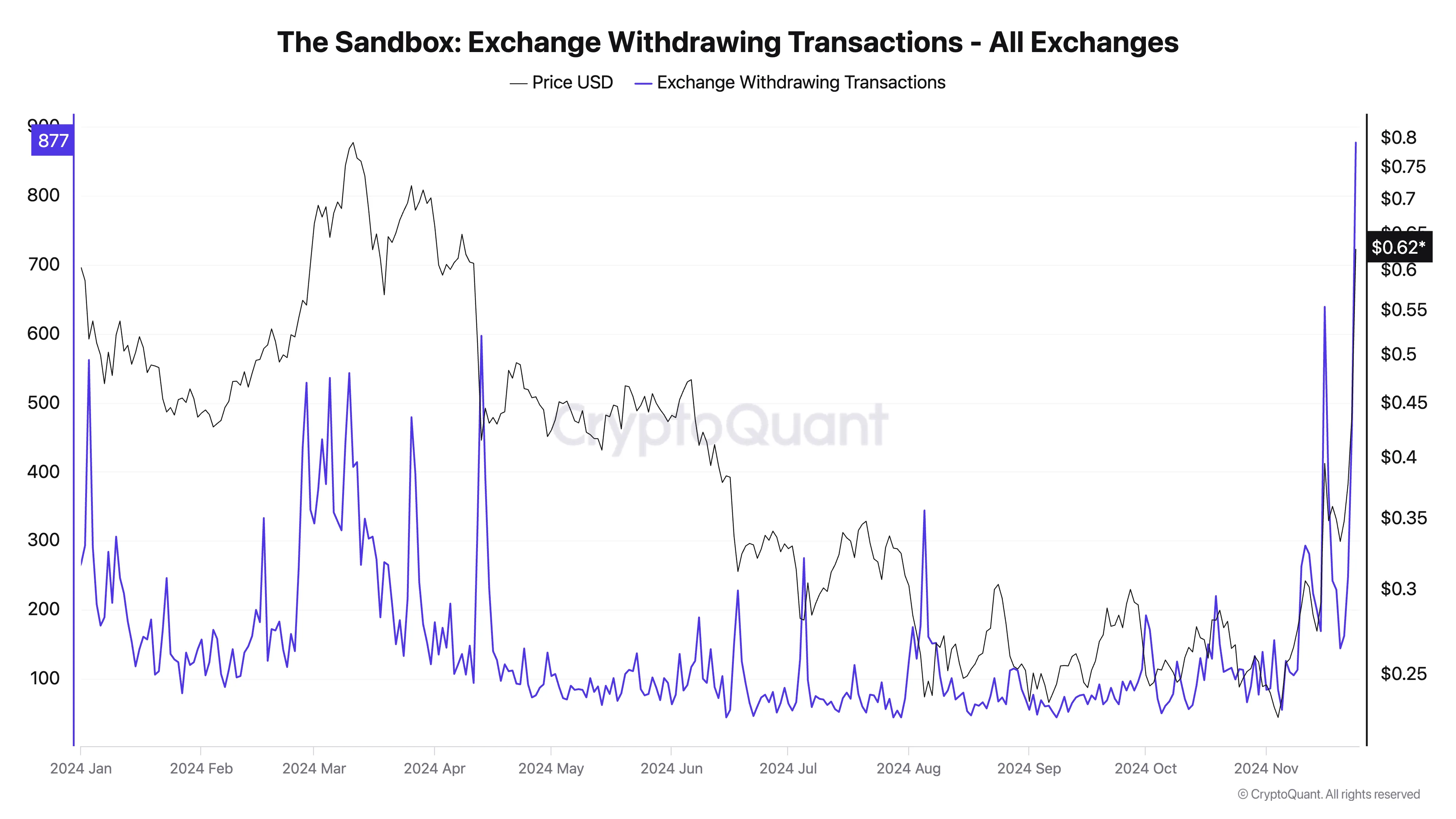

Additionally, a notable increase in exchange withdrawals for SAND has been observed. Per CryptoQuant’s data, the token’s exchange withdrawal transactions currently total 877, its single-day highest since June 2023.

The exchange withdrawing transaction metric tracks the number of cryptocurrency withdrawals from exchanges. A spike in this metric indicates that investors are moving their assets off exchanges. This is a bullish signal, suggesting increased confidence and a potential long-term holding trend.

SAND Price Prediction: Rally Above $0.66?

On the daily chart, SAND is trading at $0.61, a level last seen in April. Its price currently sits below the resistance at its cycle peak of $0.66. If bullish momentum strengthens, SAND could rally toward this peak and reclaim it.

Conversely, if bullish sentiment wanes and selling pressure strengthens, the SAND token price may plunge toward support at $0.56, invalidating this bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Token Unlocks to Watch Next Week: AVAX, ADA and More

Token unlocks release tokens previously restricted under fundraising agreements. Projects strategically schedule these releases to minimize market pressure and prevent token price declines.

Here are three major token unlocks to keep an eye on next week.

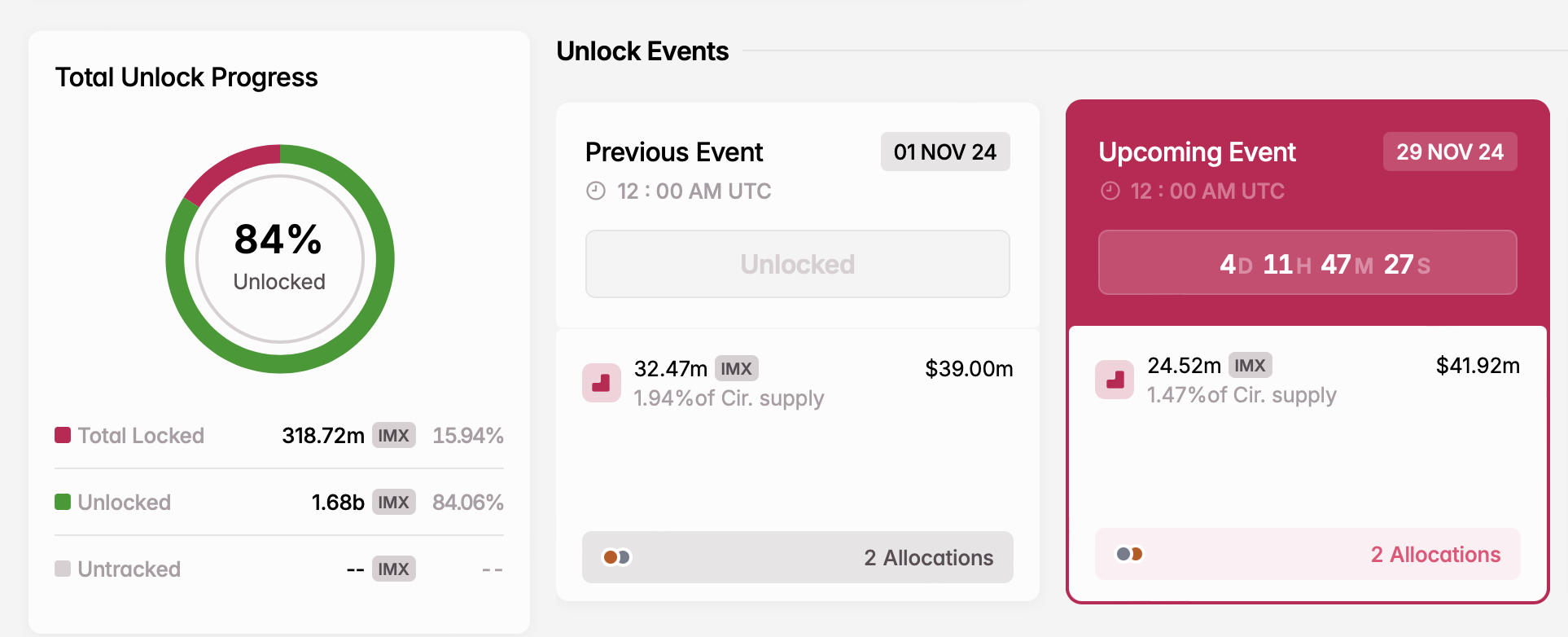

Immutable (IMX)

- Unlock date: November 29

- Number of tokens unlocked: 24.52 million IMX

- Current circulating supply: 1.67 billion IMX

Immutable, a Layer-2 solution for scaling NFTs on Ethereum, raised $12.5 million in just one hour during its IMX token sale on CoinList in September 2021. By March 2022, the project secured $60 million in an investment round, followed by an additional $200 million from investors such as ParaFi Capital, Declaration Partners, and Tencent Holdings.

On November 29, Immutable will release 24.52 million new IMX tokens into circulation. These tokens will support project development and growth within the broader Immutable ecosystem.

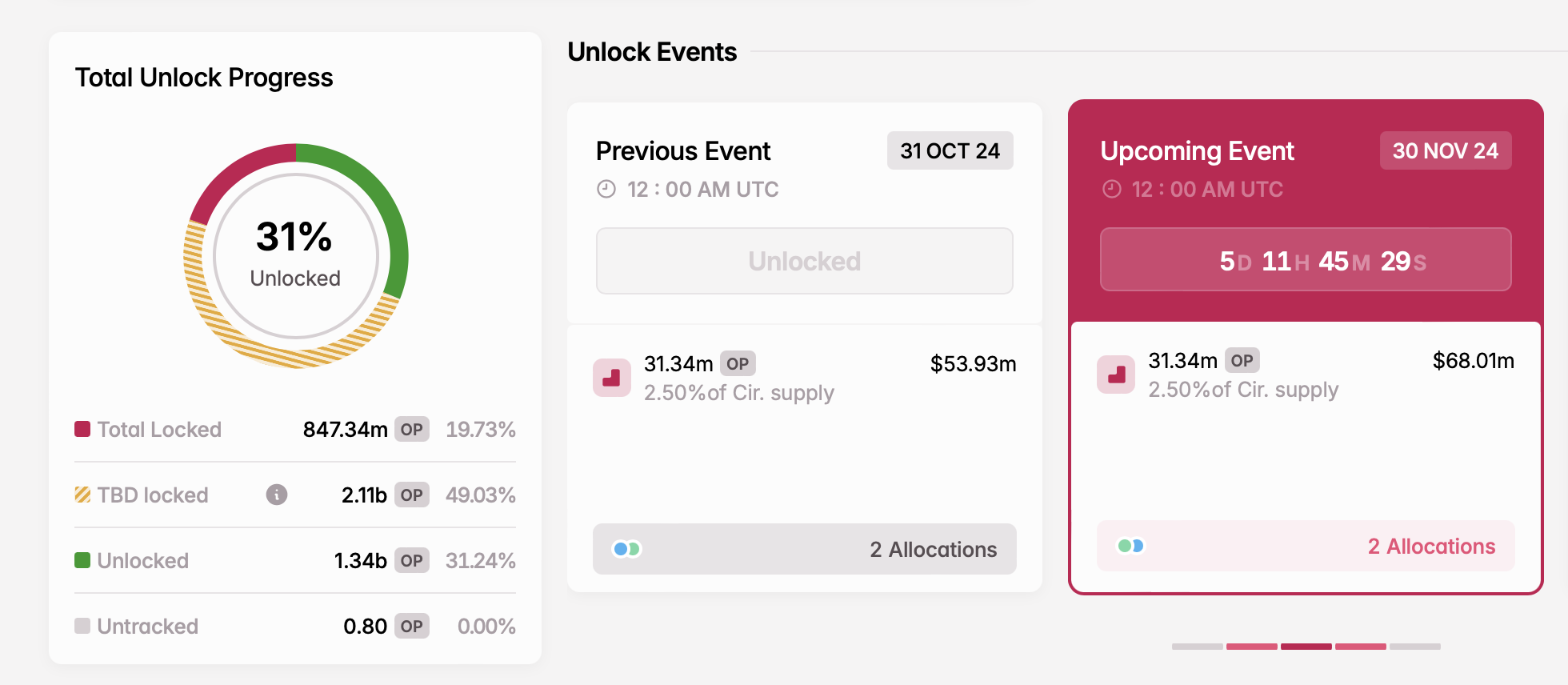

Optimism (OP)

- Unlock date: November 30

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.25 billion OP

Optimism, a Layer-2 scaling solution, enhances transaction speed and reduces costs on the Ethereum mainnet. Its OP token is vital for governance, enabling holders to vote on proposals and influence the network’s development and management.

On November 30, Optimism will release 31.34 million OP tokens into circulation. Tokenomist (formerly TokenUnlocks) reports that core contributors and investors will receive these tokens.

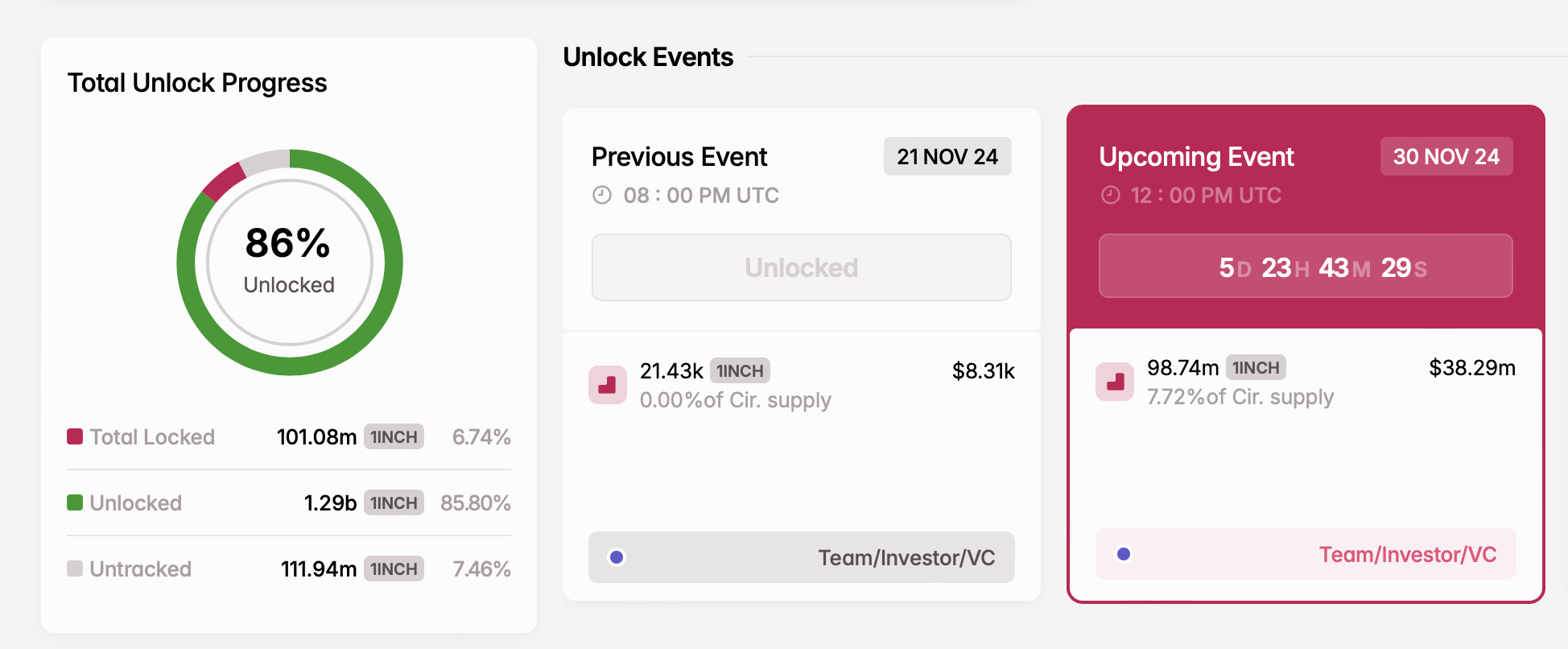

1Inch (1INCH)

- Unlock date: November 30

- Number of tokens unlocked: 98.74 million 1INCH

- Current circulating supply: 1.27 billion 1INCH

1inch is a decentralized exchange aggregator that pools liquidity from multiple DEXs to offer users the best trading rates. It streamlines trading by identifying the most efficient transaction routes, minimizing slippage, and lowering fees.

On November 30, 1inch will unlock nearly 100 million 1INCH tokens. These tokens are allocated for developers, early investors, and venture capital funds.

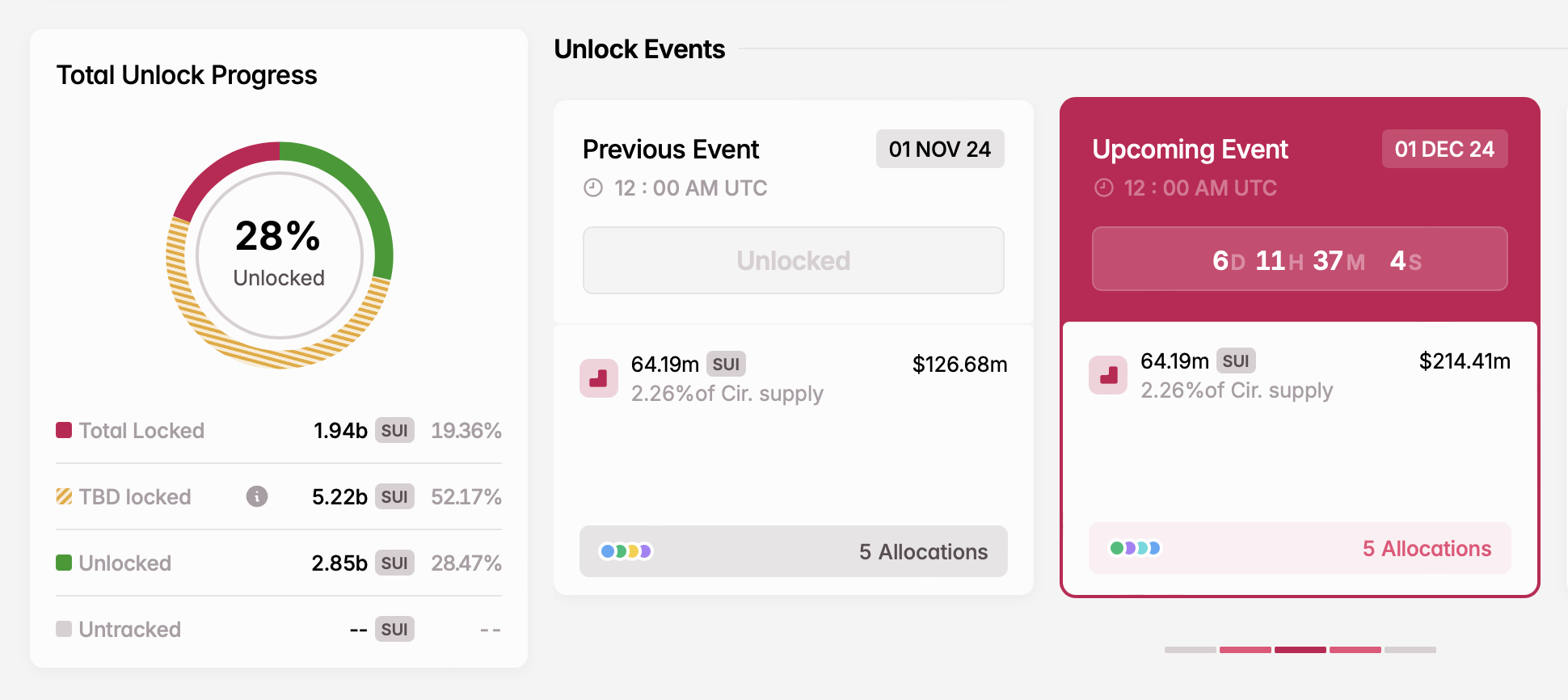

Sui (SUI)

- Unlock date: December 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 2.84 billion SUI

Sui is a high-performance Layer-1 blockchain designed to enhance network operations and security using a Proof-of-Stake consensus mechanism. Developed by Mysten Labs, the project was founded in 2021 by former Novi Research employees who were instrumental in creating the Diem blockchain and the Move programming language.

The SUI token supports governance, allowing holders to vote on key proposals and influence the platform’s direction. On December 1, the next token unlock will release a significant portion of tokens allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

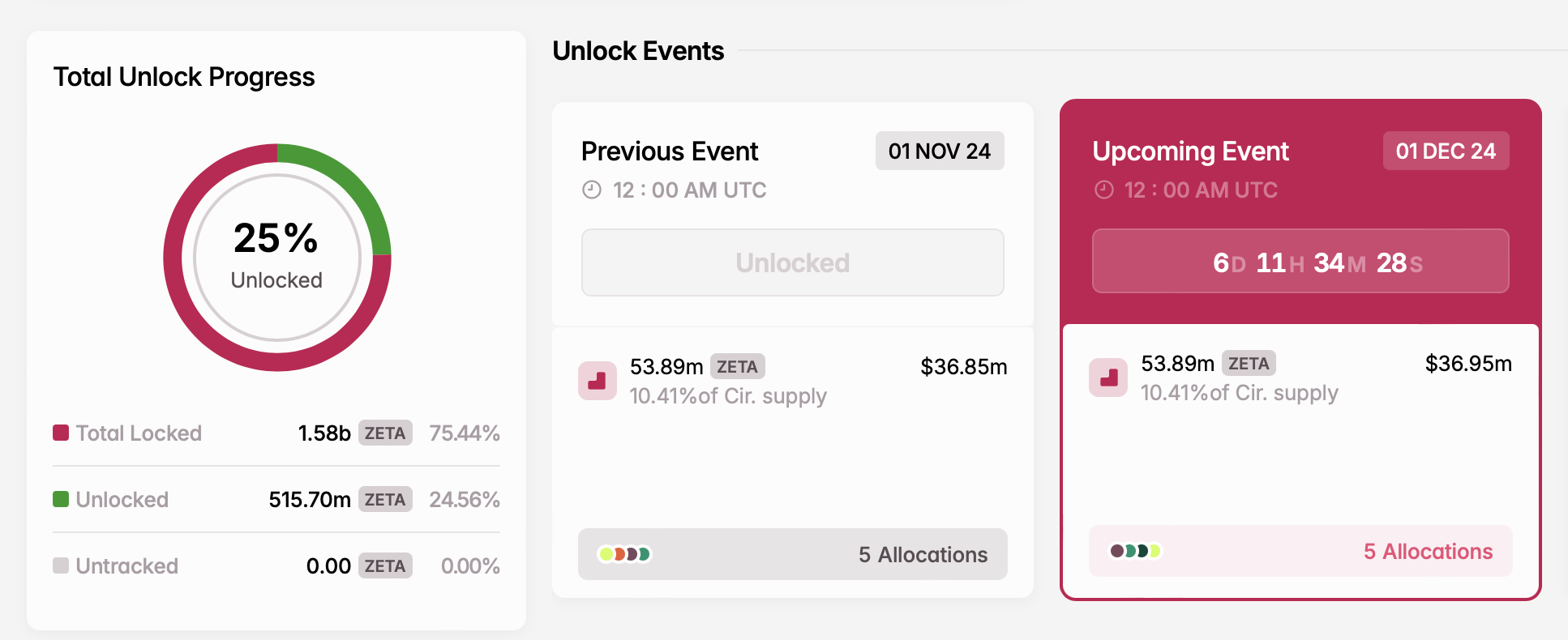

ZetaChain (ZETA)

- Unlock date: December 1

- Number of tokens unlocked: 53.89 million ZETA

- Current circulating supply: 517.85 million ZETA

ZetaChain is a decentralized blockchain platform designed to enable seamless interoperability between different blockchain networks. The platform’s standout feature enables cross-chain communication, allowing the exchange of tokens and data across blockchains like Ethereum and Binance Smart Chain.

On December 1, ZetaChain will release nearly 54 million ZETA tokens. These tokens will support various initiatives, including a user growth pool, an ecosystem growth fund, rewards for core contributors, advisory roles, and liquidity incentives.

Next week’s cliff token unlocks will also include Cardano (ADA), Ethena (ENA), and dYdX (DYDX), among others, with a total combined value exceeding $540 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is the XRP Price Decline Going To Continue?

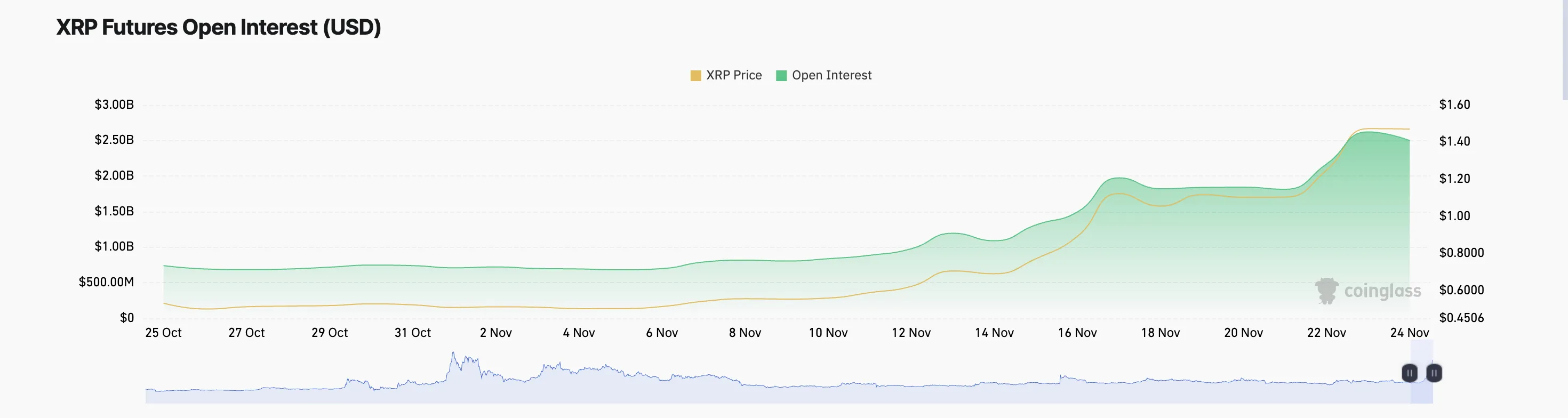

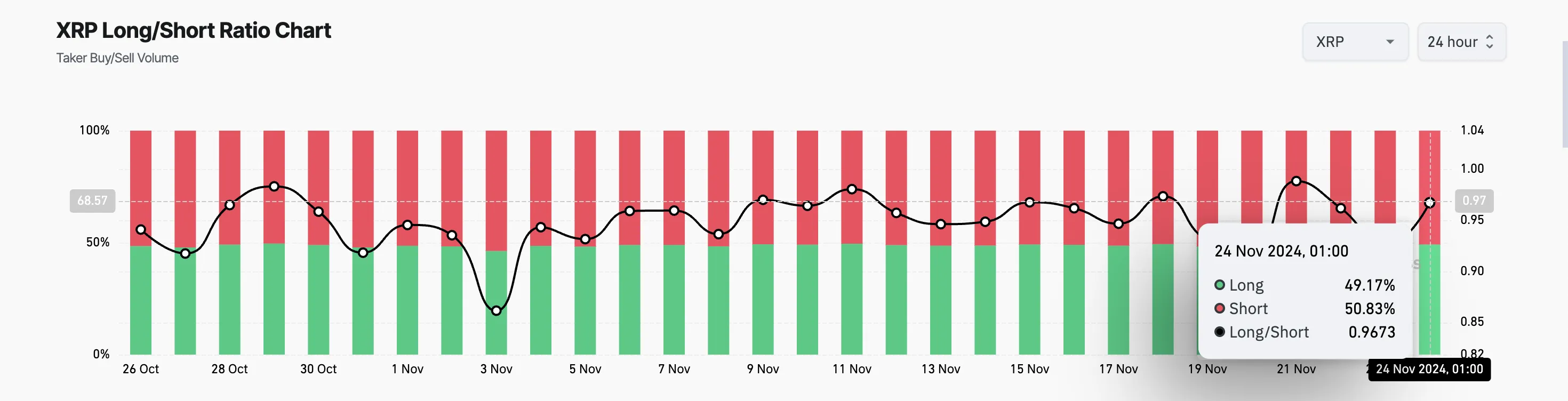

Ripple’s XRP hit a year-to-date high of $1.63 on November 23. However, fading bullish momentum has made future traders doubtful about the rally’s sustainability. An increasing number are opening short positions, expecting a near-term price correction.

Currently trading at $1.44, XRP has declined by 6% in the past 24 hours. This analysis explores the recent activity in the token’s futures market and assesses the likelihood of a continued XRP price decline.

Ripple Traders Bet on a Price Drop

A drop in its open interest has accompanied XRP’s price decline over the past 24 hours. Per Coinglass data, this sits at $2.52 billion, falling by 9% during that period.

Open interest refers to the total number of active contracts in a derivatives market, such as futures or options, that have not been settled. When open interest drops as an asset’s price falls, traders are closing their positions to lock in profits or minimize losses, indicating reduced market participation.

In XRP’s case, this suggests waning confidence in the continuation of the uptrend and hints at a sustained reversal in the asset’s price movement.

Moreover, XRP’s Long/Short ratio confirms this bearish outlook. As of this writing, this sits at 0.96%, with 51% of all positions opened shorting the altcoin.

The Long/Short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price decreases) in a market. When the ratio is below 1, it indicates that there are more short positions than long positions, suggesting a bearish sentiment among traders.

This imbalance in the XRP market reflects growing pessimism about the asset’s near-term prospects and may contribute to continued downward pressure on its price.

XRP Price Prediction: More Declines Imminent

XRP is currently trading at $1.44, holding above the $1.33 support level. If bearish sentiment intensifies, the price could drop to this support. A further decrease in buying pressure at that level may push XRP down to $1.15.

On the other hand, a shift in market sentiment from negative to positive will invalidate this bearish outlook. Should this happen, the altcoin will reclaim its year-to-date high of $1.63 and attempt to surpass it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin12 hours ago

Altcoin12 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Market23 hours ago

Market23 hours agoWhy BTC Miners Are Selling Their Coins

-

Market21 hours ago

Market21 hours agoKraken Eyes Token Expansion as Trump Promises Crypto Support

-

Altcoin21 hours ago

Altcoin21 hours agoXRP Price To $28: Wave Analysis Reveals When It Will Reach Double-Digits

-

Market20 hours ago

Market20 hours agoXRP To Hit $40 In 3 Months But On This Condition – Analyst

-

Market9 hours ago

Market9 hours agoWhy a New Solana All-Time High May Be Near

-

Market19 hours ago

Market19 hours agoExploring Hottest New Coins: FINE, CHILLGUY, and CHILLFAM

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Price To $100,000? Here’s What To Expect If BTC Makes History