Market

Vishal Sacheendran on Exchange’s Future

In a timely interview, Vishal Sacheendran from Binance offered insights into the cryptocurrency giant’s operations amidst major changes.

Sacheendran, Binance’s Head of Regional Markets, stressed the company’s dedication to staying compliant and shared insights on its future goals. Speaking to BeInCrypto, he discussed how one of the largest cryptocurrency exchanges is tackling regulatory hurdles, adapting connection with its founder Changpeng Zhao (CZ) , and planning its next steps.

What progress has there been in the policy of Binance in global regulatory compliance, especially after what happened to CZ?

It’s a bit unfair to say that we have only been paying attention to compliance from when CZ had a settlement. Compliance was our focus for four years or more. Even though we’re just a 7-year-old company, we’ve always paid huge attention to compliance over the past years.

If you look at the (US) DOJ’s settlement, what happened was from our initial years as a company when rules and regulations were not in place, and they mention that we have done a good job with the compliance program since then.

Currently, we have about 500 to 600 compliance employees and we continue to invest heavily in their team. We are hoping to hit close to 700 to 800 by the end of the year. So, we are one of the most regulated crypto firms out there. We just had our 19th registration with India a couple of weeks ago.

All in all, we’ve done pretty well in the compliance space. I don’t think the settlement with the US regulators has anything to do with our current compliance pace.

How is the relationship between CZ and Binance going to be after he is released?

He is only the ultimate shareholder. He’s not involved at all and that was a part of the settlement. He won’t come back and you can see it in the statements. We have a statement. He’s not involved in any of the operations.

There are a lot of speculations that the prices of Binance-related tokens might go up once that happens, too.

You should be more hyped about the US federal rate cuts. That is going to be more influential than anything else.

What is the industry outlook for crypto?

2025 is going to be a very interesting year for crypto, and we just hope and see what happens next. There is a lot of good stuff coming with the regulations slowly catching up to innovation. You can see regulators trying to grow the industry instead of looking at it from their own perspective.

Binance has been putting a lot of effort into education in the crypto space. What are your major achievements?

We have to start looking at crypto education from the grassroots level. In Kazakhstan, we are working with universities and high schools to teach kids about blockchain, about crypto.

Our users are becoming more knowledgeable, too. For people who want to invest, they need to know what they’re investing into, do their research extremely important, and not just follow the hype.

There’s a huge effort being placed on education not just with Binance Academy, but also in the work that we do with the regulators, law enforcement agencies, with governments across the world. Our compliance teams work with law enforcement agencies across the world, giving them training. We give cybersecurity training to a lot of people.

Just like how you did mandatory AML and KYC training when you joined a bank, I think these things should be mandatory — for crypto, too. Education is going to be the key for them to understand the industry and how to treat it.

Which jurisdiction seems to have the most reasonable regulation for the crypto industry?

Every jurisdiction is different. For example, Japan was one of the first jurisdictions globally to come up with a crypto framework. They treated crypto from an AML registration point of view.

If you look at a comprehensive framework for crypto, Abu Dhabi Global Market (ADGM) was the first one in Abu Dhabi and I was part of the team that rolled it out. Everyone has a different risk appetite and different perspectives on how they should regulate crypto.

The ones that will be successful are the ones that are going to ensure that they don’t kill the industry but regulate it. The crypto regulators either regulate it, prohibit it, or take no action. I think regulation is the key.

For specific jurisdictions, you can see the adoption of crypto in the markets in MENA, Latin America, and Southeast Asia. Indonesia, Thailand, and India have the highest crypto adoption globally.

There are other jurisdictions that are not there yet. It could be for multiple reasons. They don’t have the risk appetite for it and that’s a huge it’s a huge drain on talent.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

The SEC is quietly meeting with several issuers to discuss approving a Solana ETF, claims Fox Business reporter Eleanor Terrett. With Trump’s impending pro-crypto administration, the SEC seems more inclined to approve such a product.

However, anti-crypto figure Gary Gensler is still nominally in charge of the SEC, and public progress might not begin until 2025.

Solana ETF Approval Is Getting Closer

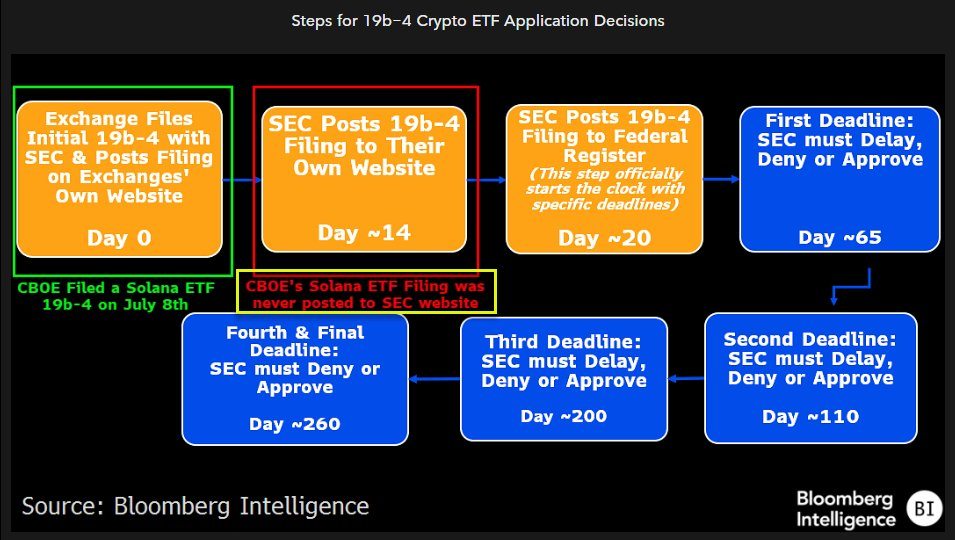

According to a scoop from Fox Business reporter Eleanor Terrett, the SEC and several ETF issuers are in talks to approve a Solana ETF. Currently, Brazil is the only country that has given this product a green light. As recently as September, Polymarket odds gave the SEC a dismal 3% chance of approving it. This reluctance, however, might soon be changing:

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Terrett was very clear about the impetus for this progress in negotiations: Donald Trump’s re-election. On the campaign trail, Trump vowed to significantly reform US crypto policy, and one cornerstone was firing anti-crypto SEC Chair Gary Gensler. Gensler has apparently conceded to his impending ouster, and his replacement will undoubtedly support the industry.

Previous attempts have floundered at an early step in the process. Once the SEC officially acknowledges an application, it must confirm or deny it within a 240-day window. Previous filings have lingered in limbo at this stage. However, the list of candidates is now growing: Canary Capital filed for a Solana ETF in October, and BitWise did the same earlier today.

Nonetheless, these positive negotiations still only consist of anonymous rumors. The Commission has not publicly moved to begin this process, and Gensler is still nominally in charge. Terrett posits that the SEC will only make serious progress on the Solana ETF at the start of 2025. Compared to previous pessimism, however, this is a complete sea change.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

The ETH/BTC ratio, a metric measuring Ethereum’s price performance compared to Bitcoin, has reached its lowest point since March 2021. This development comes amid BTC’s brief rise to $98,000.

While the flagship cryptocurrency has increased by 7.45% in the last seven days, ETH has hovered around the same region, with investors raising concerns about the altcoin’s future.

Ethereum Continues to Lag Behind Bitcoin

In February, the ETH/BTC ratio climbed to a yearly high of 0.060. During that time, speculation spread that Ethereum’s price would begin to outperform Bitcoin and validate the altcoin season. However, that has not happened, as Bitcoin’s price has continued to make new highs

Ethereum, on the other hand, is yet to retest to reclaim its all-time high despite reaching $4,000 earlier in the year. This disparity in performance could be linked to several factors. For instance, both cryptocurrencies saw approval for exchange-traded funds (ETFs) this year.

However, while Bitcoin has seen billions of dollars in inflows, ETH has been inconsistent in attracting capital. Hence, the institutional inflow has driven BTC toward $100,000, ensuring that the ETH/BTC ratio drops to $0.033 — the lowest level in 42 months.

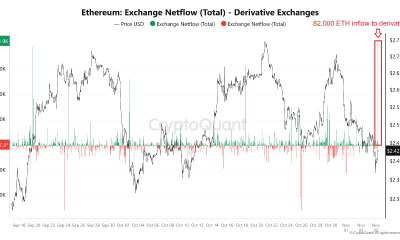

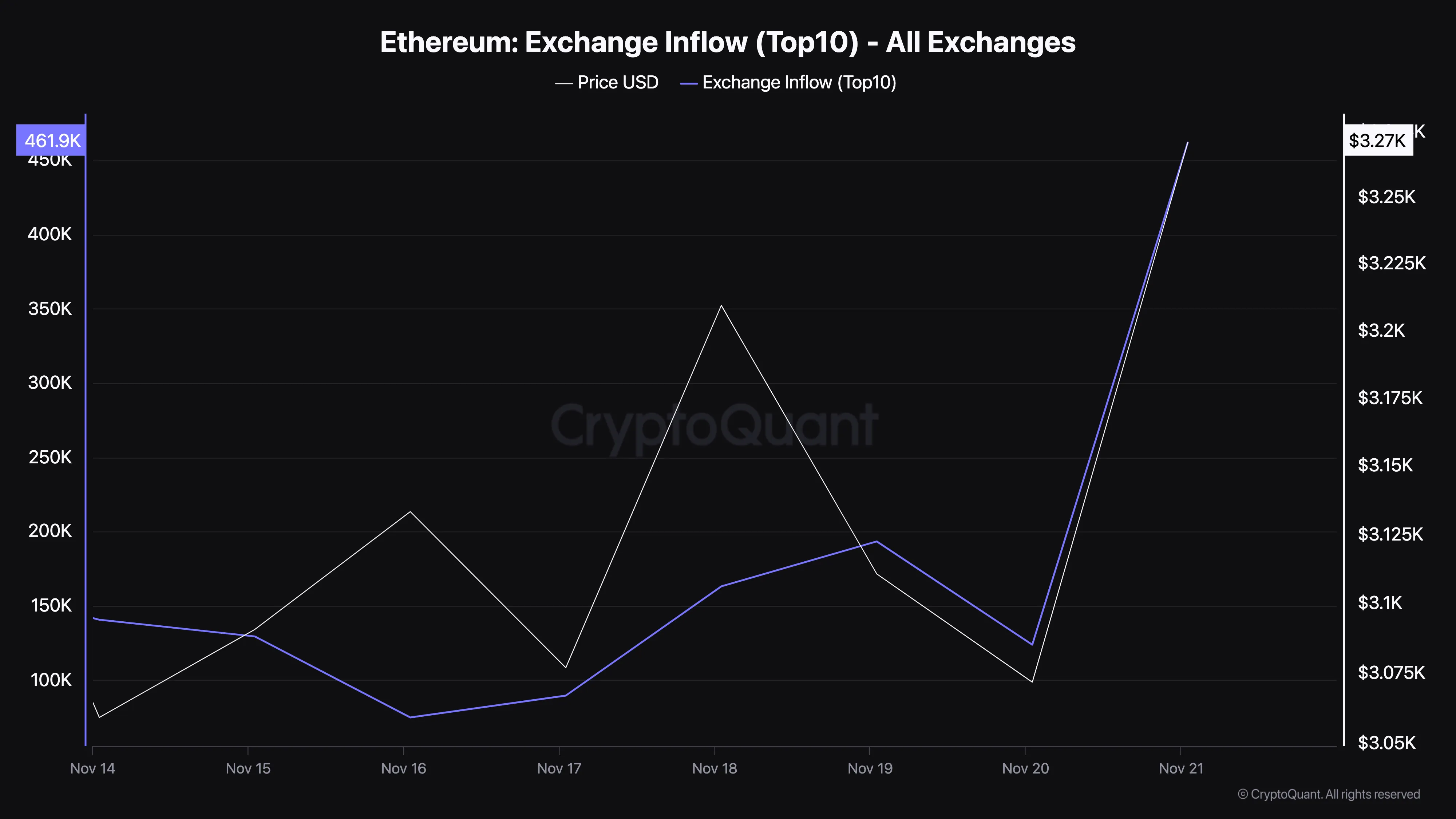

Further, the disparity in Ethereum’s performance can largely be attributed to sustained selling pressure. For instance, CryptoQuant data reveals that exchange inflows into the top 10 exchanges have climbed to 461,901 ETH, valued at approximately $1.50 billion as of this writing.

This surge in exchange inflow reflects large deposits by investors, indicating a heightened willingness to sell. Such movements typically increase the supply of ETH on exchanges, raising the likelihood of a price drop.

In contrast, a low exchange inflow generally indicates that investors are holding onto their assets, which is not the current scenario for ETH.

ETH Price Prediction: Crypto Could Retrace

As of this writing, ETH trades at $3,317, which is a higher close than yesterday’s. Despite that, the altcoin is still below the Parabolic Stop And Reverse (SAR) indicator. The Parabolic SAR generates a series of dots that track the price movement, positioning above the price during a downtrend and below the price during an uptrend.

A “flip” in the dots — shifting from one side to the other — often signals a potential trend reversal. As seen below, the indicator is above ETH’s price, suggesting that the cryptocurrency could reverse its recent gains.

If this is the case and the ETH/BTC ratio declines, Ethereum’s price could decline to $3,083. However, if buying pressure increases, that might not happen. Instead, the value could surge above $3,500 and toward 4,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Cash (BCH) Price Up, Leads Daily Gains

Bitcoin Cash (BCH) price has risen more than 10% in the last 24 hours, surpassing the $10 billion market cap and signaling renewed bullish momentum. The recent surge has brought BCH closer to key resistance levels, indicating the potential for further gains if the uptrend strengthens.

However, indicators like the RSI and ADX show that while the trend is improving, it is not yet fully strong. Whether BCH can sustain its upward momentum or face a pullback will depend on how it navigates critical resistance and support levels in the coming days.

BCH Current Uptrend Is Getting Stronger

BCH currently has an ADX of 19.31, up from 12 just a day ago. This increase indicates that the strength of the trend is gradually gaining momentum after being weak.

However, since the ADX is still below 25, it suggests that the uptrend has not yet reached a strong or sustained level of trend strength.

The ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or uncertain trend. While Bitcoin Cash is currently in an uptrend, the ADX at 19.31 suggests that the trend is still in its early stages of strengthening.

If the ADX continues to rise above 25, it could confirm a stronger uptrend, but for now, Bitcoin Cash price movement remains cautious, with room for further development.

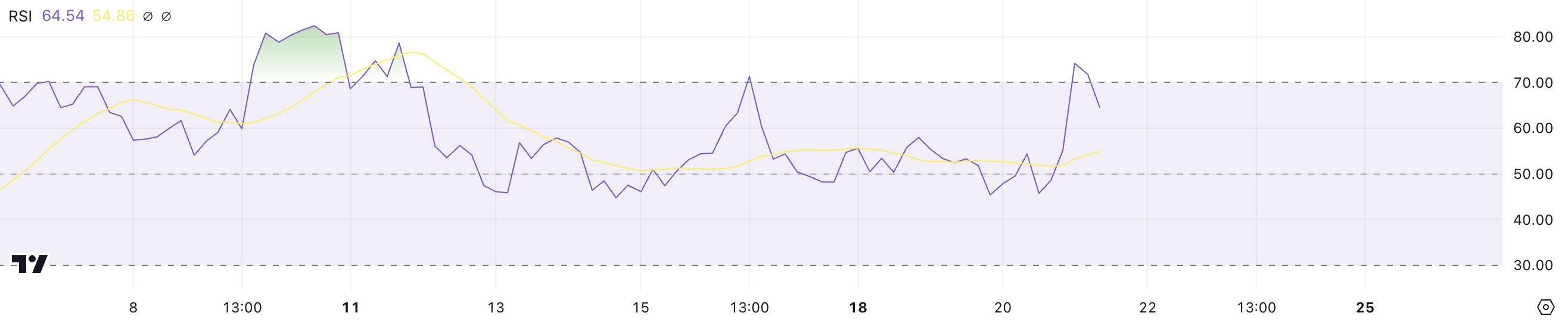

Bitcoin Cash Is Not In The Overbought Zone Anymore

Bitcoin Cash has an RSI of 64.5, down from over 70 just a day ago. This decline suggests that while the asset is still experiencing bullish momentum, the intensity of buying pressure has started to decrease.

The drop below 70 takes BCH out of the overbought zone, indicating a more balanced market sentiment.

The RSI measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 64.5, BCH remains in bullish territory, which supports the ongoing uptrend.

However, the slight decline in RSI could mean the pace of gains is moderating, potentially leading to BCH price consolidation before any further upward movement.

BCH Price Prediction: Will a New Surge Occur Soon?

If BCH maintains its current uptrend and gains additional momentum, it could continue its rise after climbing more than 10% in the last 24 hours.

This strength could push BCH price to test the resistance at $536.9. Breaking this level would signal a continuation of bullish momentum and could attract further buying interest.

On the other hand, if the uptrend fades away and reverses, BCH price could retrace to test the nearest support levels at $424 and $403. If these supports fail to hold, the price could fall further to $364, representing a potential 27% correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market13 hours ago

Market13 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum10 hours ago

Ethereum10 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation18 hours ago

Regulation18 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market17 hours ago

Market17 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Market22 hours ago

Market22 hours agoArkham Spot Trading Platform Set to Launch in the US Market

-

Regulation17 hours ago

Regulation17 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Regulation21 hours ago

Regulation21 hours agoDonald Trump’s transition team considering first-ever White House crypto office

-

Market16 hours ago

Market16 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates