Market

How Bitcoin Price, Altcoins Will Gain from $278 Billion Likely Inflow

Liquidity is projected to surge into the crypto market in the fourth quarter of the year, creating a favorable environment for a potential parabolic rally in both Bitcoin (BTC) and altcoins. This influx of capital could drive prices higher as investors look to capitalize on the anticipated momentum.

Today, Bitcoin’s price surged past $65,000, marking a significant milestone. However, according to a recent report, this rise is just the beginning of a potentially massive price boom. The anticipated surge is likely fueled by the return of retail investors and an influx of billions of dollars from the Chinese market.

More Capital Means More Upside for Bitcoin, Alts

Bitcoin’s recent jump could be attributed to the 50 basis point Fed rate Cut earlier this month. However, the number one cryptocurrency is not the only asset benefiting from the decision.

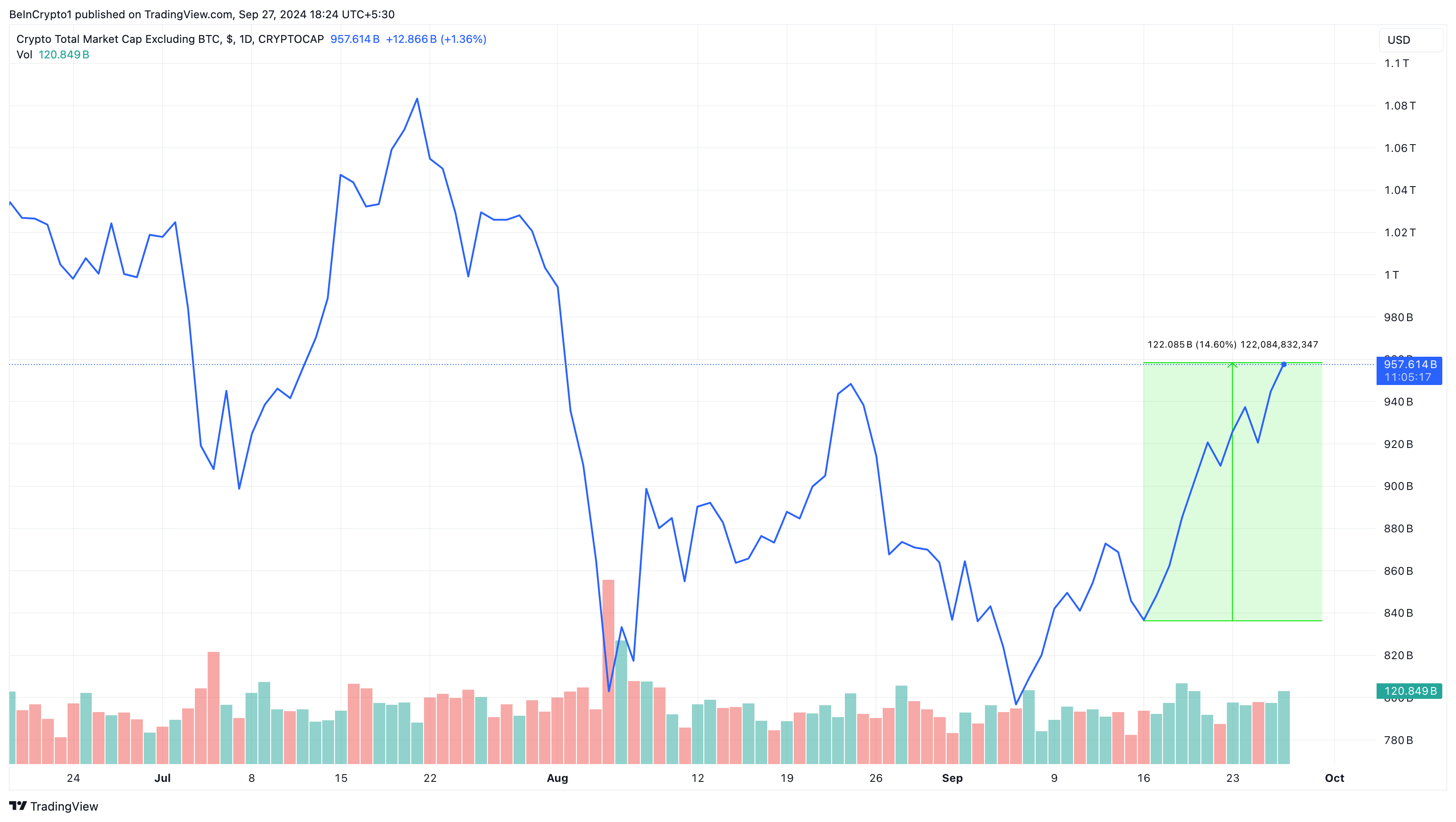

Since the rate cut, altcoins, which endured a prolonged downtrend for the last two quarters, have now enjoyed significant rallies. Despite the improved market condition, 10x Research, led by analyst Markus Thielen, believes the recent gains are nothing compared to what’s coming in Q4.

“Altcoins are exploding. Further upside appears likely as stablecoin minting accelerates and Chinese OTC brokers report billions in inflows. With Bitcoin breaking above $65,000, we anticipate a swift move toward $70,000, followed by new all-time highs in the near term,” Thielen said in the September 26 report.

While Bitcoin’s dominance has fallen, the total market cap of altcoins has increased by 15% since September 17.

However, the recent decline in BTC’s dominance does not mean that the coin price will continue to decrease. In 10x Research’s report, Theieln mentioned that Bitcoin could gain from a fresh $278 billion capital injection from the Chinese market in Q4.

“The $278 billion Chinese stimulus plan could ignite a parabolic rally in cryptocurrency prices, fueled by increasing global liquidity,” the report stated.

If that happens, then Bitcoin’s price could reach $70,000 before October, popularly called “Uptober,” closes. Another interesting twist to the matter is the rising participation of retail investors.

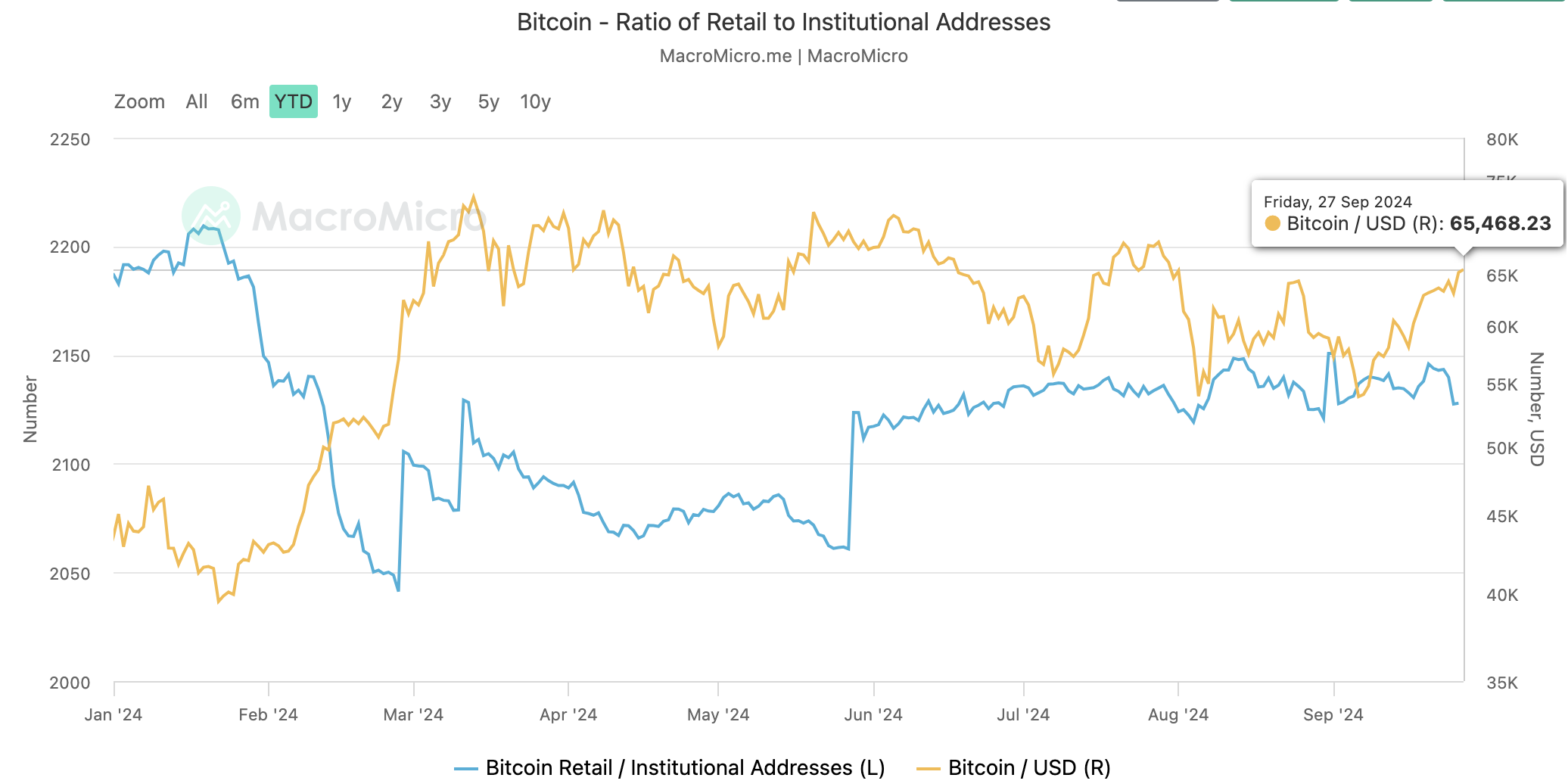

For most of this year, retail investors have stood on the sidelines as institutional investors have pushed BTC’s price to its all-time high (ATH). However, as of this writing, things have changed as the retail to institutional addresses have increased.

Read more: 10 Best Altcoin Exchanges In 2024

Retail Returns and Institutions Can Bet More

This increase is beneficial not only to Bitcoin but also to altcoins. For example, the prices of altcoins like Shiba Inu (SHIB) have rallied by 41% in the last seven days. SEI’s price has jumped by 31%, and likewise — Wormhole (W).

Interestingly, 10x Research also agrees, noting that the move seems to be starting from South Korea. With this development, it appears that the Chinese $278 liquidity, alongside significant market participation from the Asian region, could play a huge role in the projected upswing for the rest of the year.

“Retail crypto trading activity in South Korea supports this trend, with daily trading volumes now hovering around $2 billion. Although still below the staggering $13 billion seen in early March 2024 — when crypto volumes were double that of the local stock market, and Shiba Inu, traded in Korea, alone reached nearly 40% of the stock market’s volume — altcoins have dominated trading in the past week, surpassing Bitcoin,” 10x Research wrote.

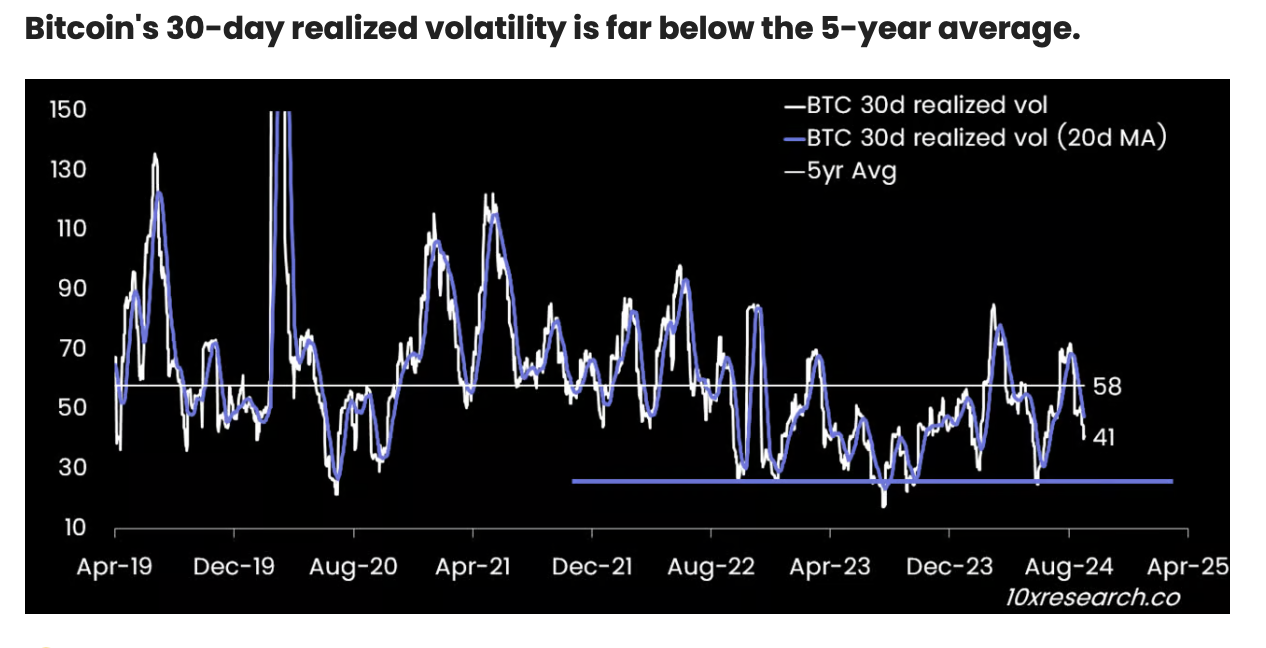

In addition, Bitcoin has registered a decline in its 30-day realized volatility. This decline means that institutional investors can increase their position size, consequently leading to BTC and the border market to higher values.

BTC Price Prediction: It’s Evidently a Bullish Cycle

From a technical point of view, Bitcoin has finally broken above the descending channel. Since July, this bearish pattern has restricted the coin from rising past $65,000.

However, with support at 62,825, BTC successfully breached the region. According to the daily chart, Bitcoin’s price might now face resistance at $68,253, which is a major point of interest. Breaking this hurdle could be crucial to rising toward $73,095.

If that happens, then BTC might reach a new ATH before Q4 ends, with potential targets starting from $76,075.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

However, the rejection of $68,253 could invalidate this prediction. Should that happen and the crypto market liquidity fails to pick up, Bitcoin’s price might drop to $58,188.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Is Why XRP Price Rallied By 25% and Could Soon Hit $2

Ripple’s (XRP) price rallied by 25% in the last 24 hours following Gary Gensler’s announcement that he would resign as the US Securities and Exchange Commission (SEC) chair on January 20, 2025.

This development comes as a relief to the popular “XRP Army,” which has had to deal with suppressed price action due to the Gensler-led SEC’s nonstop petitions against Ripple. But that is not all that happened.

Ripple Bears Face Notable Liquidation Following Gensler’s Notification

Gensler’s announcement appears to be a positive development for the broader crypto market. But XRP holders seemed to benefit the most. This was particularly significant given the unresolved Ripple-SEC legal issues that have persisted throughout the SEC Chair’s tenure.

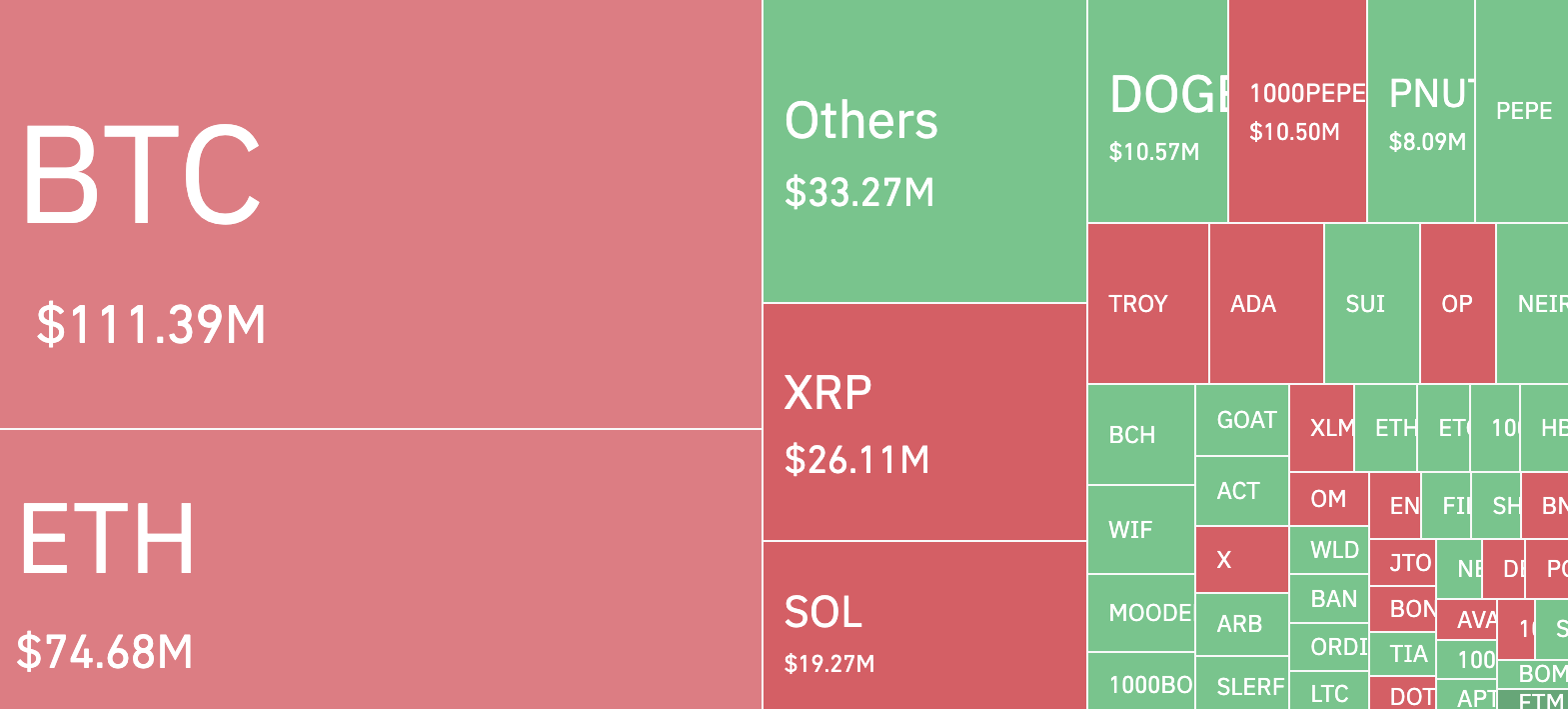

As a result, it came as no surprise that XRP price rallied and outpaced those of any other cryptocurrency in the top 10. Furthermore, the development triggered liquidations totaling $26.11 million over the last 24 hours.

Liquidation occurs when a trader fails to meet the margin requirements for a leveraged position. This forces the exchange to sell off their assets to prevent further losses. In XRP’s case, the liquidation primarily resulted in a short squeeze.

A short squeeze happens when a large number of short positions (traders betting on price declines) are forced to close, driving the price higher as they rush back to buy back the asset.

At press time, XRP trades at $1.40 and currently has a market cap of $80.64 billion. With Gensler almost gone, crypto lawyer John Deaton noted that XRP price gains could be higher, and the market cap could climb to $100 billion.

“XRP soon will achieve a $100B market cap. Times are changing,” Deaton wrote on X.

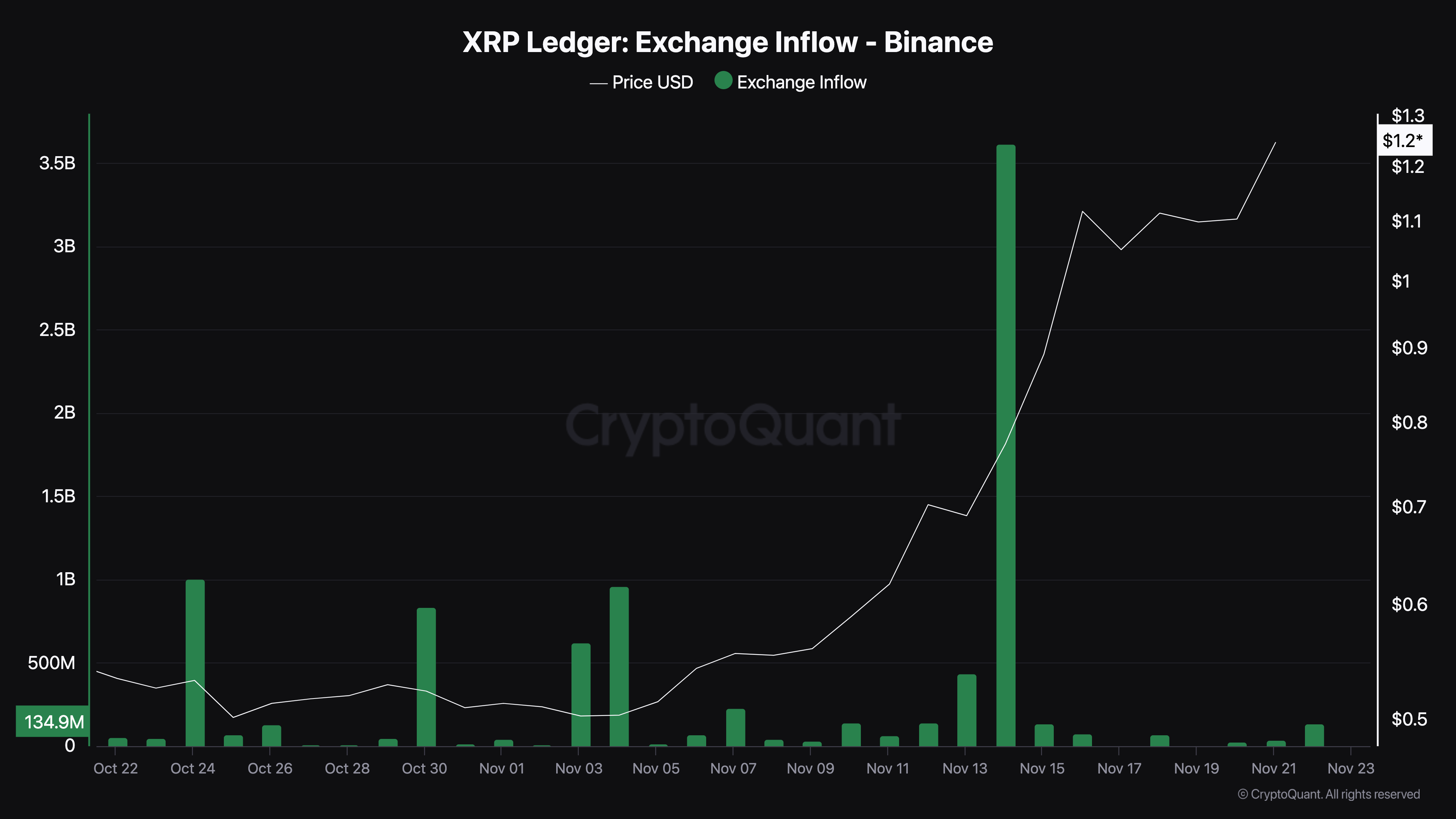

Meanwhile, CryptoQuant data shows that the total number of XRP sent into exchange has significantly decreased. Typically, high values indicate increased selling pressure in the spot market. This is because it suggests that more assets are being offloaded, potentially driving prices lower.

However, since it is low, XRP holders are refraining from selling. If this remains the case, the token’s value could rise higher than $1.40.

XRP Price Prediction: $2 Coming?

According to the 4-hour chart, XRP has been trading within a range of $1.04 to $1.17 since November 18. This sideways movement has resulted in the formation of a bull flag — a bullish chart pattern that signals potential upward momentum.

The bull flag begins with a sharp price surge, forming the flagpole, driven by significant buying pressure that outpaces sellers. This is followed by a consolidation phase, where the price retraces slightly and moves within parallel trendlines, creating the flag structure.

Yesterday, XRP broke out of this pattern, signaling that bulls have seized control of the market. If this momentum persists, XRP’s price could surpass $1.50, potentially approaching the $2 threshold.

However, this bullish scenario hinges on market behavior. If holders decide to secure profits, selling pressure could push XRP’s price below $1, erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Shows Renewed Energy: Rally Incoming?

Dogecoin is consolidating gains above the $0.380 resistance against the US Dollar. DOGE is holding gains and eyeing more upsides above $0.400.

- DOGE price started a fresh increase above the $0.3750 resistance level.

- The price is trading above the $0.3800 level and the 100-hourly simple moving average.

- There was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could continue to rally if it clears the $0.400 and $0.4080 resistance levels.

Dogecoin Price Eyes More Upsides

Dogecoin price remained supported above the $0.350 level and recently started a fresh increase like Bitcoin and Ethereum. DOGE was able to clear the $0.3650 and $0.3750 resistance levels.

The price climbed above the 50% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low. Besides, there was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair.

Dogecoin price is now trading above the $0.3750 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.3950 level or the 61.8% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low.

The first major resistance for the bulls could be near the $0.400 level. The next major resistance is near the $0.4080 level. A close above the $0.4080 resistance might send the price toward the $0.4200 resistance. Any more gains might send the price toward the $0.4500 level. The next major stop for the bulls might be $0.500.

Are Dips Supported In DOGE?

If DOGE’s price fails to climb above the $0.400 level, it could start a downside correction. Initial support on the downside is near the $0.3850 level. The next major support is near the $0.3750 level.

The main support sits at $0.3550. If there is a downside break below the $0.3550 support, the price could decline further. In the stated case, the price might decline toward the $0.3200 level or even $0.300 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.3850 and $0.3750.

Major Resistance Levels – $0.4000 and $0.4200.

Market

Solana Hits New All-Time High After 3 Years

On Friday, Solana (SOL) soared to a new all-time high (ATH), now trading at approximately $261. This breakthrough surpasses its previous peak set in November 2021.

Solana’s rise to a new ATH marks an increase of over 32 times from its lows recorded in December 2022.

Solana Hits All-Time High as Gary Gensler Plans Resignation

Solana’s path to this new high has been anything but smooth. After reaching its previous high in 2021, the platform faced a downturn in 2022 amid a broader crypto bear market, further exacerbated by technical issues and network downtimes.

The collapse of FTX in November 2022 pushed Solana’s price down to around $8.

However, Solana has since made a remarkable recovery, increasing more than 32-fold from its low. Now, Solana enthusiasts believe that SOL could eventually outpace Ethereum (ETH) in market capitalization.

“Solana has been at an all-time high by market cap for a while actually. Now, we’re finally in price discovery. The flippening is coming,” Birch, the founder of PathCrypto, said.

The surge in Solana’s market value coincides with the news of SEC Chairman Gary Gensler’s planned resignation, slated for January 20, 2025, as Donald Trump assumes office.

Known for his strict regulatory stance on cryptocurrencies, Gensler’s departure signals a potential shift toward a more crypto-friendly administration. Consequently, this political change is stoking speculations about the approval of a Solana exchange-traded fund (ETF). According to Fox Business journalist Eleanor Terrett, the SEC has begun engaging with issuers to explore the possibility of a Solana ETF.

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Previous efforts to launch a Solana ETF were stalled by regulatory roadblocks, often stopping early in the process. However, the changing political environment and the SEC’s increased openness have reignited hopes within the crypto community. Recent filings for a Solana ETF by Canary Capital and BitWise reflect a growing interest and anticipation for regulatory approval.

Despite these encouraging developments, the odds of a Solana ETF approval in 2024 remain low, with Polymarket estimates placing it at around 4%.

Meanwhile, the crypto community is also closely watching Bitcoin as it approaches the highly anticipated $100,000 mark. On Friday, Bitcoin recorded a new high of about $99,300. This milestone is viewed as a pivotal moment for Bitcoin and could impact other cryptocurrencies, including Solana.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Bitcoin18 hours ago

Bitcoin18 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation13 hours ago

Regulation13 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market18 hours ago

Market18 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin20 hours ago

Altcoin20 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin23 hours ago

Altcoin23 hours agoVitalik Buterin, Coinbase’s Jesse Pollack Buy Super Anon (ANON) Tokens On Base

-

Altcoin18 hours ago

Altcoin18 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K

-

Market17 hours ago

Market17 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift