Market

XRP Price Trapped In Consolidation: Will Bulls Break Free?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Will Solana Bears Stop SOL from Quick Run to $300?

On November 12, Solana’s (SOL) trading volume hit a four-month high of $12.60 billion amid the altcoin’s rally above $200. However, the same volume is now less than half of that, suggesting that Solana bears are ensuring that the price fails to rally toward $300.

But the question remains: Is a SOL rally no longer on the cards? This analysis examines the chances.

Solana Sees Waning Interest, Low Activity

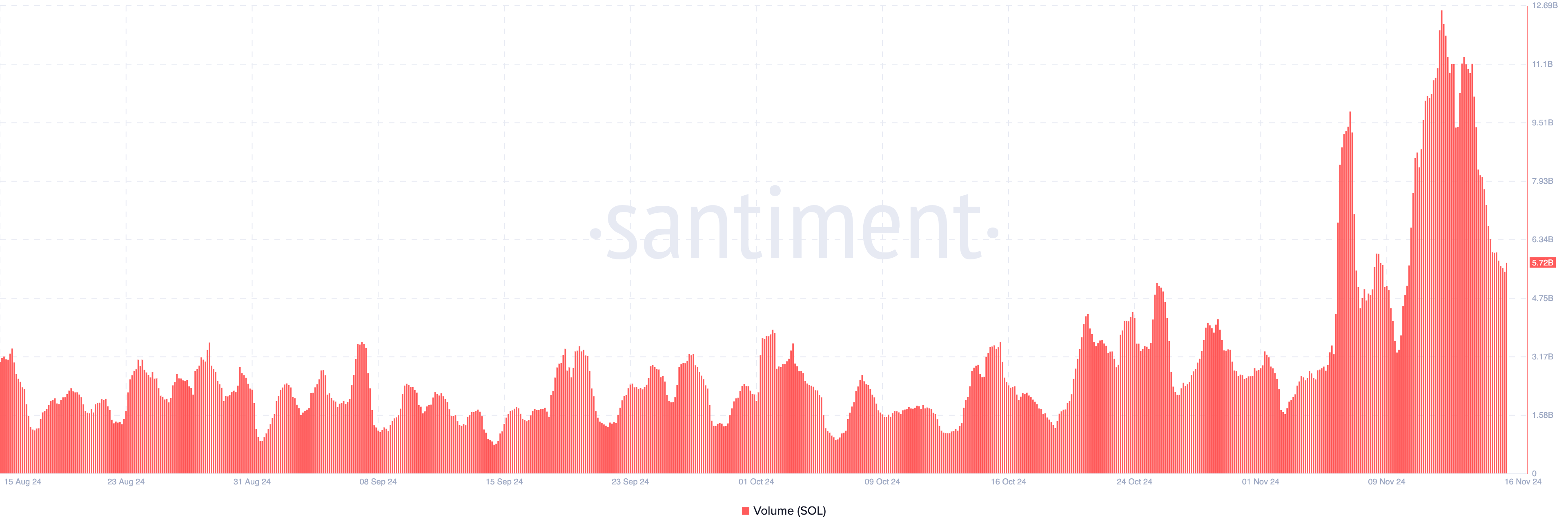

According to Santiment, Solana’s volume is down to $5.72 billion. In the crypto market, trading volume represents the total number of coins or tokens exchanged during a specific period. This key metric offers insights into market activity and liquidity, helping traders assess the strength of price movements and overall interest in a particular asset.

From a price perspective, the increase in volume alongside a rise in a crypto’s market value is a bullish sign.

However, in this case, the decline while the token trades at $216 suggests that Solana bears are restricting it from rousing higher. Thus, if the volume continues to decline, Solana’s price might also follow a downward trend.

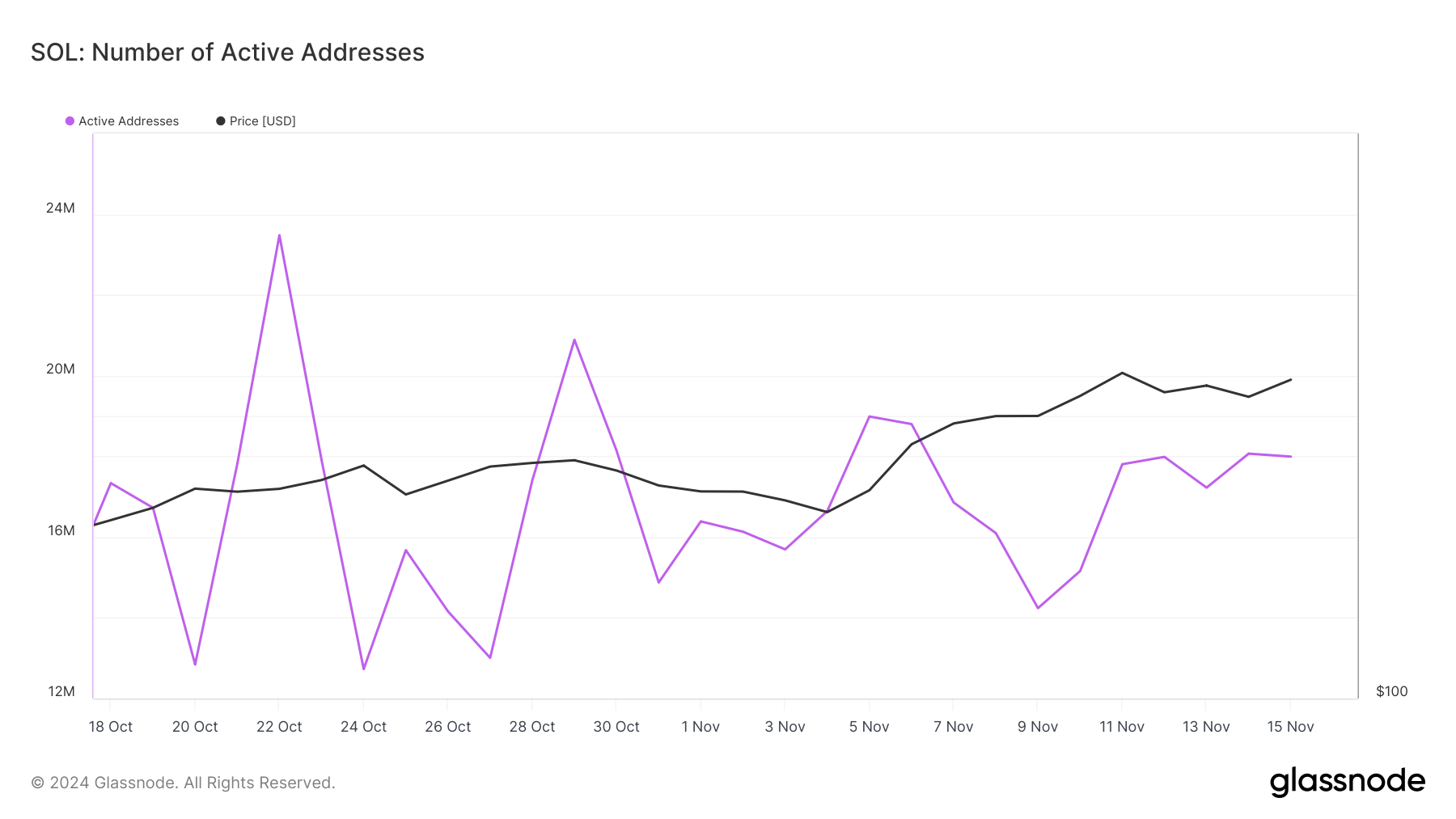

Another metric that affects this is Solana’s active addresses. Active addresses measure the unique wallet addresses involved in sending or receiving funds within a specific timeframe. This metric reflects network activity and user engagement.

A rise in active addresses often signals increased adoption and usage, which can positively influence a cryptocurrency’s price. Conversely, a decline may indicate waning interest in the network, potentially exerting downward pressure on the price.

According to Glassnode, Solana’s active addresses declined from over 20 million during the last days of October to 17.98 million. If this decrease continues, SOL might not have enough user engagement to support the uptrend.

SOL Price Prediction: Drop Below $200?

On the daily chart, Solana bears pushed the price back as soon as it hit $222.49. This pullback ensures that the altcoin’s hopes of reaching $300 have diminished. As mentioned above, the volume has decreased, which is also validated on the chart.

If that is the case, Solana’s price could decrease toward the $190.30 level. This will happen if selling pressure increases and SOL bears continue to control the price direction.

On the other hand, an increase in volume accompanied by buying pressure could invalidate this thesis. If that happens, Solana’s price might cross above $225 into the $300 level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Phishing Losses Exceed $800 Million in 2024

Giggle Academy, an educational initiative launched by Binance founder Changpeng Zhao, was a victim of a cyberattack that compromised its official X account (formerly Twitter). This resulted in the distribution of phishing links and false information.

This incident comes as the emerging industry deals with the scourge of phishing attacks, which have led to substantial losses for users.

Giggle Academy’s Hack Reinforces Growing Phishing Attack Threats

On November 16, Zhao confirmed a breach on Giggle Academy’s X account and cautioned the community against interacting with the compromised account. The attackers falsely claimed a “new CEO” had been appointed and shared phishing links to lure victims into verifying this fabricated announcement.

Giggle Academy provides free online courses covering grades 1 to 12, focusing on core subjects and additional topics such as emotional intelligence, finance, and blockchain. Its mission centers on supporting underserved communities with accessible education.

The Giggle Academy breach underscores the growing phishing problem in the blockchain industry. This year alone, phishing-related losses have surpassed $800 million. Blockchain security firm CertiK attributes this surge to increasingly sophisticated techniques like wallet draining and address poisoning.

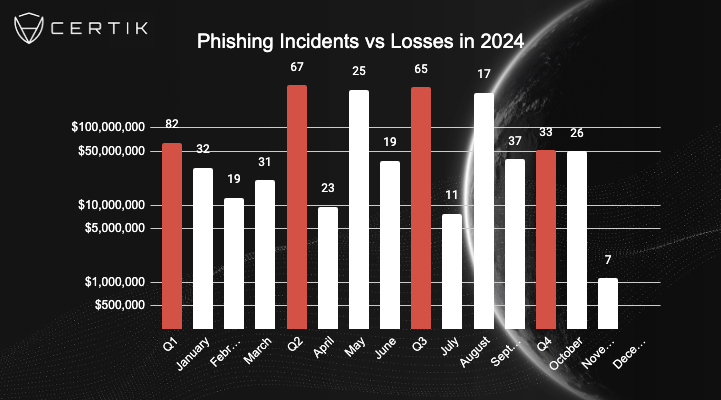

CertiK’s data reveals 247 phishing incidents recorded in 2024. The first quarter saw the highest number of attacks, with 82 cases, while Q2 and Q3 recorded 67 and 65 incidents, respectively. Q4 has already logged 33 cases, despite only being midway through.

Although Q1 experienced the most attacks, Q2 led in total losses, with over $433 million stolen. Losses in Q3 reached $343 million, while Q1 accounted for $67 million. Despite fewer incidents in Q4 so far, the monetary impact is on track to surpass early-year figures.

CertiK highlights a shift in phishing methods, with hackers increasingly employing advanced tools. Wallet-draining techniques, originally popularized by Ice Phishing, are becoming more potent. In such scams, users are tricked into granting token-spending permissions to malicious actors.

Modern variants combine these methods with additional draining tools, such as Angel Drainer and Pink Drainer. Angel Drainer’s recent acquisition of Inferno Drainer highlights the growing prevalence of such tools in phishing campaigns.

Another rising threat is address poisoning, where scammers create fake wallet addresses resembling legitimate ones. They then send scam tokens to victims, hoping to manipulate transaction histories. When users attempt to interact with a familiar address, they may accidentally transact with a fake one instead.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC’s Gensler Rumored to Step Down Before January 2025

Reports suggest that Gary Gensler, Chair of the US Securities and Exchange Commission (SEC), may step down before Donald Trump assumes office in January.

Speculation around Gensler’s resignation follows growing backlash from the crypto community against his leadership at the regulatory agency.

Gensler Could Resign SEC Role Before January

On November 15, Fox Business reporter Eleanor Terrett hinted that Gensler could announce his resignation shortly after Thanksgiving.

“It’s anyone’s guess when his resignation announcement will come, but chatter in DC circles is that he’ll likely announce after Thanksgiving his intention to exit in early January, ahead of Trump’s inauguration,” Terrett said.

Notably, recent remarks from Gensler himself add to the speculation. In a Nov. 14 speech, he expressed pride in his service at the SEC, calling attention to the agency’s efforts to protect American investors. Gensler’s speech also included reflections on his tenure and what some interpreted as a farewell message.

“I’ve been proud to serve with my colleagues at the SEC who, day in and day out, work to protect American families on the highways of finance,” Gensler wrote.

During his leadership, the SEC approved the first spot crypto exchange-traded funds (ETFs), which Gensler described as a significant step forward. He positioned this as a contrast to prior administrations that had blocked similar advancements.

However, his tenure has been marked by intense criticism from the crypto sector. Tyler Winklevoss, co-founder of Gemini, accused Gensler of harming the industry through a heavy-handed regulatory approach. Winklevoss argued that Gensler prioritized personal ambitions over fair regulation, describing his actions as damaging and deliberate.

Winklevoss warned the crypto community against associating with Gensler in the future, stating:

“No amount of apology can undo the damage he has done to our industry and our country. This type of person has no place at any institution, big or small. Americans have had enough of their tax dollars going towards a government that is supposed to protect them, but instead is wielded against them by politicians looking to advance their careers.”

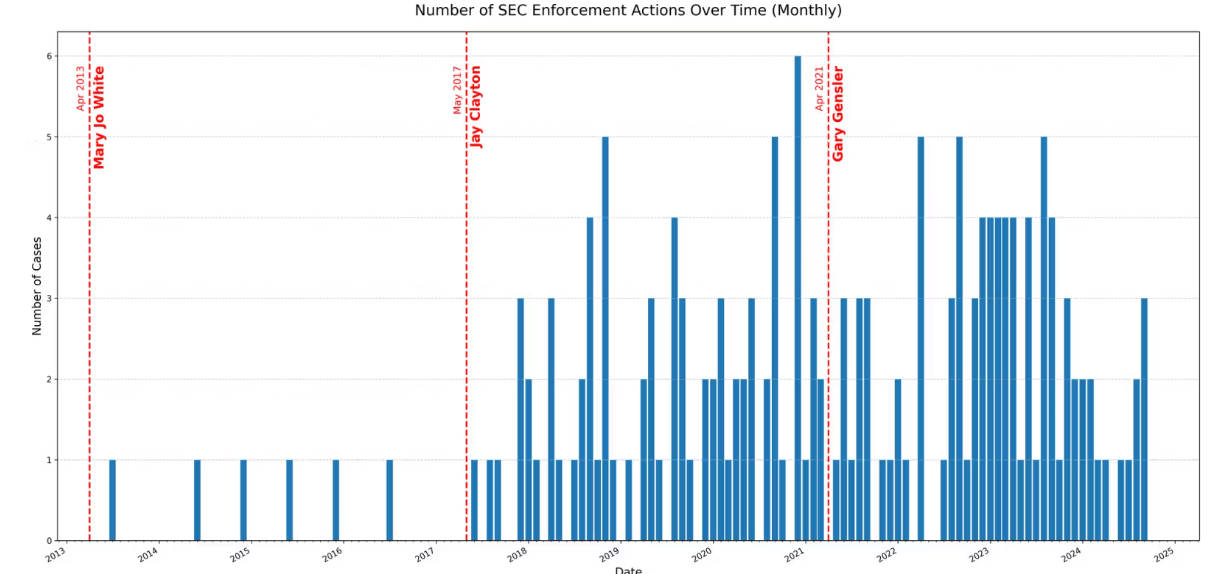

Gensler’s SEC has pursued high-profile enforcement actions against major crypto firms, including Binance, Coinbase, and Ripple. Critics claim this enforcement-heavy strategy has stifled innovation and created an adversarial relationship between regulators and the industry.

Eyes on Gensler’s Successor

As speculation about Gensler’s resignation grows, attention has shifted to his potential replacement under Trump’s administration. Possible candidates include Robinhood’s Chief Legal Officer Dan Gallagher, former SEC General Counsel Bob Stebbins, and current Republican SEC Commissioner Mark Uyeda.

Although Gallagher appears reluctant to accept the role, former SEC Chair Jay Clayton has endorsed Stebbins. Other contenders reportedly include Brad Bondi, Paul Atkins, Heath Tarbert, and Norm Champ.

The next SEC Chair will inherit a divided regulatory landscape and face the challenge of repairing strained relations with the cryptocurrency sector. As the industry continues to evolve, the SEC’s approach under new leadership will play a crucial role in shaping the future of crypto in the United States.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoExploring Hottest New Coins: MAYA, Banana, and Jorgie

-

Altcoin21 hours ago

Altcoin21 hours agoRipple CEO Garlinghouse Highlights Reason Behind XRP Rally

-

Market20 hours ago

Market20 hours agoWIF Slide Below $3.582 Sparks Fears Of Further Losses

-

Altcoin20 hours ago

Altcoin20 hours agoHere’s Why The XRP Price Surged Past $0.8 Despite The Market Dump

-

Market19 hours ago

Market19 hours agoMantra (OM) Price Breaks Records in Strong Upward Momentum

-

Altcoin19 hours ago

Altcoin19 hours agoFLOKI Price Skyrockets Amid Potential Coinbase Listing, Is 500% Pump Next?

-

Altcoin13 hours ago

Altcoin13 hours agoDogecoin Price Flashes Bull Flag On The Hourly Chart, Can It Rally To $1?

-

Bitcoin12 hours ago

Bitcoin12 hours agoMichael Saylor Explains How BTC Reserve Could Cut US Debt By $16 Trillion