Market

DeFi in Crisis: Restaking Protocols Are Devouring Liquidity

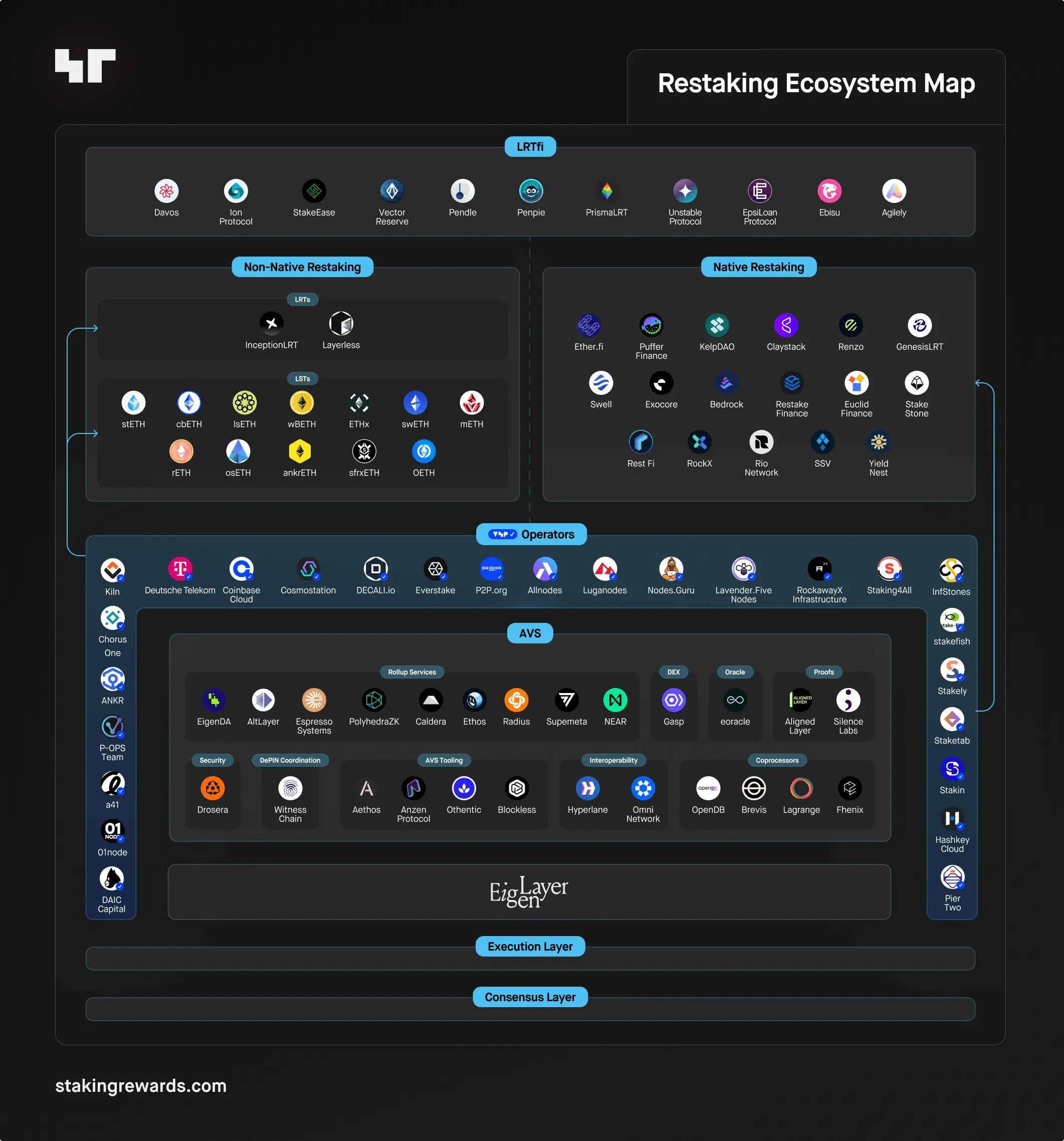

The DeFi space is expanding, with liquid staking and restaking protocols gaining more and more attention. These developments allow users to stake and reuse assets multiple times, offering the potential for higher yields. However, as these systems become more complex, they also introduce potential systemic vulnerabilities.

Projects like EigenLayer are pushing the limits of yield maximization, but are these returns sustainable? The question remains whether these innovations are setting DeFi up for lasting success or creating the next wave of risks.

The Growing Influence

Restaking protocols, led by platforms like EigenLayer, have become a major force in the decentralized finance (DeFi) sector. Restaking refers to the process where users take assets staked on one protocol, such as Ethereum’s liquid staking tokens (LSTs), and stake them again on another platform to earn additional yields.

This process has unlocked significant earning potential, driving restaking’s rise. In 2024, liquid restaking tokens (LRTs) saw an enormous 4,900% growth in Total Value Locked (TVL), surpassing $15 billion from a mere $280 million in early 2024.

“The push for higher yields is a key to keeping staking attractive, especially as the total amount of ETH staked on the Beacon Chain grows and the average APY (annual percentage yield) declines. This is one of the main reasons DeFi and restaking protocols have been so well-received,” Alon Muroch, CEO and Founder at SSV.Labs, told BeInCrypto in an exclusive interview.

Read more: Ethereum Restaking: What Is it and How Does it Work?

Restaking protocols offer users opportunities to maximize returns on their staked assets without having to sacrifice liquidity. However, as restaking scales, concerns about liquidity and security risks are emerging.

“Each additional layer in restaking increases both risk and reward, making it a choice that users must make based on their risk tolerance. While it introduces more potential points of failure, it also opens up opportunities for significantly greater returns. Ultimately, the user has the freedom to decide the level of exposure they are comfortable with,” Muroch added.

Balancing the Promise and Peril of Restaking

Although the ability to re-use staked assets has been celebrated as an innovation, it simultaneously introduces new layers of exposure. In essence, restaking involves leveraging staked assets across different protocols, which may sound appealing for yield optimization, but it creates systemic vulnerabilities.

Muroch identified several main problems associated with restaking:

- Smart Contract Vulnerabilities. The complexity of restaking mechanisms increases the potential for bugs and exploits in the smart contracts governing these protocols. Users may lose funds if a contract is compromised.

- Complexity and Lack of Understanding. As restaking strategies become more complex, there is a risk that users may not fully understand the risks they are taking on. Some Actively Validated Services (AVSs) have higher risk than others due to more/complex slashing criteria for different AVSs.

- Slashing Risks. If a validator is found guilty of malicious behavior, a portion of their restaked ETH can be slashed. This risk is compounded because node operators are subject to slashing conditions for both the Ethereum base layer and any additional AVSs.

Moreover, the financial architecture behind restaking has left DeFi exposed to potential liquidity drains. For example, EigenLayer’s current restaking system allows users to restake liquid staking tokens (LSTs) multiple times, amplifying liquidity challenges. These risks were evident in the Ankr exploit, where a hacker minted 6 quadrillion fake aBNBc tokens, crashing the price of liquid staking derivatives across various protocols.

The unclear regulatory frameworks add to the complexity of restaking. Muroch cautions that regulators will likely take a cautious approach to restaking, seeing it as distinct from traditional staking because of its added layers of risk and complexity. They may impose stricter regulations to protect investors and ensure the stability of the financial ecosystem as these protocols gain traction.

The Threat of Over-Restaking

EigenLayer, one of the biggest restaking protocols, has garnered over $19 billion in TVL by mid-2024. While this impressive expansion demonstrates the market’s appetite for higher yields, it raises questions about the sustainability of these protocols.

The dominance of EigenLayer also poses a unique threat to Ethereum’s overall security. Since these restaking platforms are handling large quantities of staked ETH, any major failure could directly impact Ethereum’s security model.

Experts, including Ethereum co-founder Vitalik Buterin, have voiced concerns that if a restaking protocol failed, it could lead to calls for a hard fork of Ethereum to “undo” the damage, an outcome that threatens the network’s decentralized consensus.

Read more: How to Participate in an EigenLayer Airdrop: A Step-by-Step Guide

Muroch, however, downplayed the severity of the situation, describing it as “theoretically bad, but practically quite unlikely.”

“If a significant amount of Ether is locked in EigenLayer and a large operator suffers a major slashing event, it could lead to a cascade of slashing damage. In a worst-case scenario, this could compromise the extended security of the Ethereum network. However, it would take the slashed operator not fixing the problem for a long period of time for Ethereum’s security to be threatened,” he explained.

He also highlighted an important upside, noting that restaking raises the cost of corruption for potential attackers. This shift strengthens security by focusing not just on individual protocols but on the total sum of all staked assets.

Hidden Dangers of Yield Optimization

The pursuit of higher yields has led stakers to adopt increasingly complex strategies, which carries both financial and technical risks. Financially, restaking protocols encourage users to stake their assets across multiple platforms, tying up more capital in interconnected systems. This raises systemic financial risks, as vulnerabilities in one protocol could trigger broader consequences across the ecosystem.

Muroch cautions that restaking is still a relatively new concept, making it difficult to predict its long-term effects. The potential for unforeseen issues, especially in volatile markets, adds uncertainty to the future of these strategies.

“Staking rewards have only recently been introduced, meaning it will take some time to fully understand their long-term effects. As always, there are ‘unknown unknowns’ that could arise. In the future, if the value of restaked assets were to drop sharply, the heavy reliance on rehypothecation and complex financial derivatives could trigger a liquidity crisis,” he said.

This would likely cause users to liquidate their positions en masse, worsening market volatility. In such a case, confidence in the underlying protocols might erode further, potentially causing widespread destabilization in the DeFi space.

“At this point it’s really speculative. Looking back to the past in DeFi, trying to milk yields as hard as possible tends to end badly,” Muroch warned.

Ultimately, the success of restaking protocols hinges on their ability to balance maximizing yields with managing the inherent financial and technical risks they introduce. As these systems mature, the sector is beginning to diversify. New competitors are launching their own restaking solutions, which could help decentralize risk currently concentrated in platforms like EigenLayer.

This shift may reduce the systemic vulnerabilities tied to one dominant protocol, leading to a more stable and resilient DeFi ecosystem over time.

“As excitement wanes, the sustainability of these protocols will be tested, and their true value will need to be assessed in a more stable market environment. This transition could reveal whether the innovations are robust or merely speculative trends,” Muroch concluded.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Recovery Stalls—Bears Keep Price Below $2K

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price attempted a recovery wave above the $1,880 level but failed. ETH is now trimming all gains and remains below the $1,880 resistance zone.

- Ethereum failed to stay above the $1,850 and $1,880 levels.

- The price is trading below $1,850 and the 100-hourly Simple Moving Average.

- There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,865 and $1,890 resistance levels to start a decent increase.

Ethereum Price Fails Again

Ethereum price managed to stay above the $1,800 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,850 and $1,880 resistance levels.

The bulls even pushed the price above the $1,920 resistance zone. However, the bears are active near the $1,950 zone. A high was formed at $1,955 and the price trimmed most gains. There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD.

A low was formed at $1,781 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

Ethereum price is now trading below $1,850 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,850 level. The next key resistance is near the $1,865 level and the 50% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

The first major resistance is near the $1,920 level. A clear move above the $1,920 resistance might send the price toward the $1,950 resistance. An upside break above the $1,950 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,000 resistance zone or even $2,050 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,865 resistance, it could start another decline. Initial support on the downside is near the $1,800 level. The first major support sits near the $1,780 zone.

A clear move below the $1,780 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,620.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,780

Major Resistance Level – $1,865

Market

Cardano (ADA) Downtrend Deepens—Is a Rebound Possible?

Cardano price started a recovery wave above the $0.680 zone but failed. ADA is consolidating near $0.650 and remains at risk of more losses.

- ADA price failed to recover above the $0.70 resistance zone.

- The price is trading below $0.680 and the 100-hourly simple moving average.

- There was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another increase if it clears the $0.70 resistance zone.

Cardano Price Dips Again

In the past few days, Cardano saw a recovery wave from the $0.6350 zone, like Bitcoin and Ethereum. ADA was able to climb above the $0.680 and $0.6880 resistance levels.

However, the bears were active above the $0.70 zone. A high was formed at $0.7090 and the price corrected most gains. There was a move below the $0.650 level. Besides, there was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair.

A low was formed at $0.6356 and the price is now consolidating losses near the 23.6% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. Cardano price is now trading below $0.680 and the 100-hourly simple moving average.

On the upside, the price might face resistance near the $0.6720 zone or the 50% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. The first resistance is near $0.6950. The next key resistance might be $0.700.

If there is a close above the $0.70 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.7420 region. Any more gains might call for a move toward $0.7650 in the near term.

Another Drop in ADA?

If Cardano’s price fails to climb above the $0.6720 resistance level, it could start another decline. Immediate support on the downside is near the $0.6420 level.

The next major support is near the $0.6350 level. A downside break below the $0.6350 level could open the doors for a test of $0.620. The next major support is near the $0.60 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.6420 and $0.6350.

Major Resistance Levels – $0.6720 and $0.7000.

Market

XRP Price Under Pressure—New Lows Signal More Trouble Ahead

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Market23 hours ago

Market23 hours agoBNB Price Faces More Downside—Can Bulls Step In?

-

Bitcoin24 hours ago

Bitcoin24 hours agoTokenized Gold Market Cap Tops $1.2 Billion as Gold Prices Surge

-

Regulation18 hours ago

Regulation18 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Altcoin22 hours ago

Altcoin22 hours agoWhat’s Fueling The Shibarium Boost?

-

Bitcoin19 hours ago

Bitcoin19 hours agoLummis Confirms Treasury Probes Direct Buys

-

Altcoin14 hours ago

Altcoin14 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Altcoin10 hours ago

Altcoin10 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin20 hours ago

Altcoin20 hours agoFranklin Templeton Eyes Crypto ETP Launch In Europe After BlackRock & 21Shares