Market

5 Facts About Binance’s Moonbix Telegram Game

Binance recently launched the Telegram mini-game Moonbix, citing a novel tap-to-earn gameplay centered on skill and timing.

With this game, the largest exchange on trading volume metrics looks to compete with tap-to-earn pioneers such as Notcoin and Hamster Kombat. The common denominator is that they all offer different avenues for players to make money.

What to Know About Binance Moonbix Game

Binance launched the crypto-themed Telegram Mini App game on September 19, marking its initial foray into the play-to-earn (P2E) space. It highlights the exchange’s newly found interest in pursuing blockchain-based games.

“The game taps into the growing popularity of Telegram mini-apps and aligns with the increasing interest in casual, crypto-themed gaming. Moonbix players take on the role of crypto space explorers, navigating a virtual galaxy to collect special items, complete tasks, and earn points,” Binance said in a Telegram announcement.

While Moonbix leverages the popular crypto rewards narrative, it capitalizes on the uniqueness of space exploration for a market edge. Here are five facts about Binance’s Telegram game.

Almost 15 Million Players in a Week

According to Moonbix’s Telegram, the game is nearing 15 million monthly users, a solid achievement for a game that is barely a week old. This reflects players’ interest in both entertainment and earning opportunities.

As of now, Moonbix has 14.95 million players, with its user base nearly doubling since Monday, suggesting even faster growth ahead. This momentum puts the game on track to surpass DOGS and Notcoin (NOT), which have 53 million and 35 million players, respectively.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

Interest in Moonbix began even before its launch, as leaked screenshots of Binance’s entry into the Telegram mini app trend sparked curiosity.

“We’re aware that our upcoming TG mini-app game, Moonbix, was leaked ahead of the planned launch date. While we’re thrilled by the community’s response, we’re still fine-tuning the product to ensure the best user experience on the official launch,” Binance wrote.

Vietnamese Players Top Moonbix Leaderboard

As BeInCrypto reported, Vietnamese players make up the majority of Moonbix’s “Hall of Fame” rankings and top the leaderboards.

However, achieving a high score quickly in Moonbix is challenging. Completing all tasks in the game earns a player around 11,500 points, making it difficult to rise up the ranks without additional help. Many players rely on the referral option, which rewards them with 10,000 extra points for inviting 10 new users.

To become a top player, one would need to invite between 100 and 300 people, which is why some participants turn to external “tools” to boost their scores.

Many Players Are Using Tools to Cheat

The use of enabling tools in Moonbix is unsurprising, given the challenging nature of its tap-to-earn gameplay. Some players have resorted to using their own tools to automate gameplay across multiple windows and accounts.

However, this approach risks detection for fraudulent behavior. For instance, Hamster Kombat (HMSTR), a game also vying for a Binance listing, recently banned 2.3 million players for cheating.

Other common cheating strategies include buying bulk Telegram accounts to “farm” the game and purchasing referrals rather than earning them through legitimate invitations.

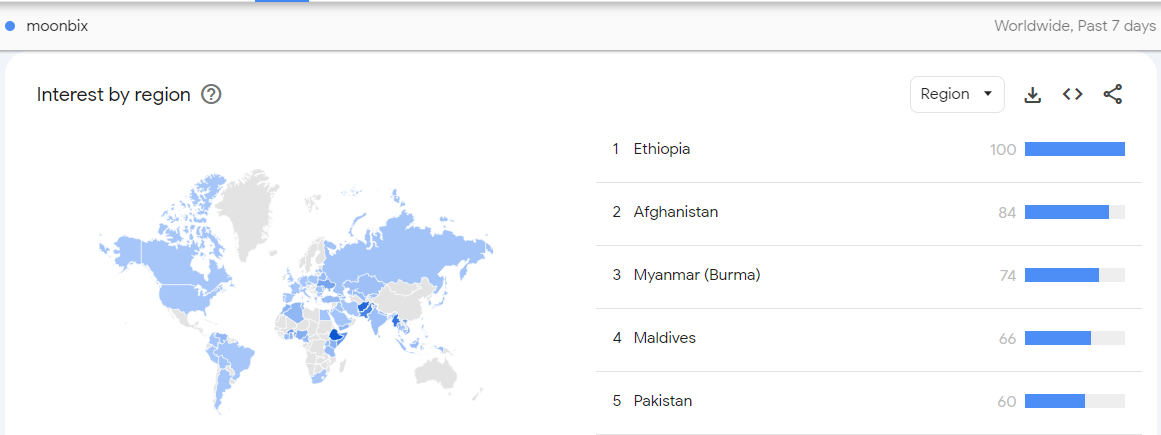

Ethiopia Leads Moonbix Searches on Google Trends

Google Trends data reveals that Ethiopia leads the world in Moonbix-related searches. The country’s strong interest in this tap-to-earn game has propelled it ahead of other nations like Afghanistan, Myanmar, Maldives, and Pakistan.

Moonbix’s unique combination of space exploration and crypto rewards has captured global attention, offering players a fresh and engaging way to earn while playing. Its integration with Telegram, a widely-used messaging platform known for its secure and user-friendly interface, has further fueled this growing interest.

Moonbix Helps Binance Attract New Users

Binance’s terms and conditions for Moonbix mandate that players complete Know-Your-Customer (KYC) verification. This requirement is essential for users to participate in the game and claim rewards in the future. By signing up and undergoing KYC, players contribute to the growing user base on the exchange.

“Only users from qualified regions who bound their Binance account in Moonbix — the Binance telegram mini app, and complete KYC shall be eligible for any rewards,” a paragraph in the guide reads.

Looking ahead, the Moonbix game has the potential to garner intense traction. The increasing interest in the broader Play-to-Earn (P2E) and Tap-to-Earn (T2E) niches also provides tailwinds.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

However, like other Telegram games, such as Catizen and Hamster Kombat, Moonbix may also be caught in the crosshairs of the ecosystem’s woes. Negativity around Telegram’s recent policy changes may affect its projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will It Smash Another ATH?

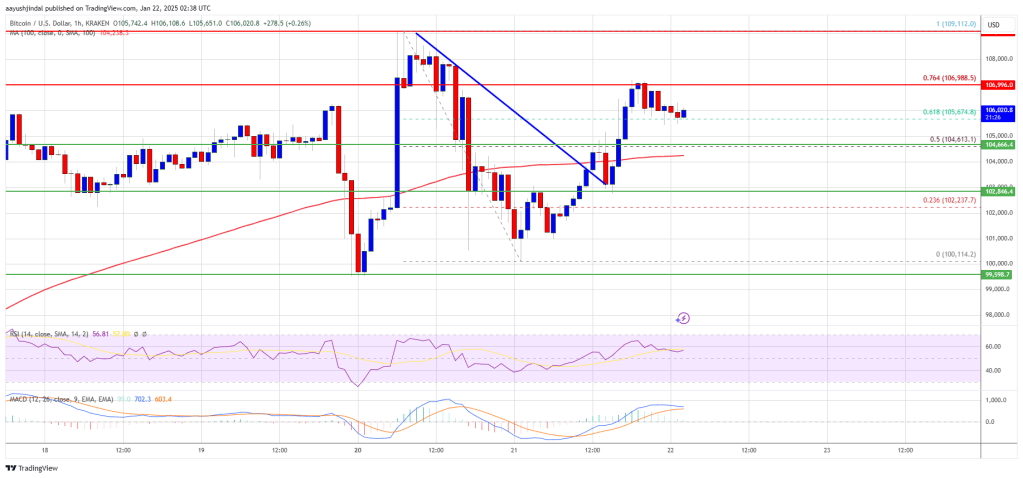

Bitcoin price started a fresh increase above the $104,000 zone. BTC is consolidating above $105,000 and might aim for a new all-time high.

- Bitcoin started a decent increase above the $102,500 resistance zone.

- The price is trading above $104,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $104,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $103,500 support zone.

Bitcoin Price Regains Traction

Bitcoin price started a decent upward move above the $102,500 zone. BTC was able to climb above the $103,500 and $104,000 levels.

The bulls even pushed the price above the $105,000 level. Besides, there was a break above a connecting bearish trend line with resistance at $104,000 on the hourly chart of the BTC/USD pair. The pair surpassed the 50% Fib retracement level of the downward move from the $109,112 swing high to the $100,114 low.

Bitcoin price is now trading above $104,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $107,000 level. It is close to the 76.4% Fib retracement level of the downward move from the $109,112 swing high to the $100,114 low.

The first key resistance is near the $107,500 level. A clear move above the $107,500 resistance might send the price higher. The next key resistance could be $109,000.

A close above the $109,000 resistance might send the price further higher. In the stated case, the price could rise and test the $110,000 resistance level and a new all-time high. Any more gains might send the price toward the $112,500 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $107,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $104,500 level. The first major support is near the $103,500 level.

The next support is now near the $102,800 zone. Any more losses might send the price toward the $100,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $104,500, followed by $103,500.

Major Resistance Levels – $107,000 and $108,500.

Market

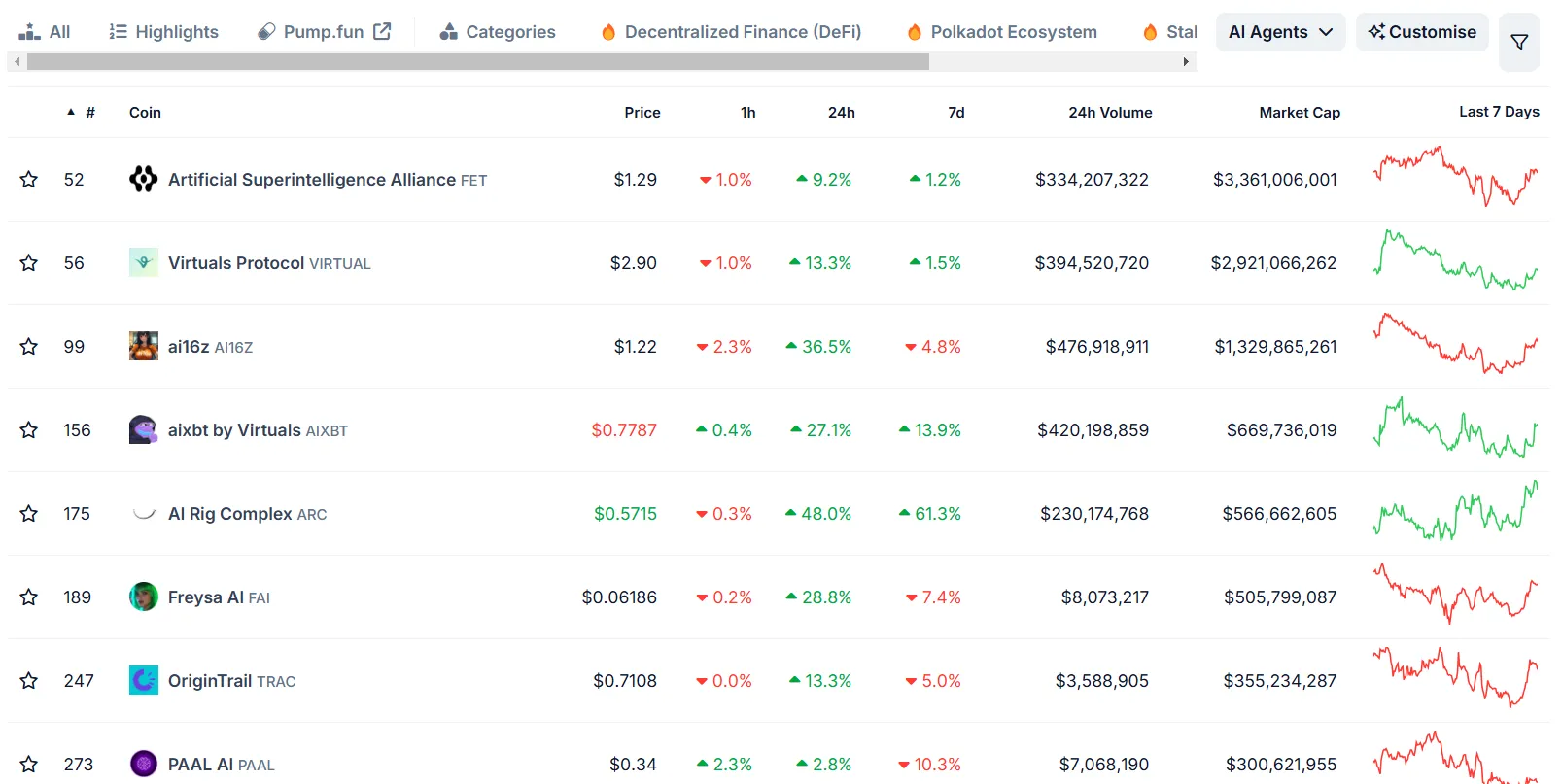

Trump’s $500 Billion Stargate Venture Sparks AI Crypto Boom

AI tokens surged on Wednesday after President Donald Trump unveiled a new joint venture to invest up to $500 billion in artificial intelligence infrastructure.

The partnership involves major players such as OpenAI, Oracle, and SoftBank and will form a new entity called Stargate.

Market Focuses on AI Coins as Trump’s Stargate Initiative Gains Traction

The Stargate Project will invest $500 billion over the next four years, building new AI infrastructure in the US. The venture will focus on developing crucial data centers and the electricity generation required to power the AI sector.

The announcement has already had a noticeable impact on the broader market, particularly in AI-related cryptocurrencies. Following the news, the market capitalization of AI tokens surged by 9%, reaching $45.83 billion at press time, according to CoinGecko.

In fact, the market cap of AI agent tokens alone rose by 13% to hit $14.9 billion.

AI agent tokens, such as Virtuals Protocol, AIXBT, and AI16Z, saw impressive gains. Virtuals Protocol rose by over 13% in the past 24 hours, while AI16Z experienced a remarkable 36% increase. AIXBT token rose by 27% over the same period.

The surge in AI tokens reflects a broader shift in market interest as investors move capital towards more “sentient” tokens.

“Capital is rotating back from static memes to sentient coins,” AI researcher S4mmy commented on Twitter.

The analyst added that Fartcoin and AIXBT are sustaining their “mindshare dominance,” but face declining market caps after a heated run. Commenting on Virtuals Protocol, he said it continues to solidify its position as a backbone of the Agentic infrastructure.

Moreover, analyst CyrilXBT said he believes “AI will create generational wealth in 2025.”

“People said Bitcoin was a joke. People said AI agents are a gimmick. Guess what else they’ll say? ‘Why didn’t I listen when generational wealth was staring me in the face?,” CyrilXBT commented.

The shift towards AI is particularly interesting, given the trend of investments a few days back. Capital was flowing into Donald Trump-related tokens, such as TRUMP and MELANIA, which have seen significant volatility.

However, BeInCrypto reported that smart money traders are now focusing on AI tokens after the hype around TRUMP faded. According to data from Nansen, a substantial amount of VIRTUAL, FARTCOIN, and AIXBT tokens are held by smart money.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will an Upside Break Spark a Surge?

Ethereum price is struggling below the $3,500 resistance while Bitcoin gains. ETH is consolidating above $3,150 and might aim for an upside break.

- Ethereum failed to gain pace for a close above $3,400 and $3,450.

- The price is trading above $3,300 and the 100-hourly Simple Moving Average.

- There is a key contracting triangle forming with resistance at $3,355 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start another increase if it clears the $3,400 resistance level.

Ethereum Price Aims Key Upside Break

Ethereum price started a decent upward move from the $3,200 level but upsides were limited compared to Bitcoin. ETH cleared the $3,250 resistance to move into a short-term bullish zone.

The bulls were able to push the price above the $3,300 resistance zone. Besides, there was a clear move above the 50% Fib retracement level of the downward move from the $3,445 swing high to the $3,203 low. However, the bears are still active below $3,400.

Ethereum price is now trading above $3,300 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level or the 61.8% Fib retracement level of the downward move from the $3,445 swing high to the $3,203 low.

There is also a key contracting triangle forming with resistance at $3,355 on the hourly chart of ETH/USD. The first major resistance is near the $3,400 level. The main resistance is now forming near $3,445.

A clear move above the $3,445 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,720 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $3,400 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250.

A clear move below the $3,250 support might push the price toward the $3,200 support. Any more losses might send the price toward the $3,120 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,200

Major Resistance Level – $3,400

-

Regulation18 hours ago

Regulation18 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Regulation16 hours ago

Regulation16 hours agoTurkey rolls out new crypto AML regulations

-

Ethereum13 hours ago

Ethereum13 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation20 hours ago

Regulation20 hours agoTether’s market capitalisation slips as MiCA regulations kick in

-

Blockchain20 hours ago

Blockchain20 hours agoJordan Adopts Blockchain Policy To Propel Government Into The Future

-

Regulation14 hours ago

Regulation14 hours agoCrypto custody firm Copper withdraws UK registration

-

Market22 hours ago

Market22 hours agoKStarCoin and Quant traders discuss the benefits of switching to 1Fuel for better ROI

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum ETFs inflows surge as Bitcoin ETFs see major outflows