Altcoin

Is Bitcoin Dominance Coming To An End? Analyst Says ‘Altcoin Season’ Is Upon Us

Bitcoin (BTC), the largest cryptocurrency by market capitalization, is one of the best-performing digital assets so far in 2024. Despite its recent struggles in the last two quarters, the premier cryptocurrency is up by more than 137% in the past year.

Bitcoin Dominance Vs. Ethereum Up 6% In 2024

According to a recent report by IntoTheBlock, Bitcoin has put a wider gap between itself and other digital assets in the market. The blockchain analytics platform reported a 6% increase in BTC’s dominance over Ethereum (ETH) and stablecoins so far in 2024.

Data from IntoTheBlock shows that Ethereum, the largest altcoin by market capitalization, is currently trading at its lowest level against BTC. This ETH underperformance has been attributed to the relatively less successful spot exchange-traded fund (ETF) launch.

The spot Bitcoin ETFs have amassed about $18 billion in capital over the last eight months, while the ETH ETFs have mostly recorded net outflows since launching in late July. This trend can be associated with investors’ preference for BTC due to its relative stability.

Ultimately, the introduction of the spot exchange-traded funds has helped Bitcoin assert more dominance over other assets in the crypto market. However, a popular crypto analyst on X has put forward an interesting prediction about Bitcoin dominance and altcoins in the current cycle.

Altcoin Season Might Be Here — Here’s How

Crypto analyst Ali Martinez took to X to explain how the current Bitcoin dominance could be coming to an end and the altcoin season might just be beginning. This analysis is based on the formation of technical patterns on the BTC dominance and total market cap (excluding top 10 assets) charts.

According to Martinez, Bitcoin dominance might be gearing for a trend reversal due to the formation of a rising wedge chart pattern on the weekly timeframe. Meanwhile, the altcoin market cap seems to be breaking out of a falling wedge pattern on the three-day chart.

Source: Ali_charts/X

Related Reading: Bitcoin Coinbase Premium Turns Deep Red: What Does It Mean?

For context, a wedge is a technical analysis pattern characterized by converging trend lines on a price chart. A rising wedge, which often occurs in an upward trend, is a bearish signal, indicating that the price is about to undergo a breakout reversal. A falling wedge, on the other hand, often signals a bullish reversal.

Martinez highlighted in his post that the “altcoin season is just around the corner,” especially with the Bitcoin dominance chart signaling a potential trend reversal and the altcoin market cap witnessing a bullish breakout.

As of this writing, the total market cap outside of assets in the top 10 stands at around $213.814 billion.

Total market cap (excluding top 10 assets) on the daily timeframe | Source: OTHERS chart on TradingView

Featured image created with Dall.E, chart from TradingView

Altcoin

Will Q2 2025 Mark the Return of Altcoin Season?

The cryptocurrency market is showing potential signs of an impending altcoin season. Market watchers cite a confluence of technical, sentiment, and macroeconomic factors that could lead to a significant rally in altcoins.

The outlook follows a notable downturn in the altcoin market, which has dropped about 37.6% since its high in early December 2024. As of the latest data, the market cap stands at $1.1 trillion.

Is Altcoin Season Coming?

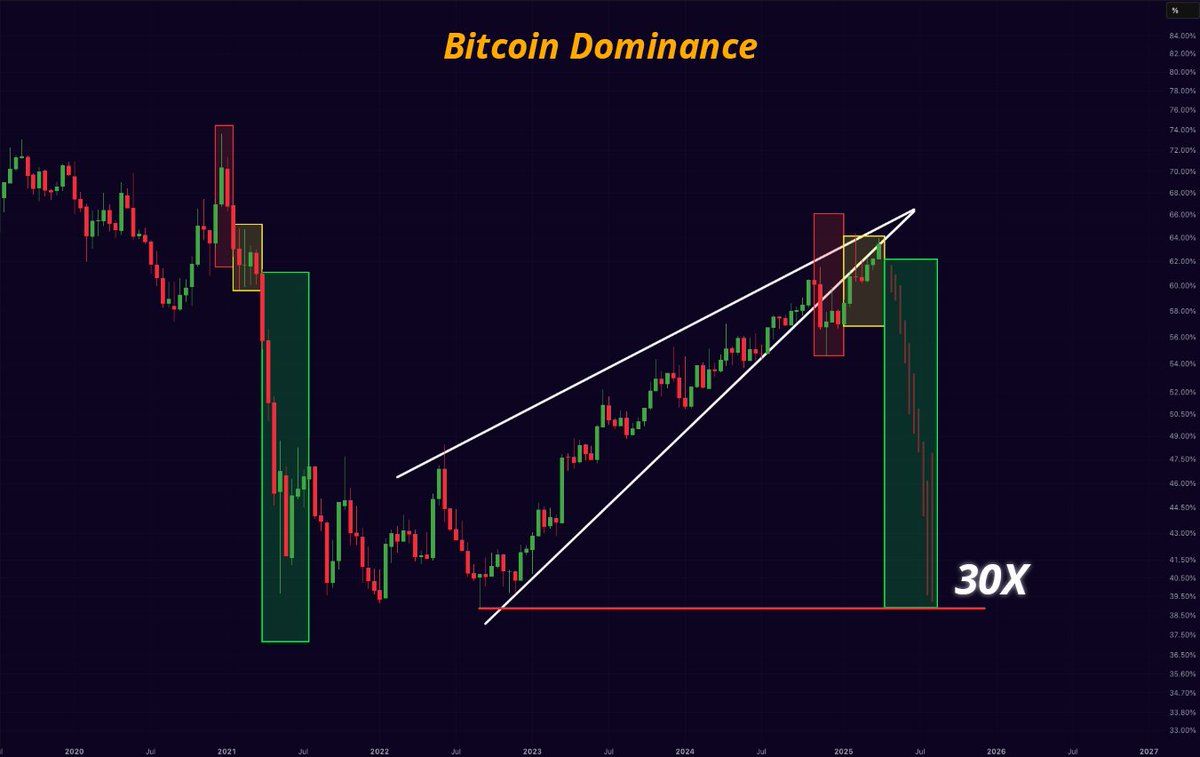

From a technical perspective, Bitcoin (BTC) Dominance, which measures Bitcoin’s market share relative to the total cryptocurrency market, seems to be at a key turning point.

A recent chart shared by crypto analyst Mister Crypto on X highlighted that Bitcoin Dominance has reached a resistance following a rising wedge pattern. This pattern is generally seen as a bearish signal, often leading to sharp pullbacks.

“Bitcoin Dominance will collapse. Altseason will come. We will all get rich this year!” he wrote.

In addition, another analyst corroborated these findings, noting that Bitcoin Dominance has reached a peak. Thus, he forecasted a subsequent downturn.

However, the Altcoin Season Index has dropped to a low of 16. The index, which analyzes the performance of the top 50 altcoins against Bitcoin, indicated that altcoins are currently underperforming.

Notably, this level mirrors the bottom for altcoins observed around August 2024. This period preceded a significant altcoin rally, and the index peaked at 88 by December 2024.

Lastly, from a macroeconomic perspective, the 90-day delay in President Donald Trump’s tariff implementation has renewed market confidence. This delay is perceived as a positive signal, potentially encouraging capital inflows into altcoins.

“90 days tariff pause = 90 days of altseason,” an analyst claimed.

Moreover, analyst Crypto Rover pointed to quantitative easing (QE) as a catalyst for an altseason. According to him, when the central bank starts pumping money into the economy (through QE), altcoins could experience a significant price surge, benefiting from the increased liquidity and investor optimism.

“Once QE starts. Altcoin season will make a massive comeback!” he stated.

However, in the latest report, Kaiko Research stressed that a traditional altcoin season may no longer be feasible. Instead, any potential rally could be selective, with only a few altcoins experiencing significant upside. The focus will likely be on assets with real-world use cases, strong liquidity, and revenue-generating potential.

“Altseasons may become a thing of the past, necessitating a more nuanced categorization beyond just ‘altcoins,’ as correlations in returns, growth factors, and liquidity among crypto assets are diverging significantly over time,” the report read.

Kaiko Research noted that the growing concentration of liquidity in a few altcoins and Bitcoin may disrupt the typical capital flow into altcoins during market upswings. Furthermore, as Bitcoin becomes more widely adopted as a reserve asset by institutions and governments, its position in the market strengthens further.

Ultimately, while the signs point to a potential altcoin rally, it’s clear that the future of altcoins could involve more nuanced market dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Most Altcoins Now In ‘Opportunity’ Zone, Santiment Reveals

The on-chain analytics firm Santiment has revealed how the majority of the altcoins are currently in what has historically been a buy zone.

Mid-Term Trading Returns Are Extremely Negative For Most Altcoins

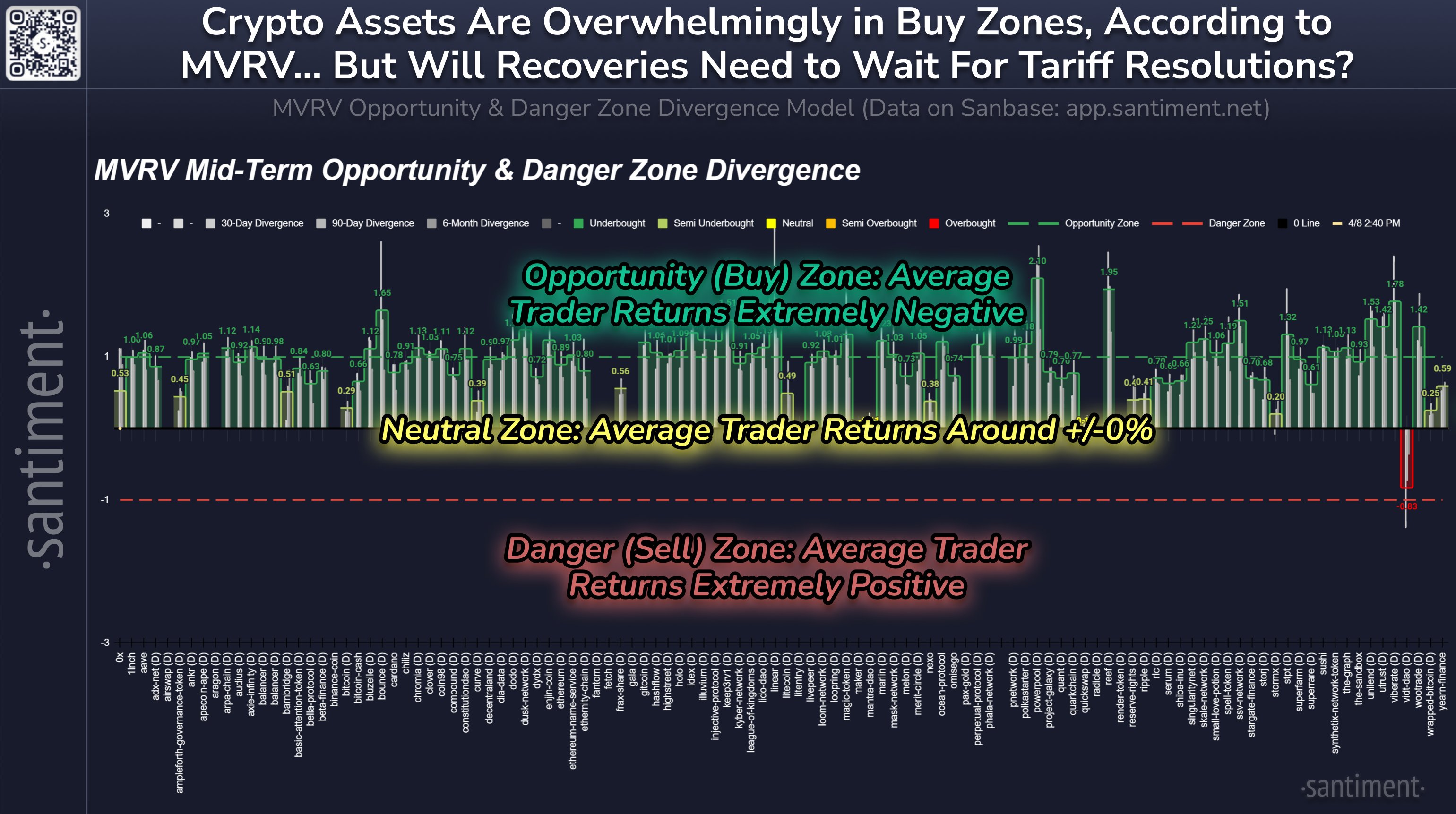

In a new post on X, Santiment has shared an update for its MVRV Opportunity & Danger Zone Divergence Model for the various altcoins in the sector. The model is based on the popular “Market Value to Realized Value (MVRV) Ratio.”

The MVRV Ratio is an on-chain indicator that basically tells us whether the investors of a cryptocurrency as a whole are holding their coins at a net profit or loss.

When the value of this metric is greater than 1, it means the average investor is holding a profit. On the other hand, it being under this threshold suggests the dominance of loss.

Historically, holder profitability is something that has tended to have an effect on the prices of digital assets. Whenever the investors are in large profits, they can become tempted to sell their coins in order to realize the piled-up gains. This can impede bullish momentum and result in a top for the price.

Similarly, holders being significantly underwater results in market conditions where profit-takers have run out, thus allowing for the cryptocurrency to reach a bottom.

Santiment’s MVRV Opportunity & Danger Zone Divergence Model exploits these facts in order to define buy and sell zones for the altcoins. The model calculates the divergence of the MVRV Ratio on various timeframes (30 days, 90 days, and 6 months) to find whether an asset is inside one of these zones or not.

Here is the chart shared by the analytics firm that shows how the different altcoins are currently looking based on this model:

Looks like most of the sector is currently in the buy region | Source: Santiment on X

In this model, a value greater than zero suggests average trader returns are negative for that timeframe and that below it is positive. This is the opposite orientation of what it’s like in the MVRV Ratio, with the zero level taking the role of the 1 mark from the indicator.

From the graph, it’s visible that almost all of the altcoins have their MVRV divergence greater than zero on the different timeframes. Out of these, most of them have their mid-term MVRV divergence greater than 1. The opportunity zone mentioned earlier lies beyond this mark, so the model is currently showing a buy signal for the majority of the altcoins.

The average negative returns have come for these coins as the market has been in turmoil following the news related to tariffs. While the model may be showing a buy signal for the altcoins, it’s possible that this uncertainty will continue to haunt the market. As Santiment explains,

If and when a global tariff solution is reached, it would undoubtedly trigger a very rapid cryptocurrency recovery,” notes However, this is currently a very big “if” based on the latest media coverage on what is quickly being referred to as a full-fledged “trade war” between the US and the majority of the world.

BTC Price

At the time of writing, Bitcoin is floating around $76,900, down more than 9% in the last seven days.

The price of the coin has already erased its attempt at recovery | Source: BTCUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Argentina Opens LIBRA Investigation, Top Officials May Be Implicated

Argentina’s Chamber of Deputies has passed several resolutions to dig deeper into the scandalous LIBRA cryptocurrency failure, whose possible connections with President Javier Milei are also now being scrutinized.

The Chamber of Deputies voted for a special committee to be created, for summoning government representatives, and for demanding detailed documentation on the collapsed crypto token.

Political Divide Emerges Over Investigation Powers

The establishment of a special commission was approved with 128 votes, 93 against, and seven abstentions, which underlines the political pressures that surround the case.

Lawmakers also authorized a bill to call up senior officials from the executive branch, such as Economy Minister Luis Caputo, Chief of Staff Guillermo Francos, Justice Minister Mariano Cúneo Libarona, and National Securities Commission President Roberto Silva. This resolution passed narrowly with 131 votes supporting and 96 opposing.

Argentina’s Javier Milei faces fraud allegations over the Libra scandal. Image: Natacha Pisarenko/AP Photo

A third resolution requesting detailed information from the Executive Branch about the LIBRA token received 135 votes in favor, 84 against, and 7 abstentions.

According to reports, these measures came in response to growing concerns about whether the cryptocurrency’s downfall harmed Argentina’s financial interests.

Lawmakers Split Along Party Lines

Members of parliament expressed sharply different views during the legislative session. Pablo Juliano from the Democracy Forever bloc emphasized the need for legislative oversight of the situation.

His position stood in stark contrast to Nicolás Mayoraz of President Milei’s La Libertad Avanza party, who warned the commission could overstep judicial authority.

Other lawmakers took middle positions. Oscar Agost Carreño of Encuentro Federal and Karina Banfi from the UCR stressed the legislature’s responsibility to demand political accountability.

Banfi noted that investigations are already happening at both national and international levels. Maximiliano Ferraro from the Civic Coalition argued for the public’s right to transparency in the matter.

Gabriel Bornoroni, the La Libertad Avanza bloc leader, dismissed the opposition’s efforts. He claimed they were simply trying to disrupt government progress, pointing to the fiscal surplus achieved in 2024 and claiming that inflation has been steadily decreasing under the current administration.

Legal Action Targets LIBRA Creator

The political debate follows serious legal challenges against LIBRA token creator Haydone Davis. On March 13, Argentine lawyer Gregorio Dalbon asked Interpol to issue a Red Notice for Davis, whose company Kelsier Ventures launched the LIBRA token in February.

Based on reports, Argentine prosecutors have identified Davis as the main person responsible for the token’s collapse, which caused widespread financial losses.

The scandal has now crossed borders, with Burwick Law, a major cryptocurrency legal firm, filing a lawsuit against Kelsier Ventures and two related platforms: Meteora and KIP Protocol.

The legal action seeks to recover profits and provide compensation for affected investors in the United States.

Featured image from Vox, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Bitcoin11 hours ago

Bitcoin11 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market23 hours ago

Market23 hours agoHow Ripple’s $1.25 Billion Deal Could Surge XRP Demand

-

Market11 hours ago

Market11 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin15 hours ago

Altcoin15 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Market12 hours ago

Market12 hours agoSEC Approves Ethereum ETF Options Trading After Delays

-

Bitcoin23 hours ago

Bitcoin23 hours agoGoldman Sachs Raises US Recession Odds to 45%

-

Regulation11 hours ago

Regulation11 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Altcoin22 hours ago

Altcoin22 hours agoPepe Coin Whales Offload Over 1 Trillion PEPE