Market

Can DOGS Price Continue to Jump After Major Exchange Listings?

Telegram meme coin Dogs (DOGS) has finally been listed on the Coinbase futures market today. This comes weeks after Binance listed the coin on both the spot and futures market.

While this listing may spark heightened interest in the cryptocurrency, it also puts the Telegram coin in a crucial position that could accelerate the recent upswing or drag it further down.

Coinbase Join Binance in Listing the Telegram Meme Coin

DOGS’s Binance listing came on August 26. This was the same day as the meme coin’s Token Generation Event (TGE), on which it airdropped billions of tokens to Telegram users.

Earlier today, specifically at 9:30 UTC, Coinbase announced that its users can now trade DOGS, alongside POL (previously MATIC), in the futures market.

“Our POL-PERP and DOGS-PERP markets are now in full-trading mode on Coinbase International Exchange and Coinbase Advanced. Limit, market, stop, and stop limit orders are all now available,” Coinbase shared on X,

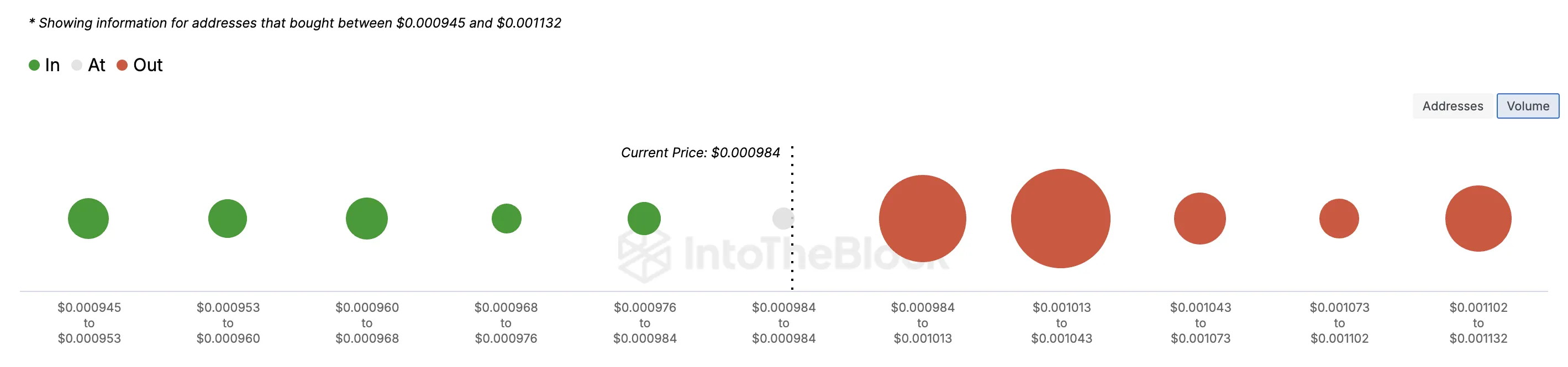

Following the development, DOGS’s price increased, and it currently trades at $0.00098. Despite the uptrend, the In/Out of Money Around Price (IOMAP) shows that over 3 million addresses are still holding 190 billion coins at a loss.

Read more: Top 9 Telegram Channels for Crypto Signals in September 2024

As seen above, this cohort purchased the Telegram coin between $0.00098 and $0.0011. This figure means that 61% of DOGS holders are out of money. A large chunk of the remaining ratio is at breakeven point while a small number are holding in profits.

Furthermore, this small number of holders in profit could make it challenging for DOGS’ price to continue appreciating. Interestingly, the Coins Holding Time revealed that many investors in the meme coin are not ready to liquidate at a loss.

Spikes in the Coins Holding Time suggest a high amount of time a cryptocurrency has been held without being sold or transacted. A decline, on the other hand, signifies otherwise.

From the image above, DOGS’ holding time has increased by over 264% in the last 30 days. Technically, this is a bullish sign, as reduced selling pressure could make some of the 190 billion coins profitable.

DOGS Price Prediction: One Zero Is Set to Leave

An assessment of the 2-hour DOGS chart shows that the Awesome Oscillator (AO) has formed a bullish twin peak. The AO measures momentum, and the bullish twin peak appears below the zero line, with the second peak significantly higher than the first.

Furthermore, the peak formation has driven the AO reading into the positive region, suggesting continued bullish momentum for DOGS. The same timeframe also shows that the meme coin faces resistance at $0.00097.

However, strong support exists at $0.0094, which could prevent another decline. Consequently, the current bullish momentum around the token might prevent it from falling below $0.00094. Instead, DOGS’s price might climb toward $0.0011.

Read more: 6 Best Exchanges To Buy and Sell Hamster Kombat (HMSTR) in 2024

Meanwhile, crypto traders should watch out for the overall mood of the market. Should the broader market struggle to maintain the upswing, the meme coin’s price could be affected and decrease to $0.00090 might show up again.

Regarding this potential, Juan Pellicer, Senior Researcher at IntoTheBlock, mentions that the meme coin could face challenges. Speaking to BeInCrypto, Pellicer says the airdrop has affected DOGS dynamics.

“In contrast to TON’s growing usage, the DOGS token has faced challenges despite initial hype from its popular airdrop. Currently, 61% of the 4.13 million $DOGS holders are at a loss relative to when they received their tokens. This suggests that the market’s initial enthusiasm has waned,” Pellicer said.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

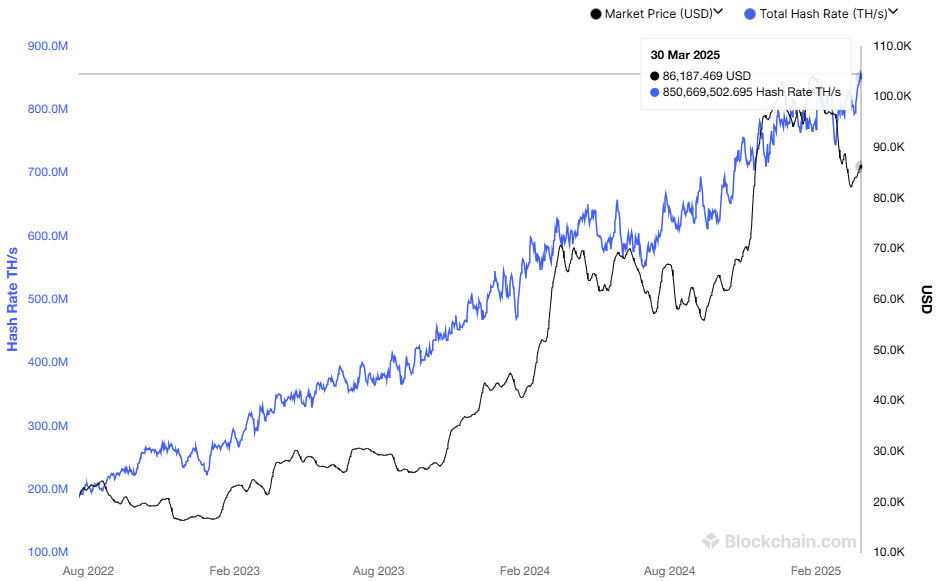

The Bitcoin mining industry is becoming increasingly competitive as the network’s hashrate reaches an all-time high (ATH). At the end of March 2025, Bitcoin’s hashrate hit 850 million TH/s.

However, alongside this impressive growth, the industry is struggling with rising production costs and new tariff barriers, particularly in the US. These factors are putting significant pressure on mining companies and could reshape the sector’s future.

Hashrate Surges, Mining Costs Soar

Bitcoin’s hashrate measures the total computing power used by miners to secure the network and validate transactions. It is expressed in terahashes per second (TH/s), representing the number of hash calculations the network performs every second.

According to Blockchain.com, Bitcoin’s hashrate surpassed 850 million TH/s in March. This increase reflects a rise in miners joining the network and growing confidence in Bitcoin’s value and security.

“Each time the network gets stronger, Bitcoin becomes harder to attack, harder to ignore, and more justified in commanding a higher valuation. This isn’t just code. It’s economic gravity. Bitcoin has become the most secure monetary network humanity has ever seen. And it’s only getting stronger.” — Thomas Jeegers, CFO & COO of Relai commented.

Despite this surge in hashrate, mining profits are not rising accordingly. According to a report from Macromicro, the cost of mining one Bitcoin has doubled since early 2024, now reaching $87,000. The main drivers behind this increase are rising electricity prices and the high operational costs of specialized mining hardware (ASICs).

With Bitcoin’s price fluctuating, many mining companies risk operating at a loss unless they optimize their efficiency. This challenge is particularly severe for smaller miners, who lack the scale advantages or access to cheap electricity that larger firms enjoy.

Tariff Challenges and Dependence on Chinese Hardware

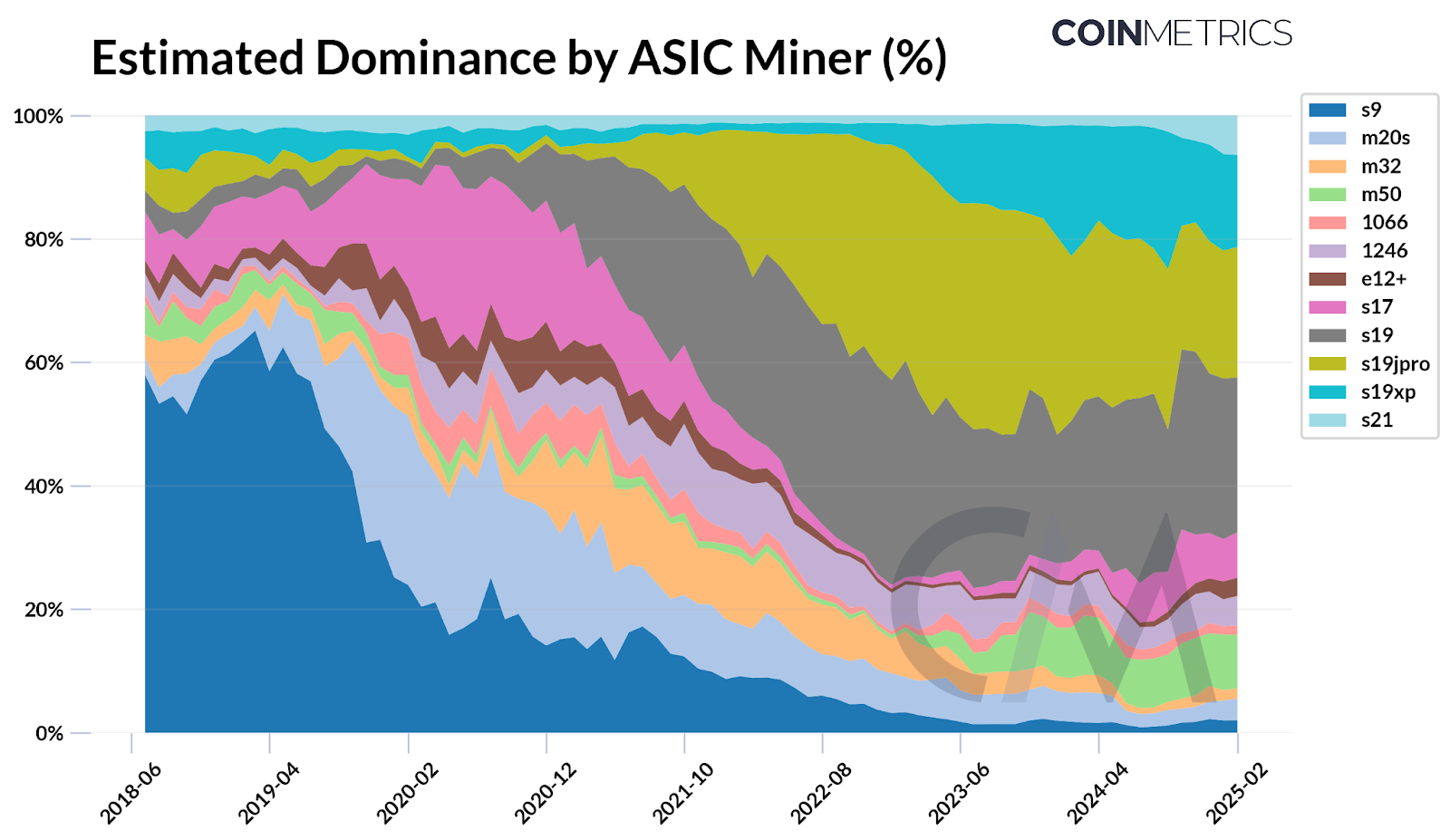

Another major obstacle for Bitcoin miners is trade restrictions, particularly in the US. According to CoinMetrics, ASIC miners produced by Bitmain, a Chinese company, account for approximately 59%–76% of Bitcoin’s total hashrate.

Bitmain has long been a dominant player in mining hardware, with popular models like the Antminer S19 and S21 known for their high efficiency. However, in early 2025, some US mining companies experienced delays in receiving Bitmain shipments due to tighter customs controls and new tariffs on Chinese imports.

“With Bitmain accounting for a majority of Bitcoin’s network hashrate, reliance on a single manufacturer, despite having distributed supply chains, presents a potential risk. Since Bitmain is primarily based in China, its dominance highlights how geopolitical dependencies can affect the stability of mining operations,” CoinMetrics reported.

These tariffs are not new. According to SCMP, the US has imposed duties of up to 27.6% on imported mining equipment from China since 2018.

However, recent measures indicate increasing regulatory scrutiny and trade pressures, further raising import costs for mining hardware. This inflates operational expenses for US-based miners and disrupts supply chains, limiting their ability to scale as global hashrate rises.

Recently, Hut 8 Corp., a Bitcoin mining and high-performance computing infrastructure firm, partnered with Eric Trump and Donald Trump Jr. to establish American Bitcoin Corp.

The company aims to become the largest and most efficient pure-play Bitcoin mining operation globally while building a strong strategic Bitcoin reserve. This move highlights the increasing interest from US institutional investors in the competitive mining industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins to Watch in the First Week of April 2025

As the crypto market enters Q2 2025, both investors and traders are anticipating a shift from bearish to bullish momentum. This change is essential for altcoins to recover, as many are currently facing challenges in bouncing back. However, growth potential remains for select tokens in the short term.

BeInCrypto has analyzed three altcoins to watch closely as April begins, highlighting the catalysts that could influence their price movements.

THORChain (RUNE)

RUNE’s price is currently at $1.117, hovering just above the $1.110 support level. For a potential rebound, the altcoin needs to reclaim $1.198 as support. Investor sentiment will play a crucial role in whether this upward movement materializes, leading to possible gains for THORChain (RUNE).

THORChain’s 3.4.0 upgrade is scheduled to take place this week, bringing significant improvements to the network. The upgrade could drive positive market sentiment, helping RUNE reclaim $1.198 as support. This momentum may push RUNE towards $1.396, aiding in recovering recent losses and supporting continued price growth.

If the support at $1.110 is broken, RUNE may fall to $1.021, pushing it closer to losing the critical $1.000 level. A failure to maintain support could signal a bearish trend, invalidating the bullish outlook.

Artificial Superintelligence Alliance (FET)

FET price saw a 20% decline over the last five days, dropping to $0.452 after losing the support of $0.458. This decline puts the altcoin under pressure. However, the doors for potential recovery are open due to upcoming developments within the network.

The Artificial Superintelligence Alliance network is set for a mainnet upgrade this week, bringing new features to the ASI-1 Mini. This upgrade is expected to act as a catalyst for the price, pushing it toward the key resistance levels of $0.524 and $0.572 to recover recent losses.

If the bearish trend continues, FET could fall further to $0.400, which would invalidate the bullish outlook and lead to extended losses. The price would need to hold above critical support levels to avoid deeper declines.

Ethereum (ETH)

Ethereum’s price is nearing a 17-month low of $1,745, following a 13.42% drop after failing to break through the $2,141 resistance. This recent price action suggests the altcoin king is struggling to regain momentum. The market conditions remain unfavorable for a quick recovery at this point.

Despite the current market downturn, Ethereum could see some recovery as investors look to capitalize on low prices. A short-term bounceback is possible if ETH successfully flips $1,862 into support, potentially pushing the price above $2,000. This would mark a significant recovery attempt from the recent drop.

If bearish conditions continue, Ethereum’s price might fall below $1,745, testing the next support at $1,625. A failure to hold this level would invalidate the bullish outlook and open the door for further declines, extending the recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top Crypto Airdrops to Watch in the First Week of April

As traders and investors anticipate the beginning of April and the onset of the second quarter (Q2) of 2025, crypto airdrops present an opportunity to join promising communities while they are still on the ground floor.

This week, three notable crypto airdrops stand out as worth watching.

Walrus

Walrus (WAL), a decentralized storage protocol on the Sui blockchain, launched its mainnet and token generation event (TGE) on March 27. The event coincided with South Korea’s Upbit exchange listing WAL.

The TGE saw Walrus distribute 4% of its 5 billion token supply via an airdrop. Eligible participants, including early Sui ecosystem users and testnet contributors, received Soulbound NFTs redeemable for WAL tokens. As April commences, 6% of Walrus tokens are reserved for future community rewards.

“At the moment 4% of the 10% tokens allocated for the airdrop have been distributed, so Walrus still has tokens to reward users,” Cryptorank.io noted.

WAL powers storage payments, staking, and governance, with listings on exchanges like Crypto.com and MEXC offering prize pools. The project’s airdrop comes after raising $140 million from Andreessen Horowitz, Standard Crypto, Electric Capital, and Comma3 Ventures, among others.

Meanwhile, Walrus’s market cap exceeds $573 million, reflecting strong adoption potential. Data on CoinGecko shows it was trading for $0.45 as of this writing.

Staking opportunities with validators like Mysten Labs or Nansen enhance rewards, but high commissions (up to 60%) apply. One of Walrus and Sui’s founders recently announced that users could stake WAL tokens to get airdrops. As this could mean airdrops from Walrus and projects from the Sui ecosystem, engaging with Sui dApps and testnets remains key for future allocations.

Nansen

The project has raised up to $88.2 million from investors such as Andreessen Horowitz, Coinbase Ventures, Accel, and Mechanism Capital, among others. Coupled with the fundraiser, Nansen has a valuation of $750 million.

Nansen, a leading blockchain analytics platform, confirmed an airdrop, drawing excitement due to its prominence and past reward patterns. The project launched a staking program and announced a point system in 2025.

“We’re excited to announce that we have acquired Stakewithus (SWU)! SWU is a non-custodial staking service provider with $80m+ staked by 30k+ users & supports 20+ chains You can now analyze data, monitor your portfolio, and stake assets in one place with Nansen,” read the announcement.

Users can stake assets (STRK and TRX), and points are expected to be credited retrospectively. Nansen also mentions the NSG token, so participants will most likely receive an airdrop for points.

Market participants should monitor Nansen’s social channels and partnerships for updates, as airdrops typically reward active users or data contributors.

With no token launched yet, any potential airdrop might tie into a future native token, likely incentivizing early adopters or premium subscribers. Given Nansen’s influence in the crypto space, tracking wallet activity and on-chain data, its airdrop could attract significant attention.

Participants should engage with its tools and stake in supported ecosystems to position themselves for unannounced opportunities.

OG Labs

This modular AI chain combines Layer-1 blockchain with decentralized AI, focusing on scalable Data Availability for AI applications.

The status of OG Labs airdrop stands confirmed, bringing forth an emerging player in the crypto space. This makes it a speculative target for market participants. It boasts up to $325 million in funds raised from investors such as Delphi Ventures, Hack VC, Animoca Brands, and OKX Ventures, among others.

The airdrop is potentially tied to Web3 innovation or NFT ecosystems (given the “OG” moniker). It follows models like Walrus, rewarding early testers or community members.

“There are new activities on the OG test network – we can request test tokens and make swaps,” Cryptorank.io noted.

The OG Labs airdrop requires no investment. Users can engage through OG Labs’ Newton Testnet, which tests-core functionalities like decentralized storage, consensus, and data availability services. Participants must complete at least 20 transactions, stay active for three days, and interact with features like swaps, storage scans, and NFT minting.

“Interact with the OG Labs Testnet and Become Eligible for the Airdrop,” crypto researcher Guatamgg stated.

Additionally, users can boost eligibility by taking Discord roles such as OGurus or OG Role. These activities involve community contributions and verification steps. This airdrop targets active ecosystem participants, aligning with OG Labs’ emphasis on community-driven development.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoJapan Set To Classify Cryptocurrencies As Financial Products, Here’s All

-

Market22 hours ago

Market22 hours agoTop 3 Made in USA Coins to Watch This Week

-

Market21 hours ago

Market21 hours agoSolana (SOL) Price Risks Dip Below $110 as Bears Gain Control

-

Altcoin16 hours ago

Altcoin16 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market12 hours ago

Market12 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market11 hours ago

Market11 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?