Ethereum

Funding Rates Hit New 2024 Lows—Is A Rally Still Possible?

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

Ethereum

Ethereum Long-Term Holders Show Signs Of Capitulation – Prime Accumulation Zone?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum saw a dramatic turnaround this week, bouncing over 21% from its recent low of $1,380 in just hours. The sharp recovery came in response to an unexpected shift in macroeconomic policy: US President Donald Trump announced a 90-day pause on reciprocal tariffs for all countries—except China, which now faces a steep 125% tariff. The news sent a ripple through global markets, sparking a short-term rally in risk assets, including crypto.

Related Reading

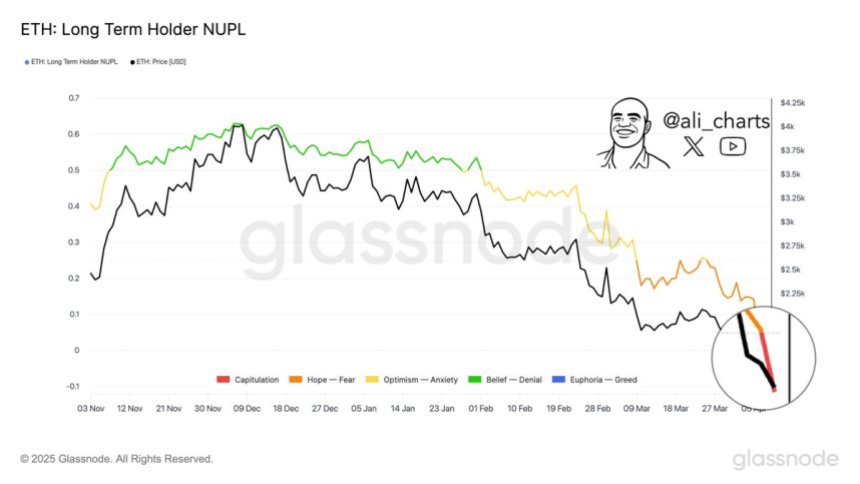

Ethereum, which had been under heavy selling pressure for weeks, appears to have found temporary relief. According to Glassnode data, long-term Ethereum holders are starting to fold, offloading positions at a loss after months of decline. Historically, these moments of long-term holder capitulation have often marked bottoming phases and preceded meaningful rebounds.

While short-term volatility remains elevated, some analysts view this setup as a potential opportunity zone, especially for contrarian investors looking to accumulate during peak fear. The market now watches to see if ETH can hold its gains or if broader uncertainty will drag prices back down. One thing is clear: the next few days could be pivotal for Ethereum’s trend heading into the second half of 2025.

Ethereum Finds Relief Amid Chaos, But Market Remains On Edge

Ethereum is now at a pivotal crossroads after enduring weeks of relentless selling pressure and uncertainty. The recent surge from sub-$1,400 levels has offered a glimmer of hope, as bulls begin to push back against the downtrend. This bounce follows aggressive volatility not just in crypto but across global equities, with price action rocked by continued geopolitical unrest and macroeconomic instability. US President Donald Trump’s unpredictable stance on tariffs remains a wildcard, keeping global markets on edge.

Since peaking in late December, Ethereum has shed over 60% of its value, triggering growing concern that a full-scale bear market may be unfolding. Many investors have already exited positions, while others remain sidelined waiting for clarity. Still, some see opportunity.

According to top analyst Ali Martinez, long-term Ethereum holders have now entered what’s commonly referred to as “capitulation” mode—a stage when even the most patient investors begin to fold under pressure. Martinez believes this could present a rare window for contrarian buyers. “For those watching risk-reward dynamics, this phase has historically marked prime accumulation zones,” he shared on X.

While Ethereum’s path forward is still uncertain, current sentiment suggests that a critical test is underway—one that could determine whether this recovery has legs, or if further pain lies ahead.

Related Reading

Bulls Look To Confirm Recovery With Key Breakout

Ethereum is showing signs of short-term strength as it forms an “Adam & Eve” bullish reversal pattern on the 4-hour chart. This classic technical formation, which starts with a sharp V-shaped low followed by a rounded bottom, often signals a potential breakout if price action holds and follows through. For Ethereum, reclaiming the $1,820 level is the first step to confirm this bullish structure.

If bulls can push ETH above this level with conviction, the next key challenge lies at the 4-hour 200 moving average (MA) and exponential moving average (EMA), both of which converge around the $1,900 mark. A decisive breakout through this zone would validate the recovery setup and could kickstart a more sustained move higher.

Related Reading

However, failure to reclaim the $1,800 level in the coming days may keep ETH stuck in a consolidation range. If rejected, price could remain rangebound between current levels and the lower support area near $1,300, where ETH recently bounced. For now, all eyes are on how price reacts to the resistance levels ahead, as bulls aim to regain control and shift the short-term momentum in their favor.

Featured image from Dall-E, chart from TradingView

Ethereum

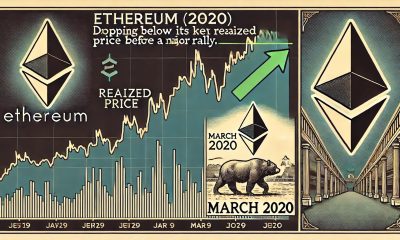

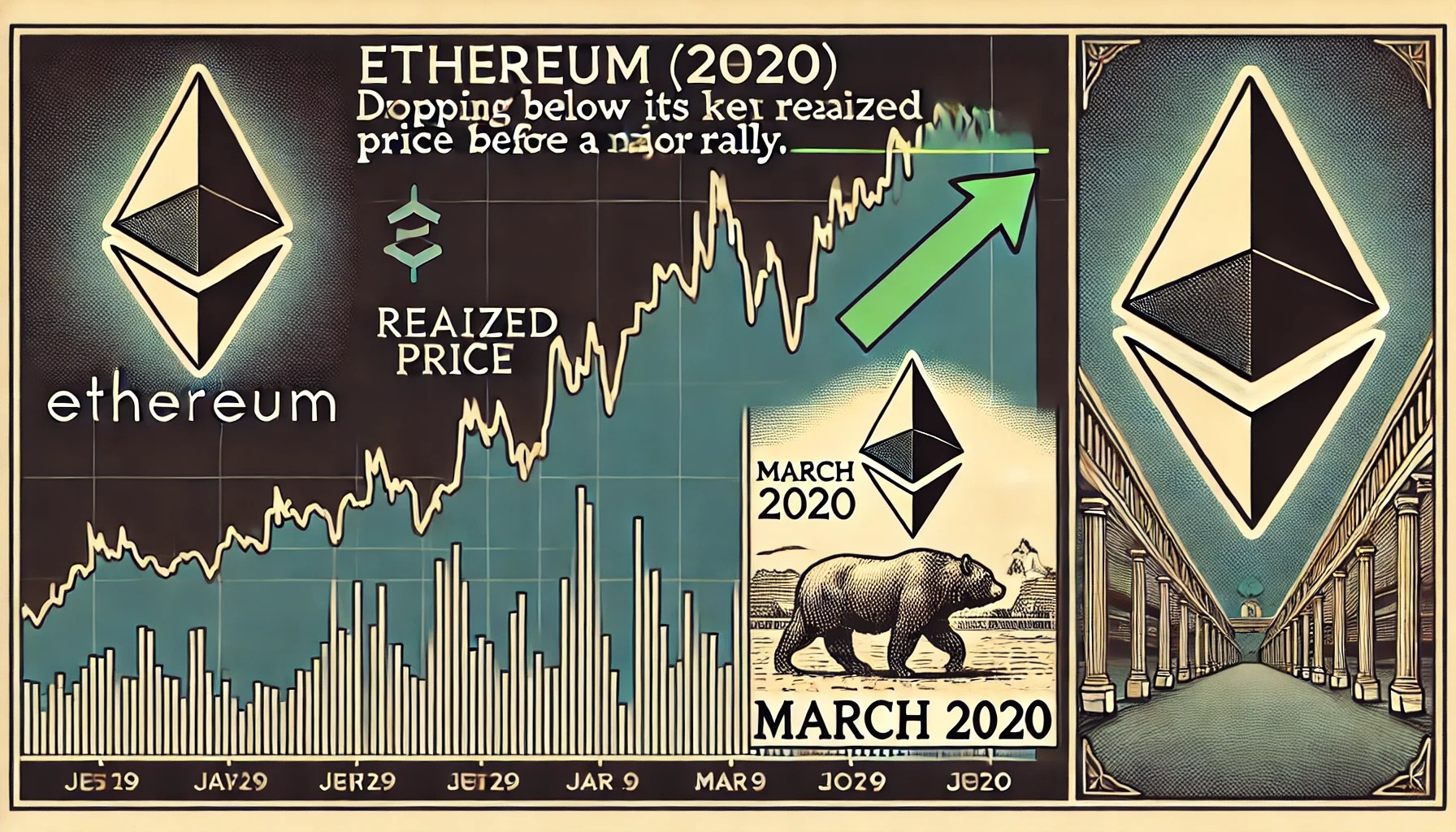

Ethereum Drops Below Key Realized Price: Last Time Was March 2020 Before A Rally

Ethereum has suffered yet another blow this week, sliding to a fresh low of around $1,380 — a level not seen since March 2023. The ongoing downtrend has left investors increasingly concerned, with many now questioning whether ETH’s long-term bullish structure is still intact. Market conditions remain harsh, driven by persistent macroeconomic tensions, rising global instability, and uncertainty stemming from U.S. trade and fiscal policies.

Sentiment across the crypto space continues to deteriorate, and Ethereum’s price action reflects that unease. After months of struggling to hold key support levels, the breakdown below $1,500 has added to fears that a deeper correction may be unfolding.

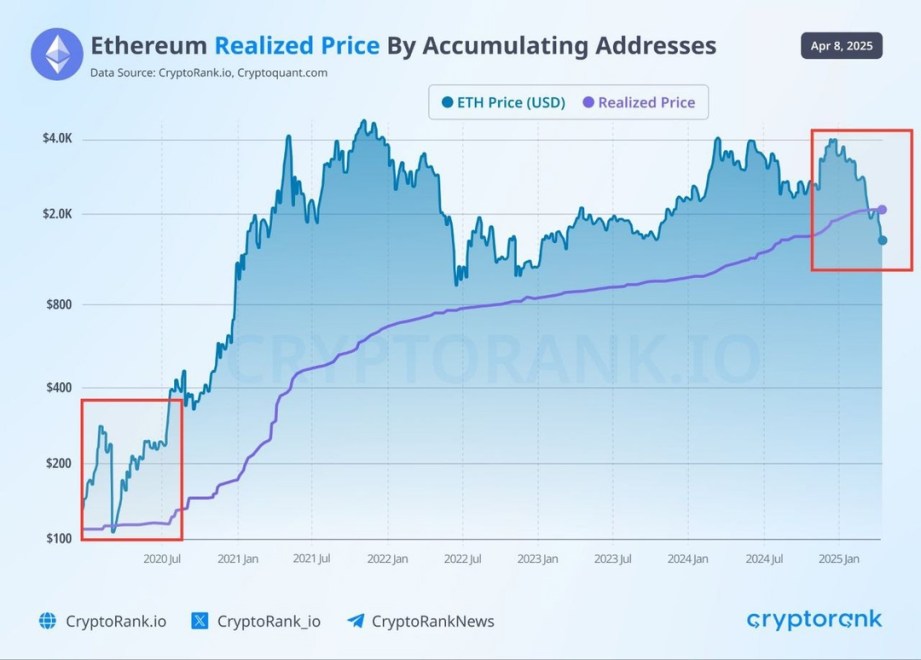

However, amidst the gloom, there may be a silver lining. According to CryptoRank data, Ethereum is now trading below its realized price — a rare occurrence historically associated with market bottoms and strong recovery phases.

While the near-term outlook remains uncertain, such rare on-chain signals could indicate that Ethereum is entering a key accumulation zone. The coming days and weeks will be critical in determining whether this is just another leg down — or the beginning of a long-term reversal.

Ethereum Sinks Below Realized Price As Fear Takes Over The Market

Ethereum has now lost over 33% of its value since late March, triggering deep concern among investors and analysts alike. The price plunge has brought ETH down to levels not seen in over two years, sparking panic and despair among holders who once expected 2025 to be a breakout year for altcoins. Instead, Ethereum has become a symbol of market fragility as the broader macroeconomic landscape continues to worsen.

Trade war fears, inflationary pressure, and a potential global recession are shaking financial markets to their core. In this climate, high-risk assets like Ethereum are among the first to suffer. As capital exits speculative assets in favor of safer havens, ETH’s selloff has only accelerated — and investor confidence has taken a serious hit.

However, there may be a glimmer of hope in the data. Top crypto analyst Carl Runefelt recently pointed out on X that Ethereum is now trading below its realized price of $2,000 — a rare occurrence that has historically signaled major turning points in ETH’s price trajectory.

Runefelt emphasized that the last time ETH dipped below its realized price was in March 2020, when it crashed from $283 to $109 — only to recover strongly in the following months. While the current environment is full of uncertainty, such on-chain metrics hint at the possibility that ETH is entering an accumulation phase once again.

Still, confidence remains fragile, and price action must stabilize before any real bullish narrative can return. Ethereum’s next moves will be critical in determining whether this level marks a true bottom — or just another stop on the way down.

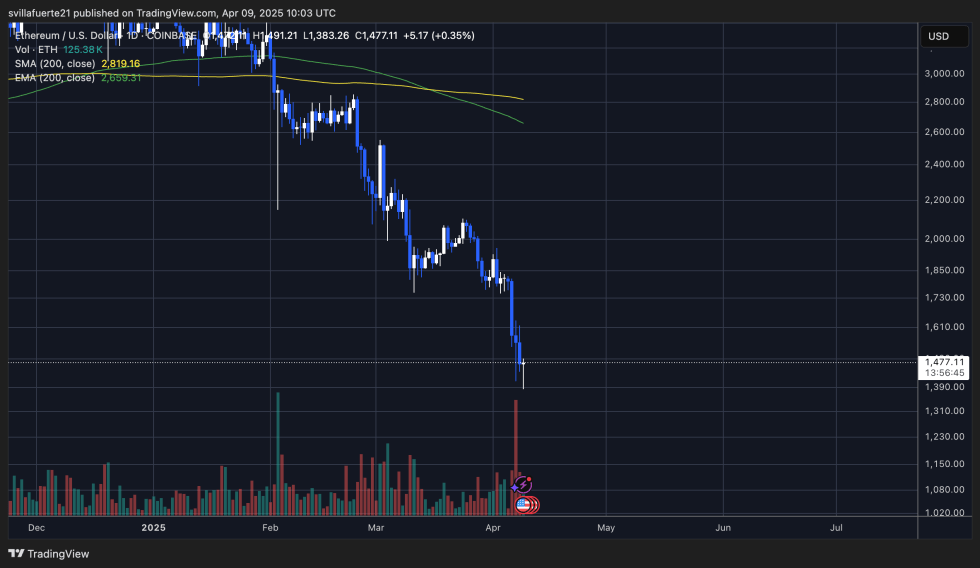

ETH Struggles Below $1,500 With No Clear Support in Sight

Ethereum is currently trading below the $1,500 level after suffering a brutal 50% decline since late February. The aggressive selloff has erased months of gains and left investors in a state of uncertainty, as ETH shows no signs of recovery. Market sentiment remains overwhelmingly bearish, and there is little indication that a bottom has been reached.

At this stage, Ethereum lacks a clearly defined support zone. Bulls have lost control, and price action continues to drift lower with weak demand and increasing fear. For a meaningful reversal to begin, ETH must first reclaim the $1,850 level — a zone that previously served as a key support and now stands as major resistance.

Until that happens, any upside attempt is likely to be met with strong selling pressure. The situation becomes even more precarious if Ethereum loses the $1,380 level, which has so far acted as a psychological threshold. Falling below this area could open the door to a deeper correction toward the $1,100–$1,200 range.

With macroeconomic tensions still high and volatility expected to persist, traders and investors will be watching closely to see whether Ethereum can stabilize — or continue its sharp decline.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Traders Pulling Back? ETH’s Open Interest On Binance Sees Continued Decline

After a slight rebound on Tuesday to the $1,600 threshold, Ethereum‘s price was faced with notable resistance, which led to a sudden breakdown to $1,450. ETH’s persistent weak performance this year has impacted investor conviction in the market, triggering significant selling pressure in the past few weeks.

Bearish Sentiment Toward Ethereum Grows On Binance

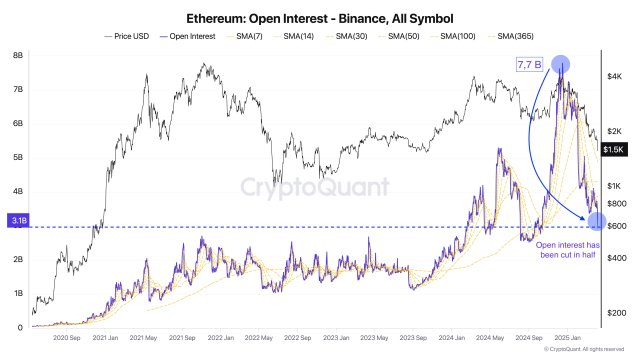

The bearish sentiment toward Ethereum has increased in crypto exchanges, especially on Binance, the world’s largest cryptocurrency exchange. Verified author and on-chain expert for CryptoQuant, Darkfost, revealed that ETH’s Open Interest (OI) on Binance continues to see a steady decline.

The persistent drop in open interest on the crypto exchange indicates that ETH‘s derivatives market is cooling down. It also reflects rising caution among investors and traders as the altcoin battles to sustain its bullish momentum.

Darkfost highlighted that the open interest on Binance continues to drop without stopping and is now changing under its 365 Simple Moving Average (SMA). This movement implies that speculative activity is pulling back as investors might be waiting for more certain signals before making a forceful comeback to the market.

After hitting an all-time high of $7.78 billion in December, the open interest on Binance has decreased by almost 50% between December and April, wiping out nearly $4 billion within the period. The chart shows that ETH’s open interest on Binance is now valued at $3.1 billion, suggesting a massive shift in investor sentiment on the platform.

According to the on-chain expert, Ethereum’s price has been significantly impacted by this sharp drop, and there are no indications that the ongoing downward trend will be stopping anytime soon. Furthermore, it reflects the magnitude of recent liquidations as well as a heightened aversion to risk among investors.

In the event that the trend continues, Darkfost noted that “Ethereum’s price is still far from entering a period of stability.” Thus, Darkfost has urged traders to monitor investors’ behavior on Binance, which remains a valuable indicator since the largest trade volumes across the market are regularly captured by the crypto platform.

ETH Is Poised For A Massive Upswing To New All-Time Highs

With ETH’s open interest decreasing on the largest crypto exchange and the market extremely volatile, this raises concerns about its price stability. Nonetheless, many crypto analysts are confident that a rebound could be on the horizon, which is likely to push the altcoin toward new highs.

Market expert and trader Milkybull Crypto shared a post on the X platform, outlining Ethereum’s potential to surge significantly in the upcoming weeks. At the time of the post, ETH was trading at $1,585, and the expert stated that the altcoin typically marks a macro bottom at this level. Should this level hold, Milkybull anticipates a huge rally, putting his next target at the $10,000 milestone.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin20 hours ago

Altcoin20 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Altcoin19 hours ago

Altcoin19 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Bitcoin16 hours ago

Bitcoin16 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market16 hours ago

Market16 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin21 hours ago

Altcoin21 hours agoEthereum Price Signals Strong Recovery After Forming Historical Pattern From 2020

-

Regulation16 hours ago

Regulation16 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Market20 hours ago

Market20 hours agoFARTCOIN Jumps 160% in 30 Days but Momentum Fades

-

Market15 hours ago

Market15 hours agoPaul Atkins Confirmed as SEC Chair, Crypto Rules to Ease