Market

Sam Bankman-Fried Appeals Conviction, Seeks Retrial

On September 13, FTX founder Sam Bankman-Fried (SBF) filed an appeal to overturn his last November conviction on fraud and conspiracy charges.

In a 102-page filing, SBF’s legal team argued the trial was unfair, calling it a “sentence first, verdict afterward” situation. They claimed the judgment was rushed and biased.

SBF’s Legal Team Claims He Was Presumed Guilty From the Outset

Led by attorney Alexandra Shapiro, SBF’s lawyers stated that he was never presumed innocent. They argued that everyone involved, including the judge, assumed his guilt from the start.

“Sam Bankman-Fried was never presumed innocent. He was presumed guilty — before he was even charged. He was presumed guilty by the media. He was presumed guilty by the FTX debtor estate and its lawyers. He was presumed guilty by federal prosecutors eager for quick headlines. And he was presumed guilty by the judge who presided over his trial,” the lawyers lamented.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The defense accused US District Judge Lewis Kaplan of bias, alleging he influenced the trial’s outcome. Shapiro contended that Kaplan’s remarks during the trial suggested guilt before the case had concluded. The defense also criticized the judge for restricting key arguments that could have demonstrated SBF’s attempts to stabilize FTX.

“Many of the judge’s rulings were not just erroneous but unbalanced — repeatedly putting a thumb on the scale to help the government and thwart the defense. But that is not all. The judge continually ridiculed Bankman-Fried during trial, repeatedly criticized his demeanor, and signaled his disbelief of Bankman-Fried’s testimony,” the lawyers wrote.

SBF’s legal team further argued that the jury saw only “half the picture” regarding FTX user funds. They claimed the prosecution misrepresented the case by portraying the funds as permanently lost, while SBF allegedly caused the loss intentionally.

“From day one, the prevailing narrative — initially spun by the lawyers who took over FTX, quickly adopted by their contacts at the US Attorney’s Office — was that Bankman-Fried had stolen billions of dollars of customer funds, driven FTX to insolvency, and caused billions in losses. Now, nearly two years later, a very different picture is emerging — one confirming FTX was never insolvent, and in fact had assets worth billions to repay its customers. But the jury at Bankman Fried’s trial never got to see that picture,” the lawyers stated.

Bankman-Fried’s lawyers also raised concerns about Sullivan & Cromwell’s role in the case. According to them, the law firm — which initially served as FTX’s external legal counsel and later became its lead bankruptcy firm — wrongly pressured SBF to step down as CEO. The lawyers also argued that the law firm aimed to place full blame on Bankman-Fried to divert attention from its own questionable practices.

“Sullivan & Cromwell — which billed hundreds of millions of dollars in this case — performed prosecutorial tasks that had nothing to do with bankruptcy. Moreover, the Debtors and S&C were motivated to place all blame squarely on Bankman-Fried — to avoid scrutiny of their own business decisions, their own conflicts of interest, their own exorbitant billing, and their own misconduct,” SBF lawyers claimed.

Considering all of these reasons, the defense is asking for a new trial with a different, impartial judge.

Read more: Who Is John J. Ray III, FTX’s New CEO?

Last year, Bankman-Fried was convicted on seven counts of fraud and conspiracy. He received a 25-year prison sentence and was ordered to forfeit $11 billion for his role in defrauding FTX customers, investors, and Alameda Research lenders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Poised for Gains: $3,600 Within Reach?

Ethereum price started a fresh increase above the $3,320 zone. ETH is rising and aiming for more gains above the $3,500 resistance.

- Ethereum started a fresh increase above the $3,300 and $3,320 levels.

- The price is trading above $3,300 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,420 resistance zone.

Ethereum Price Eyes More Gains

Ethereum price remained supported above $3,120 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,220 and $3,300 resistance levels.

The bulls pumped the price above the $3,400 level. It gained over 10% and traded as high as $3,499. Recently, there was a downside correction below $3,400. The price dipped below $3,320 and tested $3,280. A low was formed at $3,288 and the price is now consolidating above the 23.6% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

Ethereum price is now trading above $3,300 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD.

The first major resistance is near the $3,400 level. The main resistance is now forming near $3,420 or the 61.8% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

A clear move above the $3,420 resistance might send the price toward the $3,500 resistance. An upside break above the $3,500 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,600 resistance zone or even $3,620.

Downsides Limited In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,320 level. The first major support sits near the $3,285 zone.

A clear move below the $3,285 support might push the price toward $3,220. Any more losses might send the price toward the $3,120 support level in the near term. The next key support sits at $3,040.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,300

Major Resistance Level – $3,350

Market

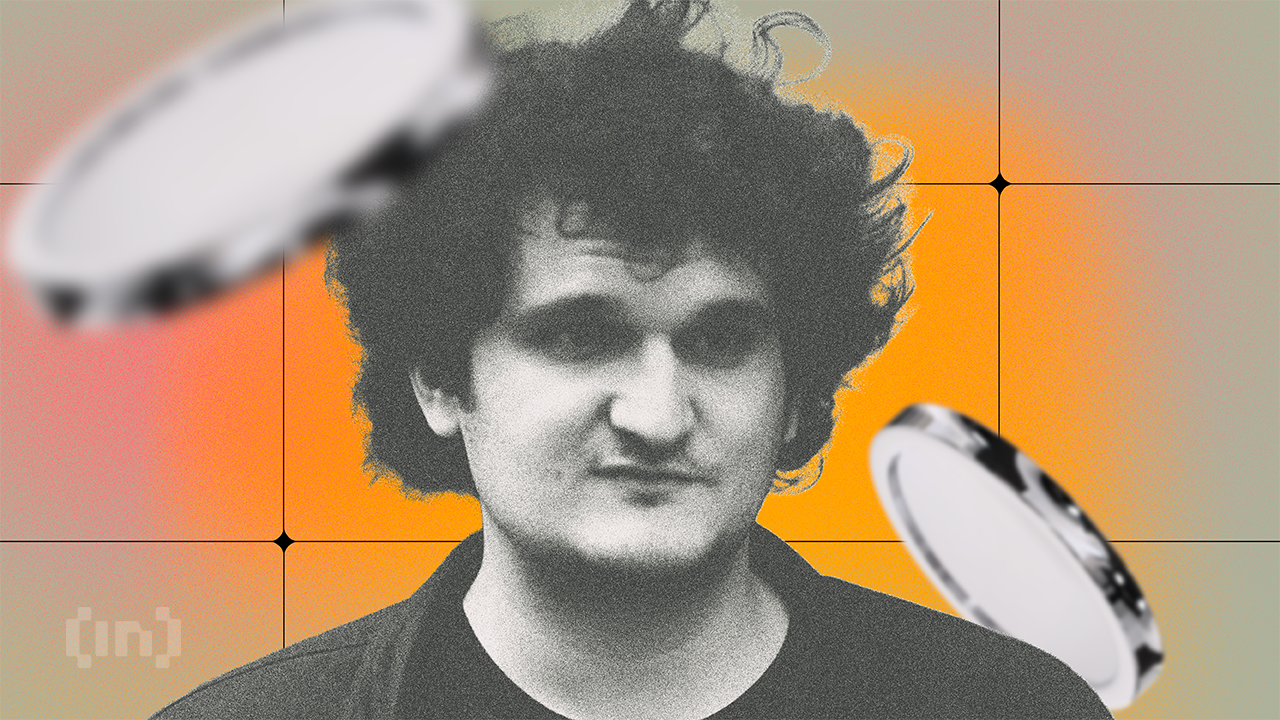

Bitcoin ETFs Could Overtake Gold ETFs by End of The Year

Spot Bitcoin exchange-traded funds (ETFs) in the US are nearing a major milestone. They are set to become the biggest BTC holders in the world, even surpassing the amount held by Bitcoin’s creator, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

Since their launch in January, US spot Bitcoin ETFs have grown significantly. According to crypto analyst HODL15Capital, these funds now hold about 1.081 million Bitcoin, just below Nakamoto’s estimated 1.1 million.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is believed to own approximately 5.68% of the total Bitcoin supply. These holdings, valued at over $100 billion, place Nakamoto among the world’s wealthiest individuals — if they are alive and a single person.

However, Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that ETFs are now 98% of the way to overtaking Nakamoto. He predicted that if the current pace of inflows continues, this could happen by Thanksgiving.

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good. If next 3 days are like the past 3 days flow-wise it’s a done deal,” Balchunas stated.

SoSoValue data shows inflows into these ETFs grew by around 97% week-on-week to $3.3 billion over the last five trading days, with BlackRock’s iShares Bitcoin Trust (IBIT) contributing $2 billion. This surge coincides with the introduction of options trading for these products, which many believe is attracting more institutional investors.

Meanwhile, Bitcoin ETFs are also narrowing the gap with gold ETFs, which currently hold $120 billion in assets under management (AUM). According to Balchunas, Bitcoin ETFs manage $107 billion and could overtake gold ETFs by Christmas.

These bullish predictions reflect Bitcoin’s exceptional performance in 2024. The top cryptocurrency has surged nearly 160% since January, trading near the $100,000 landmark. In addition, its $1.91 trillion market capitalization now exceeds that of silver and major corporations like the state-owned oil company Saudi Aramco.

However, BTC still lags behind gold, which remains the world’s largest asset with a market capitalization of more than $18 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

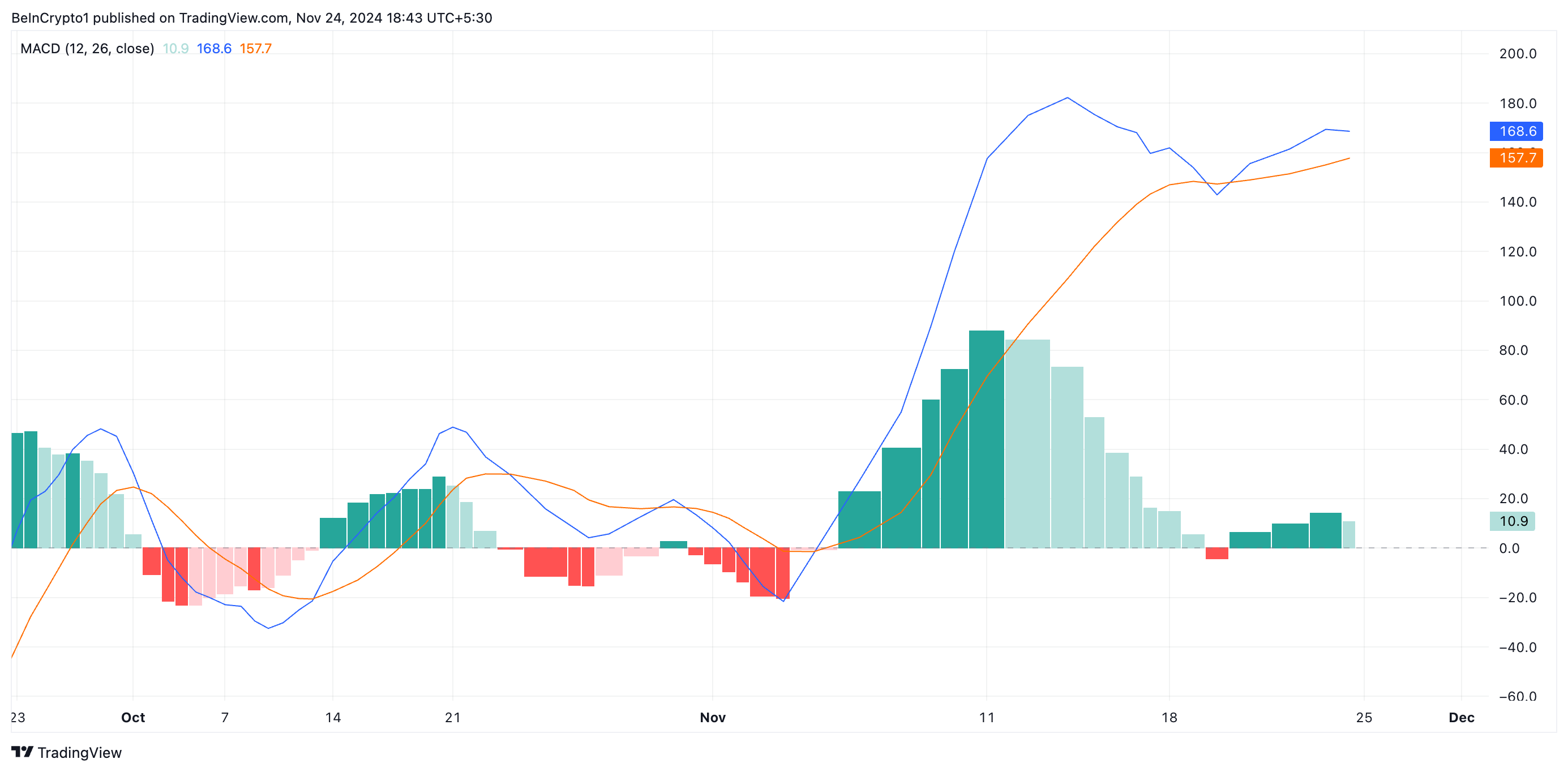

Why Ethereum Price May Fall Under $3,000

Ethereum (ETH) is currently facing significant downward pressure, with its price declining by 3% over the past 24 hours. This bearish trend could push ETH’s price below the critical $3,000 price level.

This analysis examines the factors contributing to this likelihood.

Ethereum Sellers Re-Emerge

An assessment of the ETH/USD one-day chart has revealed that the coin’s moving average convergence divergence (MACD) indicator is forming a potential death cross. As of this writing, the coin’s MACD line (blue) is attempting to fall below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. A MACD death cross occurs when the MACD line (the shorter-term moving average) crosses below the signal line (the longer-term moving average), indicating a bearish trend or momentum reversal. This signal suggests that selling pressure is increasing, and the asset’s price could decline further.

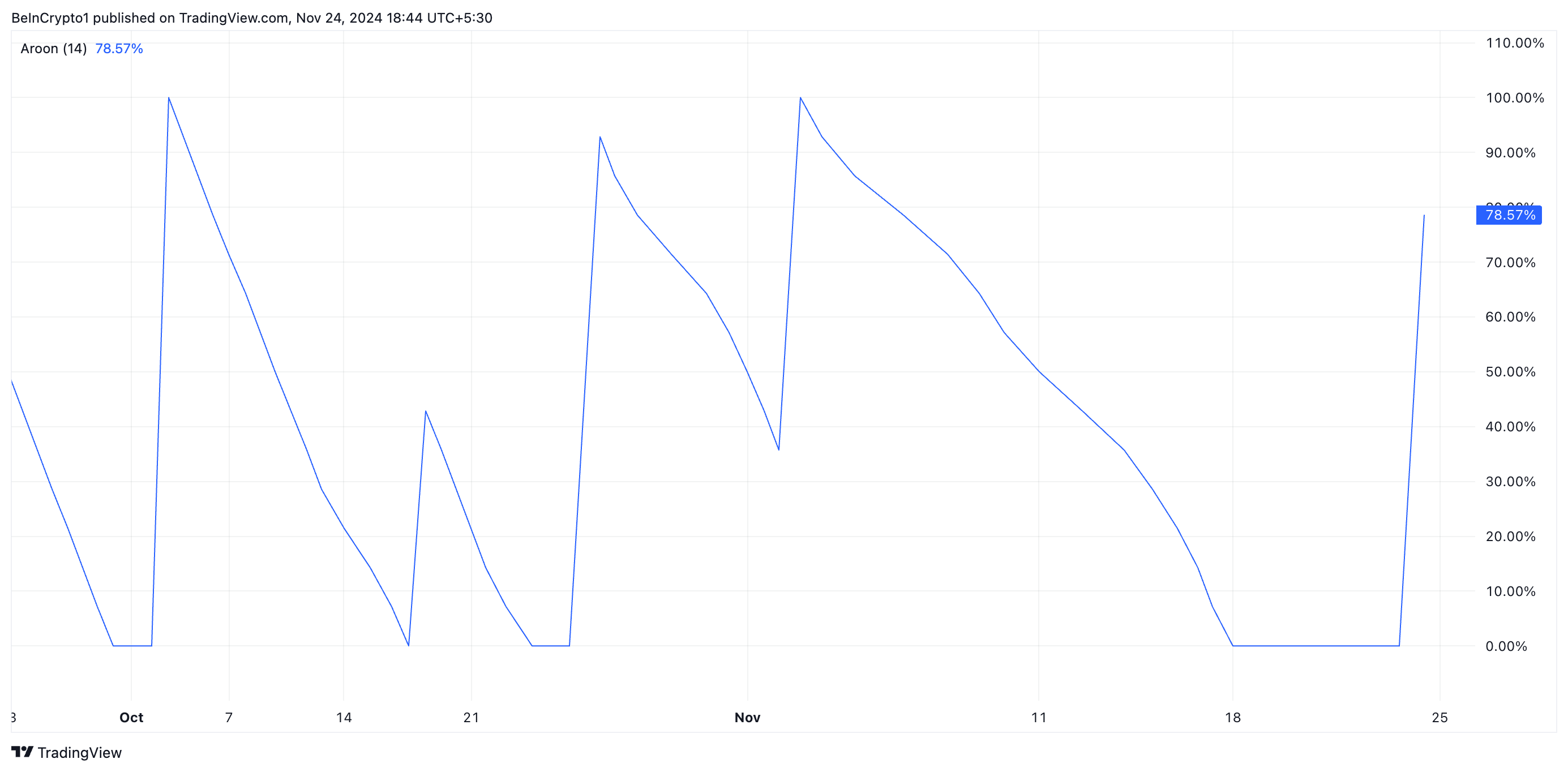

ETH’s rising Aroon Down Line confirms this strengthening bearish pressure. It currently sits at 78.57%, confirming that the decline in ETH’s price is gaining momentum.

The Aroon Indicator evaluates the strength of an asset’s price trend through two components: the Aroon Up line, which reflects the strength of an uptrend, and the Aroon Down line, which reflects the strength of a downtrend. A rising Aroon Down line indicates that recent lows are occurring more frequently, signaling growing bearish momentum or the start of a downtrend.

ETH Price Prediction: Key Support Level To Watch

ETH currently trades at $3,333, resting above the support formed at $3,203. This level is crucial because a decline below it will cause ETH to exchange hands under $3000. According to readings from the coin’s Fibonacci Retracement tool, the Ethereum price will drop to $2,970 if this happens.

However, a resurgence in the demand for the leading altcoin will invalidate this bearish thesis. If this occurs, Ethereum will rally toward $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market20 hours ago

Market20 hours agoWhy a New Solana All-Time High May Be Near

-

Bitcoin11 hours ago

Bitcoin11 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours

-

Market11 hours ago

Market11 hours agoCantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

-

Market17 hours ago

Market17 hours agoWinklevoss Urges Scrutiny of FTX and SBF Political Donations

-

Bitcoin16 hours ago

Bitcoin16 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin15 hours ago

Bitcoin15 hours agoAI Company Invests $10 Million In BTC Treasury