Market

Crypto Whales Are Buying These Altcoins

The cryptocurrency market saw a slight increase in trading activity this week, with global market capitalization rising by 3% over the seven-day period.

This growing optimism has led whales to accumulate assets such as Telegram-linked Toncoin (TON), the leading altcoin Ethereum (ETH), and AI-driven Artificial Superintelligence Alliance (FET).

Toncoin (TON)

This week, crypto whales have paid attention to Toncoin (TON) as its price continues to grow. This rally comes a week after Telegram CEO Pavel Durov broke his silence regarding his arrest in France.

At press time, the altcoin trades at $5.55, having seen a 16% price hike over the past seven days, putting many of its holders in profit.

Read more: 6 Best Toncoin (TON) Wallets in 2024

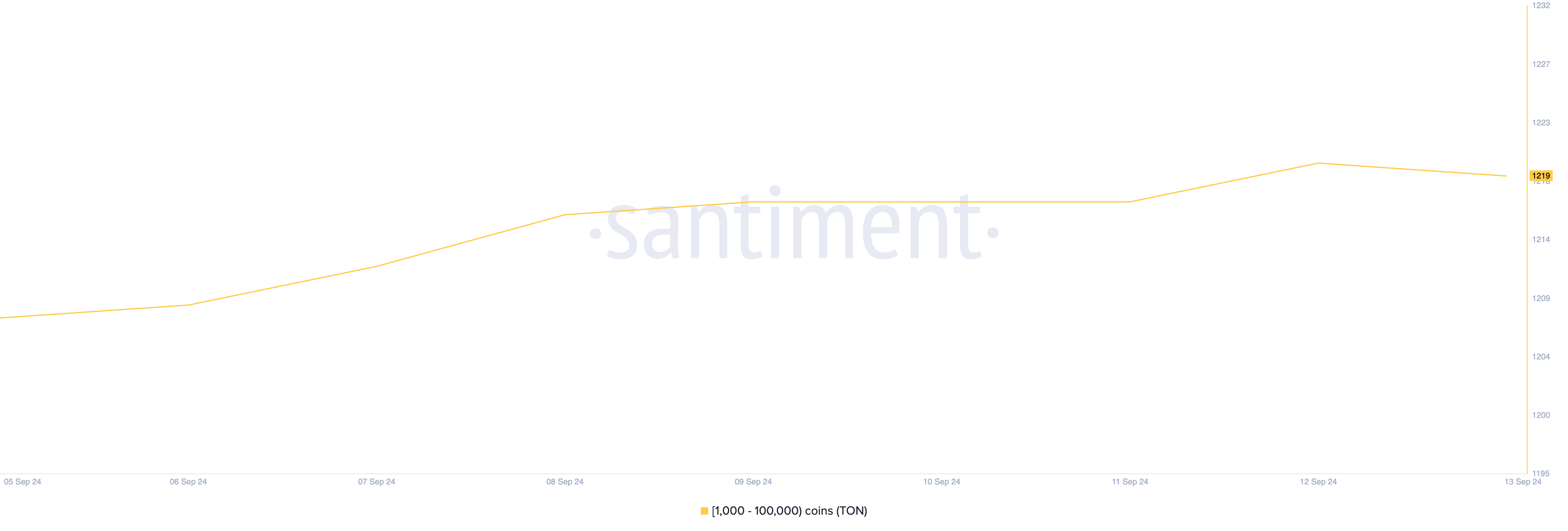

This has led to an uptick in the number of whales trading the altcoin. Santiment’s data shows that the count of whale addresses holding between 1,000 and 100,000 TON currently stands at 1219, its highest in 30 days.

Ethereum (ETH)

Ethereum’s large holders’ netflow has spiked by 109% this week. Large holders are whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins they buy and those they sell over a specific period.

This accumulation has taken place despite Ethereum facing resistance at the $2,386 price level, indicating that whales remain unfazed by the price challenges.

Whales likely expect a price rally as market sentiment shifts from negative to positive. If ETH manages to break above the $2,386 resistance level, it could continue its uptrend and reach $2,783.

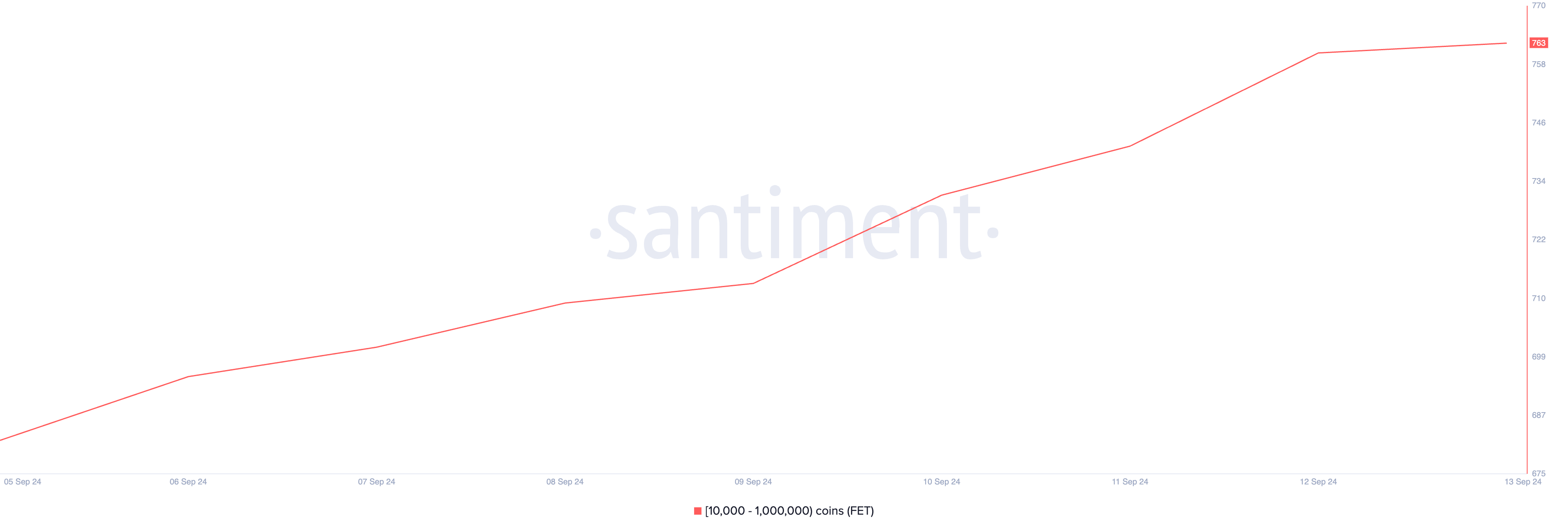

Artificial Superintelligence Alliance (FET)

The value of AI-based asset Artificial Superintelligence Alliance (FET) has witnessed a 25% growth this week. It received even more attention from market participants following reports that OpenAI wants to raise a new $6.5 billion equity financing.

Read more: 9 Best Artificial Intelligence Stocks To Buy in 2024

Santiment data reveals an 11% increase in the count of crypto whale addresses holding between 10,000 and 1,000,000 FET. As of press time, this group now includes 763 addresses, marking an all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Meme Coin FARTCOIN Hits Two-Month High, Could It Reach $1?

The Solana-based meme coin FARTCOIN has once again claimed its spot as the market’s top gainer, surging to a two-month high of $0.73.

It has seen an impressive 39% price increase over the past 24 hours, reflecting a notable uptick amid an otherwise declining market.

FARTCOIN Defies the Odds, Soars to Two-Month High

FARTCOIN plunged to a year-to-date low of $0.19 on March 10. This presented a buying opportunity for the meme coin holders, who have since increased their buy orders for the token. Trading at a two-month high of $0.72 as of this writing, FARTCOIN’s value has since soared by 279% in the past month.

On the daily chart, FARTCOIN’s triple-digit rally has pushed its price above the Leading Span A (green line) of its Ichimoku Cloud. The strengthening bullish momentum is now driving the altcoin toward the Leading Span B (red line) of this indicator, a breakout of which would further validate FARTCOIN’s current bull run.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels.

When an asset’s price breaks above Leading Span A and is poised to break above Leading Span B, it signals a strengthening bullish trend. This hints at the potential for further upward movement as FARTCOIN moves into a more favorable market position.

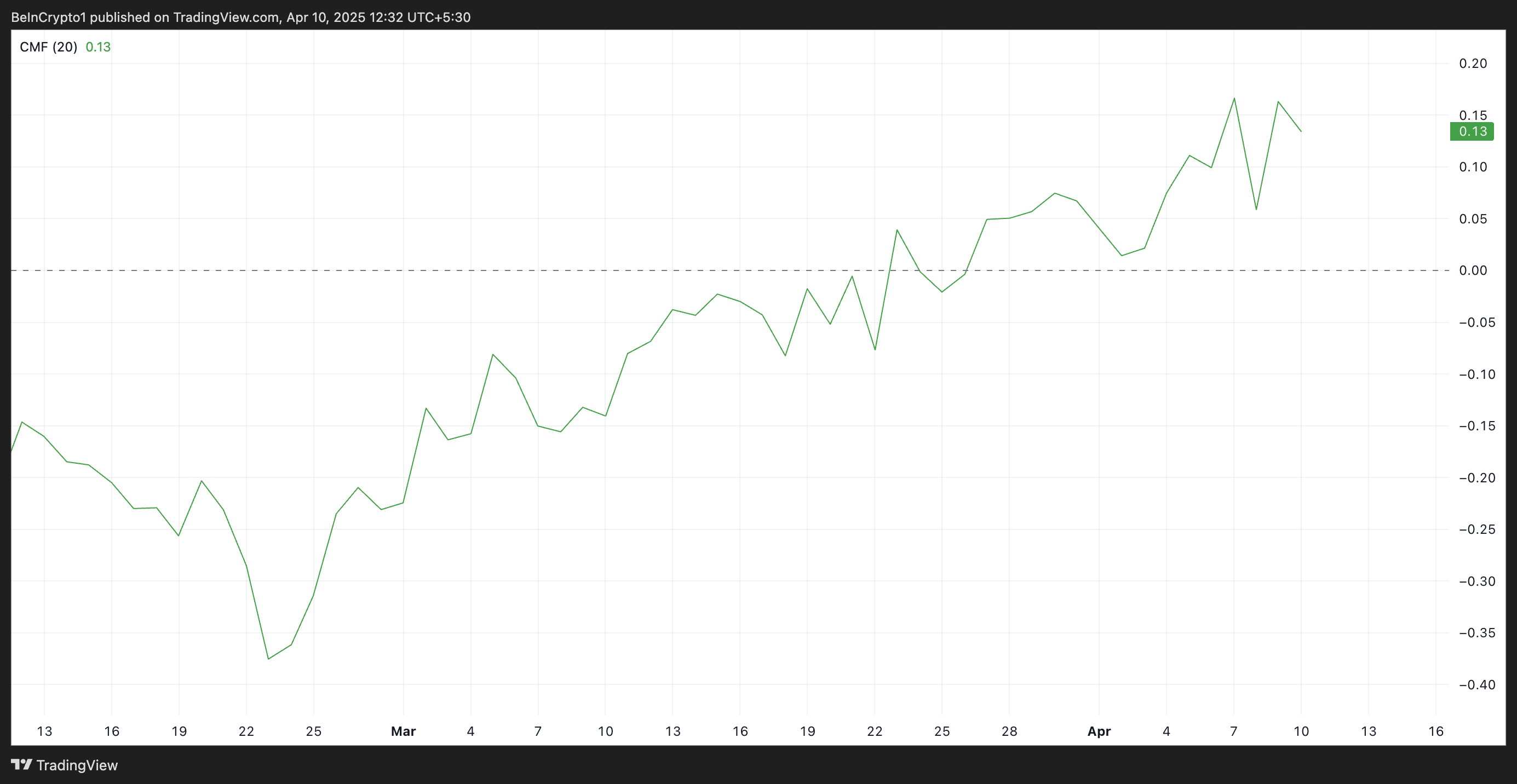

Further, the altcoin’s Chaikin Money Flow (CMF) remains above the zero line, confirming the preference for FARTCOIN accumulation over selloffs. At press time, this momentum indicator, which measures how money flows into and out of an asset, is at 0.13.

A positive CMF reading during a rally like this indicates strong buying pressure and market participation, as the volume of buy orders outweighs sell orders. This suggests that FARTCOIN’s rally is supported by solid demand, reinforcing the sustainability of the upward movement.

FARTCOIN is on Track for $1

Since its rally began on March 10, FARTCOIN has traded within an ascending parallel channel. This bullish pattern confirms the growing demand for the meme coin.

If buying pressure strengthens, FARTCOIN could extend its gains. In that case, its price could break above the Leading Span B, which currently forms a dynamic resistance above its price. A successful break above this level could propel the token toward $1.

However, if profit-taking resumes, this bullish projection will be invalidated. In that scenario, meme coin FARTCOIN’s price could dip to $0.54.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Forms Rounded Bottom Within Descending Channel, Target Set Above $3

Despite breaking above $3 earlier this year, the XRP price has since gone on to disappoint investors with multiple crashes that have rocked the altcoin. This has seen the cryptocurrency lose almost 50% of its acquired value between late 2024 and early 2025. Nevertheless, this has failed to erode bullish sentiment, with predictions for higher prices dominating the community.

Time To Go Long On The XRP Price?

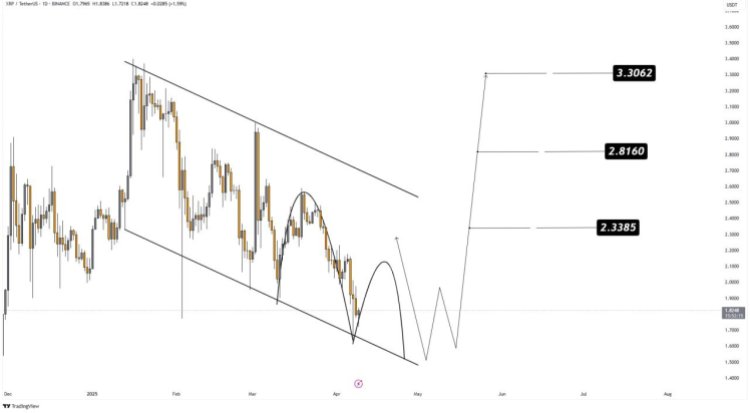

A crypto analyst on X (formerly Twitter) has renewed bullish hope after identifying an important formation on the XRP price chart. The analysis pointed out that the XRP Price is still moving within a descending channel, a formation that usually signals a bearish move.

However, the downtrend has pushed the altcoin’s price to the point where it is now testing the bottom trend line. This bottom trend line has been known to act as strong support previously and is expected to do so this time around.

With the support forming, it is likely that the XRP Price is gearing up for a bounce from this level. Furthermore, the crypto analyst points out that XRP is also forming a rounded bottom inside this descending channel. Such a rounded bottom could signal an end to the downtrend from here.

As the formation grows, the main level of support is now sitting at $1.6. So far, this level has held up quite nicely and bulls have been using it as a bounce-off point for recovery. Given this, the crypto analyst advises that entries for the XRP price are best at around $1.70 to $1.85.

This is not the only good news for the XRP price with support forming. If it holds and the altcoin does indeed bounce from this level toward $2, then the next important levels lie between $2 and $2.2. These serve as the levels for the bulls to beat to confirm a bullish continuation toward a possible all-time high.

If the bulls are successful, then three profit targets are placed by the crypto analyst. These include $2.3385, $2.8160, and $3.3062, pushing it toward January 2025 highs.

The Bearish Case

While the analysis is inherently bullish, there is still the possibility of invalidation that could send the XRP price tumbling further. As the analyst points out, the major support currently lies at $1.6. This means that bulls must hold this level. Otherwise, there is the risk of a much deeper correction as a liquidity sweep could send support further down to $1.3.

Nevertheless, with buy sentiments building once again, it is likely that XRP will follow the bullish scenario in this case.

Chart from TradingView.com

Market

RSR Price Climbs 22% After Paul Atkins Gets Named SEC Chair

Reserve Rights (RSR) has experienced a notable 22% increase in its price over the last 24 hours. This surge follows the news of Paul Atkins, former Reserve Rights Foundation advisor, becoming the new chair of the US Securities and Exchange Commission (SEC).

Additionally, US President Donald Trump’s decision to pause reciprocal tariffs has added a layer of optimism to the cryptocurrency market, further buoying RSR’s price.

Reserve Rights Investors May Note Profits Soon

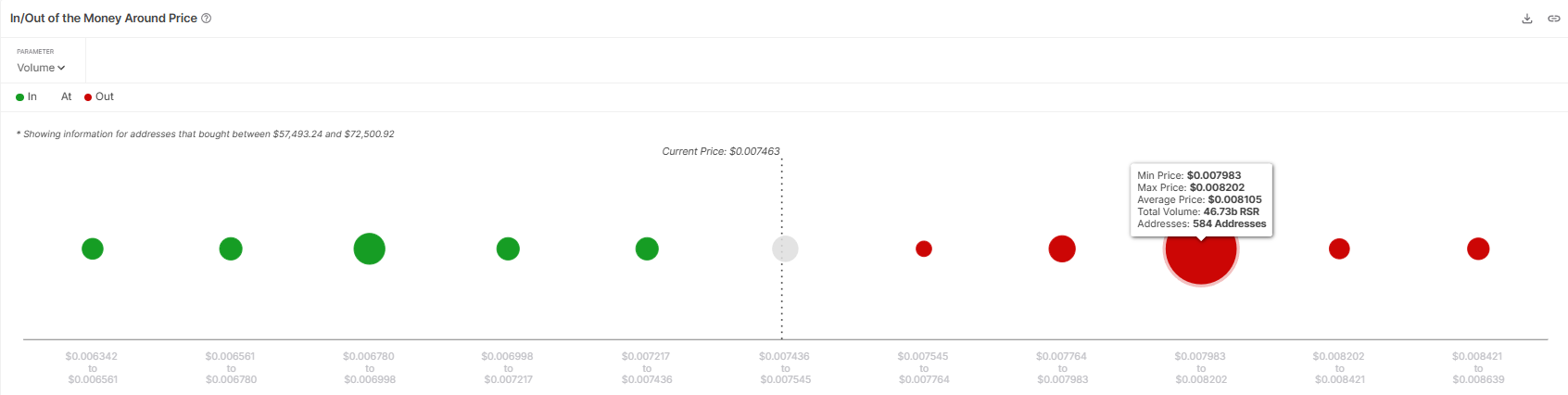

The market sentiment surrounding RSR remains cautiously optimistic, driven by a significant accumulation of tokens. According to the IOMAP, around 46.73 billion RSR tokens, valued at over $350 million, are currently sitting at a price range between $0.007983 and $0.008202.

These tokens have not yet reached a profit zone, but an 8% rally would make them profitable for investors. As these large holders are likely to maintain a bullish outlook, the anticipation of possible profits could further strengthen the buying sentiment, contributing to a price increase.

However, if the holders aim to sell for a break-even, it might negatively impact the RSR price rally.

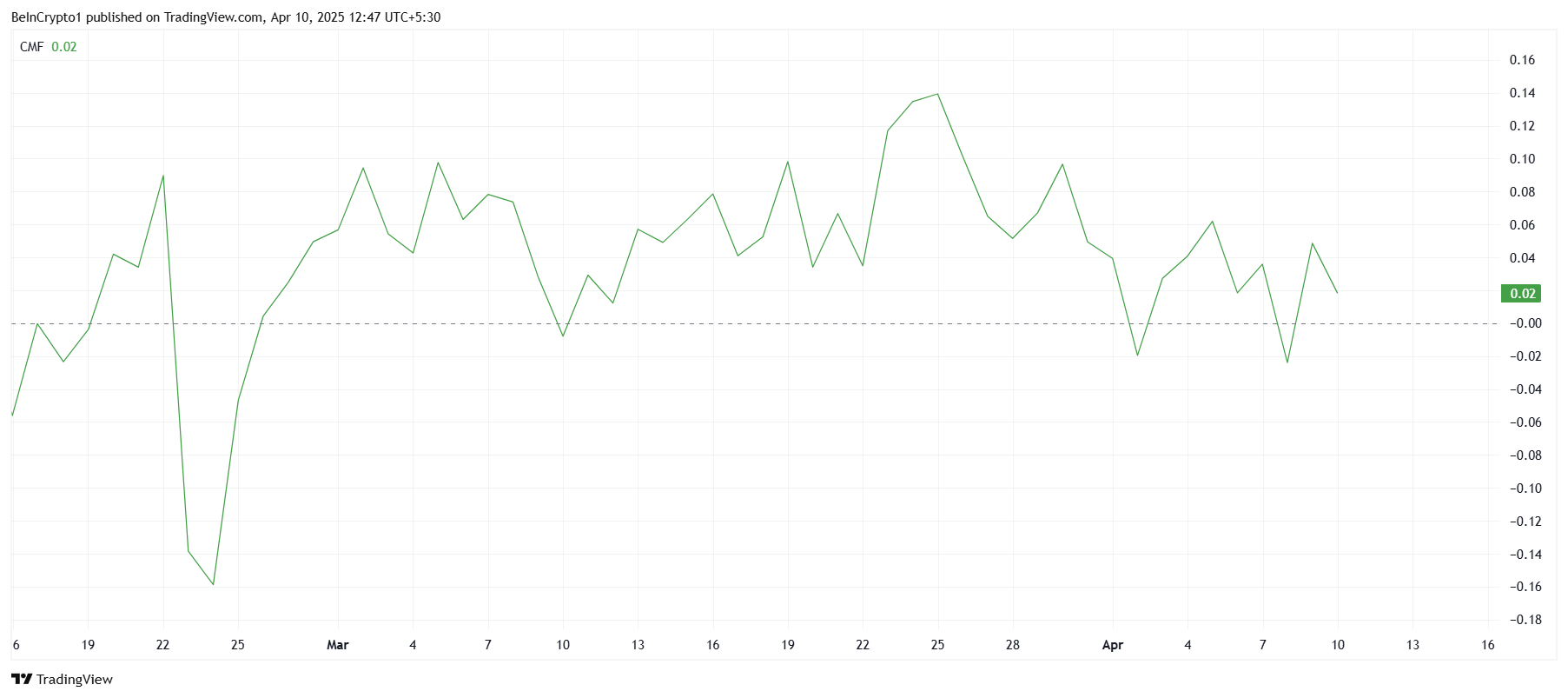

Despite the news of Paul Atkins becoming SEC Chair, the overall macro momentum for RSR appears to be lackluster. The Chaikin Money Flow (CMF) indicator, which measures market liquidity and investor buying pressure, has not seen any sharp upticks, even after the recent announcements.

This suggests that, while the netflows have been positive, they remain underwhelming compared to the size of the positive developments. If RSR’s price continues its uptick in the coming days, there is a chance that the CMF will start to reflect stronger positive sentiment.

RSR Price Is Rising

Reserve Rights (RSR) price is currently trading at $0.007543, with a strong support level at $0.007386. Given the 22% rally over the last 24 hours, it is possible that the token will continue to rise if it holds above this support.

A bounce off $0.007386 could see RSR making its way to $0.008196. This would bring the altcoin closer to a profitable range for many investors as well as imbue confidence regarding further rally.

However, should RSR fail to breach the $0.008196 resistance or fall below the support of $0.007386, the altcoin’s price could drop to $0.006601 or even lower towards $0.005900. This would significantly damage the bullish thesis and extend recent losses, potentially leading to a further period of consolidation.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin12 hours ago

Bitcoin12 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Altcoin16 hours ago

Altcoin16 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Market12 hours ago

Market12 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Bitcoin21 hours ago

Bitcoin21 hours agoWill the Corporate Bitcoin Accumulation Trend Continue in 2025?

-

Altcoin15 hours ago

Altcoin15 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Market21 hours ago

Market21 hours agoPaul Atkins SEC Confirmation Vote

-

Market8 hours ago

Market8 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Market13 hours ago

Market13 hours agoSEC Approves Ethereum ETF Options Trading After Delays