Bitcoin

MicroStrategy Purchased Additional Bitcoin Worth $1.1 Billion

MicroStrategy has made a remarkable financial maneuver by converting $1.1 billion worth of its shares into 18,300 Bitcoin (BTC). The latest Form 8-K filings with the U.S. Securities and Exchange Commission (SEC) confirmed this purchase.

It took place between August 6, 2024, and September 12, 2024.

MicroStrategy Inject Billions Into Acquiring Bitcoin

Consequently, MicroStrategy’s total Bitcoin holdings have increased to about 244,800, acquired at an average price of $38,585 per Bitcoin.

Following a strategic plan, the company announced on August 1 a Sales Agreement with prominent firms such as TD Securities (USA) LLC and The Benchmark Company, LLC.

This agreement allowed MicroStrategy to issue shares of its class A common stock, which could raise up to $2.0 billion.

“On September 13, 2024, the Company announced that, as of September 12, 2024, the Company had sold an aggregate of 8,048,449 Shares under the Sales Agreement for aggregate net proceeds to the Company (less sales commissions) of approximately $1.11 billion,” Form 8-K filing mentioned.

That being said, since August 1, the MicroStrategy share price is down by roughly 20%.

Read more: Who Owns the Most Bitcoin in 2024?

During this acquisition phase, MicroStrategy purchased Bitcoin at an average cost of $60,400 each. This acquisition reflects the company’s confidence in Bitcoin as a valuable asset for long-term investment. Furthermore, this strategy enhances the company’s investment portfolio and establishes MicroStrategy as a formidable entity in the crypto industry.

To date, the company’s total investment in Bitcoin is nearly $9.45 billion. MicroStrategy’s assertive accumulation of Bitcoin highlights its strategic initiative to leverage the growing validation of cryptocurrencies as a stable financial asset class.

This recent development is pivotal, indicating a trend where large corporations are progressively incorporating digital assets into their fiscal strategies. This also includes the Japanese firm Metaplanet, which is following MicroStrategy’s footsteps.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Indeed, MicroStrategy is pioneering a shift in corporate investment tactics, potentially influencing how other companies manage their investment portfolios in the future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Jesus Roger Ver Fights US Tax Evasion Charges

Roger Ver, a leading cryptocurrency advocate and early Bitcoin investor, has urged a US court to dismiss tax evasion charges filed against him. He is most popularly known as ‘Bitcoin Jesus’ among his 745,000 followers on X (formerly Twitter).

Ver, 45, was arrested in February while attending a crypto conference in Barcelona. He is facing allegations of evading over $48 million in taxes and filing a false tax return.

Bitcoin Jesus Claims His Arrest Was Politically Driven

The charges are based on the sale of $240 million worth of cryptocurrencies and an “exit tax” linked to Ver’s renunciation of US citizenship in 2014. Prosecutors are seeking his extradition from Spain, where he awaits a court decision.

According to Bloomberg reports, Ver’s legal team has dismissed the indictment as politically motivated. They claim it represents the Biden administration’s heavy-handed approach to cryptocurrency enforcement.

His lawyers argue the charges are part of a broader effort to regulate the sector through enforcement rather than clear policy measures.

Meanwhile, the case has drawn widespread attention in the cryptocurrency industry. Critics are accusing the US government of targeting high-profile crypto figures to set an example.

“His crime? He didn’t commit one, but that doesn’t matter in the age of American Lawfare. What Roger did do was promote a revolutionary decentralizing technology that radically empowers citizens,” popular author Bret Weinstein wrote on X (Formerly Twitter)

Ver has been a vocal critic of US crypto regulation. He has long advocated for decentralized financial systems and the adoption of Bitcoin as a global currency.

However, the government has successfully prosecuted several high-profile crypto figures over the past year. Earlier today, former Celsius CEO Alex Mashinsky pled guilty to multiple fraud charges.

The government has also successfully prosecuted all major affiliates of Sam Bankman-Fried linked to the FTX collapse.

A Legacy in Bitcoin

Nicknamed “Bitcoin Jesus,” Ver was among the first to promote Bitcoin when its value was less than $1. He would often give away BTC to followers to encourage adoption. He has also invested in leading crypto companies such as Ripple Labs, BitPay, and Kraken.

Born in the US, Ver moved to Japan in 2006 and became a citizen of Saint Kitts and Nevis in 2014 after renouncing his American citizenship.

His arrest by Spanish authorities earlier this year has reignited debates on US cryptocurrency regulations and the treatment of industry pioneers. However, this is not his first legal battle. Ver has previously faced multiple lawsuits from crypto companies, including Genesis and ConFLEX.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

MicroStrategy and MARA Double Down on Bitcoin Purchases

MicroStrategy has purchased $1.5 billion worth of Bitcoin, while Marathon Digital Holdings is raising $700 million to extend its Bitcoin purchases.

MicroStrategy’s acquisition adds 15,400 bitcoins to its portfolio, bringing its total holdings to 402,100. The company now owns nearly 2% of the capped 21 million bitcoin supply.

Public Companies Continue an Extensive Trend of Bitcoin Purchases

This purchase further extends MicroStrategy’s lead as the largest corporate Bitcoin holder. In November alone, the company purchased over $12 billion worth of BTC. The latest acquisition was completed at an average price of $95,976 per bitcoin.

Despite this move, MSTR stock prices fell nearly 1% during Monday trading. However, its year-to-date gains have mirrored Bitcoin’s performance, surging by nearly 500% so far this year. This rally recently placed MicroStrategy among the top 100 public companies in the US.

Since its first Bitcoin purchase in 2020, Saylor has advocated for companies to use Bitcoin as a treasury reserve asset. He also recently suggested Microsoft’s board of directors and its CEO Satya Nadella to invest in Bitcoin, saying that Microsoft should be powered by digital capital.

Earlier in October, Microsoft’s board urged its shareholders to vote against a proposal that suggested that the company diversify its portfolio through Bitcoin.

“There’s a pretty low supply of Bitcoin over the counter, so you have a supply shortage, and if Bitcoin moves above $100,000, there will be a big chase. I’m still confident that Bitcoin is going to close much higher before year-end, well above $100,000. It’s just a matter of time,” Entrepreneur Thomas Less said on CNBC today.

Meanwhile, Bitcoin mining firm Marathon Digital Holdings (MARA) announced a $700 million private offering of 0% convertible senior notes due in 2031. The offering, subject to market conditions, will target institutional investors under the Securities Act.

The notes, classified as unsecured senior obligations, will not bear interest. At the company’s discretion, they may be converted into cash, MARA common stock, or a combination of both.

MARA plans to allocate $50 million from the proceeds to general corporate purposes, including Bitcoin purchases, capital expenditures, and other growth initiatives. Additionally, part of the funds will go toward repurchasing its 2026 convertible notes to optimize its capital structure.

These developments highlight the growing interest in Bitcoin as a strategic asset among publicly traded companies. These firms are demonstrating an extremely bullish outlook for the leading cryptocurrency. Pantera Capital even predicted BTC to reach $740,000 by 2028.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

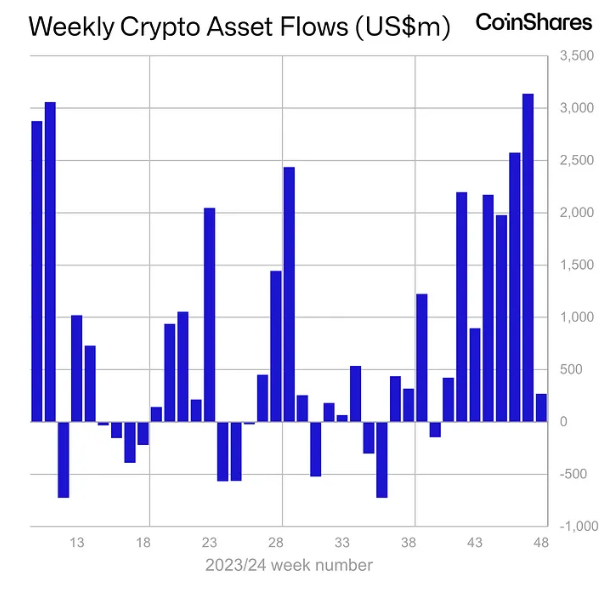

Crypto Investment Inflows Decline: Is Bitcoin Losing Momentum?

Crypto investment inflows experienced a sharp contrast last week, dropping to $270 million, signaling a slowdown after consecutive weeks of strong activity.

Year-to-date inflows have reached a record $37.3 billion, reflecting the continued growth of institutional interest in cryptocurrencies despite market volatility.

Crypto Inflows Drop Amid Profit Booking

Bitcoin faced significant outflows of $457 million last week, marking the first notable retreat since early September. It comes after a series of positive flows into digital asset investment products as BTC reached new highs. Specifically, crypto inflows reached $3.12 billion the prior week.

The impact of macroeconomic trends also played a role. Two weeks ago, inflows hit $2.2 billion as optimism surrounding a Republican sweep in US elections and a softer stance from the Federal Reserve buoyed investor sentiment.

However, momentum appears to be fading. Following the initial post-election rally, inflows have moderated. Last week’s figures also reflect a significant pullback compared to the $1.98 billion seen immediately after the elections. CoinShares’ James Butterfill attributes the selloff to profit-taking after Bitcoin approached the $100,000 psychological level.

“We believe is profit taking following bitcoin testing the very psychological level of $100,000,” Butterfill wrote.

Meanwhile, experts have divided Bitcoin’s outlook. Pessimistic analysts, including prominent figures like former Wall Street quant Tone Vays, forecast further downside.

Vays disclosed his decision to exit all long positions at $97,800, reflecting caution among seasoned traders. The analyst expressed skepticism about Bitcoin sustaining its $100,000 breakthrough this year.

“Still think sustaining a $100,000 break this year is unlikely. Will be more than happy to be wrong OR Buy the Dip sub for $90,000! Might even consider a short,” he expressed.

Conversely, more optimistic views persist. Fundstrat’s Tom Lee remains bullish, projecting Bitcoin to reach $250,000 by the end of 2025. However, Lee’s team acknowledges potential short-term setbacks, with some expecting a dip to $60,000 before resuming its upward trajectory.

Robert Kiyosaki, the author of Rich Dad Poor Dad, echoed this sentiment but highlighted that any dip is a buying opportunity for long-term accumulation.

“Bitcoin is stalled short of $100,000. That means BTC may crash to $60,000. If and when that happens, I will not sell,” Kiyosaki stated.

While Bitcoin faced outflows, Ethereum recorded a massive $634 million in inflows, signaling renewed investor confidence in the asset. Ethereum’s YTD inflows have reached $2.2 billion, supported by a growing shift in sentiment as traders pivot to altcoins amid Bitcoin’s short-term uncertainty.

The crypto exchange-traded products (ETPs) market saw a drop in trading volumes, declining to $22 billion last week from $34 billion the week before.

Even with the introduction of options on US ETFs (exchange-traded funds), their effect on overall market volumes has been limited. This development raises concerns about the level of sustained institutional interest in these financial instruments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation21 hours ago

Regulation21 hours agoCambodia crackdown locks out 16 crypto exchanges

-

Altcoin18 hours ago

Altcoin18 hours agoXLM, KAIA, SAND, & These Crypto Eye Rally As Binance Expands Support

-

Market23 hours ago

Market23 hours agoXRP Price Defies The Odds

-

Altcoin17 hours ago

Altcoin17 hours agoAnalyst Who Correctly Called The XRP Price Jump From $1.4 To $2.8 Reveals The Rest Of The Prediction

-

Market22 hours ago

Market22 hours agoTron (TRX) Price Hits New All-Time High Since 2018

-

Altcoin21 hours ago

Altcoin21 hours agoThinking Of Selling Your Dogecoin Already? Crypto Analyst Puts Price Top In The Double-Digits

-

Altcoin19 hours ago

Altcoin19 hours agoSHIB Burn Skyrockets 3400%, Shiba Inu Rally To Continue?

-

Altcoin23 hours ago

Altcoin23 hours agoPepe Coin Whale Sells 350B Coins Nabbing 31x Return, Has PEPE Price Topped?