Market

This Is How DePIN Can Solve AI’s Global Energy Crisis

The rise of artificial intelligence (AI) and generative AI technologies has been meteoric in the past two years. For some tech-savvy people, every morning begins with the help of AI, from the smart alarm that tracks their sleep cycle to the news app that curates articles based on their interests.

But behind these seamless conveniences lies a hidden reality – these technologies are part of a growing energy crisis. As AI technologies like generative AI advance, they are not just transforming our lives; they’re demanding a huge share of the world’s electricity.

Impact of AI on Energy Infrastructures

The challenge is stark. As one of the most energy-intensive modern IT endeavors, AI systems require considerable carbon emissions and electricity. Indeed, the world might not be ready for their demands.

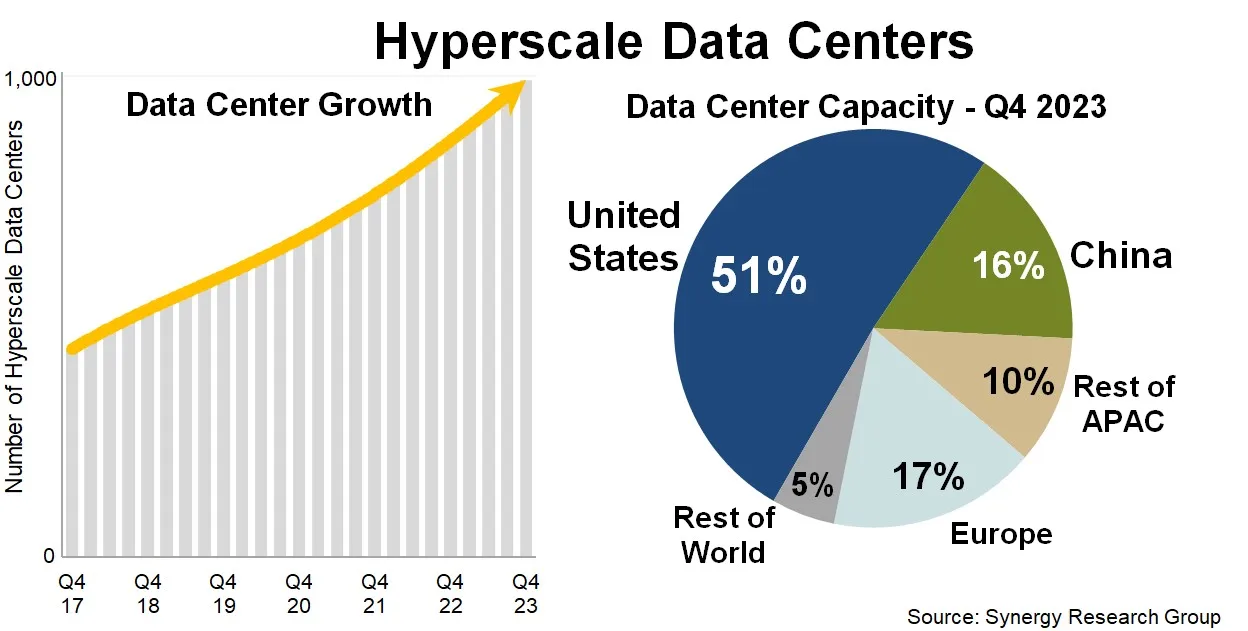

In 2023, the world became acquainted with the implications of generative AI, and by 2024, its utilization in various sectors magnified. Hence, data centers that power these AI models are becoming massive consumers of electricity.

Indeed, Forbes noted that GPT-4 required over 50 gigawatt-hours to train—equivalent to 0.02% of California’s annual electricity production. Moreover, it requires 50 times more energy than its predecessor, GPT-3.

The statistics are staggering. Globally, data centers and their transmission networks now contribute to 3% of global energy consumption, emitting as much carbon dioxide as Brazil.

Moreover, the escalating energy requirements show no signs of abating. According to an International Energy Agency (IEA) projection, global electricity demand will surge from 460 terawatt-hours (TWh) in 2022 to 1000 TWh by 2026.

Read more: How To Build Your Personal AI Chatbot Using the ChatGPT API

In the United States alone, the power demand from data centers is expected to increase from 200 TWh in 2022 to 260 TWh by 2026, marking a 6% share of the country’s total power usage. Projections suggest this demand will double by 2030.

Amid this backdrop, Ayush Ranjan, CEO of Huddle01, highlighted in an interview with BeInCrypto the urgent need for solutions like DePIN (Decentralized Physical Infrastructure Network).

“AI data centers require a substantial amount of electricity for computation and cooling. If AI applications continue to grow at the current rate, we will see a significant strain on both local and global energy grids that will prove unsustainable. This burden will continue to increase as AI systems get more and more complex with time. This will again lead to higher emissions and grid instability,” Ranjan explained.

The geographic clustering of data centers compounds the challenges. For instance, Northern Virginia hosts the largest hub of data centers globally, consuming electricity equivalent to that of 800,000 homes. This concentration creates dangerous fluctuations in power demand, posing severe risks to energy infrastructures.

How DePIN Solves the Challenges

In response, DePIN offers a promising solution by leveraging underutilized hardware resources to distribute computational tasks more efficiently. By decentralizing energy consumption and incentivizing the use of edge computing, DePIN networks could significantly alleviate the energy burden imposed by AI, offering a pathway to more sustainable and democratized access to AI resources.

Ranjan further elucidated that DePINs distribute energy consumption and workload, easing the burden on any single point. Instead of relying on huge centralized data centers, DePIN deploys multiple nodes—often utilizing underused infrastructure to offload computations closer to end-users.

“This reduces the workload on servers and spreads energy consumption more evenly across regions, easing the burden on energy grids,” Ranjan told BeInCrypto.

Currently, 84% of the data centers are concentrated around the United States, Europe, and China, making data transfers less energy efficient. However, edge computing, integral to DePIN, minimizes long-distance, energy-intensive data transfers typical of centralized data centers.

“Splitting the energy consumption across multiple devices and regions, reducing the load on data centers and energy grids by leveraging existing devices or resources to build the network will prove critical in solving this issue,” Ranjan affirmed.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

DePin Projects Addressing AI’s Demands

According to Ranjan, several DePIN projects, like Filecoin Green, Akash Network, Render, and Grass, focus on addressing AI’s energy demands.

Notably, the Daylight Energy project, backed by prominent venture capitalist firm Andreessen Horowitz (a16z), aims to transform energy grid operations through distributed energy resources (DERs). This initiative enhances grid responsiveness and facilitates sustainable energy practices by leveraging real-time data from DERs such as solar panels and smart batteries.

Moreover, on September 10, Daylight Energy announced a partnership with DIMO Network to enable electric vehicles (EVs) to support power grids. This collaboration utilizes DIMO’s EV application programming interfaces (APIs) to integrate EVs into the energy management ecosystem, thereby facilitating clean energy usage and real-time energy management for all EV owners.

DePIN networks also solve other challenges of centralized infrastructure, such as frequent outages. For instance, a recent IT outage involving Microsoft and CrowdStrike disrupted major services worldwide. However, DePIN networks are less susceptible to such outages because they do not have a single point of failure.

Currently, the total market capitalization of DePIN projects stands above $20.5 billion. Additionally, the total number of DePIN devices has crossed 18 million. However, DePIN still faces scalability challenges as the mainstream adoption of these networks requires high computational power.

“Many DePINs rely on a mix of devices, from low-powered edge devices to small-scale data centers. Scaling the network and coordinating the deployed resources to match the computational power of a centralized data center remains a formidable industry challenge,” Ranjan noted.

Read more: Top 10 Web3 Projects That Are Revolutionizing the Industry

However, while the idea of DePIN rescuing the world from a global energy crisis remains nascent, further innovation and adoption are essential. Ranjan believes that token incentives can help bring more adoption.

“Because of hardware limitations of edge devices to handle AI workload, wide adoption is crucial for any DePIN to scale and see a mainstream use case. Token incentives help drive intent to use and participate,” Ranjan concluded.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

10 Altcoins at Risk of Binance Delisting

On April 3, Binance announced that it would add a new set of tokens to its monitoring list. These tokens are under closer scrutiny and may face delisting following the upcoming review period.

This move follows the exchange’s aims to increase transparency while offering more clarity regarding the risk levels associated with different cryptocurrencies.

10 Altcoins in Danger of Binance Delisting

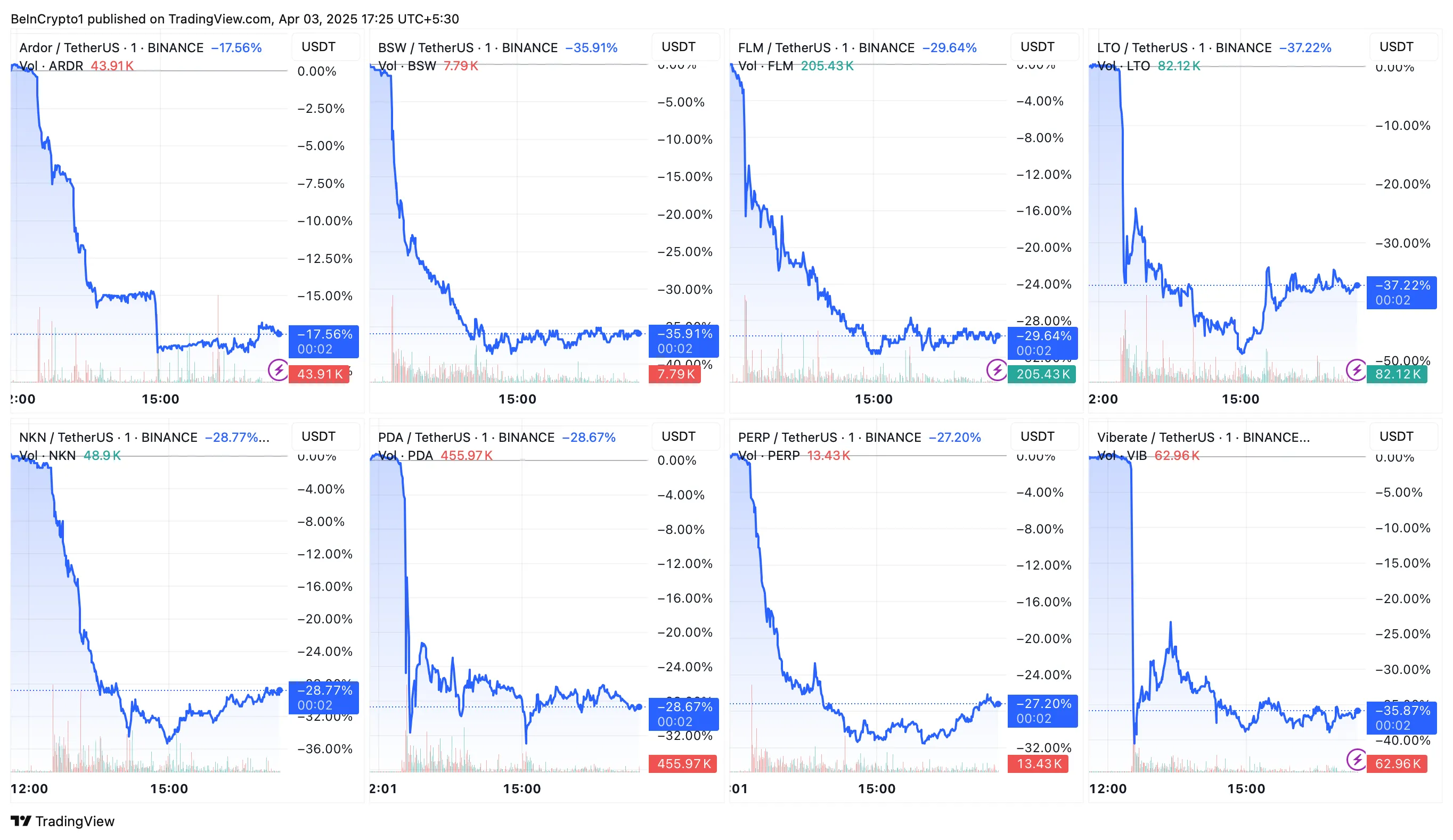

As part of this update, the following tokens will be added to the Monitoring Tag list: Ardor (ARDR), Biswap (BSW), Flamingo (FLM), LTO Network (LTO), NKN (NKN), PlayDapp (PDA), Perpetual Protocol (PERP), Viberate (VIB), Voxies (VOXEL) and Wing Finance (WING).

Tokens added to the Monitoring Tag exhibit notably higher volatility and risk compared to other listed tokens. Binance will closely monitor these tokens, with regular reviews to assess their compliance with the platform’s listing criteria.

“Tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance said.

Following the announcement, the prices of the mentioned altcoins plummeted by double-digits.

In addition to the new Monitoring Tag additions, Binance will also remove the Seed Tag from Jupiter (JUP), Starknet (STRK), and Toncoin (TON).

Tokens marked with the Seed Tag are those that are still in their early stages of development and have not yet met Binance’s full listing criteria. The removal of the Seed Tag indicates a change in the status of these projects. This suggests that they no longer fit the initial criteria for such a label.

Tokens with the Monitoring Tag or Seed Tag come with inherent risks. Binance ensures that users are well-informed before trading them. To access trading for these tokens, users must pass a risk awareness quiz every 90 days.

The quiz makes sure that users understand the potential risks associated with trading higher-risk tokens. Binance will also display a risk warning banner for these tokens on its Spot and Margin platforms.

Binance will continue to conduct periodic reviews of tokens with the Monitoring Tag and Seed Tag. During these reviews, several factors are taken into account. This includes the project team’s commitment, development activity, token liquidity, and community engagement.

The latest development follows a similar announcement from Binance in March. The exchange routinely delists tokens that fail to keep up with its criteria.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

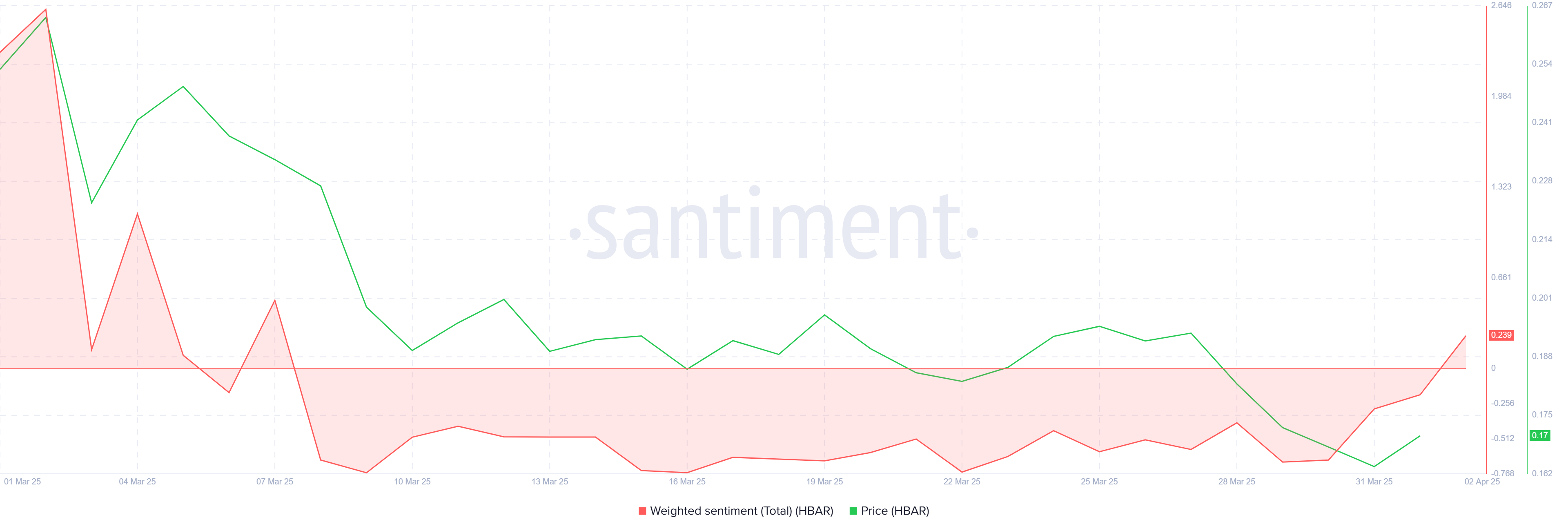

Hedera (HBAR) has faced a downtrend recently, with the crypto asset’s price failing to maintain support at $0.200. This failure to establish a solid base has led to a pullback.

However, key developments within the Hedera ecosystem and shifting investor sentiment could spark a potential price rally in the coming days.

HBAR Foundation Eyes TikTok

After nearly a month of bearish sentiment, investors are beginning to shift their stance towards bullishness. The Hedera Foundation’s recent move to team up with Zoopto for a late-stage bid to acquire TikTok has played a pivotal role in this shift. If the acquisition is approved, the partnership could expose HBAR to a massive audience due to TikTok’s extensive user base, potentially driving up demand and mainstream adoption.

The prospect of this collaboration has reignited interest among investors, sparking optimism about Hedera’s future growth potential. With TikTok’s wide-reaching influence, the strategic partnership could offer Hedera an edge in the competitive crypto market, encouraging further accumulation of HBAR tokens.

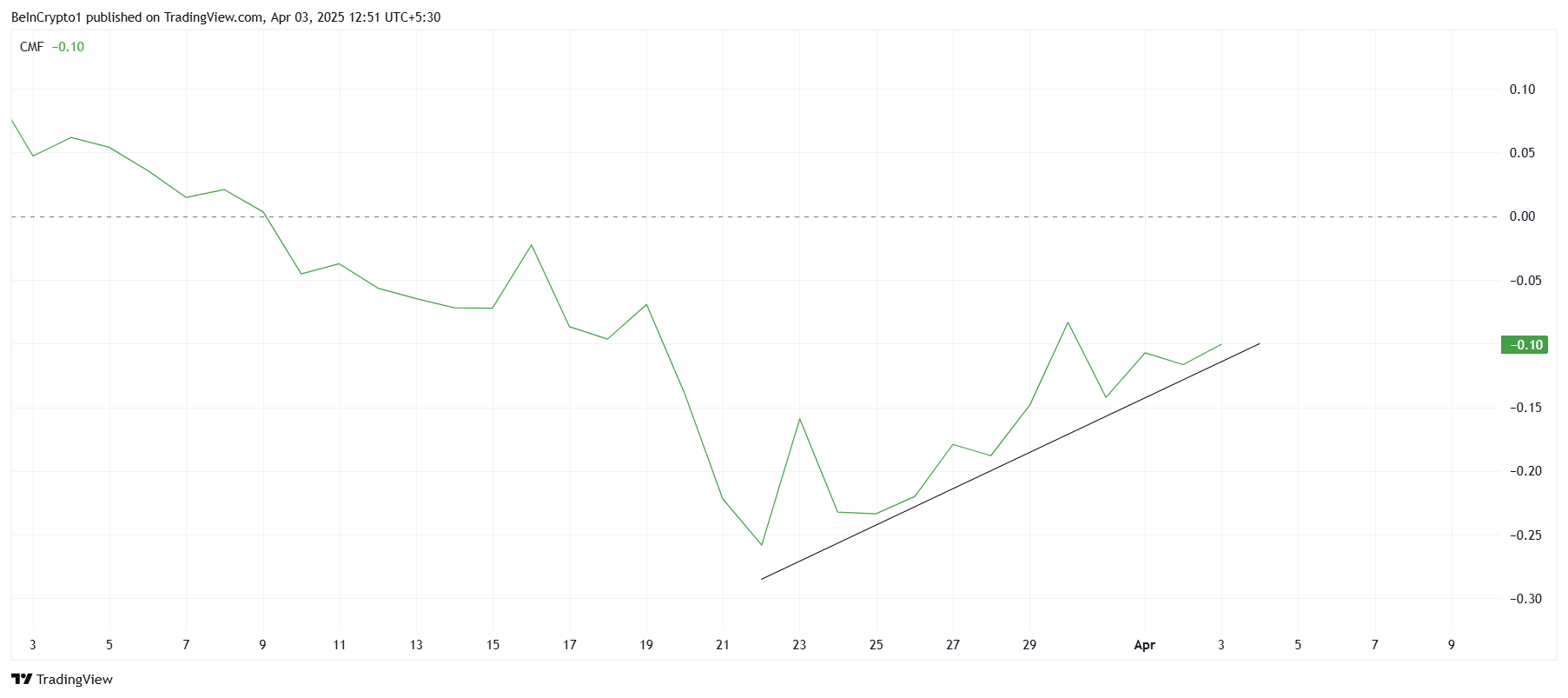

On the technical front, the Chaikin Money Flow (CMF) indicator is showing signs of recovery. The CMF has started to tick upwards, signaling a potential increase in inflows. While it hasn’t yet crossed above the zero line, the growing positive momentum indicates that more capital could be entering the market. Continued inflows could provide the necessary push for HBAR to break through key resistance levels.

The increase in capital flow suggests a strengthening of investor confidence. However, for a sustained rally, more substantial buying pressure will be required to move HBAR above its current price point. If this trend continues, HBAR may see a rise in both investor interest and market value in the near future.

HBAR Price Finds Support

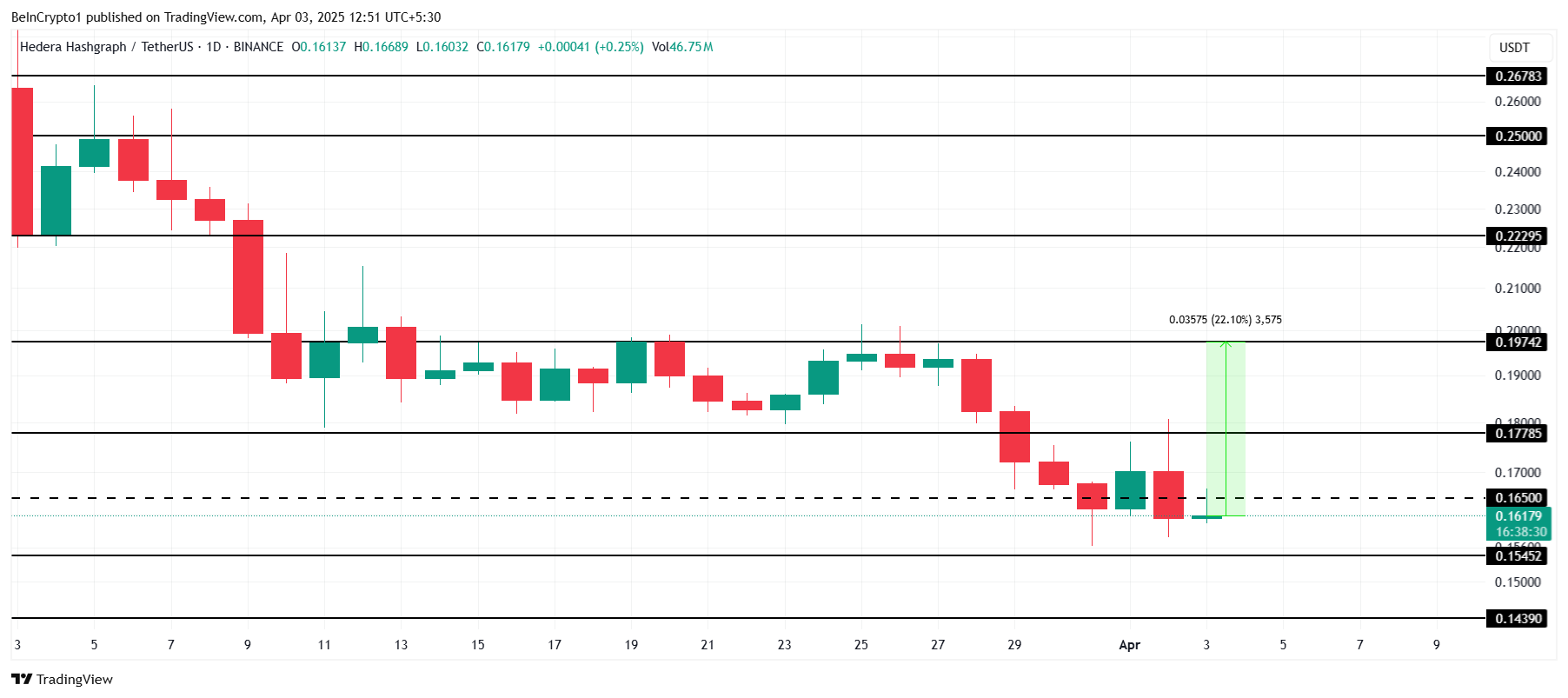

Currently, HBAR is priced at $0.161, just under the key resistance level of $0.165. The next significant resistance lies at $0.197, which has acted as a barrier to HBAR’s price recovery. With a 22% gap between the current price and this resistance, overcoming this hurdle could pave the way for a move toward $0.200.

Given the positive developments surrounding Hedera, it is plausible that HBAR could move toward these resistance levels. If the token can breach $0.165 and then $0.177, the path to $0.197 becomes much clearer. This would mark a critical point for HBAR as it seeks to regain lost ground.

However, if investors decide to take profits and sell before further upward movement, HBAR could fail to breach the $0.177 resistance. Such a scenario could push the price back down towards $0.154 or $0.143, invalidating the bullish outlook and prolonging the consolidation phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

IP Token Price Surges, but Weak Demand Hints at Reversal

Story’s IP is today’s top-performing asset. Its price has surged 5% to trade at $$4.37 at press time, defying the broader market’s lackluster performance.

However, despite the price uptick, the weakening demand for the altcoin raises concerns about its rally’s sustainability.

IP Price Rises, But Falling Volume Signals Weak Buying Momentum

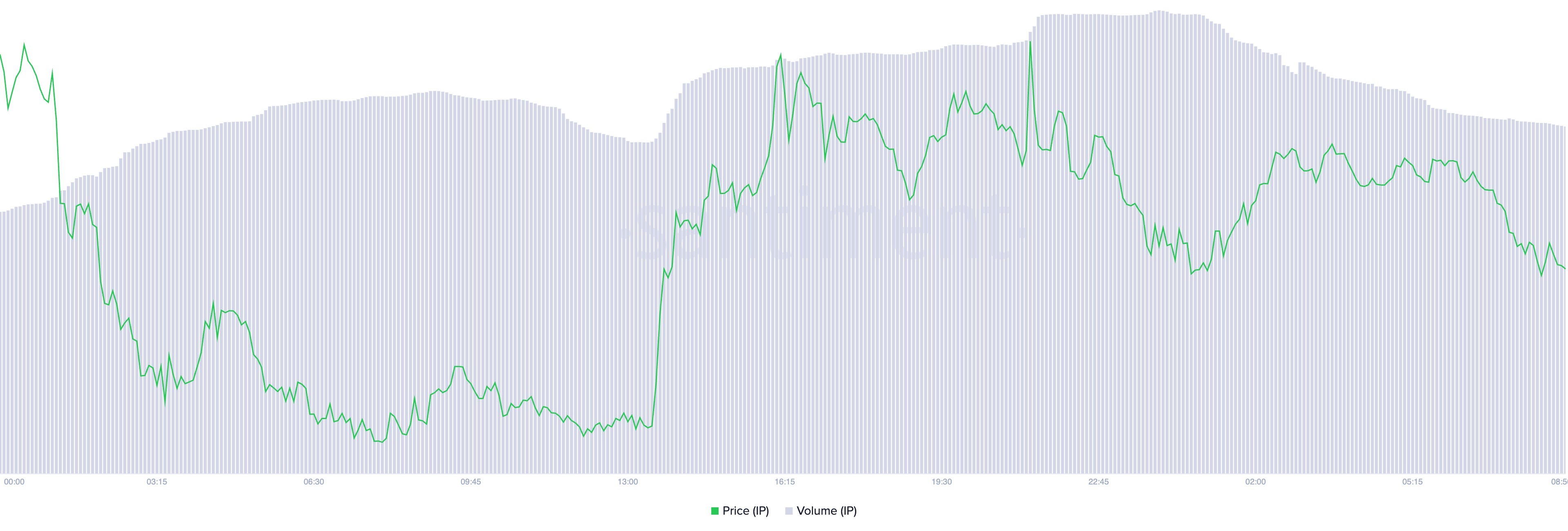

IP’s daily trading volume has plummeted by 7% over the past 24 hours despite the token’s price surge. This forms a negative divergence that hints at the likelihood of a price correction.

A negative divergence emerges when an asset’s price rises while trading volume falls. It suggests weak buying momentum and a lack of strong market participation.

This indicates that the IP rally may not be sustainable, as fewer traders are backing its upward move. Without sufficient volume to reinforce the price increase, the altcoin is at risk of a potential reversal or correction.

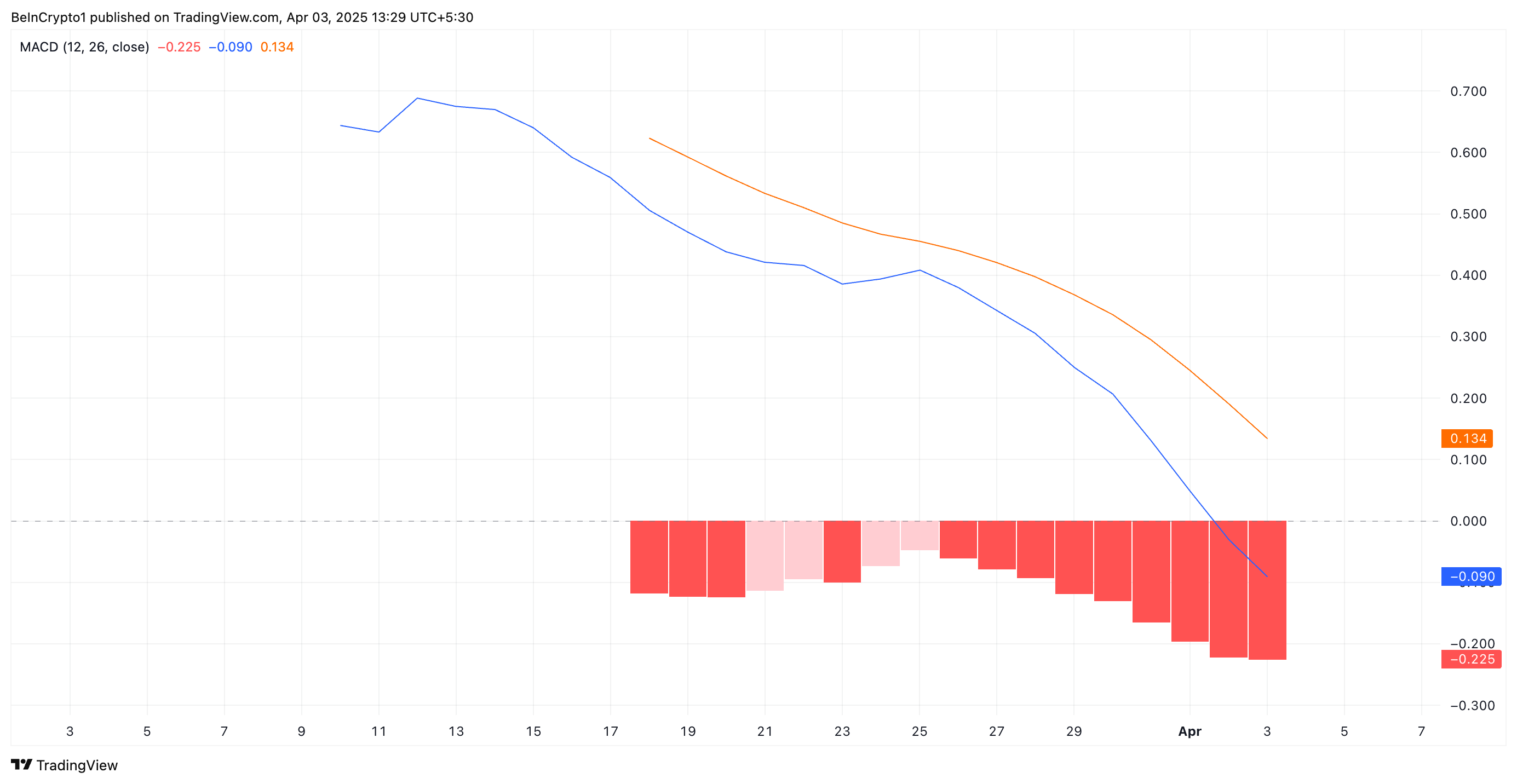

Further, IP’s Moving Average Convergence Divergence (MACD) setup supports this bearish outlook. As of this writing, the token’s MACD line (blue) rests below its signal line (orange), reflecting the selling pressure among IP spot market participants.

The MACD indicator measures an asset’s trend direction and momentum by comparing two moving averages of an asset’s price. When the MACD line is below the signal line, it indicates bearish momentum, suggesting a potential downtrend or continued selling pressure.

If this trend persists, IP’s recent 5% price surge may lose steam, increasing the likelihood of a short-term correction.

IP’s Bearish Structure Remains Intact – How Low Can It Go?

On the daily chart, IP has traded within a descending parallel channel since March 25. This bearish pattern emerges when an asset’s price moves within two downward-sloping parallel trendlines, indicating a consistent pattern of lower highs and lower lows.

This pattern confirm’s IP prevailing downtrend, suggesting continued bearish pressure unless a breakout above resistance occurs.

If the downtrend strengthens, IP’s price could break below the lower trend line of the descending parallel channel and fall to $3.68.

On the other hand, if the altcoin witnesses a spike in new demand, it could break above the bearish channel and rally toward $5.18.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoLummis Confirms Treasury Probes Direct Buys

-

Altcoin19 hours ago

Altcoin19 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Regulation22 hours ago

Regulation22 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Altcoin18 hours ago

Altcoin18 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Ethereum16 hours ago

Ethereum16 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin14 hours ago

Altcoin14 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin15 hours ago

Altcoin15 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Ethereum18 hours ago

Ethereum18 hours agoWhales Dump 760,000 Ethereum in Two Weeks — Is More Selling Ahead?