Market

Can Bulls Push Past $2,400?

Ethereum price is again rising and trading above $2,320. ETH must clear the $2,400 resistance to gain bullish momentum in the near term.

- Ethereum is attempting a recovery wave above the $2,320 zone.

- The price is trading above $2,350 and the 100-hourly Simple Moving Average.

- There was a break above a short-term declining channel with resistance at $2,350 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $2,400 resistance to continue higher in the near term.

Ethereum Price Eyes Upside Break

Ethereum price remained supported above the $2,250 level. A base was formed, and the price started another increase above the $2,300 level like Bitcoin.

There was a break above a short-term declining channel with resistance at $2,350 on the hourly chart of ETH/USD. The pair even surpassed the $2,380 level, but it stayed below the $2,400 resistance level. A high is formed at $2,390 and the price is now consolidating.

It is trading near the 23.6% Fib retracement level of the upward move from the $2,278 swing low to the $2,390 high. Ethereum price is now trading above $2,320 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $2,380 level. The first major resistance is near the $2,400 level. A close above the $2,400 level might send Ether toward the $2,450 resistance. The next key resistance is near $2,500. An upside break above the $2,500 resistance might call for more gains toward the $2,550 resistance zone in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $2,380 resistance, it could start another decline in the near term. Initial support on the downside is near $2,350. The first major support sits near the $2,330 zone or the 50% Fib retracement level of the upward move from the $2,278 swing low to the $2,390 high.

A clear move below the $2,330 support might push the price toward $2,250. Any more losses might send the price toward the $2,200 support level in the near term. The next key support sits at $2,120.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $2,330

Major Resistance Level – $2,400

Market

XLM Token Price May Experience a Correction

Stellar (XLM) has experienced a 50% price surge over the past 24 hours, making it the top-performing asset during this period. This surge can be attributed to the recent 10-K filing submitted by Grayscale Investments LLC for its Grayscale Stellar Lumens Trust.

At press time, the altcoin trades at $0.45, its highest price point since 2021. However, readings from its daily chart hint at a possible short-term decline. Here is how.

Stellar Lumens Trust Sees Spike in Net Assets

On Friday, Grayscale Investments LLC’s Grayscale Stellar Lumens Trust (XLM) submitted its 10-K filing for the fiscal year ended September 30, 2024. It noted that the trust recorded a 10% uptick in its overall net assets during the financial year considered.

A 10-K filing is an annual report that publicly traded companies in the US are required to submit to the Securities and Exchange Commission (SEC). It provides an overview of the company’s financial performance. It includes the entity’s audited financial statements, business operations, risk factors, and management discussion and analysis.

According to the report, the Grayscale Stellar Lumens Trust (XLM), an investment vehicle offering investors exposure to XLM, faced losses. This was due to the token’s price depreciation during the period considered and the fees paid to the trust’s sponsors. However, these losses were offset by the 34,875,230 XLM tokens valued at $3,923 added to the trust. This resulted in a net increase in the trust’s overall assets.

XLM Reacts To the News

The positive sentiment around this filing has resulted in a spike in XLM’s value. Over the past 24 hours, the token’s price has surged 58%, making it the market’s top gainer. As of this writing, the altcoin trades at $0.45, a price last observed in November 2021.

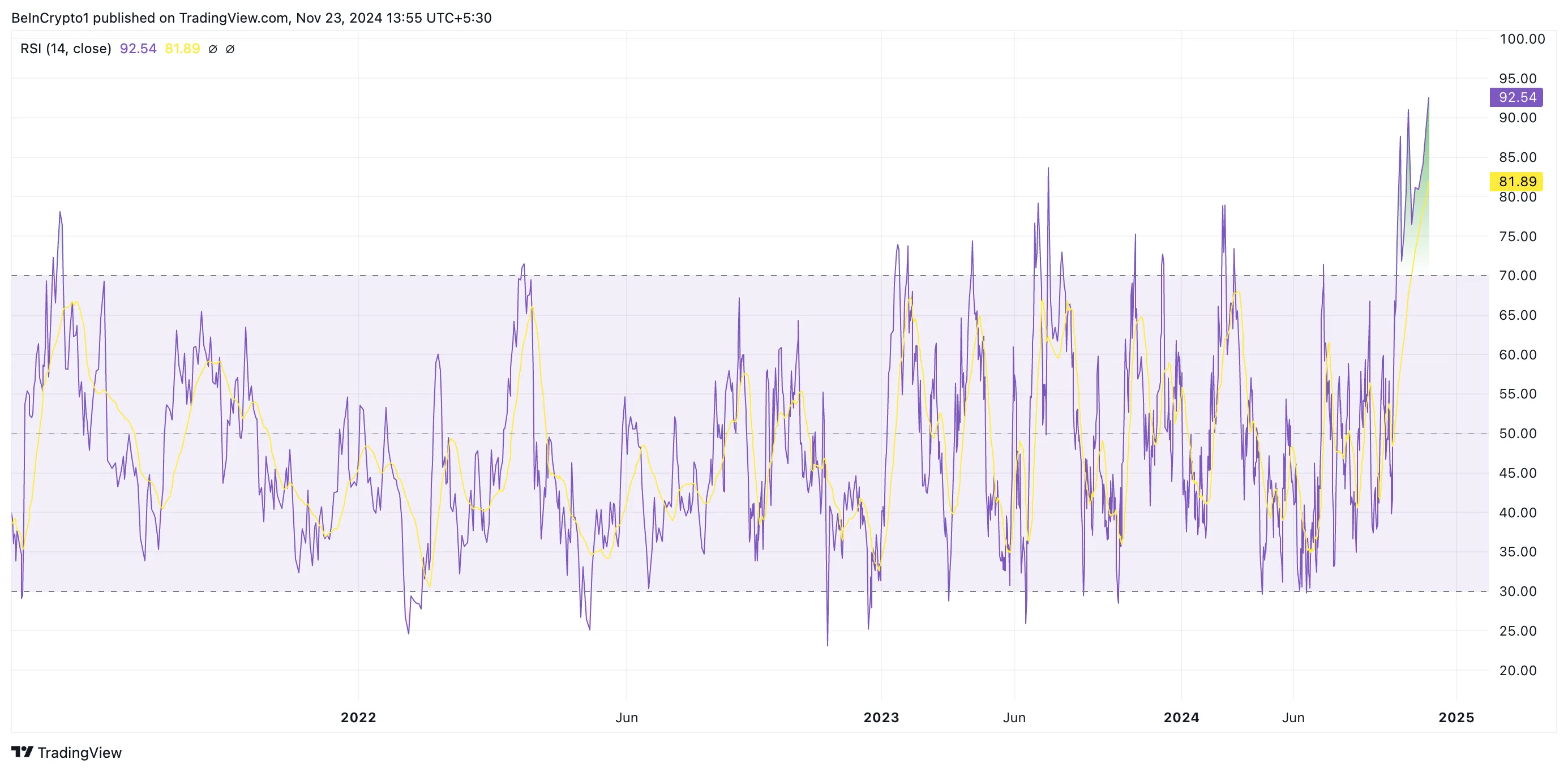

However, readings from its daily chart suggest that this rally may not continue as XLM has become overbought among market participants. For example, its Relative Strength Index (RSI) is at an all-time high of 92.54 at press time.

RSI measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. On the other hand, values below 30 suggest that the asset is oversold and may witness a rebound. XLM’s RSI reading of 92.54 suggests that it is significantly overbought and is at risk of a pullback.

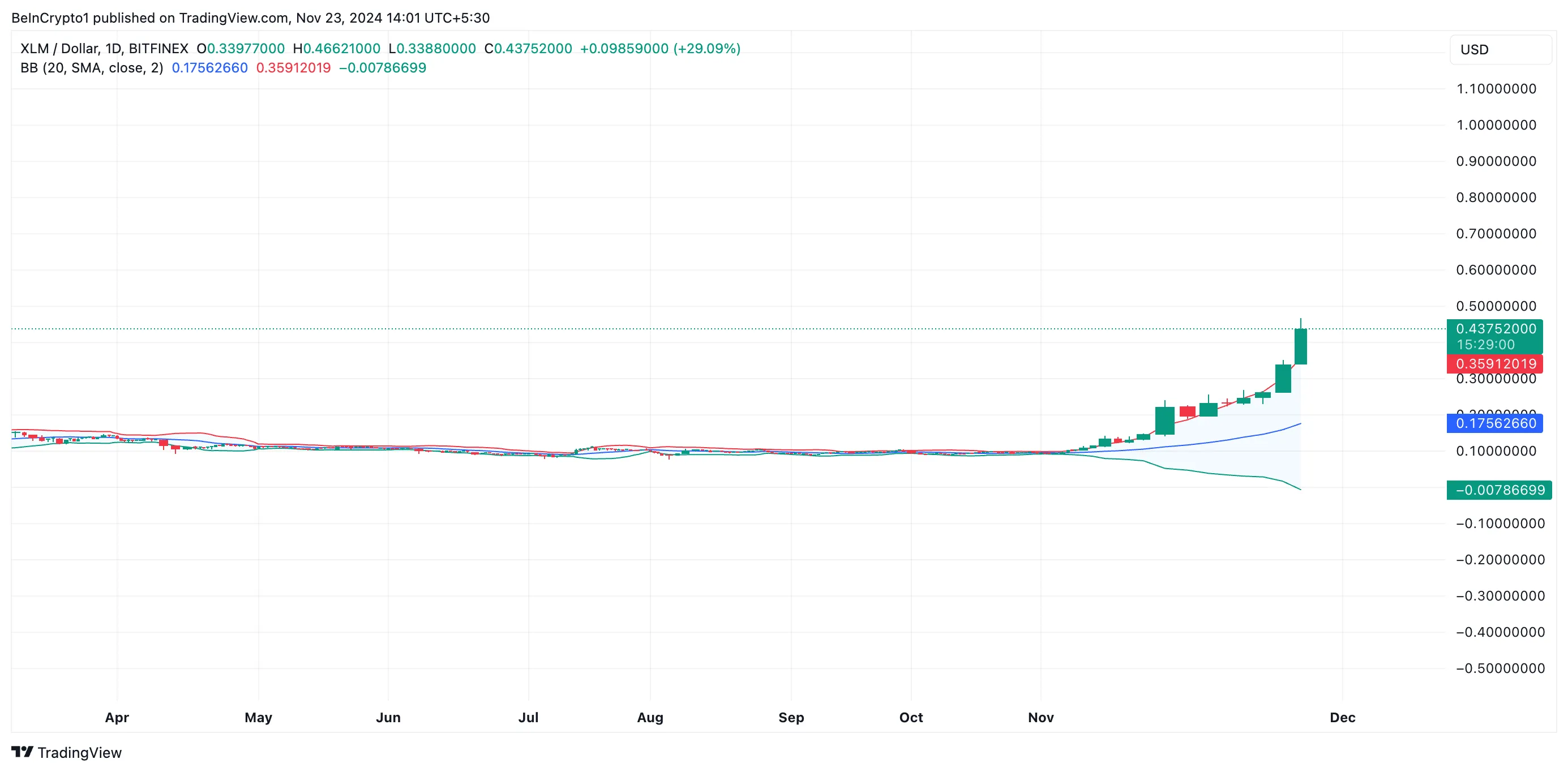

Furthermore, XLM’s price trades above the upper line of its Bollinger Bands indicator, confirming the likelihood of a price correction.

The Bollinger Bands indicator measures market volatility and identifies potential buy and sell signals. It consists of three main components: the middle band, the upper band, and the lower band.

When the price trades above the upper band, it suggests that the asset is overbought. This means that the asset’s price has moved significantly higher than its average price and is at risk of a pullback in the near term.

XLM Price Prediction: Token May Shed Recent Gains

Once buyer exhaustion sets in, XLM’s price is at risk of shedding some of its recent gains. According to its Fibonacci Retracement tool, if this happens, its price target will be the support level formed at $0.35. If the bulls fail to defend this level, the token’s price may drop further to $0.23.

On the other hand, if buying pressure intensifies, the XLM token price will continue its uptrend and attempt to breach $0.52, a high it last reached in May 2021.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Artificial Intelligence Coins on the Rise: TFUEL, ZIG, and AKT

Artificial Intelligence (AI) is now the most dominant narrative in crypto, and some coins are capitalizing on it. TFUEL is nearing a $500 million market cap after an 18% rise in the last seven days, though it remains far below its 2021 peak. ZIG, up 15% in the past week, is closing in on its all-time high, fueled by strong market interest and its growing $200 million market cap.

Meanwhile, AKT, the fifth-largest AI-focused coin, has gained 22% this week and is on the verge of breaking the $1 billion market cap, highlighting its strong momentum and expanding role in decentralized cloud computing.

Theta Fuel (TFUEL)

TFUEL is the coin of Theta Network, a blockchain-powered video streaming platform. Its approach aims to lower streaming costs while improving content quality and expanding distribution reach.

TFUEL has gained 18% in the past seven days and is now approaching the $500 million market cap. Despite this recent growth, the altcoin remains significantly below its 2021 all-time high, sitting at just one-tenth of that peak value. This highlights both its potential for recovery and the challenges it faces in regaining former levels.

TFUEL’s RSI is currently at 50, indicating neutral momentum where neither buyers nor sellers dominate. If the uptrend gets strong again, it could rise to test $0.080 and potentially reach $0.1. However, if the trend is reverted, it could go down as much as $0.054 or even $0.047.

ZIGDAO (ZIG)

ZIGDAO, formerly known as Zignaly, is a platform designed to enable crypto copy trading with artificial intelligence. It allows users to invest in digital assets by following the strategies of top managers and funds.

ZIG is currently 20% below its all-time high but may be gearing up to test it again. The coin has recently surpassed a $200 million market cap and is up 15% over the last seven days.

If the uptrend remains strong, ZIG could break past its all-time high, surpassing $0.19. However, a reversal in market sentiment could see the coin testing its support at $0.127. If that level fails, ZIG may face a deeper correction, potentially dropping to $0.081.

Akash Network (AKT)

Akash Network is a decentralized, open-source cloud computing platform designed to connect those in need of computing power with providers offering cloud resources using artificial intelligence.

AKT, Akash’s native token, is currently the fifth-largest AI-focused coin in the market and is approaching a $1 billion market cap. With a 22% gain over the past seven days, AKT has demonstrated strong momentum, positioning itself for potential further growth as it eyes this significant milestone in the coming weeks.

If the uptrend continues, AKT could test resistance at $4.71 and possibly push toward $5 for the first time since May 2024. However, if market sentiment shifts and the trend reverses, AKT may face downward pressure, testing support levels at $2.87 and $2.43.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

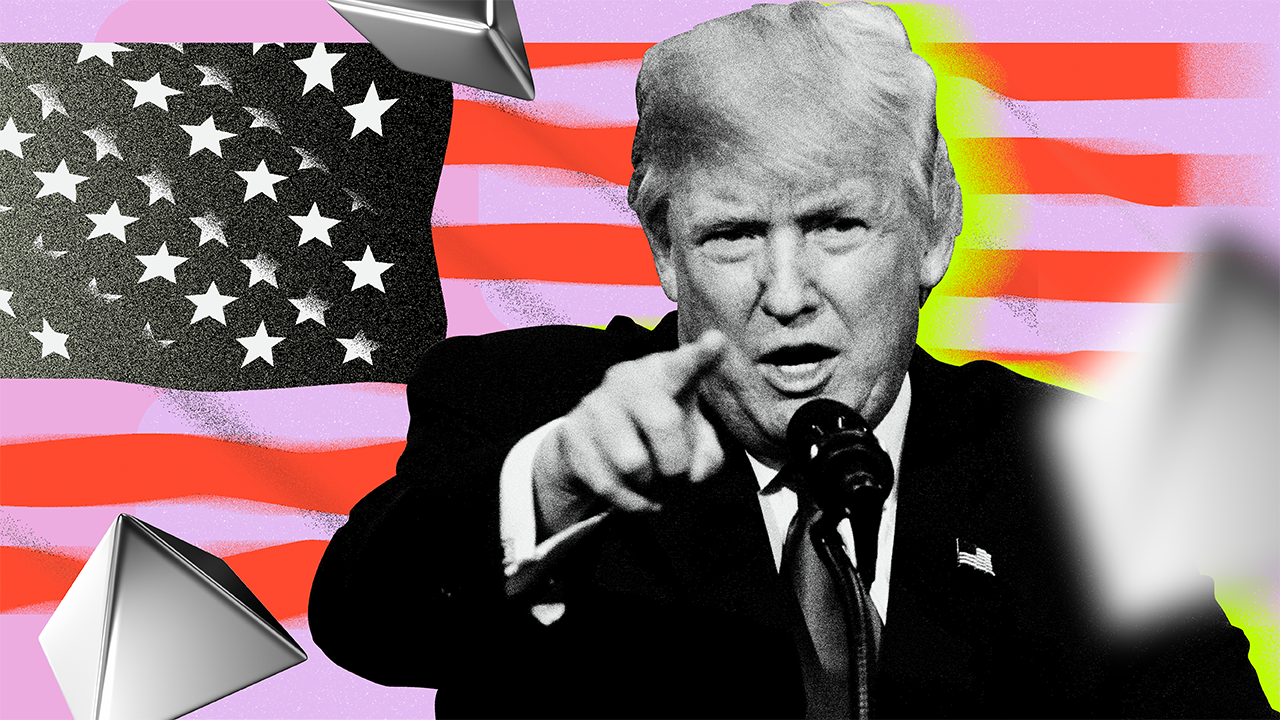

Trump Taps Pro-Crypto Scott Bessent for Treasury Secretary Role

Donald Trump, the President-elect of the United States, has nominated Scott Bessent as Treasury Secretary for his administration. This decision has generated enthusiasm in the emerging industry due to Bessent’s pro-crypto reputation.

Bessent and Cantor Fitzgerald CEO Howard Lutnick had been considered strong favorites for the position. However, Lutnick was eventually nominated as Commerce Secretary.

Crypto Industry Welcomes Scott Bessent’s Nomination for Treasury Secretary

In a November 22 announcement on Truth Social, Trump praised Bessent as the ideal candidate to support his administration’s economic goals. The President stated that Bessent will play a pivotal role in strengthening the US economy, fostering innovation, and maintaining the dollar’s status as the global reserve currency.

“Scott will support my policies that will drive US competitiveness, and stop unfair trade imbalances, work to create an economy that places growth at the forefront, especially through our coming world energy dominance,” Trump added.

Wall Street veteran Bessent, who founded the international macro investment company Key Square Group, brings extensive experience to the role. He had previously served as the chief investment officer for the prominent investor George Soros.

While President Trump’s announcement did not directly reference cryptocurrencies, many in the digital asset space view Bessent’s appointment as a positive sign. In past statements, Bessent has described crypto as a symbol of financial freedom. He also called Bitcoin an alternative investment for younger investors disillusioned with the traditional financial system.

“I have been excited about the president’s embrace of crypto and I think it fits very well with the Republican Party, crypto is about freedom in the crypto economy is here to stay,” Bessent stated.

His pro-crypto stance has led many to believe his leadership could encourage a more balanced approach to digital asset regulation. This would contrast with the outgoing administration’s enforcement-heavy tactics, such as its controversial sanctions on decentralized platforms like Tornado Cash.

Indeed, crypto industry leaders have responded enthusiastically to Bessent’s nomination. Ripple CEO Brad Garlinghouse commended Bessent’s nomination, calling it a win for innovation. He noted that Bessent’s leadership could mark a turning point for crypto-friendly policies in Washington.

Similarly, Kristin Smith, CEO of the Blockchain Association, highlighted the importance of Bessent working with Congress to establish clear regulations, ensure fair tax treatment, and protect self-custody rights for digital assets.

“Critical to this nomination would be working with Congress on a regulatory framework for digital assets, protecting the right to self custody, pushing for clearer tax treatment of digital assets, and working closely with industry experts to protect our nation’s security,” Smith remarked.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation18 hours ago

Regulation18 hours agoUS SEC Commissioner Jaime Lizárraga to resign in January

-

Blockchain22 hours ago

Blockchain22 hours agoSui and Franklin Templeton Team Up To Drive DeFi Adoption: Details

-

Market22 hours ago

Market22 hours agoAltcoins Trending Today — November 22: MYTH, MAD, MODE

-

Market21 hours ago

Market21 hours agoSui Partners with Franklin Templeton for Blockchain Development

-

Regulation20 hours ago

Regulation20 hours agoBlockchain Association Outlines 5 Crypto Priorities For Donald Trump’s Administration

-

Market24 hours ago

Market24 hours agoInvestors Says Rally Is Not Over

-

Altcoin24 hours ago

Altcoin24 hours agoDeribit To Integrate Ethena USDe As Crypto Margin Collateral

-

Market23 hours ago

Market23 hours agoGensler’s Exit, Bitfinex Hack, Bitcoin in the US