Ethereum

Ethereum Whales Increase Supply Share, Now Control 43% Of All ETH

On-chain data shows the Ethereum Whales have continued to accumulate more cryptocurrency as their supply share has risen.

Ethereum Whales Now Hold Around 43% Of The Entire Supply

In a new post on X, the market intelligence platform IntoTheBlock shared an update on how the Ethereum supply concentration has been looking for the major holder groups on the network.

The groups in question here refer to the divisions of the asset’s userbase based on holding size. IntoTheBlock has defined three main cohorts: Retail, Investors, and Whales.

The first of these, the Retail, includes the smallest hands in the sector: those holding less than 0.1% of the ETH supply in circulation. This cohort represents the everyday investor who doesn’t have much influence in the market.

Once holders exceed this 0.1% mark, they start having a more important standing on the network, although their influence is still limited until the 1% mark. Users in this range are called the Investors.

Beyond this range are the most powerful entities on the network: the Whales. These holders carry more than 1% of the ETH supply in their balance, which converts to over $2.83 billion at the current exchange rate.

Below is the chart shared by the analytics firm, which shows how the distribution of the Ethereum supply has changed between these three groups over the history of the blockchain.

Looks like the Whales have been increasing their supply share recently | Source: IntoTheBlock on X

The graph shows that the Retail cohort makes up almost half of the Ethereum circulating supply at the moment. More specifically, these small hands collectively own 48% of the ETH supply, with the Whales not too far behind with a 43% share.

While the Whales hold a significant part of the supply today, this wasn’t always the case. As the graph shows, just a few years back, these humongous entities held only a small market share.

Since then, however, large-money has seemingly become more interested in the coin, as it has constantly accumulated. Interestingly, the buying from the cohort has accelerated since 2023, when the Shanghai Upgrade went through.

The Shanghai Upgrade was a hard fork of the Ethereum network that enabled investors to unstake their holdings sitting locked in the Proof-of-Stake (PoS) contract.

The acceleration in the accumulation from the Whales coinciding with this fork may be due to the fact that investors became more interested in staking, with withdrawals becoming possible.

Many of these holders would have deposited their coins through staking pools, which collectively hold massive holdings, so with the rise in interest, these whale entities would have seen their supply share go up.

While the interest from the Whales may be bullish for the future growth in the cryptocurrency’s price, the centralization of supply on these few platforms/investors may not be so positive.

ETH Price

At the time of writing, Ethereum is floating around $2,350, down over 4% in the last seven days.

The price of the coin has made some recovery over the last few days | Source: ETHUSD on TradingView

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

Ethereum

Ethereum Analyst Predicts $3,700 Once ETH Breaks Through Resistance

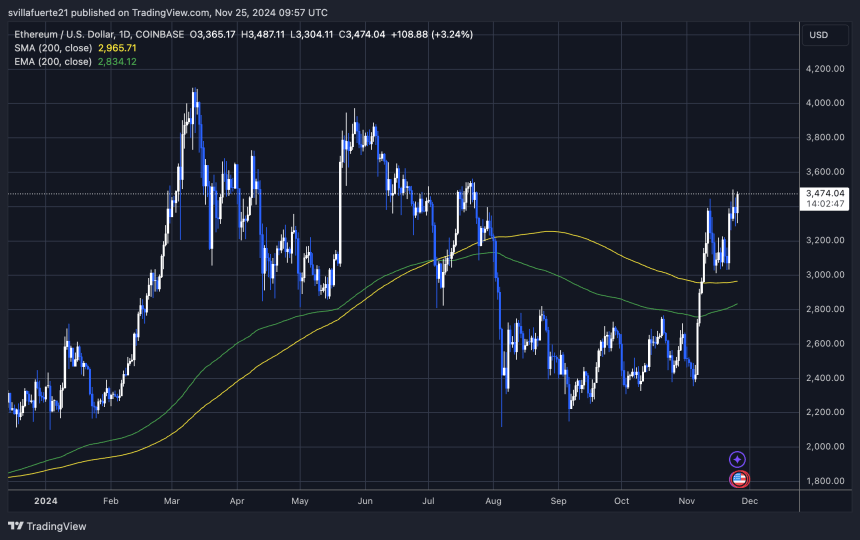

Ethereum has been trading at its highest levels since late July, hovering around $3,470. This marks a significant rebound for the second-largest cryptocurrency, which has managed to hold above the crucial 200-day moving average (MA) at $2,965. By maintaining this level, Ethereum confirmed a bullish price structure, paving the way for continued momentum as it approaches its next milestone—yearly highs near $4,000.

Top analyst and investor Carl Runefelt recently shared his technical analysis on X, pointing out that Ethereum’s price action has built a solid foundation for further growth. According to Runefelt, Ethereum is poised for a substantial rally once it breaks above key resistance levels, signaling increased confidence among traders and investors.

Related Reading

This bullish sentiment is further fueled by Ethereum’s consistent on-chain activity and growing institutional interest, which continue to support its upward trajectory. However, breaking past $4,000 will require Ethereum to overcome resistance zones that have historically triggered pullbacks.

As ETH consolidates gains, market participants are watching closely for signs of the next breakout, which could set the tone for the remainder of the year. Ethereum’s recent strength underscores its role as a market leader and a bellwether for broader cryptocurrency trends.

Ethereum Testing Crucial Supply

Ethereum is testing a crucial supply zone just below the $3,500 level, a key resistance that could propel the cryptocurrency to yearly highs in the coming days. This level has become a focal point for traders and investors, as breaking it would likely signal a bullish continuation of Ethereum’s recent momentum.

Top analyst Carl Runefelt recently shared his insights on X, emphasizing the significance of this resistance. According to his technical analysis, once Ethereum breaks through the $3,500 barrier, it could rapidly climb to $3,700, potentially within hours. The market sentiment surrounding Ethereum remains optimistic, with surging demand as a catalyst for further price gains.

Ethereum’s strength at this critical level is also reigniting speculation about a possible Altseason. If ETH continues its upward trajectory and attracts more capital, it could pave the way for other altcoins to follow suit. Historically, Ethereum’s price action has been a leading indicator for broader market movements, and this time appears no different.

Related Reading

As ETH approaches this pivotal moment, all eyes are on its ability to maintain upward momentum. A strong push past $3,500 would confirm the bullish structure and set the stage for Ethereum to dominate market narratives in the weeks ahead.

Key Levels To Watch

Ethereum is trading at $3,470, hovering below the crucial $3,500 resistance level. This local high has become a key area of focus for traders and analysts, as breaking above it could set the stage for a significant rally. If Ethereum manages to push through this resistance with strength, it could trigger a breakout that propels the price toward $3,900 within days.

However, the market remains cautious about the potential risks associated with this pivotal moment. A failed breakout at the $3,500 mark could lead to sideways consolidation as Ethereum seeks stronger buying pressure to resume its upward momentum. In a more bearish scenario, a substantial correction could occur, driving ETH back to lower levels to establish a more solid base of support.

Related Reading

The current price action highlights the importance of this resistance zone. A clean break above $3,500 would likely confirm Ethereum’s bullish structure and reinforce confidence in a continued uptrend.

On the other hand, any hesitation or rejection at this level could signal the need for further consolidation before the next major move. As ETH approaches this critical juncture, the market is closely watching to determine its next direction and the potential implications for the broader crypto landscape.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum’s Staking Weekly Net Inflows Increased Sharply, What’s Behind The Surge?

Interest in Ethereum, the second-largest cryptocurrency asset, is gaining momentum once again among retail and institutional investors, as evidenced by a robust increase in its net staking inflows in the past week in tandem with recent improvements in the price of ETH.

Consistent Growth In Ethereum’s Staking Net Inflows

In a positive development, Ethereum’s staking has attracted significant capital over the past week, leading to a surge in its net weekly inflows. Maartuun, a market watcher and analyst at leading on-chain data and analytics platform CryptoQuant, reported the development, reflecting growing commitment.

The spike in staking activity indicates that many investors are interested in supporting Ethereum’s proof-of-stake (PoS) ecosystem while receiving passive returns. It also bolsters ETH’s robust security and position in the cryptocurrency landscape.

Data shared by the analyst shows that Ethereum staking saw a net influx of +10,000 ETH over the past week, with 115,000 ETH being deposited and 105,000 ETH being withdrawn. This shows that deposits have surpassed withdrawals once again after months of net outflows, marking a significant change. With the total staked ETH rising again, it indicates renewed confidence and optimism in staking as a long-term strategy, which could be crucial in strengthening ETH’s ecosystem.

Addressing the components behind the surge, Maartuun has pointed out a mix of possible factors. These include rising ETH prices, improved staking infrastructure like liquid staking options, and institutional players entering the market.

Furthermore, the expert highlighted that this surge in net inflows might be a reaction from long-term investors to Ethereum’s stability after the merger and their increasing trust in the ecosystem.

In the event that the current rate of deposits keeps up, Maartuun is confident that the development could limit the availability of ETH in the market, which might affect price movements. “Overall, this recent inflow is a positive sign for Ethereum’s ecosystem and long-term growth,” he added.

ETH’s Open Interest Reaches New Milestone

Ethereum has been seeing major advancements lately in several key metrics, such as its Open Interest (OI). ETH’s open interest experienced a notable uptick in the past few days, surging to a new all-time high.

A report from CryptoQuant reveals that ETH’s open interest is valued at over $13 billion, representing an increase of more than 14% in the past four months. Additionally, funding rates demonstrate a positive trend, signaling that long-position traders dominate the market. This spike shows that interest in ETH’s derivative markets is rising sharply and growing market sentiment that supports price increases in the short term.

CryptoQuant also revealed that Ethereum’s estimated leverage ratio has hit a new all-time high, reaching +0.40 for the first time in history. This metric, which is determined by dividing the open interest by the exchange’s coin reserves, suggests a huge rise in leverage positions, indicating increased risk-taking by traders in derivatives trading.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Price Repeats Bullish ‘Megaphone’ Pattern From 2017

The Ethereum price has formed a key technical pattern reminiscent of the one observed in 2017 when the cryptocurrency embarked on a major bull rally. According to a crypto analyst, this pattern, known as the ‘Bullish Megaphone‘, could signal a possible price rise to $10,000 for ETH.

Related Reading

Bullish Megaphone Sets Stage For Ethereum Price Rise To $10,000

A Blockchain and crypto technical analyst, identified as ‘EtherNasyonal,’ on X (formerly Twitter), has predicted that the Ethereum price could soon surpass $10,000. According to the analyst, Ethereum‘s price action currently showcases a historical chart pattern, the Bullish Megaphone, observed during the 2016 to 2017 bull market.

The Bullish Megaphone pattern is a technical indicator consisting of two higher highs and two lower lows, often indicating a potential uptrend continuation for a cryptocurrency. This technical pattern is considered bullish when a cryptocurrency’s price breaks above the trend line with increasing volume.

Looking at the analyst’s Ethereum price chart from 2016 to 2017 and another for 2024 to 2025, the Bullish megaphone pattern has formed in both bull cycles. Moreover, at the end of the key technical pattern in 2017, the Ethereum price skyrocketed to new price levels, surpassing the $1,200 mark by 2018.

EtherNasyonal has suggested that as Ethereum repeats this pattern in the current bull market, it could signal a similar massive price surge, with a potential rally above $10,000. As of writing, CoinMarketCap reveals that the price of Ethereum is trading at $3,353, marking a 7.24% surge in the last seven days. At its current price, a rally to the $10,000 mark would represent a 198% increase for Ethereum, highlighting a substantial surge in value.

The analyst has also noted that altcoins will likely follow Ethereum’s bullish momentum and experience a similar uptrend. This price rally in ETH could further impact the future trajectory of altcoins in the crypto market this bullish cycle.

Is The Altcoin Season Here?

Historically, Ethereum has been a significant catalyst or determining factor to the start of the highly anticipated altcoin season. While Bitcoin’s dominance tends to decline significantly around this period after experiencing a remarkable bull run, altcoins typically follow this bullish trajectory, with Ethereum taking the lead as it trails behind Bitcoin’s price rally.

MikyBull Crypto, a prominent analyst on X, declared that the altcoin season for this current bull cycle has officially begun. For clarity, the altcoin season is after Bitcoin’s consolidation phase, which follows a rally, where smaller-cap cryptocurrencies begin a strong market rally.

Related Reading

MikyBull Crypto has optimistically revealed that from late December 2024 to March 2025, investors and the broader crypto market may witness “the real fun” of the altcoin season. This suggests that the altcoin market is expected to embark on a significant rally, with numerous small-cap cryptocurrencies experiencing varying price increases.

Feaatured image from The Guardian, chart from TradingView

-

Bitcoin24 hours ago

Bitcoin24 hours agoSenator’s Bold Proposal To Replenish US Reserves

-

Market23 hours ago

Market23 hours agoCan the SAND Token Price Rally Be Sustained?

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours

-

Altcoin9 hours ago

Altcoin9 hours agoSuper Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

-

Market22 hours ago

Market22 hours agoCantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

-

Market8 hours ago

Market8 hours agoHarmful Livestreams Prompt Ban Calls

-

Bitcoin21 hours ago

Bitcoin21 hours ago$100K Bitcoin Is Only The Beginning, VanEck Targets $180K

-

Market20 hours ago

Market20 hours agoWhy Ethereum Price May Fall Under $3,000