Market

Toncoin (TON) Whales Make a Comeback

The value of Telegram-linked Toncoin (TON) dropped after the arrest of the platform’s CEO, Pavel Durov. This dip created a buying opportunity for large holders, or whales, who quickly took advantage by accumulating more TON.

As the altcoin begins to recover, these whales are now positioned to profit from the rebound, signaling a potential upward trend in the coming days.

Toncoin Whales Make Their Presence Known

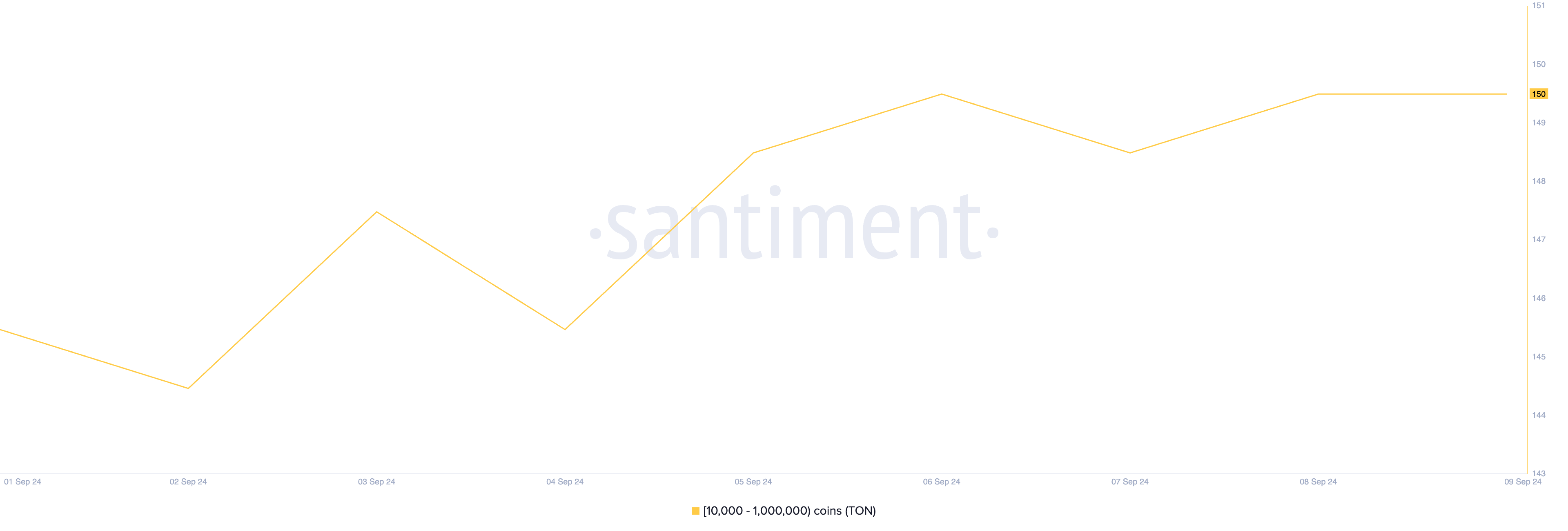

Santiment’s data shows a notable increase in TON whale count over the past few days. According to the on-chain data provider, addresses holding between 10,000 and 1,000,000 TON have risen by 3% in the last week.

For context, when French authorities arrested Telegram CEO Pavel Durov on August 24, this group of investors offloaded a significant portion of their holdings, causing the whale count to drop to a 30-day low of 131 addresses. This mass selling contributed to a sharp double-digit decline in TON’s price within 24 hours.

However, as the market stabilizes, these whales have returned, accumulating more TON. Currently, they control 53.17% of the altcoin’s circulating supply.

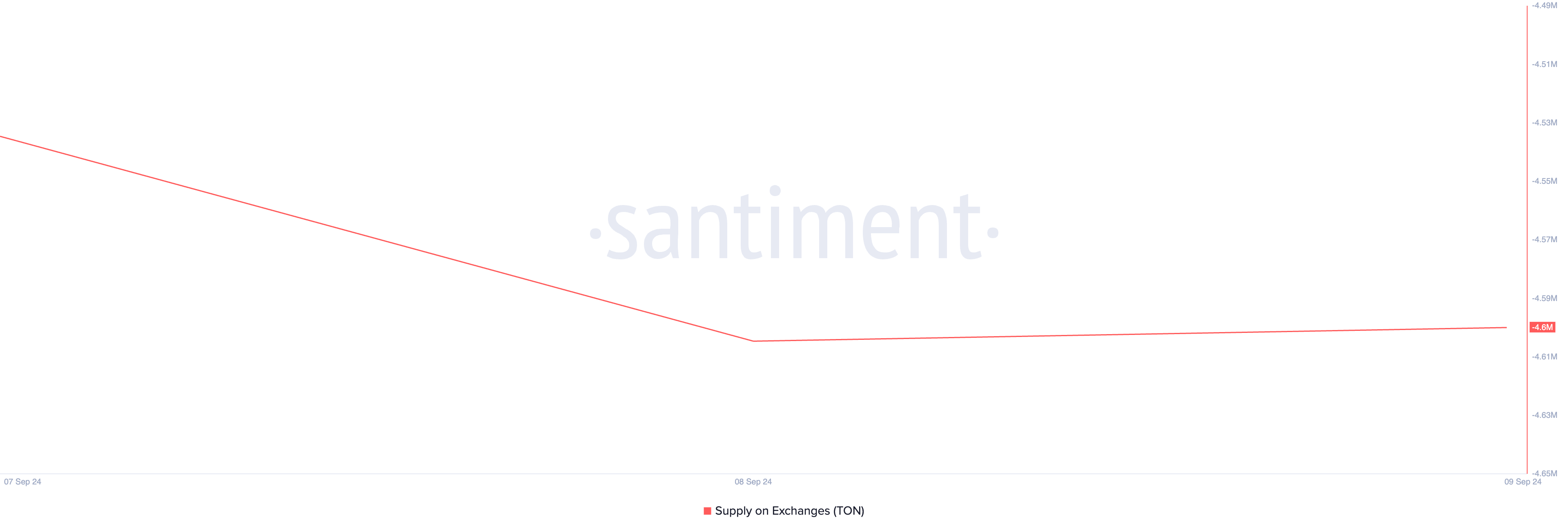

In addition to the rise in whale activity, there’s been a decline in selloffs among TON holders. Santiment reports a 5% drop in TON tokens held on exchanges since September 4, suggesting that holders are moving their assets to private wallets, indicating a long-term holding strategy.

Read more: 10 Best Altcoin Exchanges In 2024

This reduction in supply on exchanges could lessen selling pressure, potentially driving up TON’s price if demand remains stable.

TON Price Prediction: Market Shifts Toward Accumulation

Readings from Toncoin’s moving average convergence/divergence (MACD) indicator on the one-day chart confirm rising demand in recent days. Currently, the MACD line (blue) is positioned to cross above the signal line (orange), a setup that traders often see as a bullish signal. This crossover suggests a shift in market momentum toward upward price movement, potentially signaling a buying opportunity and encouraging traders to exit short positions and take long positions.

If demand for TON continues to grow, this bullish momentum could push the token toward $5.32, where it would test a critical support level. A successful breakthrough could set the next price target at $5.95.

Read more: 6 Best Toncoin (TON) Wallets in 2024

However, if profit-taking intensifies, these bullish projections may be invalidated. Increased selling pressure could drive Toncoin’s price down to $4.51.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the MANA Crypto Price Rally End After a 70% Weekly Surge?

MANA, Decentraland’s native cryptocurrency, has seen an impressive 70% price increase over the past week. This MANA crypto price surge is part of a broader rally in Metaverse-related tokens, which has caught the attention of the market.

While the development might have surprised some, a closer look by BeInCrypto provides insights into the catalysts behind this movement. This on-chain analysis looks at what could be next for the token.

Decentraland Active Addresses, Volume Reach New Heights

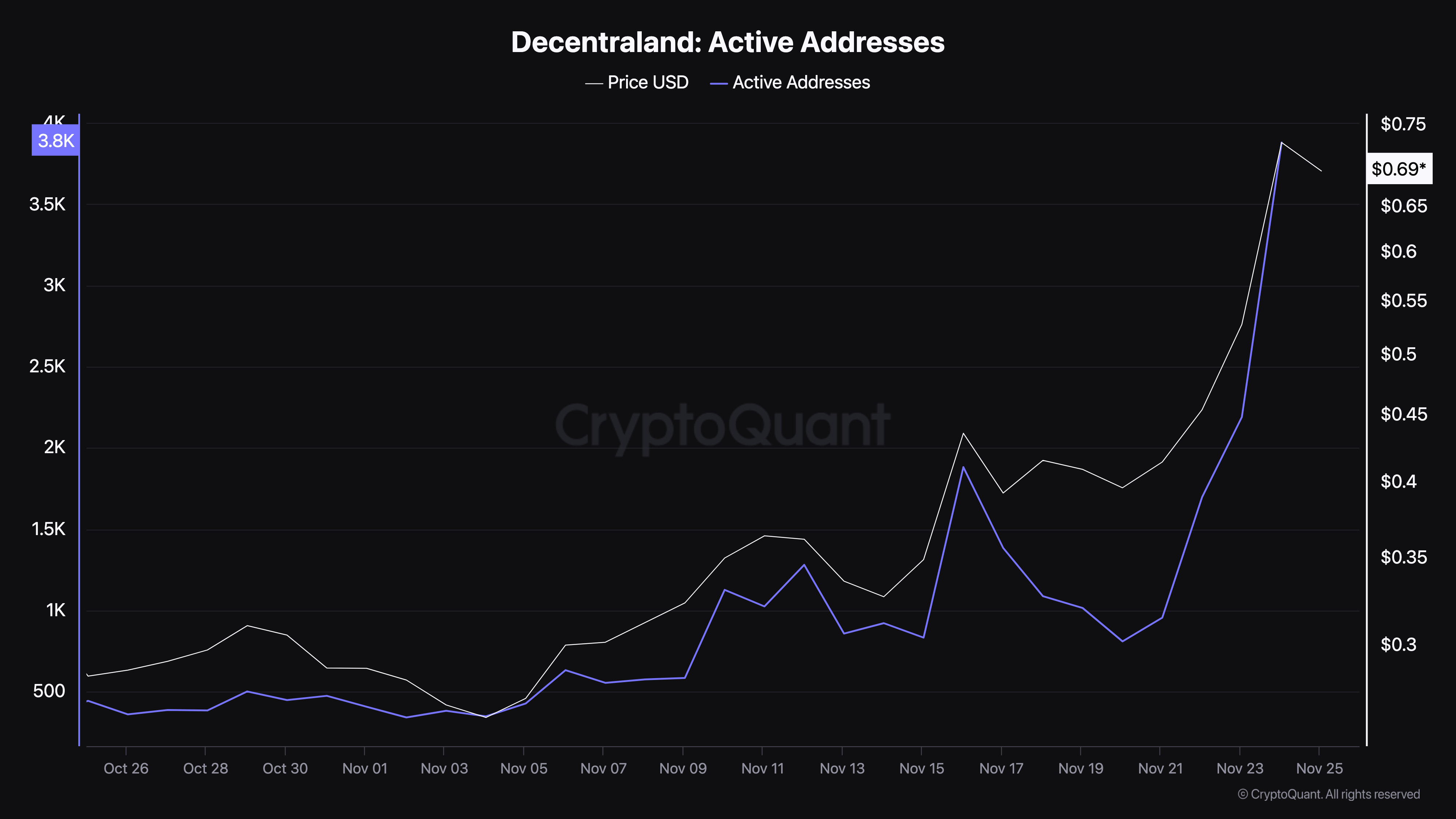

The recent rally in MANA crypto price can be attributed to a significant increase in the token’s active addresses, which indicates heightened user interaction on the blockchain. Interestingly, this also matches the condition of The Sandbox (SAND), which was also one of the frontrunners of the Metaverse revival.

Active addresses measure the number of unique users successfully completing transactions. A rise in this metric signals increased engagement with the network, which is often considered bullish for a cryptocurrency. Conversely, a decline implies reduced traction, which is typically seen as bearish.

On November 20, MANA’s active addresses were around 810. Fast-forward a few days, and this figure has surged nearly fivefold, reflecting a growing interest in the token. This spike in activity likely provided the momentum for MANA’s price to climb from $0.40 to $0.70 — the highest level since March.

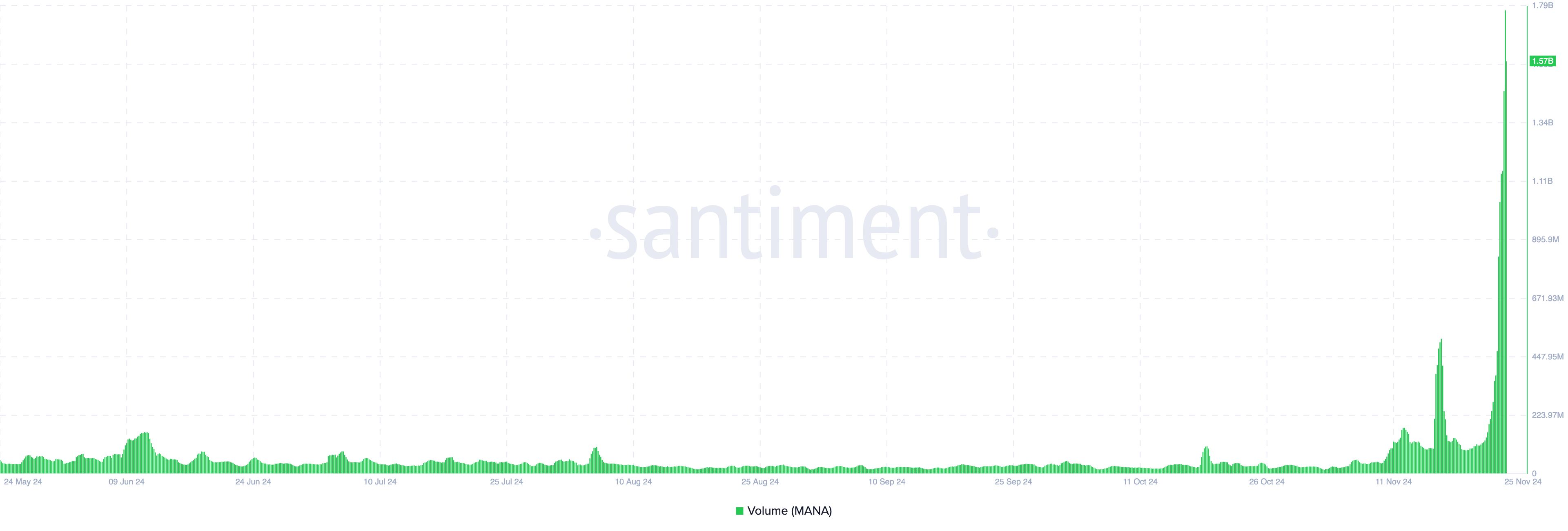

Following the development, Santiment data showed that MANA’s volume climbed to $1.57 billion. Volume represents the total value of a specific cryptocurrency traded over a defined period.

This metric reflects a coin’s level of activity and liquidity. A high trading volume indicates notable buying and selling, which often suggests strong market participation. On the other hand, low volume may signify reduced activity, leading to weaker market interest.

Therefore, the hike in the token’s volume validated the signs shown by the active addresses. However, since MANA’s price has dropped from its recent peak, it could be challenging to keep up with the uptrend, with this analysis suggesting that another pullback could be close.

MANA Price Prediction: Pullback Imminent

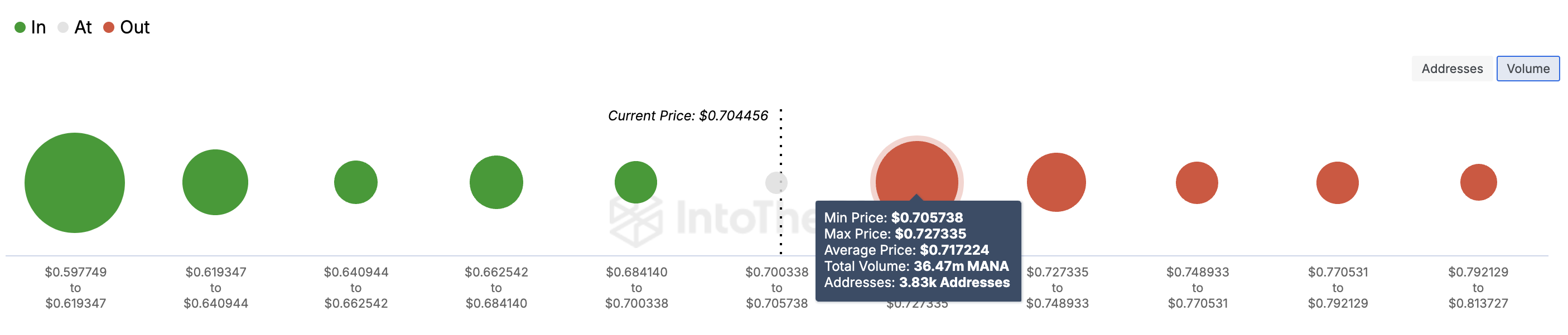

From an on-chain perspective, the MANA crypto price rally might have hit a local top. This prediction is based on the signs shown by the In/Out of Money Around Price (IOMAP).

The IOMAP is a key metric that analyzes the distribution of cryptocurrency holders based on whether their holdings are in profit, loss, or at breakeven. It also provides insights into potential support and resistance levels in the market.

When there are large clusters “out of the money,” this indicates addresses holding at a higher price than the current market value. Such areas often act as resistance. Conversely, Large clusters “in the money” typically act as support, as holders may buy more or hesitate to sell, expecting further price gains.

For MANA, approximately 36.47 million tokens held by addresses that accumulated near $0.70 are currently “out of the money.” This volume surpasses the tokens held between $0.61 and $0.68, marking that range as a key resistance zone.

As such, the MANA crypto price might experience retracement. If that is the case, then the cryptocurrency’s value could drop to $0.61 in the short term.

However, if buying pressure increases and volume outpaces the one at $0.70, this might not happen. Instead, MANA could climb to $0.80.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Pauses Under $100K: Bulls Eye the Milestone

Bitcoin price is consolidating below the $100,000 resistance. BTC bulls might soon attempt to breach the stated milestone and push the price further higher.

- Bitcoin started a fresh increase above the $96,500 zone.

- The price is trading below $98,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $98,000 resistance zone.

Bitcoin Price Eyes More Upsides

Bitcoin price remained supported above the $92,500 level. BTC formed a base and started a fresh increase above the $96,000 level. It cleared the $97,500 level and traded to a new high at $99,650 before there was a pullback.

There was a move below the $98,000 level. A low was formed at $95,973 and the price is now rising. There was a move above the $96,800 resistance level. The price cleared the 50% Fib retracement level of the downward move from the $99,650 swing high to the $95,973 low.

Bitcoin price is now trading below $98,000 and the 100 hourly Simple moving average. On the upside, the price could face resistance near the $98,000 level. There is also a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair. The trend line is close to the 61.8% Fib retracement level of the downward move from the $99,650 swing high to the $95,973 low.

The first key resistance is near the $99,000 level. A clear move above the $99,000 resistance might send the price higher. The next key resistance could be $100,000.

A close above the $100,000 resistance might initiate more gains. In the stated case, the price could rise and test the $102,500 resistance level. Any more gains might send the price toward the $105,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $98,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $96,800 level.

The first major support is near the $95,750 level. The next support is now near the $95,000 zone. Any more losses might send the price toward the $92,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $96,800, followed by $95,000.

Major Resistance Levels – $98,000, and $100,000.

Market

Harmful Livestreams Prompt Ban Calls

Since its launch earlier this year, the meme coin platform Pump.fun has become a notable name in the crypto industry. This platform allows users, regardless of their technical know-how, to create and launch meme coins swiftly.

However, the live-streaming feature has led to serious controversies and calls for a ban due to inappropriate content and financial malfeasance.

Originally, Pump.fun’s livestream was intended to let developers promote their meme coins. Regrettably, some users have misused it to broadcast extreme and harmful activities. A notable incident involved a developer promoting self-harm if his cryptocurrency reached a $25 million market cap.

Additionally, some users threaten to harm pets or even humans if their coins do not achieve certain market capitalization goals.

The situation reached a critical point when Beau, a safety project manager at Pudgy Penguins, reported an alarming livestream. In it, an individual threatened to hang themselves if their coin did not reach a specific market cap.

“Shut down the livestream feature. This is out of control,” Beau stated.

The platform has also been a hotbed for financial scams, prominently featuring “rug pulls.” A recent case involved a school-aged individual who created a meme coin named QUANT, quickly amassing $30,000 and then exiting the project, leaving investors with worthless digital tokens. This led to the kid’s doxxing, with his personal information and that of his family maliciously shared online.

In response to these incidents, some community members have called for the complete shutdown of the platform. Conversely, others suggest that simply disabling the livestream function might suffice.

Eddie, a legal intern, strongly criticized the platform’s governance. He believes that turning off the livestreams or moderating them is crucial.

“There is an art to shock value on stream. Simply sharing nudity or other shocking and even horrific content is not innately interesting. People seek stories and novel concepts that engage them. The content shared on pump livestreams at the moment are not only uninteresting, but conceptually lazy,” Eddie said.

Yet Alon, a Pump.fun executive, claims that the platform’s content has been moderated since day one.

“We have a large team of moderators working around the clock and an internal team of engineers that’s working on helping us deal with increased scale of coins, streams, and comments. I admit that our moderation isn’t perfect, so if you’re aware of a coin where moderation isn’t enforced, please report it in our support channels immediately,” Alon said.

The ongoing debate reflects the platform’s dilemma. While it offers users significant creative freedom, it also poses serious risks without stringent moderation.

Now, the community and stakeholders await decisive action. The call for stronger moderation is loud and clear, aiming to protect both the platform’s integrity and its users from further harm.

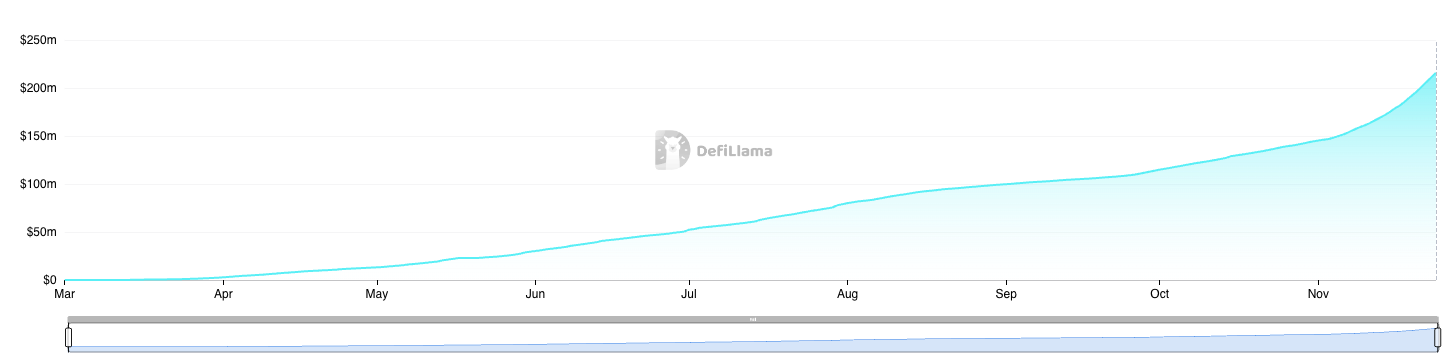

Despite these controversies, Pump.fun has continued to perform well financially. Data from DefiLlama shows that the platform has amassed over $215 million in revenue since March 2024.

Furthermore, the platform has facilitated the deployment of more than 3.8 million meme coins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin21 hours ago

Bitcoin21 hours agoAI Company Invests $10 Million In BTC Treasury

-

Market20 hours ago

Market20 hours agoIs the XRP Price Decline Going To Continue?

-

Bitcoin19 hours ago

Bitcoin19 hours agoSenator’s Bold Proposal To Replenish US Reserves

-

Market17 hours ago

Market17 hours agoCan the SAND Token Price Rally Be Sustained?

-

Bitcoin16 hours ago

Bitcoin16 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours

-

Market16 hours ago

Market16 hours agoCantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition