Market

Will US Inflation Data Boost or Sink Bitcoin This Week?

With the ongoing slump in Bitcoin (BTC) and the broader crypto market, traders should prepare for potential price swings this week, driven by key US economic updates.

Bitcoin is hovering around $54,000, with experts predicting more downward movement. Historically, September is the worst-performing month for BTC, but there’s hope for a rebound in October.

Key US Economic Events to Watch This Week

Risk-on assets like Bitcoin have started the week quietly. The largest cryptocurrency is currently trading at $54,800, reflecting a modest 0.7% rise in the last 24 hours.

However, upcoming US macroeconomic events and the anticipated debate between Donald Trump and Kamala Harris could impact traders’ sentiment and drive shifts in portfolios. Let’s take a closer look at how these events might shape the markets.

Donald Trump Debate Against Kamala Harris

As BeInCrypto previously noted, the upcoming presidential debate between Donald Trump and Kamala Harris has put crypto in the spotlight. Both candidates have made the topic central to their campaigns. Harris appears to be warming up to pro-crypto policies, according to recent reports.

Trump, meanwhile, has made bullish comments about Bitcoin and the broader crypto market, winning favor among industry insiders. Pennsylvania Senator John Fetterman predicts a “close” debate, recognizing that both Trump and Harris are capable of holding their ground.

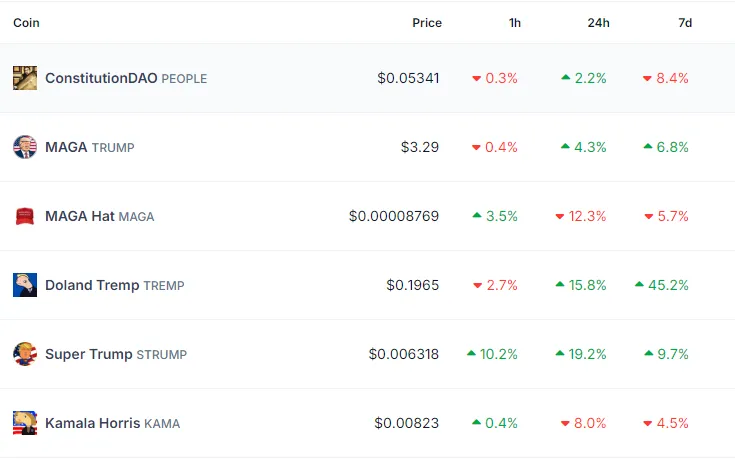

According to CoinGecko data, PolitiFi meme coins are already seeing volatility in anticipation of the debate, with some Trump-inspired coins posting double-digit gains.

Read more: How Can Blockchain Be Used for Voting in 2024?

US CPI

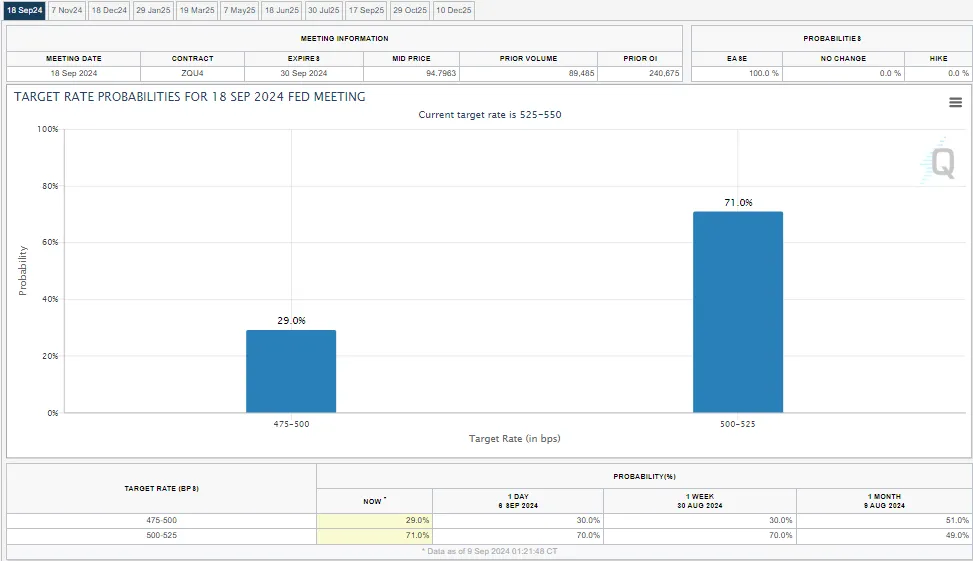

Inflation is the focal point this week with the release of the August Consumer Price Index (CPI) and the less significant Producer Price Index (PPI), both arriving before the Federal Reserve’s next meeting. These figures could play a crucial role in determining the Fed’s interest rate decision.

The Bureau of Labor Statistics (BLS) is set to release the August CPI on Wednesday, September 11. In July, inflation eased to 2.9% from June’s 3%, a shift that boosted Bitcoin’s performance.

Economists now expect inflation to drop further to 2.7%, which could bolster Bitcoin’s strength if realized. Core CPI, excluding volatile items like food and energy, is projected to cool to 3.1% in August, down from 3.2% in July. Both headline and core CPI are expected to show monthly growth of 0.2% for August.

“Amid anticipation for the CPI data and Trump-Harris debate, traders claim Bitcoin’s current value is markedly low. Crypto markets await US economic and political news impacts,” one user noted.

Consumer Sentiment

Markets will also focus on the preliminary consumer sentiment report, set for release on September 13. The University of Michigan’s Consumer Confidence data will highlight the gap between the US economy’s overall strength and how households perceive their financial well-being.

Consumer sentiment tends to be more sensitive to inflation, while consumer confidence is closely tied to the labor market. Strong consumer confidence could boost spending and drive investment in assets like Bitcoin if investors remain optimistic about the economy. However, if Friday’s data reveals that consumers are still struggling with inflation, high interest rates, and job insecurity, crypto markets may react unpredictably.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Additionally, Thursday’s initial jobless claims report could impact crypto volatility. This employment data might influence market sentiment by shaping perceptions of economic health and expectations for monetary policy, both of which could indirectly affect Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Wintermute Sells ACT Tokens Due To Binance Limit Changes

Market maker Wintermute sold off huge quantities of ACT and other BNB meme coins on April 1, tanking their prices by as much as 50%. Wintermute CEO denied intentionally selling these assets and started re-buying them.

Community sleuths believe that Binance is to blame, quietly lowering the leverage position limit for ACT and other tokens. This incident may cause further mistrust and uncertainty in a shaky meme coin market.

Why Did Wintermute Sell ACT?

A chaotic incident is currently unfolding in the meme coin sector. At the center of the story is Wintermute, a market maker that recently made headlines by interacting with World Liberty’s USD1 stablecoin before the official announcement.

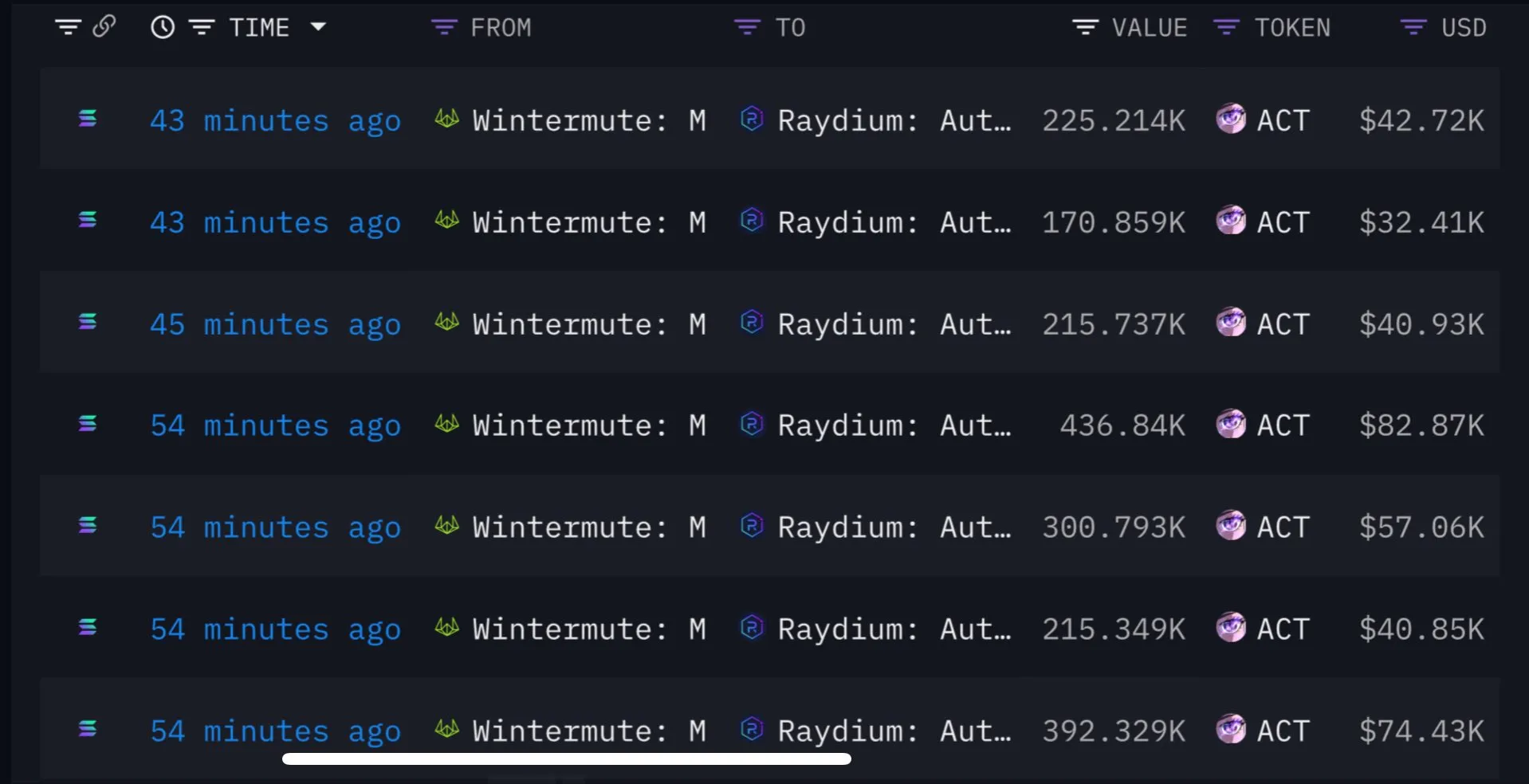

Today, Wintermute has sold off large quantities of BNB meme coins, especially ACT.

After Wintermute’s massive sell-off, the price of ACT subsequently fell 50%. This caused a stampede in other BNB meme coins, erasing millions of dollars and generating a lot of market chaos.

However, in a strange development, Wintermute’s CEO Evgeny Gaevoy denied deliberately causing the sale.

“Not us, for what it’s worth! [I’m] also curious about that postmortem. If I were to guess, we reacted post move, arbitraged the Automated Market Maker (AMM) Pool,” Gaevoy claimed in a social media thread.

This raised more questions than it answered. If Wintermute didn’t intend to sell off these ACT tokens and other meme coins, what triggered them? The firm even began buying ACT again after the sale. Subsequently, crypto sleuths started suspecting a quiet rule change from Binance, the world’s largest crypto exchange.

Both data from Lookonchain and analysis from 0xwizard, an important community leader for ACT, alleged that Binance was involved in the Wintermute debacle. Specifically, they claimed that the exchange quietly lowered the leverage position limit for ACT. This meant that market makers who held more positions than this limit were automatically liquidated at market price.

Naturally, these allegations caused a lot of outrage. Yi He, co-founder of Binance, responded, claiming that the relevant team is “collecting details and preparing a reply.” She further said that there might be another player involved but didn’t elaborate on this. This is not her first time responding to major criticism about Binance’s meme coin policies.

Ultimately, the dust is far from settled on this issue. Most of the impacted tokens are still substantially down from their positions yesterday, which is unfortunate in this fearful market. Between HyperLiquid’s short squeeze last week and this incident with Wintermute and ACT, overreach from crypto exchanges could damage market confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Stuck in Place as Tariffs and Charts Point Both Ways

Bitcoin (BTC) enters April on shaky footing. It is caught between fading bearish momentum and rising uncertainty ahead of Wednesday’s highly anticipated “Liberation Day” tariff announcement. Technical indicators like the DMI, Ichimoku Cloud, and EMA lines show mixed signals, with early signs of buyer strength emerging.

The market remains range-bound, with both downside tests and breakout rallies on the table depending on macro developments. With the JOLTS report due today and tariff clarity still pending, Bitcoin’s next major move could be just around the corner.

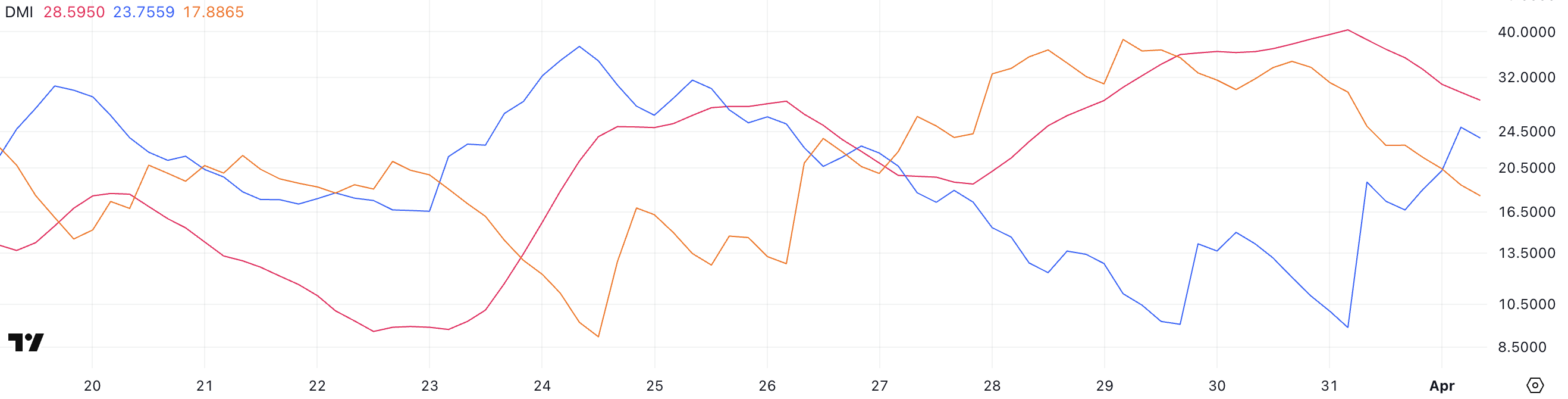

BTC DMI Shows Buyers Took Control, But Will It Last?

Bitcoin’s Directional Movement Index (DMI) is flashing potential signs of a momentum shift. The Average Directional Index (ADX), which measures the strength of a trend regardless of its direction, has dropped to 28.59 from 40.38 yesterday. That indicates that the current downtrend may be losing steam.

Typically, an ADX reading above 25 signals a strong trend, while values below that suggest a weakening or sideways market. Although 28.59 still shows moderate trend strength, the drop signals fading momentum.

Meanwhile, the +DI (positive directional indicator) has surged to 23.75 from 9.35, while the -DI (negative directional indicator) has fallen to 17.88 from 34.58—suggesting bullish pressure is beginning to build.

This crossover between the +DI and -DI could signal an early trend reversal, especially if confirmed by further price action and volume. However, it’s important to note that Bitcoin remains in a broader downtrend for now.

Market participants are also eyeing today’s JOLTS report, a key indicator of U.S. job openings. A stronger-than-expected report could lift the dollar and apply pressure to crypto markets. On the other hand, weaker data could increase expectations of rate cuts, potentially boosting Bitcoin and other risk assets.

With directional indicators shifting and macroeconomic data in play, Bitcoin’s next move could be heavily influenced by external catalysts. Recently, BlackRock CEO Larry Fink stated that Bitcoin could take the dollar’s role as the world reserve currency.

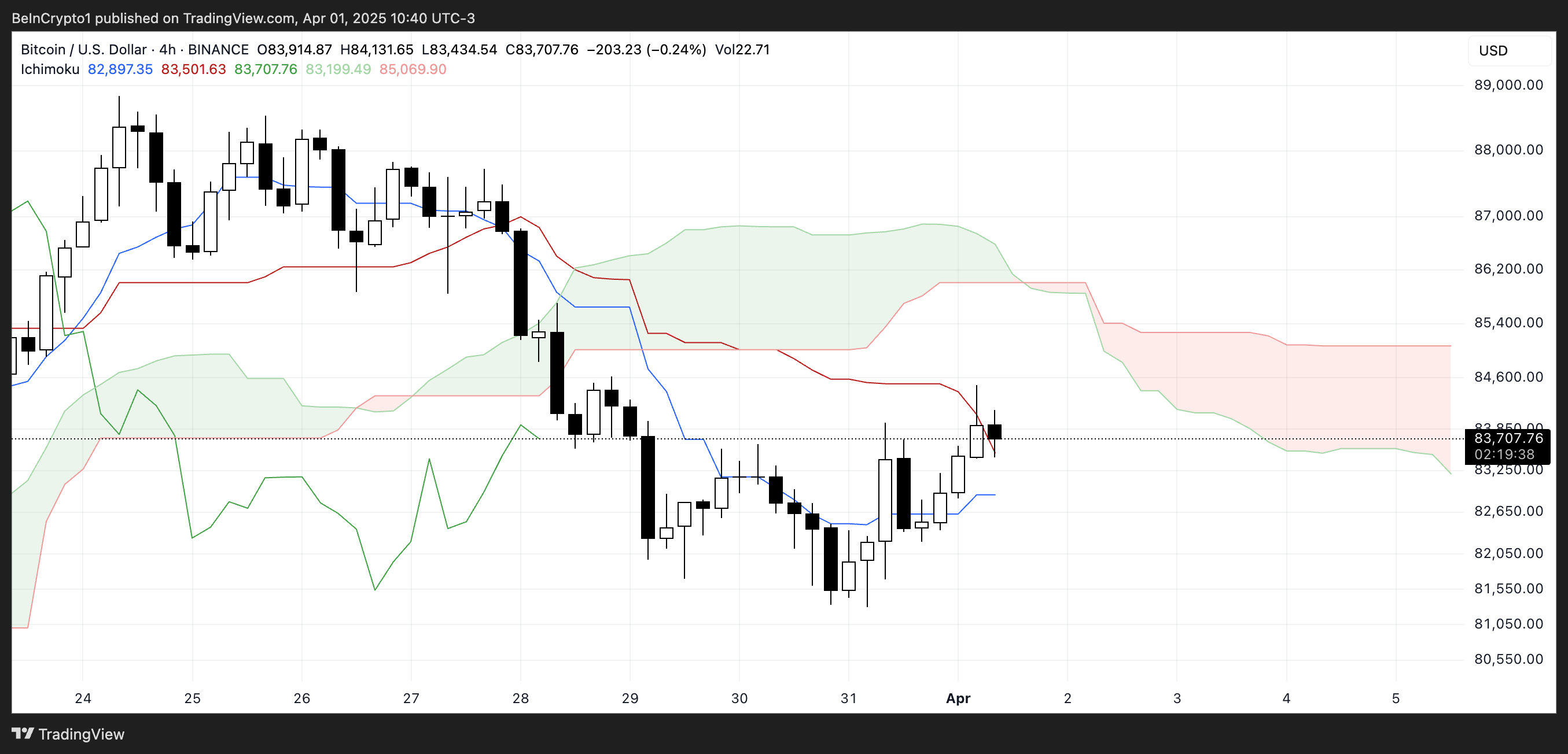

Bitcoin Ichimoku Cloud Shows The Bearish Trend Is Still Here

Bitcoin’s Ichimoku Cloud chart reveals a market still under bearish pressure, despite recent signs of short-term recovery. The price is currently testing the Kijun-sen (red line), which acts as a key resistance level.

While the Tenkan-sen (blue line) is starting to flatten and curl upward—often a sign of momentum shift—the fact that the price remains below the Kumo (cloud) indicates that the broader trend is still bearish.

The cloud ahead is red and descending, suggesting continued downward pressure in the near term.

However, the price has briefly pushed into the cloud’s lower boundary, indicating a potential challenge to the bearish structure.

For a stronger trend reversal signal, Bitcoin would need to break above the cloud and see a bullish Kumo twist form. Until then, the Ichimoku setup shows a cautious recovery at best.

Liberation Day Could Strongly Influence Bitcoin Price

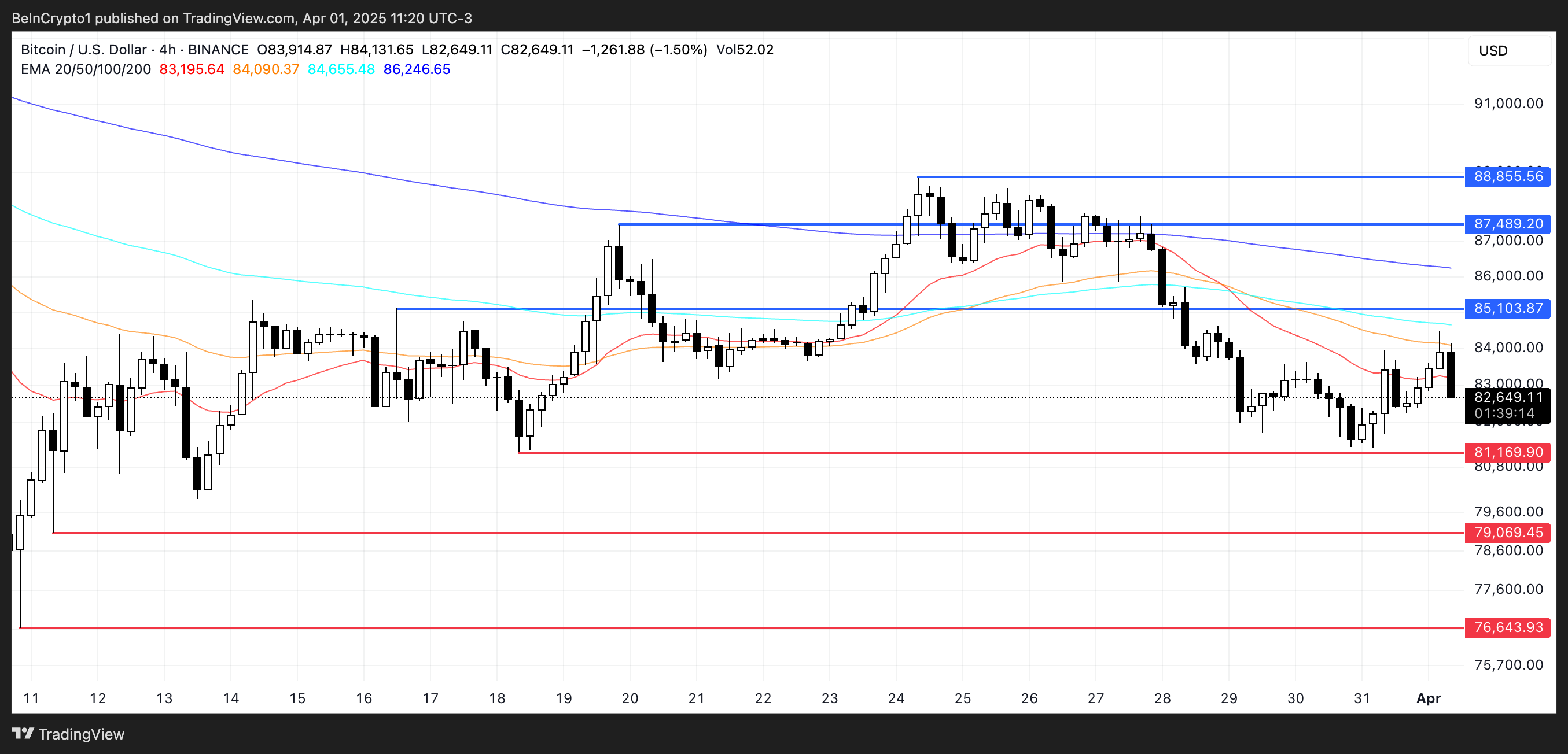

Bitcoin’s EMA lines remain bearish. Its shorter-term averages are still below the longer-term ones, an indication that downward momentum persists.

This setup suggests sellers continue to control the trend, and unless reversed, Bitcoin price could revisit key support zones. If the current downtrend accelerates, it may first test support around $81,169. If that level fails to hold, deeper drops toward $79,069 or even $76,643 could follow.

Nic Puckrin, crypto analyst and founder of The Coin Bureau told BeInCrypto the market’s heightened uncertainty ahead of the so-called “Liberation Day” tariffs. He notes that Bitcoin is equally positioned for a sharp move in either direction. It could possibly dip to $73,000 or surging toward $88,000:

“As Liberation Day approaches, the uncertainty around the magnitude of the tariffs is keeping Bitcoin and other risk assets in limbo. (…) Until there is more clarity around tariffs, this range-bound pattern will continue, but if we get softer news than feared or some sort of concessions, we could see a breakout from the current trading pattern. If we do, $88,000 is the level to watch in the short term, but we would need to see a marked increase in volume for this to indicate an extended rally.”

He defends that a tariff shock could make BTC test levels around $73,000:

“If there is a tariffs shock, conversely, we could see BTC breaking down toward $79,000 in the short term, or even further down to the next support level at $73,000 if extreme fear grips markets.“ – Nic told BeInCrypto.

Still, if Bitcoin manages to flip the trend and gain upward momentum, a climb toward resistance at $85,103 would be the first target. Breaking above that could open the path to higher levels at $87,489 and $88,855.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s USD1 Stablecoin Eyes Trust Recovery in Crypto

Trump made headlines again last week after World Liberty Financial announced the launch of USD1, its very own stablecoin. However, much anticipation surrounds just how successful the project will be. The launch of Trump’s meme coin at the beginning of the year resulted in billions of dollars in losses. Retail investors, in particular, have learned to be more cautious with Trump-backed endeavors.

BeInCrypto spoke with nine industry experts to learn more about USD1 and what it needs to restore public confidence in investors disappointed by Trump’s previous crypto ventures. These representatives unanimously agreed that USD1’s success hinges on transparency, proper utility, and a distinct advantage over well-established competitors.

USD1’s Promise and Trump’s Crypto History

Last week, World Liberty Financial (WLF), a token project heavily affiliated with the Trump family, officially acknowledged that it had launched USD1, its very own stablecoin. To a certain degree, the announcement was unsurprising.

During the Digital Assets Summit the White House held at the beginning of March, Treasury Secretary Scott Bessent said that the Trump administration would use stablecoins to preserve the US dollar’s role as the world’s strongest reserve currency.

USD1 aims to do exactly this. The stablecoin will be pegged to the US dollar and supported by a reserve comprised of short-term US Treasury securities, dollar deposits, and other highly liquid assets.

“Trump is not simply issuing his stablecoin. He is legitimizing stablecoins in general to support the US dollar. If you go through his stablecoin legislation, it is essentially about increasing the dollarization by making the US dollar easier and safer to use and selling more dollars in the process. Every USD stablecoin in circulation means USD-denominated asset in a bank somewhere. Not in CNY or any other currency,” Tae Oh, Founder of Creditcoin, told BeInCrypto.

But Trump’s track record in crypto has been polluted by heavy losses for retail investors and reiterated accusations of conflicts of interest. While some welcome the idea of a sitting president backing the launch of a new stablecoin, others say that it sparks further cause for trouble.

Can USD1 Redeem Trump’s Crypto Reputation?

The crypto market went berzerk when Trump launched his meme coin two days before assuming office. Within a day of trading, the token reached a market capitalization of over $14.5 billion.

But, since that moment, the meme coin has been in freefall, tainted by constant volatility and evidence of insider trading. According to Chainalysis, while early buyers were able to cash out $6.6 billion in profits, smaller traders have experienced collective losses of over $2 billion.

Meanwhile, the Trump family has made nearly $100 million from trading fees alone.

WLF, the President’s decentralized finance (DeFi) experiment, largely failed to restore confidence in Trump-backed crypto projects. Reports quickly unveiled that the Trump family holds a 75% stake in the platform’s net revenue and a 60% stake in the holding company.

Applying these percentages to WLF’s most recent token sale, Trump would have earned $400 million in revenue.

Now, WLF has launched USD1. Unlike meme coins, stablecoins offer investors a much higher degree of stability. Some industry leaders believe this could be Trump’s opportunity to redeem himself, while others remain doubtful. S, the pseudonymous community lead behind NEIRO, summarized it cleanly:

“If USD1 is structured well and managed transparently, it could help regain confidence, especially among newer users. But it won’t erase the impact of previous rug pulls and hype-driven projects. That healing process takes time and accountability,” he said, adding that “Authentic community engagement is now essential—it’s not enough to slap a famous name on a token.”

At the same time, the meme coin’s turbulent journey revealed Trump’s capacity to introduce newcomers to crypto, a lesson potentially applicable to USD1’s launch

Trump’s Meme Coin Impact on New Investors

TRUMP’s initial $14.5 billion market capitalization set the highest benchmark achieved by a meme coin backed by a public figure. Aside from that, according to a survey by NFTvening, 42% of TRUMP meme coin buyers were first-time crypto investors.

In other words, Trump’s meme coin project did wonders in exposing outsider investors to the cryptocurrency market. According to Oh, the same can be done with USD1– at least initially.

“The association with Trump is the strongest branding you can get in the current market. However, at the end of Trump’s term, the project needs to become disassociated from the President and more politically neutral,” he said.

Oh also added that Trump’s frequent project launches have demonstrated similarities. Though they haven’t necessarily filled a gap in the market, they have managed to onboard new users.

“I think Trump is showing us a pattern. He is legitimizing various types of cryptocurrency by issuing them himself or through his affiliate organizations. He started with memecoin and now on fiat-backed stablecoin. Is adoption the main objective of the projects? We shall see,” Oh said.

For Anthony Anzalone, CEO of XION, a Trump-backed stablecoin could create pathways for sustainable adoption compared to any meme coin.

“In the specific context of a stablecoin, Trump’s association likely provides advantages rather than disadvantages. Unlike speculative tokens, where celebrity involvement often signals short-term marketing over substance, stablecoins derive their value from stability, regulatory compliance, and institutional adoption – areas where political connections potentially confer meaningful benefits. The technical requirements and operational challenges of stablecoins are significantly different from speculative tokens, making this a more suitable venture for political backing,” Anzalone told BeInCrypto.

However, market adoption won’t exclusively hinge on presidential backing.

Will Trump’s Name Help or Hurt USD1 Adoption?

While a Trump-endorsed stablecoin could greatly increase USD1 adoption, it could also have the opposite effect.

“Trump’s polarizing presence could create skepticism, especially among those wary of political influence in financial products. While his involvement might appeal to his supporters, it risks alienating a broad portion of the market,” said Cathy Yoon, General Counsel at the Wormhole Foundation.

This risk is especially true when applied to users who believe that Trump has entered the crypto space exclusively for profit.

“Trump’s main motivation is making money from this venture, so his involvement is certainly more likely to be a downside than an advantage. You know he’ll try everything to suck as much profit out of this venture as possible, and it could be at the expense of the end user,” Jean Rausis, Co-founder of SMARDEX, told BeInCrypto.

The fact that WLF, a Trump-backed project associated with several conflicts of interest, launched USD1 does little to assuage skeptics about future risks.

Conflicts of Interest and USD1 Transparency

Trump failed to prevent similar accusations of conflicts of interest by directly associating himself with the USD1 launch through WLF.

“A conflict of interest arises when the current US President is also a key figure in World Liberty Financial. He will be closely monitored and face regulatory hurdles to ensure there is no manipulation of the financial system, but this alone could deter investors when there are highly competitive and much more mature products in that market,” Vivien Lin, Chief Product Officer at BingX, told BeInCrypto.

Suppose Trump wants to distance himself from the criticism his previous projects received. In that case, he will have to ensure that USD1 adheres to transparency mechanisms and regular audits—not only for public trust but also to ensure that the sitting President doesn’t break the law.

“Transparency should be at the forefront of all communications, especially with Trump’s involvement as the US President and stakeholder in World Liberty Financial. This situation could violate the Constitution’s emoluments clause, which broadly refers to any advantage, profit, or gain received due to holding office. If violated, this could significantly hurt the public’s trust. Another aspect that should be considered is establishing safeguards against potential market manipulation, especially given WLFI’s history of large crypto purchases before important events to prevent market manipulation,” Lin added.

USD1’s success will also largely depend on its execution.

USD1’s Path in a Competitive Market

Stablecoins have existed since 2014 and are finding a permanent home in the broader market. According to the World Economic Forum, the current supply of stablecoins in circulation exceeds $208 billion.

With a market capitalization approaching $144 billion, Tether (USDT) is today’s most dominant stablecoin. In second place comes Circle’s USDC, with a market capitalization of over $60 billion. Driven by their dollar peg and perceived inflation hedge, stablecoins have become highly popular, prompting increased stablecoin launches from banks and tech firms.

“The more we see responsible innovation that includes utility use cases– such as prudentially regulated stablecoins for global payment processing – the more crypto’s reputation will solidify and credibility will grow. I don’t think we need to rely or wait for one product such as USD1. The momentum has been building and will continue,” Beth Haddock, Global Policy Lead at Stablecoin Standard, told BeInCrypto.

USD1 must set itself apart to succeed in an already cutthroat market.

“If USD1 lacks interoperability, has limited on/off-ramps, or fails to differentiate from incumbents like USDC or USDT, it risks being relegated to a niche use case. Ultimately, mainstream success will come down to execution, partnerships, and solving real user pain points—especially in markets where traditional financial access is limited or inefficient,” said Mouloukou Sanoh, CEO of MANSA.

According to Martins Benkitis, CEO of Gravity Team, catering to niche markets isn’t a bad idea. But in an already competitive field, it might not be enough.

“If it becomes a gateway for on-chain political donations or movement-aligned payments, it’s filling a niche. The question is whether that niche is big enough to sustain a stablecoin. Jury’s still out, but it’s an angle,” he said.

Inevitably, providing some utility that is not currently available will factor into USD1’s eventual success.

What Utility Will USD1 Offer?

What USD1 can offer the market boils down to what Trump has in store. Several details regarding its launch have yet to be released.

Nonetheless, if executed properly, the stablecoin has the potential to offer a degree of stability and predictability that TRUMP’s meme coin was unable to deliver. It could also give the President the golden opportunity to restore the trust that he lost from his previous crypto ventures.

If this is among Trump’s matters of concern for USD1, he will have to prioritize factors like transparency, security, and clear utility. These will be the aspects the public will be looking out for.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

-

Market23 hours ago

Market23 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Altcoin22 hours ago

Altcoin22 hours agoElon Musk Rules Out The Use Of Dogecoin By The US Government

-

Market20 hours ago

Market20 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

-

Altcoin19 hours ago

Altcoin19 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market18 hours ago

Market18 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Market16 hours ago

Market16 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Market22 hours ago

Market22 hours agoMarket Cap Now Approaching $300 Million