Market

Latam Crypto News: Mexico Investigates Worldcoin

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup covers Mexico’s investigation into iris-scanning project Worldcoin, MicroStrategy CEO’s speech in Argentina, and more.

María Corina Machado Proposes Bitcoin as Venezuela’s Reserve Asset

María Corina Machado, leader of Venezuela’s opposition to Nicolás Maduro’s government, has introduced a bold proposal to tackle the country’s economic crisis: adopting Bitcoin as a national reserve asset.

“We are grateful for the lifeline that Bitcoin provides, and we hope to adopt it in a new and democratic Venezuela,” Machado said in an interview with Alex Gladstein, Strategy Director at the Human Rights Foundation.

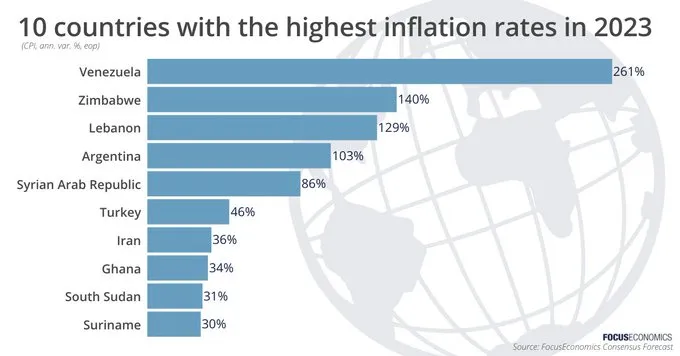

During the interview, Machado emphasized Venezuela’s economic collapse, noting that inflation has skyrocketed by 8,000,000% since 2016. This catastrophic situation has forced millions of Venezuelans to flee the country in search of stability. In addressing Venezuela’s economic woes, Machado stressed the pivotal role Bitcoin has played for many.

“Some Venezuelans found a lifeline in Bitcoin during hyperinflation, using it to protect their wealth and finance their flight. Today, Bitcoin bypasses government-imposed exchange rates and thus helps many of our people. It has evolved from a humanitarian tool to a vital means of resistance,” she explained.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Machado also highlighted how Latam country’s citizens have turned to crypto to shield their assets amid hyperinflation, stressing that the cryptocurrency could be crucial in rebuilding the nation’s economy.

“We visualize Bitcoin as part of our national reserves, helping to rebuild what the dictatorship stole. […] Fortunately, unlike bank transfers, which the regime usually blocks, Bitcoin donations cannot be seized. Let’s use this technology to achieve the change that Venezuela desperately needs,” she concluded.

Machado’s proposal positions Bitcoin not only as a financial tool but as a cornerstone for the country’s recovery and resistance against government control.

MicroStrategy CEO Praises Bitcoin During Visit to Argentina

Phong Le, CEO of MicroStrategy, recently attended the “MicroStrategy World: Buenos Aires Edition” event in Argentina, where he shared his insights on Bitcoin and the future of corporate solutions.

During his keynote speech, titled “Let the Data Lifeblood Flow & Bitcoin for Corporations and Government,” Le discussed the impact of artificial intelligence in the workplace, as well as the company’s strategy regarding AI and Bitcoin. He reaffirmed his strong belief in cryptocurrencies, calling Bitcoin “the best financial technology ever invented.”

Reflecting on MicroStrategy’s Bitcoin journey, Le recounted the company’s decision to add BTC to its balance sheet in 2020. He noted the coin’s rise from $11,000 to $67,000 and acknowledged the market downturn following the collapse of fraudulent entities like FTX and Terra Luna.

“In 2020, our company decided to put BTC on its balance sheet. Later, Square did the same. Three months later, Tesla. This is what we call corporate adoption,” he explained.

Read more: Who Owns the Most Bitcoin in 2024?

From a geopolitical standpoint, Le believes Bitcoin could play a key role in shaping the global financial landscape. He predicted that more countries would follow El Salvador’s lead, which adopted Bitcoin as legal tender in 2021.

Le also touched on the upcoming US presidential elections, noting Donald Trump’s pro-Bitcoin stance. “If you want to be the most powerful or relevant country, you have US dollars, you have gold, and you should have BTC,” Le stated. MicroStrategy remains the largest institutional Bitcoin holder, with 226,500 BTC — over 1% of the total Bitcoin supply.

El Salvador’s Financial System Converted Only $6.6 Million to Bitcoin, Reports GAFI

A recent report from the Latin American Financial Action Task Force (GAFILAT) highlights the minimal impact Bitcoin has had in El Salvador since its adoption as legal tender. Despite being the first country to embrace the cryptocurrency, the financial system has only converted $6.6 million to Bitcoin between 2021 and 2024. This amount represents a mere 0.03% of the assets managed by the country’s major banks.

While the Latam country’s government remains optimistic about Bitcoin, GAFILAT’s findings suggest that the crypto has yet to significantly influence the national economy. Remittances sent via digital wallets account for less than 1% of total remittances received. In the first seven months of 2024, Salvadorans abroad sent $49.7 million through digital wallets, a 6.3% decline compared to the previous year.

The report also notes that Salvadoran banks have set strict limits on automatic Bitcoin-to-dollar conversion, capping transactions at $200,000. Additionally, alert systems are in place to detect suspicious activity, though GAFILAT warns that digital asset exchanges still carry risks, including potential use for unregulated cryptocurrency transactions.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Since Bitcoin’s adoption in September 2021, the government established a convertibility trust managed by the Development Bank of El Salvador (Bandesal). However, details regarding the amounts converted remain classified.

Meta has announced that it will inform users in Brazil about how their personal data is used to train its Artificial Intelligence (AI). Notifications will be sent via email and through Facebook and Instagram, asking for permission to use their data.

In July, Meta suspended its Generative AI tool in Brazil after the National Data Protection Authority (ANPD) requested changes to its privacy policy. Despite Meta’s efforts to comply with AI regulations in the country, the tool was halted. Now, the Brazilian Ministry of Health will inform citizens about how Meta plans to use their data, with users given the option to decline.

“We are disappointed with the ANPD’s decision. AI training is not unique to our services, and we are more transparent than many in the industry who have used public content to train their models,” Meta explained. “Our approach complies with Brazilian privacy laws, and we will continue to work with the ANPD to address their concerns. This is a setback for innovation and AI competitiveness, delaying the benefits of AI for people in Brazil.”

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Global efforts to regulate AI remain scattered. In March, the European Parliament passed a regulation aimed at curbing AI practices that infringe on human rights. This includes bans on AI for biometric categorization and unauthorized photo or video captures.

“Thanks to the Parliament, unacceptable AI practices will be banned in Europe, and the rights of workers and citizens will be protected. The new AI Office will help companies comply before the rules take effect. We are ensuring that human values remain central to AI development,” the Parliament stated.

Additionally, the United Nations General Assembly proposed a resolution to create governance systems for AI. The UN urged member states to avoid AI practices that violate human rights or hinder societal development, pushing for systems that promote safety, inclusivity, and sustainable technological growth.

Mexico’s INAI Launches Investigation Into Worldcoin

Adrián Alcalá, president commissioner of Mexico’s National Institute for Transparency, Access to Information, and Protection of Personal Data (INAI), announced that an investigation will be initiated against Worldcoin (WLD) for allegedly obtaining personal data without proper consent.

In recent weeks, Worldcoin has come under fire in several Latam countries, including Chile, Colombia, Ecuador, and Argentina, all raising concerns about crypto project’s data collection practices. The accusations center on improper handling and misuse of personal data. Alcalá confirmed that INAI will now look into potential data violations by Worldcoin, which has been operating in Mexico since last year.

“We initiated an ex officio investigation to analyze the possible data breach by Worldcoin. We invite all persons who feel their information was compromised to file complaints,” Alcalá shared on X.

Read more: What Is Worldcoin? A Guide to the Iris-Scanning Crypto Project

The company is also facing growing criticism from users who claim their privacy was violated. Customers have alleged they were “scammed” by not receiving the promised cryptocurrency payments, and some accuse the company of scanning the irises of minors.

In April, Mexican Congresswoman María Eugenia Hernández introduced a proposal to investigate Worldcoin’s operations. She highlighted the importance of safeguarding Mexicans’ personal data, noting that Mexico had not yet addressed the issue as other nations had. Hernández emphasized the need for clear rules on how private companies handle citizens’ biometric data.

“We cannot allow our citizens’ data to be in the hands of private individuals without clear guidelines for its use. It’s crucial to raise awareness about what this company is doing and the risks of continuing to exchange biometric data for a few cryptocurrencies,” Hernández said.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Price Faces More Downside—Can Bulls Step In?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

VanEck Sets Stage for BNB ETF with Official Trust Filing

Global investment management firm VanEck has officially registered a statutory trust in Delaware for Binance’s BNB (BNB) exchange-traded fund (ETF).

This move marks the first attempt to launch a spot BNB ETF in the United States. It could potentially open new avenues for institutional and retail investors to gain exposure to the asset through a regulated investment vehicle.

VanEck Moves Forward with BNB ETF

The trust was registered on March 31 under the name “VanEck BNB ETF” with filing number 10148820. It was recorded on Delaware’s official state website.

The proposed BNB ETF would track the price of BNB. It is the native cryptocurrency of the BNB Chain ecosystem, developed by the cryptocurrency exchange Binance.

As per the latest data, BNB ranks as the fifth-largest cryptocurrency by market capitalization at $87.1 billion. Despite its significant market position, both BNB’s price and the broader cryptocurrency market have faced some challenges recently.

Over the past month, the altcoin’s value has declined 2.2%. At the time of writing, BNB was trading at $598. This represented a 1.7% dip in the last 24 hours, according to data from BeInCrypto.

While the trust filing hasn’t yet led to a price uptick, the community remains optimistic about the prospects of BNB, especially with this new development.

“Send BNB to the moon now,” an analyst posted on X (formerly Twitter).

The filing comes just weeks after VanEck made a similar move for Avalanche (AVAX). On March 10, VanEck registered a trust for an AVAX-focused ETF.

This was quickly followed by the filing of an S-1 registration statement with the US Securities and Exchange Commission (SEC). Given this precedent, a similar S-1 filing for a BNB ETF could follow soon.

“A big step toward bringing BNB to US institutional investors!” another analyst wrote.

Meanwhile, the industry has seen an influx of crypto fund applications at the SEC following the election of a pro-crypto administration. In fact, a recent survey revealed that 71% of ETF investors are bullish on crypto and plan to increase their allocations to cryptocurrency ETFs in the next 12 months.

“Three-quarters of allocators expect to increase their investment in cryptocurrency-focused ETFs over the next 12 months, with demand highest in Asia (80%), and the US (76%), in contrast to Europe (59%),” the survey revealed.

This growing interest in crypto ETFs could drive further demand for assets like BNB, making the VanEck BNB ETF a potentially significant product in the market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Recovery Stalls—Are Bears Still In Control?

XRP price started a fresh decline from the $2.20 zone. The price is now consolidating and might face hurdles near the $2.120 level.

- XRP price started a fresh decline after it failed to clear the $2.20 resistance zone.

- The price is now trading below $2.150 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $2.120 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might extend losses if it fails to clear the $2.20 resistance zone.

XRP Price Faces Rejection

XRP price failed to continue higher above the $2.20 resistance zone and reacted to the downside, like Bitcoin and Ethereum. The price declined below the $2.150 and $2.120 levels.

The bears were able to push the price below the 50% Fib retracement level of the recovery wave from the $2.023 swing low to the $2.199 high. There is also a connecting bearish trend line forming with resistance at $2.120 on the hourly chart of the XRP/USD pair.

The price is now trading below $2.150 and the 100-hourly Simple Moving Average. However, the bulls are now active near the $2.10 support level. They are protecting the 61.8% Fib retracement level of the recovery wave from the $2.023 swing low to the $2.199 high.

On the upside, the price might face resistance near the $2.120 level and the trend line zone. The first major resistance is near the $2.150 level. The next resistance is $2.20. A clear move above the $2.20 resistance might send the price toward the $2.240 resistance. Any more gains might send the price toward the $2.2650 resistance or even $2.2880 in the near term. The next major hurdle for the bulls might be $2.320.

Another Decline?

If XRP fails to clear the $2.150 resistance zone, it could start another decline. Initial support on the downside is near the $2.10 level. The next major support is near the $2.0650 level.

If there is a downside break and a close below the $2.0650 level, the price might continue to decline toward the $2.020 support. The next major support sits near the $2.00 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $2.10 and $2.050.

Major Resistance Levels – $2.120 and $2.20.

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Could Serve as Inflation Hedge or Tech Stock, Say Experts

-

Market22 hours ago

Market22 hours agoSUI Price Stalls After Major $147 Million Token Unlock

-

Market21 hours ago

Market21 hours agoBeInCrypto US Morning Briefing: Standard Chartered and Bitcoin

-

Market20 hours ago

Market20 hours agoAnalyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

-

Market18 hours ago

Market18 hours agoBitcoin Price Bounces Back—Can It Finally Break Resistance?

-

Altcoin17 hours ago

Altcoin17 hours agoWill BNB Price Rally to ATH After VanEck BNB ETF Filing?

-

Regulation8 hours ago

Regulation8 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Altcoin4 hours ago

Altcoin4 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x