Altcoin

Shiba Inu (SHIB) Price Prediction: September October November December 2024

As we head into the final quarter of 2024, the meme coin market remains as volatile and exciting as ever. With Shiba Inu (SHIB) showing resilience, and new competitors like Mpeppe (MPEPE) rising fast, it’s a good time to evaluate where these coins might be headed. Below, we dive into a month-by-month price prediction for Shiba Inu (SHIB), examining key trends, catalysts, and the influence of the burgeoning casino and De-Fi ecosystems, particularly the role of Mpeppe (MPEPE).

Shiba Inu (SHIB) Price Prediction: September 2024

Shiba Inu (SHIB) Consolidates Amid Market Uncertainty

September is often a crucial month for the cryptocurrency market, as traders reassess their portfolios ahead of the year’s final quarter. Shiba Inu (SHIB) is expected to experience minor fluctuations, with a potential price range of $0.0000085 to $0.0000092. The focus will be on the token’s DeFi integrations and growing utility within its ecosystem.

At the same time, Mpeppe (MPEPE) is gaining ground in the market, especially in the online casino space. Mpeppe (MPEPE)’s combination of DeFi features and blockchain-based gaming has piqued the interest of investors looking for both entertainment and financial gain, further intensifying the competition between meme tokens.

Shiba Inu (SHIB) Price Prediction: October 2024

A Potential Upswing for Shiba Inu (SHIB)?

October could be the month where Shiba Inu (SHIB) breaks out of its consolidation phase, with predictions of it reaching $0.0000098 to $0.0000110. This price rise may be driven by positive market sentiment around the token’s utility in decentralized finance, coupled with any new partnerships or platform updates.

In parallel, Mpeppe (MPEPE) is continuing to leverage its position in the online gambling sector. The integration of smart contracts and decentralized ledgers ensures a seamless experience for users, while the DeFi features allow participants to stake their tokens and earn passive income through liquidity pools. These innovations make Mpeppe (MPEPE) a growing threat to Shiba Inu (SHIB)’s dominance.

Shiba Inu (SHIB) Price Prediction: November 2024

Shiba Inu (SHIB) to Test New Highs?

By November, we expect a broader crypto market rally that could push Shiba Inu (SHIB) to new highs, potentially reaching $0.0000120 to $0.0000140. The increase in demand may be fueled by Shiba Inu (SHIB)’s upcoming features or a possible integration with major decentralized exchanges, increasing its exposure.

However, Mpeppe (MPEPE) could continue to siphon interest away from Shiba Inu (SHIB). As Mpeppe (MPEPE) finalizes its gaming platform launch, the token’s growing appeal among casino enthusiasts and DeFi investors is likely to drive significant price momentum. Mpeppe (MPEPE) offers an interactive and profitable experience by allowing users to participate in its decentralized casino with full transparency and security.

Shiba Inu (SHIB) Price Prediction: December 2024

End-of-Year Surge for Shiba Inu (SHIB)?

Historically, December has been a strong month for the cryptocurrency market. Shiba Inu (SHIB) could capitalize on this seasonal trend, with some analysts forecasting a potential price target of $0.0000150 to $0.0000175. If Shiba Inu (SHIB) can maintain its community strength and deliver on its roadmap, it may close the year on a high note.

Yet, Mpeppe (MPEPE) continues to make waves, particularly with the integration of NFT-based gaming assets into its ecosystem. As the token becomes increasingly embedded in both the gaming and casino markets, Mpeppe (MPEPE) could see a substantial year-end rally. This makes it a must-watch cryptocurrency as we move into 2025.

Conclusion: What to Expect for Shiba Inu (SHIB) in 2024

As we enter the final months of 2024, Shiba Inu (SHIB) is poised for growth, although it will face stiff competition from rising meme tokens like Mpeppe (MPEPE). Both coins offer intriguing opportunities for investors, with Shiba Inu (SHIB)’s DeFi applications and Mpeppe (MPEPE)’s dominance in the gaming and casino space being key factors to watch. Whether you’re a fan of Shiba Inu (SHIB) or looking for new opportunities with Mpeppe (MPEPE), 2024 promises to be an exciting year for meme coin enthusiasts.

For more information on the Mpeppe (MPEPE) Presale:

Visit Mpeppe (MPEPE)

Join and become a community member:

Altcoin

Analyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

XRP price has surged nearly 10% today, indicating a renewed market interest in Ripple’s native asset. Notably, the robust surge comes amid a broader crypto market recovery and several other positive developments like the successful ETF launch in the US. Amid this, a top expert has highlighted the XRP/BTC performance and said that Ripple’s native asset is likely to hit $22 if Bitcoin hits a new ATH ahead.

XRP/BTC Bullish Cross Signals Massive Surge Ahead

Crypto analyst EGRAG CRYPTO recently highlighted a major bullish signal on the XRP/BTC chart. He pointed out a rare crossover of two key indicators, i.e. the 55-week Exponential Moving Average (EMA) and the 155-week Moving Average (MA). According to him, this “Bullish Cross” could be a game-changer for XRP holders.

EGRAG explained that the last time this crossover occurred was back in May 2017. XRP price rallied 958% shortly after that event. A similar cross took place again on February 17, 2025, and could repeat the explosive pattern if market conditions align.

Meanwhile, he added that if XRP/BTC retests the 55 EMA level of 0.00001850, Ripple’s coin could reach around $1.48, assuming Bitcoin trades at $80,000. However, if the historical pattern plays out and XRP/BTC gains another 958%, XRP price could skyrocket much higher. Besides, it also comes amid a surge of nearly 6% in BTC price today.

XRP Price Likely To Follow Bitcoin Move

EGRAG CRYPTO’s prediction hinges heavily on Bitcoin’s next major move. If Bitcoin price revisits its 2025 ATH near $109,000 and retraces to $97,000, XRP could hit $16.5. But if BTC breaks into higher territory, the numbers look even more bullish.

For context, he calculated that if Bitcoin touches $130K, XRP could trade at $22. Furthermore, if BTC rallies to $150K, XRP might surge to $25. A push toward $170K could propel XRP to $29, he added.

Why Does This Technical Signal Matters?

The analyst believes most traders overlook the significance of the 55 EMA and 155 MA combination. He noted that many still doubt XRP’s ability to reach double digits, especially after the recent crypto market crash.

However, the analyst remains firm in his belief that the chart tells a different story. He believes that as long as the XRP/BTC pair holds above the 55 EMA, the bullish projection for the XRP price stays valid.

XRP Price Soars 10%

XRP price today was up nearly 10% and exchanged hands at $2, while its one-day volume rose 3% to $8 billion. Simultaneously, the XRP Futures Open Interest also soared past the $3 billion mark with over 4% surge, CoinGlass data showed.

Notably, this recent surge comes as the Ripple network has seen a massive surge in active addresses recently. Besides, the recent XRP ETF launch in the US has also bolstered market confidence. The first-day volume of the Teucrium 2X Long Daily XRP ETF has outshined Solana’s 2X ETF (SOLT) first-day volume.

Considering all these fundamental developments, it appears that the crypto is gearing up for a major rally ahead. Besides, the analyst’s forecast, if holds true, could send the crypto to over $20 in the coming days.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Will Q2 2025 Mark the Return of Altcoin Season?

The cryptocurrency market is showing potential signs of an impending altcoin season. Market watchers cite a confluence of technical, sentiment, and macroeconomic factors that could lead to a significant rally in altcoins.

The outlook follows a notable downturn in the altcoin market, which has dropped about 37.6% since its high in early December 2024. As of the latest data, the market cap stands at $1.1 trillion.

Is Altcoin Season Coming?

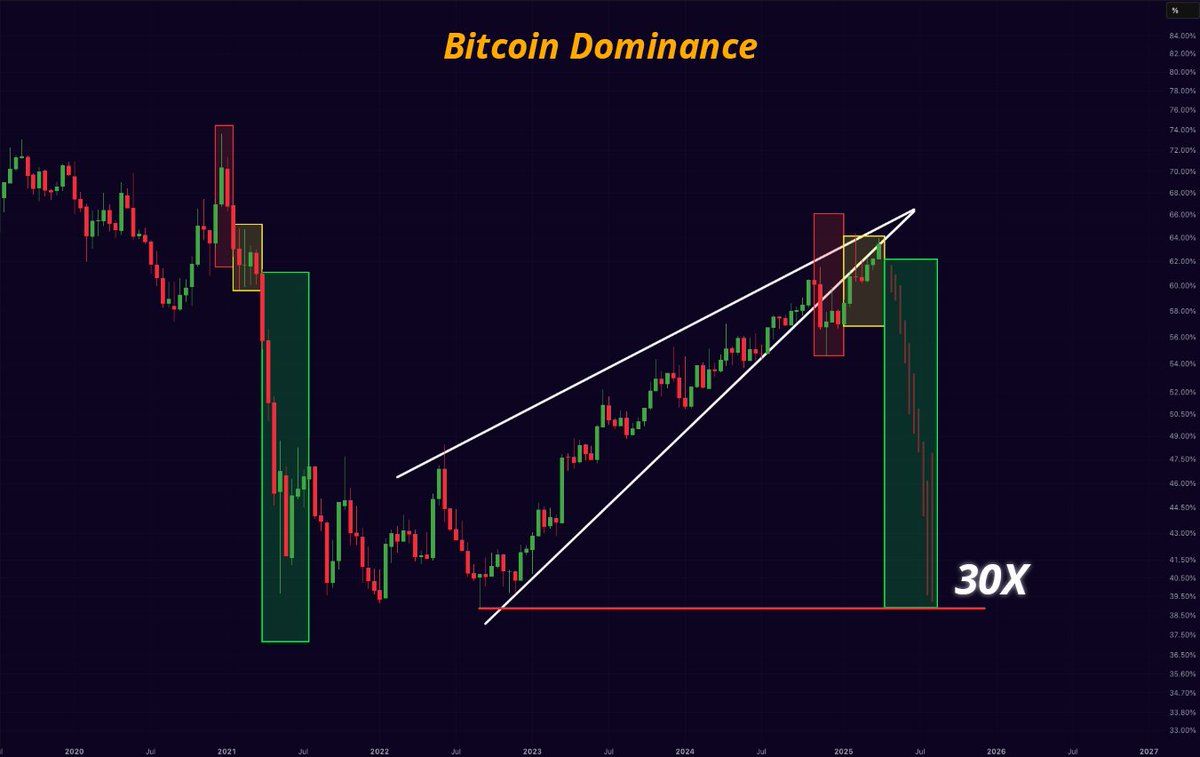

From a technical perspective, Bitcoin (BTC) Dominance, which measures Bitcoin’s market share relative to the total cryptocurrency market, seems to be at a key turning point.

A recent chart shared by crypto analyst Mister Crypto on X highlighted that Bitcoin Dominance has reached a resistance following a rising wedge pattern. This pattern is generally seen as a bearish signal, often leading to sharp pullbacks.

“Bitcoin Dominance will collapse. Altseason will come. We will all get rich this year!” he wrote.

In addition, another analyst corroborated these findings, noting that Bitcoin Dominance has reached a peak. Thus, he forecasted a subsequent downturn.

However, the Altcoin Season Index has dropped to a low of 16. The index, which analyzes the performance of the top 50 altcoins against Bitcoin, indicated that altcoins are currently underperforming.

Notably, this level mirrors the bottom for altcoins observed around August 2024. This period preceded a significant altcoin rally, and the index peaked at 88 by December 2024.

Lastly, from a macroeconomic perspective, the 90-day delay in President Donald Trump’s tariff implementation has renewed market confidence. This delay is perceived as a positive signal, potentially encouraging capital inflows into altcoins.

“90 days tariff pause = 90 days of altseason,” an analyst claimed.

Moreover, analyst Crypto Rover pointed to quantitative easing (QE) as a catalyst for an altseason. According to him, when the central bank starts pumping money into the economy (through QE), altcoins could experience a significant price surge, benefiting from the increased liquidity and investor optimism.

“Once QE starts. Altcoin season will make a massive comeback!” he stated.

However, in the latest report, Kaiko Research stressed that a traditional altcoin season may no longer be feasible. Instead, any potential rally could be selective, with only a few altcoins experiencing significant upside. The focus will likely be on assets with real-world use cases, strong liquidity, and revenue-generating potential.

“Altseasons may become a thing of the past, necessitating a more nuanced categorization beyond just ‘altcoins,’ as correlations in returns, growth factors, and liquidity among crypto assets are diverging significantly over time,” the report read.

Kaiko Research noted that the growing concentration of liquidity in a few altcoins and Bitcoin may disrupt the typical capital flow into altcoins during market upswings. Furthermore, as Bitcoin becomes more widely adopted as a reserve asset by institutions and governments, its position in the market strengthens further.

Ultimately, while the signs point to a potential altcoin rally, it’s clear that the future of altcoins could involve more nuanced market dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

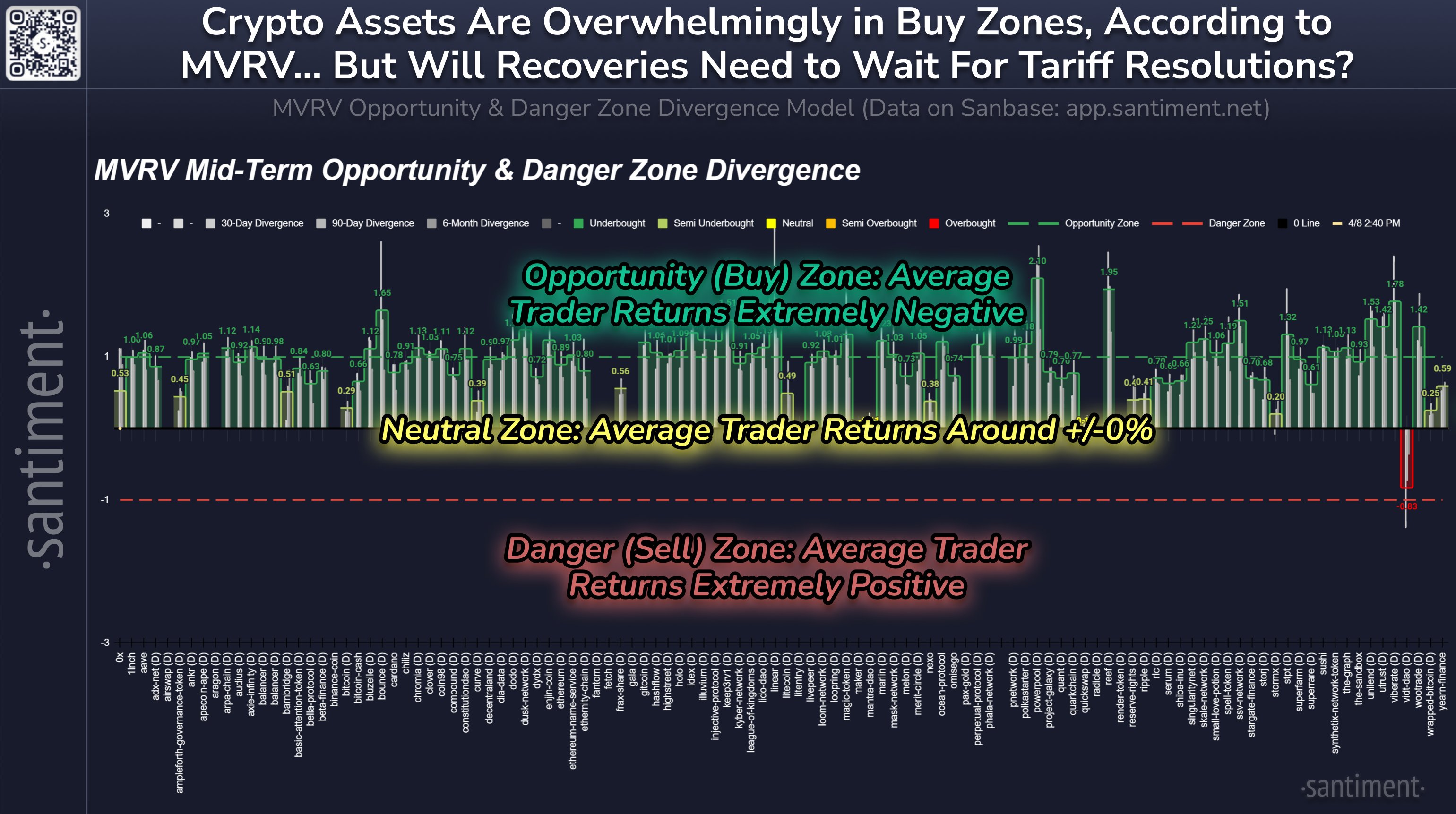

Most Altcoins Now In ‘Opportunity’ Zone, Santiment Reveals

The on-chain analytics firm Santiment has revealed how the majority of the altcoins are currently in what has historically been a buy zone.

Mid-Term Trading Returns Are Extremely Negative For Most Altcoins

In a new post on X, Santiment has shared an update for its MVRV Opportunity & Danger Zone Divergence Model for the various altcoins in the sector. The model is based on the popular “Market Value to Realized Value (MVRV) Ratio.”

The MVRV Ratio is an on-chain indicator that basically tells us whether the investors of a cryptocurrency as a whole are holding their coins at a net profit or loss.

When the value of this metric is greater than 1, it means the average investor is holding a profit. On the other hand, it being under this threshold suggests the dominance of loss.

Historically, holder profitability is something that has tended to have an effect on the prices of digital assets. Whenever the investors are in large profits, they can become tempted to sell their coins in order to realize the piled-up gains. This can impede bullish momentum and result in a top for the price.

Similarly, holders being significantly underwater results in market conditions where profit-takers have run out, thus allowing for the cryptocurrency to reach a bottom.

Santiment’s MVRV Opportunity & Danger Zone Divergence Model exploits these facts in order to define buy and sell zones for the altcoins. The model calculates the divergence of the MVRV Ratio on various timeframes (30 days, 90 days, and 6 months) to find whether an asset is inside one of these zones or not.

Here is the chart shared by the analytics firm that shows how the different altcoins are currently looking based on this model:

Looks like most of the sector is currently in the buy region | Source: Santiment on X

In this model, a value greater than zero suggests average trader returns are negative for that timeframe and that below it is positive. This is the opposite orientation of what it’s like in the MVRV Ratio, with the zero level taking the role of the 1 mark from the indicator.

From the graph, it’s visible that almost all of the altcoins have their MVRV divergence greater than zero on the different timeframes. Out of these, most of them have their mid-term MVRV divergence greater than 1. The opportunity zone mentioned earlier lies beyond this mark, so the model is currently showing a buy signal for the majority of the altcoins.

The average negative returns have come for these coins as the market has been in turmoil following the news related to tariffs. While the model may be showing a buy signal for the altcoins, it’s possible that this uncertainty will continue to haunt the market. As Santiment explains,

If and when a global tariff solution is reached, it would undoubtedly trigger a very rapid cryptocurrency recovery,” notes However, this is currently a very big “if” based on the latest media coverage on what is quickly being referred to as a full-fledged “trade war” between the US and the majority of the world.

BTC Price

At the time of writing, Bitcoin is floating around $76,900, down more than 9% in the last seven days.

The price of the coin has already erased its attempt at recovery | Source: BTCUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Bitcoin12 hours ago

Bitcoin12 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market12 hours ago

Market12 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin16 hours ago

Altcoin16 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Bitcoin21 hours ago

Bitcoin21 hours agoWill the Corporate Bitcoin Accumulation Trend Continue in 2025?

-

Altcoin15 hours ago

Altcoin15 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Market21 hours ago

Market21 hours agoPaul Atkins SEC Confirmation Vote

-

Market8 hours ago

Market8 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Market13 hours ago

Market13 hours agoSEC Approves Ethereum ETF Options Trading After Delays

✓ Share: