Market

Is SunPump Losing Steam? Onchain Metrics Shows Major Drop

The excitement surrounding Tron blockchain’s meme coin launchpad, SunPump, seems to be waning after weeks of mainstream attention, despite ongoing efforts from Tron founder Justin Sun.

SunPump’s debut marked the start of market competition with Solana blockchain’s Pump.fun, as both platforms aim to dominate the meme coin launchpad space.

SunPump Platform’s Glory Days Fade

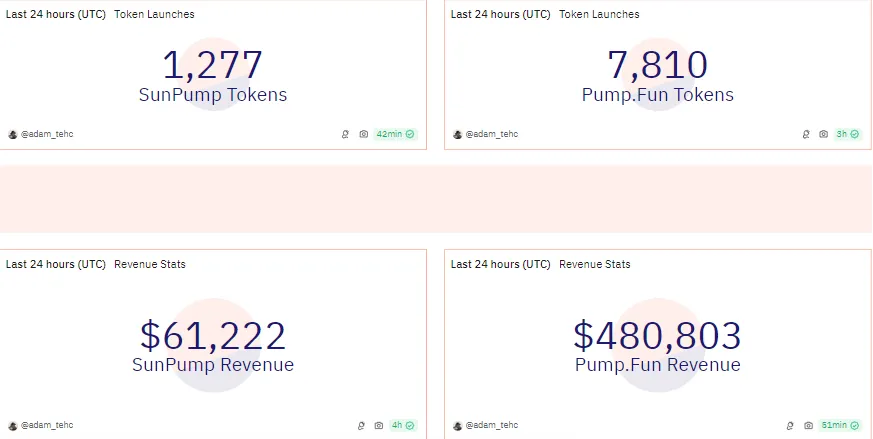

After making headlines throughout August with key milestones, developments, and token launches, SunPump’s momentum appears to be fading. Dune Analytics data shows that Solana’s Pump.fun has deployed more than six times the number of tokens compared to SunPump in the last 24 hours.

Additionally, Pump.fun’s revenue is nearly eight times higher than SunPump’s during the same period. Solana’s launchpad also outperformed in terms of new and active addresses, with 29,873 and 59,331, respectively, compared to SunPump’s 2,134 and 6,538. These figures suggest Pump.fun is regaining its dominance as the hype around SunPump diminishes.

Read more: What Is TRON (TRX) and How Does It Work?

BeInCrypto reported several key achievements for SunPump, including fee cuts and Tron’s implementation of a 100% buyback and burn process. These milestones, supported by Justin Sun’s bullish commentary, kept the platform in the spotlight among meme coin traders and enthusiasts.

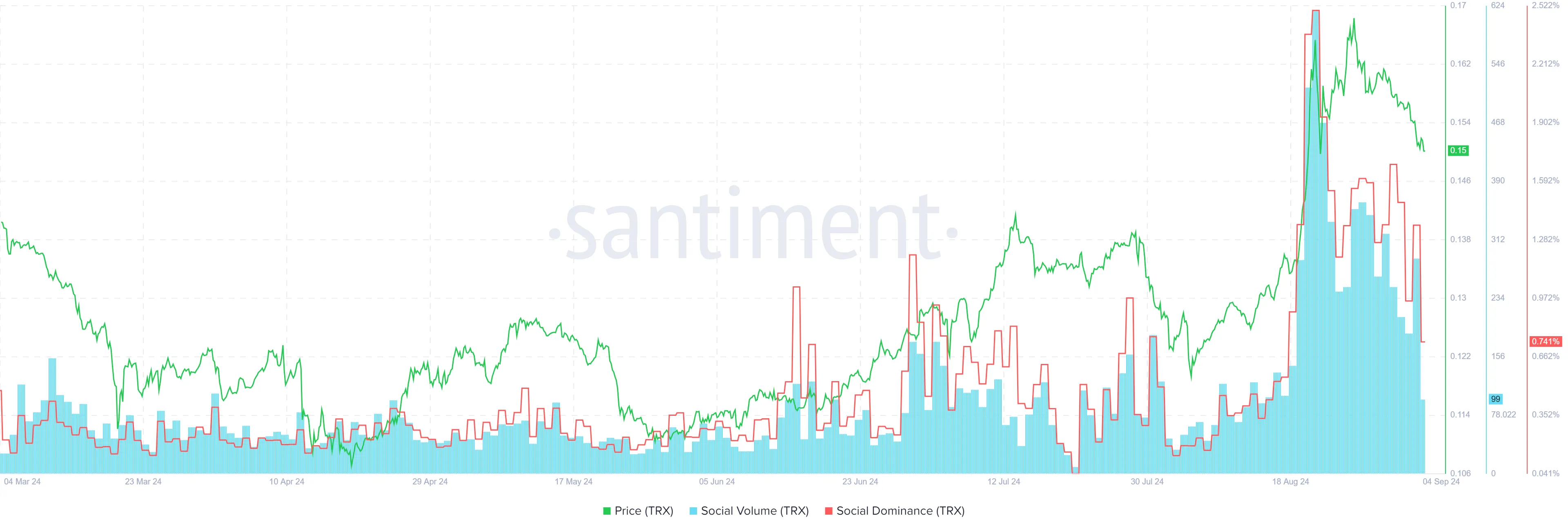

However, the outlook is shifting. Santiment data shows a significant decline in Tron’s (TRX) metrics, with a 70% drop in TRX social dominance and an 83% drop in TRX social volume since August 21, indicating waning interest in the platform.

In a recent development, Sun hinted at a potential collaboration with Australian rapper Iggy Azalea. The speculation followed a post by BullBnB, which encouraged a partnership between the two.

“I think Iggy Azalea and Justin Sun should join forces. She is the only celeb working hard for her meme. Dedicated and persistent. MOTHER is the only token I keep buying on dips. After all whatever doesn’t kill you only makes you stronger,” BullBnB wrote.

In response, Iggy Azalea called on Sun for ideas. Meanwhile, the rapper has independently launched her own meme coin, Mother Iggy (MOTHER), with plans to build trust and integrity in the space.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

A collaboration between Justin Sun and Iggy Azalea could certainly generate buzz, though it remains uncertain whether it will materialize. One user has already proposed a MOTHER NFT project on the Tron blockchain, envisioning a unique fan experience.

“MOTHER NFT Project on TRON for each concert venue/location/country you at. Users get to use the NFT for entry to the concert. The more expensive the NFT the higher the level of access in seating or VIP areas will be. Just some ideas to start your TRON journey with Justin,” the user wrote.

Justin Sun also hinted at bringing celebrity meme coins to the Tron blockchain, with Iggy Azalea likely to be the first candidate. This potential move could mark the beginning of a new trend for celebrity-driven meme coins on the platform.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why SUI Network Outage Did Not Cause a Price Crash

Earlier today, the Layer-1 blockchain Sui experienced a two-hour blackout, halting block production and rendering transaction processing impossible. This network outage led to a slight dip in SUI’s price, falling from $3.73 to $3.64.

Despite concerns of a more significant decline, the price stabilized after the project announced that the network was fully restored and operational.

Sui Comes Back Online, Altcoin Still in Good Position

Around 10:52 UTC, web3 security firm ExVull disclosed that a DOS bug caused the Sui network outage. Fully known as a Denial-of-Service (DoS) attack, the bug” refers to a software attack that overwhelms a system with excessive traffic or requests, causing it to become unavailable to legitimate users by crashing or severely slowing its functionality.

“After our analysis, it was found that the Sui Network node occur DOS due to integer overflow,” ExVul stated.

Following this development, several exchanges halted SUI transactions as the price also dipped a little. However, nearly two hours later, the project updated its community, saying that validators had assisted in resolving the issue.

“The Sui network is back up and processing transactions again, thanks to swift work from the incredible community of Sui validators. The 2-hour downtime was caused by a bug in transaction scheduling logic that caused validators to crash, which has now been resolved,” it explained.

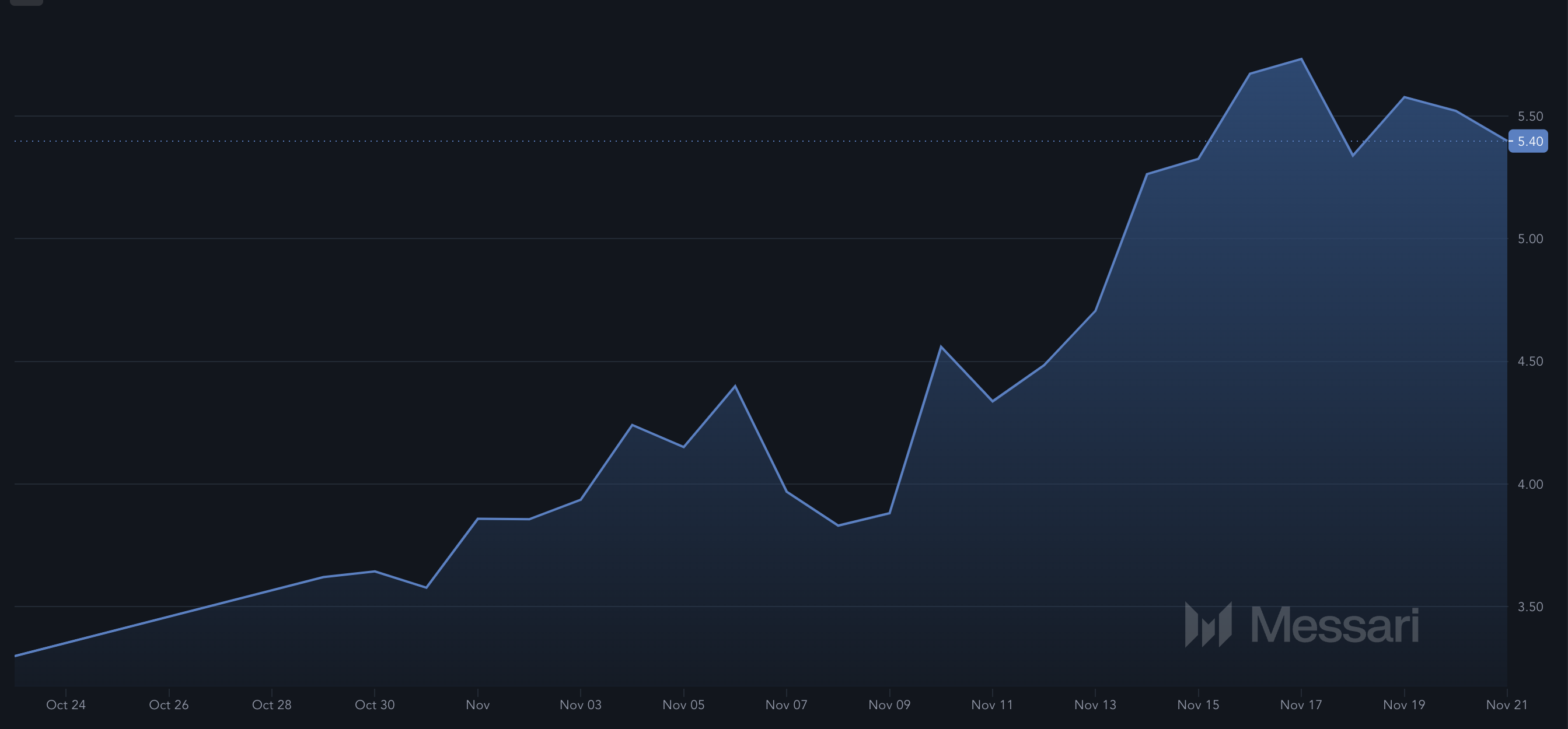

Meanwhile, data from Messari showed that, amid the outage, the Sharpe ratio remained positive. The Sharpe ratio is a key measure of risk-adjusted return, indicating how much excess return an investment generates relative to its volatility.

It helps investors assess whether the returns of a riskier asset justify the risk taken. A higher ratio signifies better risk-adjusted performance. Typically, when the ratio is negative, it means that the risk might not be worth the reward.

However, since it is positive for SUI, it indicates that accumulating the altcoin around its current value could still yield positive returns.

SUI Price Prediction: Run Above $4

On the daily chart, SUI continues to trade within an ascending channel. An ascending channel, also called a rising channel or channel up, is a chart pattern defined by two parallel upward-sloping lines.

It forms when the price shows higher swing highs and higher swing lows, indicating an ongoing uptrend. Furthermore, the Chaikin Money Flow (CMF) has increased, suggesting that buying pressure has outpaced distribution.

If this continues, SUI’s price could climb above $4. However, if a Sui network outage occurs again, this might not happen. In that scenario, the value could drop below $3.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Aptos Partners with Circle and Stripe to Revitalize Network

The Aptos Foundation announced a new partnership with Circle and Stripe, hoping to revolutionize its network functionality. Circle’s CCTP and USDC stablecoin will enhance blockchain interoperability, while Stripe will attract TradFi by simplifying fiat interactions.

Aptos has set ambitious goals with this partnership, but APT’s upward momentum has stagnated.

Aptos Partners with Circle and Stripe

According to a new announcement from the Aptos (APT) Foundation, its network is integrating Circle’s USDC stablecoin and Cross-Chain Transfer Protocol (CCTP). Additionally, Aptos is integrating the payment platform Stripe, generally streamlining fiat-related features. These include on- and off-ramps, payment processing, and TradFi ease of adoption.

“Once the integration is complete, users will be able to seamlessly transfer USDC between Aptos and 8 major blockchains. In addition to USDC and CCTP, Stripe will soon launch its payment services on Aptos, creating a reliable fiat on-ramp to streamline merchant pay-ins and payouts using Aptos-compatible wallets,” the firm claimed via press release.

In other words, Aptos aims to use this partnership to make itself “the ultimate hub for interoperable DeFi.” These companies will approach this goal from both ends: enticing new users and investors while substantially improving the core experience. This partnership marks a new development for Stripe’s integration with crypto.

Indeed, Stripe took a six-year hiatus from cryptocurrency payments, which only ended this April. Since then, however, it’s been engaging seriously with the industry. The firm entered an earlier partnership with Circle this June, hoping to promote USDC adoption. Additionally, Stripe acquired Bridge, a crypto payment platform, last month.

For its part, Aptos is undertaking a recovery process. Despite a major price spike in March, it suffered a lingering decline for most of 2024. The asset began regaining steam in October, and the November bull market has brought increased optimism. Still, its gains have stagnated for about a week.

This partnership between Aptos, Circle, and Stripe may help APT regain its forward momentum. These ambitious new features will greatly add functionality and accessibility to Aptos’ network. Still, the firm has set a very ambitious goal for itself: to solidify “its place as a leader in interoperable DeFi and enterprise-grade blockchain technology.” Only time can tell its success level.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

The SEC is quietly meeting with several issuers to discuss approving a Solana ETF, claims Fox Business reporter Eleanor Terrett. With Trump’s impending pro-crypto administration, the SEC seems more inclined to approve such a product.

However, anti-crypto figure Gary Gensler is still nominally in charge of the SEC, and public progress might not begin until 2025.

Solana ETF Approval Is Getting Closer

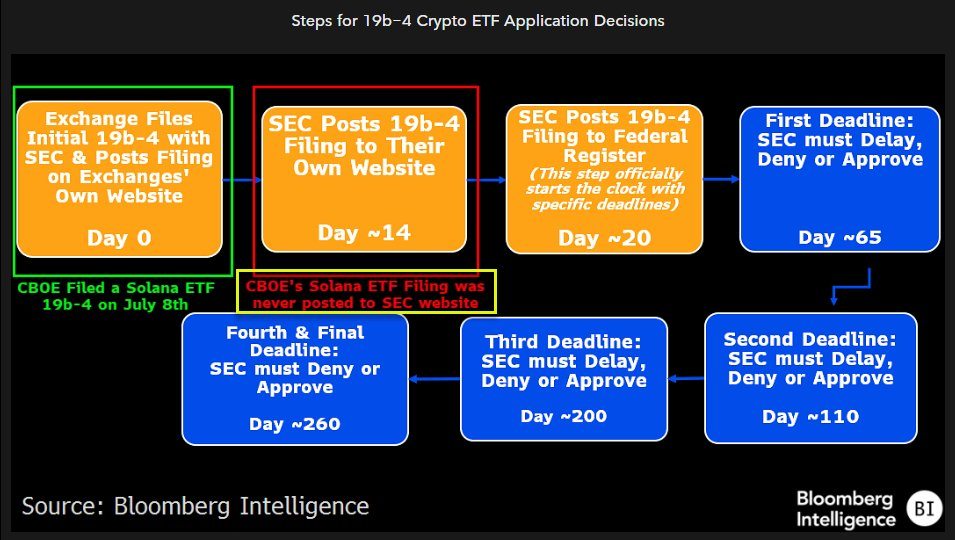

According to a scoop from Fox Business reporter Eleanor Terrett, the SEC and several ETF issuers are in talks to approve a Solana ETF. Currently, Brazil is the only country that has given this product a green light. As recently as September, Polymarket odds gave the SEC a dismal 3% chance of approving it. This reluctance, however, might soon be changing:

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Terrett was very clear about the impetus for this progress in negotiations: Donald Trump’s re-election. On the campaign trail, Trump vowed to significantly reform US crypto policy, and one cornerstone was firing anti-crypto SEC Chair Gary Gensler. Gensler has apparently conceded to his impending ouster, and his replacement will undoubtedly support the industry.

Previous attempts have floundered at an early step in the process. Once the SEC officially acknowledges an application, it must confirm or deny it within a 240-day window. Previous filings have lingered in limbo at this stage. However, the list of candidates is now growing: Canary Capital filed for a Solana ETF in October, and BitWise did the same earlier today.

Nonetheless, these positive negotiations still only consist of anonymous rumors. The Commission has not publicly moved to begin this process, and Gensler is still nominally in charge. Terrett posits that the SEC will only make serious progress on the Solana ETF at the start of 2025. Compared to previous pessimism, however, this is a complete sea change.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market16 hours ago

Market16 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum13 hours ago

Ethereum13 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market20 hours ago

Market20 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Regulation19 hours ago

Regulation19 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Regulation23 hours ago

Regulation23 hours agoDonald Trump’s transition team considering first-ever White House crypto office

-

Market19 hours ago

Market19 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates

-

Market18 hours ago

Market18 hours agoDogecoin (DOGE) Price Momentum Weakens Despite Rally