Ethereum

Switzerland’s 4th largest bank ZKB launches Bitcoin and Ethereum trading

- Zürcher Kantonalbank (ZKB) now offers Bitcoin and Ethereum trading via ZKB eBanking and Mobile Banking.

- The bank has partnered with Crypto Finance AG and will use Fireblocks for secure custody.

- The services are available only to Swiss residents with the necessary agreements signed.

Zurich Cantonal Bank, Switzerland’s fourth-largest bank locally known as Zürcher Kantonalbank (ZKB), has taken a major step into the cryptocurrency realm with the launch of Bitcoin (BTC) and Ethereum (ETH) trading services.

Announced on September 4, this development marks a significant milestone in the mainstream adoption of digital currencies by traditional financial institutions.

ZKB has partnered with Crypto Finance AG and Fireblocks

ZKB’s new offering allows retail clients to trade and store Bitcoin (BTC) and Ether (ETH) directly through its digital platforms: ZKB eBanking and ZKB Mobile Banking. This integration provides a seamless experience for customers, who can now manage their cryptocurrency holdings alongside their traditional investments without needing separate wallets.

To ensure a secure and regulated environment for these transactions, ZKB has partnered with Crypto Finance AG, a subsidiary of Deutsche Börse Group.

Crypto Finance AG’s technology, licensed by both FINMA and BaFin, will support the ZKB’s trading operations, ensuring compliance and security.

ZKB has also developed its own crypto custody solution, with Fireblocks playing a key role in safeguarding digital assets.

This strategic moves positions ZKB at the forefront of the cryptocurrency revolution, providing a centralized platform for trading and storage that eliminates the need for clients to manage their own private keys.

According to Alexandra Scriba, ZKB’s head of institutional clients, the bank’s approach offers high levels of security and the potential for integrating other digital currencies and applications in the future.

Currently, the crypto trading services are only available to clients residing in Switzerland and to activate an account, clients must sign agreements for trading, securities, and a “Consent Declaration Disclosure.”

This cautious approach reflects ZKB’s commitment to maintaining robust security standards while expanding access to digital currencies.

ZKB’s entry into the cryptocurrency market underscores a broader trend within the banking sector, where institutions are increasingly embracing digital assets. Competitors like PostFinance are also exploring crypto services, highlighting a growing acceptance of digital currencies in traditional finance, paving the way for more integrated and accessible cryptocurrency solutions.

Ethereum

Ethereum Drops Below Key Realized Price: Last Time Was March 2020 Before A Rally

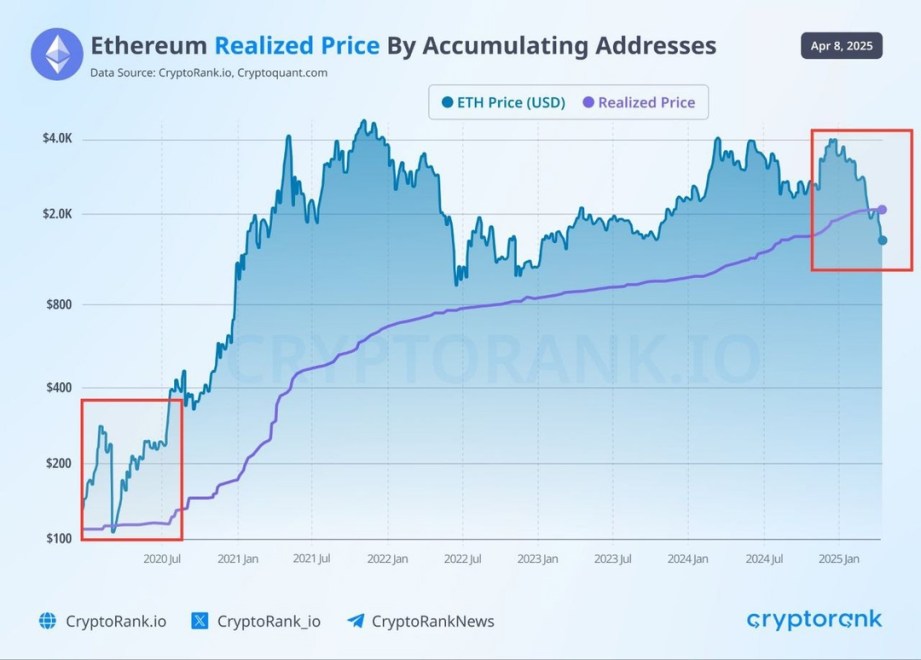

Ethereum has suffered yet another blow this week, sliding to a fresh low of around $1,380 — a level not seen since March 2023. The ongoing downtrend has left investors increasingly concerned, with many now questioning whether ETH’s long-term bullish structure is still intact. Market conditions remain harsh, driven by persistent macroeconomic tensions, rising global instability, and uncertainty stemming from U.S. trade and fiscal policies.

Sentiment across the crypto space continues to deteriorate, and Ethereum’s price action reflects that unease. After months of struggling to hold key support levels, the breakdown below $1,500 has added to fears that a deeper correction may be unfolding.

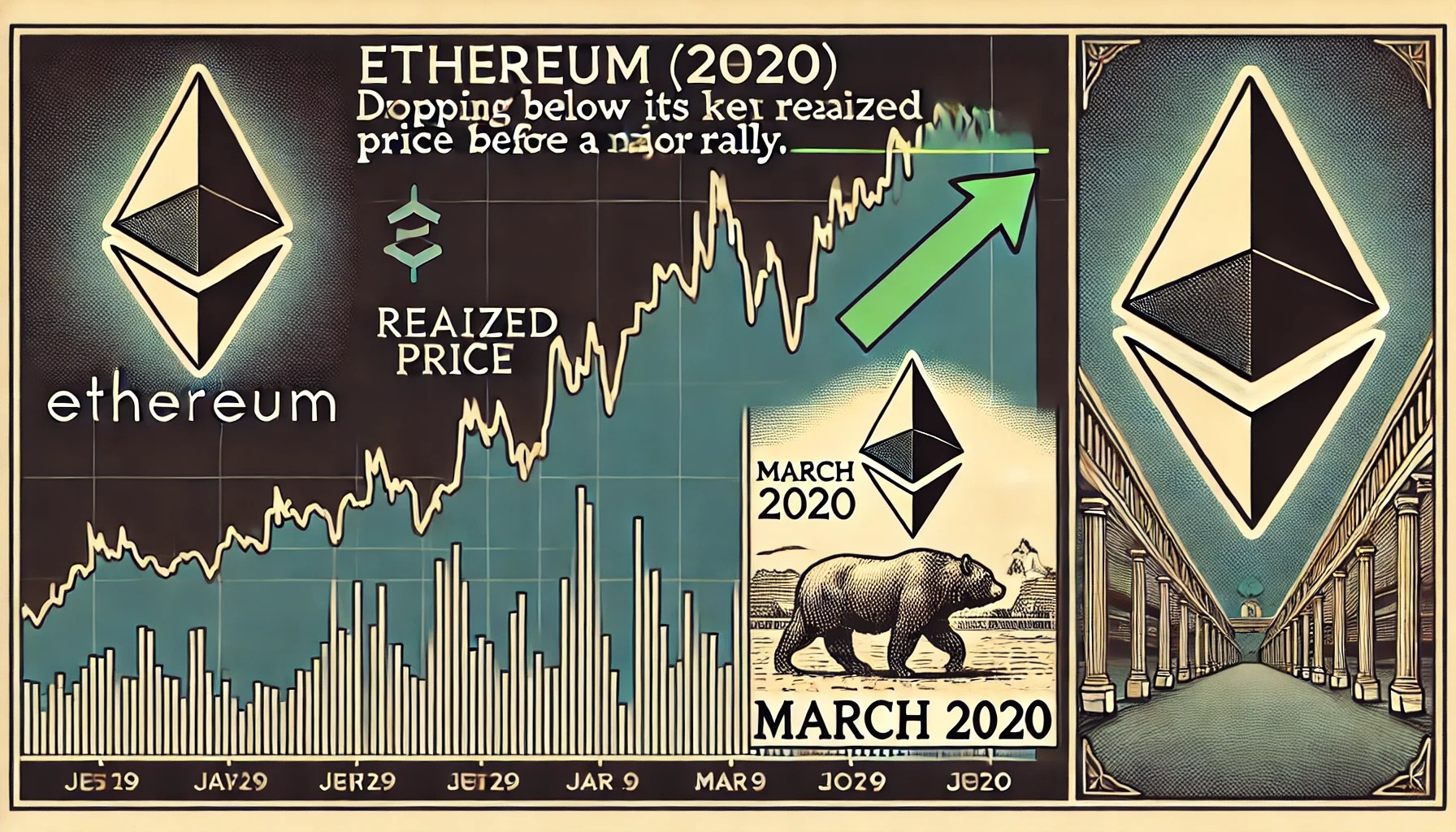

However, amidst the gloom, there may be a silver lining. According to CryptoRank data, Ethereum is now trading below its realized price — a rare occurrence historically associated with market bottoms and strong recovery phases.

While the near-term outlook remains uncertain, such rare on-chain signals could indicate that Ethereum is entering a key accumulation zone. The coming days and weeks will be critical in determining whether this is just another leg down — or the beginning of a long-term reversal.

Ethereum Sinks Below Realized Price As Fear Takes Over The Market

Ethereum has now lost over 33% of its value since late March, triggering deep concern among investors and analysts alike. The price plunge has brought ETH down to levels not seen in over two years, sparking panic and despair among holders who once expected 2025 to be a breakout year for altcoins. Instead, Ethereum has become a symbol of market fragility as the broader macroeconomic landscape continues to worsen.

Trade war fears, inflationary pressure, and a potential global recession are shaking financial markets to their core. In this climate, high-risk assets like Ethereum are among the first to suffer. As capital exits speculative assets in favor of safer havens, ETH’s selloff has only accelerated — and investor confidence has taken a serious hit.

However, there may be a glimmer of hope in the data. Top crypto analyst Carl Runefelt recently pointed out on X that Ethereum is now trading below its realized price of $2,000 — a rare occurrence that has historically signaled major turning points in ETH’s price trajectory.

Runefelt emphasized that the last time ETH dipped below its realized price was in March 2020, when it crashed from $283 to $109 — only to recover strongly in the following months. While the current environment is full of uncertainty, such on-chain metrics hint at the possibility that ETH is entering an accumulation phase once again.

Still, confidence remains fragile, and price action must stabilize before any real bullish narrative can return. Ethereum’s next moves will be critical in determining whether this level marks a true bottom — or just another stop on the way down.

ETH Struggles Below $1,500 With No Clear Support in Sight

Ethereum is currently trading below the $1,500 level after suffering a brutal 50% decline since late February. The aggressive selloff has erased months of gains and left investors in a state of uncertainty, as ETH shows no signs of recovery. Market sentiment remains overwhelmingly bearish, and there is little indication that a bottom has been reached.

At this stage, Ethereum lacks a clearly defined support zone. Bulls have lost control, and price action continues to drift lower with weak demand and increasing fear. For a meaningful reversal to begin, ETH must first reclaim the $1,850 level — a zone that previously served as a key support and now stands as major resistance.

Until that happens, any upside attempt is likely to be met with strong selling pressure. The situation becomes even more precarious if Ethereum loses the $1,380 level, which has so far acted as a psychological threshold. Falling below this area could open the door to a deeper correction toward the $1,100–$1,200 range.

With macroeconomic tensions still high and volatility expected to persist, traders and investors will be watching closely to see whether Ethereum can stabilize — or continue its sharp decline.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

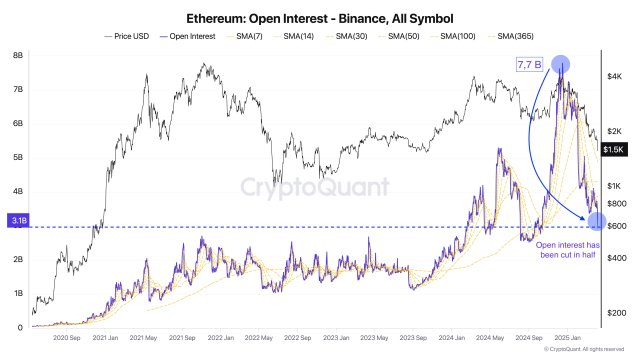

Ethereum Traders Pulling Back? ETH’s Open Interest On Binance Sees Continued Decline

After a slight rebound on Tuesday to the $1,600 threshold, Ethereum‘s price was faced with notable resistance, which led to a sudden breakdown to $1,450. ETH’s persistent weak performance this year has impacted investor conviction in the market, triggering significant selling pressure in the past few weeks.

Bearish Sentiment Toward Ethereum Grows On Binance

The bearish sentiment toward Ethereum has increased in crypto exchanges, especially on Binance, the world’s largest cryptocurrency exchange. Verified author and on-chain expert for CryptoQuant, Darkfost, revealed that ETH’s Open Interest (OI) on Binance continues to see a steady decline.

The persistent drop in open interest on the crypto exchange indicates that ETH‘s derivatives market is cooling down. It also reflects rising caution among investors and traders as the altcoin battles to sustain its bullish momentum.

Darkfost highlighted that the open interest on Binance continues to drop without stopping and is now changing under its 365 Simple Moving Average (SMA). This movement implies that speculative activity is pulling back as investors might be waiting for more certain signals before making a forceful comeback to the market.

After hitting an all-time high of $7.78 billion in December, the open interest on Binance has decreased by almost 50% between December and April, wiping out nearly $4 billion within the period. The chart shows that ETH’s open interest on Binance is now valued at $3.1 billion, suggesting a massive shift in investor sentiment on the platform.

According to the on-chain expert, Ethereum’s price has been significantly impacted by this sharp drop, and there are no indications that the ongoing downward trend will be stopping anytime soon. Furthermore, it reflects the magnitude of recent liquidations as well as a heightened aversion to risk among investors.

In the event that the trend continues, Darkfost noted that “Ethereum’s price is still far from entering a period of stability.” Thus, Darkfost has urged traders to monitor investors’ behavior on Binance, which remains a valuable indicator since the largest trade volumes across the market are regularly captured by the crypto platform.

ETH Is Poised For A Massive Upswing To New All-Time Highs

With ETH’s open interest decreasing on the largest crypto exchange and the market extremely volatile, this raises concerns about its price stability. Nonetheless, many crypto analysts are confident that a rebound could be on the horizon, which is likely to push the altcoin toward new highs.

Market expert and trader Milkybull Crypto shared a post on the X platform, outlining Ethereum’s potential to surge significantly in the upcoming weeks. At the time of the post, ETH was trading at $1,585, and the expert stated that the altcoin typically marks a macro bottom at this level. Should this level hold, Milkybull anticipates a huge rally, putting his next target at the $10,000 milestone.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Major Ethereum Whale Dumps 10,000 ETH After 2 Years, Is It Time To Get Out?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

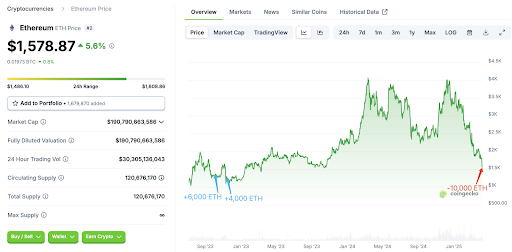

An Ethereum whale has dumped its ETH holdings after holding them for over two years, even through a bull market. This capitulation from the ETH whale suggests it might be a good time to offload the leading altcoin, with a further crash in the coming weeks a possibility.

Ethereum Whale Dumps 10,000 ETH After 900 Days

In an X post, on-chain analytics platform Lookonchain revealed that an Ethereum whale finally capitulated after holding for over 900 days, selling all their 10,000 ETH for $15.71 million. This whale had originally bought 10,000 ETH for $12.95 million at an average price of $1,295 on October 4 and November 14, 2022.

Related Reading

The Ethereum whale didn’t sell any of their ETH holdings, even when the leading altcoin broke through $4,000 twice in 2024. However, the whale has now capitulated with the Ethereum price below $1,500, nearing their average entry price of $1,295. The investor sold the coins for a $2.75 million profit, while their unrealized profit was $27.6 million at its peak.

This Ethereum whale isn’t the only one who is capitulating. As Bitcoinist reported, ETH whales have dumped over 500,000 coins in the space of 48 hours. This development is thanks to Ethereum’s massive crash, with the leading altcoin at risk of dropping lower. This decline is part of a broader crypto market crash, which has occurred due to Donald Trump’s tariffs.

Trump’s tariffs have led to a major trade war with China, which has promised not to back down, further sparking concerns among investors. As such, the Ethereum price looks more likely to suffer a further crash in the meantime, which explains why these Ethereum whales are capitulating to cut their losses.

Donald Trump’s World Liberty Financial Also Capitulating?

Donald Trump’s World Liberty Financial (WLFI), an Ethereum whale, looks to be feeling the heat and might have already started capitulating. Citing Arkham Intelligence’s data, Lookonchain revealed that a wallet possibly linked to WLFI sold 5,471 ETH for $8.01 million at the price of $1,465, representing a loss for the whale in question.

Related Reading

World Liberty Financial had previously bought 67,498 ETH for $210 million at an average price of $3,259. The crypto firm is now sitting on an unrealized loss of $125 million, seeing as the Ethereum price has declined by over 50% since their purchases.

Crypto analyst Ali Martinez predicts that the Ethereum price will crash further in the short term, indicating that Ethereum whales like WLFI could witness more unrealized loss on their ETH holdings. Martinez stated that $1,200 could be where the leading altcoin finds its footing.

At the time of writing, the Ethereum price is trading at around $1,400, down over 8% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

-

Altcoin24 hours ago

Altcoin24 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Altcoin21 hours ago

Altcoin21 hours agoBinance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?

-

Market21 hours ago

Market21 hours agoXRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

-

Bitcoin20 hours ago

Bitcoin20 hours agoWhy Bitcoin’s Value Could Benefit from Trade War, Analyst Explains

-

Bitcoin19 hours ago

Bitcoin19 hours agoGoldman Sachs Raises US Recession Odds to 45%

-

Market7 hours ago

Market7 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Market19 hours ago

Market19 hours agoHow Ripple’s $1.25 Billion Deal Could Surge XRP Demand

-

Bitcoin24 hours ago

Bitcoin24 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US