Bitcoin

Bitcoin Vs. AI — Who’s Draining The Power Grid Faster?

Energy rivalry between Artificial Intelligence and Bitcoin mining is heating up. As tech firms improve AI, they compete with Bitcoin miners for energy. This competition reshapes US energy consumption, as both sectors have driven unprecedented electrical demand.

AI data centers are leading in the race for energy consumption. These power-thirsty projects have forecasts indicating they will consume anywhere from 85 to 134 TWh of electricity annually by the year 2027. This is roughly equal to the yearly energy consumption of Norway or Sweden and demonstrates how massive an amount of power needs to be utilized in order to execute complex AI models such as ChatGPT.

Each one of these models runs on large farms of servers, and to run ChatGPT for every search conducted by Google, estimates are that the number needed would be over 500,000 servers, with estimated consumption of about 29.2 TWh annually.

According to estimates, Bitcoin mining uses 120 TWh of energy annually. Bitcoin mining consumed 0.4% of global electricity last year, which is a massive figure. Analysts expect AI to outperform Bitcoin miners in energy demand by 2027, shifting 20% of their power capacity to AI.

Competing For Resources

With the growth of both AI and Bitcoin mining, they are increasingly competing for some of the same energy resources. Competition is soaring, with major technology companies such as Amazon and Microsoft aggressively pursuing energy assets that, until recently, had been controlled by crypto miners.

Competition is warming up wherein, for some mining operators, cash is made through leasing and selling power infrastructure while for others, the risk of losing access to the electricity that keeps them in business becomes a reality.

This makes for such a mad scramble for energy that data centers are projected to gobble up as much as 9% of all US electricity by the end of the decade, more than doubling their current consumption.

Curiously, while crypto mining relies more on renewable energy sources-as it gets approximately 70% of its energy consumption from green sources-AI data centers mostly depend on fossil fuels.

Image: AsianInvestor

This therefore presents disparities in the views on the sustainability of both technologies. As AI demand continues to see an upward movement, tech companies weigh their carbon footprint against other source alternatives, including nuclear power.

The Road Ahead

The future of energy consumption in the tech industry is highly unpredictable. While AI continues to push the limits, its appetite for energy will see a corresponding increase. And unless efficiency starts to outpace growth radically, the environmental consequence is sure to be dire.

According to the International Energy Agency, the combined energy consumption of AI and Bitcoin mining would surge to 1,050 TWh by 2026-a quantity of electricity needed by an entire country.

But one question will always remain, as with most high-stakes energy races: will AI and Bitcoin mining be able to coexist, as in not sucking up all the earth’s resources?

How that is accomplished depends on how well these industries are able to innovate and adapt to the rising tide of sustainable energy solutions. As they race for power, the future of technology and the environment is hanging in the balance.

Featured image from Ken O./LinkedIn, chart from TradingView

Bitcoin

Bitcoin’s Put-to-Call Ratio Tops 1.0: Bearish Signs Ahead?

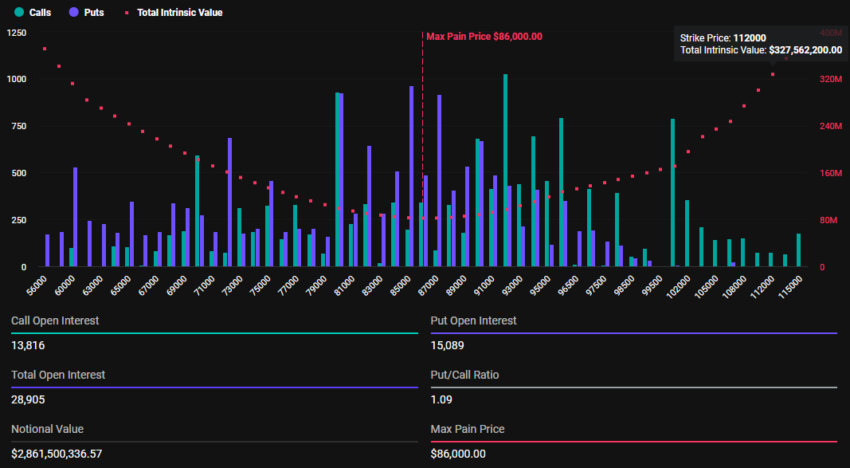

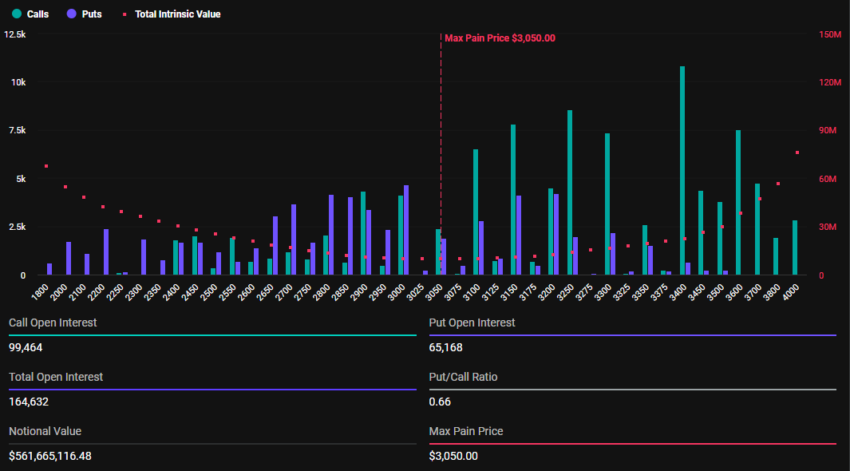

Crypto markets will witness $3.42 billion in Bitcoin and Ethereum options contracts expire today. The massive expiration could cause a short-term price impact, particularly as markets wait expectantly for Bitcoin to tag $100,000.

With Bitcoin options valued at $2.86 billion and Ethereum at $561.66 million, traders are bracing for potential volatility.

Unlike Ethereum, Traders Bet On Bitcoin Price Pullback

There has been a significant increase in Bitcoin (BTC) and Ethereum (ETH) contracts due for expiry today compared to last week. According to Deribit data, 28,905 Bitcoin options contracts will expire on Friday with a put-to-call ratio of 1.09 and a maximum pain point of $86,000.

On the other hand, 164,687 Ethereum contracts are due for expiry today, with a put-to-call ratio of 0.66 and a maximum pain point of $3,050.

Bitcoin’s Put-to-call ratio stands above 1, indicating a generally bearish sentiment despite BTC’s whales and long-term holders fueling its recent growth. In comparison, Ethereum counterparts have a put-to-call ratio of 0.66, reflecting a generally bullish market outlook.

The put-to-call ratio gauges market sentiment. Put options represent bets on price declines, whereas call options point to bets on price increases.

When this ratio is above 1, it suggests a lack of optimism in the market, with more traders betting on price decreases. On the other hand, a put-to-call ratio below 1 suggests optimism in the market, and more traders are betting on price increases.

Bitcoin’s Put-to-Call Ratio, Implications for BTC

As options near expiration, traders are betting on BTC prices dropping and ETH prices rising. According to the Max Pain Theory in options trading, BTC and ETH could each pull toward their maximum pain points (strike prices) of $86,000 and $3,050, respectively. Here, the largest number of contracts — both calls and puts — would expire worthless.

Notably, price pressure for both assets will ease after Deribit settles contracts at 08:00 UTC today. At the time of writing, however, BTC was trading for $98,876, whereas ETH was exchanging hands for $3,389. Meanwhile, in line with put-to-call ratios, analysts at Greeks.live anticipate an extended move north for ETH and say BTC is at the cusp of a correction.

“With about 8% of positions expiring this week, the big rally in Ethereum has led to a significant increase in ETH major term options IV [implied volatility], while BTC major term options IV has remained relatively stable. The market sentiment remains extremely optimistic at this point,” Greeks.live analysts said.

The analysts also note that while Bitcoin risks a correction, the generalized market rally keeps this potential pullback at bay. They ascribe the positive sentiment in the market to significant capital inflows into ETFs (exchange-traded funds), specifically BlackRock’s IBIT options, which started to trade only recently alongside a strongly driven spot bull market.

Nevertheless, with today’s high-volume expiration, traders should anticipate fluctuations in Bitcoin and Ethereum prices that could shape their short-term trends.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Marathon Digital Raises $1B to Expand Bitcoin Holdings

Marathon Digital Holdings, one of the largest Bitcoin miners, has completed a record $1 billion offering of 0% convertible senior notes due 2030. The net proceeds from the sale were approximately $980 million.

According to the firm’s statement, the net proceeds will be primarily used to buy Bitcoin.

Marathon Digital Holds over $2.5 Billion Worth of Bitcoin

After its last purchase in September, Marathon Digital’s Bitcoin holdings stand at 25,945 BTC. This is currently worth approximately $2.52 billion, as Bitcoin reached an all-time high of $98,000 earlier today.

However, the company’s decision to expand its holdings potentially points to a larger bullish cycle for the token in the long term. According to its press release, Marathon Digital plans to use $199 million of the net proceeds to repurchase existing convertible notes due 2026.

The remainder will be used to acquire additional Bitcoin and for general corporate purposes. Marathon Digital is currently the second largest Bitcoin holder among publicly traded companies.

The notes offer flexibility, with options for conversion into cash, shares of Marathon’s common stock, or a combination of both. Redemption terms include the ability for the company to redeem the notes at full principal value plus accrued interest.

“$1 Billion. 0% interest. MARA has completed the largest convertible notes offering ever amongst BTC miners. The mission, as always: Provide value. Acquire #bitcoin,” the company wrote on X (formerly Twitter).

Increasing Bitcoin Acquisition Among Public Firms

Marathon Digital is following an ongoing trend of public companies increasing their Bitcoin holdings in this bull market. Earlier this week, MicroStrategy announced plans to issue $1.75 billion in convertible notes maturing in 2029. The proceeds will be used to fund additional Bitcoin purchases.

On the same day, the company secured $4.6 billion worth of Bitcoin, building on a $2 billion acquisition from the prior week.

Bitcoin’s all-time high and these aggressive purchases propelled MicroStrategy’s stock price by nearly 120% in a single month. The largest Bitcoin holder also entered the list of top 100 public companies in the US.

Meanwhile, Marathon Digital has faced challenges despite its growing Bitcoin reserves. The company reported a $125 million net loss in Q3. This was driven by a $92 million year-over-year increase in operating costs.

However, its operational capacity has strengthened. Earlier this month, its energized hash rate surged by 93%, signaling increased mining efficiency. Marathon Digital also signed an $80 million agreement with the Keynan government to expand its Bitcoin mining capabilities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

cbBTC Surges Past $1 Billion as Coinbase Ends WBTC Support

Coinbase, the largest US-based crypto exchange, has announced it will suspend trading for Wrapped Bitcoin (WBTC) on December 19, 2024, at approximately 12 p.m. ET.

The decision, revealed in a post on X (formerly Twitter), cites a routine review of its listed assets to ensure compliance with listing standards.

Coinbase Sidesteps WBTC Amid cbBTC Boom

The suspension will apply to both Coinbase Exchange and Coinbase Prime. Although trading will cease, WBTC holders will retain full access to their funds and the ability to withdraw them at any time. In preparation for the transition, Coinbase has moved WBTC trading to a limit-only mode, where users can place and cancel limit orders while matches may still occur.

“Coinbase will suspend trading for WBTC (WBTC) on December 19, 2024, at or around 12 pm ET. Your WBTC funds will remain accessible to you, and you will continue to have the ability to withdraw your funds at any time. We have moved our WBTC order books to limit-only mode. Limit orders can be placed and canceled, and matches may occur,” Coinbase detailed.

Coinbase’s move to suspend WBTC comes amid the rapid success of its wrapped Bitcoin token, cbBTC. Recently, cbBTC surpassed a $1 billion market capitalization, reflecting growing adoption and trust within the crypto community. This milestone has further cemented cbBTC’s position as a strong competitor to WBTC in the decentralized finance (DeFi) space.

As of this writing, data on Dune shows that cbBTC market capitalization has increased to $1.44 billion. CBTC’s native availability on networks like Solana, Ethereum, and Base has significantly expanded its accessibility, with Arbitrum being the latest addition.

“cbBTC is live on Arbitrum. cbBTC is an ERC-20 token that is backed 1:1 by Bitcoin (BTC) held by Coinbase. It is natively available on Arbitrum and securely accessible to more users across the Ethereum ecosystem,” Coinbase shared on Tuesday.

Additionally, prominent DeFi protocol Aave is targeting cbBTC for its Version 3 (V3) platform, enhancing its utility within the ecosystem. This growing momentum may have played a key role in Coinbase’s decision to phase out WBTC trading.

WBTC Core Team Urge Coinbase to Reconsider

The team behind Wrapped Bitcoin expressed regret and surprise at Coinbase’s decision. In a statement on X, WBTC’s core team emphasized its commitment to compliance, transparency, and decentralization.

“We regret and are surprised by Coinbase’s decision to delist WBTC…We urge Coinbase to reconsider this decision and continue supporting WBTC trading,” the team said.

The statement outlined WBTC’s longstanding reputation for novel mechanisms, regulatory compliance, and decentralized governance. Highlighting its seamless integration with DeFi protocols, WBTC described itself as an essential liquidity solution for Bitcoin users. Urging Coinbase to reconsider, WBTC reaffirmed its readiness to address any concerns or provide additional information to support its case.

Meanwhile, Coinbase’s announcement has sparked mixed reactions across the crypto community. Some users criticized the exchange, suggesting the decision reflects an inability to handle competition.

“Coinbase can’t handle fair competition?? WBTC superior to cbBTC” said Gally Sama in a post.

Nevertheless, others support the move, citing concerns over WBTC’s custody model, with one user referencing BitGo’s recent adoption of a multi-jurisdictional custody system.

“You put custody in the hands of a fraud. What did you think was gonna happen?” the user expressed.

This critique aligns with growing fears about Justin Sun’s involvement in WBTC’s custody processes, as BeInCrypto reported recently. Some users have acted preemptively to avoid potential risks, with one commenter sharing their reservations.

“When Sun got on the multisig for WBTC, I sent all my WBTC on OP to Coinbase and exchanged for true BTC that I withdrew to my hardware wallet… You gave me confirmation just now that I made the right move,” they wrote.

The decision to suspend WBTC trading could mark a pivotal moment in the competition between wrapped Bitcoin solutions. While cbBTC’s integration across multiple blockchain networks has gained momentum, skepticism surrounding WBTC’s custody model and leadership has intensified.

Justin Sun has voiced criticism of Coinbase’s cbBTC strategy, labeling it a setback for Bitcoin’s broader adoption. As the debate continues, the industry watches closely to see whether Coinbase’s cbBTC will solidify its dominance or if WBTC can regain its position as a leading wrapped Bitcoin solution. Regardless, the shifting dynamics reflect the importance of transparency, governance, and community trust in shaping the future of DeFi.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin22 hours ago

Bitcoin22 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation17 hours ago

Regulation17 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market22 hours ago

Market22 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market14 hours ago

Market14 hours agoGOAT Price Sees Slower Growth After Reaching $1B Market Cap

-

Market20 hours ago

Market20 hours agoAptos Partners with Circle and Stripe to Revitalize Network

-

Altcoin14 hours ago

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

-

Regulation20 hours ago

Regulation20 hours agoGary Gensler To Step Down As US SEC Chair In January

-

Ethereum20 hours ago

Ethereum20 hours agoAnalyst Reveals When The Ethereum Price Will Reach A New ATH, It’s Closer Than You Think