Bitcoin

Key for Crypto Market Trends

The cryptocurrency markets are closely watching several key US macroeconomic events this month, which could significantly impact portfolios. Fed interest rates announcements in particular will be a key print in September.

Positive economic data often influences investor sentiment in the crypto space. As traditional markets strengthen, investors become more confident in the overall economy, and vice versa. This could influence risk appetite and, ultimately interest in alternative assets like cryptocurrencies

US Economic Events to Watch in September

Bitcoin (BTC) has slipped further from the $60,000 psychological level, continuing its sluggish performance despite positive catalysts. Factors like growing institutional adoption, a potentially more favorable regulatory environment, and expected Federal Reserve (Fed) rate cuts have done little to boost BTC’s price.

Currently, Bitcoin is over 20% below its recent all-time high of nearly $73,500, recorded more than five months ago. As the new month begins, crypto market participants are closely watching key events, particularly because historical data indicates that September has traditionally been Bitcoin’s worst-performing period.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Non-Farm Payrolls, Unemployment Rates

Investors will keep a close eye on the upcoming US Non-Farm Payrolls (NFP) report, which includes key data on job creation and the unemployment rate. The July report showed weaker-than-expected job growth with 114,000 jobs added, leading to a median forecast of 162,000 for August.

If August’s NFP figures are strong and the unemployment rate declines, it could indicate a robust economy, which might positively influence investor sentiment toward cryptocurrencies. Employment-related reports like these can significantly affect market sentiment, risk appetite, and the overall economic outlook, indirectly impacting Bitcoin and the broader crypto market.

Before the NFP report, the Job Openings and Labor Turnover Survey (JOLTS) data, set to be released on Wednesday, will offer insights into the labor market’s health. A median forecast of 8.1 million job openings in July, slightly down from 8.18 million, could indicate a growing economy, increased consumer spending, and potential wage growth.

Additionally, the ADP National Employment Report, due on Thursday, will provide a snapshot of private sector employment. If July’s ADP report exceeds the previous 122,000 jobs added, it would signal strong job creation and economic growth

Donald Trump Debate Against Kamala Harris

On September 10, the Republican and Democrat presidential candidates for the upcoming November elections, Donald Trump and Kamala Harris, will participate in a debate. With cryptocurrencies and digital assets becoming key issues in the campaign, this event could trigger volatility in the Bitcoin and broader cryptocurrency markets.

Both parties have shown an interest in crypto, with Harris reportedly warming up to pro-crypto policies.

“They’ve expressed that one of the things that they need are stable rules, rules of the road…focus on cutting needless bureaucracy and unnecessary regulatory red tape… innovative technologies while protecting consumers and creating a stable business environment with consistent and transparent rules of the road,” Bloomberg reported, citing Brian Nelson, a senior advisor on Vice President Harris’ campaign.

On the Republican side, Trump’s team is working to position the US as the world crypto capital. As both candidates seek to connect with the crypto community, the debate is expected to be intense, especially given Trump’s combative style and Harris’s background as a prosecutor.

US CPI

The US Consumer Price Index (CPI) data for August, scheduled for release on September 11, will be one of the key economic indicators for the month. This data measures the rate of inflation by tracking price changes in consumer goods and services. In July, the CPI inflation rate came in at 2.9%, slightly lower than the 3% recorded in June, according to the US Bureau of Labor Statistics (BLS).

The August CPI data will be crucial for determining whether inflation is continuing to slow, as the Federal Reserve targets a 2% inflation rate. If the CPI falls below 2.9%, it would suggest that inflation is moving in the right direction, potentially reducing the pressure on the Fed to maintain high-interest rates.

Ahead of the CPI release, speeches by New York Fed President John C. Williams on September 6 and Fed Governor Christopher Waller will be closely watched. Both have previously indicated a possible shift towards looser monetary policy as inflation shows signs of easing and the labor market stabilizes. If their upcoming speeches express confidence that the disinflationary trend is holding steady, it could be bullish for the cryptocurrency market.

Currently, price pressures are easing across the economy, with declines in goods prices, slower increases in housing costs, and more moderate wage growth contributing to a broader reduction in inflation, especially in the services sector. This trend, if sustained, could positively influence investor sentiment, particularly in riskier assets like cryptocurrencies.

US PPI

The day after the CPI data is released, the US Bureau of Labor Statistics will publish the US Producer Price Index (PPI) inflation data. In July, the PPI showed more significant easing than expected, providing relief for both stocks and Bitcoin.

Specifically, the US PPI inflation rate decreased to 2.2% year-on-year (YoY) in July, below the expected 2.3% and down from the previous period’s revised 2.7%. Similarly, Core PPI inflation, which excludes food and energy prices, dropped to 2.4% YoY in July, also below the forecast of 2.7% and significantly lower than the previous 3.0%.

If the August PPI data, set to be released on September 12, shows continued declines in inflationary pressure, it could boost risk appetite among investors, favoring assets like Bitcoin and other cryptocurrencies.

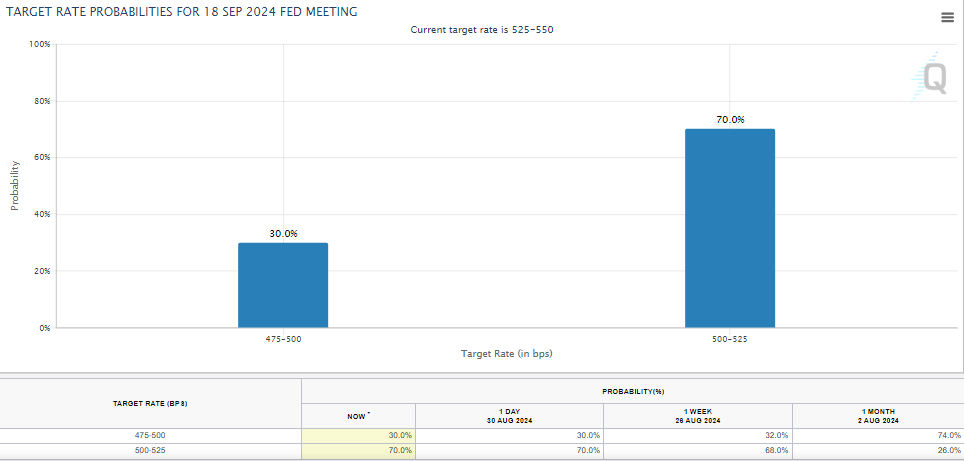

Fed Interest Rate

Another key event this month will be the Federal Reserve’s interest rate decision on September 18. In its previous meeting, the Federal Open Market Committee (FOMC) decided to keep interest rates unchanged, with policymakers unanimously voting to maintain the benchmark overnight borrowing rate between 5.25% and 5.50%.

However, during a recent meeting, Fed Chair Jerome Powell expressed increased confidence that inflation is on a sustainable path toward the Fed’s 2% target.

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks,” Powell stated.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

This signals that the Fed may be nearing the end of its rate-hiking cycle, depending on the latest economic data. Markets participants will closely watch the upcoming decision, as it could widely impact financial markets, including cryptocurrencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Vitalik’s L2 Roadmap, XRP Unlock and More

This week in crypto, a lot happened across different ecosystems, despite the broader market’s prevailing bearish sentiment. Besides Bitcoin’s (BTC) drop to a 7-day low of $81,400, here are this week’s biggest updates.

For starters, crypto markets could have a new Ethereum Layer-2 roadmap. Meanwhile, Hyperliquid users could soon start enjoying better security.

Vitalik Buterin Pushes for Ethereum L2 Roadmap

Co-founder Vitalik Buterin outlined a roadmap for Ethereum’s Layer-2 (L2) ecosystem, emphasizing decentralization, security, and cost-efficiency.

He advocates for a model that reduces centralization risks while ensuring user-friendly experiences for developers and investors.

Buterin also reiterated his commitment to open-source funding within the Ethereum community. This stance comes as the phrase “public goods” has become politically and socially loaded. The phrase is often used in ways that prioritize perception over impact.

Against this backdrop, Buterin proposed shifting the focus from “public goods funding” to “open-source funding.” He said this would encourage greater financial support for projects that enhance network security and scalability.

“A big part of the reason why the term ‘public good’ is vulnerable to social gaming is precisely the fact that the definition of ‘public good’ is stretched so easily,” Buterin argued.

His vision aligns with ongoing efforts to strengthen Ethereum’s L2 playing field and make it more resistant to potential censorship or network failures.

Hyperliquid Tightens Security After JELLY Crisis

Decentralized trading platform Hyperliquid also features among the key headlines this week in crypto. The platform announced new security measures following the JELLY incident, which resulted in substantial losses for users.

To prevent future incidents, the platform has increased monitoring, enhanced smart contract audits, and introduced stricter withdrawal limits.

Hyperliquid’s response aims to restore confidence in decentralized finance (DeFi) platforms amid rising security concerns.

“Hyperliquid is not perfect, but it will continue to iterate and grow through the collective efforts of builders, traders, and supporters,” the network explained.

BeInCrypto data shows that Hyperliquid’s HYPE token price was $11.89 as of this writing, up by a modest 0.97% in the last 24 hours.

Crypto Markets, Equities Sync Amid Recession Fears

Another headline this week in crypto was how the digital assets industry continues to mirror traditional financial (TradFi). Specifically, more than ever, the crypto market appears synchronized with indices like the S&P 500 and Nasdaq.

The synchrony comes as investors react to growing recession concerns. Bitcoin and Ethereum have followed similar downturns seen in stock markets, reinforcing the argument that cryptocurrencies are increasingly correlated with broader economic conditions.

With macroeconomic uncertainty looming, analysts warn that crypto could further decline if economic conditions worsen. However, some argue long-term investors may find opportunities in current market lows.

According to former BitMEX CEO Arthur Hayes, Bitcoin could reach $250,000 by year-end. However, this forecast is contingent on the Federal Reserve (Fed) shifting to Quantitative Easing (QE) to support markets.

Meanwhile, former Goldman Sachs executive Raoul Pal pointed to macroeconomic indicators that suggest a Bitcoin rally is imminent. He shared a chart correlating the global M2 money supply and Bitcoin’s price.

Based on history, Bitcoin tends to rise around 10 weeks after M2 increases. Pal’s analysis suggests that Bitcoin may soon enter a bullish phase.

“The waiting game is almost over…the 10-week lead is my preferred… but,” Pal stated.

Ripple Unlocked $1 Billion in XRP

Also, this week in crypto, Ripple released another 1 billion XRP from its escrow, increasing selling pressure on the token.

Historically, such unlocks have been followed by price declines. This aligns with recent Keyrock research that showed that 90% of unlocks create negative price pressure.

The tokens were moved from the “Ripple (27)” escrow address to two operational wallets, “Ripple (12)” and “Ripple (13).” This suggested the intention to distribute or sell XRP.

Investors remain cautious, watching for signs of potential accumulation. Meanwhile, others anticipate further downside as XRP struggles to regain upward momentum amid broader market uncertainty.

Notwithstanding, there are other positive developments for the XRP market. According to Glassnode data, Retail investors are choosing XRP over Bitcoin, and nearly half of XRP’s realized cap is increasing.

Another bullish fundamental for XRP this week is Coinbase’s filing for a futures contract offering in the Ripple token. The move indicates shifting regulatory tides in the US and also bolsters XRP ETF (exchange-traded funds) approval odds.

Standard Chartered Predicts Crypto Winners

Standard Chartered also made it to the top headlines this week in crypto. The bank identified Bitcoin (BTC) and Avalanche (AVAX) as the primary beneficiaries of a potential post-Liberation Day crypto market surge.

The bank suggests that favorable macroeconomic conditions and increasing institutional adoption could propel these assets higher in the coming months.

“We expect volatility to edge gradually lower once the ETF market matures, increasing Bitcoin’s share of an optimal gold-BTC portfolio. Access plus lower volatility could see Bitcoin reach the $500,000 level before Trump leaves office,” wrote Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, in an email to BeInCrypto.

This forecast aligns with the growing narrative that institutional interest will play a key role in shaping the next phase of the crypto market cycle. However, skeptics remain cautious, citing regulatory uncertainty and potential economic headwinds as factors that could delay or dampen such a rally.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Why Bitcoin Is Gaining Appeal Amid Falling US Treasury Yields

The US 10-year Treasury yield has fallen below 4% for the first time since October.

This signals a potential shift in Federal Reserve (Fed) policy, sparking renewed interest in Bitcoin (BTC) and other risk assets.

Treasury Yields and Bitcoin: A Risk-On Rotation?

As highlighted by financial markets aggregator Barchart, this decline reflects growing economic uncertainty. Specifically, it suggests rising recession fears and increasing speculation that the Fed may pivot to rate cuts sooner than expected.

A drop in Treasury yields reduces the attractiveness of traditional safe-haven assets like bonds, often encouraging investors to seek higher returns elsewhere.

Historically, Bitcoin and altcoins have benefitted from such shifts, as declining real yields increase liquidity and risk appetite. Crypto analyst Dan Gambardello emphasized this connection. He noted that lower yields are bullish for Bitcoin, aligning with expectations that a dovish Fed will drive liquidity into riskier assets.

“The irony is that when yields fall, there’s less reason to sit in “safe” bonds— And ultimately more reason to chase returns in risk assets like BTC and alts. This is why you see risk-on bulls get excited when 10-year yields begin falling,” he stated.

Additionally, BitMEX founder and former CEO Arthur Hayes pointed out that the 2-year Treasury yield sharply declined after the new tariffs were introduced. He said this reinforced the market’s expectation of imminent Fed rate cuts.

“We need Fed easing, the 2yr treasury yield dumped after Tariff announcement because the market is telling us the Fed will be cutting soon and possibly restarting QE to counter -ve economic impact,” Hayes shared on X (Twitter).

Hayes previously projected that Bitcoin could surge as high as $250,000 if quantitative easing (QE) returns in response to economic downturns.

The Trump Factor: Tariffs and Market Volatility

Further, analysts have tied the yield drop to economic uncertainty triggered by Trump’s aggressive tariff strategy. As Gambardello noted, these tariffs have spurred a flight to safety, pushing bond prices higher and lowering yields.

This trend aligns with Trump’s broader economic approach of weakening the dollar and lowering interest rates, which historically benefit Bitcoin. During his first term, Trump frequently desired a weaker dollar and lower interest rates to boost exports and economic growth. He also pressured the Fed to cut rates multiple times.

Another analyst, Kristoffer Kepin, highlighted that the M2 money supply is growing. This reinforces expectations of increased liquidity entering the market further. This influx of capital could flow into Bitcoin and altcoins as investors seek alternative stores of value amid economic turbulence.

Despite Bitcoin’s potential upside, Goldman Sachs has recommended gold and the Japanese yen as preferred hedges against US recession risks. Specifically, the bank cited its historical performance in risk-off environments.

“The yen offers investors the best currency hedge should the chances of a US recession increase,” Bloomberg reported, citing Kamakshya Trivedi, head of global foreign exchange, interest rates, and emerging market strategy at Goldman Sachs.

The bank expressed the same sentiment toward gold, raising its forecast as investors buy the yellow metal. Similarly, a Bank of America (BofA) survey showed that 58% of fund managers prefer gold as a trade war haven, while only 3% back Bitcoin.

Meanwhile, JPMorgan has raised its global recession probability to 60%. Likewise, the multinational banking and financial services company attributed the increased risk to the economic shock from tariffs announced on Liberation Day.

“These policies, if sustained, would likely push the US and possibly global economy into recession this year,” wrote head of global economic research Bruce Kasman in a note late Thursday.

However, Kasman acknowledged that while a scenario where the rest of the world muddles through a US recession is possible, it is less likely than a global downturn.

As Treasury yields continue to fall and economic uncertainty mounts, the Fed becomes a key watch for investors for signs of a policy shift.

If rate cuts and liquidity injections materialize, Bitcoin could see substantial gains, particularly as traditional assets undergo re-pricing. However, as experts caution, short-term volatility remains a key risk factor amidst these market shifts.

BeInCrypto data shows Bitcoin was trading for $82,993 as of this writing, up by a modest 1.42% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Drops as China Escalates Trade War With 34% Tariff on US

On April 4, 2025, China responded to the latest US tariff imposition by imposing an additional 34% tariff on all goods imported from the US. This escalates the already tense trade war between the two largest economies in the world.

Bitcoin dropped 3% within hours of the announcement, briefly falling below $82,000. This latest development has caused concern among investors, analysts, and participants in the cryptocurrency sector about its potential impact.

Bitcoin Investors Worry About The Escalating Trade War

According to Xinhua News Agency, China will impose a 34% tariff on all products imported from the US starting April 10. Xinhua reported that the US’s “Reciprocal Tariff” violated WTO rules, severely damaging the legal and legitimate rights of WTO members and undermining the multilateral trade system and the international trade order based on rules.

“This is a typical act of unilateral hegemony that harms the stability of the global economic and trade order. China firmly opposes this,” The spokesperson for the Ministry of Commerce said in an interview about China’s lawsuit against the US’s “Reciprocal Tariff” at the WTO.

Previously, President Trump had imposed a 34% tariff on China in addition to the 20% tariffs already imposed in two phases. This means a total of 54% tariffs were applied to China.

News from China has caused concern among crypto investors. On April 4, Bitcoin’s price dropped from $84,600 to $82,000, a 3% decrease.

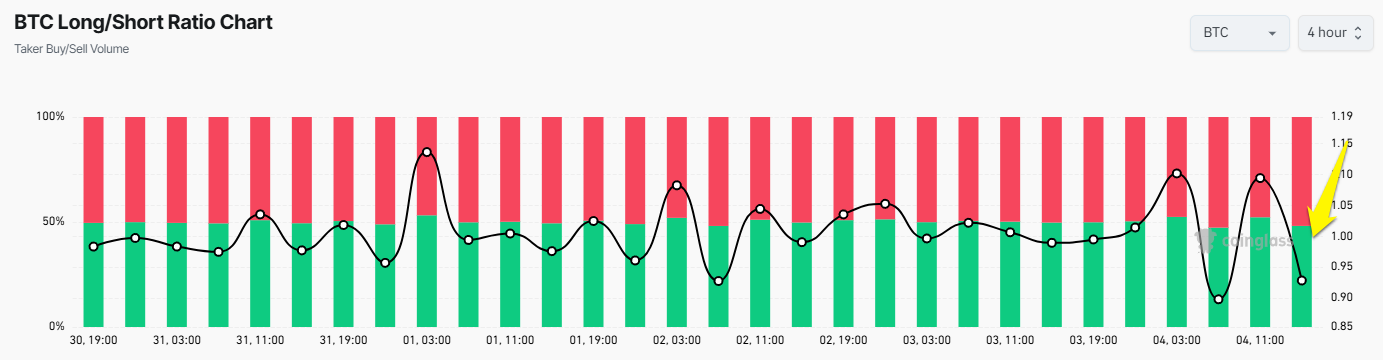

At the same time, following the news, the Long/Short ratio of Bitcoin dropped below 1, indicating a growing sentiment for short-selling, which has become dominant in the market.

Both Bitcoin and other markets have been affected. The S&P 500 fell from 5,260 points to 5,250 points, while the Dow Jones Industrial Average dropped from 41,100 points to 40,500 points. China’s actions have raised concerns about the potential escalation of the global trade war.

“The ‘Third World War’ of the trade war has begun,” The Kobeissi Letter commented.

What Will Happen to Bitcoin When The US-China Trade War Escalates?

This cryptocurrency, often praised as a hedge against economic instability, tends to behave like a risky asset during sudden uncertain periods. Historical patterns support this reaction—during the US-China trade war in 2018-2019, Bitcoin experienced significant sell-offs as tariffs escalated, only recovering when the narrative of value preservation took precedence.

A significant portion of the global cryptocurrency hardware supply chain comes from China, where companies like Bitmain dominate the production of ASIC mining machines—important devices for Bitcoin mining.

With the US now facing a 34% tariff on technology imports from China, the cost of importing these mining machines is expected to rise dramatically. Bitcoin miners in the US, already facing high energy costs and competitive pressure on hashrate, may see their profits shrink further.

However, the long-term outlook for Bitcoin may not be as bleak as the initial market reaction. Some analysts suggest that prolonged trade wars and economic friction could enhance Bitcoin’s appeal as a decentralized asset unaffected by government intervention. If tariffs lead to inflation or weaken fiat currencies like the USD, investors may turn to cryptocurrencies as a safe haven.

“It’s not gold, and it’s not the yen. Instead, Bitcoin is emerging as a risk-dynamic asset – one that doesn’t crumble like high-growth stocks but also doesn’t attract the same flight-to-safety flows as traditional safe havens,” Nexo Dispatch Editor Stella Zlatarev told BeInCrypto.

This sentiment aligns with research indicating that instability often causes initial price drops but can pave the way for growth as acceptance increases.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

-

Bitcoin21 hours ago

Bitcoin21 hours agoWhy ETF Issuers are Buying Bitcoin Despite Recession Fears

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Faces ‘Hyperinflation Hellscape’—Analyst Reveals Key On-Chain Insights

-

Market18 hours ago

Market18 hours agoWhat to Expect After March’s Struggles

-

Market17 hours ago

Market17 hours agoBitcoin Price Still In Trouble—Why Recovery Remains Elusive

-

Altcoin23 hours ago

Altcoin23 hours agoHere’s Why Is Shiba Inu Price Crashing Daily?

-

Market22 hours ago

Market22 hours agoCrypto Market Mirrors Nasdaq and S&P 500 Amid Recession Fears