Market

Coinbase Powers First AI-to-AI Crypto Transaction

On August 30, 2024, Coinbase, the US’ largest publicly traded crypto exchange, managed the first AI-to-AI crypto transaction.

This milestone, announced by Coinbase’s CEO Brian Armstrong, represents a significant leap toward a future where artificial intelligence’s intersection with the crypto industry is becoming more evident.

Coinbase Leverages AI Agents for Transactions in a Decentralized Economy

Coinbase conducted its first AI-to-AI crypto transactions using the Base Sepolia Network. Known for its scalability and low transaction costs, Base Sepolia provided the ideal environment for this event.

Coinbase employed its advanced Multi-Party Computation (MPC) technology to create a secure AI agent wallet. This ensured the transaction remained controlled and tamper-proof.

After creating and funding a wallet using a faucet method, the AI agent could seamlessly transfer crypto assets to another wallet. This wallet could belong to either a human user or another AI agent. It demonstrated the versatility and potential of AI-to-AI transactions in a decentralized ecosystem.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

The concept of AI agents conducting transactions autonomously is revolutionary. Traditionally, AI has been limited to processing information and making decisions based on pre-programmed algorithms. However, with the ability to manage and transfer assets without human oversight, AI agents can now operate within decentralized financial systems.

This development enables AI agents to transact with other AI entities, humans, and merchants. Furthermore, it allows AI agents to acquire resources, pay for services, and perform tasks that require financial transactions. All of these transactions can happen without human intervention.

“This is an important step for AIs to get useful work done. Today, if you give an AI agent a task and come back in a few days or hours, it can’t get useful work done. In part, this is a limitation of the technology itself, and products like devin.ai are getting closer to this. But the other reason is that AIs can’t transact to acquire the resources they need. They don’t have a credit card to use AWS, Github, or Vercel. They don’t have a payment method to book you the plane ticket or hotel for your upcoming trip. They can’t get through paywalls (for instance, to read a scientific article), promote their post on X with a paid ad, or use the growing network of paid APIs to integrate the data they need,” Armstrong elaborated.

AI Agents in the Crypto Economy: Opportunities and Obstacles Ahead

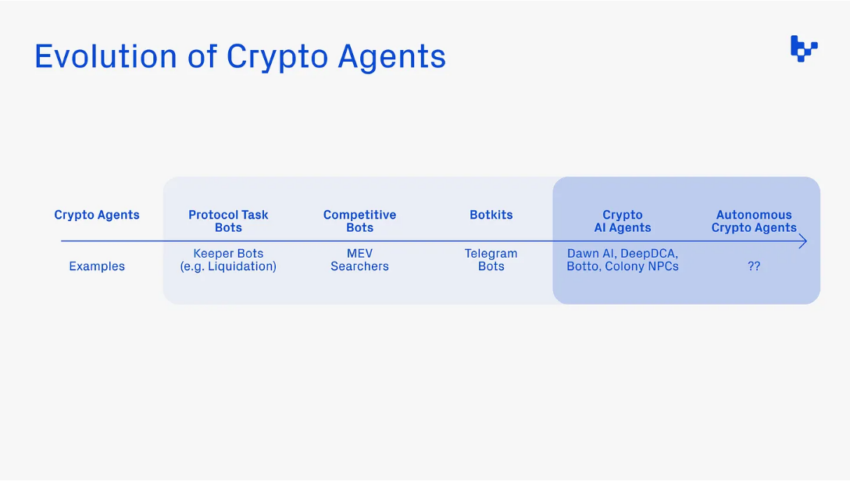

In a December 2023 report, Mason Nystrom, a Junior Partner at Pantera Capital, noted how bots have evolved into “robust AI agents” capable of autonomously handling complex tasks and making well-informed decisions. Nystrom also emphasized that building AI agents on cryptonative rails offers several key advantages. One of the primary benefits is AI agents’ ability to access capital through native payment rails, such as cryptocurrencies.

“Crypto rails present a meaningful improvement for giving AI agents access to capital over having them obtain access to bank accounts or payment processors (e.g. Stripe), or deal with the vast majority of other inefficiencies that exist in our offchain world,” he wrote.

Additionally, AI agents with wallet ownership gain the ability to hold digital assets, such as NFTs or yield-bearing tokens. This grants them digital property rights inherent to crypto assets. Such capability is particularly important for agent-to-agent transactions, where verifiable and deterministic actions are crucial.

“On-chain transactions are deterministic in nature—they either happened or didn’t—which means AI agents will be able to more accurately complete tasks on-chain than off-chain,” he remarked.

Despite AI agents’ promise in the crypto economy, Nystrom also identified significant challenges and limitations. One major limitation is that AI agents need to perform complex logic off-chain to optimize efficiency.

While on-chain transactions are deterministic and verifiable, the computational logic required for decision-making and task execution often needs to be processed off-chain. This condition introduces a layer of complexity and potential vulnerability, as the off-chain components may not have the same level of security and transparency as on-chain transactions.

Additionally, the quality of the tools given directly influences the effectiveness of AI agents. For example, an AI agent tasked with summarizing real-time news events needs access to web scraping tools, while an agent that engages in trading requires a wallet with key signing permissions. This reliance on external tools means that the capabilities of AI agents are inherently limited by the resources and infrastructure available to them.

Moreover, ensuring these tools are secure, reliable, and integrated seamlessly with blockchain technology remains a significant challenge.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

Coinbase’s latest initiative also strengthens the narrative of the intersection between AI and crypto, specifically blockchain. According to a January report from Grayscale Research, the intersection of AI and crypto could offer significant benefits in mitigating societal issues associated with AI. These problems include spreading misinformation and deepfakes.

Galaxy Digital Research adds another dimension to this discussion. It points out that blockchains can serve as a transparent, data-rich environment that AI models require for optimal performance. Although blockchains have limited computational capacity, their transparency and decentralized nature make them ideal for integrating AI in a way that enhances both security and trust.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Recovery Stalls—Bears Keep Price Below $2K

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price attempted a recovery wave above the $1,880 level but failed. ETH is now trimming all gains and remains below the $1,880 resistance zone.

- Ethereum failed to stay above the $1,850 and $1,880 levels.

- The price is trading below $1,850 and the 100-hourly Simple Moving Average.

- There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,865 and $1,890 resistance levels to start a decent increase.

Ethereum Price Fails Again

Ethereum price managed to stay above the $1,800 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,850 and $1,880 resistance levels.

The bulls even pushed the price above the $1,920 resistance zone. However, the bears are active near the $1,950 zone. A high was formed at $1,955 and the price trimmed most gains. There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD.

A low was formed at $1,781 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

Ethereum price is now trading below $1,850 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,850 level. The next key resistance is near the $1,865 level and the 50% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

The first major resistance is near the $1,920 level. A clear move above the $1,920 resistance might send the price toward the $1,950 resistance. An upside break above the $1,950 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,000 resistance zone or even $2,050 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,865 resistance, it could start another decline. Initial support on the downside is near the $1,800 level. The first major support sits near the $1,780 zone.

A clear move below the $1,780 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,620.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,780

Major Resistance Level – $1,865

Market

Cardano (ADA) Downtrend Deepens—Is a Rebound Possible?

Cardano price started a recovery wave above the $0.680 zone but failed. ADA is consolidating near $0.650 and remains at risk of more losses.

- ADA price failed to recover above the $0.70 resistance zone.

- The price is trading below $0.680 and the 100-hourly simple moving average.

- There was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another increase if it clears the $0.70 resistance zone.

Cardano Price Dips Again

In the past few days, Cardano saw a recovery wave from the $0.6350 zone, like Bitcoin and Ethereum. ADA was able to climb above the $0.680 and $0.6880 resistance levels.

However, the bears were active above the $0.70 zone. A high was formed at $0.7090 and the price corrected most gains. There was a move below the $0.650 level. Besides, there was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair.

A low was formed at $0.6356 and the price is now consolidating losses near the 23.6% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. Cardano price is now trading below $0.680 and the 100-hourly simple moving average.

On the upside, the price might face resistance near the $0.6720 zone or the 50% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. The first resistance is near $0.6950. The next key resistance might be $0.700.

If there is a close above the $0.70 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.7420 region. Any more gains might call for a move toward $0.7650 in the near term.

Another Drop in ADA?

If Cardano’s price fails to climb above the $0.6720 resistance level, it could start another decline. Immediate support on the downside is near the $0.6420 level.

The next major support is near the $0.6350 level. A downside break below the $0.6350 level could open the doors for a test of $0.620. The next major support is near the $0.60 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.6420 and $0.6350.

Major Resistance Levels – $0.6720 and $0.7000.

Market

XRP Price Under Pressure—New Lows Signal More Trouble Ahead

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Market23 hours ago

Market23 hours agoVanEck Sets Stage for BNB ETF with Official Trust Filing

-

Market22 hours ago

Market22 hours agoBNB Price Faces More Downside—Can Bulls Step In?

-

Regulation17 hours ago

Regulation17 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Bitcoin23 hours ago

Bitcoin23 hours agoTokenized Gold Market Cap Tops $1.2 Billion as Gold Prices Surge

-

Bitcoin19 hours ago

Bitcoin19 hours agoLummis Confirms Treasury Probes Direct Buys

-

Altcoin9 hours ago

Altcoin9 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin21 hours ago

Altcoin21 hours agoWhat’s Fueling The Shibarium Boost?

-

Altcoin19 hours ago

Altcoin19 hours agoFranklin Templeton Eyes Crypto ETP Launch In Europe After BlackRock & 21Shares