Market

XRP Price Trapped in a Tight Range: Will It Break Free?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

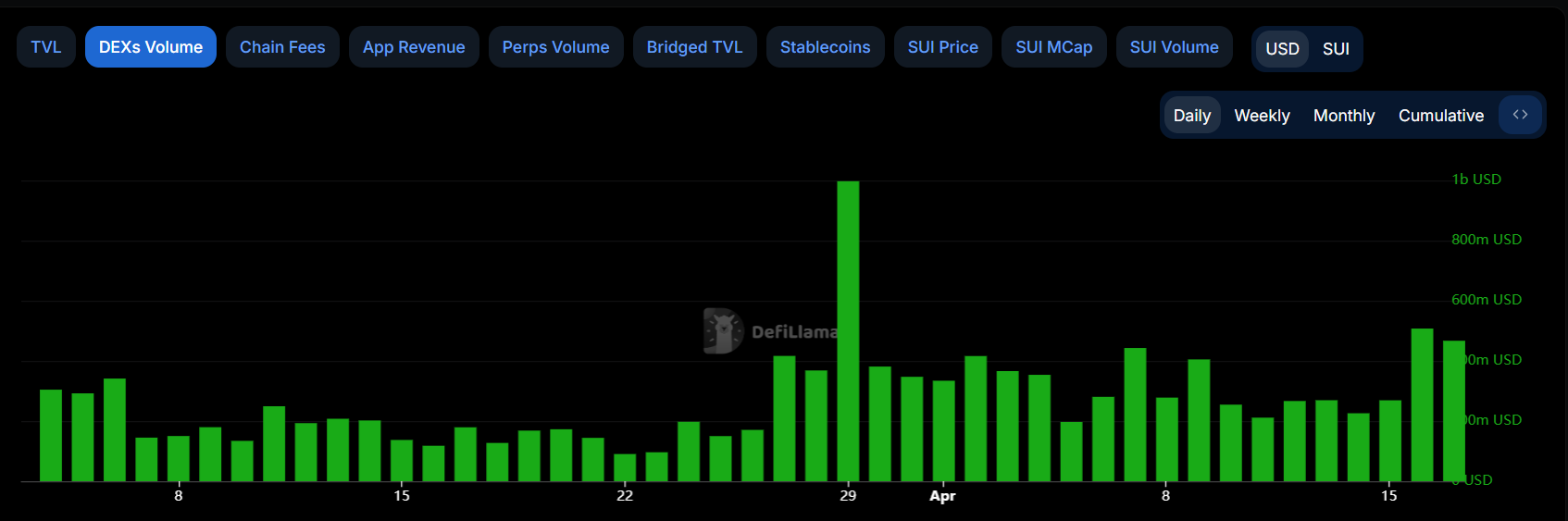

Sui Meme Coins Surge With Rising DEX Volumes

Sui meme coins, not typically seen at the forefront of the sector, are surging in volume recently. Their market cap is far smaller than Solana meme coins, but it’s also growing fast.

LOFI, a meme coin deployed on the blockchain, surged by over 186% in a week. If fresh DEX trading volumes start flowing into these assets, Sui could be the next emerging ecosystem for meme coins.

Are Sui Meme Coins About to Explode?

Meme coins based on Solana have been getting a lot of attention lately, with surging trade volumes and token prices. This has fueled speculation that Solana’s poised to lead a new meme coin boom, especially as the sector is exposed to new risks.

However, Sui meme coins are gaining some unexpected traction, and DEX volumes are noticeably soaring.

Sui is a high-performance Layer-1 blockchain that shares many similarities with Solana but several key differences.

Its design focuses on scalability, using parallel transaction processing and an object-centric transaction model to achieve this aim. Sui’s ecosystem is much less mature than Solana’s, but this could present opportunities for meme coins.

Sui’s developers are constantly working on upgrades to encourage new projects, some of which are explicitly geared towards meme coins. Solana’s 6.3 billion meme coin market cap grew by 2.4% in the previous 24 hours, while Sui’s increased by 4.6%.

LOFI grew 184.5% in the last week, highlighting its dedicated community.

LOFI’s impressive rise stands out, but several other projects on the layer-1 network have also attracted speculative interest. Meme coins thrive on community hype, and the blockchain’s DEX volumes are soaring.

If this high performance and committed enthusiasm connect with fresh investors, it could present an explosive opportunity.

For now, Sui’s meme coin ecosystem has a ways to go, with a total market cap of $123 million. However, this sector moves fast, and the Sui ecosystem could be poised to make some major growth soon, if meme coin enthusiasts continue to trade.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 AI Coins To Watch: RENDER, IP, and CLANKER

AI coins continue to draw attention as April nears its end, with Render (RENDER), Story Protocol (IP), and CLANKER standing out. RENDER has led the pack, surging nearly 17% this week and reclaiming a $2 billion market cap.

In contrast, Story (IP) is down 6.5%, the worst performer among the top 10 AI tokens, while CLANKER dropped over 7% in the last 24 hours. With momentum shifting across the sector, all three tokens are positioned at key technical levels that could define their next move.

RENDER

Render Network provides decentralized GPU computing power for creators, developers, and artificial intelligence applications. Its infrastructure supports rendering for 3D graphics, visual effects, and artificial intelligence model training.

RENDER, the network’s native token, has surged nearly 17% over the past week, pushing its market cap back above $2 billion. It was the top performer among the ten largest AI coins in the market.

If the bullish momentum holds, RENDER could test resistance levels at $4.065 and $4.21, and a breakout could open the path to $4.63.

However, if the trend reverses, key support lies at $3.82 and $3.68—losing these could trigger a deeper decline toward $3.47 or even $3.14 in a stronger correction.

Story (IP)

Story Protocol is a decentralized infrastructure designed to manage and monetize intellectual property (IP) on-chain, with a strong focus on artificial intelligence.

It allows creators to register stories, characters, and other digital assets, enabling collaborative development, licensing, and programmable royalties—all while integrating AI into the creation and distribution process.

Despite its explosive 477% rally between February 16 and 26, Story’s native token, IP, is down 6.5% over the last seven days—the largest drop among the top 10 AI coins.

If the current correction continues, IP could test support at $3.82, and a break below that may push the price under $3. However, if bullish momentum returns, IP could retest resistance at $4.49 and then aim for $5.04.

A strong rebound could eventually lift the token back toward the $6.61 zone, reclaiming some of its earlier hype.

tokenbot (CLANKER)

Tokenbot is a coin launchpad built on the Base chain. Its native token, CLANKE, has been down over 7% in the last 24 hours.

Notably, Base has climbed to the fourth spot in weekly DEX volume, reaching $4.7 billion—just behind BNB, Ethereum, and Solana—although its volume is down 7.73% in the last week.

Interest remains around Base’s recent push into “Content Coins,” with the community watching closely to see how the narrative evolves.

If CLANKER’s current downtrend deepens, it could test support at $27.97 and potentially fall to $22.84, dropping below $25 for the first time since April 6.

On the upside, a recovery could lead to a test of the $36 resistance, followed by $40. If sentiment around Base tokens strengthens, CLANKER could rally toward $47 as momentum builds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera Struggles Under $0.17 Despite Strong Support

Hedera (HBAR) is up more than 5% in the last 24 hours, showing signs of short-term relief after a rough start to April.

Despite the bounce, technical indicators still point to a weak overall trend, with bearish EMA alignment and a flat ADX reading. Momentum remains uncertain, but bulls have managed to defend key support levels so far.

Hedera Shows Early Signs of Bullish Shift, But Trend Still Weak

Hedera’s DMI indicator shows its ADX at 19.8—slightly up from 18.49 two days ago but down from a recent high of 21.94 earlier today.

The ADX (Average Directional Index) measures the strength of a trend, regardless of its direction. Values below 20 typically indicate a weak or consolidating market, while readings above 25 suggest a strong trend is developing.

HBAR’s current ADX near 20 suggests momentum is still relatively soft, with no clear directional strength in place.

Looking at the directional indicators, the +DI (Directional Indicator) has risen from 13.42 to 14.2, showing a slight increase in bullish pressure. Meanwhile, the -DI has declined from 19.89 to 17.15, indicating weakening bearish momentum.

This narrowing gap between +DI and -DI may signal a potential shift in favor of the bulls, but with ADX still under 25, the trend remains unconfirmed.

If +DI continues to climb and crosses above -DI, Hedera could attempt a short-term reversal—but for now, the market remains in a cautious, sideways phase.

HBAR Enters Cloud Zone as Trend Momentum Stalls

The Ichimoku Cloud chart for HBAR reflects a mostly neutral to slightly bearish trend.

The price is currently trading below the Kijun-sen (red line) and very close to the Tenkan-sen (blue line), indicating weak short-term momentum and a lack of clear direction.

Both lines are flat, which often signals consolidation and market indecision.

Looking ahead, the Kumo (cloud) is relatively thick and bearish, with the Senkou Span A below the Senkou Span B. However, price action has entered the cloud zone, suggesting possible trend exhaustion or transition.

The Chikou Span (lagging green line) is overlapping with recent price candles, reinforcing the sideways outlook.

Unless HBAR breaks cleanly above the cloud and reclaims the Kijun-sen, the market is likely to remain in a holding pattern.

Hedera Holds Key Supports, But Bearishness Still Lingers

Hedera’s EMA lines are currently showing a bearish structure, with short-term averages positioned below the long-term ones—typically a sign of ongoing downward momentum.

Despite this, HBAR price has recently tested and held support at both $0.156 and $0.153, signaling that buyers are still defending key levels. If the trend reverses from here, HBAR could begin a recovery move, first targeting resistance at $0.168.

A break above that level could open the path to $0.178, and if bullish momentum strengthens further, a move toward $0.201 could follow.

On the flip side, if selling pressure resumes, Hedera could retest the same support zones at $0.156 and $0.153.

Losing these levels would weaken the technical structure significantly and could trigger a deeper drop.

In that case, the next major support comes all the way down near $0.124, which would represent a substantial decline and reinforce the current bearish trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoBitcoin and Global M2 Money Supply: A Misleading Connection?

-

Market23 hours ago

Market23 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market17 hours ago

Market17 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Market22 hours ago

Market22 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way

-

Ethereum22 hours ago

Ethereum22 hours ago77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

-

Bitcoin18 hours ago

Bitcoin18 hours agoGary Gensler Explains Why Bitcoin Will Outlast Altcoins

-

Altcoin17 hours ago

Altcoin17 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?

-

Bitcoin22 hours ago

Bitcoin22 hours agoSemler Scientific Files To Buy $500-M In Bitcoin