Market

Top Meme Coins To Buy in September: Picks and Predictions

The meme coin market has experienced a significant downturn over the past month, with its market capitalization dropping by 20% due to reduced trading activity.

Despite this decline, a resurgence in bullish interest is positioning certain meme coins for potential growth in September. These coins include Popcat (POPCAT), Pepe Fork (PORK), Floki (FLOKI), Shiba Inu (SHIB), and Book of Meme (BOME).

Popcat (POPCAT)

POPCAT is currently trading at $0.69, having surged by 46% over the past week. The technical setup for this Solana-based meme coin indicates increased accumulation by market participants in recent weeks.

At press time, POPCAT’s Relative Strength Index (RSI) stands at 57.58 and is trending upwards. This RSI level indicates that buying activity is gaining momentum, as the indicator measures whether an asset is overbought or oversold.

The Moving Average Convergence Divergence (MACD) also shows a strong bullish bias. The MACD line (blue) is above its signal line (orange) and the zero line, suggesting a solid uptrend.

If this trend continues, POPCAT’s price could rise to $0.71. However, if a reversal occurs, the price might drop to $0.62.

Pepe Fork (PORK)

PORK’s price has risen by 82% over the past month. In the last 24 hours, it surged to a monthly high of $0.00000016 before correcting to $0.00000013 at the time of writing.

The frog-themed meme coin is currently trading above its 20-day exponential moving average (EMA), which reflects the average price over the past 20 trading days. When an asset’s price is above this moving average, it indicates that recent prices are consistently higher than the 20-day average, suggesting strong and positive price action.

Read more: What Are Meme Coins?

Additionally, the token’s Chaikin Money Flow (CMF) is rising and currently stands at 0.23, above the zero line. A CMF value above zero indicates market strength, signaling liquidity inflow, which is crucial for sustaining a rally. If the trend remains, PORK may exchange hands at $0.00000024.

Floki (FLOKI)

Over the past month, Floki’s value has dropped by 13%. However, this price dip has created a potential buying opportunity for traders looking to trade against the market trend.

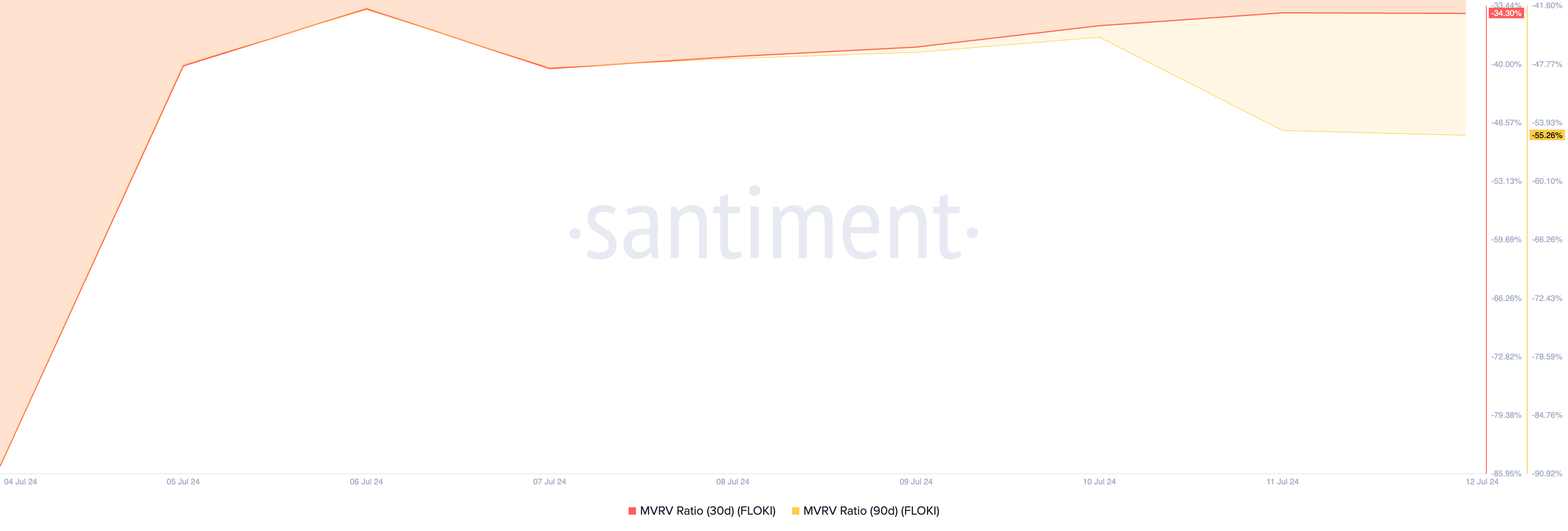

An on-chain assessment of Floki’s Market Value to Realized Value (MVRV) ratio shows that the metric is signaling a buy. According to data from Santiment, FLOKI’s 30-day and 90-day MVRV ratios are -34.30% and -55.26%, respectively.

When an asset’s MVRV ratio is below zero, it is considered undervalued, meaning its current price is lower than the average price of all its circulating tokens. This situation often presents a buy signal for traders who aim to buy low and sell high.

Shiba Inu (SHIB)

Despite SHIB’s double-digit price decline over the past month, whales have been accumulating more coins, as indicated by an 81% spike in large holders’ netflow.

Large holders, or whales, are addresses that control over 0.1% of an asset’s circulating supply. A surge in their netflow signals increased accumulation, a bullish sign that often prompts retail investors to follow suit, potentially driving up the asset’s value.

Read more: 7 Hot Meme Coins and Altcoins that Are Trending in 2024

If SHIB sees a broader market-wide accumulation, this could reverse its downtrend, with the price potentially rallying toward $0.000018.

Book of Meme

BOME’s value has dropped by 13% over the past week. Despite this decline, the meme coin’s Chaikin Money Flow (CMF) has been rallying and is now close to crossing above the zero line.

A bullish divergence occurs when an asset’s price falls while its CMF rises, indicating underlying accumulation despite the price drop. The increasing CMF shows positive money flow into the asset, suggesting that a potential rebound could be on the horizon.

If BOME begins to rally, its next price target could be $0.01. However, if the downtrend continues, BOME’s value might slip to its August 5 low of $0.005.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

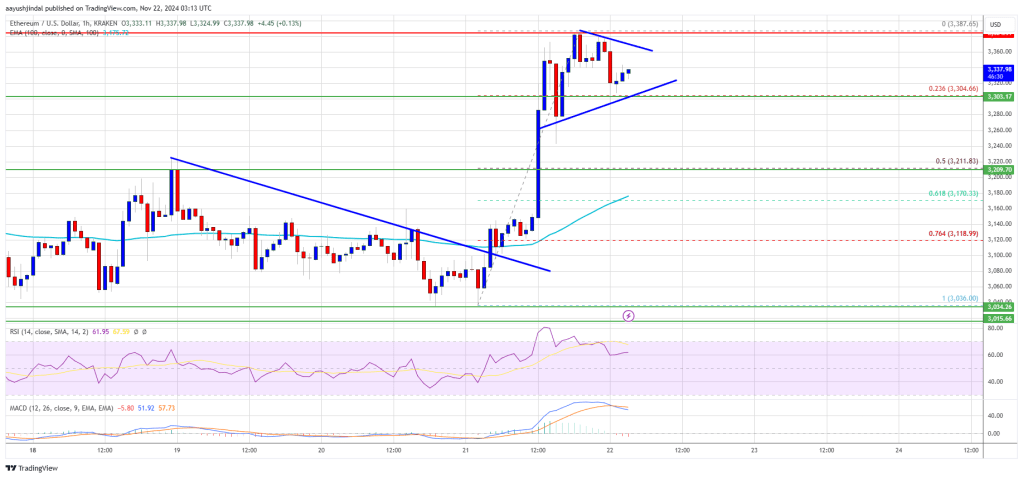

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

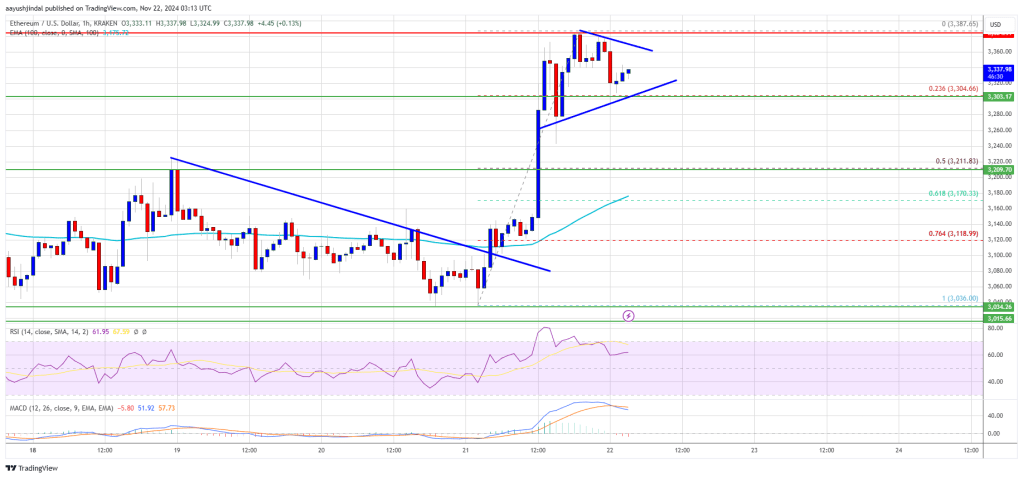

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum22 hours ago

Ethereum22 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market19 hours ago

Market19 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market23 hours ago

Market23 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin21 hours ago

Altcoin21 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin14 hours ago

Bitcoin14 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Market14 hours ago

Market14 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin17 hours ago

Altcoin17 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market22 hours ago

Market22 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?