Market

69% of Institutional Investors Eye Crypto Expansion

Research commissioned by OKX exchange discovered institutional investors view entry into the digital asset space as inevitable. The report cites a “growing consensus” among institutional investors that digital assets like cryptocurrencies, NFTs, and tokenized private funds are critical to portfolio asset allocations.

Institutional interest in the crypto space continues to increase, partly inspired by the advent of Bitcoin ETFs (exchange-traded funds) in the US, which delivered BTC to Wall Street.

Institutional Investors Find Digital Assets Inevitable

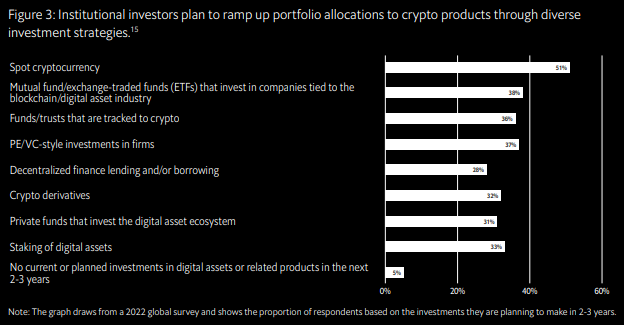

OKX’s report cited responses from TradFi titans like Citi, Al Mal Capital, Skybridge Capital, and VanEck, among others. Based on the study, institutional investors intend to ramp up their allocations to crypto, leveraging a range of investment strategies.

The low correlation between digital assets and traditional assets fuels institutional interest, making them valuable for diversification. With the growing availability of investment vehicles such as ETFs and derivatives, institutions are increasingly optimistic about integrating digital assets into their portfolios.

“Approximately 51% of investors considering spot crypto allocations, 33% considering staking of digital assets, and 32% considering crypto derivatives. 69% of institutional investors anticipated increasing their allocations to digital assets and/or related products in the next two to three years,” read the report.

Institutions currently allocate an average of 1% to 5% of their portfolios to digital assets, depending on their risk tolerance. They anticipate increasing this allocation to 7.2% by 2027.

This growing interest is driven by the emergence of institutional-grade custodians and the availability of crypto ETFs. As the digital asset ecosystem matures, traditional investors are expected to work more closely with digital-native custodians.

“As the institutional digital asset custody market grows, such criteria security, regulatory compliance, and efficiency, as are expected to become more refined, further facilitating institutional adoption of digital assets. According to our research brief, the institutional digital asset custody market is projected to experience a compound annual growth rate of over 23% through 2028, and 80% of traditional and crypto hedge funds that invest in digital assets use a third-party digital asset custodian,” OKX Chief Commercial Officer Lennix Lai told BeInCrypto.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in August 2024

Institutional investors are also focusing on understanding and adapting to changing regulations to align with best practices. They are staying updated on changes in key financial centers to ensure a more secure market. The alignment of local and regional regulations, like the MiCA framework in Europe, is helping to make global adoption of digital assets more achievable.

Crypto Narratives Drawing Institutional Interest

Indeed, institutional interest in crypto markets continues to grow, driven by developments such as crypto ETFs, Decentralized Physical Infrastructure Networks (DePIN), and Real-World Assets (RWAs). The market capitalization of DePIN is approaching $19 billion, with key projects like Render and Bittensor leading the sector.

Experts believe that DePIN and RWA trends will fuel the next wave of crypto adoption. Institutional investors, including Andreessen Horowitz, are also making notable moves in this space.

“We’re seeing a promising trajectory towards the tokenization of assets like stocks, bonds and even real estate. This emerging trend has the potential to dramatically increase the liquidity and accessibility of these asset classes. Imagine being able to trade a fraction of a commercial building as easily as you buy shares of a public company today — that’s the kind of democratization of finance we’re looking at,” Lennix Lai shared with BeInCrypto.

Read More: How To Fund Innovation: A Guide to Web3 Grants

Tokenized RWAs have become one of the most prominent trends in 2024, bridging the gap between traditional and decentralized finance. The tokenized RWA market, valued at over $10 billion, caters to institutional clients looking for secure banking partners and custody solutions for their crypto assets.

Blockchain technology, through asset tokenization, offers a safer alternative to less secure exchanges or wallet providers. This process also streamlines operations and creates new opportunities for the financial sector.

“While it’s too early to say if tokenized assets will become as liquid and accessible as traditional equities and bonds in the near term, the long-term potential is immense. As blockchain technology continues to mature, regulatory frameworks evolve and digital security practices improve, we expect to see institutional investors becoming increasingly comfortable with integrating tokenized assets into their portfolios,” Lai added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Is Why XRP Price Rallied By 25% and Could Soon Hit $2

Ripple’s (XRP) price rallied by 25% in the last 24 hours following Gary Gensler’s announcement that he would resign as the US Securities and Exchange Commission (SEC) chair on January 20, 2025.

This development comes as a relief to the popular “XRP Army,” which has had to deal with suppressed price action due to the Gensler-led SEC’s nonstop petitions against Ripple. But that is not all that happened.

Ripple Bears Face Notable Liquidation Following Gensler’s Notification

Gensler’s announcement appears to be a positive development for the broader crypto market. But XRP holders seemed to benefit the most. This was particularly significant given the unresolved Ripple-SEC legal issues that have persisted throughout the SEC Chair’s tenure.

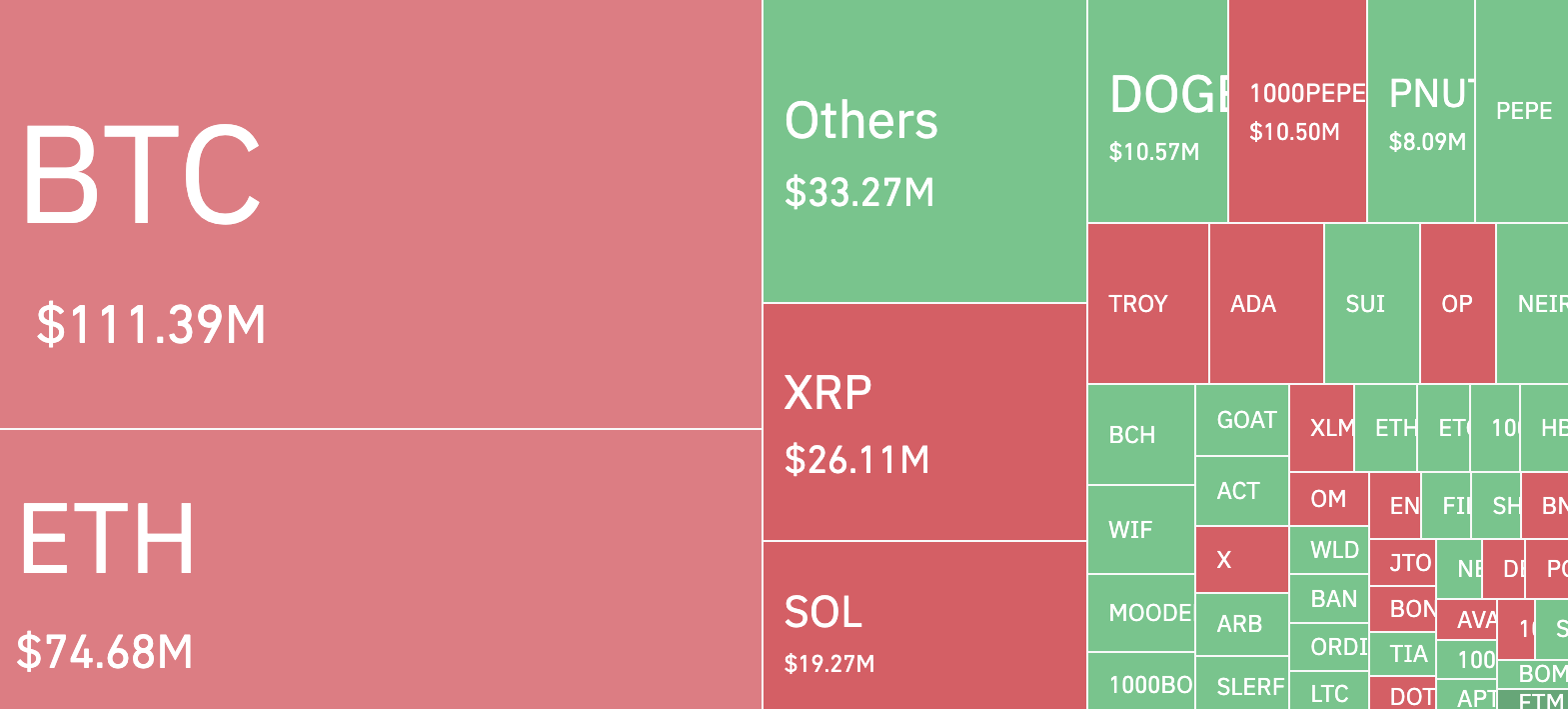

As a result, it came as no surprise that XRP price rallied and outpaced those of any other cryptocurrency in the top 10. Furthermore, the development triggered liquidations totaling $26.11 million over the last 24 hours.

Liquidation occurs when a trader fails to meet the margin requirements for a leveraged position. This forces the exchange to sell off their assets to prevent further losses. In XRP’s case, the liquidation primarily resulted in a short squeeze.

A short squeeze happens when a large number of short positions (traders betting on price declines) are forced to close, driving the price higher as they rush back to buy back the asset.

At press time, XRP trades at $1.40 and currently has a market cap of $80.64 billion. With Gensler almost gone, crypto lawyer John Deaton noted that XRP price gains could be higher, and the market cap could climb to $100 billion.

“XRP soon will achieve a $100B market cap. Times are changing,” Deaton wrote on X.

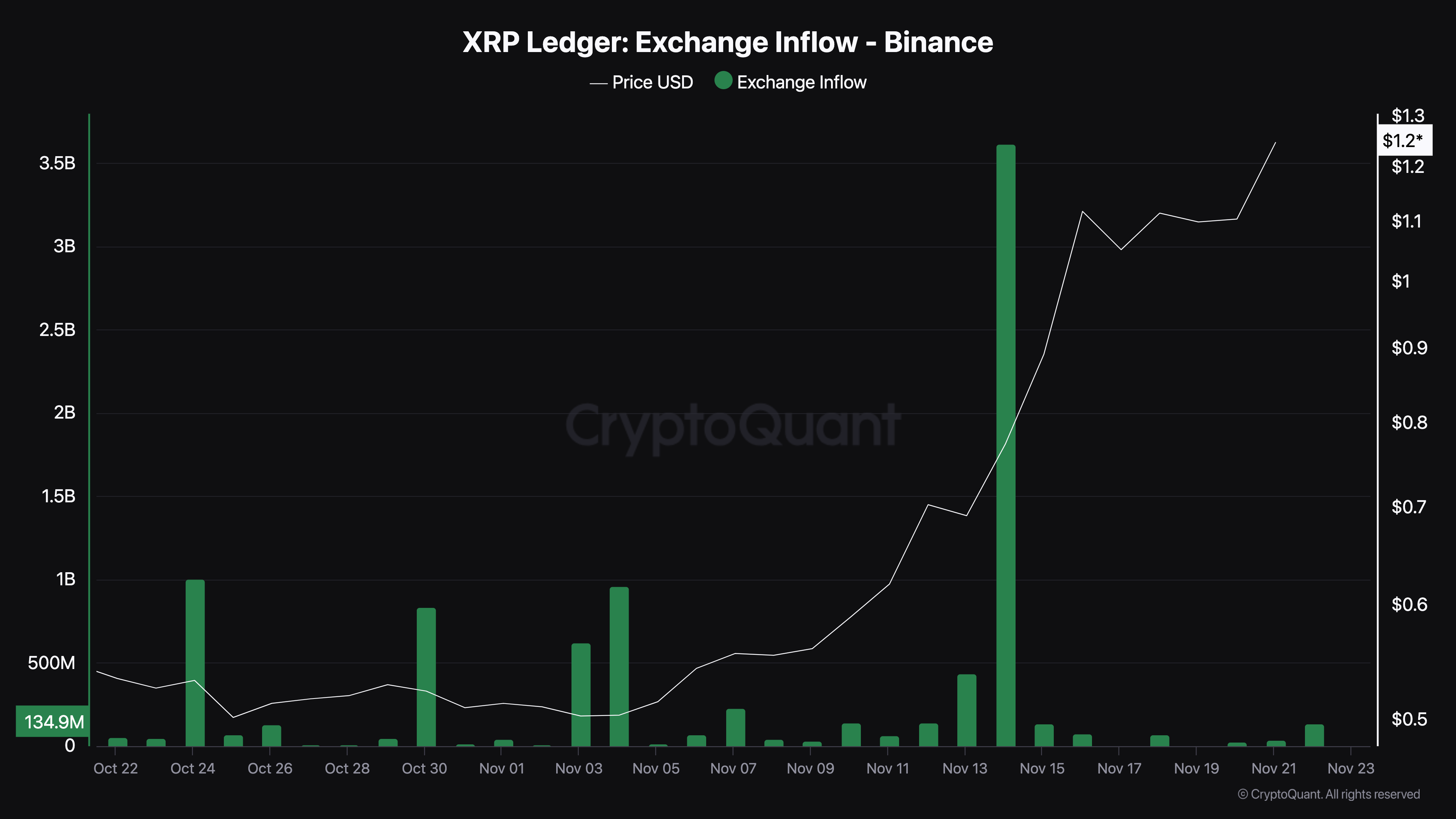

Meanwhile, CryptoQuant data shows that the total number of XRP sent into exchange has significantly decreased. Typically, high values indicate increased selling pressure in the spot market. This is because it suggests that more assets are being offloaded, potentially driving prices lower.

However, since it is low, XRP holders are refraining from selling. If this remains the case, the token’s value could rise higher than $1.40.

XRP Price Prediction: $2 Coming?

According to the 4-hour chart, XRP has been trading within a range of $1.04 to $1.17 since November 18. This sideways movement has resulted in the formation of a bull flag — a bullish chart pattern that signals potential upward momentum.

The bull flag begins with a sharp price surge, forming the flagpole, driven by significant buying pressure that outpaces sellers. This is followed by a consolidation phase, where the price retraces slightly and moves within parallel trendlines, creating the flag structure.

Yesterday, XRP broke out of this pattern, signaling that bulls have seized control of the market. If this momentum persists, XRP’s price could surpass $1.50, potentially approaching the $2 threshold.

However, this bullish scenario hinges on market behavior. If holders decide to secure profits, selling pressure could push XRP’s price below $1, erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Shows Renewed Energy: Rally Incoming?

Dogecoin is consolidating gains above the $0.380 resistance against the US Dollar. DOGE is holding gains and eyeing more upsides above $0.400.

- DOGE price started a fresh increase above the $0.3750 resistance level.

- The price is trading above the $0.3800 level and the 100-hourly simple moving average.

- There was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could continue to rally if it clears the $0.400 and $0.4080 resistance levels.

Dogecoin Price Eyes More Upsides

Dogecoin price remained supported above the $0.350 level and recently started a fresh increase like Bitcoin and Ethereum. DOGE was able to clear the $0.3650 and $0.3750 resistance levels.

The price climbed above the 50% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low. Besides, there was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair.

Dogecoin price is now trading above the $0.3750 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.3950 level or the 61.8% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low.

The first major resistance for the bulls could be near the $0.400 level. The next major resistance is near the $0.4080 level. A close above the $0.4080 resistance might send the price toward the $0.4200 resistance. Any more gains might send the price toward the $0.4500 level. The next major stop for the bulls might be $0.500.

Are Dips Supported In DOGE?

If DOGE’s price fails to climb above the $0.400 level, it could start a downside correction. Initial support on the downside is near the $0.3850 level. The next major support is near the $0.3750 level.

The main support sits at $0.3550. If there is a downside break below the $0.3550 support, the price could decline further. In the stated case, the price might decline toward the $0.3200 level or even $0.300 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.3850 and $0.3750.

Major Resistance Levels – $0.4000 and $0.4200.

Market

Solana Hits New All-Time High After 3 Years

On Friday, Solana (SOL) soared to a new all-time high (ATH), now trading at approximately $261. This breakthrough surpasses its previous peak set in November 2021.

Solana’s rise to a new ATH marks an increase of over 32 times from its lows recorded in December 2022.

Solana Hits All-Time High as Gary Gensler Plans Resignation

Solana’s path to this new high has been anything but smooth. After reaching its previous high in 2021, the platform faced a downturn in 2022 amid a broader crypto bear market, further exacerbated by technical issues and network downtimes.

The collapse of FTX in November 2022 pushed Solana’s price down to around $8.

However, Solana has since made a remarkable recovery, increasing more than 32-fold from its low. Now, Solana enthusiasts believe that SOL could eventually outpace Ethereum (ETH) in market capitalization.

“Solana has been at an all-time high by market cap for a while actually. Now, we’re finally in price discovery. The flippening is coming,” Birch, the founder of PathCrypto, said.

The surge in Solana’s market value coincides with the news of SEC Chairman Gary Gensler’s planned resignation, slated for January 20, 2025, as Donald Trump assumes office.

Known for his strict regulatory stance on cryptocurrencies, Gensler’s departure signals a potential shift toward a more crypto-friendly administration. Consequently, this political change is stoking speculations about the approval of a Solana exchange-traded fund (ETF). According to Fox Business journalist Eleanor Terrett, the SEC has begun engaging with issuers to explore the possibility of a Solana ETF.

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Previous efforts to launch a Solana ETF were stalled by regulatory roadblocks, often stopping early in the process. However, the changing political environment and the SEC’s increased openness have reignited hopes within the crypto community. Recent filings for a Solana ETF by Canary Capital and BitWise reflect a growing interest and anticipation for regulatory approval.

Despite these encouraging developments, the odds of a Solana ETF approval in 2024 remain low, with Polymarket estimates placing it at around 4%.

Meanwhile, the crypto community is also closely watching Bitcoin as it approaches the highly anticipated $100,000 mark. On Friday, Bitcoin recorded a new high of about $99,300. This milestone is viewed as a pivotal moment for Bitcoin and could impact other cryptocurrencies, including Solana.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Bitcoin18 hours ago

Bitcoin18 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation12 hours ago

Regulation12 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market17 hours ago

Market17 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin23 hours ago

Altcoin23 hours agoVitalik Buterin, Coinbase’s Jesse Pollack Buy Super Anon (ANON) Tokens On Base

-

Altcoin17 hours ago

Altcoin17 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K

-

Market16 hours ago

Market16 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

-

Altcoin20 hours ago

Altcoin20 hours agoSui Network Back Online After 2-Hour Outage, Price Slips