Market

These Altcoins Can Hit New All-Time Highs in September 2024

Many altcoins have struggled to maintain a bullish outlook for much of this cycle, resulting in only a few reaching new all-time highs (ATH).

However, as the third quarter of the year enters its final month, some altcoins are beginning to show signs of potentially surpassing their previous peaks. This analysis highlights the top four altcoins with the potential to achieve new ATHs and the reasoning behind this optimistic outlook.

Kaspa (KAS)

Kaspa (KAS), a cryptocurrency operating on the Proof-of-Work (PoW) consensus mechanism like Bitcoin (BTC), leads the list of altcoins with potential for new all-time highs. Currently trading at $0.16, KAS has been setting new ATHs since June, up until August 1.

Looking ahead to September, BeInCrypto anticipates that KAS will maintain its upward momentum, potentially surpassing $0.20. On the daily chart, KAS has been oscillating between $0.15 and $0.17 for the past 22 days, indicating that the $0.15 level has become a crucial support point for the cryptocurrency.

Additionally, the Money Flow Index (MFI) for KAS is currently at 24.38, indicating an oversold condition. The MFI measures the flow of liquidity in and out of an asset and helps determine whether a cryptocurrency is overbought or oversold. A reading of 80.00 or above suggests an overbought condition, while a reading of 20.00 or below indicates an oversold state, potentially signaling a buying opportunity.

KAS is approaching the oversold level, which suggests that a significant bounce could be on the horizon. Historical data shows that whenever KAS reaches an MFI reading similar to the current level, it often climbs to a new all-time high (ATH).

If this pattern holds, KAS could potentially reach $0.21 or higher in September. However, this prediction could be invalidated if the broader crypto market experiences another downturn, in which case KAS might drop to $0.14.

Binance Coin (BNB)

Ranked as the 4th most valuable cryptocurrency, Binance Coin (BNB) was the first major altcoin from the 2021 bull market to reach a new all-time high in June. In September, BNB could rally to another high, driven by the potential release of former Binance CEO Changpeng Zhao (CZ) from prison.

Currently priced at $540.26, BNB is 24.95% below its all-time high. On the weekly chart, BNB has formed a symmetrical triangle, a pattern that emerges when two trendlines — one sloping downward and the other upward — converge at a point.

A symmetrical triangle can signal either a bullish or bearish outcome, so it’s crucial to consider other indicators. In BNB’s case, BeInCrypto focuses on the 50-day Exponential Moving Average (EMA), which measures the trend direction over a specific period and could provide insight into the coin’s next move.

Read more: What Are Altcoins? A Guide to Alternative Cryptocurrencies

When the price of a cryptocurrency trades above its 50-day Exponential Moving Average (EMA), the trend is bullish; if it trades below, the trend is bearish. Despite BNB’s recent decline, it currently trades above the 50 EMA (blue), which could support the possibility of a new all-time high (ATH).

If buying pressure for BNB increases in September, it might once again outperform other top 10 altcoins and potentially reach a new ATH, possibly around $750. However, this outcome could be jeopardized if CZ’s release is delayed or if market interest in BNB wanes.

Brett (BRETT)

Regarded as “PEPE’s best friend” but built on the Base Layer-2 network, BRETT is part of the altcoins that could hit a new ATH in September. The meme coin currently trades at $0.081 and hit its ATH of $0.19 in June.

On the 4-hour chart, BRETT has formed an ascending triangle, a technical pattern that tends to be bullish. An ascending triangle arises from the convergence of a horizontal trendline and a rising one drawn along swing lows and highs.

As prices fluctuate along these highs and lows, cryptocurrencies often encounter resistance, as BRETT did with its drop from $0.10 to $0.081. However, this reversal might be temporary, suggesting that a significant rally could be imminent, potentially pushing the token toward $0.20.

However, if BRETT does not experience significant accumulation in September, this bullish forecast could be nullified. In that scenario, the price might drop to $0.079.

Mantra (OM)

Mantra’s (OM) position as one of the top Real World Assets (RWA) altcoins is a key reason it makes this list. OM’s all-time high of $1.42 happened on July 22, but it has since dropped 37% from that height.

From a technical standpoint, OM has formed a falling wedge pattern on the daily chart. This pattern is characterized by two descending trendlines that connect the asset’s highs and lows. Typically, traders consider a falling wedge bullish because the narrowing lines suggest that sellers might be losing momentum.

If buyers take advantage of this potential seller exhaustion, a significant rally could ensue. For OM, a breakthrough of the 38.2% Fibonacci level could signal the start of a surge toward a new all-time high. Still, the 61.8% golden ratio at $1.15 might pose resistance to the price.

Read more: How to Invest in Real-World Crypto Assets (RWA)?

If OM breaks past the $1.15 resistance level, its price could potentially surpass $1.42 in September, making it one of the altcoins to hit a new all-time high (ATH). However, the bullish scenario could be invalidated if the token drops below the falling wedge’s lowest point again. If that occurs, the price might tumble to $0.62.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Price Hits 41% Weekly Growth, $1 Target in Sight

Cardano (ADA) price has surged 41.89% in the last seven days, signaling strong bullish momentum in the market. The uptrend remains strong, supported by key technical indicators like the ADX and Ichimoku Cloud, which point to sustained positive sentiment.

However, signs of consolidation and narrowing gaps in short-term indicators suggest that the rally could face challenges if buying pressure weakens.

ADA Current Uptrend Is Still Strong

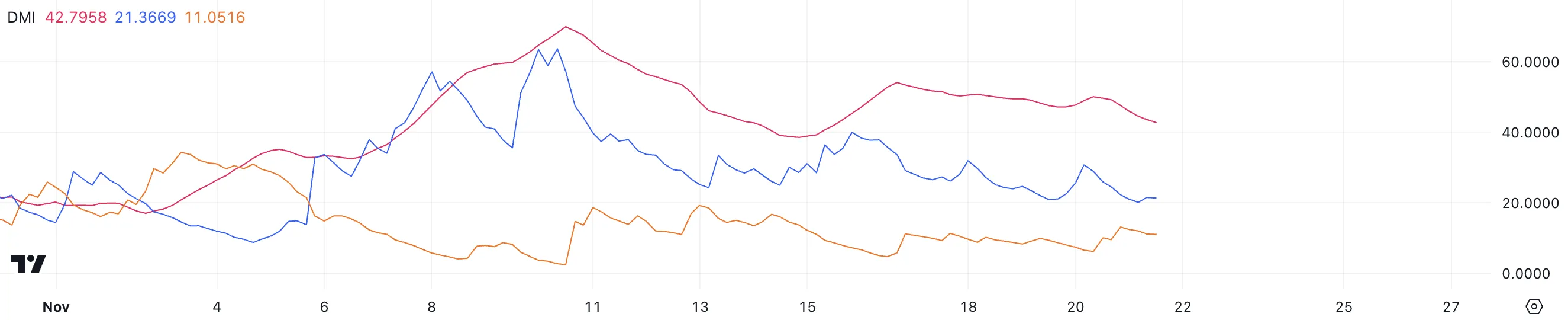

Cardano DMI chart shows an ADX of 42.7, indicating a strong trend. The metric has remained above 40 since November 7. This high ADX value confirms the robustness of ADA ongoing uptrend, signaling solid momentum behind the recent price movements.

With the positive directional index (D+) at 21.3 and the negative directional index (D-) at 11, bullish pressure continues to outweigh bearish activity, further supporting the upward trajectory.

The ADX measures the strength of a trend without considering its direction. Values above 25 indicate a strong trend, while those below 20 suggest a weak or nonexistent trend. With an ADX at 42.7, ADA is clearly in a strong uptrend, showing significant market confidence.

The gap between D+ and D- reinforces the bullish dominance, suggesting that ADA price could sustain its upward movement if current conditions persist.

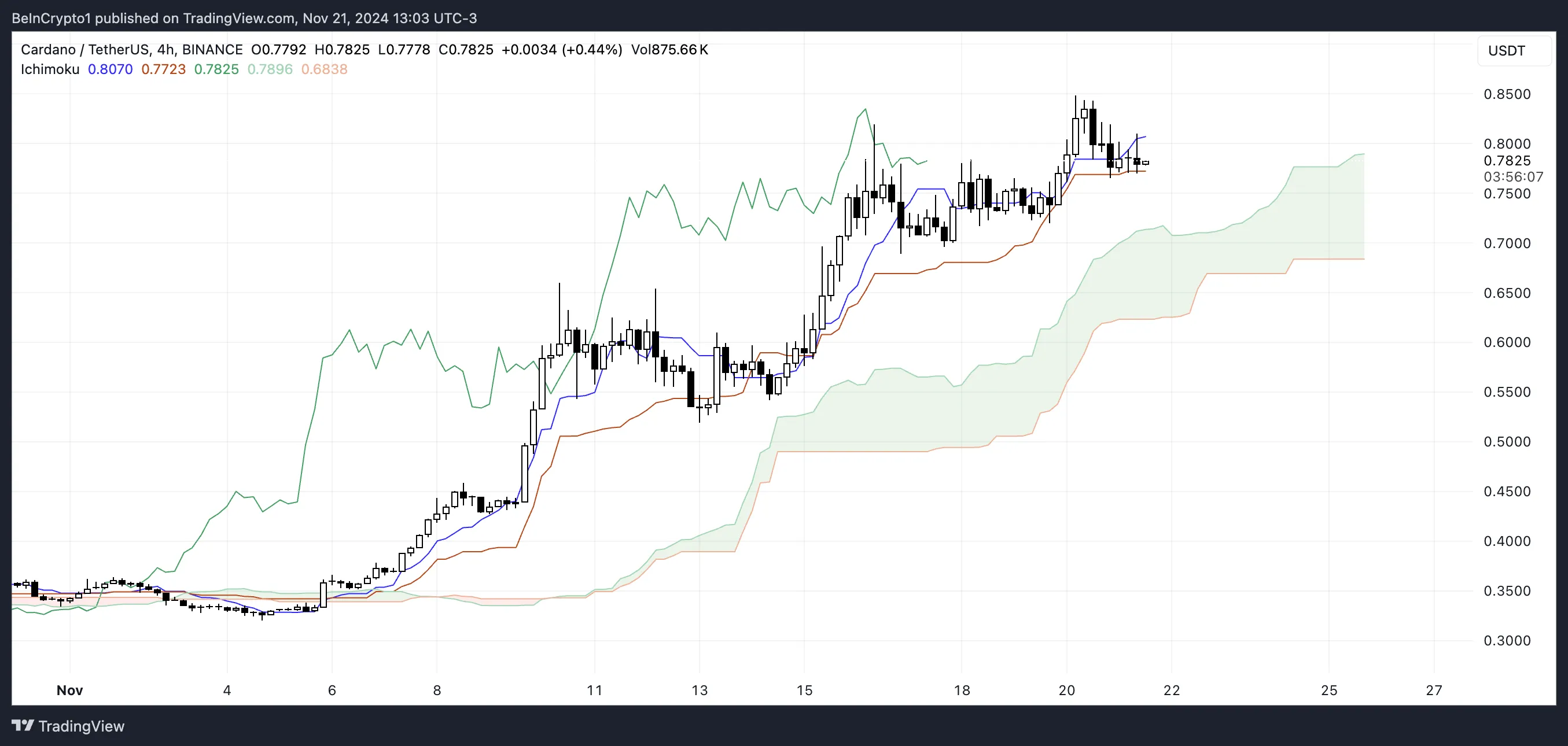

Cardano Ichimoku Cloud Shows An Important Signal

The Ichimoku Cloud chart for Cardano indicates a generally bullish trend, as the price remains above the cloud (Kumo). The Tenkan-sen (blue line) and Kijun-sen (red line) are relatively flat, showing signs of consolidation after ADA’s recent rally.

While the price is still trading above these lines, the narrowing gap between the price and the Tenkan-sen suggests weakening short-term momentum.

The green cloud ahead signals potential support for ADA uptrend, but the current consolidation phase highlights the need for sustained buying pressure to maintain this momentum.

If the price drops below the Kijun-sen or approaches the cloud, it could signal a possible shift toward bearish sentiment.

ADA Price Prediction: Can It Reach $1 In November?

If Cardano (ADA) maintains its strong uptrend, it could test the resistance at $0.85. Breaking this level could pave the way for further gains, with the potential to reach the $1 threshold, marking a 20% rise from current levels and the highest price for Cardano since April 2022.

However, as indicated by the Ichimoku Cloud, a potential reversal could be on the horizon. If bearish momentum takes over, ADA price could face significant downward pressure, potentially dropping to $0.51.

If this support fails, the price could decline further to $0.32, representing a steep 59% correction. This highlights the importance of the current support and resistance levels in determining ADA’s next direction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why SUI Network Outage Did Not Cause a Price Crash

Earlier today, the Layer-1 blockchain Sui experienced a two-hour blackout, halting block production and rendering transaction processing impossible. This network outage led to a slight dip in SUI’s price, falling from $3.73 to $3.64.

Despite concerns of a more significant decline, the price stabilized after the project announced that the network was fully restored and operational.

Sui Comes Back Online, Altcoin Still in Good Position

Around 10:52 UTC, web3 security firm ExVull disclosed that a DOS bug caused the Sui network outage. Fully known as a Denial-of-Service (DoS) attack, the bug” refers to a software attack that overwhelms a system with excessive traffic or requests, causing it to become unavailable to legitimate users by crashing or severely slowing its functionality.

“After our analysis, it was found that the Sui Network node occur DOS due to integer overflow,” ExVul stated.

Following this development, several exchanges halted SUI transactions as the price also dipped a little. However, nearly two hours later, the project updated its community, saying that validators had assisted in resolving the issue.

“The Sui network is back up and processing transactions again, thanks to swift work from the incredible community of Sui validators. The 2-hour downtime was caused by a bug in transaction scheduling logic that caused validators to crash, which has now been resolved,” it explained.

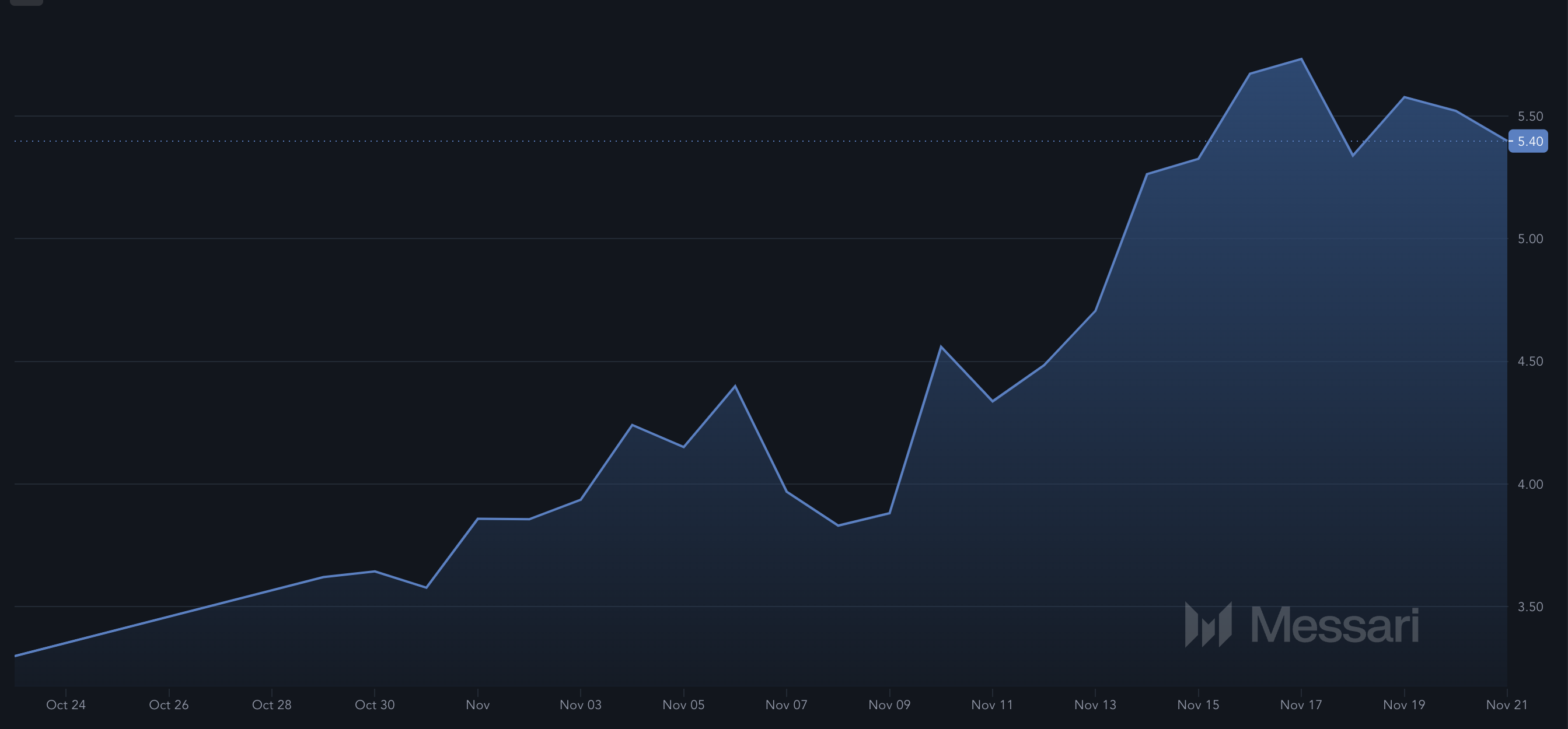

Meanwhile, data from Messari showed that, amid the outage, the Sharpe ratio remained positive. The Sharpe ratio is a key measure of risk-adjusted return, indicating how much excess return an investment generates relative to its volatility.

It helps investors assess whether the returns of a riskier asset justify the risk taken. A higher ratio signifies better risk-adjusted performance. Typically, when the ratio is negative, it means that the risk might not be worth the reward.

However, since it is positive for SUI, it indicates that accumulating the altcoin around its current value could still yield positive returns.

SUI Price Prediction: Run Above $4

On the daily chart, SUI continues to trade within an ascending channel. An ascending channel, also called a rising channel or channel up, is a chart pattern defined by two parallel upward-sloping lines.

It forms when the price shows higher swing highs and higher swing lows, indicating an ongoing uptrend. Furthermore, the Chaikin Money Flow (CMF) has increased, suggesting that buying pressure has outpaced distribution.

If this continues, SUI’s price could climb above $4. However, if a Sui network outage occurs again, this might not happen. In that scenario, the value could drop below $3.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Aptos Partners with Circle and Stripe to Revitalize Network

The Aptos Foundation announced a new partnership with Circle and Stripe, hoping to revolutionize its network functionality. Circle’s CCTP and USDC stablecoin will enhance blockchain interoperability, while Stripe will attract TradFi by simplifying fiat interactions.

Aptos has set ambitious goals with this partnership, but APT’s upward momentum has stagnated.

Aptos Partners with Circle and Stripe

According to a new announcement from the Aptos (APT) Foundation, its network is integrating Circle’s USDC stablecoin and Cross-Chain Transfer Protocol (CCTP). Additionally, Aptos is integrating the payment platform Stripe, generally streamlining fiat-related features. These include on- and off-ramps, payment processing, and TradFi ease of adoption.

“Once the integration is complete, users will be able to seamlessly transfer USDC between Aptos and 8 major blockchains. In addition to USDC and CCTP, Stripe will soon launch its payment services on Aptos, creating a reliable fiat on-ramp to streamline merchant pay-ins and payouts using Aptos-compatible wallets,” the firm claimed via press release.

In other words, Aptos aims to use this partnership to make itself “the ultimate hub for interoperable DeFi.” These companies will approach this goal from both ends: enticing new users and investors while substantially improving the core experience. This partnership marks a new development for Stripe’s integration with crypto.

Indeed, Stripe took a six-year hiatus from cryptocurrency payments, which only ended this April. Since then, however, it’s been engaging seriously with the industry. The firm entered an earlier partnership with Circle this June, hoping to promote USDC adoption. Additionally, Stripe acquired Bridge, a crypto payment platform, last month.

For its part, Aptos is undertaking a recovery process. Despite a major price spike in March, it suffered a lingering decline for most of 2024. The asset began regaining steam in October, and the November bull market has brought increased optimism. Still, its gains have stagnated for about a week.

This partnership between Aptos, Circle, and Stripe may help APT regain its forward momentum. These ambitious new features will greatly add functionality and accessibility to Aptos’ network. Still, the firm has set a very ambitious goal for itself: to solidify “its place as a leader in interoperable DeFi and enterprise-grade blockchain technology.” Only time can tell its success level.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market16 hours ago

Market16 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum13 hours ago

Ethereum13 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market24 hours ago

Market24 hours agoHow WIF Active Addresses Could Affect the Meme Coin Price

-

Altcoin18 hours ago

Altcoin18 hours agoCrypto Analyst Says Dogecoin Price Has Entered Parabolic Surge To $23.36. Here Are The Reasons Why

-

Market17 hours ago

Market17 hours agoSteady Climb Toward New Highs

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market20 hours ago

Market20 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Regulation20 hours ago

Regulation20 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution