Market

Five Charts Explain the Decline

As Bitcoin (BTC) struggles to reclaim the $60,000 psychological level, the on-chain data provider CryptoQuant has highlighted five key charts that illustrate the recent price drop.

The crypto markets are in turmoil, leaving traders on edge as Bitcoin’s price sends mixed signals. Analysts are divided on whether the market is heading for a correction or set to continue its uptrend.

Five Charts to Explain the Latest Bitcoin Price Drop

Bitcoin has slipped below the critical $60,000 psychological level, extending its decline after a recent surge above $65,000. A closer look at the underlying fundamentals reveals intriguing dynamics as traders and investors navigate the market conditions.

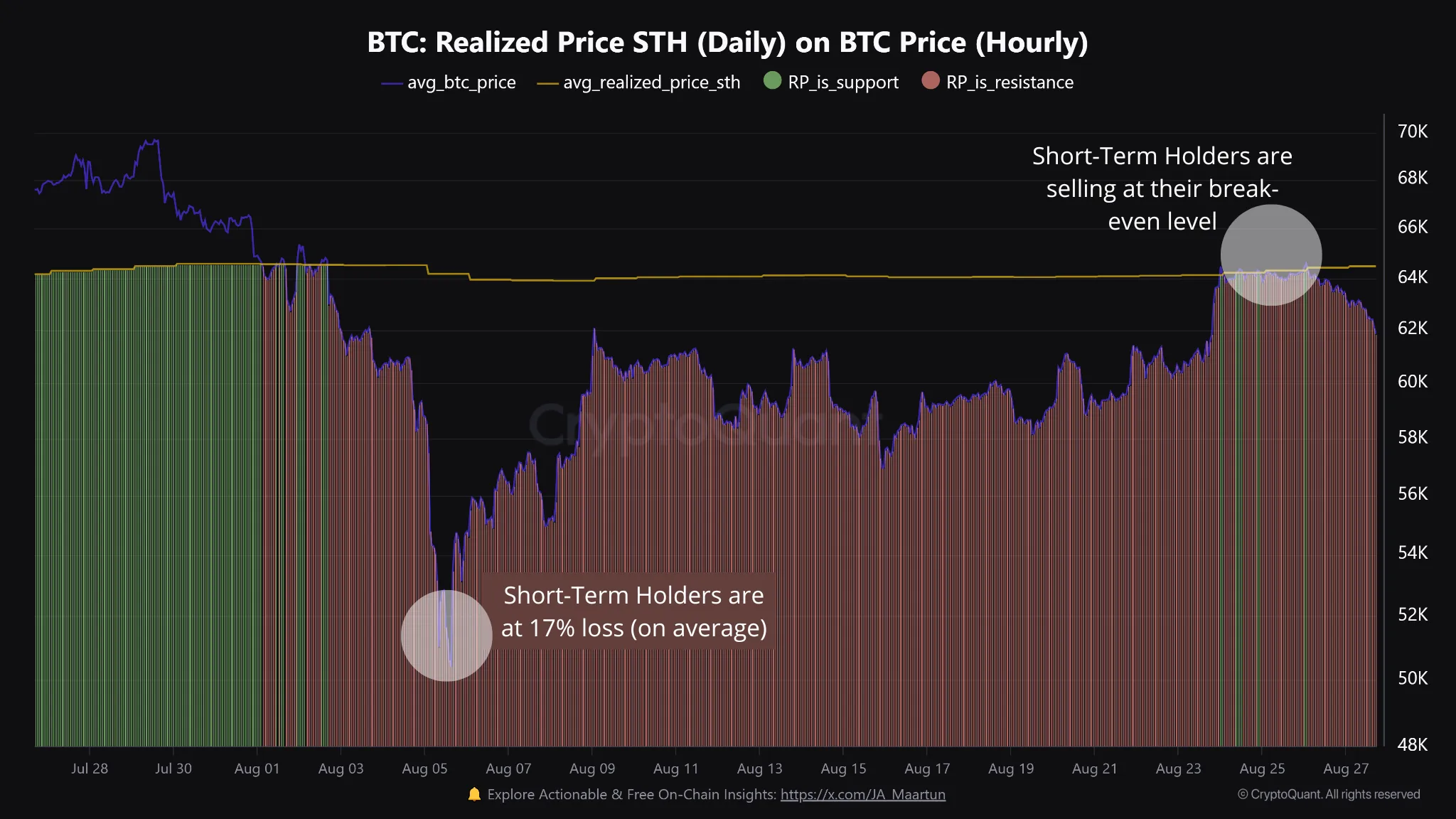

Short-term Holders Cash in at Break-Even

According to CryptoQuant, Bitcoin short-term holders established a resistance wall at their break-even price, indicating they took profits. The break-even price is where traders neither gain nor lose, with the asset trading near their purchase price.

This strategic profit-taking followed Bitcoin’s earlier price drop, which had caused short-term holders to incur a 17% loss. When the price rebounded to their average cost basis, these holders sold around their break-even prices. The resulting selling pressure contributed to the latest price drop.

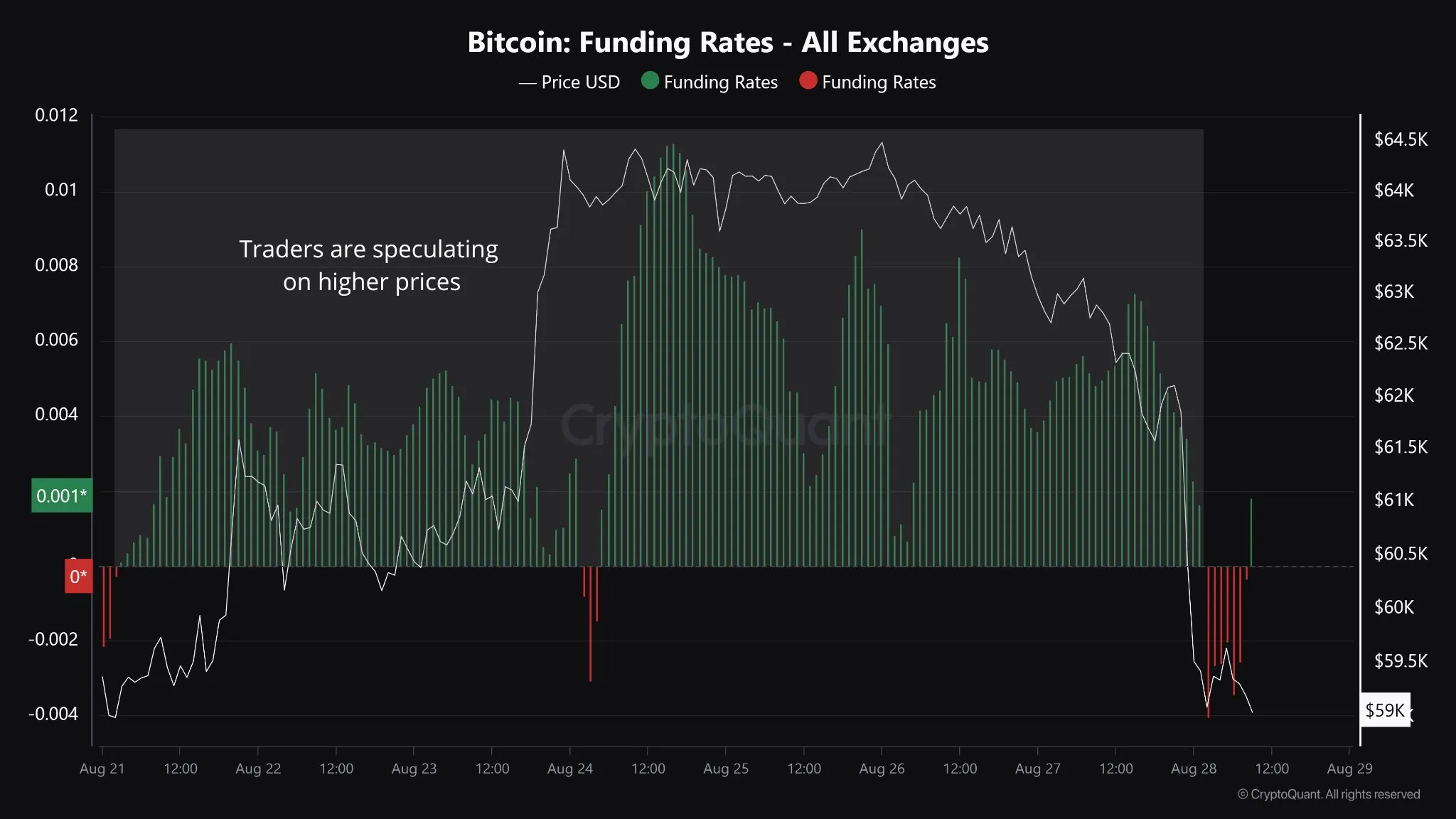

Increased Open Interest and Positive Funding Rates

CryptoQuant also reports a premium on Bitcoin perpetual contracts, with open interest rising by 31% since August 5, moving from $13.5 billion to $17.9 billion. Open interest represents the total number of open positions, reflecting futures traders’ predictions about the next market move.

In a liquid market, high open interest typically results in better execution prices, tighter bid-ask spreads, and reduced slippage, providing traders with enhanced market efficiency and easier entry and exit opportunities. The 31% increase in open interest suggests growing market participation and heightened interest in Bitcoin.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

At the same time, funding rates remained positive, indicating that long positions (buyers) were paying short positions (sellers) to maintain their positions. This scenario reflects market conditions where demand exceeds supply.

The combination of rising open interest and positive funding rates can destabilize traders’ positions, primarily due to increased speculative activity. As more participants enter and exit positions in an attempt to capitalize on potential price movements, volatility escalates, causing sudden shifts in market sentiment.

This dynamic can create a feedback loop, where growing market participation fuels further price movements. As a result, herd behavior and momentum trading amplify market trends, making it increasingly difficult to predict and manage risks effectively.

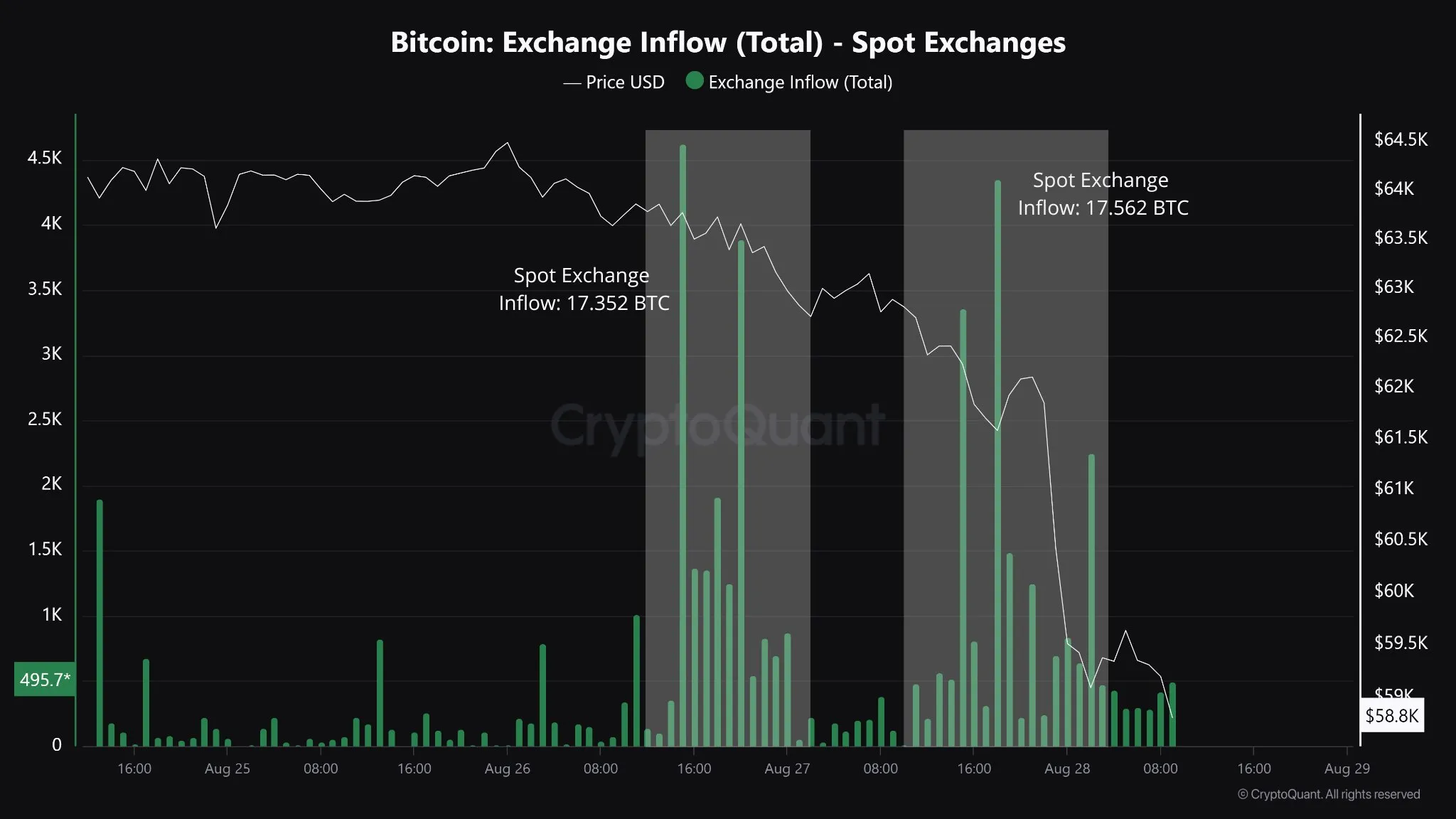

Increased Spot Inflows

Research indicates that increased Bitcoin inflows into spot exchanges during the price drop further contributed to the decline, as traders viewed it as a sign of impending selling pressure. When investors transfer their holdings to exchanges, it is often seen as an intent to sell.

This influx added strain to already fragile futures positions. According to CryptoQuant’s Head of Research, Julio Moreno, these inflows were attributed to large holders, amplifying the pressure on the market.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

As shown in the chart above, the rise in spot exchange inflows coincided with price drops, reinforcing the thesis.

This increase in Bitcoin supply available for trading on exchanges means more sellers are offering their BTC for sale. When supply outpaces demand from buyers, it exerts downward pressure on the price, contributing to the decline.

Shaking Off Weak Hands

The series of events has led to “weak hands” exiting their positions, resulting in increased liquidations. Ethereum and Bitcoin longs were liquidated for $55 million and $90 million, respectively, marking the highest levels of liquidation since August 5, according to research.

CryptoQuant’s research suggests that the market will need time to stabilize before a clear directional bias can emerge. As of this writing, Bitcoin is trading at $59,118, down nearly 5% since the Wednesday session began, according to BeInCrypto data.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Ethereum Price May Fall Under $3,000

Ethereum (ETH) is currently facing significant downward pressure, with its price declining by 3% over the past 24 hours. This bearish trend could push ETH’s price below the critical $3,000 price level.

This analysis examines the factors contributing to this likelihood.

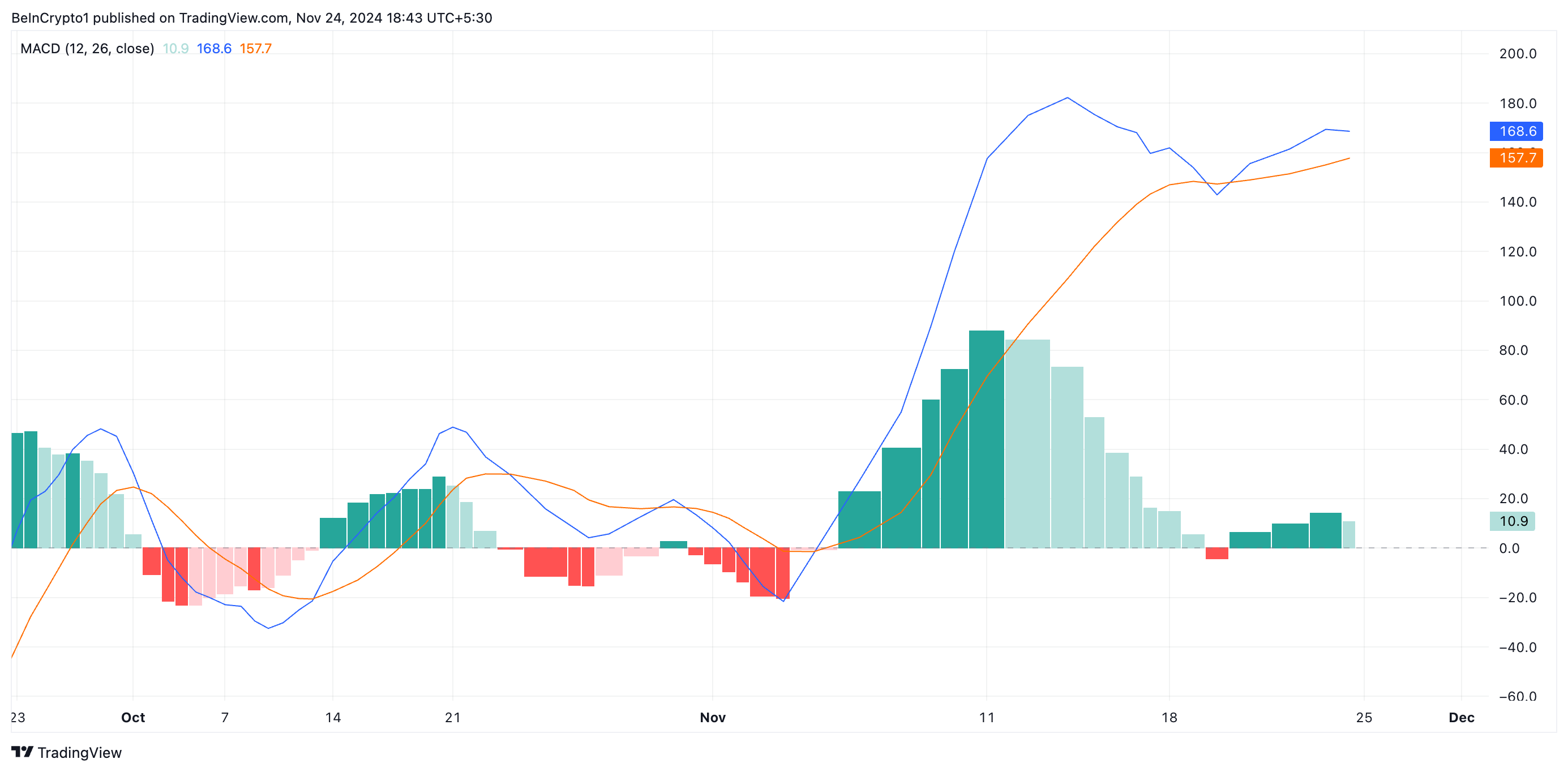

Ethereum Sellers Re-Emerge

An assessment of the ETH/USD one-day chart has revealed that the coin’s moving average convergence divergence (MACD) indicator is forming a potential death cross. As of this writing, the coin’s MACD line (blue) is attempting to fall below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. A MACD death cross occurs when the MACD line (the shorter-term moving average) crosses below the signal line (the longer-term moving average), indicating a bearish trend or momentum reversal. This signal suggests that selling pressure is increasing, and the asset’s price could decline further.

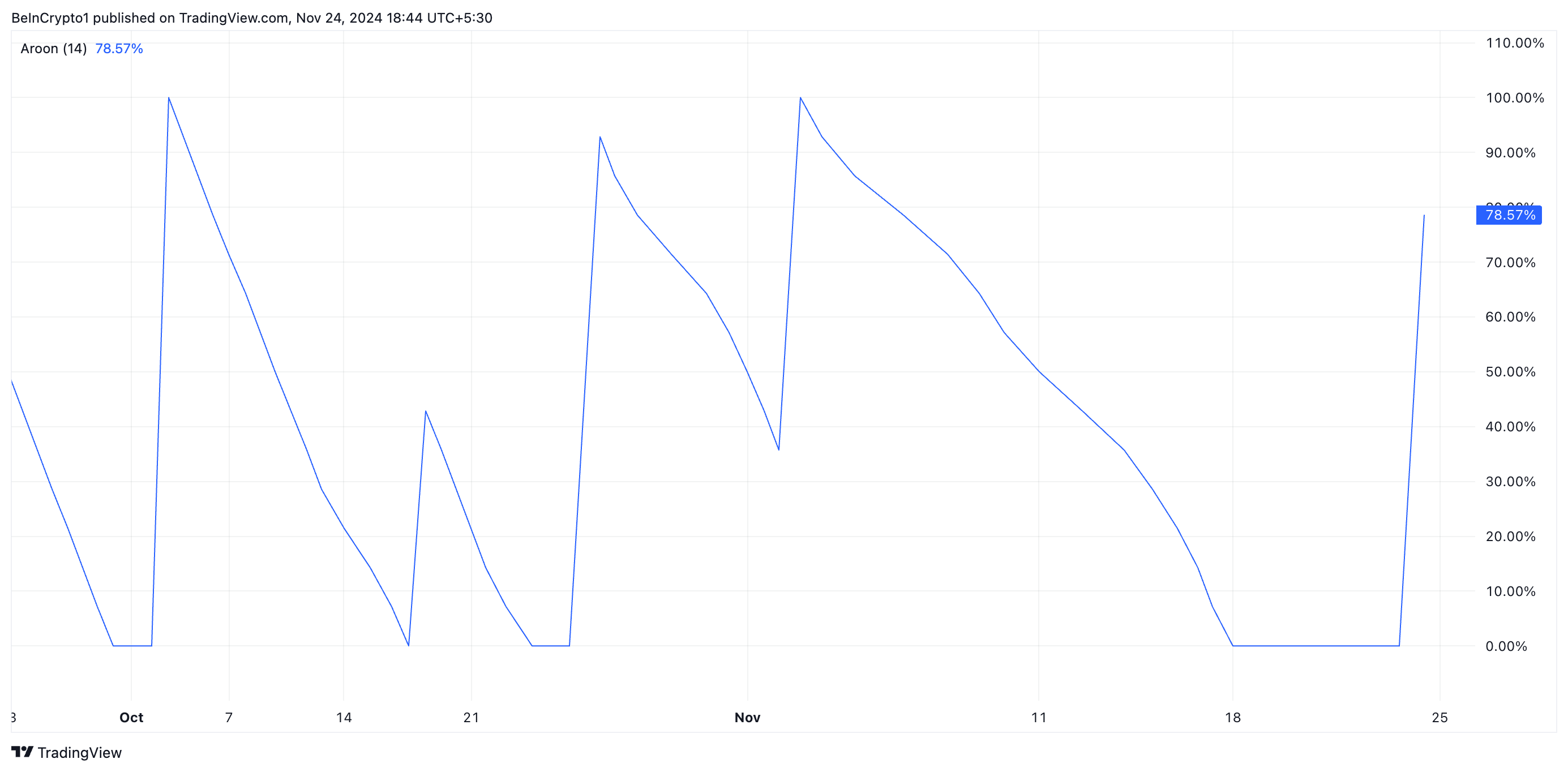

ETH’s rising Aroon Down Line confirms this strengthening bearish pressure. It currently sits at 78.57%, confirming that the decline in ETH’s price is gaining momentum.

The Aroon Indicator evaluates the strength of an asset’s price trend through two components: the Aroon Up line, which reflects the strength of an uptrend, and the Aroon Down line, which reflects the strength of a downtrend. A rising Aroon Down line indicates that recent lows are occurring more frequently, signaling growing bearish momentum or the start of a downtrend.

ETH Price Prediction: Key Support Level To Watch

ETH currently trades at $3,333, resting above the support formed at $3,203. This level is crucial because a decline below it will cause ETH to exchange hands under $3000. According to readings from the coin’s Fibonacci Retracement tool, the Ethereum price will drop to $2,970 if this happens.

However, a resurgence in the demand for the leading altcoin will invalidate this bearish thesis. If this occurs, Ethereum will rally toward $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

Cantor Fitzgerald, a prominent US financial services firm, is expanding its alliance with Tether, a key player in the digital asset industry and the issuer of the world’s largest stablecoin.

According to reports, the firm has agreed to acquire a 5% stake in Tether as part of a broader collaboration that includes Bitcoin-backed lending initiatives.

Tether Mints $13 Billion USDT as Cantor Fitzgerald Deepens Tie

The acquisition talks, reportedly finalized in 2023, valued the 5% stake at approximately $600 million. This partnership positions Tether to gain strategic advantages, particularly as Cantor Fitzgerald’s CEO, Howard Lutnick, takes on his new role as Secretary of Commerce under President-elect Donald Trump.

Market observers suggest that the nomination raises the possibility of enhanced regulatory support for Tether, which has faced scrutiny over potential violations of sanctions and anti-money laundering regulations—a claim the company has denied. However, Lutnick has promised to step down from his positions at Cantor Senate confirmation.

Beyond the ownership stake, Tether is expected to support Cantor Fitzgerald’s Bitcoin lending program, a multi-billion-dollar initiative. The program aims to offer loans backed by Bitcoin, initially funded with $2 billion, with plans for significant future expansion.

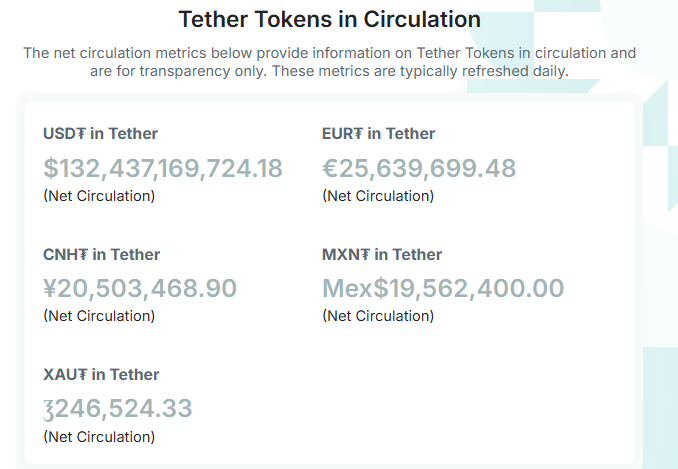

Meanwhile, Cantor Fitzgerald is already a critical partner for Tether, reportedly holding a significant portion of the stablecoin issuer’s $134 billion reserves in US Treasury bills.

As Cantor Fitzgerald deepens its involvement with Tether, the firm has continued its aggressive token minting. On November 24, blockchain analytics platform Lookonchain reported that stablecoin company minted an additional $3 billion USDT, bringing the total minted since November 8 to $13 billion. This expansion has pushed the total supply of USDT to approximately $132 billion.

The increased USDT supply may reflect the growing demand for stablecoins, often used to hedge market positions or facilitate crypto transactions without converting to fiat. This liquidity influx could reduce volatility and enhance price stability across the digital asset market.

This surge in USDT supply coincides with a broader market rally led by Bitcoin and other assets such as Dogecoin and Solana, signaling renewed investor confidence in the crypto ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can the SAND Token Price Rally Be Sustained?

SAND, the token powering the metaverse platform The Sandbox, has seen a meteoric rise, surging 55% in the past 24 hours. This performance far outpaces leading assets like Bitcoin and Ethereum, which each gained just 1% during the same period. SAND’s trading volume has also skyrocketed, surpassing $1.91 billion — a climb of over 500% in 24 hours.

On-chain data has shown a significant increase in daily SAND transactions and a decrease in selling pressure. These factors suggest the potential for a sustained rally.

The Sandbox Holders Adopt a Bullish Approach

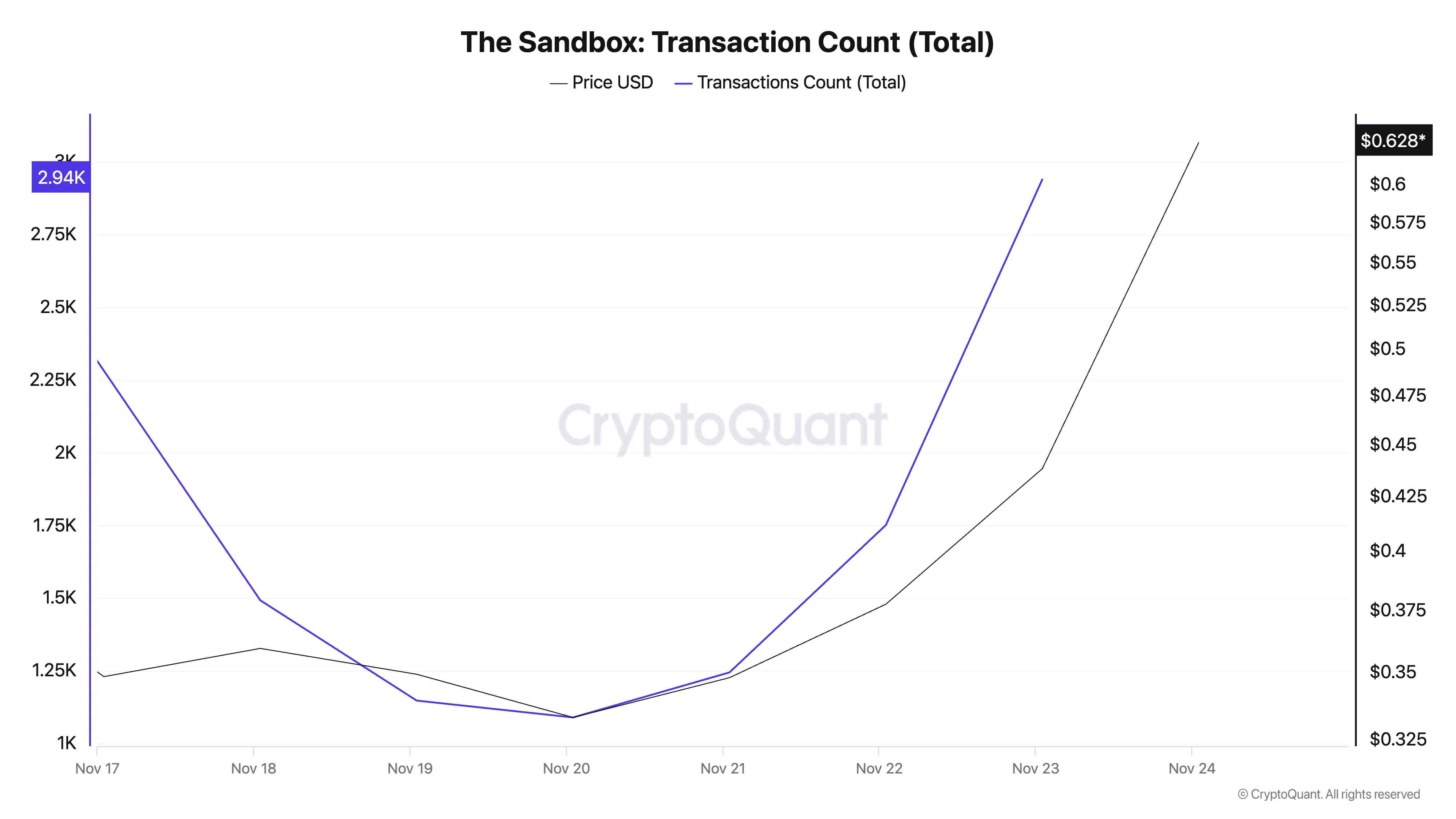

According to CryptoQuant’s data, the daily count of SAND transactions has rocketed over the past few days. For context, on November 23, 2,940 transactions involving SAND were completed, representing the highest count over the past seven days.

This is a bullish signal for the metaverse-based token because a surge in an asset’s transaction count indicates increased activity and interest. It signals higher demand and participation by market participants. Also, it suggests growing confidence in SAND’s price, potentially driving it further upward.

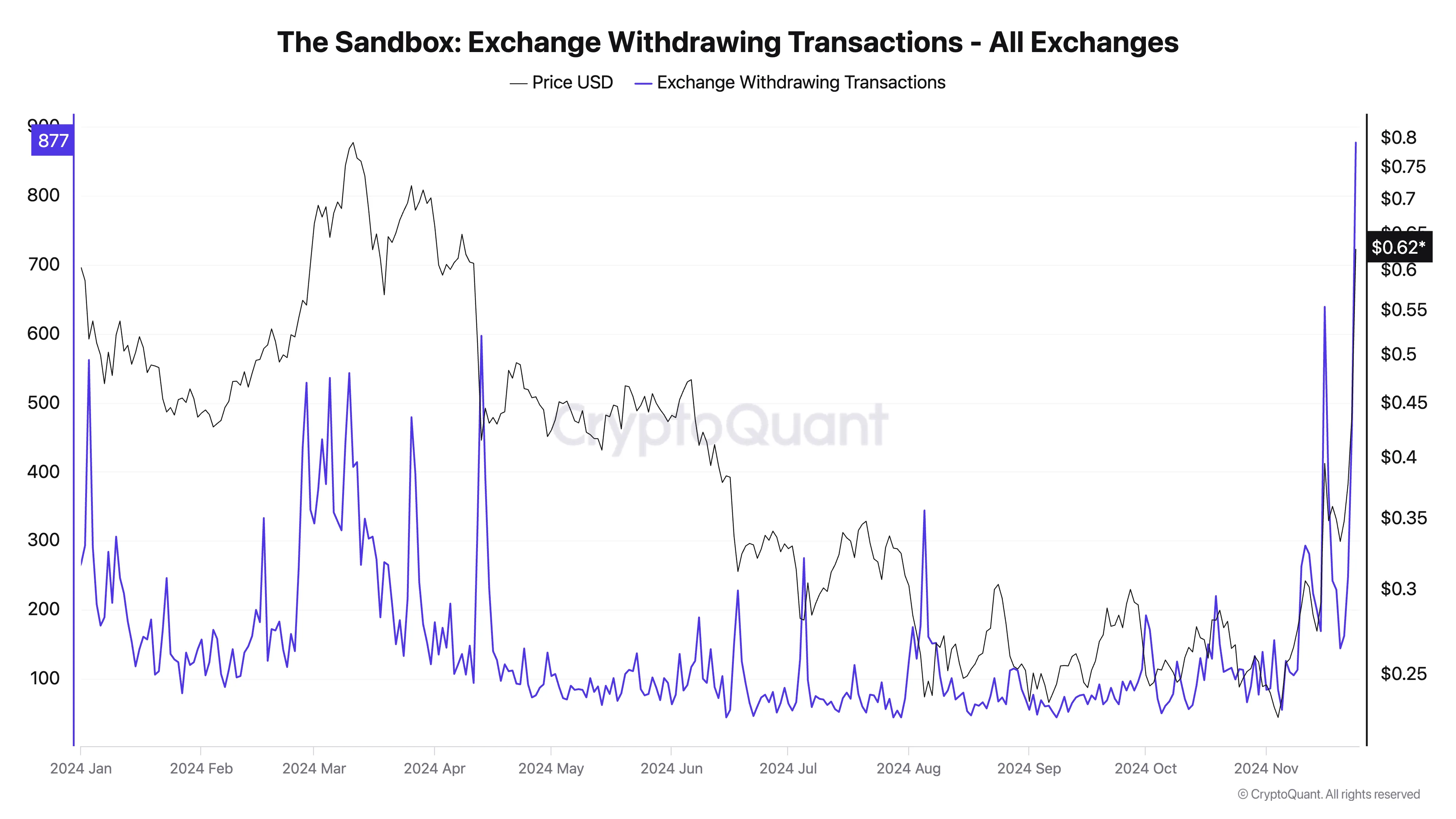

Additionally, a notable increase in exchange withdrawals for SAND has been observed. Per CryptoQuant’s data, the token’s exchange withdrawal transactions currently total 877, its single-day highest since June 2023.

The exchange withdrawing transaction metric tracks the number of cryptocurrency withdrawals from exchanges. A spike in this metric indicates that investors are moving their assets off exchanges. This is a bullish signal, suggesting increased confidence and a potential long-term holding trend.

SAND Price Prediction: Rally Above $0.66?

On the daily chart, SAND is trading at $0.61, a level last seen in April. Its price currently sits below the resistance at its cycle peak of $0.66. If bullish momentum strengthens, SAND could rally toward this peak and reclaim it.

Conversely, if bullish sentiment wanes and selling pressure strengthens, the SAND token price may plunge toward support at $0.56, invalidating this bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin15 hours ago

Altcoin15 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Market23 hours ago

Market23 hours agoXRP To Hit $40 In 3 Months But On This Condition – Analyst

-

Market24 hours ago

Market24 hours agoKraken Eyes Token Expansion as Trump Promises Crypto Support

-

Altcoin24 hours ago

Altcoin24 hours agoXRP Price To $28: Wave Analysis Reveals When It Will Reach Double-Digits

-

Market22 hours ago

Market22 hours agoExploring Hottest New Coins: FINE, CHILLGUY, and CHILLFAM

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Price To $100,000? Here’s What To Expect If BTC Makes History

-

Market12 hours ago

Market12 hours agoWhy a New Solana All-Time High May Be Near

-

Bitcoin9 hours ago

Bitcoin9 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?