Altcoin

Why BTC, ETH, XRP & Altcoins Are Dropping?

The crypto market today is experiencing significant turbulence, with major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) facing notable declines. This downturn has sparked widespread concern among investors, with many wondering what’s driving this bearish trend. Thus, we have listed the key factors contributing to the market’s current state, focusing on Bitcoin, Ethereum, and altcoins.

Bitcoin Miners Under Pressure Amid Declining Crypto Market Today

Bitcoin, the market leader, is also facing significant headwinds. The revenue per terahash for Bitcoin miners has dropped to a 12-month low of 4 cents, down from over 10 cents earlier in the year. This sharp decline in mining profitability is due to several factors, including the upcoming halving event, low on-chain activity, and increasing network difficulty.

The Halving event in April 2024 reduced the block reward by 50%, putting further pressure on miners. As a result, smaller mining operators are being forced to either shut down or consolidate their operations. This consolidation is likely to lead to a decrease in network decentralization, which could have long-term implications for Bitcoin price.

Also, as the crypto market declined today, FUD grew around Binance’s suspicious transfer of 75,117 BTC worth $4.69 billion. Out of this, the crypto exchange shifted 45,000 BTC to an unknown wallet, sparking speculations. However, it was then clarified that it was an internal transfer.

In addition, long liquidations in the market currently stand at $112.25 million, according to Coinglass. While this figure may not seem overly significant, it reflects the heightened market uncertainty that is contributing to the overall bearish sentiment.

The crypto market today is also reacting to profit-taking behavior. Last week, Bitcoin rallied past $65,000 amid optimism surrounding potential Federal Reserve rate cuts. However, traders have been quick to take profits, leading to the current slump.

Moreover, BTC 6-month Returns By Day chart by Velo Data shows that it tends to experience declines on Tuesdays, while Sundays often see price surges. This “buy the dip on Tuesday, sell on Sunday” pattern may be at play, further contributing to the recent price drop. Furthermore, altcoins generally mimic BTC price trend, which may have led to the latest pullback.

Ethereum’s On-Chain Activity Slumps

Ethereum, the second-largest crypto by market capitalization, has seen a notable decline in its on-chain activity. On August 21, the 7-day moving average (7DMA) of Ethereum’s daily on-chain volume dropped to $2.37 billion, marking a 9-month low. This decline in on-chain volume is significant, as it indicates a reduction in network activity, which often correlates with lower market interest and, consequently, falling prices.

Moreover, Ethereum’s transaction count hit a low of 1.06 million on August 23, coinciding with a 20% drop in ETH’s price. This sharp decline in transaction volume suggests that fewer users are engaging with the network. This further exacerbates bearish sentiment.

Adding to the negative outlook, the Ethereum Foundation recently deposited $100 million worth of ETH to Kraken as it liquidated its holdings for operational purposes. Additionally, a prominent Ethereum whale recently offloaded $24 million worth of ETH, contributing to the downward momentum.

Another critical factor is the outflow from spot Ethereum ETFs. The crypto market today is witnessing continued outflows from Ethereum ETFs, with $13.2 million being withdrawn on Monday. Notably, no new funds have seen any inflows, indicating the lack of investor confidence in Ether funds.

XRP Faces Volatility As Crypto Market Slumps Today

XRP, one of the top altcoins, is also experiencing significant volatility. The legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) continues to weigh heavily on XRP price. Currently, XRP is trading lower than the $0.60 level amid the SEC’s appeal uncertainty.

Earlier this month, Judge Analisa Torres ordered Ripple to pay a $125 million penalty, which is 94% less than what the SEC had originally demanded. While this ruling was seen as a partial victory for Ripple, the uncertainty surrounding the SEC’s appeal has kept the market on edge.

Toncoin Declines After Telegram CEO’s Arrest

Lastly, Toncoin has been facing a sustained downtrend following the arrest of Telegram CEO Pavel Durov in France. Durov is currently facing 12 criminal charges related to alleged failures in monitoring criminal activities on the Telegram platform. Moreover, the Telegram CEO’s detent until Wednesday.

The legal troubles surrounding Durov have cast a shadow over Toncoin. This led to increased selling pressure as the broader crypto market decline today. TON ecosystem’s Notcoin (NOT) also bore the brunt as NOT price now risks downfall to $0.0005.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Cardano Price Can Clinch $1 As It Eyes Bounce From New Support Zone

While predictions for Cardano to $1 may seem like a far cry, a cryptocurrency expert has injected new life into the claims. Cardano’s price is headed below 50 cents in search of a new support zone that can serve as a springboard to reach new highs.

Cardano Price Can Still Clinch $1 Despite Price Slump

Market technician Jonathan Carter in an analysis on X predicts that Cardano’s price can reclaim the $1 price point in the coming months. According to Carter, the recent ADA correction will not be a hindrance for Cardano’s price to reach $1.

ADA has lost a jarring 13% over the last week and trades at $0.64 in an unremarkable week for the cryptocurrency. On the daily charts, prices have generally moved sideways, underscoring a lack of investor enthusiasm.

For Carter, Cardano’s recent decline has seen it fail to stay above the $0.65 support level. The analyst opined that a downtrend is the offing for the Cardano price that could see a new support zone of $0.59. Carter says the new $0.59 support zone will hurl Cardano price to reach $1.

“Despite the long correction, the price still has a chance to bounce off this support and rise towards $1,” said Carter. “Otherwise, we will fall to the lower border of the broadening wedge.”

While some investors are eyeing an ADA bounce to $0.70, a plausible play will be a slump below $0.60 before the start of a rally.

A Slew Of Positives For ADA

Despite the pervading negative sentiment around ADA price, the cryptocurrency has a wave of positive fundamentals going for it. Cardano price spiked following Charles Hoskinson’s confirmation of Ripple’s RLUSD on ADA.

Furthermore, Charles Hoskinson reveals that Cardano will play a major role in Bitcoin decentralized finance (DeFi) application. In more positive technicals, Cardano price is forming a cyclical pattern from 2024 that can send prices to astronomical proportions in May.

While the prediction pegged prices at $2.5, optimists say ADA price to $10 is not a crazy hypothesis. The report cites present solid fundamentals and ADA’s over 1,000% spike to set its all-time high back in 2021 as pointers for the seismic rally to $10.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

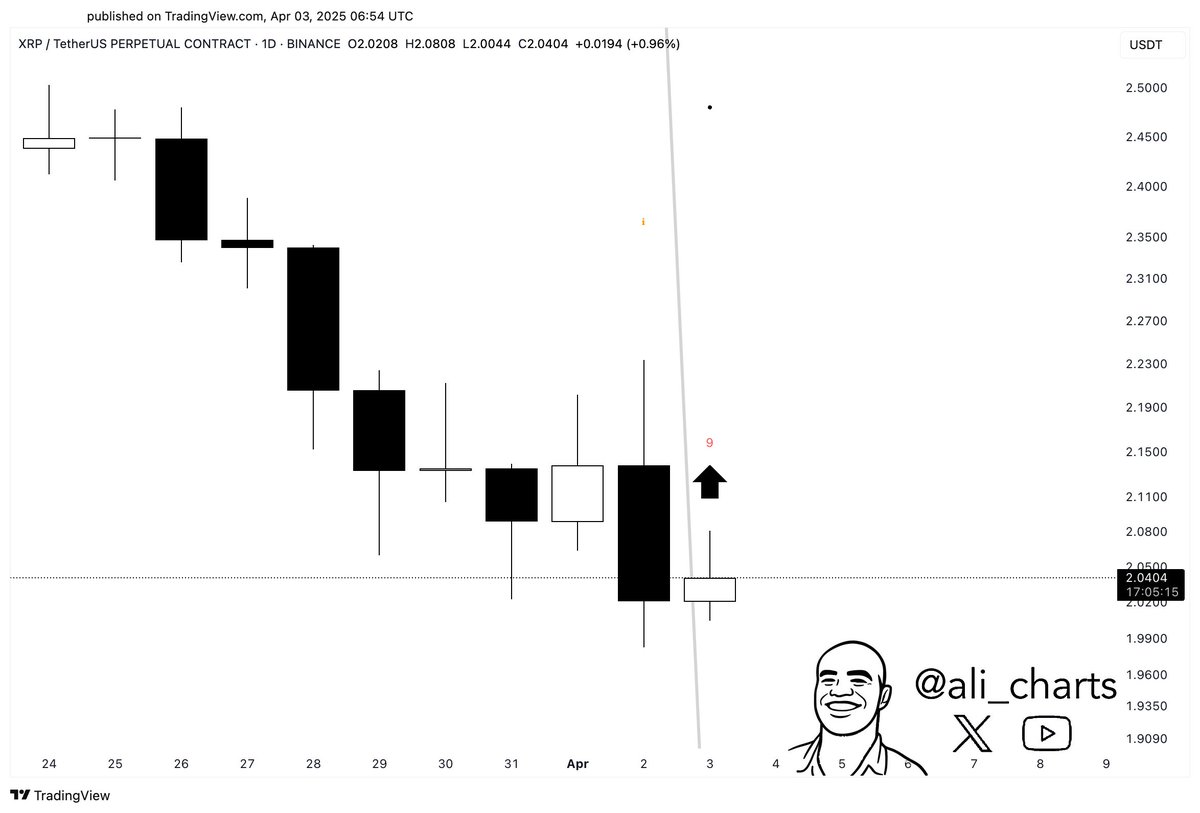

Expert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

Crypto analyst CasiTrades has provided a roadmap for the XRP price, revealing what could happen before the altcoin reaches a new all-time high (ATH). Based on her analysis, XRP could still witness a price decline before it potentially rallies past its current ATH of $3.4.

XRP Price Could Drop To $1.9 Before Rally To New Highs

In an X post, CasiTrades stated that in the event of a deeper flush, the XRP price could wick down to $1.90, suggesting that the altcoin could visit this low before it rallies to new highs. She believes XRP will ideally hold above this $1.90 and avoid dropping to new lows.

The crypto expert noted that the next move is critical. She claimed that if XRP gets that flush with bullish RSI divergence, it could mark the bottom before the altcoin rockets into Wave 3. However, CasiTrades warned that a break below $1.90 could force a reset of the entire new trend count.

Meanwhile, there is still the possibility that the XRP price might not drop to as low as $1.90. CasiTrades stated that $1.95 is the prime target, with subwaves heavily aligning there and a drop to $1.90 only likely to occur in the event of a deeper flush.

It is worth mentioning that US President Donald Trump recently announced reciprocal tariffs on all countries, a move which is set to ignite a global trade war and is bearish for XRP and the broader crypto market. As such, this development could be what sparks the deeper flush and send the altcoin to as low as $1.90.

A Drop To $1.4 Is Also The Cards

In an X post, crypto analyst Brandon asserted that the XRP price is about to have a massive breakout, to the downside. His accompanying chart showed that XRP could drop to as low as $1.4.

On the other hand, crypto analysts such as Ali Martinez have provided a bullish outlook for the XRP price. In an X post, he stated that XRP could be setting up for a rebound. The analyst further remarked that the altcoin is holding above $2 while the TD Sequential flashes a buy signal.

Crypto analyst Javon Marks also recently predicted that Ripple’s coin could surge 44x and reach as high as $99. He alluded to the 2017 bull run as the reason why he is confident that the altcoin could record such a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Here’s Why Is Shiba Inu Price Crashing Daily?

Shiba Inu price is on a strong bearish trend, with price indicators recording losses in all time frames. The highly popular meme token now threatens to add an additional zero to its value if the current bear run continues for much longer. Even with Shibarium, SHIB’s layer-2, reaching the milestone of 1 billion transactions recently, the token’s price has not responded positively to this milestone.

Falling Shiba Inu Price Affects Holder Profitability

According to current data, SHIB is down 4.6% in the past 24 hours, 14.7% over seven days and a substantial 54.9% over the past year.

The current context for the SHIB price appears tough for the majority of investors. Based on on-chain analytics, 62% of SHIB investors are at the moment in a loss, while merely 34% are in profit and 4% are breaking even as per IntoTheBlock data.

SHIB has fallen 85.9% from its all-time high of $0.00008616 on October 28, 2021, over three years ago. This extended period of decline has made many of the investors who bought during the bull run in 2021 underwater on their holdings.

The token reflects a high ownership concentration with 74% of SHIB owned by major holders. The concentration may be behind price volatility. This is due to the fact that the moves by the large holders tend to have disproportionate impacts on the market. Major volume trading in the last week has hit $184.02 million which indicates sustained activity even as the price goes down.

Shibarium Milestone Fails To Reverse Trend

Despite Shiba Inu’s layer-2 scaling solution, Shibarium recently achieved a major milestone of 1 billion transactions. However, this accomplishment has not translated into positive price action for SHIB. This disconnect between ecosystem development and token price shows the current market’s focus on overall trends rather than project-specific achievements.

Shibarium is a key component of the Shiba Inu ecosystem that focuses on reducing transaction fees, increasing processing speed, and enabling more advanced applications within the SHIB ecosystem.

The continued negative price action despite reaching such a substantial transaction milestone raises questions about what catalysts might eventually reverse SHIB’s downward trend.

Will Shiba Inu Token Burns Aid In Price Pump?

The Shiba Inu community has historically highlighted token burns as one possible method of driving scarcity and price support. Recent burn behavior has been spotty and inadequate to have any real effect on the enormous Shiba Inu token supply.

After a recent spike in burn rate of more than 12,000%, the last 24 hours have seen the burn rate decline by 60%. During this period, only 37.6 million SHIB tokens were removed from circulation as per Shibburn data.

Token burns continue to be a mainstay narrative among the SHIB community. However, the volume of burning has to rise in order to have an effect on the token’s supply that can be measured. The 17.88% hike in trading volume in the last 24 hours to $311.14 million gives some indications of market action. This potentially could be being driven by the larger holders stockpiling at lower prices.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market20 hours ago

Market20 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market19 hours ago

Market19 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K

-

Market24 hours ago

Market24 hours agoXRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

-

Market21 hours ago

Market21 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Market16 hours ago

Market16 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Bitcoin18 hours ago

Bitcoin18 hours agoUS Dollar Index Drops – What Does It Mean for Bitcoin?

✓ Share: