Market

Is Bitcoin (BTC) Ready For $70,000?

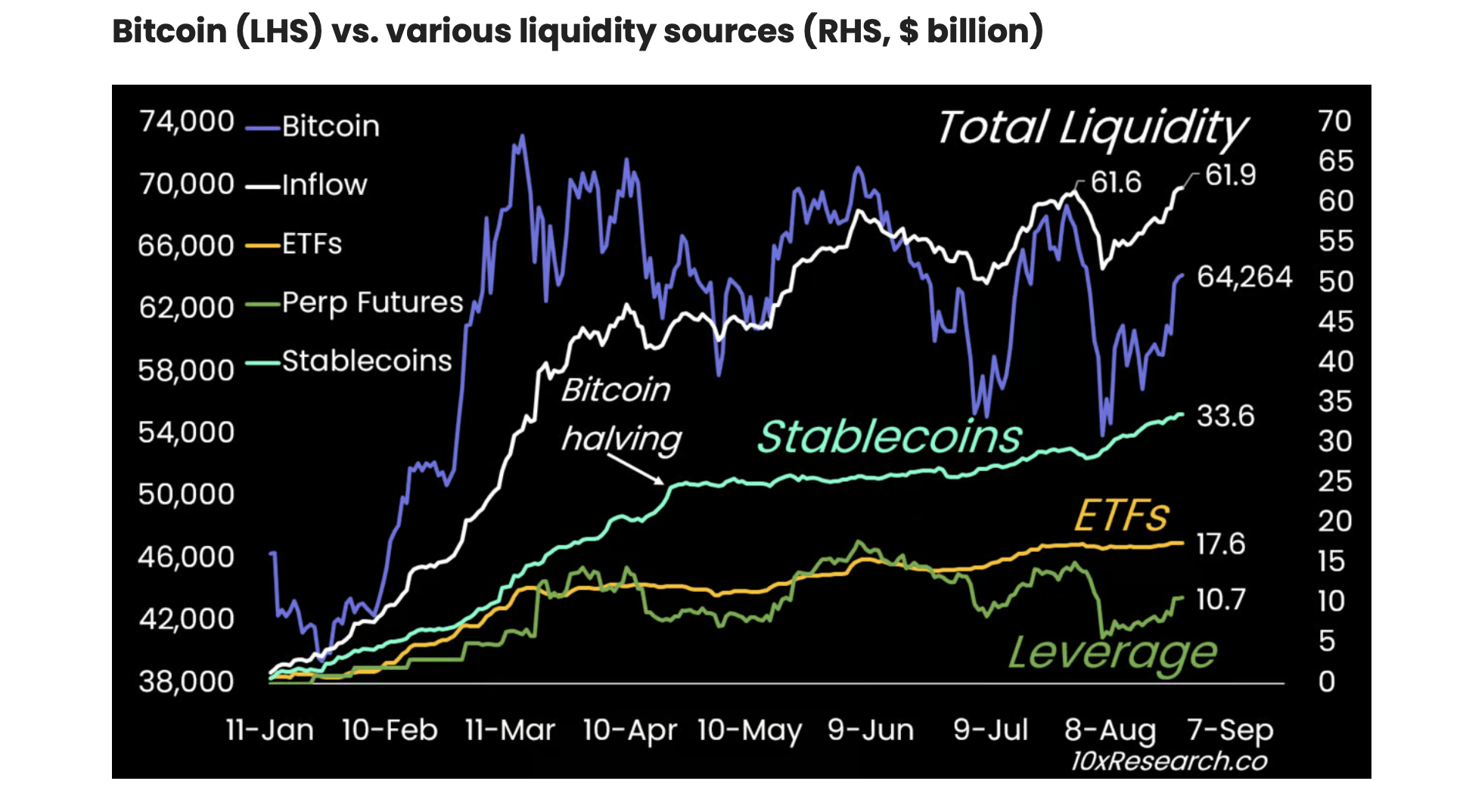

In the last few months, Bitcoin (BTC) has been trading within the $56,000 to $70,000 range. According to a new report from 10x Research, rising liquidity inflows position the coin to sustain its uptrend.

As of this writing, Bitcoin (BTC) trades at $63,632, reflecting a 9% increase over the past seven days.

Bitcoin May Be Poised For Rally

In its new report, 10x Research found that the BTC market has become flush with liquidity in the past few weeks. According to it, total liquidity inflows have reached a year-to-date high of $61.9 billion, surpassing the previous peak in July

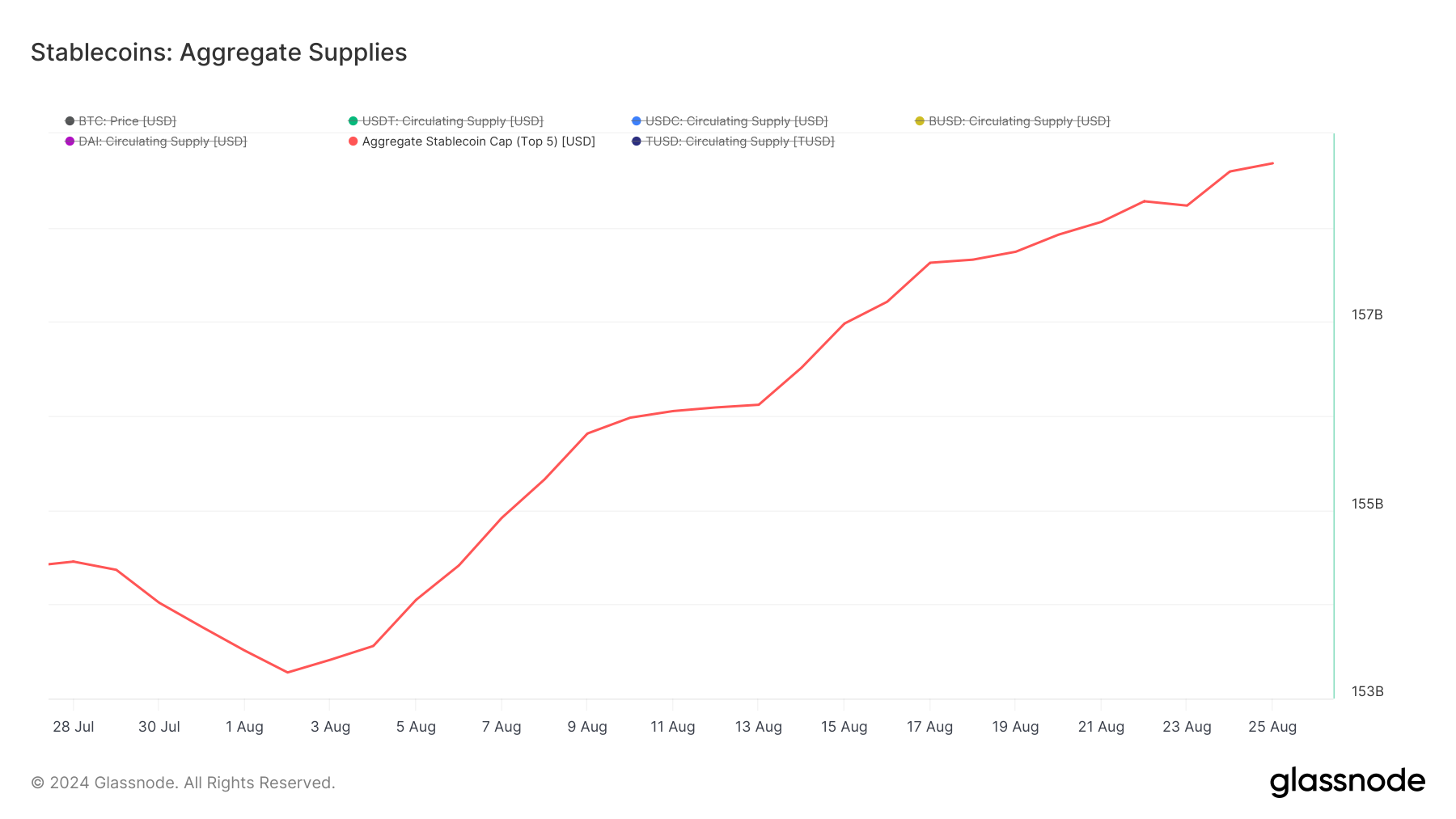

This surge in liquidity has been partly driven by an increase in stablecoin minting. According to Glassnode, the combined supply of the top five stablecoins — Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and TrueUSD (TUSD) — has increased by 3% over the past month.

Read more: What Is a Bitcoin ETF?

The rise in stablecoin minting is a bullish signal because it indicates a growing demand for cryptocurrencies. As more people convert fiat currency into stablecoins, they effectively buy crypto.

While noting that the 7-day minting impulse has decreased from $2.7 billion to $1.0 billion, 10x Research stated that “it remains strong.”

Additionally, the derivatives market has witnessed a rise in leverage through Bitcoin’s perpetual futures, contributing to its recent price momentum. This leverage and ongoing liquidity inflows can help drive the coin’s price toward $70,000.

Weakening Dollar Equals Price Hike For Bitcoin

Further, 10x Research observed a significant macroeconomic shift in early July which may aid BTC’s price. According to the report, the US Dollar peaked in the first few days of July, and 10-year Treasury bond yields declined.

Oil prices, a key indicator of economic strength, also dropped by 10% after reaching their peak in early July. Furthermore, the ISM Manufacturing Index, which has remained below 50 for the third consecutive month, suggests a potential slowdown in the US economy.

When analyzing these macroeconomic trends in relation to BTC’s historical performance, the research firm noted that a weaker US Dollar and lower bond yields have traditionally been favorable for the leading cryptocurrency.

“Fed Chair Powell’s speech, combined with the weakness in the ISM Manufacturing Index and the decline in the US Dollar, has set the stage for expectations of increased market liquidity, which could stimulate risk assets like stocks and Bitcoin,” 10x Research said.

On August 23, Bitcoin broke above the resistance at $61,000 and has since trended upward. However, 10x Research notes that its bullish target of $70,000 will only materialize “if the broader economy doesn’t falter.”

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

If the macro trend stays favorable and Bitcoin maintains its uptrend, the next price target is $64,442. If this level holds and the rally continues, BTC could reclaim the critical $68,000 support before pushing toward $70,000.

Conversely, if selling pressure intensifies, BTC’s price may drop to $61,509, invalidating the bullish projection.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cryptos Dip Further on China’s Retaliatory Tariffs

- Cryptos fell further early Tuesday after China announced retaliatory tariffs on select US imports.

- Meanwhile, US Bitcoin spot ETFs recorded $234.40Mn outflows yesterday.

Cryptocurrency prices have taken another hit as retaliatory tariffs, announced by China, further dampen sentiments.

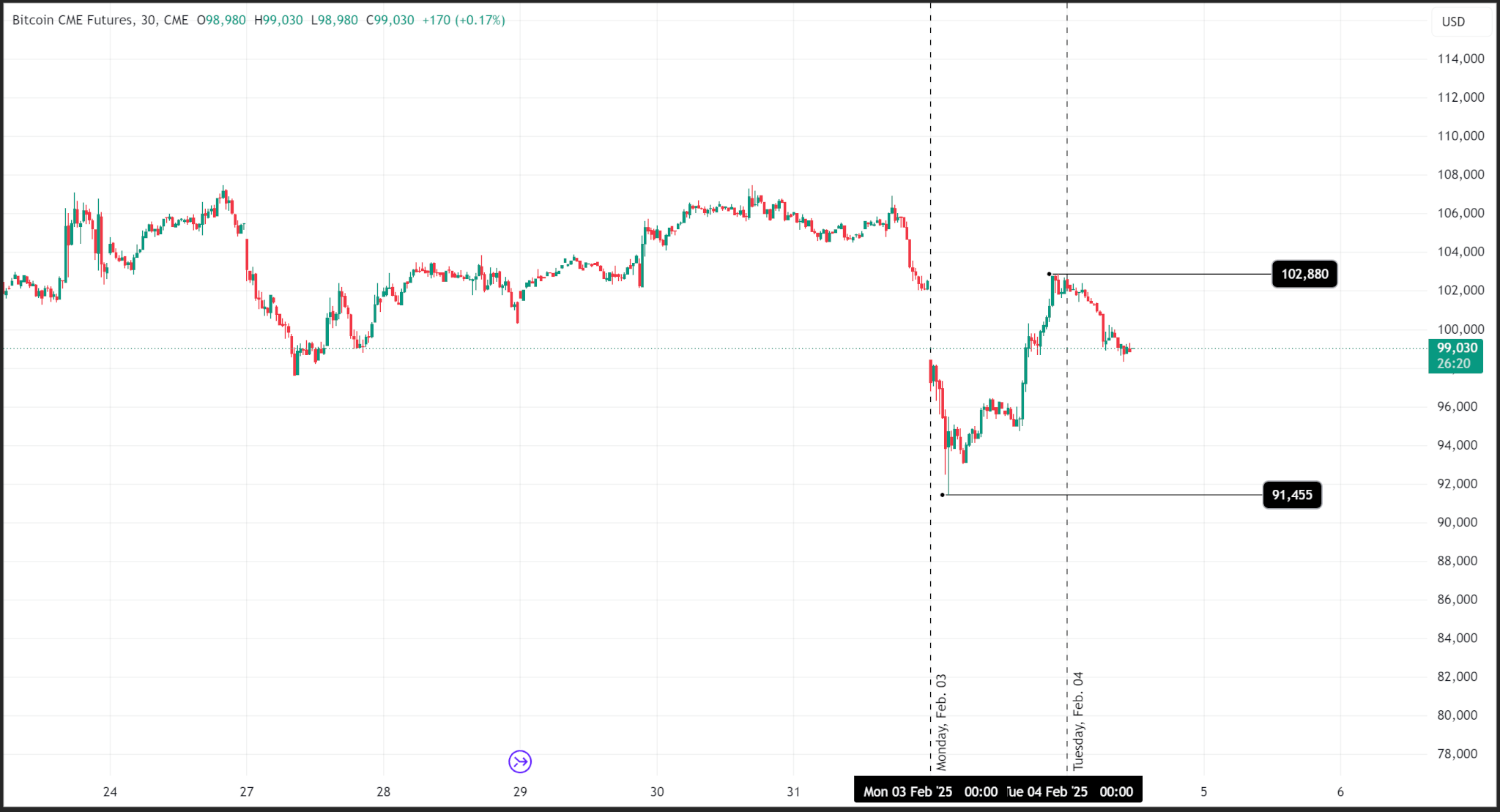

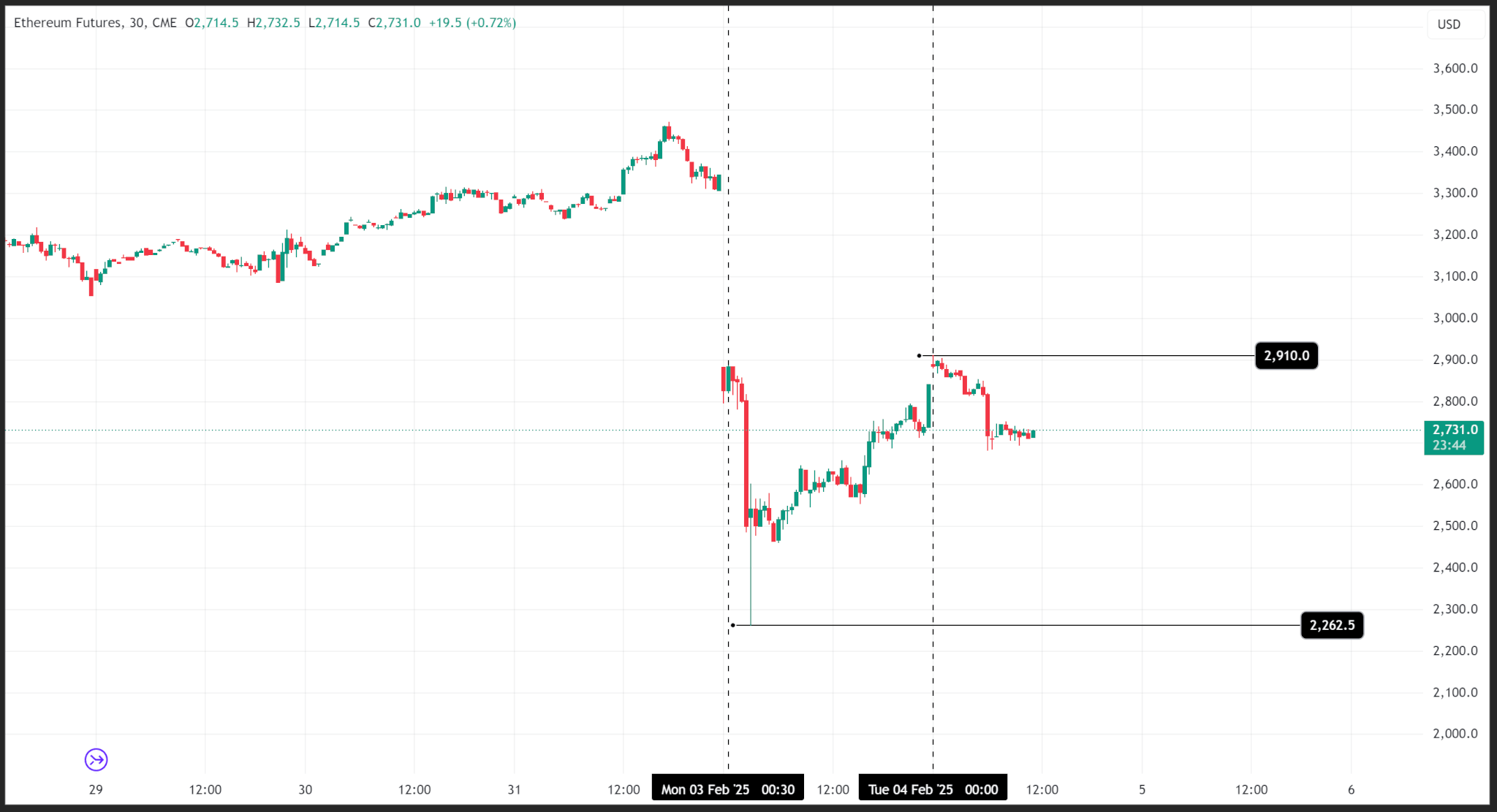

Bitcoin’s price, which showed some resilience in Monday’s trading session, opened the week at $98,465 at the CME and fell to a daily low of $91,455 during the Asian trading session.

Liquidations worth roughly $2.2 billion rocked the market as major alts logged double-digit losses.

Bitcoin’s price began to recover over the London and NY sessions, breaking above $100,000 to a daily high of $102,880. Major alts like Ethereum also parred losses as it rose to $2,910 from a daily low of $2,262.

However, during the early hours of Tuesday, Beijing announced a 15% tariff on coal and other energy imports from the US and a 10% tariff on oil and agricultural equipment, further dousing sentiments.

Bitcoin is down 3.65% at $99,125 while Ethereum is 5.86% lower at $2,730 as of publishing.

Market

ETHFI, TAO Prices Spike on Roadmap Update

Coinbase, the largest US-based crypto exchange, indicated the addition of Ether.fi (ETHFI) and Bittensor (TAO) to its listing roadmap.

ETHFI is a decentralized protocol token offering liquid staking and restaking solutions for Ethereum. Meanwhile, Bittensor’s TAO has multiple purposes within the ecosystem, acting as a utility token and a reward mechanism.

Traders React to Coinbase Listing Announcement

Coinbase only supports two types of assets: native assets on their network and tokens that adhere to a supported token standard. Based on this standard, the exchange has added ETHFI and TAO to its listing roadmap.

The exchange posted the update on X (Twitter), suggesting that ETHFI and TAO meet its listing threshold. The US-based exchange also shared the contract addresses for the two tokens.

“Assets added to the roadmap today: Ether.fi (ETHFI), and Bittensor (TAO),” the post read.

Coinbase’s decision to add ETHFI and TAO to its listing roadmap follows what the exchange describes as a “thorough processes and standards evaluation for legal, compliance and technical security.” The criteria do not consider a project’s market cap or popularity.

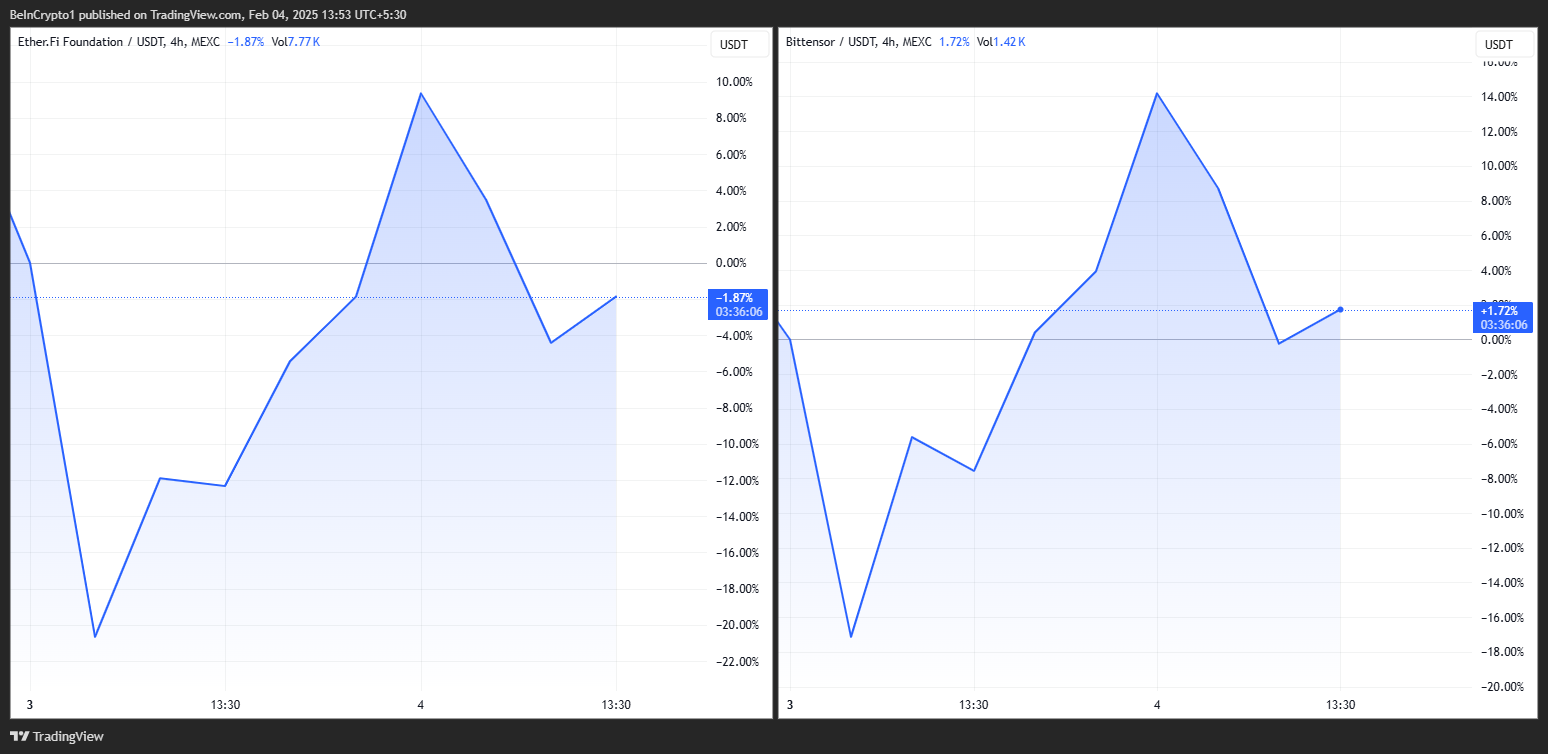

After the Coinbase listing announcement, ETHFI and TAO token prices reacted, soaring by over 30% each before profit booking kicked in.

The surge was expected, coming off as a typical reaction of tokens following listing announcements on popular crypto exchanges. For instance, the Base token TOSHI recently skyrocketed by 70% when Coinbase added it to its listing roadmap. The same reaction happens following Binance exchange’s listing announcements.

Such reactions come amid the “buy-the-rumor, sell-the-event” situation and the expectation of increased liquidity. It is worth noting that Binance is the largest crypto exchange in terms of trading volume metrics. Meanwhile, Coinbase is the largest US-based crypto exchange. Given their high trading volumes and liquidity, it becomes easier for traders to buy and sell the tokens on these platforms.

Higher liquidity often leads to price appreciation, reducing price volatility and making it easier for traders to enter and exit positions. Other factors at play include increased accessibility, increasing demand, credibility, and trust.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

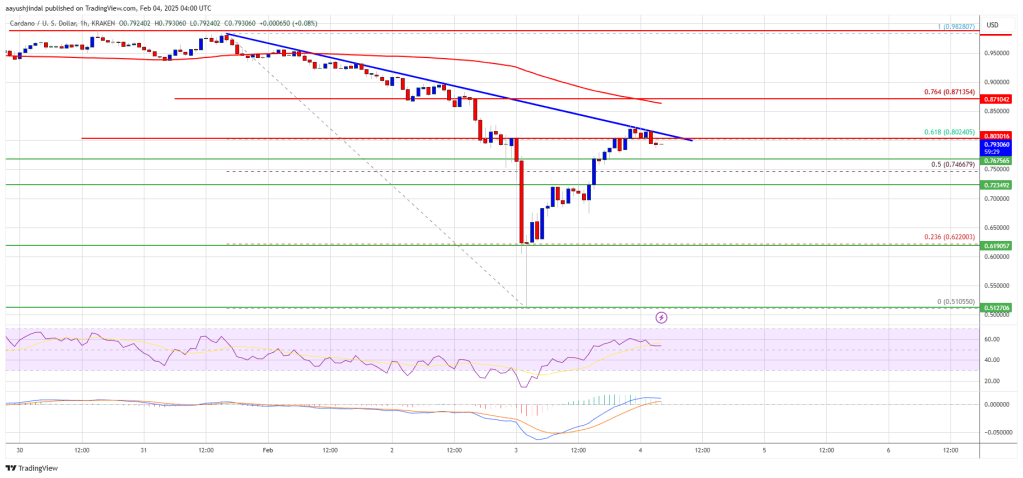

Cardano (ADA) at a Crossroads: Could Bears Take Control Again?

Cardano price started a fresh decline below the $0.9250 zone. ADA is now correcting losses and struggling to clear the $0.80 resistance.

- ADA price started a fresh decline from the $0.9250 zone.

- The price is trading below $0.850 and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $0.8050 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another decline if it trades below the $0.7650 support zone.

Cardano Price Faces Resistance

After struggling to stay above the $0.950 level, Cardano started a fresh decline like Bitcoin and Ethereum. ADA declined below the $0.90 and $0.850 support levels.

There was a clear move below the $0.60 support zone. A low was formed at $0.5105 and the price recently started a decent upward move. The price cleared the $0.60 and $0.70 resistance levels. The bulls pumped the price above the 50% Fib retracement level of the downward move from the $0.9828 swing high to the $0.5105 low.

However, the bears are now active near the $0.80 zone. There is also a key bearish trend line forming with resistance at $0.8050 on the hourly chart of the ADA/USD pair.

Cardano price is now trading below $0.80 and the 100-hourly simple moving average. On the upside, the price might face resistance near the $0.80 zone and the 61.8% Fib retracement level of the downward move from the $0.9828 swing high to the $0.5105 low.

The first resistance is near $0.820. The next key resistance might be $0.850. If there is a close above the $0.850 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.9250 region. Any more gains might call for a move toward $1.00 in the near term.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.80 resistance level, it could start another decline. Immediate support on the downside is near the $0.7650 level.

The next major support is near the $0.7230 level. A downside break below the $0.7230 level could open the doors for a test of $0.6880. The next major support is near the $0.6250 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now above the 50 level.

Major Support Levels – $0.7650 and $0.7230.

Major Resistance Levels – $0.8000 and $0.8200.

-

Market23 hours ago

Market23 hours agoBitcoin Tumbles to $92k as Geopolitical Headwinds Roil Markets

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Uptrend Weakens: ETH Faces Pullback Risks As Selling Pressure Intensifies

-

Market19 hours ago

Market19 hours ago3 Altcoins That Reached All-Time Low Today — February 3

-

Market24 hours ago

Market24 hours agoFARTCOIN Token Price Drops 31% – Is a Two-Month Low Next?

-

Regulation19 hours ago

Regulation19 hours agoKraken Expands In Europe With Regulated Derivatives

-

Market17 hours ago

Market17 hours agoXRP Traders See 6-Month High Liquidation, Price Falls Under $2

-

Market16 hours ago

Market16 hours agoUS-Mexico Tariffs Paused for One Month: XRP Rallies 6%

-

Market15 hours ago

Market15 hours agoDogizen readies for open market as crypto majors rebound