Market

Why Pepe (PEPE) Recent Gains May Not Last

Although PEPE had a sluggish start this month, its price still managed a 25% increase. However, the bullish momentum around the meme coin has waned over the last 24 hours, raising questions about the sustainability of its recent rally.

According to several key on-chain metrics, PEPE may struggle to maintain this momentum.

Pepe Investors Put More Tokens in Circulation

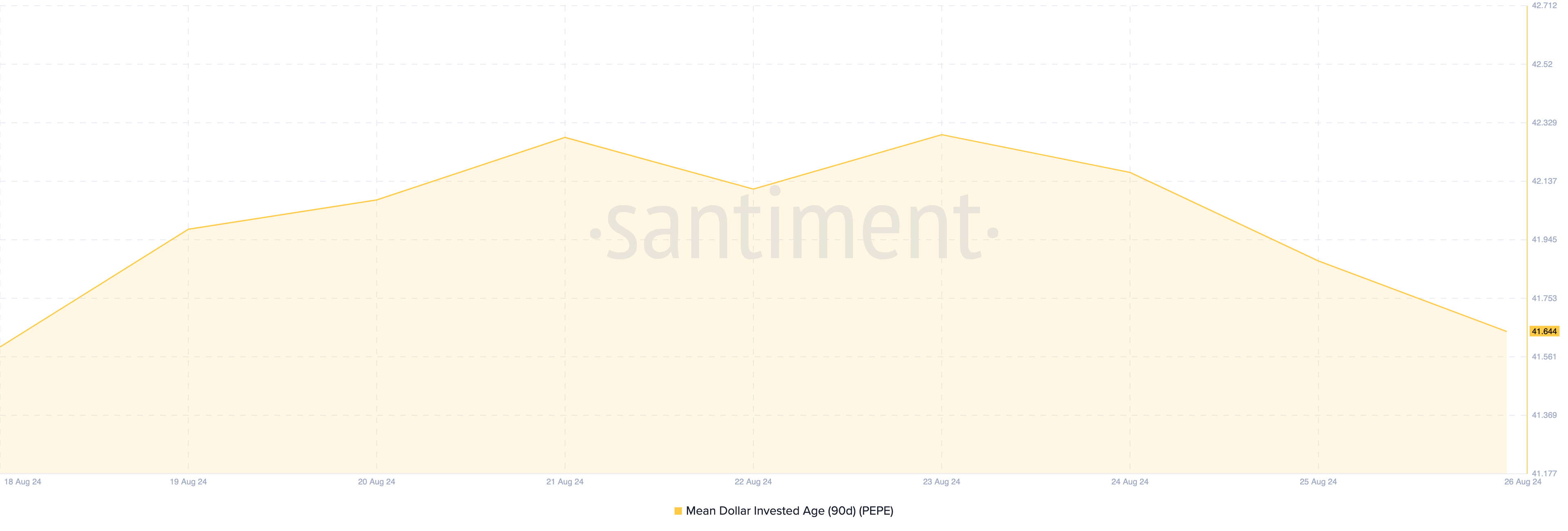

A key metric suggesting this is the Mean Dollar Invested Age (MDIA), which tracks the average period a cryptocurrency has been in the same wallet.

When the MDIA increases, holders keep the same tokens in the same wallet. Conversely, a decreasing MDIA indicates that previously dormant wallets are now moving back into circulation.

Read more: 5 Best Pepe Wallets for Beginners and Experienced Users

While the former is a bullish sign, the latter is a bearish one. According to Santiment, PEPE’s 90-day MDIA was 42.30. At press time, it had decreased, indicating rising trading activity and a potential price drop.

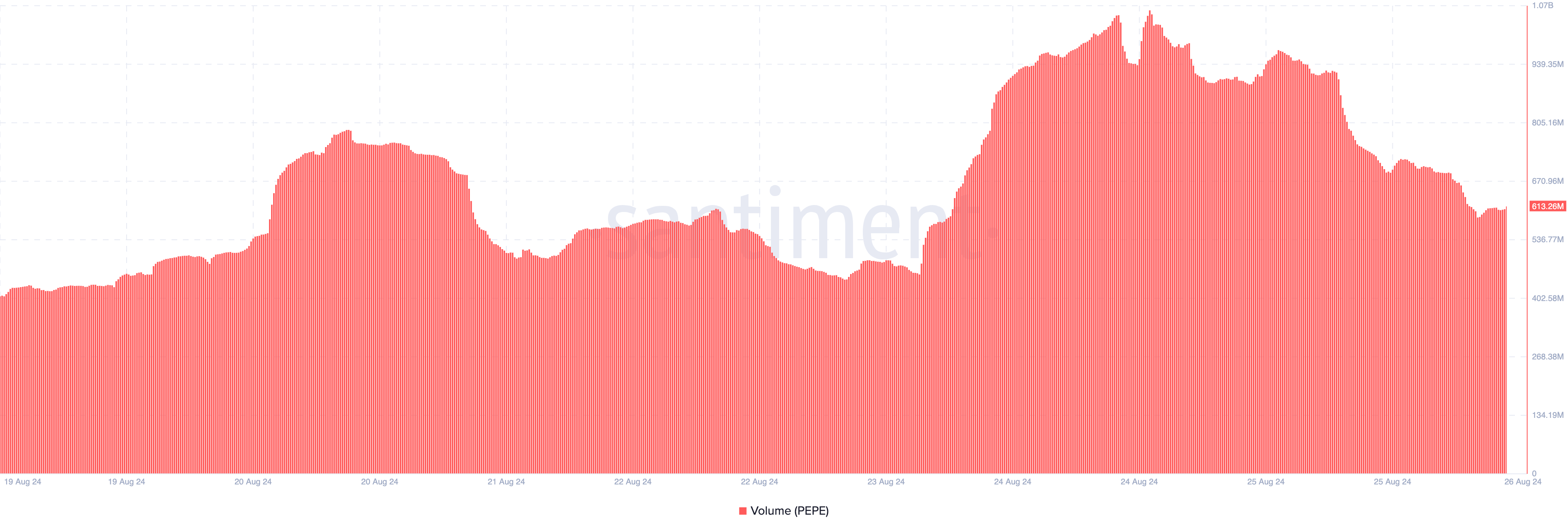

Additionally, trading volume has declined, currently sitting at $613.26 million. Typically, rising volume alongside a rising price strengthens the uptrend.

However, when volume drops after a notable price increase, it suggests that the upswing may not persist.

PEPE Price Prediction: Critical Resistance Close

According to the daily chart, PEPE’s price faces resistance around the 50-day Exponential Moving Average (EMA), shown in yellow. The EMA indicates a cryptocurrency’s trend direction. Currently, the meme coin trades slightly below this level, suggesting a potential bearish trend.

However, the price remains above the 20-day EMA (blue). Given the recent red candlestick, there’s a risk of the price falling below this shorter-period indicator.

Additionally, the token is yet to break above the descending triangle pattern. If this continues, the frog-themed meme coin could see a price drop, with the next target near $0.0000077.

Read more: What Are Meme Coins?

This outlook could change if crypto whales start accumulating the token in large volumes. In that scenario, PEPE might break above the descending triangle, potentially reaching $0.0000098.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Altcoins Trending Today — November 22: MYTH, MAD, MODE

Several altcoins are trending today for various reasons. CoinGecko data shows that all these cryptocurrencies share one thing in common: their prices have risen in the last 24 hours.

This notable hike could be linked to broader market recovery. That said, the top three altcoins trending today are Mythos (MYTH), MAD (MAD), and Mode (MODE).

Mythos (MYTH)

Mythos tops the list of trending altcoins today, specifically due to its 45% price increase in the last seven days. As a project built on the Ethereum blockchain, MYTH’s price also increased due to the rise in ETH’s value.

As of this writing, MYTH’s price is $0.27 but has encountered resistance around the same area. However, the Awesome Oscillator (AO), which measures momentum, shows that the sentiment around the altcoin remains bullish.

In this scenario, MYTH’s price is likely to bounce toward $0.32. However, if momentum turns bearish and the AO reading drops to the negative area, this might not happen. Should that be the case, the altcoin’s value might decline to $0.21.

MAD (MAD)

Another crypto among the altcoins trending today is MAD, a meme coin built on the Solana blockchain. MAD is trending because its value has spiked by 85% in the last 24 hours and over 600% within the last seven days.

This rise in price could be linked to a surge in buying pressure. From a technical point of view, despite the hike, the Bull Bear Power (BBP), which measures the strength of buyers compared to sellers, reveals that bulls are still in control.

If this continues, MAD’s price could rise to $0.00010. However, if cryptocurrency holders decide to sell in large volumes, this might not happen. Instead, the altcoin’s value could sink to $0.000045.

Mode (MODE)

Like yesterday, Mode is also one of the trending altcoins today. Unlike its price action on November 21, MODE’s price has increased 26.50% in the last 24 hours.

Between August and the first few days of this month, MODE’s price traded within a descending triangle. This bearish pattern ensures that the altcoin value failed to notch a significant hike.

However, at press time, it broke out, as BeInCrypto had predicted earlier. With the current price movement, MODE is likely to raise $0.022 in the short term. But in a scenario where selling pressure rises, that might not happen. Instead, it might drop to $0.012.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Gensler’s Exit, Bitfinex Hack, Bitcoin in the US

The crypto market recorded several important developments this week, from regulatory advancements to significant legal rulings. Taken together, the highlights display how the global cryptocurrency ecosystem continues to advance.

The following is a roundup of crucial developments that happened this week but will continue shaping the sector.

Gary Gensler’s to Resign as SEC Chair

Gary Gensler, Chair of the US Securities and Exchange Commission (SEC), announced his resignation effective January 2025. The crypto industry had long anticipated his departure, which marks the end of a controversial tenure characterized by a strict approach to digital asset regulation.

“On January 20, 2025, I will be stepping down as SEC Chair,” he shared.

Gensler’s tenure saw multiple enforcement actions against crypto companies, leading to heightened scrutiny of projects like XRP, Solana, Cardano, and others. Against this backdrop, news of his imminent resignation had a notable impact on the cryptocurrency market. XRP, a token at the center of the SEC’s lawsuit against Ripple, and Solana (SOL) experienced significant rallies.

The rallies came as the crypto industry now anticipates a leadership change that could introduce clearer frameworks for digital assets. Gensler’s departure coincides with ongoing calls for balanced regulation, offering hope for less adversarial interactions between regulators and the crypto community.

US Eyes Crypto-Czar Role

The Trump administration is reportedly considering appointing a “crypto-czar” to shape and lead the nation’s approach to digital assets. Chris Giancarlo, the former chair of the Commodity Futures Trading Commission (CFTC), is among those under discussion for the role.

Other considerations include Coinbase CEO Brian Armstrong, who drew significant support from Cardano’s Charles Hoskinson. Similarly, Brian Brooks, former BinanceUS and Coinbase executive, is also on the list of considerations.

Beyond the crypto-czar role, Trump’s social media and technology company is also in talks to purchase crypto exchange Bakkt. The general sentiment is that purchasing Bakkt could bring Trump fresh skin in the game.

Russia’s Crypto Policy Shake-Up

As BeInCrypto reported, Russia has revised its crypto taxation bill, introducing measures to regulate and tax crypto transactions more effectively. The country has also banned crypto mining in occupied Ukrainian territories, citing security concerns.

“Starting Dec 2024, Russia’s Energy Ministry is clamping down on mining rigs in energy-stressed zones like Irkutsk, Chechnya, and DPR. The takeaway’s clear: energy ≠ infinite, and miners might need to get stealthy or pivot,” Mario Nawfal wrote on X (formerly Twitter).

These developments reflect Russia’s dual approach of harnessing crypto’s economic potential while maintaining stringent control over its use. Analysts warn that these policies could stifle innovation while ensuring compliance with state interests.

Bitfinex Hack Case: Couple Sentenced

BeInCrypto also reported on the US legal system’s sentencing of Heather Morgan, the wife of Ilya Lichtenstein, to prison for the infamous 2016 Bitfinex hack. This sentencing came shortly after Lichtenstein’s sentencing to five years in prison.

Morgan and her husband attempted to launder the loot through various means, including buying gold and NFTs. Of note, Lichtenstein’s sentence was far below his potential 20-year maximum, as he also cooperated significantly with the authorities.

These sentences reflect the ongoing efforts to bring crypto-related crimes to justice. It also highlights the importance of strong security and regulatory oversight in the industry. Notwithstanding, the 2016 Bitfinex attack remains one of the largest cryptocurrency thefts in history.

OCC Approves Bitcoin ETF Options Trading

This week, the Options Clearing Corporation (OCC) also approved Bitcoin ETF (exchange-traded funds) options trading. This decision marked a significant regulatory milestone in the US financial markets. This approval enhances market liquidity, providing institutional and retail investors with greater flexibility to hedge risks.

The move is expected to catalyze broader acceptance of Bitcoin ETFs, potentially driving increased trading volumes and market participation. Analysts believe this approval could pave the way for further advancements in Bitcoin-related financial products.

Author of “Softwar” Enters Presidential Race

To add to this list of interesting things that happened in the crypto market this week, Jason Lowery, the author of Softwar, is eyeing a position in the White House. His bid centered on Bitcoin adoption and national security. Lowery advocates for Bitcoin as a strategic asset, reflecting its potential to fortify the US against global economic uncertainties.

His interest reflects the growing intersection of politics and crypto as policymakers recognize Bitcoin’s strategic implications beyond its financial utility.

“I recommend Maj Jason Lowery for presidential advisor on the Advancement of Bitcoin as a National Strategic Asset,” one user on X pushed.

Grayscale’s Bitcoin Covered Call ETF

Further, Grayscale updated its Bitcoin Covered Call ETF, enhancing its utility for investors seeking income generation strategies. The ETF employs options strategies to provide returns, offering a unique way for investors to capitalize on Bitcoin’s volatility.

This product demonstrates the continued innovation in crypto financial instruments, catering to diverse investor needs amidst a fast-paced market.

“Grayscale wasting no time after BTC ETF options approval. They’ve filed an updated prospectus for their Bitcoin Covered Call ETF (no ticker yet). The fund will offer exposure to GBTC and BTC while writing and/or buying options contracts on Bitcoin ETPs for income,” James Seyffart remarked.

China Recognizes Crypto as Property

A landmark legal ruling also passed among top crypto news this week. As it happened, a Chinese court recognized cryptocurrency as legal property. The determination granted protections to crypto holders, with the decision coming amid China’s stringent crypto regulations. It offers a glimmer of hope for crypto enthusiasts in the region.

This ruling could influence future regulatory approaches, balancing state control with individual rights in the digital economy.

Paul Tudor Jones Doubles Down on Bitcoin

Additionally, hedge fund manager Paul Tudor Jones reaffirmed his commitment to Bitcoin this week. Jones revealed a continued stake in Bitcoin, citing the asset’s resilience amid economic uncertainty. The endorsement highlights Bitcoin’s enduring appeal among institutional investors, reinforcing its status as “digital gold” in turbulent financial landscapes.

“Billionaire hedge fund manager Paul Tudor Jones: All roads lead to inflation … I’m long gold, I’m long Bitcoin, I’m long commodities,” Michael Burry said, citing Jones.

His firm, Tudor Investment Corporation, also significantly increased its Bitcoin reserves, emphasizing its role as a hedge against inflation and geopolitical risks.

Poland’s Bitcoin Reserve Proposal

Beyond Paul Tudor Jones, another show of support for Bitcoin this week came from Polish lawmaker Sławomir Mentzen. The Presidential aspirant vowed to establish a Bitcoin reserve if elected, signaling a potential crypto-friendly policy shift in Poland.

“Poland should create a Strategic Bitcoin Reserve. If I become the President of Poland, our country will become a cryptocurrency haven, with very friendly regulations, low taxes, and a supportive approach from banks and regulators,” Mentzen shared.

His vision includes embracing Bitcoin as a hedge against economic instability and fostering blockchain innovation to strengthen the national economy. His proposal resonates with growing trends among nations exploring Bitcoin adoption to safeguard financial sovereignty.

Mentzen’s promise reflects a rising sentiment across Europe toward leveraging crypto for economic resilience. If realized, this policy could position Poland among a handful of nations integrating Bitcoin into their fiscal strategies. It would also signal a pivotal shift in European crypto policy frameworks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Investors Says Rally Is Not Over

Crypto investor Raoul Pal has shared a bullish outlook for Solana (SOL), suggesting the altcoin could see further gains despite recently reaching a new all-time high. His prediction coincides with two new ETF filings featuring SOL, which could increase the cryptocurrency’s demand and visibility in mainstream markets.

For investors, this forecast aligns with Solana’s expanding ecosystem and growth. The key question remains: How high can SOL rise before hitting the ceiling of this bull cycle?

Pal Expects Solana to Continue Climbing

Pal’s comment after SOL’s price climbed above its previous peak of $260. According to the investor, who is also the founder of Real Vision, a crypto education platform, the rally is far from over, suggesting that the recent hike could be the start of another incredible run.

“SOL — been quite the ride so far from the low to new all time highs. Plenty more to go,” Pal shared on X.

Furthermore, this Raoul Pal Solana prediction might not surprise market observers. Since the FTX collapse in 2022, Pal has consistently argued that Solana was undervalued, especially after it plunged to as low as $8.

What makes this forecast even more intriguing is its timing. It coincides with two notable developments in the institutional space: asset management giants VanEck and 21Shares filing for Solana-based ETFs.

These filings signify the growing institutional interest in Solana, potentially driving demand and reinforcing the bullish sentiment around its price potential.

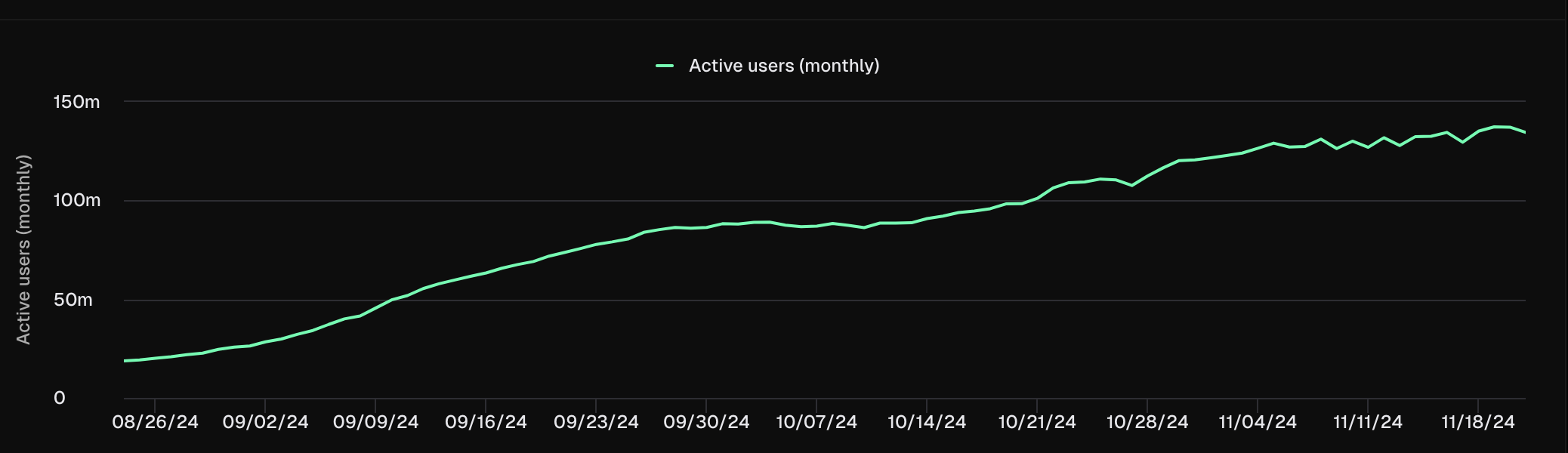

Besides institutional developments, retail investors are also contributing to Solana’s growing momentum. According to Token Terminal, Solana’s monthly active users have seen a significant increase, reaching 134.60 million.

This uptick reflects a rise in the number of addresses actively transacting with SOL, suggesting a broad-based interest in the ecosystem.

Such sustained growth in active users typically suggests healthy network activity and adoption — both of which are bullish indicators for the altcoin’s long-term outlook.

SOL Price Prediction: $300 Looks Feasible

On the daily chart, Solana’s price, currently at $258.81, rallied due to the formation of an inverse head-and-shoulders pattern. An inverse head and shoulders is a bullish chart pattern indicating a potential reversal from a downtrend to an uptrend

Furthermore, a neckline connects the highs of the two troughs and serves as a key resistance level. When the price breaks above this neckline, it confirms the reversal, often accompanied by increased volume.

As seen below, SOL’s price has broken out of the pattern. Should buying pressure increase, the altcoin could climb as high as $300 in the short term.

However, a breakdown below the $235.91 support could invalidate the thesis. In that scenario, the cryptocurrency could decline to $215.21.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation19 hours ago

Regulation19 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market21 hours ago

Market21 hours agoCardano (ADA) Price Hits 41% Weekly Growth, $1 Target in Sight

-

Market19 hours ago

Market19 hours agoTrump Media Files Trademark for Crypto Platform TruthFi

-

Market24 hours ago

Market24 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

-

Market17 hours ago

Market17 hours agoGOAT Price Sees Slower Growth After Reaching $1B Market Cap

-

Market23 hours ago

Market23 hours agoAptos Partners with Circle and Stripe to Revitalize Network

-

Altcoin17 hours ago

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

-

Regulation22 hours ago

Regulation22 hours agoGary Gensler To Step Down As US SEC Chair In January