Market

Crypto Salary in Dubai and More

BeInCrypto’s Asia Crypto Roundup dives into the region’s most crucial updates and developments. Covering key markets like China, South Korea, Japan, and Singapore, our roundup offers insights into Asia’s regulatory shifts, blockchain innovations, major project launches, and market trends.

Last week’s notable events include Story Protocol’s successful $80 million series B funding round and Dubai’s legal ruling that recognizes cryptocurrency payments for salaries.

Bitpanda and RAKBANK Partner to Boost UAE’s Crypto Access

On August 19, Bitpanda Technology Solutions (BTS) and The National Bank of Ras Al Khaimah (RAKBANK) finalized an agreement to enhance digital asset access in the UAE. This collaboration will enable UAE residents to manage various digital assets securely. The partnership is a strategic move that allows banks to participate in the virtual asset economy without developing in-house capabilities.

In this initiative, Bitpanda Broker MENA DMCC’s operational approval and licensing by the Virtual Assets Regulatory Authority (VARA) are crucial. Similarly, RAKBANK must obtain approval from the Central Bank of the UAE (CBUAE).

Read more: Top 9 Safest Crypto Exchanges in 2024

Korean Founder Secures $80 Million from Andreessen Horowitz

On August 21, venture capitalist Andreessen Horowitz (a16z) announced leading an $80 million series B funding round for PIP Labs, the developer of Story Protocol. The funding also saw participation from Polychain Capital and notable investors like HYBE founder Bang Si-hyuk and Paris Hilton. This investment propels PIP Labs’ valuation at over $2.2 billion.

Story Protocol is a blockchain startup that helps creators protect their intellectual property (IP). It aims to generate sustainable revenue in an era where AI-driven copyright theft is becoming increasingly prevalent.

Furthermore, it provides creators with a platform to register their IP, set usage terms, and receive compensation for their work. These will effectively protect their creations from unauthorized AI usage.

“We believe that all intellectual and creative works can fall under the category of IP, and all of them are going to face dramatic changes in this new age of AI. […] Story is trying to solve a problem of how IP will be monetized when the entire internet is being scraped by these AI models,” Jason Zhao, Chief Protocol Officer and co-founder of the PIP Labs, said.

Zhao, a former product manager at Google’s AI lab DeepMind, co-founded PIP Labs with Lee Seung-Yoon, a South Korean entrepreneur who sold his mobile fiction platform, Radish, for $374 million in 2021. Together, they bring deep expertise in the tech and creative industries to Story Protocol.

The firm has already attracted over 200 entities to register over 20 million intellectual properties on the platform. Story Protocol is gearing up for its mainnet launch to become a cornerstone for future internet content creation and monetization.

Dubai Recognizes Crypto as Legitimate Salary Payment

The Dubai Court of First Instance has recently recognized cryptocurrency payments for salaries under employment contracts. The ruling was based on Article 912 of the UAE Civil Transactions Law and the Federal Decree-Law No. (33) of 2021. It emphasizes the importance of upholding clear contractual agreements, provided they align with public policy and law.

This ruling contrasts with a previous decision in 2023, where a similar claim was denied due to the plaintiff’s failure to provide a precise valuation of the digital currency involved.

The recent case involved a wrongful termination and unpaid wages claim. The plaintiff’s employment contract stipulated a salary in fiat currency and additional payment in EcoWatt tokens, a form of cryptocurrency.

The employer argued that the crypto payments were not legally enforceable. Still, the court ruled in favor of the employee. It validated the payment in EcoWatt tokens rather than converting them into fiat currency.

Malaysia Cracks Down on Illegal Bitcoin Mining

Following a court order, on August 19, Malaysian authorities destroyed 985 Bitcoin mining machines worth approximately $452,500. The machines, seized during enforcement operations from 2022 to April 2023, were crushed with a steamroller in the Perak Tengah district.

This action came after the arrest of seven individuals involved in illegal Bitcoin mining operations that allegedly stole electricity to power their activities. The suspects were detained separately last week, including three local residents and four foreign nationals.

Sepang District Police Chief ACP Wan Kamarul Azran Wan Yusof stated that these individuals had no prior criminal records, but their illegal activities had caused significant losses to the country. The authorities estimate Malaysia lost as much as 3.4 billion Malaysian ringgits ($757 million) between 2018 and 2023 due to electricity theft linked to Bitcoin mining.

Deputy Energy Transition and Water Transformation Minister Akmal Nasrullah Mohd Nasir highlighted the growing prevalence of this issue. He emphasized the detrimental impact of electricity theft for crypto mining on Tenaga Nasional Berhad (TNB) and the country.

“The theft of electricity by those who mine cryptocurrency occurs because they believe this activity cannot be detected due to the absence of meters on their premises. However, energy supply companies have various methods to detect unusual energy consumption in an area,” Nasir said.

Read more: How Much Electricity Does Bitcoin Mining Use?

Tether Unveils UAE’s First Dirham-Pegged Stablecoin

On August 21, Phoenix Group PLC, a holding company listed on the Abu Dhabi Securities Exchange (ADX), unveiled a strategic partnership with Tether, a leading issuer of stablecoins, to introduce a stablecoin linked to the UAE dirham. Green Acorn Investments Ltd. supports this initiative, which aims to revolutionize the digital asset sector.

By merging the UAE dirham’s reliability with blockchain’s technological advantages, this stablecoin provides a reliable digital currency that mirrors one of the world’s most stable currencies. Moreover, it could potentially play a pivotal role in enhancing business operations and expanding growth opportunities in the digital age.

Backed by Phoenix Group and Tether’s financial strength and technical expertise, this stablecoin will be governed by strict regulatory compliance procedures that align with the UAE’s regulatory framework. The introduction of this stablecoin is expected to be globally accessible, with deep roots in the UAE’s economic strength and stability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

The crypto market watches with bated breath as XRP teeters at $1.97, a battleground where bullish conviction clashes with bearish determination. After a retreat from recent highs, the digital asset now faces a critical test.

The current standoff mirrors the broader tug-of-war in crypto markets, where sentiment shifts rapidly and key price levels dictate the next major move. For XRP, $1.97 isn’t just another number; it’s a line in the sand. A decisive hold here could reignite upward momentum, while a breakdown may embolden the bears.

Market Sentiment: Fear, Greed, Or Indecision?

According to Grumlin Mystery, a well-known crypto analyst, XRP is likely to experience a further downside in the near future, potentially dropping to $1.96. In his March 30th post on X, he highlighted that a decrease in liquidity within the crypto market is playing a crucial role in weakening XRP’s price stability, driven by the impact of US tariffs and the implementation of Trump’s policy changes.

Grumlin pointed out that restrictive trade policies and economic uncertainty have led to a slowdown in capital flow into riskier assets like cryptocurrencies. With reduced liquidity, market participants have less buying power, making it easier for bears to push prices lower. He warned that if these economic conditions persist, XRP could struggle to find strong support, and a drop below $1.96 could trigger further declines.

This drying up of liquidity has allowed sellers to gain the upper hand, exerting downward pressure on prices. As a result, XRP’s ability to hold support at $1.96 remains uncertain, and unless market conditions improve, a deeper correction could be on the horizon.

Grumlin Mystery further elaborated that a sharp change in Trump’s rhetoric regarding tariffs remains highly unpredictable, making it difficult to gauge its full impact on the financial markets, including cryptocurrencies. While many initially believed that Trump’s stance would be a major positive catalyst for the crypto market, the reality appears to be more complex.

The analyst emphasized that market uncertainty is increasing as traders struggle to anticipate the next move in U.S. economic policy. If Trump maintains or intensifies his tariff approach, it could further tighten liquidity conditions, making it even harder for XRP to sustain bullish momentum.

Possible Scenarios For XRP

If buyers successfully defend the $1.96 level, XRP could see renewed upside momentum. A bounce from this support zone might trigger a rally toward $2.64, where the next resistance lies. A breakout above this level raises the potential to $2.92 or even $3.4, confirming a bullish recovery. Increased trading volume and improving market sentiment would be key indicators of this scenario playing out.

Sellers’ failure to maintain control and XRP’s failure to hold above $1.96 may cause a sharper decline. In this case, the next critical support levels to watch would be $1.70 and $1.34. Breaking below these levels could expose the asset to more losses to $0.93 or lower.

Market

Binance Managed 94% of All Crypto Airdrops and Staking Rewards

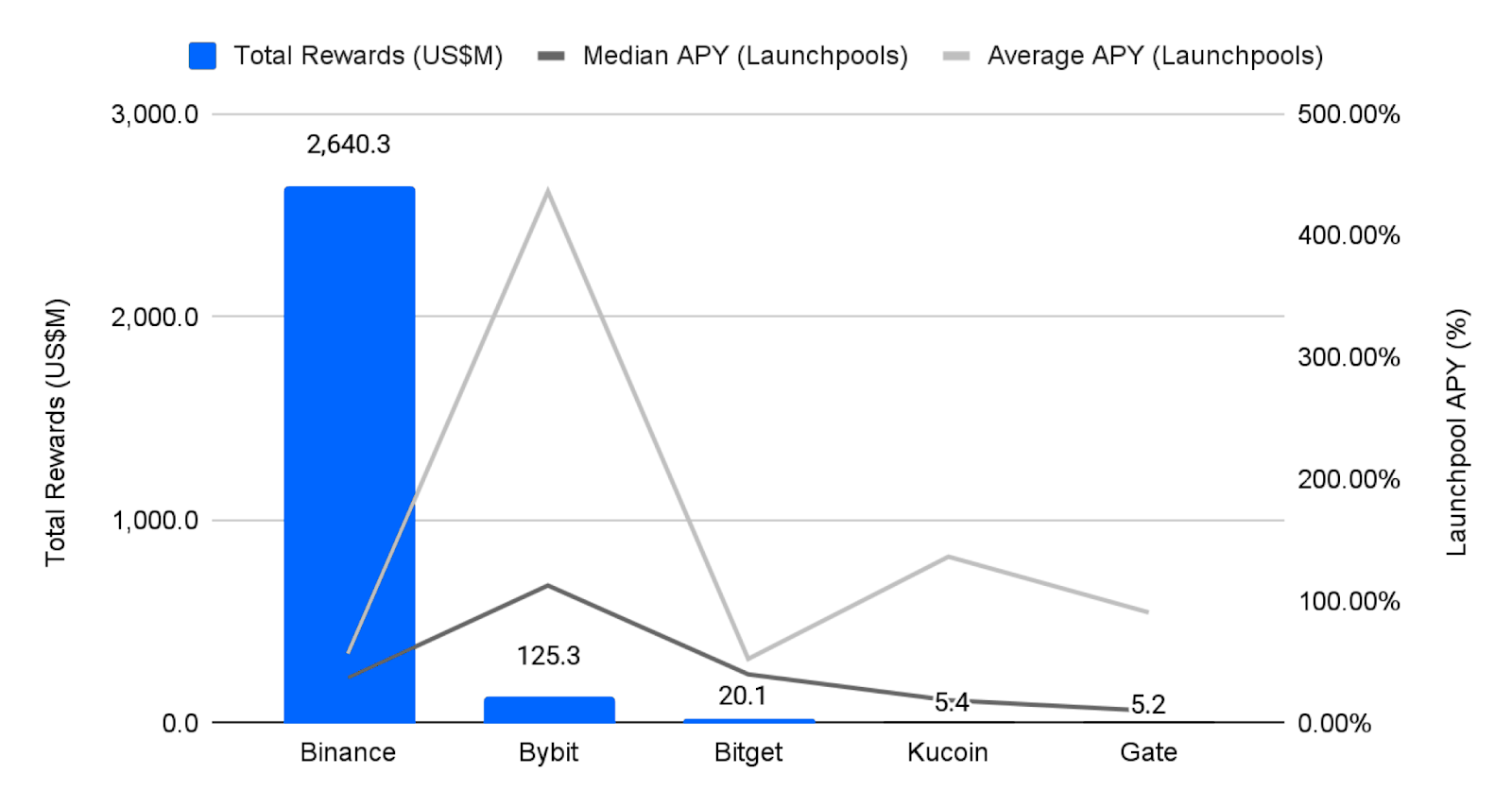

A new report shows that Binance almost has a monopoly in the CEX market in terms of crypto airdrop distribution and staking rewards. In 2024, the exchange received $2.6 billion of a total of $2.7 billion in rewards, amounting to 94% of the entire market segment.

In an exclusive press release shared with BeInCrypto, Binance also revealed that it’s making substantial changes to its airdrop services to improve user experience and make participation easier.

Binance Leads the Market in Crypto Airdrops

Binance, the world’s largest crypto exchange, has become the go-to platform for airdrops and staking rewards. It launched the HODLer airdrop program less than a year ago, providing many new projects with a comprehensive platform to reward early adopters.

In the past year, the exchange has become synonymous with the latest airdrops, as most users are accessing their rewards through the platform.

Based on this impressive performance in the airdrop sector, Binance has substantially upgraded a few of its services. The platform has revamped its Launchpool and BNB Earn pages, making it easier for users to both track and participate in airdrops.

“With these upgrades, we’re making it easier than ever for users to unlock the full potential of BNB and participate in high-quality token launches. The redesigned Binance Launchpool and BNB pages reflect our commitment to user education, simplicity, and maximizing rewards,” said Jeff Li, VP of Product at Binance.

The updated BNB page will give Binance users key benefits, such as real-time information on airdrops across its platforms, including Launchpool, Megadrop, and HODLer Airdrops.

Users will also see features like trading fee discounts, VIP perks, and a historical rewards section. These improvements are designed to help the firm maintain its significant dominance while continuing to focus on integrity.

Hopefully, these improvements will allow the firm to maintain its significant dominance while maintaining its usual integrity. Last month, Binance Research identified some systemic problems with airdrops in general, and the exchange seems particularly concerned with its reputation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Falls To Record New Low Amid Weak Inflows

Pi Network (PI) has experienced a significant downtrend recently, with price declines that have left many holders facing losses.

The altcoin has failed to break free from this negative momentum, and the market conditions continue to worsen. As a result, investors are losing confidence, and the price may continue to drop further.

Pi Network Continues To Suffer

The Chaikin Money Flow (CMF) continues to show bearish signs, remaining well below the zero line. This indicates that the network is suffering from outflows, meaning that investors are moving their funds out of Pi Network. Despite a bullish start, Pi failed to sustain interest, leading many holders to sell off their positions.

The outflow trend is concerning for investors, as the lack of positive momentum suggests a prolonged downtrend. The market sentiment remains bearish, with sellers outweighing buyers. As the CMF stays in the negative zone, it signals that Pi Network’s price could struggle to find stability in the short term.

The Ichimoku Cloud, a widely used technical indicator, is hovering well above the candlesticks, signaling that the bearish trend is gaining strength. This indicates that there is little upward momentum in the market, and Pi Network is likely to face more downward pressure.

Additionally, broader market conditions are still negative, which suggests that Pi Network may fail to recover in the immediate future. With bearish technical indicators and a lack of support from investors, the outlook for Pi Network remains grim for now.

PI Price Hits A New Low

Pi Network is currently priced at $0.61, having formed a new all-time low of $0.60 after dropping by nearly 14% over the last 24 hours. The altcoin continues to struggle under the weight of negative sentiment and is not showing signs of reversal in the near term.

Based on the ongoing outflows and bearish technical indicators, Pi Network will likely continue its decline. It could fall further to $0.50, potentially forming new all-time lows. The current market conditions suggest that recovery is unlikely without a significant shift in sentiment.

However, if Pi Network can bounce off the $0.60 level, it might regain some support and climb back to $0.87. This would help recover some of the recent losses and potentially give the altcoin another chance at a bullish move. But, without a strong catalyst, it may struggle to break through the resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Ethereum22 hours ago

Ethereum22 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin21 hours ago

Altcoin21 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin22 hours ago

Altcoin22 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market13 hours ago

Market13 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market4 hours ago

Market4 hours agoBitcoin’s Future After Trump Tariffs

-

Altcoin16 hours ago

Altcoin16 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Market14 hours ago

Market14 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead