Market

This Is Why Vitalik Buterin Is Confident in Ethereum’s Future

Ethereum (ETH) co-founder Vitalik Buterin has sparked curiosity among community members by promoting the largest altcoin by market cap.

Known for his philosophical insights, the Russo-Canadian innovator recently noted that his followers have been asking him to cut back on the “philosophizing” and do more “Ethereum bull posting.”

ETH Fundamentals ‘Crazy Strong’ — Vitalik Buterin

After publishing his blog titled “Plurality philosophy in an incredibly oversized nutshell,” Buterin mentioned that many of his followers want “less philosophizing and more Ethereum bull posting.” This change in tone sparked speculation, with one user jokingly suggesting Buterin had sold his X (formerly Twitter) account. They noted the difference in his usual content style.

“Vitalik 100% sold their account comparing their early posts to their posts now completely different in almost every way, the language, the nomenclature, the phrasing, practically everything. People don’t change that radically that quickly, regardless of personal situation,” one user expressed.

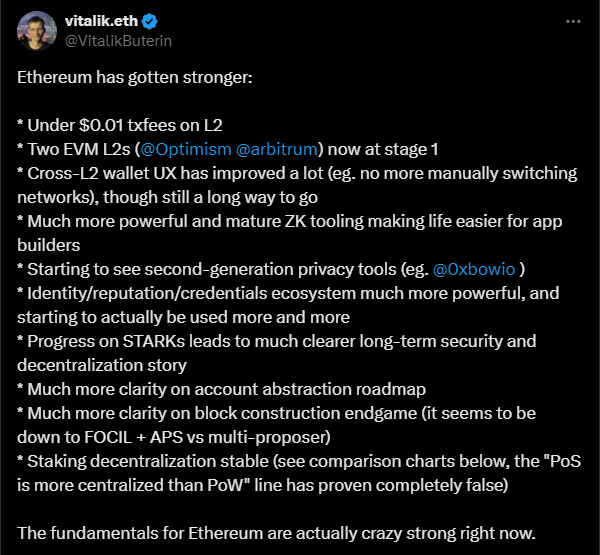

In a recent development, Vitalik Buterin strongly defended Ethereum after a user questioned its strength in the current market cycle. The critic argued that Layer-1s and Layer-2s are nearing bankruptcy, with investors losing up to 80% of their value.

“Hey Vitalik, Ethereum has weakened a lot in this cycle, layer-1 and layer-2 projects in the ecosystem are almost going bankrupt, and investors have already lost up to 80%, what will happen?” the trader wrote.

Read more: How to Invest in Ethereum ETFs?

Challenging the bearish outlook, Buterin stated that “Ethereum has gotten stronger.” He highlighted key factors such as transaction fees on Layer-2 solutions dropping to less than $0.01 and pointed to Arbitrum and Optimism as Ethereum Virtual Machines (EVMs) now in Stage 1. Buterin further said that the “fundamentals for Ethereum are crazy strong right now.”

While Buterin highlights Ethereum’s strong fundamentals, Ignas, co-founder of DeFi studio Pink Brains, argues that it’s easy to be bearish on ETH. He cites Ethereum’s underperformance relative to Solana (SOL) and Bitcoin (BTC), noting that bearish sentiment is widespread.

However, Ignas remains optimistic, suggesting that Ethereum’s upcoming Pectra Upgrade could act as a bullish catalyst. This upgrade might renew investor confidence and shift market sentiment in favor of ETH.

Ethereum Plans Changes With Pectra Upgrade

The Ethereum blockchain has scheduled the Pectra Upgrade for the first quarter of 2025. This hard fork combines the Prague and Electra upgrades, aimed at enhancing the execution and consensus layers of the network, respectively.

Key features of the Pectra Upgrade include an increased staking limit, PeerDAS/rollup improvements, and enhancements to the EVM. Ethereum developers chose to delay the upgrade’s release until after Devcon in November 2024, prioritizing thorough testing and monitoring based on lessons learned from previous upgrades.

Although Pectra is considered a relatively minor update, Ethereum Foundation protocol support lead Tim Beiko and Vitalik Buterin have also highlighted the upcoming Verkle tree development, another significant upgrade planned for 2025.

“I’m looking forward to Verkle trees. They will enable stateless validator clients, which can allow staking nodes to run with near-zero hard disk space and sync nearly instantly – far better solo staking UX. Also good for user-facing light clients,” Buterin shared.

The Pectra Upgrade follows Ethereum’s Dencun hard fork, which occurred in March 2024. Dencun, which combined Deneb and Cancun upgrades, was intended to lower transaction fees for L2 solutions while improving Ethereum scalability.

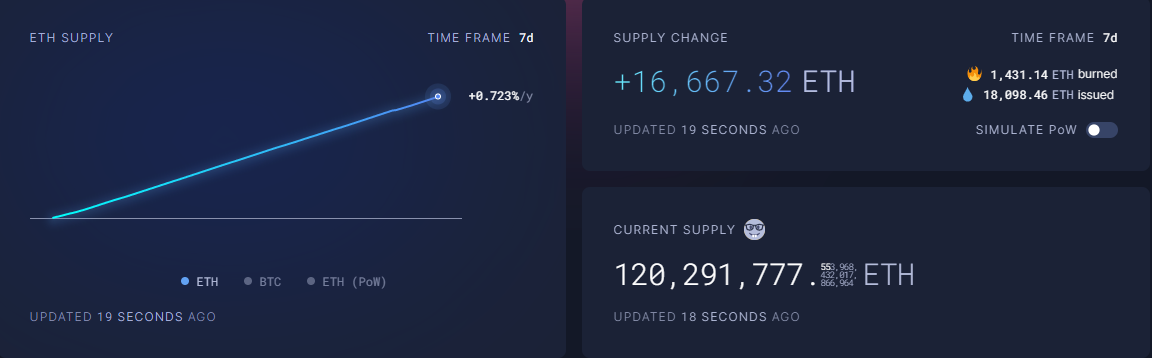

While Ethereum’s upcoming upgrades are generating optimism, the network’s deflationary status has been fading since the Dencun Upgrade. According to recent data, Ethereum has experienced a notable increase in ETH supply since mid-April, leading to concerns about its inflationary trend. Despite initial expectations for Ethereum to maintain its deflationary stance following its shift to Proof-of-Stake (PoS), it is now experiencing its longest inflationary period since the transition.

The current inflation rate is around 0.72% per year, according to ultrasound.money. This means that Ethereum is now issuing more units than it is burning, weakening the “ultra-sound money” narrative that has been a key selling point for the network.

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

While the upgrade successfully lowered transaction fees, it inadvertently decreased the total amount of ETH burned on the mainnet. This reduction has resulted in a slower burn rate, pushing Ethereum back into inflationary territory.

“Due to the decrease in on-chain activity, ETH Gas has been below 2 Gwei for a long time since early April this year. In the past four and a half months, the total amount of ETH has increased from 120,063,605 to 120,291,622, and inflation has increased by 228,000. Based on this, the annual inflation will be 600k, with an inflation rate of 0.5%,” blockchain sleuth EmberCN wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price 25% Rally: Breaking Barriers and Surpassing Odds

XRP price rallied above the $1.15 and $1.20 resistance levels. The price is up over 25% and might rise further above the $1.420 resistance.

- XRP price started a fresh surge above the $1.20 resistance level.

- The price is now trading above $1.250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is up over 25% and it seems like the bulls are not done yet.

XRP Price Eyes Steady Increase

XRP price formed a base above $1.050 and started a fresh increase. There was a move above the $1.150 and $1.20 resistance levels. It even pumped above the $1.25 level, beating Ethereum and Bitcoin in the past two sessions.

There was also a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair. A high was formed at $1.4161 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high.

The price is now trading above $1.30 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.400 level. The first major resistance is near the $1.420 level. The next key resistance could be $1.450.

A clear move above the $1.450 resistance might send the price toward the $1.50 resistance. Any more gains might send the price toward the $1.550 resistance or even $1.620 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Supported?

If XRP fails to clear the $1.420 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3350 level. The next major support is near the $1.2850 level.

If there is a downside break and a close below the $1.2850 level, the price might continue to decline toward the $1.240 support or the 50% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high in the near term. The next major support sits near the $1.20 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.3350 and $1.2850.

Major Resistance Levels – $1.4000 and $1.4200.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

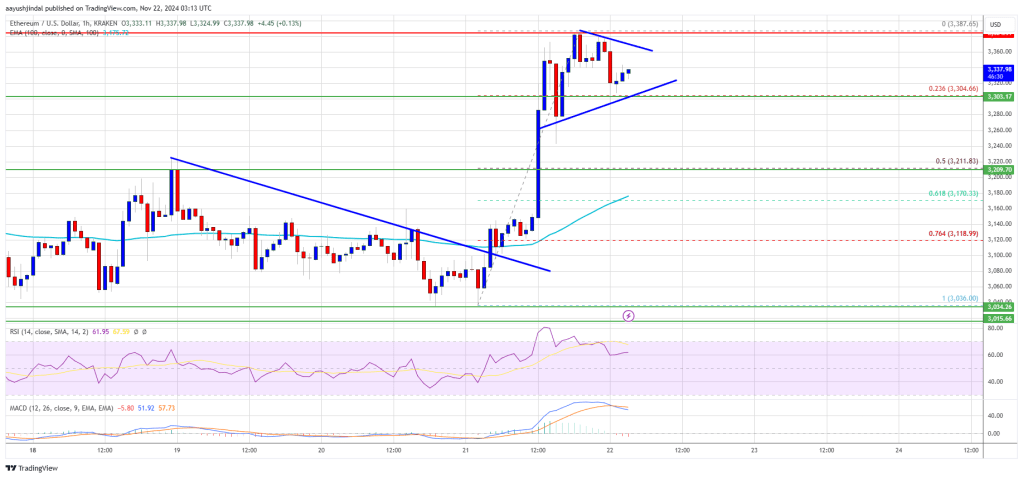

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market20 hours ago

Market20 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Bitcoin15 hours ago

Bitcoin15 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Market15 hours ago

Market15 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market23 hours ago

Market23 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin22 hours ago

Altcoin22 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Altcoin20 hours ago

Altcoin20 hours agoVitalik Buterin, Coinbase’s Jesse Pollack Buy Super Anon (ANON) Tokens On Base

-

Altcoin15 hours ago

Altcoin15 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K