Market

Bitcoin drops below $60k and could dip lower as MEXC lists POODL

Key takeaways

- Bitcoin has lost 3% of its value and is trading below $60k once again.

- Poodlana’s native token is now live on the MEXC exchange after its presale has been concluded.

BTC could drop below $59k as Mt.Gox moves more bitcoins

Bitcoin is underperforming again following a positive start to the week. The world’s leading cryptocurrency by market cap is trading below $60k after losing 3% of its value in the last 24 hours.

At press time, the price of Bitcoin stands at $59,409 and could dip lower if the bears remain in control. The bearish performance comes after Mt.Gox moved over $700 million worth of bitcoins to an unknown wallet. Traders are anticipating more selloff in the market as Mt.Gox distributes more bitcoins to its creditors.

What is Poodlana?

The broader market is bearish, but the adoption of cryptocurrencies continues to pick up pace, both among retail and institutional investors.

Poodlana is one of the projects that is gaining traction among investors. It is a Solana-based meme coin focused on introducing the glamor of high fashion to the crypto world.

By focusing on promoting the ethos of community while providing utility to users, Poodlana could become one of the leading dog-themed meme coins in the world. The team will leverage Poodlana’s popularity in Japan, Korea, and China to build a strong community for this project.

Poodlana’s token now live on MEXC

The Poodlana presale has officially ended, with $8 million raised during the event. The project didn’t waste time getting its token listed on a centralised cryptocurrency exchange.

MEXC, a leading crypto exchange, announced earlier this week that POODL, Poodlana’s native token, is now live on its trading platform. Currently, only the POODL/USDT pair is live on MEXC, but the crypto exchange could list more pairs, such as POODL/BTC and POODL/ETH, in the coming weeks or months.

Poodlana allocates 50% of the total supply to presale

Poodlana didn’t adopt a lock-up period, which means its tokens are now available to investors. Per their tokenomics, Poodlana will have 1 billion POODL tokens, with 50% going presale.

The remaining 50% will be divided among marketing (15%), rewards (5%), partnerships (5%), treasury (10%), and liquidity (15%).

Poodlana’s team kept their promise and unlocked 100% of their tokens immediately after the presale. The unsold tokens would be burned, ensuring the token’s deflation.

Should you buy POODL as it lists on exchanges?

If you missed buying the Poodlana tokens during the presale, you can still purchase them from crypto exchanges. At the moment, POODL is only available on MEXC but could be listed on other exchanges soon.

Meme coins have become a crucial part of the cryptocurrency ecosystem, with several having a market cap of $1 billion or more. With POODL still in its early days, this could be the perfect opportunity to invest in the project.

Market

Rallies 10% and Targets More Upside

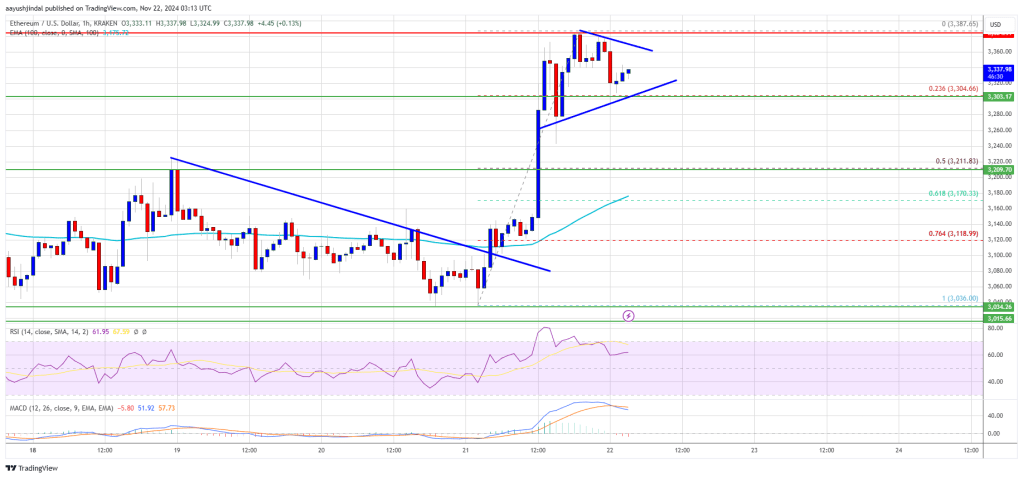

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

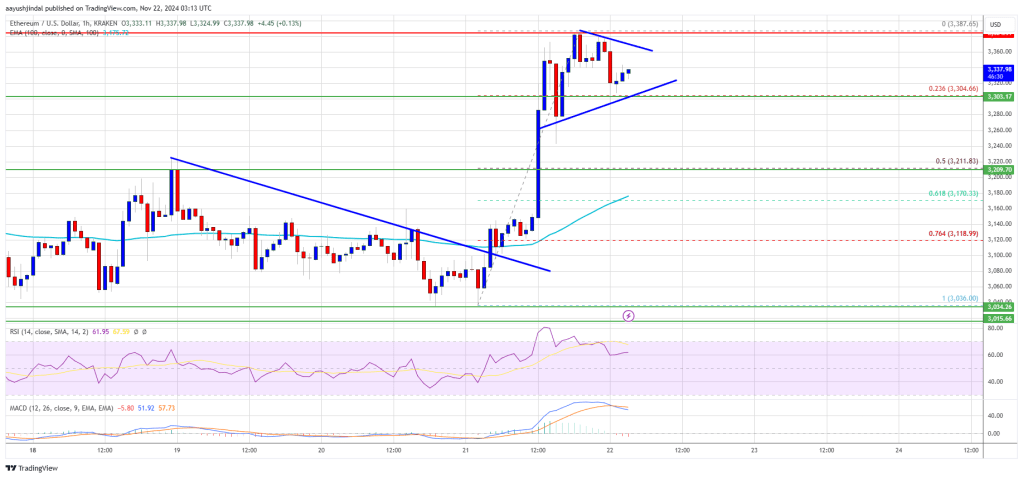

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

GOAT Price Sees Slower Growth After Reaching $1B Market Cap

GOAT price has skyrocketed 214.29% in one month, recently breaking into the $1 billion market cap and securing its place as the 10th largest meme coin. It now stands just ahead of MOG, which closely trails its position in the rankings.

However, recent indicators suggest that GOAT’s uptrend may be weakening, raising questions about whether it can sustain its rally or face a potential correction.

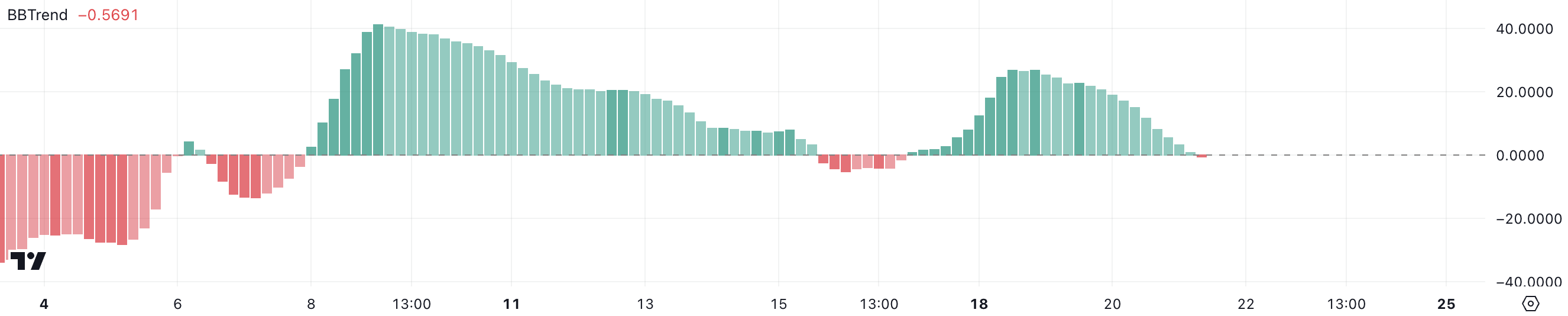

GOAT BBTrend Is Negative For The First Time In 4 Days

GOAT BBTrend has turned negative for the first time since November 17, now sitting at -0.54. This shift suggests that bearish momentum is beginning to take hold, with the asset’s recent upward trajectory starting to weaken potentially.

BBTrend measures the strength and direction of price trends using Bollinger Bands, with positive values indicating an uptrend and negative values signaling a downtrend. A negative BBTrend reflects increased downward pressure, which could indicate the start of a broader market shift.

GOAT has had an impressive November, gaining 61% and reaching a new all-time high on November 17.

However, the current negative BBTrend, if it persists and grows, could signal the potential for further bearish momentum.

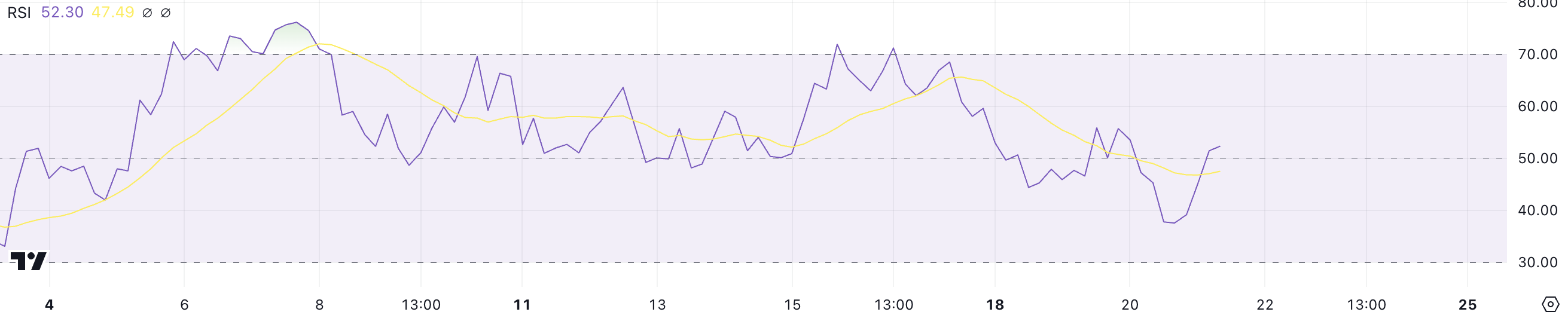

GOAT Is In A Neutral Zone

GOAT’s RSI has dropped to 52, down from over 70 a few days ago when it reached its all-time high. This decline indicates that buying momentum has cooled off, and the market has moved out of the overbought zone.

The drop suggests a shift toward a more neutral sentiment as traders consolidate gains and the strong bullish pressure seen earlier subsides.

RSI measures the strength and velocity of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 52, GOAT’s RSI is in a neutral zone, neither signaling strong bullish nor bearish momentum.

This could mean the current uptrend is losing strength, and the price may consolidate or move sideways unless renewed buying pressure reignites upward momentum.

GOAT Price Prediction: A New Surge Until $1.50?

If GOAT current uptrend regains strength, it could retest its all-time high of $1.37, establishing its market cap above $1 billion, a fundamental threshold for being among the biggest meme coins in the market today.

Breaking above this level could pave the way for further gains, potentially reaching the next thresholds at $1.40 or even $1.50, signaling renewed bullish momentum and market confidence.

However, as shown by indicators like RSI and BBTrend, the uptrend may be losing steam. If a downtrend emerges, GOAT price could test its nearest support zones at $0.80 and $0.69.

Should these levels fail to hold, the price could fall further, potentially reaching $0.419, putting its position in the top 10 ranking of biggest meme coins at risk.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum21 hours ago

Ethereum21 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Altcoin24 hours ago

Altcoin24 hours agoBTC Reaches $97K, Altcoins Gains

-

Market18 hours ago

Market18 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market22 hours ago

Market22 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin16 hours ago

Altcoin16 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market21 hours ago

Market21 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin15 hours ago

Altcoin15 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin20 hours ago

Altcoin20 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?