Market

Market Making and Beyond: Insights from Vortex Co-Founder

Vortex, a prominent market maker, has become a reliable solution for projects facing growth and liquidity challenges. Founders often struggle with issues like stagnant token performance, weak chart metrics, and the risk of delisting from exchanges. Vortex addresses these problems with effective market-making algorithms, liquidity provision, and tailored advisory services that support project success.

In this interview, Vortex’s Co-Founder Gleb Gora discusses with BeInCrypto how the company’s’s strategic approach is driving sustainable growth for crypto projects in today’s competitive market

Can you share how Vortex started and how it evolved over time?

Vortex was first started as a vision of managing and growing wealth, providing an efficient trading infrastructure for professional and institutional traders in crypto. However, since 2021, we’ve seen a bigger opportunity in another niche, which was still pretty empty back then — market making. That’s when our vision consolidated into this journey and we’ve decided to fully move into the world of market making.

Vortex has adopted several unique market approaches, including various tech innovations and a broad range of strategic offerings for projects. However, what truly sets us apart is our client service. Over the years, we’ve refined our client communication to the highest level compared to our competitors. This focus on communication is a key metric where Vortex excels, contributing to our 93% client retention rate in 2023 and 85% year-to-date — outpacing the industry average by 25-30%.

Understanding your client needs is vital for any business, alongside efficient communication, which is absolutely crucial for profitable market making, especially when it comes to strategies based on project’s KPIs and unique needs. Alongside 24/7 support, that’s one of the key reasons why most of our clients make money while working with Vortex.

How does the world of market making look from the inside?

Since the beginning, we introduced Vortex’s proprietary trading software and dashboard, and we continuously improve them on a dynamic basis. Without spoiling all the juice, here are some of the key metrics and tools we rely on when managing markets.

- Order book integration from CEX with increased order history and added metrics which allow us to analyze the order book within seconds and make informed decisions based on that. Those metrics include order segregation, historical order book data, combined data across all exchanges and instant order execution based on that.

- Batch orders. A basic feature which allows you to instantly place multiple orders or execute them.

- Dynamic orders, a feature which allows to put efficient buy and sell walls.

- Advanced order execution, an automated tool which trades with the best bid and ask order to ensure dynamic trading environment.

- Proprietary trading algorithms designed for both T1 and T2 markets, tailored to meet the specific needs of each project. One of the most in-demand systems is our treasury-building algorithm.

- Additionally, we continuously refine a range of innovative tools, including metrics for stats, balance deltas, built-in PNL tracking, and more. We update and improve these features daily to ensure they deliver optimal market insights.

It’s very important to have a panel which meets all of the essential needs MMs face. An effective dashboard is a major part of success when it comes to executing most market making strategies, especially dynamic ones.

What are the main challenges market makers might face?

Market makers face various daily challenges, making it crucial to have dynamic tools for tracking accurate real-time data and automated algorithms that can trade without constant human intervention.

One of the most common issues is dealing with market takers who sell into the liquidity provided during volatile conditions. Market makers must offer liquidity 24/7, even in turbulent environments. During sell-offs or periods of high volatility, market takers can exploit this liquidity, leading to losses. While effective risk management and dynamic order strategies can mitigate this risk, it remains a key focus area for MMs.

In retainer-based market making, specific risks arise from inadequate client KPIs, especially in illiquid markets. A typical issue is excessive price support requested by projects without sufficient budgets or clear goals, leading to unnecessary spending. While not a direct risk, this challenge highlights the importance of projects listening to expert traders to avoid costly mistakes.

Does Vortex expand beyond market making?

Becoming a full-fledged token partner is one of the key visions behind creating Vortex. Apart from providing market making service, Vortex always goes beyond that and actively supports clients on:

Marketing. Vortex goes beyond standard market making by offering strategic marketing assistance. This includes introducing clients to top Key Opinion Leaders (KOLs) and leading marketing agencies. Vortex also offers guidance on developing and implementing marketing plans. This helps projects gain visibility and reach their target audience effectively.

Smart Contract Audits. Vortex ensures that projects are built on a secure foundation by offering comprehensive smart contract audits. These audits are conducted both in-house and through trusted partners, focusing on identifying potential vulnerabilities and ensuring the robustness of the contract’s code. This helps prevent security breaches and instills confidence in the project’s community and investors.

Strategic Web3 Advisory. Beyond market making, Vortex offers in-depth advisory services tailored to the unique challenges and opportunities within the Web3 space. This includes guiding clients through token launches, ecosystem development, and long-term strategic planning. The goal is to help projects achieve sustainable growth while navigating the rapidly evolving landscape of decentralized technologies.

Tokenomics Development and Audit. Vortex assists projects in designing and refining their tokenomics, ensuring that the economic model aligns with long-term project goals. This service includes auditing existing tokenomics structures to identify inefficiencies or areas for improvement. By offering data-driven insights, Vortex helps projects create token models that support liquidity, incentivize engagement, and foster ecosystem stability.

Providing all of the mentioned services proves highly valuable for many clients, as it ensures that market-making strategies align seamlessly with project plans and development timelines. This holistic approach enhances the effectiveness of market-making efforts by directly supporting the broader goals of each project.

Beyond these services, Vortex actively collaborates with over 20 launchpads and 15 venture capital firms, helping projects secure primary funding. We also plan to introduce our own launchpad by Q2 2025, further expanding the ecosystem.

What are the main trends driving the market right now, and where do you see things heading next?

Since I’ve started my journey in Web3, I’ve seen the space evolve so many times that it actually makes crypto completely different from what it was back in 2017. The NFT bags from 2021 are not going back to their ATH, most L0/1s turned out to be useless even as of today, rugs are more common than during the ICO boom and memes are now a major share of Web3.

I guess we can say that the space has evolved from building and innovating exciting tech to mostly pumping our own bags. We stopped caring about the fundamental part of most coins, predominantly focusing on hype, momentum and greed. Most innovative AI and blockchain projects are going down, while the Solana ecosystem grew. It’s obviously a temporary stage of the market, but it still sets us back from the initial vision behind Bitcoin in the first place.

I do believe that the next stage of crypto will be characterized as a stage of mass institutional adoption of crypto, which will completely evolve the space. DeFi and CeFi will most likely be even less interlinked than today, with DeFi slowly losing its market share over the years due to increased regulations from most nations.

The ETFs will be the key cash inflow to the market, influencing major altcoins and helping other similar projects grow as a whole asset class. Just like in every bull market before, most projects will lose a significant portion of their market cap, while others will capture their market share and many new solutions will appear, with a strong emphasis on RWA, AI and dApps.

What are the key factors that can make or break a project’s success?

Web3 is a very fascinating and somewhat complicated space with a unique blend of important traits a project has to have to become the next big thing. When it comes to success factors though, I would typically tend to divide short term success and long term vision as to different yet somewhat interconnected aspects.

Good momentum is achieved through a combination of effective community management, good brand that vibes with the overall space and/or strong support from respected industry experts. If those three are executed to a top-notch level, projects have enough momentum to generate sufficient buzz to shoot for the “next big thing” type of project. When it comes to long term success, we do have to account for more technical aspects — team execution, funding and economic model and, most importantly, the idea or vision itself.

Partnerships, backers and the overall vibe is crucial in helping the project get the initial traction — with enough experience, you can typically distinguish projects that have a shot from those that don’t in less than one minute just by checking those metrics.

Disclaimer

In compliance with the Trust Project guidelines, this guest expert article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What to Expect on May 7

The highly anticipated Pectra upgrade will launch on the Ethereum (ETH) mainnet on May 7, 2025, after overcoming a series of technical challenges and delays in the testnet phase.

Ethereum developers announced the date during the All Core Developers Consensus (ACDC) meeting on April 3, 2025.

Pectra Upgrade Countdown Begins

The upgrade was initially slated for a tentative mainnet launch on April 30. However, Ethereum developers have postponed the launch by one week.

“We’ll go ahead and lock in May 7 for Pectra on mainnet,” Ethereum Foundation researcher Alex Stokes said.

In preparation for this, Stokes confirmed that client releases will be made available by April 21, ensuring that all users have the necessary updates and tools ahead of the mainnet launch. On April 23, a detailed blog post outlining the Pectra mainnet will be published.

The Pectra upgrade will introduce 11 Ethereum Improvement Proposals (EIPs) to enhance various aspects of the network. Notably, three EIPs are dedicated to improving the validator experience.

The first is EIP-7251. This will increase the staking limit for validators from 32 ETH to 2,048 ETH per validator. This change aims to enhance capital efficiency for large stakers and staking pools.

“This simplifies the staking experience, allowing users to manage multiple validators under one node instead of several,” an analyst remarked.

Moreover, EIP-7002 introduces execution-layer triggerable withdrawals, giving validators more control. Meanwhile, EIP-6110 reduces the deposit processing delay from about 9 hours to just 13 minutes.

The upgrade will also include EIP-7702, a major step toward account abstraction. It allows Externally Owned Accounts (EOAs) to gain smart contract functionality while maintaining simplicity. This enables features like transaction batching, gas sponsorship (where third parties pay fees), passkey-based authentication, spending controls, and asset recovery mechanisms.

Finally, the upgrade increases blob capacity through EIP-7691. In addition, EIP-7623 helps manage the increased bandwidth requirements. These updates aim to make Ethereum more scalable, efficient, and user-friendly.

It is worth noting that the road to the mainnet launch has not been without hurdles. Two previous tests on the Holesky and Sepolia test networks failed to finalize properly. However, Pectra achieved full finalization on the Hoodi testnet on March 26, marking a significant milestone toward the successful deployment of the upgrade.

Despite the technical progress, ETH continues to face market challenges.

Data from BeInCrypto shows that ETH dropped 4.8% over the past week, with weekly losses extending to 17.1%. At the time of writing, the altcoin was trading at $1,822, reflecting a small daily gain of 0.8%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Futures and Illinois Lawsuit Relief

Coinbase filed with the US Commodity Futures Trading Commission (CFTC) to launch futures contracts for Ripple’s XRP token.

The move comes after a positive development for the crypto derivatives market in the US, reflecting shifting regulatory ties in the country.

Coinbase Files for XRP Futures Trading With CFTC

Coinbase Derivatives has submitted a filing to self-certify XRP futures. It will provide a regulated, capital-efficient means for market participants to gain exposure to XRP. The new contract could go live as soon as April 21.

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures – bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets. We anticipate the contract going live on April 21, 2025,” read the announcement.

Meanwhile, the official filing indicates that the XRP futures contract will be a monthly cash-settled and margined contract trading under the symbol XRL.

Each contract represents 10,000 XRP and will be settled in US dollars. Trading will be available for the current month and two subsequent months. As a protective measure, trading will be temporarily halted if the spot XRP price moves more than 10% within an hour.

The Coinbase Exchange also confirmed that it has engaged with Futures Commission Merchants (FCMs) and other market participants. Both references reportedly expressed support for the launch.

However, Coinbase is not the first US-based exchange to introduce regulated XRP futures. In March, Chicago-based Bitnomial launched what it advertised as the country’s first CFTC-regulated XRP futures contract.

For Coinbase, however, the boldness comes after the CFTC eased key regulatory hurdles for crypto derivatives trading. As BeInCrypto reported, this signaled a more accommodating stance towards the sector.

“Pursuant to Commodity Futures Trading Commission (“CFTC” or “Commission”) Regulation 40.2(a), Coinbase Derivatives, LLC (the “Exchange” or “COIN”) hereby submits for self-certification its initial listing of the XRP Futures contract to be offered for trading on the Exchange…,” an excerpt in the filing indicated.

This suggests that the commodities regulator’s shift, revoking previous crypto-related guidelines, may boost institutional confidence. For XRP, this development bolsters confidence in the asset’s previously contentious status following Ripple’s recent regulatory breakthrough.

“Coinbase Derivatives’ filing with the CFTC to self-certify XRP futures aims to legitimize XRP trading by offering a regulated, capital-efficient product for investors,” one user remarked.

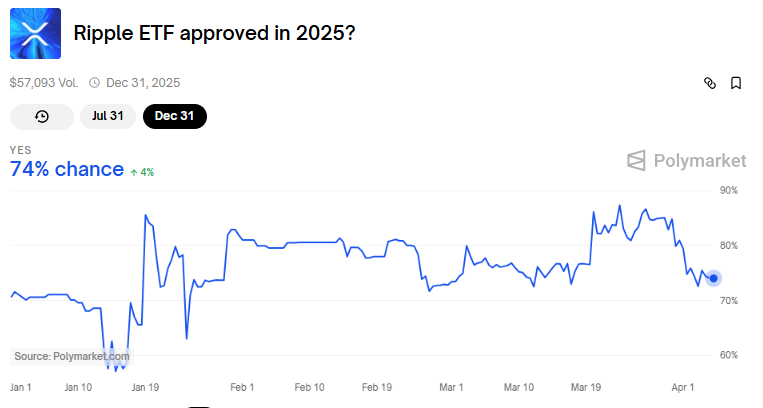

The futures contract might also help the odds of XRP ETF approval. Recently, the SEC delayed several applications to create one, and its status is in limbo.

Data on Polymarket shows bettors see a 74% chance for XRP ETF approval in 2025 and a more modest 34% by July 31.

Regulatory and Legal Developments Favor Coinbase

Elsewhere, the timing of this filing aligns with recent favorable regulatory developments for Coinbase. Reports suggest Illinois intends to drop its lawsuit against the exchange over its staking services.

Up to 10 states filed a lawsuit against Coinbase in June 2023 alleging that its staking program constituted unregistered securities offerings.

This recent development makes Illinois the fourth state to withdraw legal action against Coinbase. Vermont, South Carolina, and Kentucky also dismissed their cases on March 13, 27, and 31, respectively.

However, the cases remain active in Alabama, California, Maryland, New Jersey, Washington and Wisconsin.

These legal retreats coincide with the US SEC’s (Securities and Exchange Commission) February decision to abandon its federal lawsuit against Coinbase. BeInCrypto reported that this development marked a broader shift in the regulatory approach under the current administration.

“Regulators are losing steam, and Coinbase is stacking quiet courtroom wins. Staking’s future in the US might just be back on track,” a user commented.

Illinois’ decision to drop its lawsuit comes as the state advances a Bitcoin strategic reserve bill. Specifically, Illinois State Representative John M. Cabello introduced House Bill 1844 (HB1844), highlighting Bitcoin’s potential as a decentralized, finite digital asset.

“A strategic bitcoin reserve aligns with Illinois’ commitment to fostering innovation in digital assets and providing Illinoisans with enhanced financial security,” the bill read.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Bleeds Further—Fresh Weekly Lows Test Investor Patience

Dogecoin started a fresh decline from the $0.180 zone against the US Dollar. DOGE is consolidating and might struggle to recover above $0.1680.

- DOGE price started a fresh decline below the $0.1750 and $0.170 levels.

- The price is trading below the $0.1680 level and the 100-hourly simple moving average.

- There was a break below a key bullish trend line forming with support at $0.170 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could extend losses if it breaks the $0.1550 support zone.

Dogecoin Price Dips Again

Dogecoin price started a fresh decline after it failed to clear $0.180, like Bitcoin and Ethereum. DOGE dipped below the $0.1750 and $0.1720 support levels.

There was a break below a key bullish trend line forming with support at $0.170 on the hourly chart of the DOGE/USD pair. The bears were able to push the price below the $0.1620 support level. It even traded close to the $0.1550 support.

A low was formed at $0.1555 and the price is now consolidating losses. There was a minor move above the 23.6% Fib retracement level of the downward move from the $0.180 swing high to the $0.1555 low.

Dogecoin price is now trading below the $0.170 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.1650 level. The first major resistance for the bulls could be near the $0.1680 level. It is near the 50% Fib retracement level of the downward move from the $0.180 swing high to the $0.1555 low.

The next major resistance is near the $0.1740 level. A close above the $0.1740 resistance might send the price toward the $0.180 resistance. Any more gains might send the price toward the $0.1880 level. The next major stop for the bulls might be $0.1950.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.170 level, it could start another decline. Initial support on the downside is near the $0.160 level. The next major support is near the $0.1550 level.

The main support sits at $0.150. If there is a downside break below the $0.150 support, the price could decline further. In the stated case, the price might decline toward the $0.1320 level or even $0.120 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.1600 and $0.1550.

Major Resistance Levels – $0.1680 and $0.1740.

-

Market20 hours ago

Market20 hours agoBitcoin’s Future After Trump Tariffs

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Market21 hours ago

Market21 hours agoEDGE Goes Live, RSR Added to Roadmap

-

Regulation19 hours ago

Regulation19 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Bitcoin24 hours ago

Bitcoin24 hours agoBlackRock Approved by FCA to Operate as UK Crypto Asset Firm

-

Market23 hours ago

Market23 hours agoHBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

-

Altcoin23 hours ago

Altcoin23 hours agoJohn Squire Says XRP Could Spark A Wave of Early Retirements

-

Market22 hours ago

Market22 hours ago10 Altcoins at Risk of Binance Delisting