Market

Redefining Social Interaction with Meme Coins

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

As crypto assets are gaining acceptance in the traditional financial industry, market dynamics are progressively shifting towards a more retail-oriented approach. Perhaps influenced by the GameStop incident, the meme coin sector has caught the attention of Gen Z, gradually transitioning from being considered alternative assets to essential components within the mainstream investment landscape.

According to CoinMarketCap, meme coins account for about 2% of the entire crypto market. The underlying reason for the meme craze is that institution-dominated value projects have become less attractive due to high valuations and the selling pressure from continuous unlocking, leading to decreased retail participation. As institutions and retail investors avoid buying from each other, meme projects have become the market’s focal point.

The key issue is the weakening wealth effect rather than a conflict between institutions and retail investors. The crucial problem is matching projects with users.

Match is a social platform based on AI and big data technology, aiming to establish an efficient value-based social network enabled by the wealth effect of meme coins. By constructing a sustainable value-based social ecosystem, Match deeply understands how to integrate user needs and economic mechanisms to promote both social interaction and economic returns. Match provides privacy-protected social functions and powerful AI capabilities, enabling users to securely manage their social data assets across various Web 3.0 applications, thereby achieving true value-based social networking.

The social networking market has always been in high growth, making it one of the most competitive fields. Recent data shows that there are 5.07 billion social media users globally, accounting for 62.6% of the world’s population. According to Ecwid, the number of social media users grew from 1.72 billion in 2013 to 4.76 billion in 2023, with a compound annual growth rate of 10.72%.

Despite its vast potential, the social networking market has high entry barriers. Walter Isaacson, a renowned author who has written biographies for Einstein, Jobs, and Kissinger, has a viewpoint on social networking: “Almost every digital tool, whether designed for it or not, was commandeered by humans for a social purpose”. But they must first be effective tools to create social opportunities. Therefore, recent social networking applications like Clubhouse and Damus quickly rose and fell due to the lack of unique tool attributes.

Match’s design is different from previous ones; it is a SocialFi application based on meme coins. Similar to social networking, meme culture is rooted in fundamental human needs. Any type of viral cultural transmission can form a meme culture. When meme culture combines with cryptocurrency, it creates meme coins.

Meme coins inherently have social spreading value. Match introduces new gameplay, creating strong community consensus through the resonance of Meme culture to drive ecosystem development. Match is about to issue its exclusive meme coin, RFG. RFG not only creates wealth effects but also attracts a large number of users, laying a solid foundation for social interaction on the platform. By leveraging its meme coin, RFG, Match will accumulate substantial user data, providing a solid foundation for subsequent AI analysis and social interaction.

In its development into an innovative value-based social ecosystem, Match follows four stages: Departure, Sailing, Breaking Waves, and Voyage. In the “Departure” stage, Match focuses on decentralized auction, social matching and mining, and the development of backend services. In the “Sailing” stage, Match enters a period of rapid expansion and application innovation. After launching basic functions, the platform promotes community building and promotional activities.

In the “Breaking Waves” stage, Match will further expand RFG’s application scenarios and deeply integrate AI technology into its infrastructure. RFG’s application covers multiple fields, including finance and social networking, meeting users’ diverse needs with innovative financial products and services. Through rich application scenarios, Match achieves both user scale and platform value growth. Match also introduces an on-chain DID system and social accessories to activate and amplify personal social value. By bringing in more SocialFi services and partners, Match continuously expands its ecosystem and drives global development.

In the “Voyage” stage, Match will complete the construction of a comprehensive service ecosystem, advancing to higher development levels. The platform offers diverse AI services, including intelligent advisory, personalized recommendations, and risk assessments, helping users make more informed decisions in complex market environments.

Match also utilizes ZK technology for privacy capabilities, addressing trust issues with off-chain data and computations. Users can share data confidentially within a trustless settlement layer, ensuring data privacy. ZK applications allow users to create confidential on-chain identities in a modular manner, surpassing traditional data obfuscation methods. Off-chain security guarantees provided by ZK technology ensure the integrity and expected state of vast off-chain data and computations.

Meme coins currently hold a market cap of around USD 49 billion. Match combines SocialFi with meme coins, forging a new value-based social ecosystem. Building upon the wealth effects of meme coins, Match attracts users and encourages them to engage in social activities, enabling value exchange and wealth amplification among users with SocialFi mechanisms. This innovative model not only attracts a large user base but also enhances long-term user retention and activity.

However, meme coins are community-driven and rely on community enthusiasm and hype, lacking sustainable development mechanisms for the long haul. How can Match sustain itself when interest in meme coins fades?

After accumulating data in the first stage, Match will use AI technology as its core driving force. Through intelligent data monitoring, precise user profiling, and AI-driven recommendation engines, Match helps users identify lucrative investment opportunities amidst the ocean of information, improving investment decision efficiency and reducing operational costs.

The success of meme coins often involves inevitability and chance. In the second stage, Match aims to help users seize early opportunities through AI. For example, when CCTV featured the meme coin SAMO, its community hype led to a 500% price surge. Similarly, the pre-sale of Darkfarm’s BOME surpassed expectations. By leveraging AI, such events can be identified, analyzed, and capitalized on.

Currently, Match is still in the early stages of AI training with limited data sets. As the volume and quality of data improve, Match may experience a breakthrough moment for SocialFi similar to the iPhone’s launch.

Additionally, Match plans to introduce a modular social layer to nurture a sustainable ecosystem. In the future, Match will be compatible with various mainstream public chains, allowing seamless integration of data and functionalities. This means that users can enjoy a unified, seamless social experience on the Match platform, regardless of the public chain they use. Furthermore, Match aims to evolve as the ideal platform for social IDOs. Through intelligent recommendations and precise matching, Match provides project teams with high-quality authentic users, facilitating swift traffic and user aggregation for projects on public chains. This not only improves the efficiency and success rate of token issuance but also enhances user engagement via social interactions, forming a sustainable ecosystem.

By harmonizing the four core pillars of wealth, traffic, social interaction, and information, Match forges a powerful value flywheel.

In the rapidly evolving and cacophonous blockchain domain, AI is often more of a gimmick rather than a practical tool. Match seeks to integrate AI into meme coins and SocialFi to deliver tangible applications, potentially heralding a fresh wave of transformation.

By utilizing AI for intelligent data monitoring and analysis, Match creates precise user profiles and offers tailored strategies to guide users toward profitable investments amidst vast information streams.

By analyzing social media trends, discussion scales, and on-chain data, Match’s AI delineates authentic project potential across multifaceted dimensions, distinguishing between retail and project-oriented buyers, empowering users to make more informed trading decisions. Besides, Match’s AI enables real-time access to project insights, saving users research time and helping them seize investment opportunities. The integration of AI not only improves the platform’s service quality but also provides users with personalized social experiences.

Moreover, Match’s AI can craft tailored strategies based on user profiles. Whether users are looking for quick profits, interested in memes, or are seasoned investors, Match’s AI provides bespoken recommendations and helps project teams devise more effective marketing strategies. In a cacophony of information, Match’s AI filters out valuable insights, providing value to users and addressing user retention issues. This not only increases user engagement but also enhances user loyalty.

Through AI-driven recommendations and precise matching, Match provides project teams with high-quality authentic users, making it the ideal platform for social IDOs. The deep integration of social interaction and finance allows users to enjoy the fun of socializing while earning considerable investment returns. Through in-depth AI-based analysis over social interaction data of users, Match generates precise user profiles and personalized recommendation strategies, offering more targeted services to meet different user needs. Moreover, Match uses social interaction data to create soul identities and on-chain credit certificates, further enhancing user trust and security on the platform. This approach not only improves user experience but also reduces costs and increases efficiency.

As Match accumulates more data and users, AI will provide more assistance to both users and project teams. For example, AI can aid in identifying product strengths and weaknesses for targeted optimization and improvements. It can also design more intelligent and personalized financial products to meet diverse user needs. Just like OpenAI, by increasing parameter training data sets, Match aims to trigger an AI revolution through qualitative changes brought by quantitative accumulation.

Surveying the industry’s social applications, from the early ONO to BM’s Voice, the common goal was to attract users to these new platforms for token rewards. However, this narrative has been debunked. The hurdle lies not in the veracity of Web 3.0 + social interaction but in the lofty costs associated with user migration from giants like Sina Weibo and Twitter. Even Sina Weibo’s own pictorial social platform, Oasis, faded quickly, illustrating the challenge.

An alternative approach entails leveraging niche appeal, akin to Douban or the present-day Farcaster, catering to specific user groups without attempting to supplant other social platforms.

In Web 3.0’s landscape, where trading takes a central stage, social applications can explore this facet, as exemplified by Match. Preceding Match, Friend.tech emerged with a viable proposition akin to exclusive circles where users believed prominent influencers could unlock wealth. However, Friend.tech merely attracted users through wealth effects without resolving the core query of user retention. Match aims to fill this gap.

Imagine such an offering: AI streamlines redundant social information for you, identifies investment projects that align with your flair, and offers you with passive SocialFi income while you are trading. Would you embrace this offering? This epitomizes the essence of most users’ demands in Web 3.0, a pain point Match solves.

At the heart of any application lies user retention; users are the linchpin for all endeavors, especially in the realm of social platforms. Presently, valuations of most prevalent social applications stay under USD 1 billion. To sustain these valuations, project teams must incessantly helm operations to enhance user retention. Conversely, Match, possessing an innate ability to naturally draw and retain a substantial user base, could potentially command valuations surpassing these figures by a wide margin, possibly even breaching the hundred-billion-dollar mark.

Disclaimer

This article is sponsored content and does not represent the views or opinions of BeInCrypto. While we adhere to the Trust Project guidelines for unbiased and transparent reporting, this content is created by a third party and is intended for promotional purposes. Readers are advised to verify information independently and consult with a professional before making decisions based on this sponsored content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Faces Resistance While ETH Sees DEX Volume Boost

Solana (SOL) is attempting to recover from an almost 12% correction over the past seven days. The RSI has surged into overbought territory, suggesting strong bullish momentum. However, the BBTrend remains deeply negative—though it’s beginning to ease, hinting at potential stabilization.

Meanwhile, the EMA lines are setting up for a possible golden cross, signaling that a trend reversal could be forming if key resistance levels are broken. Still, with Ethereum overtaking Solana in DEX volume for the first time in six months and critical support levels not far below, SOL remains in a delicate position.

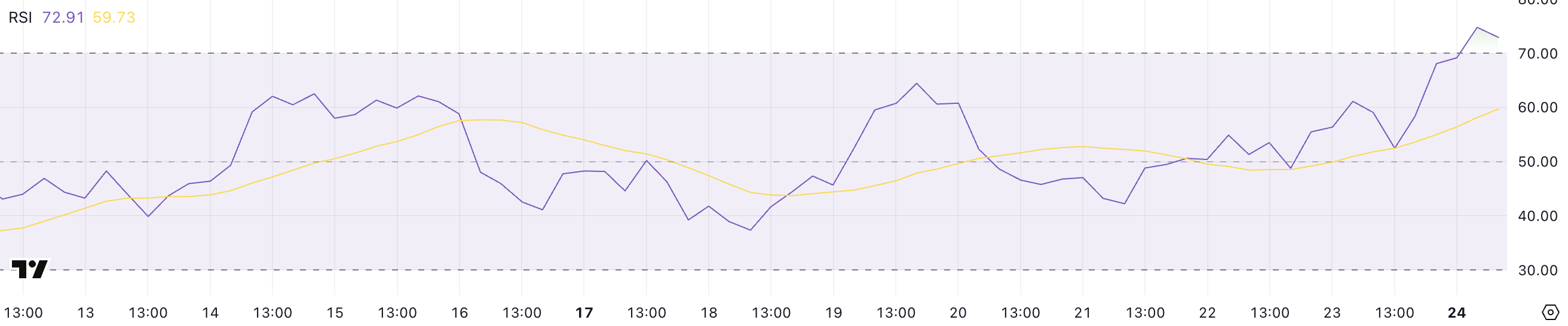

SOL RSI Is Now At Overbought Levels

Solana’s Relative Strength Index (RSI) has surged to 72.91, up sharply from 38.43 just a day ago—indicating a rapid shift in momentum from neutral to strongly bullish territory.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Readings above 70 typically suggest an asset is overbought and may be due for a pullback, while levels below 30 indicate oversold conditions and potential for a rebound.

With Solana’s RSI now above 70, the asset has officially entered overbought territory, reflecting intense buying pressure in the short term.

While this can sometimes precede a correction or consolidation, it can also signal the start of a breakout rally.

Traders should watch closely for signs of continuation or exhaustion. If momentum holds, Solana could push higher, but any stalling may trigger profit-taking and short-term volatility.

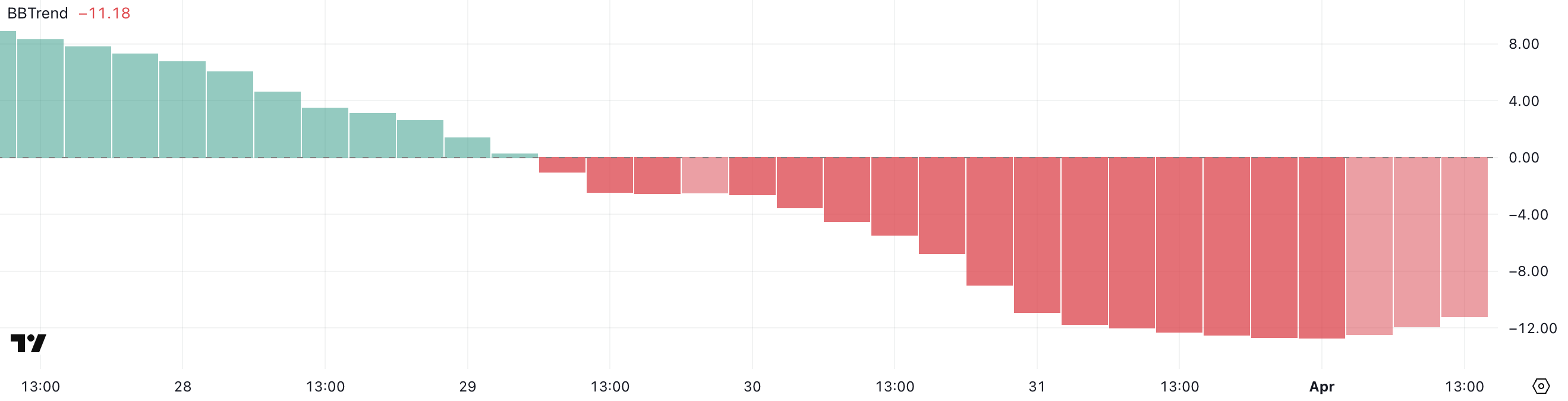

Solana BBTrend Is Decreasing, But Still Very Negative

Solana’s BBTrend indicator has climbed slightly to -11.18 after hitting a low of -12.68 earlier today. That suggests that the bearish momentum is starting to ease.

The BBTrend (Bollinger Band Trend) measures the strength and direction of a trend based on how price interacts with the Bollinger Bands.

Values below -10 typically indicate strong bearish pressure, while values above +10 reflect strong bullish momentum. A rising BBTrend from deep negative territory can be an early sign of a potential reversal or at least a slowdown in the downtrend.

With SOL’s BBTrend still in bearish territory but improving, the market may be attempting to stabilize after a period of intense selling.

However, broader ecosystem developments complicate the technical picture. For example, Ethereum recently surpassed Solana in DEX volume for the first time in six months.

While the easing BBTrend hints at recovery potential, Solana still needs a stronger confirmation to shift the trend fully in its favor. Until then, cautious optimism may be warranted, but the bears haven’t fully let go.

Solana Still Has Challenges Ahead

Solana’s EMA lines are showing signs of an impending golden cross. A golden cross occurs when a short-term moving average crosses above a long-term one. That’s often seen as a bullish signal that can mark the start of a sustained uptrend.

If this pattern is confirmed and buying momentum continues, Solana price could push up to test the resistance at $131.

A successful breakout above that level may open the door to further gains toward $136, and potentially even $147.

However, downside risks remain if buyers fail to hold recent gains.

If SOL pulls back and loses the key support at $124, it could trigger further selling pressure, pushing the price down to $120.

Should the downtrend gain strength from there, SOL might revisit deeper support levels around $112.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hill Rejects Interest-Bearing Stablecoins Despite Armstrong’s Wish

Representative French Hill, who Chairs the House Committee on Financial Services, rejected requests to approve interest-bearing stablecoins. Coinbase CEO Brian Armstrong made a public appeal in support of this yesterday.

Hill has been a vocal supporter of new stablecoin regulations, and the crypto industry counted his Committee appointment as a victory.

French Hill Rejects Interest-Bearing Stablecoins

If there’s one topic that’s a top priority for US crypto policy, it’d be stablecoin regulations. Significant momentum is building behind pro-industry regulations, and President Trump claimed that stablecoins will play a role in dollar dominance. However, Representative French Hill pushed back on one request, saying he opposes interest-bearing stablecoins:

“I hear the point of view, but I don’t think that there’s consensus among the parties or the Houses [of Congress] on having a dollar-backed payment stablecoin pay interest to the holder of that stablecoin,” Hill told reporters earlier today.

Although Hill portrayed this position on stablecoins as a common-sense viewpoint, it represents a limit to the crypto industry’s political influence. When Hill was chosen to head the House Committee on Financial Services, crypto took it as a big win. Further, he’s been a visible presence in the fight for stablecoin regulation. So, what’s the problem?

Essentially, Coinbase CEO Brian Armstrong made an appeal to Hill and other legislators regarding interest-bearing stablecoins. Just yesterday, Armstrong called this policy a “win-win” and a huge opportunity to help consumers and the economy.

“US stablecoin legislation should allow consumers to earn interest on stablecoins. The government shouldn’t put it’s thumb on the scale to benefit one industry over another. Banks and crypto companies alike should both be allowed to, and incentivized to, share interest with consumers. This is consistent with a free market approach,” Armstrong claimed.

Since Armstrong made this public appeal yesterday, it’s remarkable that Hill rejected his vision of stablecoins so quickly. Ostensibly, Armstrong’s political influence has been on the rise, as he played a prominent role in Trump’s Crypto Summit, and the SEC dropped its suit against Coinbase.

It’s an important fact for the US crypto industry to learn: no matter how quickly its influence is growing, it’s still very new to most people. Earlier this year, a string of state-level Bitcoin Reserve proposals failed in Republican-controlled states. President Trump may support crypto, but his supporters have limits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

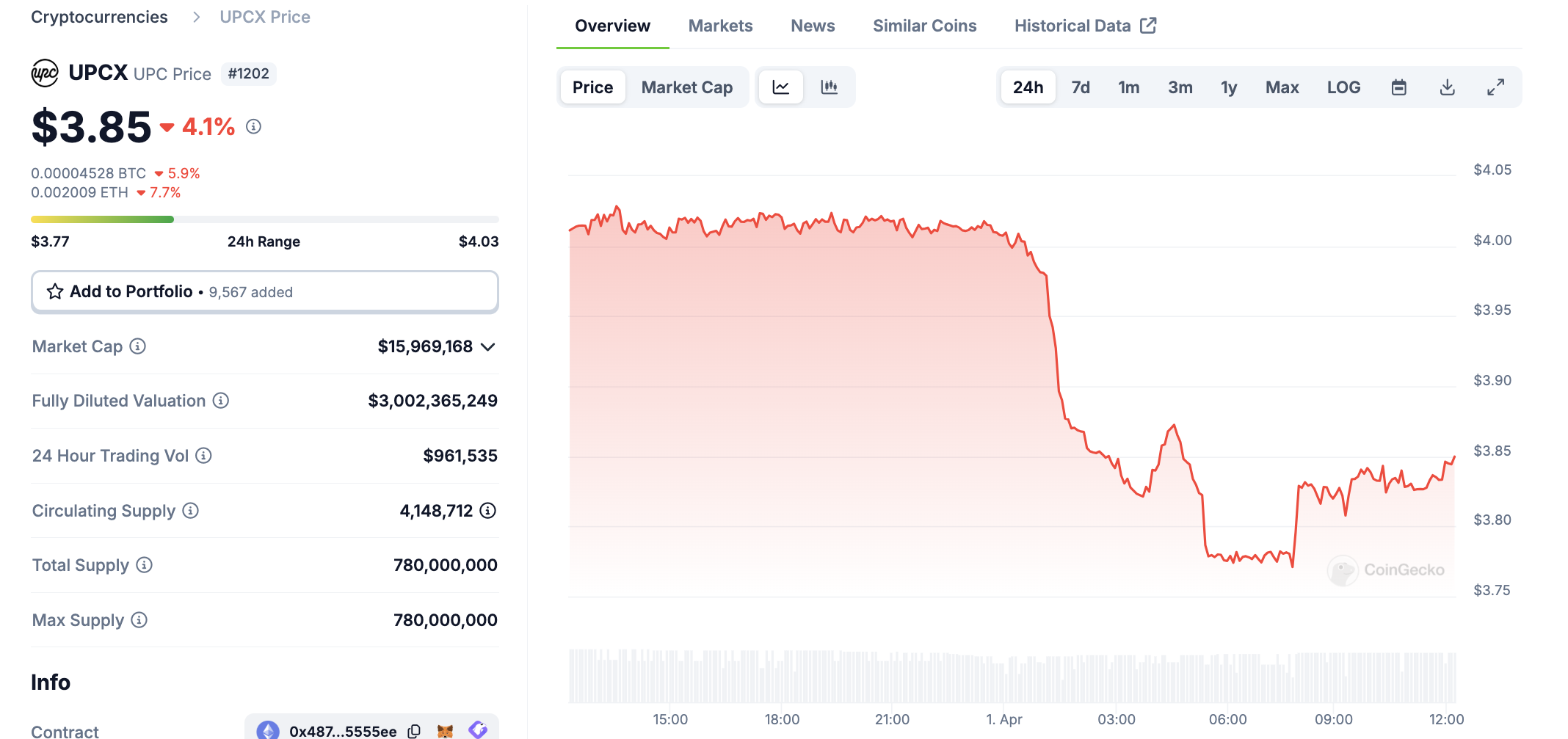

How Did UPCX Lose $70 Million in a UPC Hack?

UPCX suffered a major hack today, with 18.4 million UPC tokens stolen from its management accounts. This amounts to about $70 million dollars, and the price of UPC fell drastically.

The hackers stole more UPC than is currently circulating in the markets and haven’t offloaded any assets yet. It is unclear who did this or how they will be able to secure their gains in other assets.

UPCX Suffers Major Hack

Cyvers, a crypto security firm that has tracked and uncovered several major crimes, identified a serious hack this morning. Multiple suspicious transactions took place involving UPCX’s management account, and the firm acknowledged suspicious activity. UPCX didn’t go into great detail, only describing a few security measures, but Cyvers showed the extent of the hack:

“It appears that someone gained access to the address 0x4C….3583E, upgraded the ‘ProxyAdmin’ contract, and executed the ‘withdrawByAdmin’ function, resulting in the transfer of 18.4 million UPC (approximately $70 million) from three different management accounts,” Cyvers claimed via social media.

UPCX is an open-source crypto payment system, and this hack may represent a serious blow to the company. According to CoinGecko data, the hackers stole significantly more UPC tokens than are currently available, which is around 4 million. Naturally, this caused the price to drop significantly, in an immediate drop of over 4%:

Although a $70 million hack will certainly damage UPCX individually, it’s unclear if it will actually impact the broader market much. The largest hack in crypto history took place a little over a month ago, and the community is still assessing the fallout. Meanwhile, UPCX is comparatively tiny; less than 10,000 X users viewed its post admitting to the security breach.

Since the UPCX hack took place, the recipient account hasn’t moved any of its UPC tokens. Indeed, it may be difficult for the perpetrator to convert these assets into usable fiat in the first place. If the hackers stole nearly 5x the amount of UPC tokens in circulation, any attempt to liquidate them will crash UPC’s token price even further.

Ultimately, the UPCX hack is strange for several reasons. Despite a large dollar amount, it hasn’t attracted a huge amount of buzz or impacted the market outside UPC. Hopefully, further analysis will identify the perpetrators, and possibly freeze the assets. Otherwise, the threat of a future sale could hamper UPC’s recover for the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoCoinbase Tries to Resume Lawsuit Against the FDIC

-

Altcoin23 hours ago

Altcoin23 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market23 hours ago

Market23 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Market22 hours ago

Market22 hours agoThis is Why PumpSwap Brings Pump.fun To the Next Level

-

Market20 hours ago

Market20 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Market14 hours ago

Market14 hours agoXRP Bulls Fight Back—Is a Major Move Coming?

-

Market13 hours ago

Market13 hours agoIs CZ’s April Fool’s Joke a Crypto Reality or Just Fun?

-

Market12 hours ago

Market12 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?